Global Glycerin Market

市场规模(十亿美元)

CAGR :

%

USD

3.21 Million

USD

5.68 Million

2024

2032

USD

3.21 Million

USD

5.68 Million

2024

2032

| 2025 –2032 | |

| USD 3.21 Million | |

| USD 5.68 Million | |

|

|

|

|

全球甘油市場細分,依等級(精煉甘油、原油)、來源(植物油、生質柴油、動物脂肪、合成甘油)、應用(製藥、個人護理和化妝品、食品和飲料、工業)和最終用途行業(醫療保健、化學、個人護理、汽車)劃分-行業趨勢及預測(至2032年)

甘油市場規模

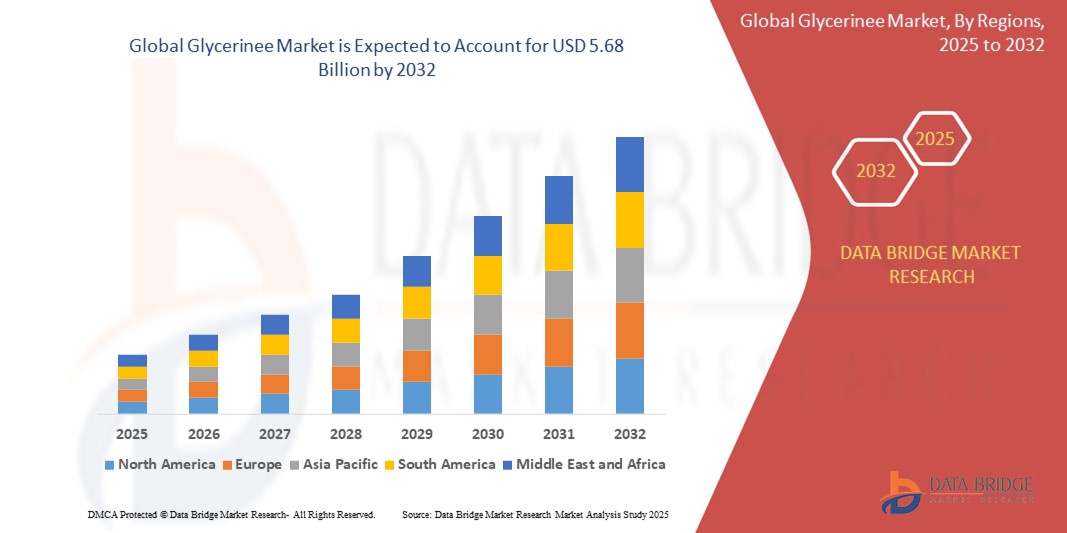

- 2024 年全球甘油市場規模價值 32.1 億美元,預計到 2032 年將達到 56.8 億美元,預測期內複合年增長率為 7.20%。

- 這種增長歸因於個人護理和化妝品、製藥和加工食品行業的需求不斷增長,以及生物柴油的利用率不斷提高,從而提高了甘油作為副產品的可用性。

甘油市場分析

- 甘油,又稱丙三醇,是一種多元醇化合物,因其保濕劑、溶劑和甜味劑的特性而廣泛使用。它在醫療保健、化妝品、食品飲料和化學品等一系列行業的製造過程中發揮關鍵作用。

- 由於健康和衛生意識的增強、對植物成分的需求不斷增長以及生物基化學製造的使用不斷增加,市場正在經歷強勁增長。

- 精製甘油預計將佔據市場主導地位,佔據超過 62.75% 的市場份額,這得益於其高純度和在藥品和個人護理配方中的廣泛應用。

- 由於食品、化妝品和醫療保健領域中天然和可持續成分的趨勢日益增長,預計植物油基甘油將引領市場。

- 個人護理和化妝品應用領域預計將保持其主導地位,市場份額超過 33.40%,因為它具有保濕、乳化和皮膚調理特性,廣泛用於乳霜、乳液和口腔護理產品。

- 預計亞太地區將佔據甘油市場的 38.91% 份額,這得益於充足的原材料供應、不斷增長的人口以及個人護理、食品和製藥行業的強勁需求。

- 預計北美將成為預測期內成長最快的地區,這得益於對天然成分的需求不斷增長、製藥和食品製造業的擴張以及鼓勵採用生物基化學品的有利監管標準。

報告範圍和甘油市場細分

|

屬性 |

甘油市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

甘油市場趨勢

“生物基和藥用級甘油需求激增”

