Global Medical Instruments Disinfections Market

市场规模(十亿美元)

CAGR :

%

USD

2.34 Billion

USD

4.11 Billion

2024

2032

USD

2.34 Billion

USD

4.11 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 4.11 Billion | |

|

|

|

|

Global Medical Instruments Disinfections Market Segmentation, By Type (Wipes, Liquid, and Sprays), Environmental Protection Agency Classification (Low Level, Intermediate Level, and High Level), Product Type (Disinfector and Others), End User (Hospitals, Medical Device Manufacturers, Pharma Manufacturers, and Laboratory), Distribution Channel (Tender and Over the Counter) - Industry Trends and Forecast to 2032

Medical Instruments Disinfections Market Size

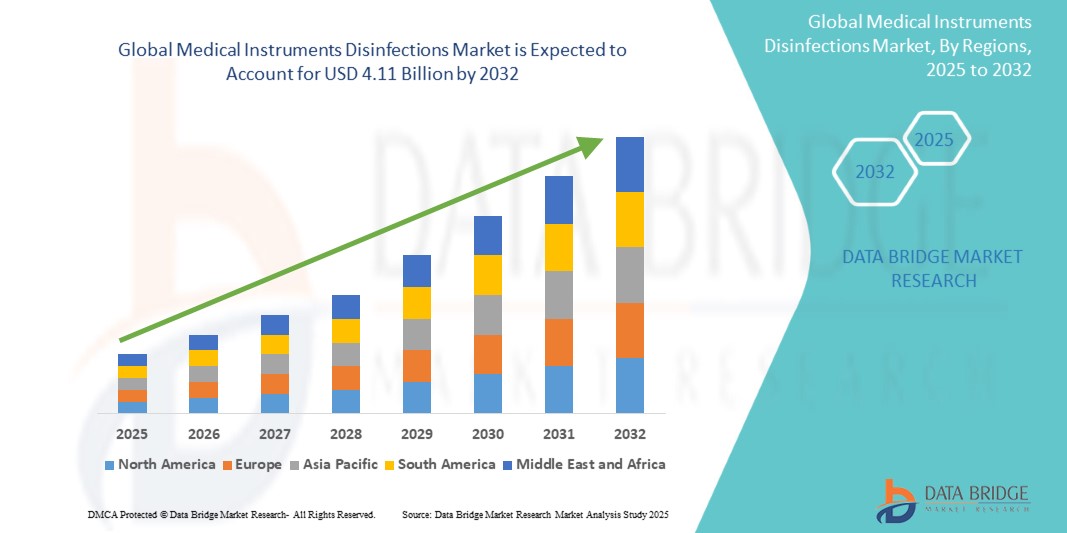

- The global medical instruments disinfections market size was valued at USD 2.34 billion in 2024 and is expected to reach USD 4.11 billion by 2032, at a CAGR of 7.25% during the forecast period

- This growth is driven by rising incidence of infectious diseases

Medical Instruments Disinfections Market Analysis

- Medical Instruments Disinfections systems play a vital role in infection prevention by ensuring that surgical anddiagnostic toolsS are properly decontaminated, thereby reducing the risk ofhealthcare-associated infections (HAIs)and ensuring compliance with hygiene standards

- The growing demand for medical instruments disinfections is fueled by the rising volume of surgical procedures, stricter regulatory mandates on sterilization protocols, and technological innovations that enhance disinfection efficacy, reduce cycle times, and enable integration with centralized sterile services departments (CSSDs)

- North America is expected to dominate the medical instruments disinfections market with the largest market share of 34.66%, driven by strong presence of major market players, widespread adoption of infection control protocols, and the region’s advanced hospital infrastructure supporting stringent sterilization standards

- Asia-Pacific is projected to register the highest growth rate in the medical instruments disinfections market during the forecast period, fueled by rapid healthcare infrastructure development, increased awareness of sterilization practices, and growing healthcare investments in both public and private sectors

