Global Hexamethylenediamine Market

市场规模(十亿美元)

CAGR :

%

USD

122.04 Million

USD

174.22 Million

2024

2032

USD

122.04 Million

USD

174.22 Million

2024

2032

| 2025 –2032 | |

| USD 122.04 Million | |

| USD 174.22 Million | |

|

|

|

|

Global Hexamethylenediamine Market Segmentation, By Application (Nylon Synthesis, Curing Agents, Water Treatment Chemicals, Chemical Synthesis, Medical Applications, Adhesives, and Others), End User (Automotive, Textile, Paints and Coatings, Petrochemical, and Others) - Industry Trends and Forecast to 2032

Hexamethylenediamine Market Size

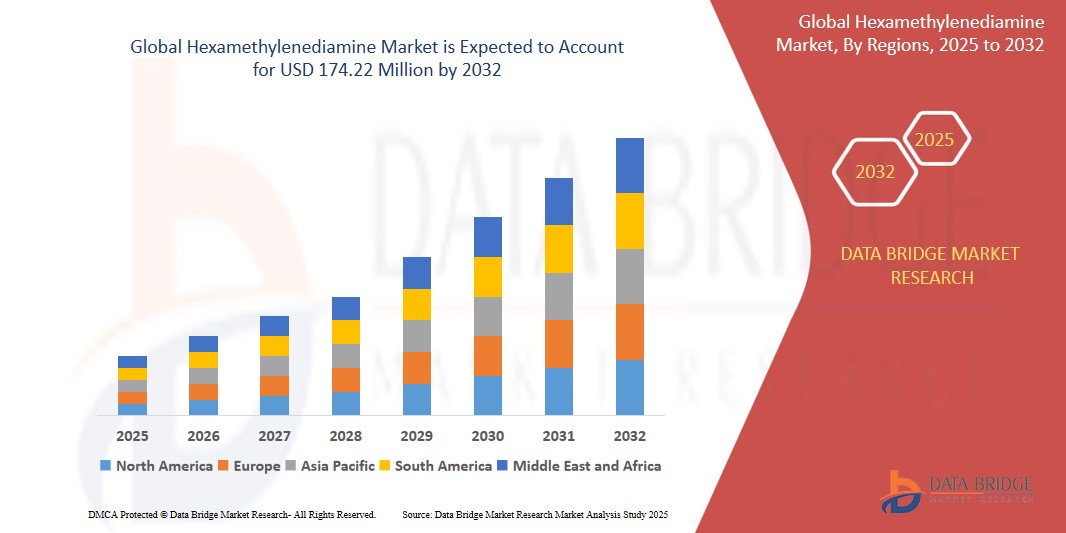

- The global Hexamethylenediamine market was valued atUSD 122.04 Million in 2024 and is expected to reachUSD 174.22 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.6%, primarily driven by the increasing demand for nylon 6,6

- This growth is driven by increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

Hexamethylenediamine Market Analysis

- Hexamethylenediamine (HMDA) is widely used in the production of nylon, coatings, and adhesives. The demand for these applications in automotive, textiles, and construction industries is driving growth in the global HMDA market.

- With increasing environmental regulations, there is a growing focus on developing bio-based or sustainable production methods for HMDA. Companies are investing in green technologies to meet sustainability targets and appeal to eco-conscious consumers.

- Rapid industrialization in emerging economies, particularly in Asia Pacific, has led to increased demand for hexamethylenediamine, especially in the automotive and textile sectors. This region is expected to contribute significantly to the global market expansion.

Report Scope and Hexamethylenediamine Market Segmentation

|

Attributes |

Hexamethylenediamine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hexamethylenediamine Market Trends

“Rising Demand for Bio-Based Hexamethylenediamine”

- The global shift towards sustainable and eco-friendly products is propelling the demand for bio-based HMDA.

- Consumers and industries alike are seeking greener alternatives, leading to increased interest in renewable HMDA sources.

- Major chemical companies are forming strategic partnerships to develop and commercialize bio-based HMDA.

- Innovations in biotechnology are enabling more efficient and cost-effective production of bio-based HMDA.

- For instance, Asahi Kasei and Genomatica have collaborated to produce renewably-sourced nylon 6,6 using bio-based HMDA

- The increasing demand for bio-based HMDA is a significant trend in the global market, driven by sustainability goals, industry collaborations, technological innovations, and supportive regulations. This trend is expected to continue, shaping the future of HMDA production and application.

Hexamethylenediamine Market Dynamics

Driver

“Increasing Demand for Nylon 6,6”

- The automotive sector is increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

- This shift aims to enhance fuel efficiency and reduce emissions, thereby boosting HMDA demand.

- Nylon 6,6 fibers are favored in the textile industry for their strength, durability, and resistance to abrasion.

- The growing demand for high-quality textiles in clothing, home furnishings, and technical applications is driving the need for HMDA.

- For instance, Companies like Ford and BMW have been increasingly using nylon 6,6 components to reduce vehicle weight and improve fuel efficiency, replacing heavier metal parts with durable, lighter nylon-based parts.

- The multifaceted applications of nylon 6,6 across various industries underscore the critical role of HMDA as a foundational chemical, positioning it as a key driver in the global market's growth trajectory.

Opportunity

“Increasing Application in High-Performance Coatings and Adhesives Across Various Industries”

- HMDA-based epoxy curing agents are gaining traction due to their ability to enhance the durability and corrosion resistance of coatings, making them ideal for construction and industrial applications.