- 全球甘油市場的主要趨勢之一是對生物基和藥用級甘油的需求不斷增長。這一趨勢主要源自於製藥、個人照護、食品飲料等產業對天然和再生原料的日益青睞。

- 例如,嘉吉公司和豐益國際等公司正在擴大其生物基甘油產品組合,以滿足化妝品和製藥製造商尋求更安全、更永續成分的日益增長的需求。

- 由於精製高純度甘油在口腔護理產品、止咳糖漿和靜脈注射藥物中的應用日益廣泛,其需求也不斷增長。隨著成分安全性和永續性監管標準日益嚴格,製造商正致力於開發USP級和EP級甘油,以滿足品質基準。

- 此外,生物燃料產業的成長也產生了大量的粗甘油,這些甘油正在被精煉並重新用於高價值應用,從而強化了循環經濟模式。隨著各行各業採用更清潔和可再生的投入,預計生物基甘油的需求在預測期內將進一步增長。

甘油市場動態

司機

“製藥和個人護理行業應用日益增加”

- The growing use of Glycerine in pharmaceutical and personal care applications is a major driver of market growth. Glycerine’s non-toxic, moisturizing, and solvent properties make it highly valuable in products such as toothpaste, skin creams, cough syrups, and wound care formulations.

- This trend is particularly prominent in the pharmaceutical industry, where Glycerine is used as a humectant and excipient in drug formulations due to its compatibility with active pharmaceutical ingredients and its ability to enhance shelf-life and efficacy.

- In the personal care segment, consumers’ increasing demand for clean-label and plant-based products is accelerating the use of Glycerine in skincare and hygiene products.

- For instance, Godrej Industries and Croda International have developed Glycerine-based ingredients tailored for sensitive-skin personal care products, catering to evolving consumer preferences.

- As global awareness about ingredient safety, product efficacy, and sustainability grows, pharmaceutical and personal care manufacturers are increasingly incorporating high-purity Glycerine into their formulations, fueling strong demand across developed and emerging markets alike.

Restraint/Challenge

“Fluctuations in Raw Material Supply and Glycerine Prices”

- Volatility in the supply of raw materials used in biodiesel and oleochemical production presents a significant challenge for the Glycerine market. Since Glycerine is largely derived as a byproduct from biodiesel and fatty acid production, any disruption in these upstream sectors can directly impact Glycerine availability and pricing.

- The market is also influenced by inconsistent crude Glycerine quality from biodiesel plants, which adds to purification costs and affects downstream applications requiring high-purity grades.

- For instance, during periods of lower biodiesel production due to feedstock shortages or policy changes, Glycerine supply tightens, leading to price spikes and limiting availability for industries such as food, personal care, and pharmaceuticals.

- Additionally, the rising cost of refining technology required to convert crude Glycerine into pharmaceutical or food-grade Glycerine poses challenges for smaller manufacturers and cost-sensitive regions.

- These fluctuations in supply and pricing create uncertainty and may hinder long-term planning and procurement strategies, especially for manufacturers dependent on stable input costs and consistent quality.

Glycerinee Market Scope

The Glycerine market is segmented on the basis of grade, source, application, and end-use industry.

- By Type

On the basis of grade, the Glycerine market is segmented into Refined and Crude. The refined Glycerine segment is expected to dominate the market with the largest revenue share of 64.7% in 2025. This dominance is due to its widespread use in high-value applications such as pharmaceuticals, personal care products, and food & beverages, where high-purity standards and compliance with pharmacopeial regulations are essential. Refined Glycerine offers superior quality, low toxicity, and excellent compatibility with other formulation ingredients, making it indispensable in sensitive applications.