- The sprays segment is anticipated to capture the largest market share of 59.96%, due to efficiency of disinfectant sprays in eliminating a broad spectrum of pathogens, including bacteria, viruses, and fungi, which are commonly found on medical instruments

Report Scope and Medical Instruments Disinfections Market Segmentation

|

Attributes |

Medical Instruments Disinfections Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Instruments Disinfections Market Trends

“Shift Toward Eco-Friendly and Biodegradable Disinfection Solutions”

- A growing trend in the medical instruments disinfections market is the shift toward sustainable, non-toxic, and biodegradable disinfection solutions that meet hospital-grade efficacy standards while minimizing environmental impact

- Healthcare facilities are increasingly opting for green alternatives to harsh chemical disinfectants due to concerns about residue, safety, and regulatory compliance

- Suppliers are responding with plant-based formulations, enzymatic cleaners, and low-VOC (volatile organic compound) solutions that align with global sustainability goals

- For instance, in 2023, Ecolab introduced its OxyCide Daily Disinfectant Cleaner, a hydrogen peroxide-based product designed to deliver high-level disinfection with reduced environmental footprint

- This trend is reshaping procurement practices, encouraging innovation in eco-conscious infection prevention solutions across healthcare ecosystems

Medical Instruments Disinfections Market Dynamics

Driver

“Surge in Hospital-Acquired Infections (HAIs) and Post-Surgical Complications”

- A major driver for the medical instruments disinfections market is the alarming rise in HAIs and the complications associated with surgical instrument contamination

- Healthcare systems are under pressure to meet stringent infection control standards due to the growing scrutiny from global health organizations and accrediting bodies

- Enhanced hospital protocols now mandate advanced disinfection and sterilization equipment to ensure compliance and patient safety

- For instance, the U.S. CDC reported in 2023 that nearly 5% of hospitalized patients acquire at least one HAI, intensifying the push for rigorous instrument disinfection protocols

- This increasing demand for safety and accountability continues to drive investments in high-performance disinfection technologies globally

Opportunity

“Growth in Emerging Economies with Expanding Surgical Infrastructure”

- A significant opportunity lies in emerging markets, where expanding healthcare infrastructure and surgical capacity are driving the demand for medical instrument disinfection systems

- Countries in Asia, Latin America, and Africa are rapidly building hospitals and outpatient surgical centers, creating a surge in demand for sterilization and disinfection technologies

- Manufacturers offering affordable, compact, and mobile solutions are well-positioned to capture these growing market segments

- For instance, in 2023, India’s Ministry of Health allocated new funding to upgrade sterilization equipment across 200+ government hospitals under its National Health Mission

- This regional expansion opens new revenue streams for global disinfection solution providers and encourages strategic partnerships

Restraint/Challenge

“Lack of Standardized Disinfection Protocols across Healthcare Facilities”

- A major challenge in the medical instruments disinfections market is the lack of universally accepted disinfection and sterilization protocols across regions and facility types

- This inconsistency leads to improper use of products, equipment inefficiencies, and potential risks of cross-contamination

- Smaller clinics and outpatient centers, particularly in underregulated regions, often lack trained personnel and standardized workflow protocols

- For instance, in 2023, a WHO audit revealed inconsistent disinfection practices in over 40% of public health clinics in sub-Saharan Africa, contributing to elevated infection rates

- This variability in practices hinders product efficacy, complicates training efforts, and affects the uniform adoption of disinfection technologies globally

Medical Instruments Disinfections Market Scope

The market is segmented on the basis of type, environmental protection agency classification, product type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Environmental Protection Agency Classification |

|

|

By Product Type |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the sprays is projected to dominate the market with a largest share in type segment

The sprays segment is expected to dominate the medical instruments disinfections market with the largest market share of 59.96% in 2025 due to efficiency of disinfectant sprays in eliminating a broad spectrum of pathogens, including bacteria, viruses, and fungi, which are commonly found on medical instruments.

