Global High Potency Oncology Api Hpapi Market

市场规模(十亿美元)

CAGR :

%

USD

693.00 Million

USD

1,421.90 Million

2025

2033

USD

693.00 Million

USD

1,421.90 Million

2025

2033

| 2026 –2033 | |

| USD 693.00 Million | |

| USD 1,421.90 Million | |

|

|

|

|

Global High-Potency Oncology API (HPAPI) Market Segmentation, By Product Type (Synthetic HPAPIs and Biotech HPAPIs), Drug Class (Cytotoxic Drugs, Targeted Therapy Drugs, and Hormonal Therapy Drugs), By Potency Level (≤100 µg/g, 100–1000 µg/g, and 1000 µg/g), Application (Chemotherapy, Targeted Cancer Therapy, Antibody-Drug Conjugates (ADCs), and Others)- Industry Trends and Forecast to 2033

High-Potency Oncology API (HPAPI) Market Size

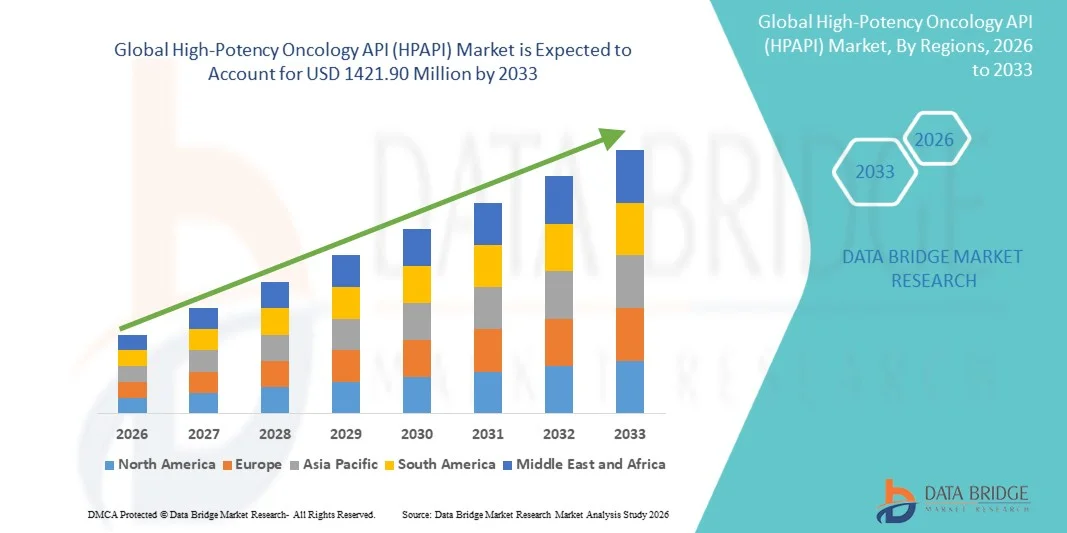

- The global High-Potency Oncology API (HPAPI) market size was valued at USD 693 Million in 2025 and is expected to reach USD 1421.90 Million by 2033, at a CAGR of 9.40% during the forecast period

- The market growth is largely fueled by the rising global burden of cancer and the increasing demand for highly effective and targeted oncology treatments, driving greater adoption of high-potency active pharmaceutical ingredients (HPAPIs) in cancer drug development and manufacturing across both innovator and generic pharmaceutical segments

- Furthermore, growing investments in oncology R&D, expanding pipelines of targeted therapies and antibody-drug conjugates (ADCs), and the need for low-dose, high-efficacy compounds are establishing HPAPIs as critical components of modern cancer therapeutics. These converging factors are accelerating the uptake of High-Potency Oncology API (HPAPI) solutions, thereby significantly boosting the overall market growth

