Global High Performance Coatings Market

市场规模(十亿美元)

CAGR :

%

USD

113.88 Billion

USD

167.74 Billion

2024

2032

USD

113.88 Billion

USD

167.74 Billion

2024

2032

| 2025 –2032 | |

| USD 113.88 Billion | |

| USD 167.74 Billion | |

|

|

|

|

全球高性能塗料市場細分,按類型(環氧樹脂、矽樹脂、聚酯、丙烯酸、醇酸樹脂、聚氨酯、含氟聚合物、陶瓷等)、塗料技術(溶劑型、水基、粉末型和紫外線固化)、噴塗技術(熱噴塗、化學氣相沉積 (CVD)、物理氣相沉積(CVD)、溶膠-凝膠等)、最終用戶產業(一般工業、防護、包裝、線圈、鐵路、建築、汽車和運輸、工業木材、航空航太和國防、海洋等) - 產業趨勢和預測到 2032 年。

高性能塗料市場規模

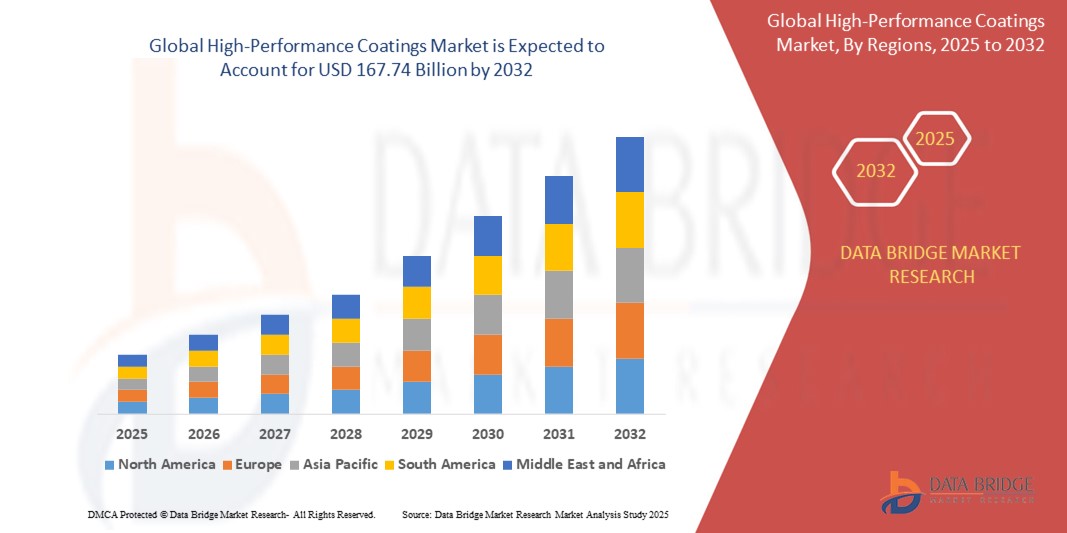

- 2024 年全球高性能塗料市場規模為1,138.8 億美元 ,預計 到 2032 年將達到 1,677.4 億美元,預測期內 複合年增長率為 4.96%。

- 市場成長主要受各行各業對耐用、耐腐蝕、環保塗料需求的不斷增長以及塗料技術的進步所驅動

- 工業化進程加快、基礎設施建設發展以及嚴格的環境法規推動了環保塗料的發展,進一步加速了市場擴張,使高性能塗料成為工業和商業應用的首選解決方案

高性能塗料市場分析

- 高性能塗料以其卓越的耐用性、耐化學性和美觀性而聞名,對於保護汽車、航空航太、船舶和建築等行業嚴苛環境下的表面至關重要

- 工業化進程的加速、對永續和高品質塗料的需求不斷增長,以及水性和紫外線固化系統等塗料技術的進步,推動了市場的發展

- 亞太地區在高性能塗料市場佔據主導地位,2024 年其收入份額最高,為 45.3%,這得益於快速的工業化、基礎設施的發展以及強大的製造業基礎,尤其是在中國、印度和日本