However, the crude Glycerine segment is projected to grow with the highest CAGR of 6.91% during the forecast period of 2025–2032. This growth is driven by its increasing use in industrial applications such as animal feed, biogas production, and chemical intermediates, especially in cost-sensitive markets where purity requirements are less stringent and operational efficiency is a key focus.

- By Source

Based on source, the market is segmented into Vegetable Oils, Biodiesel, Animal Fat, and Synthetic. The vegetable oils segment is expected to hold the largest market share of 48.3% in 2025, attributed to its clean-label appeal and alignment with consumer preferences for natural and sustainable inputs. Vegetable-oil-derived Glycerine is widely used in pharmaceutical and personal care applications due to its renewable origin, high purity, and low allergenicity.

On the other hand, the biodiesel segment is anticipated to witness the highest CAGR of 7.15% during the forecast period. This growth is supported by the expanding biodiesel production across major economies, particularly in Europe, Southeast Asia, and North America, resulting in increased availability of crude Glycerine as a byproduct. With advancements in refining technologies, more of this byproduct is being upgraded to pharmaceutical and industrial-grade Glycerine, creating a cost-effective supply stream for various downstream applications.

- By Application

On the basis of application, the Glycerine market is segmented into Pharmaceuticals, Personal Care & Cosmetics, Food & Beverages, and Industrial. The personal care & cosmetics segment is expected to lead the market in 2025 with a share of 29.4%, driven by its intensive use as a humectant, moisturizer, and emulsifier in skincare, oral care, and hair care products. The rise in demand for clean-label, plant-based, and skin-friendly cosmetic formulations is further boosting the segment.

Meanwhile, the pharmaceuticals segment is forecasted to record the highest CAGR of 7.23% during 2025–2032. This is due to growing consumption of Glycerine in cough syrups, capsule formulations, and wound care solutions, coupled with regulatory support for the use of non-toxic excipients and increased investment in health infrastructure globally.

- By End-Use Industry

The end-use industry segmentation includes Healthcare, Chemical, Personal Care, and Automotive. In 2025, the personal care industry is anticipated to dominate the market, accounting for the largest revenue share of 33.6%. Glycerine’s wide functionality, biocompatibility, and regulatory acceptance have made it a key ingredient in a range of personal hygiene and cosmetic products, including lotions, shaving creams, and deodorants.

However, the healthcare segment is expected to witness the fastest growth over the forecast period, with a projected CAGR of 7.35%. This growth is driven by the increasing use of Glycerine in medical formulations, topical treatments, and nutraceuticals, especially amid rising health awareness and pharmaceutical production in emerging economies.

Global Glycerinee Market Regional Analysis

- North America Glycerinee Market Insight

North America accounts for a significant share of the global Glycerine market, contributing 28.4% of the total revenue in 2025, driven by mature demand across pharmaceuticals, personal care, and food & beverage industries. The region’s strict quality regulations and preference for high-purity, sustainable ingredients support widespread use of refined Glycerine in both consumer and industrial products.

Increasing demand for bio-based products and advancements in chemical manufacturing technologies further bolster the growth of Glycerine in this region.

- U.S. Glycerinee Market Insight

The U.S. leads the North American Glycerine market, accounting for the majority share in 2025, supported by its dominant pharmaceutical and personal care sectors. The rise in health-conscious consumer trends, coupled with the demand for natural and non-toxic ingredients, is boosting Glycerine usage in cough syrups, skincare products, and functional foods. Additionally, the U.S. is a major producer of biodiesel, providing an abundant supply of crude Glycerine for industrial upgrading.

- Canada Glycerinee Market Insight

Canada’s Glycerine market is growing steadily, driven by the expansion of the personal care and food processing sectors. Increasing demand for clean-label and sustainable products has encouraged the adoption of vegetable-based Glycerine in cosmetics, moisturizers, and dietary supplements. Regulatory alignment with the U.S. and ongoing innovation in specialty chemicals support the country’s role in North America’s Glycerine value chain.

