全球貸款服務軟體市場,按類型(基於雲端、基於SaaS、內部部署)、應用程式(銀行、信用合作社、抵押貸款人和經紀人、其他)、國家(美國、加拿大、墨西哥、巴西、阿根廷、南美洲其他地區、德國、義大利、英國、法國、西班牙、荷蘭、比利時、瑞士、土耳其、俄羅斯、歐洲其他地區、日本、中國、印度、韓國、澳洲、新加坡、馬來西亞、泰國、印尼、菲律賓、亞聯其他地區劃分、年。

市場分析與洞察 全球貸款服務軟體市場

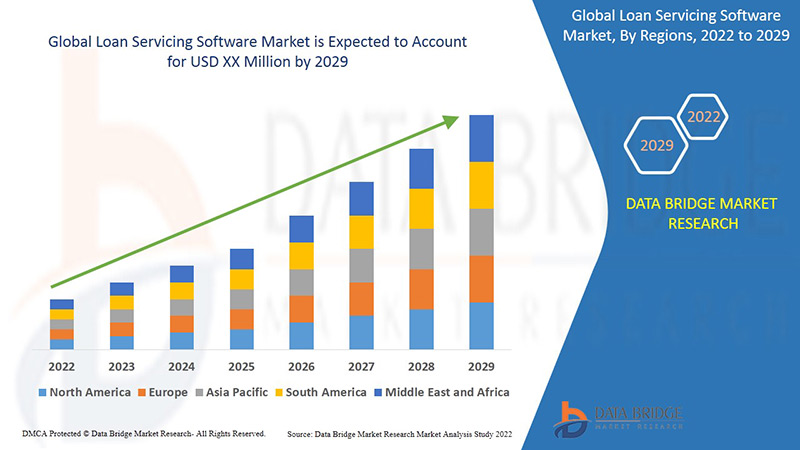

預計在2022年至2029年的預測期內,貸款服務軟體市場將以12.62%的速度成長。 Data Bridge Market Research關於貸款服務軟體市場的報告提供了對預測期內各種預期因素的分析和見解,並分析了這些因素對市場成長的影響。為了自動化、優化和改進貸款服務功能,越來越多的企業採用貸款服務軟體,從而提高業務績效,這正在加速貸款服務軟體市場的成長。

貸款服務是指貸款的行政管理特徵,從資產分配到貸款償還。它是金融公司或貸款機構收取本金、利息和託管款項的程序。此外,它還包括發送每月付款單、收取每月付款、維護付款和餘額記錄、收取和繳納稅款和保險、向票據持有人匯款以及跟進任何拖欠情況。目前,客戶需要多種貸款償還方式。貸款管理軟體為客戶提供多種還款方式,包括定期指示、現金和電子支付。

預計在預測期內推動貸款服務軟體市場成長的主要因素是企業數位化的興起。此外,金融機構和銀行對遵守多項法規的需求日益增長,預計將進一步推動貸款服務軟體市場的成長。此外,先進技術的出現預計將進一步緩衝貸款服務軟體市場的成長。另一方面,軟體服務產品的安全隱患預計將進一步阻礙貸款服務軟體市場的成長。

此外,網路普及率的不斷提高、智慧型手機普及率的不斷上升以及對簡化貸款流程的需求日益增長,將為未來幾年貸款服務軟體市場的成長提供潛在的機會。然而,日益增長的資料安全和隱私問題可能在不久的將來進一步挑戰貸款服務軟體市場的成長。

本貸款服務軟體市場報告詳細介紹了最新發展動態、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響,並分析了新興收入來源、市場法規變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品審批、產品發布、地域擴展以及市場技術創新等方面的機遇。如需了解更多關於貸款服務軟體市場的信息,請聯繫 Data Bridge 市場研究公司以獲取分析師簡報。我們的團隊將協助您做出明智的市場決策,實現市場成長。