- 預計北美將成為預測期內成長最快的地區,這得益於技術進步、航空航太和國防投資的增加以及環保塗料解決方案的轉變

- 2024年,環氧樹脂佔據了最大的市場收入份額,達32%,這得益於其卓越的耐久性、耐腐蝕性和在工業應用中的多功能性。它在基礎設施和重型機械防護塗層中的廣泛應用鞏固了其主導地位。

報告範圍和高性能塗料市場細分

|

屬性 |

高性能塗料關鍵市場洞察 |

|

涵蓋的領域 |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

High-Performance Coatings Market Trends

“Increasing Adoption of Eco-Friendly and Sustainable Coating Solutions”

- The global high-performance coatings market is experiencing a notable trend toward the integration of eco-friendly and sustainable coating technologies

- Advanced formulations, such as water-based and UV-cured coatings, are gaining traction due to their low volatile organic compound (VOC) emissions and reduced environmental impact

- These technologies enable enhanced durability, corrosion resistance, and aesthetic appeal, meeting stringent regulatory requirements and consumer demand for sustainability

- For instance, companies are developing bio-based and recyclable coatings to cater to industries such as automotive, aerospace, and construction, where environmental compliance is critical

- This trend is enhancing the market’s appeal by aligning with global sustainability goals, making high-performance coatings more attractive to environmentally conscious industries and consumers

- Innovations in coating technologies, such as self-healing and anti-microbial coatings, are further improving performance and expanding applications across diverse end-user industries

High-Performance Coatings Market Dynamics

Driver

“Growing Demand for Durable and High-Quality Coatings across Industries”

- The rising need for coatings that offer superior protection, durability, and aesthetic qualities in industries such as automotive, aerospace, construction, and marine is a key driver for the high-performance coatings market

- High-performance coatings enhance surface resistance to corrosion, abrasion, and extreme weather conditions, extending the lifespan of components and structures

- Stringent government regulations, particularly in regions such as Europe and North America, mandating low-VOC and sustainable coatings are accelerating market growth

- The proliferation of advanced manufacturing technologies and the adoption of Industry 4.0 practices are enabling the development of high-performance coatings with improved application efficiency and performance

- Manufacturers are increasingly incorporating high-performance coatings as standard solutions to meet industry standards and enhance product value in competitive markets

Restraint/Challenge

“High Costs of Advanced Coating Technologies and Regulatory Compliance”

- The significant initial investment required for research, development, and application of high-performance coatings, such as fluoropolymer and ceramic coatings, can be a barrier, particularly for small and medium-sized enterprises in emerging markets

- The complexity of applying advanced coating technologies, such as thermal spray or chemicals vapor deposition (CVD), increases implementation costs

- In addition, stringent regulations on VOC emissions and hazardous material usage pose challenges, as manufacturers must invest in compliant formulations and processes, increasing operational costs

- The fragmented regulatory landscape across regions regarding environmental standards and safety requirements complicates operations for global manufacturers and service providers

- These factors can deter adoption in cost-sensitive markets and limit market expansion, particularly in regions with lower awareness of advanced coating benefits or high price sensitivity

High-Performance Coatings market Scope

The market is segmented on the basis of type, coating technology, spray technology, and end-user industry.

- By Type

On the basis of type, the market is segmented into epoxy, silicon, polyester, acrylic, alkyd, polyurethane, fluoropolymer, ceramic, and others. The epoxy segment held the largest market revenue share of 32% in 2024, driven by its superior durability, corrosion resistance, and versatility across industrial applications. Its widespread use in protective coatings for infrastructure and heavy machinery supports its dominance.

The polyurethane segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-performance coatings with excellent weatherability, flexibility, and aesthetic appeal in automotive, aerospace, and construction industries. Advancements in eco-friendly polyurethane formulations further accelerate adoption.

- By Coating Technology

On the basis of coating technology, the market is segmented into solvent-based, water-based, powder-based, and UV-cured. The solvent-based segment is expected to hold the largest market revenue share of 45% in 2024, owing to its established use in high-performance applications requiring robust adhesion and chemical resistance. Its widespread adoption in industrial and automotive sectors drives its dominance.

The water-based segment is anticipated to experience the fastest growth rate of 18.5% from 2025 to 2032, driven by stringent environmental regulations promoting low-VOC coatings and growing consumer preference for sustainable solutions. Water-based coatings offer comparable performance with reduced environmental impact, boosting their adoption across industries.

