Global Immunoassay Biomarker Test Menu Expansion Market

市场规模(十亿美元)

CAGR :

%

USD

666.46 Million

USD

1,524.86 Million

2025

2033

USD

666.46 Million

USD

1,524.86 Million

2025

2033

| 2026 –2033 | |

| USD 666.46 Million | |

| USD 1,524.86 Million | |

|

|

|

|

Global Immunoassay Biomarker Test Menu Expansion Market Segmentation, By Product (Reagents & Kits, Instruments & Analyzers, and Software & Services), Technology (Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Fluorescent Immunoassay, Radioimmunoassay, Lateral Flow Immunoassay, and High-Throughput Immunoassay), Biomarker Type (Oncology Biomarkers, Cardiac Biomarkers, Endocrine & Hormonal Biomarkers, Infectious Disease Biomarkers, Autoimmune Disease Biomarkers, Neurological Biomarkers, and Therapeutic Drug Monitoring Biomarkers), Application (Clinical Diagnostics, Companion Diagnostics, Personalized Medicine, and Drug Discovery & Clinical Research), End User (Hospitals & Clinics, Diagnostic & Reference Laboratories, Point-of-Care Settings, Pharmaceutical & Biotechnology Companies, and Academic & Research Institutes)- Industry Trends and Forecast to 2033

Immunoassay Biomarker Test Menu Expansion Market Size

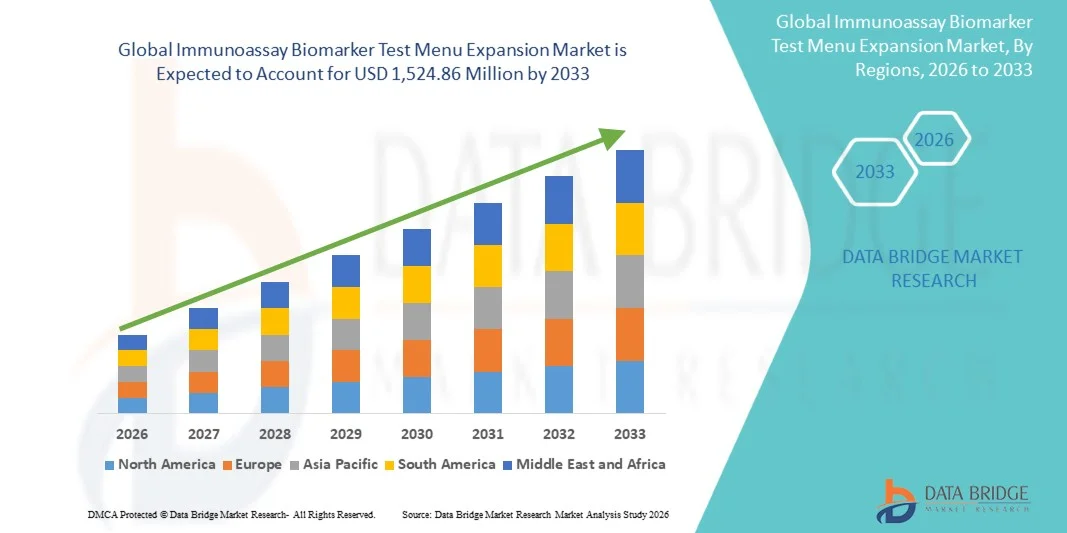

- The global immunoassay biomarker test menu expansion market size was valued at USD 666.46 million in 2025 and is expected to reach USD 1,524.86 million by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is primarily driven by the increasing expansion of immunoassay test menus to include a broader range of disease-specific and high-value biomarkers, supported by technological advancements in assay sensitivity, multiplexing, and automation across clinical laboratories

- Furthermore, rising demand for early disease detection, personalized medicine, and companion diagnostics particularly in oncology, cardiology, and infectious diseases is positioning expanded immunoassay biomarker menus as essential tools in modern diagnostics, thereby significantly accelerating overall market growth

