Global Intelligent Process Automation Market

市场规模(十亿美元)

CAGR :

%

USD

15.31 Billion

USD

40.41 Billion

2024

2032

USD

15.31 Billion

USD

40.41 Billion

2024

2032

| 2025 –2032 | |

| USD 15.31 Billion | |

| USD 40.41 Billion | |

|

|

|

|

全球智慧流程自動化市場細分,按組件(解決方案和服務)、部署(本地和基於雲端)、組織規模(大型組織和中小型組織)、技術(自然語言處理、機器和深度學習、神經網路、虛擬代理、迷你機器人和 RPA、電腦視覺等)、垂直行業(BFSI、電信和 IT、運輸和物流、媒體和娛樂、零售和電子商務營運、業務流程自動化、應用程式管理、內容管理、安全等)– 產業趨勢與預測到 2032 年

智慧流程自動化市場規模

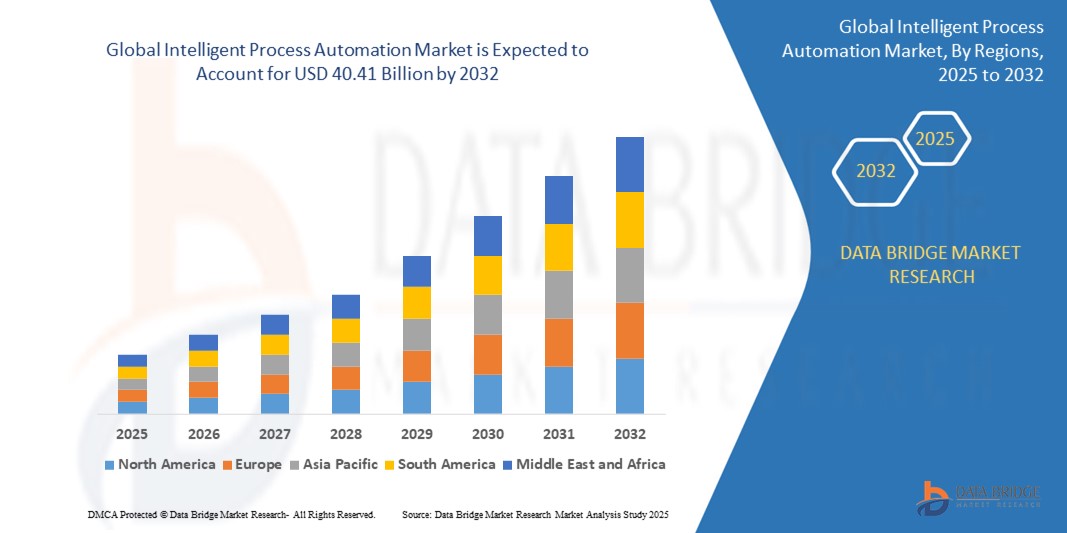

- 2024 年全球智慧過程自動化市場規模為153.1 億美元 ,預計 到 2032 年將達到 404.1 億美元,預測期內 複合年增長率為 12.90%。

- 市場成長主要受到各行各業對營運效率、降低成本和提高生產力日益增長的需求的推動,這些行業尋求加速其數位轉型計劃

- 此外,人工智慧 (AI) 和機器學習 (ML) 技術的快速發展,加上對重複性和基於規則的任務自動化的需求日益增長,使得 IPA 成為現代企業優化工作流程和改善決策的關鍵工具。

智慧流程自動化市場分析

- 智慧流程自動化 (IPA) 代表了機器人流程自動化(RPA) 與先進人工智慧(AI) 功能的強大融合,包括機器學習 (ML)、自然語言處理 (NLP) 和電腦視覺

- IPA 解決方案需求的不斷增長,主要源自於企業需要提高生產力、降低營運成本,並透過加快處理速度和減少錯誤來改善客戶體驗

- 北美在智慧過程自動化市場佔據主導地位,2024 年的收入份額最大,為 38.5%,其特點是早期採用先進技術、高度重視數位轉型以及主要 IPA 解決方案提供商的存在

- 由於數位化措施不斷增加、經濟快速成長以及中國和印度等新興經濟體企業對自動化優勢的認識不斷提高,預計亞太地區將成為預測期內智慧過程自動化市場成長最快的地區

- 服務領域在智慧流程自動化市場佔據主導地位,到 2024 年市佔率將達到 57%,這得益於對實施、維護和優化複雜 IPA 解決方案的專業支援和專業知識的迫切需求

報告範圍和智慧流程自動化市場細分

|

屬性 |

智慧流程自動化關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。 |

智慧流程自動化市場趨勢

“超自動化和人工智慧驅動的決策”

- 智慧流程自動化市場的一個重要且加速的趨勢是向超自動化的轉變,這涉及結合 RPA、AI、ML、流程挖掘和智慧文件處理 (IDP) 等多種先進技術,以自動化盡可能多的業務和 IT 流程