- Innovations in epoxy resin formulations have improved the performance of HMDA-based adhesives, offering better mechanical properties and chemical resistance, which are essential for demanding applications.

- The automotive and aerospace sectors are increasingly adopting HMDA-based coatings and adhesives for lightweight and high-strength bonding solutions, contributing to fuel efficiency and performance.

- HMDA-based products are being developed to meet stringent environmental regulations, including low volatile organic compound (VOC) emissions, aligning with global sustainability goals.

- For instance, Companies like Huntsman Corporation and Evonik Industries have developed epoxy curing agents based on HMDA derivatives (like IPDA – isophorone diamine) for industrial floor coatings and protective marine coatings, offering high chemical resistance and durability.

- The expanding use of HMDA in advanced coatings and adhesives presents a significant growth opportunity, driven by technological advancements and the demand for high-performance, sustainable solutions across multiple industries.

Restraint/Challenge

“Volatility in Raw Material Prices”

- Regulatory bodies like the FDA and EMA require detailed justification for the inclusion of excipients in pharmaceutical formulations. This includes demonstrating safety, efficacy, and necessity, which can be time-consuming and resource-intensive for manufacturers.

- The rigorous standards set by regulatory agencies have led to a shortage of FDA-approved manufacturing sites for sugar-based excipients.

- This limitation restricts production capacity and can delay the introduction of new products to the market.

- Manufacturers must adhere to strict quality control procedures to ensure product consistency and safety. These demands can increase operational costs and require significant investment in quality assurance infrastructure.

- Navigating the complex regulatory landscape is a major challenge for the sugar-based excipients market. While these regulations are essential for ensuring product safety and efficacy, they can also impede market growth and innovation.

Hexamethylenediamine Market Scope

The market is segmented on the basis of application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By End User |

|

Hexamethylenediamine Market Regional Analysis

“North America is the Dominant Region in the Hexamethylenediamine Market ”

- North America dominates the hexamethylenediamine market, driven by its strong automotive, construction, and textile industries, which drive high demand for nylon 66, a major application

- U.S. holds a significant share due to advanced chemical manufacturing infrastructure, abundant raw materials, and significant investments in research and development, supporting consistent production and innovation in hexamethylenediamine applications.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the hexamethylenediamine market, driven by increasing demand for HMDA in nylon production and polymer applications

- China is growing with highest CAGR in the region due to affordable labor, access to raw materials, and strategic investments by global players further bolster regional growth

Hexamethylenediamine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Asahi Kasei Corporation (Japan)

- Solvay (Belgium)

- Ashland (U.S.)

- Merck KGaA (Germany)

- DuPont (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- INVISTA (U.S.)

- Radici Partecipazioni SpA (Italy)

- DAEJUNGCHE CHEMICAL & METALS CO., LTD. (South Korea)

- Genomatica, Inc (U.S.)

- Junsei Chemical Co.,Ltd. (Japan)

- Suzhou Sichang Learning Technology Co., Ltd. (China)

- Alfa Aesar, Thermo Fisher Scientific (U.S.)

- Eastman Chemical Company (U.S.)

- Arkema (France)

- Ascend Performance Materials (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Huntsman International LLC (U.S.)

Latest Developments in Global Hexamethylenediamine Market

- In March 2025, DOMO Chemicals announced it would cease production of hexamethylene diamine (HMD) and base polyamide 66 (PA66) at its Belle-Etoile facility in Saint-Fons, France, to focus on downstream processes and engineered materials. The closure is in response to tough market conditions in the polyamide sector, including rising costs and lower demand. Production of PA66 will continue at the company’s Blanes, Spain, and Valence, France, sites. The shutdown is expected to be completed by summer 2025, although DOMO Chemicals has not yet issued an official statement.

- In February 2025, Fujian Haichen Chemical Co., Ltd. marked the inauguration of the gasification purification section of its 400,000-ton annual adiponitrile production and raw material support project at the Gulei Petrochemical Base in Zhangzhou. This event signifies the transition of the project into its construction phase, following an investment of USD 2.02 billion. The project will utilize coal as its primary raw material and establish a full production chain that includes ethylene cracking, butadiene, adiponitrile, hexamethylenediamine, and nylon 66, enhancing the resource distribution of Fujian Energy and Chemical Group.

- In March 2022, Asahi Kasei Corporation formed a partnership with Genomatica Inc. to commercialize renewable nylon 6.6 derived from bio-based hexamethylenediamine building blocks. This collaboration is intended to further strengthen Asahi Kasei's position in the market.

- In January 2022, BASF SE announced plans to build a new hexamethylenediamine plant in Chlaampe, France. This facility will increase BASF's annual production capacity of hexamethylenediamine to 260,000 metric tons, with production expected to begin in 2024.

- In October 2024, Ascend Performance Materials celebrated the opening of its hexamethylene diamine (HMD) plant in Lianyungang, China, with a ribbon-cutting ceremony attended by government officials, customers, and suppliers. This marks Ascend's first chemical production site and its largest investment outside the U.S. The plant’s capacity increases the company’s total HMD output by about 50%, complementing its two existing plants in Decatur, Alabama, and Pensacola, Florida. HMD is a key ingredient in polyamide 66 production, and the plant will also manufacture Ascend’s FlexaTram specialty amines, used in industries like coatings, pharmaceuticals, and oil and gas.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。