Immunoassay Biomarker Test Menu Expansion Market Analysis

- Immunoassay biomarker test menu expansion, involving the continuous addition of new disease-specific and high-value biomarker assays across diagnostic platforms, is becoming a core component of modern clinical diagnostics due to its importance in early disease detection, therapy monitoring, and precision medicine across hospitals, laboratories, and research settings

- The increasing demand for expanded immunoassay test menus is primarily driven by the rising prevalence of chronic and infectious diseases, growing emphasis on early and accurate diagnosis, and ongoing technological advancements in assay sensitivity, automation, and multiplexing capabilities

- North America dominated the immunoassay biomarker test menu expansion market with the largest revenue share of 40.5% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, strong R&D investments, and a significant presence of leading diagnostic companies, with the U.S. witnessing robust growth driven by the expanding use of biomarker-based assays in oncology, cardiology, and companion diagnostics

- Asia-Pacific is expected to be the fastest growing region in the immunoassay biomarker test menu expansion market during the forecast period, owing to expanding healthcare infrastructure, increasing disease burden, rising laboratory testing volumes, and improving access to advanced diagnostic solutions across emerging economies

- Chemiluminescence immunoassay segment dominated the market with a share of 39.2% in 2025, driven by its high sensitivity, broad compatibility with expanding biomarker menus, and widespread adoption in high-throughput clinical laboratories

Report Scope and Immunoassay Biomarker Test Menu Expansion Market Segmentation

|

Attributes |

Immunoassay Biomarker Test Menu Expansion Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Immunoassay Biomarker Test Menu Expansion Market Trends

“Expansion of Multiplex and High-Sensitivity Biomarker Panels”

- A significant and accelerating trend in the global immunoassay biomarker test menu expansion market is the growing shift toward multiplex and high-sensitivity assays that enable simultaneous detection of multiple biomarkers, enhancing diagnostic efficiency and clinical decision-making across laboratories and hospitals

- For instance, major diagnostics companies are increasingly expanding chemiluminescence and bead-based immunoassay platforms to include multiplex oncology, cardiac, and inflammatory biomarker panels, allowing clinicians to obtain broader diagnostic insights from a single patient sample

- Advances in assay chemistry, automation, and signal amplification are enabling improved sensitivity and specificity, making it feasible to detect low-abundance biomarkers critical for early disease diagnosis and therapy monitoring. For instance, next-generation CLIA platforms are being designed to support ultra-sensitive biomarker detection suitable for early-stage cancer and neurodegenerative disease testing

- The integration of expanded biomarker menus with automated laboratory workflows and digital data management systems supports higher throughput, faster turnaround times, and consistent results, which is increasingly important for high-volume clinical and reference laboratories

- This trend toward broader, more integrated, and high-performance immunoassay menus is reshaping diagnostic testing strategies globally. Consequently, companies such as Roche Diagnostics and Abbott are continuously adding new biomarker assays to existing platforms to address evolving clinical needs across oncology, cardiology, and infectious diseases

- The demand for multiplex and expanded immunoassay biomarker menus is rising rapidly across hospitals, diagnostic laboratories, and research institutions, as healthcare systems increasingly emphasize early detection, precision medicine, and cost-effective testing solutions

Immunoassay Biomarker Test Menu Expansion Market Dynamics

Driver

“Rising Demand for Early Diagnosis and Precision Medicine”

- The increasing prevalence of chronic diseases, cancer, and infectious conditions, combined with a growing emphasis on early and accurate diagnosis, is a key driver fueling demand for expanded immunoassay biomarker test menus

- For instance, in 2025, several diagnostic companies announced the launch of new companion diagnostic and oncology biomarker assays designed to support targeted therapies, reflecting the strong alignment between immunoassay menu expansion and precision medicine initiatives

- As clinicians and healthcare providers seek more comprehensive diagnostic information to guide treatment decisions, immunoassay platforms capable of supporting a wider range of clinically relevant biomarkers are becoming increasingly essential