The intermediate level is expected to account for the largest share during the forecast period in environmental protection agency classification segment

In 2025, the intermediate level segment is expected to dominate the market with the largest market share of 57.19% due to effectiveness of intermediate-level disinfectants in eliminating a broad spectrum of pathogens, including tuberculocidal microbes, while being less corrosive to medical equipment compared to high-level disinfectants.

Medical Instruments Disinfections Market Regional Analysis

“North America Holds the Largest Share in the Medical Instruments Disinfections Market”

- North America dominates the medical instruments disinfections market with the largest market share of 34.66%, driven by strong presence of major market players, widespread adoption of infection control protocols, and the region’s advanced hospital infrastructure supporting stringent sterilization standards

- U.S. dominates within the region, owing to robust regulatory frameworks (e.g., CDC, FDA guidelines), high surgical volumes, and growing emphasis on preventing hospital-acquired infections (HAIs) through regular use of intermediate and high-level disinfectants

- In addition, continuous technological advancements, increased government funding for healthcare-associated infection reduction, and rising use of automated endoscope reprocessors and UV-C systems are expected to reinforce North America’s dominance in the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Medical Instruments Disinfections Market”

- Asia-Pacific is expected to witness the highest growth rate in the medical instruments disinfections market, driven by rapid healthcare infrastructure development, increased awareness of sterilization practices, and growing healthcare investments in both public and private sectors

- Growth factors include rising hospital and surgical center expansions, greater emphasis on infection prevention training, and widespread adoption of disinfection protocols in response to global pandemics and antimicrobial resistance threats

- China and India are witnessing high demand fueled by government-led healthcare reform programs, local production of disinfection devices, and greater access to surgical care in tier-2 and tier-3 cities

Medical Instruments Disinfections Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M(U.S.)

- STERIS(U.S.)

- Steelco S.p.A. (Italy)

- Schülke & Mayr GmbH (Germany)

- O&M Halyard (U.S.)

- Bergen Group of Companies (India)

- Ecolab(U.S.)

- Tristel, Inc. (U.S.)

- Belimed INC. (Switzerland)

- ASP (Advanced Sterilization Products) (U.S.)

- Getinge(Sweden)

- JAYCO, INC. (U.S.)

- MMM Group (Germany)

- MATACHANA GROUP (Spain)

- Huaiyin Medical Instruments Co., Ltd. (China)

- SAKURA SI CO., LTD. (Japan)

- Crest Ultrasonics Corp. (China)

- MCKESSON CORPORATION (U.S.)

Latest Developments in Global Medical Instruments Disinfections Market

- In January 2024, KYZEN showcased its advanced medical cleaning solutions, METALNOX M6093 and M6386, at MD&M West 2024 held in Anaheim, California, aiming to promote eco-friendly and effective device cleaning practices. This exhibition reinforced KYZEN’s commitment to sustainable innovation in the medical device cleaning market

- In August 2021, Ecolab launched the Ecolab Healthcare Advanced Design Center to collaborate with medical device industry leaders in designing infection prevention solutions tailored for surgical equipment and hospital environments. This initiative underscored Ecolab’s strategic focus on customer-centric innovation and operational hygiene

- In February 2021, Getinge partnered with the University of Gothenburg to drive innovation and improve sustainability efforts across its healthcare offerings. This partnership marked a significant step toward environmentally responsible healthcare technology development

- In January 2021, STERIS entered into an agreement to acquire Cantel, significantly expanding its infection prevention product portfolio across dental and medical markets. This acquisition bolstered STERIS’s competitive position in the global sterilization and disinfection sector

- In January 2020, Getinge AB completed the acquisition of Applikon Biotechnology B.V., a specialist in bioreactor systems used for vaccine and antibody production, as well as industrial biotechnology applications. This move expanded Getinge’s capabilities in the biopharmaceutical production and laboratory solutions market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。