- By Spray Technology

On the basis of spray technology, the market is segmented into thermal spray coating, chemical vapor deposition (CVD), physical vapor deposition (PVD), sol-gel, and others. The thermal spray coating segment is expected to hold the largest market revenue share of 38% in 2024, driven by its ability to provide high-performance coatings with excellent wear and corrosion resistance for demanding applications in aerospace, automotive, and industrial sectors.

The sol-gel segment is projected to witness significant growth from 2025 to 2032, attributed to its ability to produce thin, high-quality coatings with enhanced durability and thermal stability. Its increasing use in advanced applications, such as electronics and aerospace, supports its growth.

- By End-User Industry

On the basis of end-user industry, the market is segmented into general industrial, protective, packaging, coil, rail, building and construction, automotive and transportation, industrial wood, aerospace and defense, marine, and others. The protective segment dominated the market revenue share of 40% in 2024, driven by the critical need for corrosion-resistant and durable coatings in infrastructure, oil and gas, and heavy machinery industries.

The automotive and transportation segment is expected to witness rapid growth of 20.1% from 2025 to 2032, fueled by increasing demand for high-performance coatings that enhance vehicle durability, aesthetics, and resistance to environmental factors. The rise in electric vehicle production and advancements in coating technologies further drive growth.

High-Performance Coatings Market Regional Analysis

- Asia-Pacific dominated the high-performance coatings market with the largest revenue share of 45.3% in 2024, driven by rapid industrialization, infrastructure development, and a robust manufacturing base, particularly in China, India, and Japan

- Consumers prioritize high-performance coatings for enhanced durability, corrosion resistance, and aesthetic appeal, particularly in harsh environmental conditions across various industries

- Growth is supported by advancements in coating technologies, such as water-based and UV-cured formulations, alongside rising adoption in OEM and aftermarket applications across multiple end-user industries

U.S. High-Performance Coatings Market Insight

The U.S. expected to be the fastest growing region in the smart high-performance coatings market, fueled by robust demand in automotive, aerospace, and general industrial applications. Increasing adoption of advanced coating types such as fluoropolymer and ceramic, coupled with a focus on energy-efficient and sustainable solutions, supports market growth. The trend toward customized coatings and regulatory compliance for environmental safety enhances both OEM and aftermarket segments.

Europe High-Performance Coatings Market Insight

The Europe high-performance coatings market is experiencing steady growth, supported by a strong emphasis on sustainability and innovation in industries such as automotive, marine, and building and construction. Consumers seek coatings that offer superior protection and energy efficiency while meeting strict regulatory standards. Countries such as Germany and the U.K. show significant uptake due to advanced manufacturing and environmental concerns.

U.K. High-Performance Coatings Market Insight

The U.K. market for high-performance coatings is expected to witness significant growth, driven by demand for durable and aesthetically appealing coatings in urban construction and automotive sectors. Increased awareness of corrosion resistance and sustainability benefits encourages adoption. Evolving regulations promoting eco-friendly coating technologies, such as water-based and UV-cured systems, influence consumer preferences and market trends.

Germany High-Performance Coatings Market Insight

由於先進的製造能力以及對汽車、航空航太和工業應用領域高品質塗料的專注,德國預計將迎來高性能塗料市場的快速成長。德國消費者更青睞聚氨酯和環氧樹脂等技術先進的塗料,這些塗料不僅耐用性更強,還能減少對環境的影響。高階產品和售後解決方案的整合有助於持續拓展市場。

亞太高性能塗料市場洞察

亞太地區佔據全球高性能塗料市場的最大份額,這得益於中國、印度和日本等國家汽車、建築和工業產業的蓬勃發展。可支配收入的提高、城鎮化進程的推進以及人們對塗料防護和美觀意識的不斷提升,進一步推動了高性能塗料的需求。政府推廣永續和節能技術的措施進一步加速了先進塗料的普及。