全球貸款服務軟體市場範圍與市場規模

貸款服務軟體市場根據類型和應用進行細分。細分市場之間的成長有助於您分析利基市場的成長潛力和進入市場的策略,並確定您的核心應用領域以及目標市場的差異。

- 根據類型,貸款服務軟體市場分為基於雲端的、基於 SaaS 的和內部部署的。

- 根據應用,貸款服務軟體市場細分為銀行、信用合作社、抵押貸款機構和經紀人等。

貸款服務軟體 市場國家級分析

對貸款服務軟體市場進行了分析,並按國家、類型和應用提供了上述市場規模和數量資訊。

貸款服務軟體市場報告涵蓋的國家包括北美洲的美國、加拿大和墨西哥,南美洲的巴西、阿根廷和南美洲其他地區,歐洲的德國、義大利、英國、法國、西班牙、荷蘭、比利時、瑞士、土耳其、俄羅斯,歐洲其他地區,日本、中國、印度、韓國、澳洲、新加坡、馬來西亞、泰國、印尼、菲律賓,亞太地區(APAC)的其他地區,美國地區的其他國家,

由於各行各業對貸款服務軟體的採用率不斷上升,北美在貸款服務軟體市場佔據主導地位。此外,在預測期內,銀行業的成長和金融科技新創文化的蓬勃發展將進一步推動該地區貸款服務軟體市場的成長。

報告的國家部分還提供了影響各個市場當前和未來趨勢的國內市場監管變化以及影響因素。下游和上游價值鏈分析、技術趨勢、波特五力分析和案例研究等數據點是預測各個國家市場狀況的一些指標。此外,在對國家/地區數據進行預測分析時,還考慮了全球品牌的存在和可用性,以及它們因本土和國內品牌的激烈競爭或稀缺而面臨的挑戰、國內關稅的影響以及貿易路線。

競爭格局與貸款服務軟體 市佔率分析

貸款服務軟體市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場舉措、區域佈局、公司優勢和劣勢、產品發布、產品廣度和廣度以及應用主導地位。以上提供的數據僅與公司在貸款服務軟體市場的重點相關。

貸款服務軟體市場的一些主要參與者包括 DownHome Solutions、AUTOPAL SOFTWARE, LLC、Nortridge Software, LLC.、Fiserv, Inc.、Q2 Software, Inc.、Emphasys Software、NBFC Software.、Shaw Systems Associates, LLC、Simnang LLC、Graveco Software Inc.、Oracle、Sopra Banking Software Software Associates, LLC、Simnang LLC、Graveco Software Inc.、Oracle、Soprax Software Software、 Solutions 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LOAN SERVICING SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LOAN SERVICING SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LOAN SERVICING SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 FEATURES OF LOAN SERVICING SOFTWARE

6 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 LENDING & CREDIT SOFTWARE

6.2.2 LOAN ORIGINATION SYSTEM

6.2.3 LOAN MANAGEMENT SOFTWARE

6.2.4 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.1.1. CONSULTING

6.3.1.2. IMPLEMENTATION & INTEGRATION

6.3.1.3. SUPPORT & MAINTENANCE

6.3.2 MANAGED SERVICES

7 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY ENTERPRISE SIZE

7.1 OVERVIEW

7.2 SMALL & MEDIUM SIZE ENTERPRISE

7.3 LARGE SIZE ENTERPRISE

8 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 SAAS

8.4 ON-PREMISES

9 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY LOAN TYPE

9.1 OVERVIEW

9.2 SECURED LOANS

9.2.1 SECURED LOANS, BY TYPE

9.2.1.1. HOME LOANS

9.2.1.2. LOAN AGAINST PROPERTY (LAP)

9.2.1.3. LOAN AGAINST INSURANCE POLICIES

9.2.1.4. GOLD LOANS

9.2.1.5. LOAN AGAINST MUTUAL FUNDS & SHARES

9.2.1.6. LOAN AGAINST FIXED DEPOSITS

9.3 UNSECURED LOANS

9.3.1 UNSECURED LOANS, BY TYPE

9.3.1.1. PERSONAL LOANS

9.3.1.2. SHORT TERM BUSINESS LOANS

9.3.1.3. VEHICLE LOANS

9.3.1.4. EDUCATION LOANS

9.4 DEMAND LOANS

9.5 SUBSIDIZED LOANS

9.6 CONCESSIONAL LOANS

9.7 OTHERS

10 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY PURCHASING MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION BASED

10.2.1 MONTHLY SUBSCRIPTION

10.2.2 ANNUAL SUBSCRIPTION

10.3 ONE TIME LICENSE

10.4 FREE

11 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY END USER

11.1 OVERVIEW

11.2 BANKS

11.2.1 BY ENTERPRISE SIZE

11.2.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.2.1.2. LARGE SIZE ENTERPRISE