- Furthermore, the expanding adoption of personalized medicine and biomarker-driven treatment pathways is accelerating the need for immunoassay menus that can support disease stratification, therapy selection, and treatment monitoring across multiple therapeutic areas

- The growing emphasis on value-based healthcare and outcome-driven diagnostics is encouraging healthcare providers to adopt broader immunoassay biomarker menus that support timely diagnosis, reduce repeat testing, and improve patient management efficiency

- Moreover, increasing investments in laboratory infrastructure modernization, particularly in emerging economies, are enabling laboratories to deploy advanced immunoassay systems capable of supporting continuous test menu expansion

- The growing role of centralized and reference laboratories, along with rising test volumes and automation, further supports the expansion of immunoassay biomarker menus, as laboratories aim to consolidate testing on fewer, more versatile platforms while improving operational efficiency

Restraint/Challenge

“Regulatory Complexity and Validation Requirements”

- The stringent regulatory environment governing diagnostic assays, particularly for new and expanded biomarker tests, poses a significant challenge to the rapid expansion of immunoassay test menus across global markets

- For instance, regulatory requirements for analytical validation, clinical performance data, and post-market surveillance can extend development timelines and increase costs for manufacturers introducing new biomarker assays

- Ensuring consistent assay performance across diverse populations, specimen types, and laboratory settings requires extensive validation studies, which can slow down menu expansion and limit rapid commercialization, especially for smaller companies

- In addition, varying regulatory frameworks across regions increase compliance complexity, making it more challenging for manufacturers to launch expanded immunoassay menus simultaneously in multiple markets

- High costs associated with biomarker discovery, assay development, and clinical validation can limit the pace of immunoassay test menu expansion, especially for smaller diagnostic companies with constrained R&D budgets

- In addition, reimbursement uncertainties for newly introduced biomarker assays may restrict adoption, as laboratories and healthcare providers often delay implementation until clear reimbursement pathways are established

- Overcoming these challenges through streamlined regulatory strategies, strong clinical evidence generation, and close collaboration with regulatory authorities will be critical for enabling sustained growth and broader adoption of expanded immunoassay biomarker test menus globally

Immunoassay Biomarker Test Menu Expansion Market Scope

The market is segmented on the basis of product, technology, biomarker type, application, and end user.

- By Product

On the basis of product, the market is segmented into reagents & kits, instruments & analyzers, and software & services. The reagents & kits segment dominated the market in 2025, accounting for the largest revenue share, driven by their recurring consumption and essential role in routine diagnostic testing. Immunoassay reagents and kits are required for every test performed, ensuring continuous demand across hospitals and diagnostic laboratories. The expansion of biomarker test menus directly increases reagent utilization volumes, particularly for oncology, infectious disease, and cardiac biomarkers. In addition, the introduction of disease-specific and multiplex biomarker kits has strengthened the dominance of this segment. Reagents and kits also benefit from faster regulatory approvals compared to instruments, enabling quicker commercialization. Their compatibility with existing immunoassay platforms further supports widespread adoption.

The software & services segment is expected to witness the fastest growth during the forecast period, driven by increasing complexity of biomarker data interpretation and laboratory workflow optimization. As immunoassay test menus expand, laboratories require advanced software solutions for result analysis, quality control, and data integration. The growing adoption of laboratory information systems (LIS) and AI-enabled analytics is accelerating demand for software-driven services. In addition, services related to assay validation, calibration, and compliance are becoming critical as new biomarkers are introduced. Cloud-based data management and remote monitoring capabilities are further supporting growth. This segment is also benefiting from the digital transformation of diagnostic laboratories worldwide.