日本高性能塗料市場洞察

日本高性能塗料市場預計將迎來快速成長,這得益於消費者對高品質、技術先進、能夠提升耐用性和性能的塗料的強烈偏好。大型汽車和電子產品製造商的入駐,以及塗料在原廠設備製造商 (OEM) 應用中的集成,推動了市場滲透率的提升。消費者對永續售後市場解決方案的興趣日益濃厚,也促進了市場的成長。

中國高性能塗料市場洞察

受快速城鎮化、工業產出成長以及防護和裝飾塗料需求成長的推動,中國在亞太高性能塗料市場佔據主導地位。中國不斷壯大的中產階級和對智慧製造的重視,推動了粉末塗料和紫外光固化塗料等先進塗料技術的採用。強大的國內生產能力和極具競爭力的價格提升了市場准入。

高性能塗料市場份額

高性能塗料產業主要由知名公司主導,其中包括:

- 贏創工業股份公司(德國)

- 阿爾諾石油公司(美國)

- 科騰公司(美國)

- 巴斯夫(德國)

- 嘉吉公司(美國)

- 伊士曼化學公司(美國)

- 寶潔(美國)

- Godrej & Boyce 製造公司有限公司 (印度)

- PPG工業俄亥俄公司(美國)

- Emery Oleochemicals(美國)

- PTT全球化學公共有限公司(泰國)

- Jet-Hot, Inc.(美國)

- 工業控制發展公司(美國)

- SPI 高性能塗料(美國)

- EverCoat Industries Sdn Bhd(馬來西亞)

全球高性能塗料市場的最新發展是什麼?

- 2024年12月,Rodda Paint Company與Cloverdale集團合作收購了Miller Paint Company,後者是太平洋西北地區享有盛譽的員工持股品牌。此次策略性收購將兩家標誌性塗料製造商強強聯手,提升市場影響力、營運效率和客戶服務。 Rodda Paint旨在傳承Miller Paint的輝煌,同時利用整合後的資源擴展產品線,鞏固業界領先地位。此次合作彰顯了Rodda Paint對品質、創新和社區參與的承諾,確保客戶和員工的無縫過渡。

- 2024年12月,美國工業合作夥伴公司 (AIP) 以5.5億美元完成了對PPG在美國和加拿大建築塗料業務的收購。這家新獨立的公司已更名為匹茲堡塗料公司 (The Pittsburgh Paints Company),以致敬其在塗料行業125年的輝煌歷史。該公司將繼續為專業人士和DIY消費者提供內外牆塗料、著色劑、填縫劑、黏合劑和密封劑。 AIP旨在利用匹茲堡塗料公司強大的品牌組合,加速成長和創新。

- 2024年10月,Sudarshan Chemical Industries Limited (SCIL) 宣布收購 Heubach 集團,旨在打造全球顏料巨頭。這項策略性舉措將 SCIL 的營運專長與 Heubach 的技術能力結合,擴大其產品組合,並在19個國際生產基地拓展市場。此次收購鞏固了 SCIL 在歐洲、美洲和亞太地區的市場地位,確保為各行各業提供高品質的顏料解決方案。在董事總經理 Rajesh Rathi 的領導下,合併後的公司將專注於創新、高效和以客戶為中心的成長。

- 2024年7月,艾仕得塗料系統公司以2.85億美元的價格從Transtar控股公司手中收購了CoverFlexx集團,並根據業績支付了額外的盈利。這項策略措施增強了艾仕得的修補漆產品組合,擴大了其在汽車修補漆和售後市場的應用範圍。 CoverFlexx集團以其底漆、色漆、清漆、氣霧劑和美容產品而聞名,在密西根州和安大略省設有生產基地。艾仕得致力於提升顧客價值,加速塗料產業的成長。

- 2024年5月,阿克蘇諾貝爾推出了Eclipse Gloss TUK™,這是一款創新的補漆套裝,旨在最大限度地減少油漆浪費,同時保持高品質的飾面。這款聚氨酯面漆具有卓越的光澤度、耐污性和柔韌性,確保持久耐用。 Eclipse Gloss TUK™專為高效施工而設計,可增強表面保護,並符合商業外牆的OEM標準。此套裝採用低VOC(揮發性有機化合物)配方,支持環保塗料。阿克蘇諾貝爾對永續性和性能的承諾體現在這款先進的補漆解決方案中。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。