High-Potency Oncology API (HPAPI) Market Analysis

- High-Potency Oncology APIs (HPAPIs), which are highly active pharmaceutical ingredients used in targeted cancer therapies, are becoming increasingly critical in modern oncology drug development due to their high efficacy at low doses, improved therapeutic outcomes, and growing use in advanced formulations such as antibody-drug conjugates (ADCs) and targeted therapies across both clinical and commercial settings

- The escalating demand for HPAPIs is primarily fueled by the rising global cancer burden, rapid expansion of oncology drug pipelines, increasing focus on targeted and personalized medicine, and growing outsourcing of high-potency manufacturing to specialized CDMOs with advanced containment capabilities

- North America dominated the high-potency oncology API (HPAPI) market with the largest revenue share of approximately 41.5% in 2025, supported by a strong biopharmaceutical ecosystem, high oncology R&D spending, early adoption of advanced cancer therapeutics, and the presence of major pharmaceutical companies and specialized HPAPI manufacturers, with the U.S. accounting for the majority of regional demand driven by robust clinical trial activity and ADC development

- Asia-Pacific is expected to be the fastest-growing region in the High-Potency Oncology API (HPAPI) market during the forecast period, registering a strong CAGR due to increasing cancer prevalence, expanding pharmaceutical manufacturing capacity, rising investments in oncology research, and growing adoption of outsourced HPAPI production in countries such as China and India

- The synthetic HPAPIs segment dominated the largest market revenue share of 62.8% in 2025, driven by their extensive use in conventional and targeted oncology drug manufacturing. Synthetic HPAPIs are widely used due to their cost-effectiveness, scalability, and well-established chemical synthesis routes

Report Scope and High-Potency Oncology API (HPAPI) Market Segmentation

|

Attributes |

High-Potency Oncology API (HPAPI) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

High-Potency Oncology API (HPAPI) Market Trends

“Expansion of Specialized Manufacturing and Containment Technologies”

- A significant and accelerating trend in the global high-potency oncology API (HPAPI) market is the increasing focus on specialized manufacturing facilities and advanced containment technologies. Due to the extreme potency and toxicity of these compounds, manufacturers are investing heavily in highly controlled environments to ensure operator safety, regulatory compliance, and product integrity

- For instance, several global contract development and manufacturing organizations (CDMOs) have expanded dedicated HPAPI production lines equipped with isolators and high-containment systems to support the growing oncology drug pipeline

- This reflects the industry’s shift toward safer and more scalable HPAPI manufacturing capabilities

- The trend is further reinforced by the growing adoption of targeted cancer therapies, such as antibody–drug conjugates (ADCs) and cytotoxic small molecules, which rely heavily on high-potency APIs

- In addition, advancements in process automation and closed-system handling are improving manufacturing efficiency while minimizing cross-contamination risks in HPAPI production

- This ongoing evolution toward highly specialized, compliant, and scalable manufacturing infrastructure is reshaping competitive dynamics within the HPAPI market globally

High-Potency Oncology API (HPAPI) Market Dynamics

Driver

“Rising Global Burden of Cancer and Growing Demand for Targeted Therapies”

- The increasing global prevalence of cancer and oncology-related disorders is a primary driver for the high-potency oncology API market

- Pharmaceutical companies are intensifying efforts to develop highly effective, targeted cancer treatments that often require potent active ingredients

- For instance, the continued growth in the development of antibody–drug conjugates and cytotoxic chemotherapy agents has significantly increased demand for HPAPIs used in both clinical and commercial-stage oncology drugs

- Expanding oncology pipelines, supported by increased investment in cancer research and drug development, are accelerating the need for reliable and scalable HPAPI supply chains

- Furthermore, the rise of personalized medicine and precision oncology is driving demand for highly potent APIs that enable selective targeting of cancer cells while minimizing systemic toxicity

- The growing role of CDMOs in outsourcing HPAPI production is also contributing to market growth, as pharmaceutical companies seek specialized expertise and compliant manufacturing capabilities

Restraint/Challenge

“High Manufacturing Costs and Stringent Regulatory Requirements”