11.3 FINANCIAL INSTITUTIONS

11.3.1 BY ENTERPRISE SIZE

11.3.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.3.1.2. LARGE SIZE ENTERPRISE

11.4 CREDIT UNIONS

11.4.1 BY ENTERPRISE SIZE

11.4.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.4.1.2. LARGE SIZE ENTERPRISE

11.5 MORTAGAGE LENDERS

11.5.1 BY ENTERPRISE SIZE

11.5.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.5.1.2. LARGE SIZE ENTERPRISE

11.6 BROKERS

11.6.1 BY ENTERPRISE SIZE

11.6.1.1. SMALL & MEDIUM SIZE ENTERPRISE

11.6.1.2. LARGE SIZE ENTERPRISE

11.7 OTHERS

12 GLOBAL LOAN SERVICING SOFTWARE MARKET, BY GEOGRAPHY

GLOBAL LOAN SERVICING SOFTWARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

12.2 EUROPE

12.2.1 GERMANY

12.2.2 FRANCE

12.2.3 U.K.

12.2.4 ITALY

12.2.5 SPAIN

12.2.6 RUSSIA

12.2.7 TURKEY

12.2.8 BELGIUM

12.2.9 NETHERLANDS

12.2.10 NORWAY

12.2.11 FINLAND

12.2.12 SWITZERLAND

12.2.13 DENMARK

12.2.14 SWEDEN

12.2.15 POLAND

12.2.16 REST OF EUROPE

12.3 ASIA PACIFIC

12.3.1 JAPAN

12.3.2 CHINA

12.3.3 SOUTH KOREA

12.3.4 INDIA

12.3.5 AUSTRALIA

12.3.6 NEW ZEALAND

12.3.7 SINGAPORE

12.3.8 THAILAND

12.3.9 MALAYSIA

12.3.10 INDONESIA

12.3.11 PHILIPPINES

12.3.12 TAIWAN

12.3.13 VIETNAM

12.3.14 REST OF ASIA PACIFIC

12.4 SOUTH AMERICA

12.4.1 BRAZIL

12.4.2 ARGENTINA

12.4.3 REST OF SOUTH AMERICA

12.5 MIDDLE EAST AND AFRICA

12.5.1 SOUTH AFRICA

12.5.2 EGYPT

12.5.3 SAUDI ARABIA

12.5.4 U.A.E

12.5.5 OMAN

12.5.6 BAHRAIN

12.5.7 ISRAEL

12.5.8 KUWAIT

12.5.9 QATAR

12.5.10 REST OF MIDDLE EAST AND AFRICA

12.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL LOAN SERVICING SOFTWARE MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL LOAN SERVICING SOFTWARE MARKET, SWOT & DBMR ANALYSIS

15 GLOBAL LOAN SERVICING SOFTWARE MARKET, COMPANY PROFILE

15.1 FINASTRA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 FIS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 LENDFOUNDRY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 SALESFORCE, INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 LOANPRO.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CHETU INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENT

15.7 MARGILL / JURISMEDIA INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENT

15.8 SAGENT M&C, LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENT

15.9 APPLIED BUSINESS SOFTWARE, INC

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENT

15.1 BLACK KNIGHT TECHNOLOGIES, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENT

15.11 BRYT SOFTWARE LCC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENT

15.12 TURNKEY LENDER

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENT

15.13 FUNDINGO

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENT

15.14 NORTRIDGE SOFTWARE, LLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENT

15.15 HES FINTECH.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENT

15.16 ABLE PLATFORM INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENT

15.17 HYLAND SOFTWARE, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENT

15.18 NUCLEUS SOFTWARE EXPORTS LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENT

15.19 ARYZA LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENT

15.2 LOAN SERVICING SOFT INC

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENT

15.21 GOLDPOINT SYSTEMS, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENT

15.22 DHI COMPUTING SERVICE, INC. (FPS GOLD)

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENT

15.23 INFINITY ENTERPRISE LENDING SYSTEMS

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENT

15.24 VERGENT

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENT

15.25 MORTGAGEFLEX

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENT

15.26 BIZ CORE

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 GEOGRAPHIC PRESENCE

15.26.4 PRODUCT PORTFOLIO

15.26.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 CONCLUSION

17 QUESTIONNAIRE

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。