Global Glass Substrate Market

市场规模(十亿美元)

CAGR :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

全球玻璃基板市場細分,按類型(硼矽酸鹽基、熔融石英/石英基、矽及其他)、晶圓直徑(300 毫米、200 毫米、150 毫米、125 毫米、300 毫米以上和 100 毫米以下)、應用(晶圓封裝、基板太陽能2032 年)

玻璃基板市場規模

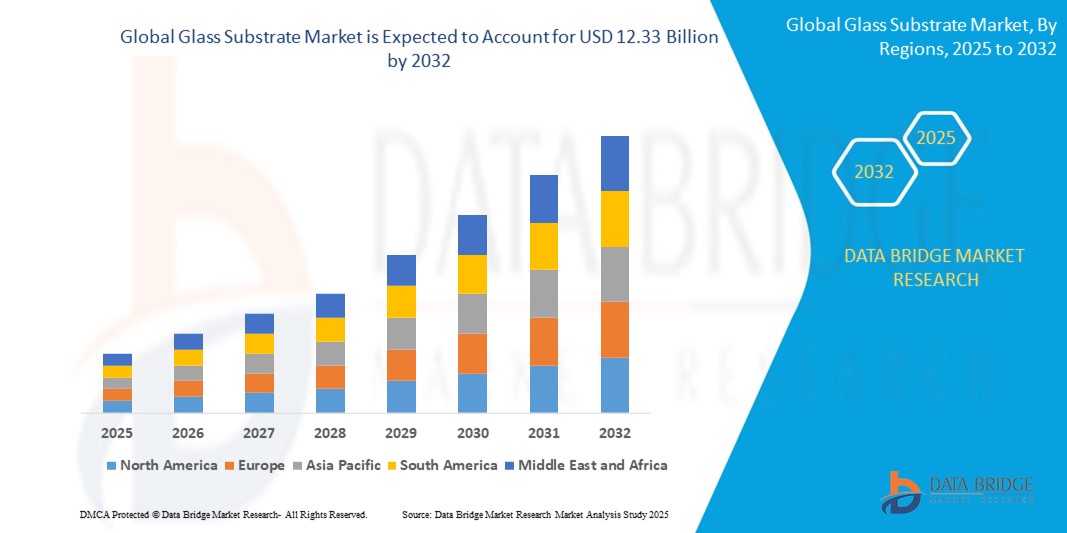

- 2024 年全球玻璃基板市場規模為70.1 億美元 ,預計 到 2032 年將達到 123.3 億美元,預測期內 複合年增長率為 7.30%。

- 市場成長主要得益於智慧型手機、平板電腦和電視等消費性電子產品對先進顯示技術的需求不斷增長,以及太陽能板和柔性電子產品的應用不斷擴大

- 此外,OLED 和 AMOLED 顯示器的普及率不斷提高,需要高品質的玻璃基板來實現更好的性能和耐用性,這進一步推動了全球市場的擴張

玻璃基板市場分析

- 由於消費性電子產品對高性能顯示器的需求不斷增長,玻璃基板市場正在擴大,為智慧型手機和電視等設備提供更高的耐用性和清晰度

- 製造商正致力於開發更薄、更靈活的玻璃基板,以滿足柔性和可折疊顯示技術不斷發展的需求

- 受電子產業蓬勃發展、先進顯示技術需求不斷增長以及領先半導體製造商的推動,北美在 2024 年佔據玻璃基板市場主導地位,收入份額最大

- 受快速工業化、電子製造業擴張以及中國、日本、韓國和印度等國家對半導體和顯示面板需求不斷增長的推動,亞太地區預計將成為全球玻璃基板市場成長率最高的地區。

- 硼矽酸鹽基板憑藉其優異的耐熱性和耐化學性,在2024年佔據了市場主導地位,佔據了最大的市場收入份額,這使其適用於各種微電子和光子學應用。由於尺寸穩定性和成本效益,硼矽酸鹽基板在半導體封裝領域的需求強勁。

報告範圍和玻璃基板市場細分

|

屬性 |

玻璃基板關鍵市場洞察 |

|

涵蓋的領域 |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Glass Substrate Market Trends

“Rise of Flexible and Foldable Display Glass Substrates”

- The glass substrate market is witnessing a significant trend toward the development and adoption of flexible and foldable glass substrates, driven by the increasing popularity of foldable smartphones and wearable devices

- Manufacturers are innovating ultra-thin and bendable glass materials that can withstand repeated folding without compromising durability or display clarity

- For instance, Samsung’s foldable smartphones and Microsoft’s Surface Duo utilize flexible glass substrates, highlighting the commercial viability and consumer demand for such technologies

- This trend is pushing glass producers to enhance glass toughness and elasticity through advanced chemical strengthening and coating techniques

- In addition, the trend supports the growth of new product categories in consumer electronics, such as rollable displays and flexible tablets, opening fresh opportunities for glass substrate applications beyond traditional rigid displays