- For instance, leading enterprises are leveraging process mining tools to identify automation opportunities, then deploying RPA bots enhanced with AI to handle complex, unstructured data, and finally using analytics to monitor and continuously improve these automated workflows

- AI integration in IPA enables features such as intelligent decision-making, predictive analytics, and self-learning capabilities for automation bots

- The rise of low-code/no-code platforms within the IPA ecosystem is also democratizing automation, allowing business users with minimal coding knowledge to design and deploy automation workflows

- This trend towards more intelligent, adaptive, and interconnected automation systems is fundamentally reshaping how businesses operate, driving efficiency, reducing human error, and freeing up human capital for more strategic tasks

- The demand for IPA solutions that offer advanced AI integration, hyperautomation capabilities, and user-friendly development interfaces is growing rapidly across all industry verticals, as organizations increasingly prioritize agility, cost-effectiveness, and enhanced operational resilience

Intelligent Process Automation Market Dynamics

Driver

“Growing Need for Digital Transformation and Operational Efficiency”

- The increasing imperative for organizations across all sectors to undergo rapid digital transformation, coupled with an escalating focus on achieving superior operational efficiency and cost reduction, is a primary driver for the heightened demand for intelligent process automation solutions

- For instance, in the BFSI sector, banks are deploying IPA to automate customer onboarding, loan processing, and fraud detection, significantly reducing manual effort, accelerating turnaround times, and improving compliance

- As businesses face intense competitive pressures and the need to do more with less, IPA offers a compelling solution by automating repetitive, rule-based, and even cognitive tasks, thereby freeing human employees to focus on higher-value

- Furthermore, the COVID-19 pandemic accelerated the adoption of remote work models, highlighting the critical need for automated, resilient, and scalable digital processes that can function independently of physical presence

- The ability of IPA to integrate disparate legacy systems, improve data accuracy, and provide real-time insights into process performance are key factors propelling its adoption across both large enterprises and small & medium-sized organizations seeking to optimize their workflows and maintain a competitive edge

Restraint/Challenge

“Complexity of Integration and Shortage of Skilled Talent”

- Concerns surrounding the complexity of integrating intelligent process automation solutions with existing legacy systems and the significant shortage of skilled talent required for successful implementation and maintenance pose a notable challenge to broader market penetration

- For instance, while IPA promises seamless automation, many organizations operate with fragmented IT landscapes, making the integration of new automation platforms a complex and time-consuming endeavor

- Addressing these integration challenges requires robust planning, specialized technical expertise, and often custom development, which can deter potential adopters, especially SMEs with limited IT resources

- In addition, the rapid evolution of IPA technologies creates a significant demand for professionals skilled in RPA, AI, ML, process mining, and change management

- Overcoming these challenges through comprehensive training programs, strategic partnerships with service providers, and the development of more intuitive, easily integratable platforms will be vital for sustained market growth

Intelligent Process Automation Market Scope

The market is segmented on the basis of component, deployment, organization size, technology, vertical, and application.

- By Component

On the basis of component, the intelligent process automation market is segmented into Solutions and Services. The service segment dominates the largest market revenue share of 57% in 2024, driven the essential need for specialized expertise in the complex implementation, customization, and ongoing management of IPA solutions. Organizations often rely on external consultants for strategic planning, integration with existing systems, training, and continuous optimization, especially given the dynamic nature of AI and automation technologies.

The Solutions segment is anticipated to witness significant growth during the forecast period, fueled by the continuous innovation and development of new IPA platforms, software, and tools that offer enhanced capabilities and ease of deployment.

- By Deployment

On the basis of deployment, the intelligent process automation market is segmented into on-premise and cloud based. The Cloud Based segment held the largest market revenue share in 2024, driven by its inherent scalability, flexibility, reduced upfront infrastructure costs, and accessibility from anywhere. Cloud-based IPA solutions are particularly appealing for organizations seeking rapid deployment, automatic updates, and the ability to scale automation capabilities up or down as needed, especially in supporting remote workforces.

The on-premise deployment segment is expected to witness the fastest CAGR from 2025 to 2032, to its advantages, including full infrastructure control, enhanced security, easier regulatory compliance (notably in healthcare and finance), lower latency, seamless integration with legacy systems, and long-term cost efficiency. SMEs and small-scale manufacturers seeking automation solutions often prefer this model for its reliability and operational benefits.

- By Organization Size

On the basis of organization size, the intelligent process automation market is segmented into large size organization and medium and small size organization. The large size organization segment accounted for the largest market revenue share in 2024, driven by their extensive and complex operational processes, larger budgets for digital transformation initiatives, and the significant potential for efficiency gains and cost savings through large-scale automation. These organizations often have the resources to invest in comprehensive IPA deployments.