- The production of high-potency oncology APIs involves significant capital investment, as manufacturers must comply with strict occupational safety, environmental, and regulatory standards. These requirements increase overall production costs and limit entry for smaller players

- For instance, the need for specialized containment systems, advanced air-handling units, and extensive operator training substantially raises the cost of setting up and maintaining HPAPI manufacturing facilities

- Regulatory scrutiny from authorities such as the FDA and EMA adds further complexity, as manufacturers must demonstrate robust risk mitigation, validation, and quality control processes

- In addition, limited availability of skilled professionals with experience in handling highly potent compounds can constrain manufacturing capacity and scalability

- Overcoming these challenges through process optimization, strategic outsourcing, technological innovation, and regulatory harmonization will be critical to ensuring sustained growth and wider accessibility of high-potency oncology APIs globally

High-Potency Oncology API (HPAPI) Market Scope

The market is segmented on the basis of product type, drug class, potency level, and application.

• By Product Type

On the basis of product type, the High-Potency Oncology API (HPAPI) market is segmented into synthetic HPAPIs and biotech HPAPIs. The synthetic HPAPIs segment dominated the largest market revenue share of 62.8% in 2025, driven by their extensive use in conventional and targeted oncology drug manufacturing. Synthetic HPAPIs are widely used due to their cost-effectiveness, scalability, and well-established chemical synthesis routes. These APIs are commonly applied in cytotoxic chemotherapy agents and small-molecule targeted therapies. Pharmaceutical companies prefer synthetic HPAPIs for large-scale commercial production owing to consistent quality and regulatory familiarity. Mature manufacturing infrastructure further supports adoption. Increasing approvals of oncology drugs containing synthetic HPAPIs drive demand. Strong presence of CMOs specializing in chemical synthesis strengthens supply. Long shelf life and stability also favor this segment. Continuous process optimization improves yield. These factors collectively position synthetic HPAPIs as the dominant product type.

The biotech HPAPIs segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, driven by the rising adoption of biologics and antibody-drug conjugates (ADCs). Biotech HPAPIs are increasingly used in precision oncology and immunotherapy treatments. Growing investments in biologics manufacturing boost market growth. The expansion of monoclonal antibody pipelines accelerates demand. Biotech HPAPIs offer higher target specificity and reduced systemic toxicity. Advancements in recombinant technology support scalability. Increasing regulatory approvals for biologics further fuel growth. Pharmaceutical companies are shifting toward biologically derived HPAPIs. CDMOs are expanding biologics capabilities. These factors establish biotech HPAPIs as the fastest-growing product segment.

• By Drug Class

On the basis of drug class, the High-Potency Oncology API (HPAPI) market is segmented into cytotoxic drugs, targeted therapy drugs, and hormonal therapy drugs. The cytotoxic drugs segment dominated the largest market revenue share of 45.6% in 2025, driven by their long-standing use in cancer treatment across multiple indications. Cytotoxic HPAPIs are widely used in chemotherapy regimens for solid tumors and hematological malignancies. High potency is required to achieve therapeutic efficacy at low doses. Established clinical protocols support continued demand. Generic chemotherapy drugs further strengthen market presence. Widespread availability across global markets drives volume consumption. Strong manufacturing capabilities support scalability. Cytotoxic HPAPIs remain essential in combination therapies. Cost-effectiveness compared to biologics sustains adoption. High patient volumes contribute to dominance. These factors position cytotoxic drugs as the leading drug class.

The targeted therapy drugs segment is projected to register the fastest CAGR of 13.4% from 2026 to 2033, driven by the shift toward precision oncology. Targeted HPAPIs offer selective action against cancer cells, reducing adverse effects. Rising prevalence of biomarker-driven therapies accelerates growth. Increasing approvals of kinase inhibitors and pathway-specific drugs boost demand. Strong R&D investment supports pipeline expansion. Improved clinical outcomes drive physician preference. Pharmaceutical companies prioritize targeted therapies for differentiation. Companion diagnostics enhance adoption. Higher pricing supports revenue growth. These factors establish targeted therapy drugs as the fastest-growing drug class.