Glass Substrate Market Dynamics

Driver

“Increasing Demand for Advanced Display Technologies”

- The growing demand for advanced display technologies is driving the glass substrate market, as consumers seek high-resolution, durable, and user-friendly devices

- Glass substrates are essential for displays such as liquid crystal displays, organic light-emitting diodes, and emerging flexible and foldable screens, providing a smooth and flat surface for uniform electronic layers

- Innovations such as ultra-thin and chemically strengthened glass allow for lighter and more robust screens, meeting consumer needs for sleek yet durable gadgets

- The widespread adoption of smartphones, tablets, laptops, and televisions with advanced displays is accelerating market growth; for instance, major smartphone brands use chemically strengthened glass to enhance scratch resistance and durability

- New display formats, including flexible and rollable screens, depend on specialized glass substrates that maintain flexibility without sacrificing transparency or strength, expanding usage in automotive dashboards and wearable devices

- For instance, Samsung’s latest foldable smartphones use ultra-thin, chemically strengthened glass substrates that allow the screen to bend smoothly while maintaining durability and clarity

Restraint/Challenge

“High Production Costs and Manufacturing Complexities”

- The glass substrate market faces challenges due to the high costs involved in producing advanced glass materials, especially those that are ultra-thin or chemically treated

- Manufacturing requires multiple precise stages such as melting, forming, annealing, and chemical strengthening, each needing strict quality checks and specialized equipment

- Producing flexible glass substrates involves maintaining bendability and optical clarity, which is technically demanding and raises operational costs

- For instance, developing ultra-thin flexible glass for foldable displays requires nano-level thickness control to prevent breakage while ensuring visual performance

- Alternative materials such as plastic substrates, though less durable, are gaining popularity for flexible displays due to lower production costs and easier processing

Glass Substrate Market Scope

The market is segmented on the basis of type, wafer diameter, application, and end-use.

- By Type

On the basis of type, the high glass substrate market is segmented into borosilicate based, fused silica/quartz based, silicon, and others. The borosilicate-based segment dominated the market with the largest market revenue share in 2024, driven by its high thermal and chemical resistance, making it suitable for a variety of microelectronics and photonics applications. The demand for borosilicate substrates is strong in semiconductor packaging due to their dimensional stability and cost-effectiveness.

The fused silica/quartz-based segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its exceptional optical transparency and low coefficient of thermal expansion. These properties make it ideal for high-frequency electronics, optical components, and advanced lithography, particularly in semiconductor and aerospace applications.

- By Wafer Diameter

On the basis of wafer diameter, the high glass substrate market is segmented into 300 mm, 200 mm, 150 mm, 125 mm, above 300 mm, and up to 100 mm. The 200 mm segment held the largest market revenue share in 2024, supported by its extensive use in legacy semiconductor fabrication facilities and its cost-efficiency in producing MEMS and analog devices.

The 300 mm segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by ongoing advancements in semiconductor manufacturing, including 3D packaging and high-volume IC production. As foundries shift towards larger wafers to improve yield and reduce cost per chip, demand for 300 mm glass substrates is rapidly increasing.

- By Application

On the basis of application, the high glass substrate market is segmented into wafer packaging, substrate carrier, and TGV interposer. The wafer packaging segment accounted for the largest market revenue share in 2024, propelled by growing demand for high-density and miniaturized packaging solutions in consumer electronics and communication devices. Glass substrates provide excellent planar surfaces and thermal performance ideal for wafer-level packaging.

The TGV interposer segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to increasing adoption of Through Glass Via technology in advanced chip integration and heterogeneous packaging. Its high precision and low dielectric loss characteristics are appealing for high-performance computing and RF applications.

- By End-Use

On the basis of end-use, the high glass substrate market is segmented into electronics, optical applications, aerospace & defense, automotive & solar, and medical. The electronics segment dominated the market in 2024, driven by the surging demand for smartphones, wearables, and semiconductor devices requiring compact and efficient substrate solutions.

The medical segment is anticipated to witness the fastest growth rate from 2025 to 2032, due to the rising adoption of biosensors, microfluidic chips, and lab-on-a-chip technologies that utilize glass substrates for their biocompatibility, chemical stability, and transparency.