The medium and small size organization segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing accessibility of cloud-based and low-code/no-code IPA solutions that reduce upfront costs and technical barriers. SMEs are increasingly recognizing the competitive advantages of automation in streamlining operations, improving customer service, and optimizing resource allocation, enabling them to compete more effectively with larger entities.

- By Technology

On the basis of technology, the intelligent process automation market is segmented into natural language processing, machine and deep learning, neural networks, virtual agents, mini bots and RPA, computer vision, and others. The mini bots and RPA segment held a significant market share in 2024, driven by its foundational role in automating repetitive, rule-based tasks and serving as an entry point for many organizations into the automation journey. RPA offers quick returns on investment and is continuously being enhanced with cognitive capabilities.

The natural language processing are expected to witness the fastest CAGR from 2025 to 2032, driven by the rising reliance on data across industries. The surge in unstructured data from texts, emails, images, and social media necessitates advanced processing capabilities. NLP enhances IPA by extracting actionable insights, powering chatbots and virtual assistants for improved customer engagement. Innovations such as AI integration and sentiment analysis further expand growth opportunities, making NLP a vital tool for businesses seeking efficient data utilization.

- By Vertical

On the basis of vertical, the intelligent process automation market is segmented into BFSI, telecom and IT, transport and logistics, media and entertainment, retail and ecommerce, manufacturing, healthcare and life sciences, and others. The banking, financial services, and insurance segment accounted for the largest market revenue share in 2024, driven by the high volume of repetitive transactions, stringent regulatory compliance requirements, and the critical need for fraud detection and enhanced customer service. IPA helps BFSI firms streamline back-office operations, accelerate loan processing, and improve data accuracy.

The healthcare and life sciences segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing need to automate administrative tasks, manage vast amounts of patient data, streamline claims processing, and accelerate drug discovery and clinical trials. The increasing pressure to reduce operational costs and improve patient outcomes is driving significant investment in IPA within this vertical.

- By Application

On the basis of application, the intelligent process automation market is segmented into IT operations, business process automation, application management, content management, security, and others. The business process automation segment held the largest market revenue share in 2024, as IPA's core strength lies in optimizing and automating end-to-end business workflows across various departments, leading to significant gains in efficiency, productivity, and cost reduction.

The IT operations segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing complexity of IT environments, the demand for faster incident resolution, and the need to automate routine IT tasks such as system monitoring, patch management, and user provisioning. IPA enhances IT resilience and enables proactive problem-solving.

Intelligent Process Automation Market Regional Analysis

- North America dominates the intelligent process automation market with the largest revenue share of 38.5% in 2024, characterized by early adoption of advanced technologies, a strong focus on digital transformation, and the presence of major IPA solution providers

- Consumers and businesses in the region highly value the strategic advantages offered by IPA, including significant operational cost savings, enhanced productivity, and improved decision-making capabilities.

- This widespread adoption is further supported by high disposable incomes, a strong venture capital ecosystem funding innovation, and the presence of major technology providers and early adopters, establishing IPA as a favored solution for optimizing diverse business functions.

U.S. Intelligent Process Automation Market Insight

The U.S. intelligent process automation market captured the largest revenue share within North America in 2024, fueled by the swift uptake of AI and automation technologies and the expanding trend of enterprise-wide digital transformation. Businesses are increasingly prioritizing the optimization of complex workflows through intelligent automation. The growing preference for cloud-based IPA solutions, combined with robust demand for AI-driven analytics and hyperautomation initiatives, further propels the IPA industry. Moreover, the increasing integration of advanced AI capabilities, such as Generative AI, into automation platforms is significantly contributing to the market's expansion.

Europe Intelligent Process Automation Market Insight

The Europe intelligent process automation market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strong digitalization initiatives, the escalating need for operational efficiency in a competitive landscape, and increasing regulatory pressures that necessitate automated compliance processes. The focus on industry 4.0 and smart manufacturing, coupled with the demand for resilient and agile business processes, is fostering the adoption of IPA. European enterprises are also drawn to the benefits of improved data accuracy and reduced human error that IPA solutions offer. The region is experiencing significant growth across manufacturing, BFSI, and public sector applications, with IPA being incorporated into both legacy system modernization and new digital strategies.

U.K. Intelligent Process Automation Market Insight

The U.K. intelligent process automation market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of digital transformation across industries and a strong desire for heightened operational efficiency and cost reduction. Additionally, the focus on enhancing customer experience and navigating complex regulatory environments is encouraging both private and public sector organizations to choose IPA solutions. The UK’s embrace of cloud-based solutions, alongside its robust financial services and technology sectors, is expected to continue to stimulate market growth.