Europe Glycerinee Market Insight

The Europe Glycerine market is expected to grow at a CAGR of 6.78% during the forecast period of 2025–2032, supported by strong demand in pharmaceutical formulations, eco-friendly personal care products, and food-grade applications. The region’s robust regulatory framework and circular economy initiatives are accelerating the shift toward bio-based and sustainable ingredients. Europe’s extensive biodiesel production also ensures a stable supply of crude Glycerine for refining.

- Germany Glycerinee Market Insight

德國憑藉其先進的製藥和化妝品行業,仍然是歐洲甘油的重要市場。德國高度重視研發、永續發展和產品安全,增加了高純度甘油在局部治療、口腔護理和食品領域的應用。此外,德國在綠色化學和工業生物技術領域的領先地位也為甘油衍生物的創新提供了支持。

- 法國甘油市場洞察

法國甘油市場正穩步成長,這得益於有機化妝品、營養保健品和健康產品消費的成長。政府對生物經濟發展的支持以及消費者對天然成分的需求,正在激發人們對植物油提取甘油的興趣。製藥業的蓬勃發展以及道德美容品牌的興起也助長了市場的發展動能。

亞太甘油市場洞察

亞太地區佔據全球甘油市場的主導地位,2025年其收入份額最高,達39.6%,預計2025年至2032年期間的複合年增長率將達到8.45%。新興經濟體的快速工業化、城鎮化和人口成長,推動了食品飲料、個人護理和工業應用領域對甘油的需求。良好的生產經濟效益、不斷壯大的中產階級以及消費者對產品品質意識的不斷提升,共同推動了該地區的蓬勃發展。

- 中國甘油市場洞察

中國在亞太甘油市場中佔最大份額,這得益於其廣大的製藥、化妝品和食品加工產業。國內生質柴油基粗甘油供應充足,且出口導向產能強勁,是其關鍵優勢。政府支持的改善醫療保健可及性和推廣綠色化學品的舉措,進一步支持了甘油基配方的採用。

- 印度甘油市場洞察

印度甘油市場預計將大幅成長,這得益於個人護理、食品和製藥行業日益增長的需求。阿育吠陀和保健產品中對天然和永續成分的追求,正推動精製甘油的廣泛使用。此外,印度不斷增長的生物柴油產量以及特種化學品製造業的外商投資,也為甘油供應和下游整合創造了新的機會。

甘油市場參與者

甘油產業主要由知名公司主導,包括:

- 寶潔化工(美國)

- KLK OLEO(馬來西亞)

- 金剛砂油脂化學品(馬來西亞)

- 嘉吉公司(美國)

- Godrej Industries(印度)

- IOI Oleochemicals(馬來西亞)

- 豐益國際(新加坡)

- Aemetis Inc.(美國)

- 雷普索爾公司(西班牙)

- 艾薇兒集團(法國)

- 萬斯集團有限公司(新加坡)

- 春金控股(新加坡)

- Croda International Plc(英國)

- Vantage Specialty Chemicals Inc.(美國)

- 坂本藥品工業株式會社(日本)

全球甘油市場最新動態

- 2025年2月,Emery Oleochemicals宣布擴建其位於俄亥俄州辛辛那提工廠的技術級甘油產能,以滿足日益增長的工業和化學應用需求。此擴建旨在提升Emery在北美的供應可靠性,並鞏固其在樹脂、防凍劑和潤滑劑等下游領域的市場地位。甘油在這些領域被廣泛用作保濕劑和溶劑。

- 2024年10月,KLK OLEO 推出了一系列以永續植物油為原料的全新藥用和食品級甘油,並以「Olebased PureGlyc」品牌命名。這項創新符合日益增長的監管要求和消費者對健康和營養產品中可追溯、非基因改造和 RSPO 認證原料的偏好,鞏固了 KLK 在甘油市場對道德採購和高純度標準的承諾。

- 2024年5月,Godrej Industries擴大了其在印度的甘油產能,瞄準印度國內和東南亞市場,提供用於個人護理、口腔衛生和食品應用的精製甘油。此次擴張旨在滿足該地區對生物基和清真認證原料日益增長的需求,鞏固Godrej在亞洲加值油脂化學領域的策略性成長。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。