- By Technology

On the basis of technology, the market is segmented into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, fluorescent immunoassay, radioimmunoassay, lateral flow immunoassay, and high-throughput immunoassay. Chemiluminescence immunoassay (CLIA) dominated the market in 2025 with a market share of 39.2%, owing to its high sensitivity, broad dynamic range, and suitability for automated, high-volume testing environments. CLIA platforms are widely used in centralized and reference laboratories for expanded biomarker menus across oncology, endocrinology, and infectious diseases. Their ability to support continuous menu expansion without compromising accuracy makes them the preferred choice among diagnostic providers. In addition, CLIA systems offer faster turnaround times compared to traditional ELISA methods. Strong investments by leading diagnostics companies in CLIA platform upgrades have reinforced this dominance. Regulatory familiarity and established clinical acceptance further contribute to its leading position.

High-throughput immunoassay technology is expected to register the fastest CAGR during the forecast period, driven by rising testing volumes and laboratory consolidation trends. Large diagnostic laboratories increasingly require platforms capable of processing thousands of samples daily while supporting expanded biomarker panels. High-throughput systems enable cost-efficient scaling of test menus without proportional increases in labor or infrastructure. The growing demand for population screening and companion diagnostics further accelerates adoption. Integration with automation and digital workflow solutions enhances operational efficiency. These advantages position high-throughput immunoassays as a key growth engine for future market expansion.

- By Biomarker Type

On the basis of biomarker type, the market is segmented into oncology biomarkers, cardiac biomarkers, endocrine & hormonal biomarkers, infectious disease biomarkers, autoimmune disease biomarkers, neurological biomarkers, and therapeutic drug monitoring biomarkers. Oncology biomarkers dominated the market in 2025, driven by the rising global cancer burden and increasing reliance on biomarker-driven diagnostics for early detection and treatment monitoring. Immunoassay platforms are extensively used to measure tumor markers and protein-based cancer biomarkers in routine clinical practice. The rapid expansion of companion diagnostics for targeted therapies has further strengthened demand. Oncology biomarkers are frequently added to immunoassay menus due to their high clinical and commercial value. Continuous R&D investments and regulatory approvals support ongoing menu expansion. This segment also benefits from strong reimbursement coverage in developed healthcare markets.

Neurological biomarkers are expected to be the fastest growing segment during the forecast period, supported by increasing focus on early diagnosis of neurodegenerative diseases such as Alzheimer’s and Parkinson’s. Advances in biomarker research are enabling the identification of blood-based neurological markers suitable for immunoassay testing. Growing awareness of cognitive disorders and aging populations are driving testing demand. Pharmaceutical research into neurodegenerative therapies is also boosting biomarker utilization in clinical trials. Immunoassay-based neurological testing offers a less invasive alternative to imaging and cerebrospinal fluid analysis. These factors collectively accelerate growth in this segment.

- By Application

On the basis of application, the market is segmented into clinical diagnostics, companion diagnostics, personalized medicine, and drug discovery & clinical research. Clinical diagnostics dominated the market in 2025, as immunoassay biomarker testing remains a cornerstone of routine disease diagnosis and monitoring. Hospitals and laboratories rely heavily on immunoassays for high-volume testing across multiple therapeutic areas. Expanded test menus enhance diagnostic accuracy and reduce the need for multiple testing platforms. The widespread availability of automated immunoassay systems supports this dominance. In addition, clinical diagnostics benefit from established reimbursement pathways. Growing demand for early and preventive diagnostics further strengthens this segment.

Companion diagnostics is anticipated to witness the fastest growth over the forecast period, driven by the rapid expansion of targeted therapies and precision medicine. Immunoassay-based companion diagnostics help identify suitable patients for specific drug treatments. Increasing collaboration between pharmaceutical and diagnostic companies accelerates assay development. Regulatory agencies increasingly mandate companion diagnostic testing for certain therapies. Immunoassays offer cost-effective and scalable solutions for this purpose. These factors position companion diagnostics as a high-growth application area.