Germany Intelligent Process Automation Market Insight

The Germany intelligent process automation market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of the strategic benefits of automation and the demand for technologically advanced, high-efficiency solutions, particularly within its strong manufacturing sector. Germany’s well-developed industrial infrastructure, combined with its emphasis on innovation and precision engineering, promotes the adoption of IPA, especially for optimizing production lines, supply chain management, and quality control. The integration of IPA with Industry 4.0 initiatives is also becoming increasingly prevalent, with a strong preference for secure, data-driven automation solutions aligning with local enterprise expectations.

Asia-Pacific Intelligent Process Automation Market Insight

The Asia-Pacific intelligent process automation market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards digital transformation, supported by government initiatives promoting digitalization and smart city concepts, is driving the adoption of IPA. Furthermore, as APAC emerges as a manufacturing hub and a significant consumer market, the need for scalable and efficient automation solutions is expanding to a wider enterprise base, making IPA increasingly affordable and accessible.

Japan Intelligent Process Automation Market Insight

The Japan intelligent process automation market is gaining momentum due to the country’s high-tech culture, the pressing need to address labor shortages, and a strong demand for operational efficiency and precision. The Japanese market places a significant emphasis on quality and continuous improvement, and the adoption of IPA is driven by the increasing number of enterprises seeking to optimize complex processes and integrate AI into their workflows. The integration of IPA with other digital transformation initiatives, such as smart factories and digital government services, is fueling growth. Moreover, Japan's aging population is likely to spur demand for automated solutions to maintain productivity and service levels across various industries.

China Intelligent Process Automation Market Insight

The China intelligent process automation market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding digital economy, rapid industrial automation, and high rates of technological adoption driven by government policies and massive enterprise investments. China stands as one of the largest and fastest-growing markets for enterprise software, and IPA solutions are becoming increasingly popular across manufacturing, financial services, and public administration sectors. The push towards intelligent cities and the availability of robust domestic IPA providers, alongside strong government support for AI and automation, are key factors propelling the market in China.

Intelligent Process Automation Market Share

The intelligent process automation industry is primarily led by well-established companies, including:

- HCL Technologies Limited (India)

- Pegasystems Inc. (U.S.)

- Atos SE (U.S.)

- Happiest Minds (India)

- Cognizant (U.S.)

- Tech Mahindra Limited (India)

- Blue Prism Limited (U.K.)

- Xerox Corporation (U.S.)

- Wipro (India)

- CGI Inc. (Canada)

- Infosys Limited (India)

- ExlService Holdings, Inc. (U.S.)

- Accenture (Ireland)

- UiPath (U.S.)

- Tata Consultancy Services Limited (India)

Latest Developments in Global Intelligent Process Automation Market

- In February 2025, UiPath, a leading RPA provider, announced a strategic partnership with Microsoft to integrate its Automation Cloud with Microsoft Azure. This collaboration enhances scalability, allowing enterprises to deploy AI-driven automation solutions seamlessly across cloud environments. Leveraging Azure’s robust infrastructure, the integration supports advanced AI capabilities such as natural language processing (NLP) and intelligent document processing (IDP), improving operational efficiency and decision-making. This move solidifies UiPath’s market leadership by offering a cloud-native, AI-augmented automation platform

- In September 2024, Automation Anywhere launched AI Agent Studio, a platform designed to help businesses create proprietary AI bots that function autonomously within digital ecosystems. By integrating generative AI and RPA, the studio enables companies to develop self-sufficient bots for tasks such as document processing and workflow automation. This innovation strengthens Automation Anywhere’s intelligent automation solutions, particularly benefiting industries such as finance, retail, and healthcare. The platform enhances efficiency by streamlining complex processes and boosting productivity

- In January 2025, International Paper completed acquisition of DS Smith, primarily impacting the packaging industry but also influencing IPA adoption. The merger enhances operational scale and drives innovation in sustainable solutions, potentially increasing the demand for IPA to automate supply chain and logistics processes. This strategic move underscores the growing role of automation in optimizing operations across various industries

- In November 2024, Automation Anywhere partnered with PwC India to develop generative AI-powered business automation solutions. This collaboration merges Automation Anywhere’s advanced automation technology with PwC’s industry expertise to enhance operational efficiency across financial services, retail, and healthcare. The partnership aims to reduce costs, improve customer engagement, and streamline enterprise workflows, reflecting the growing trend of consultancy-RPA collaborations. By leveraging AI-driven automation, businesses can optimize processes and drive innovation

- In June 2024, Nintex, a leader in process intelligence and automation, introduced AI-driven enhancements to its Nintex Process Platform. These updates streamline business process management, automation, and documentation, significantly reducing execution time. The improvements bolster intelligent automation capabilities, enabling faster deployment of automation solutions across industries. By integrating advanced AI features, Nintex enhances operational efficiency and simplifies complex workflows, helping businesses optimize their processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。