Glass Substrate Market Regional Analysis

- North America dominated the glass substrate market with the largest revenue share in 2024, driven by a robust electronics industry, growing demand for advanced display technologies, and the presence of leading semiconductor manufacturers

- The region benefits from increasing investments in R&D for microelectronics and optoelectronic applications, which is bolstering the demand for high-performance glass substrates

- In addition, supportive government initiatives and the expansion of fabrication facilities across the U.S. and Canada are accelerating market adoption across end-use industries such as automotive, aerospace, and healthcare

U.S. Glass Substrate Market Insight

2024年,美國玻璃基板市場佔據北美最大的營收份額,這得益於領先電子和半導體公司的強勁發展。美國先進的技術生態系統,加上消費性電子產品對微型化和高精度組件的旺盛需求,共同推動了市場的發展。醫療成像設備和光伏組件應用的日益增長也促進了市場的成長。玻璃製造技術和材料科學的持續創新進一步提升了市場前景。

歐洲玻璃基板市場洞察

預計歐洲玻璃基板市場將在2025年至2032年間實現最快的成長,這得益於光子學、MEMS和顯示器技術投資的持續成長。該地區在汽車電子領域的穩固地位,加上智慧顯示器和光學元件的日益普及,支撐了持續的市場需求。嚴格的環境和品質法規也促進了德國、法國和英國等國在多種應用中使用高純度、可持續的玻璃基板。

英國玻璃基板市場洞察

英國玻璃基板市場預計將在2025年至2032年間實現最快成長,這得益於醫療、航空航太和光電產業對先進材料日益增長的需求。柔性電子和光學感測器領域的創新,以及政府對國內製造業的支持,正在提升市場前景。此外,英國對永續性和精密製造的重視,也正鼓勵新興高科技領域的應用。

德國玻璃基板市場洞察

預計德國玻璃基板市場將在2025年至2032年期間實現最快成長,這得益於該國在汽車技術、光學和工業自動化領域的領先地位。德國高度重視精密工程和高性能材料,正大力投資微加工和先進基板材料。工業4.0和智慧工廠的興起進一步增加了感測器和顯示器整合領域對玻璃基板的需求。

亞太玻璃基板市場洞察

預計亞太地區玻璃基板市場將在2025年至2032年期間實現最快成長,這得益於消費性電子產品生產的蓬勃發展、政府的利好政策以及快速的工業化進程。中國大陸、日本、韓國和台灣等國家和地區在顯示面板、半導體和太陽能技術創新方面處於領先地位。低成本製造、熟練勞動力以及對無塵室設施的策略性投資,正在顯著加速該地區的成長。

日本玻璃基板市場洞察

由於其在精密材料、微電子和高端光學技術領域的深厚專業知識,日本玻璃基板市場預計在2025年至2032年間實現最快的成長。日本成熟的消費性電子和顯示面板產業是需求的主要驅動力。此外,汽車平視顯示器、光掩模和先進醫療設備等領域的應用也正在推動玻璃基板的普及。對產品小型化和耐用性的重視進一步鞏固了日本市場在高價值應用領域的地位。

中國玻璃基板市場洞察

2024年,受智慧型手機、平板電腦和顯示器大規模生產推動,中國玻璃基板市場佔據亞太地區最大收益份額。中國積極推動半導體自給自足,並擴大光電製造規模,正推動優質玻璃基板的需求。憑藉強大的國內供應商和政府對技術發展的激勵措施,中國在產量和產能擴張方面繼續引領區域成長。

玻璃基板市場佔有率

玻璃基板產業主要由知名公司主導,包括:

- AGC株式會社(日本)

- 肖特(德國)

- AvanStrate Inc.(日本)

- 東旭集團有限公司 (中國)

- 彩虹集團新能源有限公司 (中國)

- TECNISCO株式會社(日本)

- 康寧公司(美國)

- 日本電氣硝子株式會社(日本)

- 豪雅株式會社(日本)

- Plan Optik AG(德國)

- Ohara公司(日本)

全球玻璃基板市場最新動態

- 2024年4月,AGC株式會社鹿島工廠生產的建築浮法玻璃獲得了SuMPO認證的環境產品聲明 (EPD)。該聲明旨在幫助買家更透明地評估環境影響,並支持其符合LEED等綠建築標準。 AGC秉承其減少環境影響的中期目標,強化了其綠色採購策略,從而提升了建築業的成長機會。

- 2024年1月,肖特擴大了與Lumus的合作,以滿足日益增長的擴增實境 (AR) 眼鏡需求。肖特馬來西亞工廠的擴建將支持Lumus Z-Lens波導技術的生產。此次合作旨在簡化AR開發從原型設計到量產的整個流程,使AR眼鏡更加普及,並增強肖特在消費性電子產品領域的影響力。

- 2023年5月,康寧公司宣布全球顯示器玻璃基板價格調高20%,以因應能源和原物料成本飆升。這項策略性定價措施旨在在通膨環境下保持獲利能力,並充分利用顯示器玻璃日益增長的需求。此次價格調整將使康寧在復甦的電子產業中繼續保持市場領先地位並實現收入成長。

- 2023年4月,蕭特在上海AWE 2023展會上推出了創新廚房解決方案,包括易於維護的CleanPlus塗層和用於先進爐具設計的CERAN Luminoir等功能。這些產品獲得了行業認可,體現了肖特對智慧廚房創新的專注,並增強了其在家電市場的競爭力。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。