- By End User

On the basis of end user, the market is segmented into hospitals & clinics, diagnostic & reference laboratories, point-of-care settings, pharmaceutical & biotechnology companies, and academic & research institutes. Diagnostic & reference laboratories dominated the market in 2025, driven by high testing volumes and centralized laboratory operations. These laboratories are primary adopters of expanded immunoassay test menus to serve diverse clinical needs. Their ability to invest in advanced automated platforms supports broad biomarker coverage. Reference labs also play a critical role in specialized and esoteric testing. Consolidation trends further increase testing concentration within this segment. As a result, diagnostic laboratories remain the largest revenue contributors.

Pharmaceutical & biotechnology companies are expected to grow at the fastest rate during the forecast period, supported by increasing biomarker utilization in drug development and clinical trials. Immunoassays are widely used for biomarker validation and therapeutic monitoring studies. The expansion of precision medicine pipelines is driving demand for novel biomarker assays. Pharma-led funding accelerates assay innovation and menu expansion. Growing emphasis on translational research further supports adoption. This segment’s strong R&D focus underpins its rapid growth trajectory.

Immunoassay Biomarker Test Menu Expansion Market Regional Analysis

- North America dominated the immunoassay biomarker test menu expansion market with the largest revenue share of 40.5% in 2025, supported by advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, strong R&D investments, and a significant presence of leading diagnostic companies

- Healthcare providers and diagnostic laboratories in the region place high value on the availability of expanded, high-sensitivity immunoassay biomarker menus that support early disease detection, precision medicine, and companion diagnostics, particularly in oncology, cardiology, and infectious diseases

- This widespread adoption is further supported by favorable reimbursement frameworks, a strong presence of leading diagnostic companies, and increasing demand for automated and high-throughput testing solutions, establishing North America as a key hub for immunoassay biomarker test menu expansion across clinical and research settings

U.S. Immunoassay Biomarker Test Menu Expansion Market Insight

The U.S. immunoassay biomarker test menu expansion market captured the largest revenue share of 80% within North America in 2025, driven by strong adoption of advanced diagnostic technologies and the rapid integration of biomarker-based testing into routine clinical practice. Healthcare providers increasingly prioritize early disease detection, precision medicine, and companion diagnostics, particularly in oncology and cardiology. The presence of leading diagnostic manufacturers, well-established reimbursement frameworks, and high R&D spending further support market growth. Moreover, the widespread use of automated and high-throughput immunoassay platforms across hospitals and reference laboratories continues to accelerate test menu expansion in the U.S.

Europe Immunoassay Biomarker Test Menu Expansion Market Insight

The Europe immunoassay biomarker test menu expansion market is projected to grow at a steady CAGR during the forecast period, driven by strong regulatory oversight, increasing emphasis on early diagnosis, and rising adoption of personalized medicine. The growing burden of chronic diseases and cancer across the region is fueling demand for expanded biomarker panels. European healthcare systems are increasingly integrating advanced laboratory diagnostics to improve clinical outcomes and cost efficiency. Growth is observed across hospital laboratories, reference labs, and research institutions, supported by ongoing investments in diagnostic infrastructure and innovation.

U.K. Immunoassay Biomarker Test Menu Expansion Market Insight

The U.K. immunoassay biomarker test menu expansion market is expected to grow at a notable CAGR during the forecast period, supported by increasing adoption of precision diagnostics within the National Health Service (NHS). Rising awareness of early disease detection and preventive healthcare is driving demand for expanded immunoassay biomarker menus. The country’s strong focus on oncology diagnostics and clinical research further supports market growth. In addition, collaborations between academic institutions and diagnostic companies are accelerating biomarker assay development and adoption across clinical laboratories.

Germany Immunoassay Biomarker Test Menu Expansion Market Insight

The Germany immunoassay biomarker test menu expansion market is anticipated to expand at a considerable CAGR, driven by the country’s advanced healthcare infrastructure and strong emphasis on technological innovation. Germany’s focus on high-quality diagnostics, laboratory automation, and standardized testing supports the adoption of expanded immunoassay menus. Increasing demand for biomarker-based testing in oncology, cardiology, and endocrine disorders is contributing to growth. The preference for reliable, high-precision diagnostic solutions aligns well with expanded immunoassay platforms, reinforcing market momentum.