• By Potency Level

On the basis of potency level, the High-Potency Oncology API (HPAPI) market is segmented into ≤100 µg/g, 100–1000 µg/g, and >1000 µg/g. The 100–1000 µg/g segment accounted for the largest market revenue share of 48.3% in 2025, driven by its balanced potency and manageable handling requirements. This potency range is widely used in both cytotoxic and targeted oncology drugs. It allows effective dosing while minimizing extreme containment complexity. Pharmaceutical manufacturers prefer this range for scalable production. Regulatory compliance is easier compared to ultra-high potency APIs. Growing use in oral solid dosage forms supports demand. Compatibility with standard high-containment facilities boosts adoption. Strong pipeline of mid-potency oncology drugs sustains growth. Cost-efficiency further supports dominance. These factors position the 100–1000 µg/g segment as the leading potency category.

The >1000 µg/g segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, driven by the increasing development of highly potent targeted therapies and ADC payloads. Ultra-potent HPAPIs enable lower dosing with enhanced efficacy. Rising ADC approvals significantly boost demand. Advanced containment and handling technologies support manufacturing. Growing focus on personalized medicine accelerates growth. Pharmaceutical companies invest in specialized facilities for ultra-high potency APIs. High therapeutic value supports premium pricing. CDMOs expand capabilities to meet demand. Regulatory approvals encourage commercialization. These factors establish >1000 µg/g as the fastest-growing potency segment.

• By Application

On the basis of application, the High-Potency Oncology API (HPAPI) market is segmented into chemotherapy, targeted cancer therapy, antibody-drug conjugates (ADCs), and others. The chemotherapy segment dominated the largest market revenue share of 41.9% in 2025, driven by its continued role as a cornerstone of cancer treatment. Chemotherapy drugs rely heavily on HPAPIs for effective tumor suppression. High patient volumes globally support sustained demand. Generic chemotherapy drugs contribute significantly to market revenue. Combination regimens maintain relevance in treatment protocols. Cost-effectiveness compared to novel therapies supports adoption. Strong manufacturing base ensures steady supply. Chemotherapy remains essential in low- and middle-income regions. Clinical familiarity sustains physician confidence. These factors position chemotherapy as the dominant application segment.

The antibody-drug conjugates (ADCs) segment is expected to witness the fastest CAGR of 15.1% from 2026 to 2033, driven by rapid innovation in targeted cancer therapeutics. ADCs require ultra-potent HPAPIs as cytotoxic payloads. Increasing approvals of ADC-based oncology drugs fuel growth. Strong clinical efficacy with reduced systemic toxicity accelerates adoption. Pharmaceutical companies heavily invest in ADC pipelines. Advancements in linker and conjugation technologies support expansion. Rising demand for precision oncology drives growth. High commercial value boosts revenue contribution. CDMOs expand ADC manufacturing services. These factors establish ADCs as the fastest-growing application segment.

High-Potency Oncology API (HPAPI) Market Regional Analysis

- North America dominated the high-potency oncology API (HPAPI) market, accounting for approximately 41.5% of the global revenue share in 2025

- The region’s leadership is supported by a strong biopharmaceutical ecosystem, high oncology R&D spending, early adoption of advanced cancer therapeutics, and the presence of major pharmaceutical companies and specialized HPAPI manufacturers

- Robust clinical trial activity, particularly for targeted therapies and antibody–drug conjugates (ADCs), continues to drive sustained demand across the region

U.S. High-Potency Oncology API (HPAPI) Market Insight

The U.S. high-potency oncology API (HPAPI) market accounted for the majority of North America’s HPAPI market revenue in 2025, driven by extensive oncology drug development pipelines, high investment in clinical research, and strong presence of leading pharmaceutical and biotechnology companies. Increasing focus on precision oncology, growing ADC development, and widespread outsourcing of HPAPI manufacturing further propel market growth.

