Global Industrial Lubricants Market

市场规模(十亿美元)

CAGR :

%

USD

54.76 Billion

USD

78.17 Billion

2024

2032

USD

54.76 Billion

USD

78.17 Billion

2024

2032

| 2025 –2032 | |

| USD 54.76 Billion | |

| USD 78.17 Billion | |

|

|

|

|

Global Industrial Lubricants Market, By Grade (Group I, Group II, Group III, Group IV and Group V), Base Oil (Bio-based, Mineral Oil and Synthetic and Semi-synthetic), Product Type (Process Oils, Compressor Lubricants, Turbine Lubricants, Circulation and Transmission Oils, Hydraulic Fluids, Metalworking Fluids, Gear Oils, Greases, and Others), End Use Industry (Metalworking, Textiles, Energy, Chemical Manufacturing, Food Processing, Hydraulic, and Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa)- Industry Trends and Forecast to 2032

Industrial Lubricants Market Size

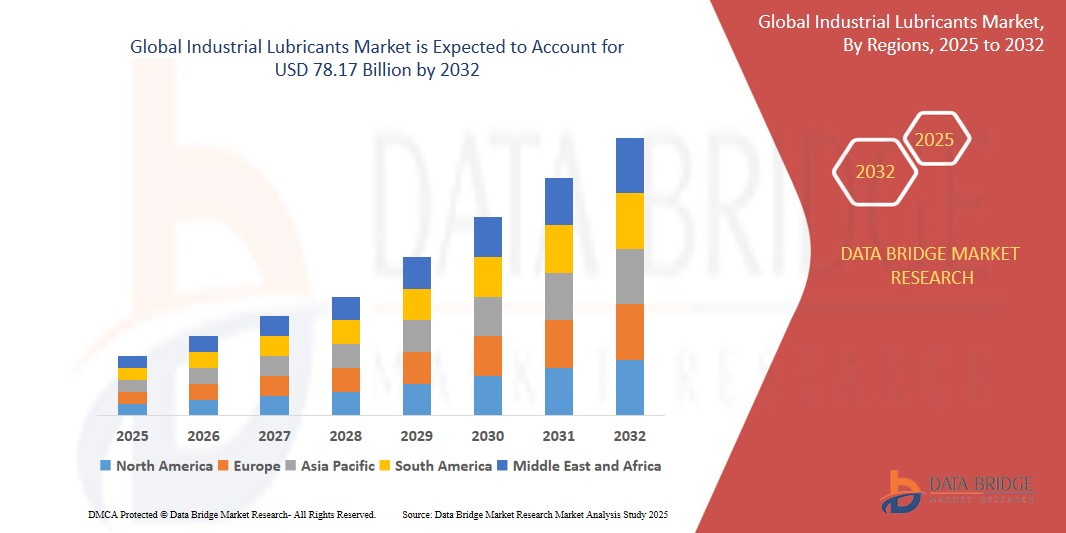

- The Global Industrial Lubricants Market was valued atUSD 54.76 Billion in 2024 and is expected to reachUSD 78.17 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.6%, primarily driven by technological advancements, increasing industrialization, demand for eco-friendly solutions, automation in manufacturing, energy efficiency needs, and rising awareness of equipment maintenance and longevity.

- The growth of the global Industrial Lubricants market is driven by technological innovations, industrial expansion, eco-friendly solutions, and maintenance demand.

Industrial Lubricants Market Analysis

- The Industrial Lubricants market is evolving due to innovations like AI integration, sensor-embedded lubricants, and real-time monitoring, improving efficiency, reducing maintenance costs, and enhancing machinery performance.

- Increasing awareness about environmental sustainability drives demand for biodegradable, renewable, and eco-friendly lubricants, influencing industries to adopt lubricants that minimize ecological footprints and comply with regulatory standards.

- With growing industries such as automotive, construction, and power generation, industrial lubricants are essential for ensuring smooth operations, reducing wear, and extending the life of machinery in diverse applications.

Report Scope and Industrial Lubricants Market Segmentation

|

Attributes |

Industrial Lubricants Key Market Insights |

|

Segments Covered |

•By Grade:Group I, Group II, Group III, Group IV and Group V •By Base Oil:Bio-based, Mineral Oil and Synthetic and Semi-synthetic •By Product Type:• Process Oils, Compressor Lubricants, Turbine Lubricants, Circulation and Transmission Oil, Hydraulic Fluids, Metalworking Fluids, Gear Oil, Greases, and Others •By End Use Industry:Metalworking, Textiles, Energy, Chemical Manufacturing, Food Processing, Hydraulic, and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Industrial Lubricants Market Trends

“Shift towards bio-based lubricants for sustainability and performance”

- Growing environmental concerns and stringent regulations are pushing manufacturers to adopt bio-based lubricants, which offer reduced toxicity, biodegradability, and competitive performance compared to traditional mineral-based oils.

- Industrial sectors are increasingly integrating IoT-enabled sensors with lubrication systems to monitor equipment health in real-time, reduce downtime, and optimize lubricant usage through predictive maintenance strategies.

- For instance, a notable instance of the industry's shift towards bio-based lubricants is ExxonMobil's launch of the Mobil SHC™ Elite Series. These synthetic lubricants are engineered to deliver exceptional performance in high-temperature industrial applications, offering up to 12 times the oil life of mineral oils and double that of previous synthetic oils. They also provide up to a 3.6% improvement in energy efficiency, contributing to both sustainability and operational cost savings..

- Industries are shifting to synthetic lubricants due to their superior thermal stability, longer service life, and enhanced performance in extreme temperatures, supporting operational efficiency and reducing maintenance frequency.