Asia-Pacific Immunoassay Biomarker Test Menu Expansion Market Insight

The Asia-Pacific immunoassay biomarker test menu expansion market is expected to grow at the fastest CAGR during the forecast period, driven by expanding healthcare access, rising disease burden, and increasing investments in diagnostic infrastructure across emerging economies. Countries such as China, India, and Japan are witnessing rapid growth in laboratory testing volumes. Government initiatives aimed at improving healthcare delivery and early disease detection are further accelerating adoption. In addition, the growing presence of local diagnostic manufacturers is improving affordability and accessibility of advanced immunoassay testing.

Japan Immunoassay Biomarker Test Menu Expansion Market Insight

The Japan immunoassay biomarker test menu expansion market is gaining traction due to the country’s advanced healthcare system, aging population, and strong emphasis on early diagnosis. Increasing prevalence of chronic and age-related diseases is driving demand for expanded biomarker testing. Japanese laboratories are rapidly adopting automated and high-sensitivity immunoassay platforms to support precision diagnostics. Integration of immunoassays into clinical research and pharmaceutical development further contributes to market growth, particularly in oncology and neurological biomarkers.

India Immunoassay Biomarker Test Menu Expansion Market Insight

The India immunoassay biomarker test menu expansion market accounted for the largest revenue share within Asia-Pacific in 2025, driven by rapid urbanization, rising healthcare awareness, and expanding diagnostic laboratory networks. India is emerging as a key market for advanced diagnostics due to increasing demand for affordable and scalable testing solutions. Growth in private healthcare facilities and reference laboratories is accelerating adoption of expanded immunoassay menus. Government initiatives focused on preventive healthcare and early disease detection, along with strong domestic diagnostic manufacturers, are further propelling market growth in India.

Immunoassay Biomarker Test Menu Expansion Market Share

The Immunoassay Biomarker Test Menu Expansion industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- Danaher (U.S.)

- BIOMÉRIEUX (France)

- QuidelOrtho Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Sysmex Corporation (Japan)

- DiaSorin S.p.A. (Italy)

- Agilent Technologies, Inc. (U.S.)

- Bio-Techne Corporation (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Fujirebio Diagnostics, Inc. (Japan)

- Quanterix Corporation (U.S.)

- Autobio Diagnostics Co., Ltd. (China)

- BioGnost Ltd. (Croatia)

- Beckman Coulter, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Shenzhen New Industries Biomedical Engineering Co., Ltd. (China)

What are the Recent Developments in Global Immunoassay Biomarker Test Menu Expansion Market?

- In October 2025, Roche Diagnostics and Eli Lilly announced the FDA clearance of the Elecsys pTau181 plasma test, a blood-based immunoassay for Alzheimer’s disease assessment that supports earlier, less invasive screening in primary care settings, marking a key expansion in neurological biomarker diagnostics

- In July 2025, Spear Bio commercially launched SPEAR UltraDetect™, an ultrasensitive immunoassay solution featuring four assays targeting key neurology biomarkers (pTau231, pTau217, GFAP, NfL), enhancing research and clinical capabilities for neurodegenerative disease biomarker measurement

- In May 2025, the U.S. FDA cleared the Lumipulse G pTau217/β-Amyloid 1-42 Plasma Ratio immunoassay for early detection of amyloid plaques associated with Alzheimer’s, enabling non-invasive biomarker testing and supporting clinical diagnosis pathways

- In April 2025, Labcorp launched its pTau-217/Beta Amyloid 42 Ratio blood immunoassay nationwide in the U.S. to assist in Alzheimer’s disease evaluation, providing comparable performance to PET imaging and CSF tests broadening access to critical neurological biomarker testing

- In March 2024, Beckman Coulter Diagnostics and Fujirebio expanded their collaboration to develop patient-friendly, blood-based neurodegenerative disease diagnostics, reinforcing the trend toward broader immunoassay biomarker menus in neurological testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。