Europe High-Potency Oncology API (HPAPI) Market Insight

The Europe high-potency oncology API (HPAPI) market is projected to expand at a substantial CAGR during the forecast period, supported by rising cancer incidence, increasing investment in oncology research, and growing adoption of targeted therapies. Strong regulatory frameworks and expanding pharmaceutical manufacturing capabilities across the region continue to support market expansion.

U.K. High-Potency Oncology API (HPAPI) Market Insight

The U.K. high-potency oncology API (HPAPI) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing oncology R&D activities, strong academic–industry collaborations, and rising clinical trial volumes. The presence of established pharmaceutical companies and contract development and manufacturing organizations (CDMOs) further supports demand for HPAPIs.

Germany High-Potency Oncology API (HPAPI) Market Insight

The high-potency oncology API (HPAPI) market is expected to expand at a considerable CAGR, fueled by a well-developed pharmaceutical manufacturing base, strong emphasis on innovation, and increasing adoption of advanced cancer therapies. Growing investments in oncology drug development and biologics further contribute to market growth.

Asia-Pacific High-Potency Oncology API (HPAPI) Market Insight

The Asia-Pacific high-potency oncology API (HPAPI) market region is expected to be the fastest-growing market for HPAPIs during the forecast period, registering a strong CAGR. Growth is driven by increasing cancer prevalence, expanding pharmaceutical manufacturing capacity, rising investments in oncology research, and growing adoption of outsourced HPAPI production. Countries such as China and India are emerging as key hubs due to cost advantages and improving regulatory compliance.

Japan High-Potency Oncology API (HPAPI) Market Insight

The Japan high-potency oncology API (HPAPI) market is gaining momentum due to rising oncology drug development activities, strong regulatory support for innovative cancer therapies, and increasing focus on precision medicine. The country’s advanced healthcare infrastructure and growing clinical research activity support steady demand for HPAPIs.

China High-Potency Oncology API (HPAPI) Market Insight

China high-potency oncology API (HPAPI) market accounted for a significant revenue share within the Asia-Pacific region in 2025, driven by rapid expansion of pharmaceutical manufacturing, increasing oncology R&D investment, and growing adoption of outsourced HPAPI production. Government support for domestic drug development and rising demand for advanced cancer therapeutics continue to propel market growth.

High-Potency Oncology API (HPAPI) Market Share

The High-Potency Oncology API (HPAPI) industry is primarily led by well-established companies, including:

- Lonza Group AG (Switzerland)

- WuXi AppTec (China)

- Piramal Pharma Solutions (India)

- Cambrex Corporation (U.S.)

- Jubilant Life Sciences (India)

- Boehringer Ingelheim (Germany)

- Thermo Fisher Scientific (U.S.)

- Syngene International Ltd. (India)

- Samsung Biologics (South Korea)

- Recipharm AB (Sweden)

Latest Developments in Global High-Potency Oncology API (HPAPI) Market

- In February 2023, Lonza announced the completion of its expansion of the HPAPI conjugation facility in Visp, Switzerland, adding two new manufacturing suites and supporting infrastructure. This extension enhanced Lonza’s capacity to support bioconjugates and HPAPI payload-linker production for oncology and other high-potency therapies at pre-clinical, clinical, and commercial scales

- In March 2023, Lonza completed a new clinical and commercial drug product line at its Visp, Switzerland site that increased capacities for highly potent molecules, enabling broader cGMP supply for oncology HPAPI projects and supporting end-to-end drug substance and drug product manufacturing workflows

- In May 2025, AGC Pharma Chemicals announced a major expansion of its high-potency API (HPAPI) capabilities in Barcelona, Spain, enabling seamless scale-up from gram quantities to ton-level production within a single integrated facility. This expansion directly supports rising global demand for oncology-focused HPAPIs and advanced targeted therapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。