Industrial Lubricants Market Dynamics

Driver

“Rising industrialization boosts demand for efficient, high-performance lubricants globally”

- Rapid growth in manufacturing industries across Asia and Africa increases the need for industrial lubricants to ensure machinery efficiency, minimize downtime, and extend equipment life under high-load operations.

- Massive infrastructure projects, including smart cities, transportation networks, and power plants, require reliable, high-performance lubricants to support construction equipment and continuous operations in harsh environments.

- As industries adopt automated and high-precision machinery, demand rises for lubricants that maintain performance under tight tolerances, high speeds, and extreme temperatures to avoid breakdowns and production losses.

- Companies globally are prioritizing cost-effective operations. High-performance lubricants reduce maintenance frequency, energy consumption, and wear-and-tear, aligning with industrial goals for sustainability and improved productivity across sectors.

Opportunity

“Growing industrialization creates demand for advanced, eco-friendly lubricant solutions worldwide.”

- Industries are increasingly adopting eco-friendly lubricants due to growing environmental awareness, stricter regulations, and the need to reduce carbon footprints, leading to heightened demand for sustainable, biodegradable, and recyclable lubricants.

- As industries become more reliant on high-performance machinery, the demand for advanced lubricants that enhance efficiency, extend equipment life, and reduce downtime is driving the growth of specialized, eco-friendly formulations.

- Rapid industrial growth in emerging markets, especially in manufacturing and energy sectors, requires high-quality lubricants for smooth operations. This expansion boosts the need for lubricants that are both efficient and environmentally safe.

- Governments worldwide are implementing stricter environmental regulations, compelling industries to shift towards eco-friendly lubricants. These innovations help companies comply with regulations while minimizing their environmental impact in sectors like automotive, manufacturing, and mining.

For instance,

- In May 2019 Shell India has launched the Rimula R5 LE 10W-40 and 10W-30 synthetic engine oils, formulated to meet India's BS-VI emission norms. These oils offer enhanced engine protection, excellent oxidation control, and are compatible with both existing and future BS-VI vehicles. Developed with superior CK-4 technology, they aim to reduce CO₂ emissions and contribute to a cleaner environment. Shell's initiative supports the government's air pollution control efforts and aligns with the transition to a low-emission economy.

Restraint/Challenge

“High cost of eco-friendly lubricants limits widespread industry adoption”

- Industries focused on minimizing operational costs find it challenging to adopt eco-friendly lubricants due to their higher price compared to conventional options, impacting their willingness to transition.

- Eco-friendly lubricants often require specialized raw materials and advanced production processes, which increases their manufacturing cost. This limited availability can restrict the mass adoption of these lubricants in industries worldwide.

- Small and medium-sized businesses, especially in developing regions, may struggle to afford the premium cost of eco-friendly lubricants, limiting their adoption despite growing environmental awareness and regulatory pressure to reduce emissions.

Industrial Lubricants Market Scope

The market is segmented on the basis grade, base oil, product type and end-use industry

|

Segmentation |

Sub-Segmentation |

|

By Grade |

|

|

By Base Oil |

|

|

By Product Type |

|

|

By End Use Industry

|

|

Industrial Lubricants Market Regional Analysis

“The Asia Pacific (APAC) is the Dominant Region in the Industrial Lubricants Market”

- Asia Pacific leads the global market, driven by industrialization, manufacturing growth, and key economies like China and India.

- China and India, as major industrial hubs, significantly contribute to the rising demand for lubricants.

- The region's booming manufacturing industries, particularly in automotive and heavy machinery, fuel lubricant consumption and growth.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific's accelerated industrialization and urbanization, particularly in China and India, drive robust demand for industrial lubricants across diverse sectors, including manufacturing, automotive, and energy production, fueling market growth.

- The region's rapidly expanding manufacturing and automotive industries, coupled with ongoing infrastructure development, significantly increase lubricant consumption, especially as industries focus on advanced technologies and high-performance machinery.

- Government initiatives, along with increased foreign and domestic investments in the region's industrial sectors, are expected to further stimulate demand for industrial lubricants, contributing to a projected high CAGR in the market.

Industrial Lubricants Market Share

The competitive landscape of the Industrial Lubricants market offers insights into key players and their market positioning. Key details include company overview, financial performance, revenue generation, market potential, and investment in research and development. Additionally, the analysis covers new market initiatives, global presence, production facilities, manufacturing capacities, and strategic expansions. Companies are evaluated based on their strengths, weaknesses, product innovation, and competitive advantages in nutraceuticals, pharmaceuticals, cosmetics, and functional foods.

The Major Market Leaders Operating in the Market Are:

- Shell (Netherlands)

- ExxonMobil (U.S.)

- BP (U.K.)

- Chevron (U.S.)

- TotalEnergies (France)

- FUCHS Petrolub SE (Germany)

- Valvoline (U.S.)

- Sinopec (China)

- Indian Oil Corporation (India)

- Idemitsu Kosan (Japan)

- Lukoil (Russia)

- Petrobras (Brazil)

- SK Lubricants (South Korea)

- Klüber Lubrication (Germany)

- Castrol (U.K.)

- HF Sinclair Corporation (U.S.)

- Quaker Chemical Corporation (U.S.)

- Blaser Swisslube, Inc. (Germany)

- PETRONAS Lubricants International (Malaysia)

Latest Developments in Global Industrial Lubricants Market

- In July 2024, Castrol India launched new lubricants under the brand name, Castrol EDGE. This new product line contributed to a 3.1% increase in the company's Q2 profit for 2024, driven by sustained demand in the automobile lubricants market. The launch reflects Castrol's commitment to innovation and meeting the evolving needs of the automotive sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。