Global Next Generation Rsv Drug And Vaccine Market

市场规模(十亿美元)

CAGR :

%

USD

594.00 Million

USD

1,250.80 Million

2025

2033

USD

594.00 Million

USD

1,250.80 Million

2025

2033

| 2026 –2033 | |

| USD 594.00 Million | |

| USD 1,250.80 Million | |

|

|

|

|

Global Next-Generation RSV Drug & Vaccine Market Segmentation, By Product Type (Monoclonal Antibodies, Vaccines, Antiviral Drugs, and Others), End User (Hospitals, Clinics, Research & Academic Institutes, and Homecare Settings )- Industry Trends and Forecast to 2033

Next-Generation RSV Drug & Vaccine Market Size

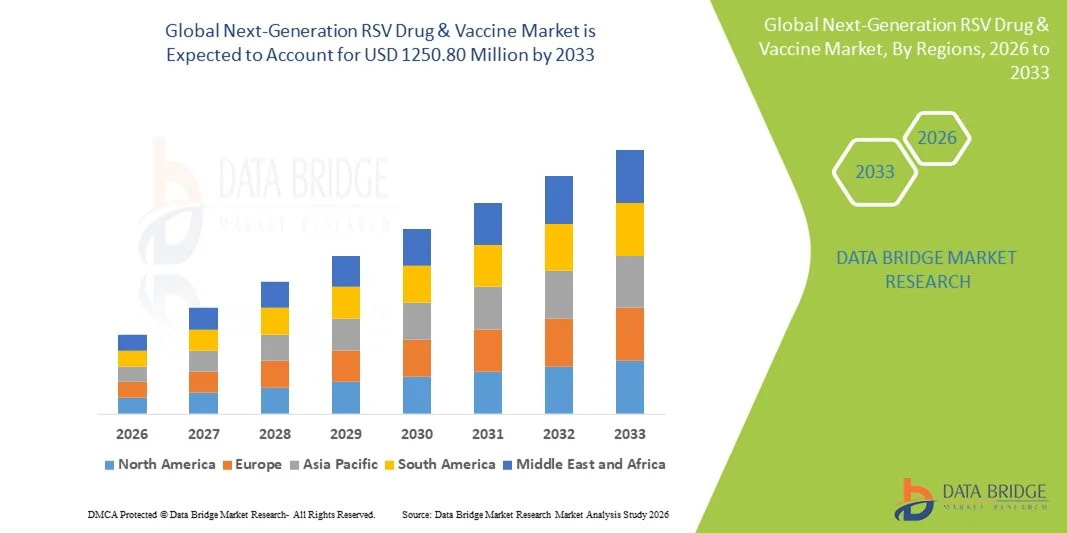

- The global next-generation RSV Drug & vaccine market size was valued at USD 594 Million in 2025 and is expected to reach USD 1250.80 Million by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by increasing awareness of respiratory syncytial virus (RSV), rising incidence of RSV infections in infants, elderly, and immunocompromised patients, and ongoing innovations in next-generation therapeutics and vaccines

- Furthermore, growing investments by pharmaceutical companies in RSV drug development, government vaccination programs, and rapid adoption of novel monoclonal antibodies and vaccine technologies are accelerating the uptake of Next-Generation RSV Drug & Vaccine solutions, thereby significantly boosting the industry's growth

Next-Generation RSV Drug & Vaccine Market Analysis

- Next-generation RSV drugs and vaccines, designed to prevent and treat respiratory syncytial virus infections, are becoming increasingly critical components of modern infectious disease management across pediatric, adult, and geriatric populations due to their improved efficacy, longer duration of protection, and advancements in vaccine and monoclonal antibody technologies

- The escalating demand for next-generation RSV drug and vaccine solutions is primarily driven by the rising global burden of RSV infections, growing awareness among healthcare providers and patients, expanding immunization programs, and increased investment in innovative biologics and vaccine platforms aimed at improving prevention and treatment outcomes

- North America dominated the Next-Generation RSV Drug & Vaccine market with the largest revenue share of approximately 42.5% in 2025, driven by advanced clinical infrastructure, high healthcare expenditure, early adoption of innovative RSV vaccines and therapeutics, and strong presence of leading biopharmaceutical companies. The U.S. is experiencing significant growth in RSV drug and vaccine adoption, supported by government immunization initiatives and ongoing clinical trials

- Asia-Pacific is expected to be the fastest growing region in the Next-Generation RSV Drug & Vaccine market during the forecast period, registering a CAGR of around 11.4%, fueled by increasing population at risk, rising healthcare awareness, improving medical infrastructure, and expanding access to next-generation RSV therapeutics and vaccines in countries such as China and India

- Monoclonal antibodies dominated the market with the largest revenue share of 41.5%, driven by their proven efficacy in providing immediate passive immunity to high-risk infants and elderly populations

Report Scope and Next-Generation RSV Drug & Vaccine Market Segmentation

|

Attributes |

Next-Generation RSV Drug & Vaccine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Next-Generation RSV Drug & Vaccine Market Trends

Advancements in RSV Vaccine Formulations and Novel Drug Development

- A significant and accelerating trend in the global next-generation RSV Drug & vaccine market is the development of next-generation vaccines and long-acting monoclonal antibodies designed to provide broader protection against RSV infections in infants, elderly, and high-risk populations

- For instance, in November 2022, Pfizer reported positive results from its RSV maternal vaccine trial, demonstrating strong immune responses in both mothers and newborns, highlighting the increasing focus on maternal immunization strategies

- There is a growing emphasis on developing vaccines that are effective across multiple RSV strains, reducing hospitalization rates and severe disease burden

- Companies are also focusing on pediatric formulations, single-dose regimens, and combination vaccines to improve compliance and efficacy

- Long-acting monoclonal antibodies are emerging as a complementary preventive strategy, offering protection for several months with a single injection

- There is rising research into inhaled or intranasal RSV vaccines to enhance mucosal immunity and patient compliance

- Global clinical trials are expanding to cover diverse populations, including infants, adults over 65, and immunocompromised patients, reflecting the broad applicability of next-generation products

- Regulatory approvals and fast-track designations by authorities such as the FDA and EMA are encouraging rapid innovation and commercialization

- Partnerships between biopharma companies and biotech firms are facilitating accelerated vaccine development

- Increasing awareness of RSV-associated hospitalizations and deaths is motivating governments and healthcare providers to adopt new prophylactic therapies

- The trend is further supported by advancements in adjuvant technologies and delivery mechanisms that improve vaccine stability and immune response

- Overall, the market is witnessing a shift toward safer, more effective, and patient-friendly RSV prevention solutions globally

Next-Generation RSV Drug & Vaccine Market Dynamics

Driver

Growing Burden of RSV Infections and Healthcare Initiatives

- The increasing prevalence of RSV infections, particularly among infants, elderly, and immunocompromised patients, is a key driver for market growth

- For instance, in October 2021, AstraZeneca expanded its RSV monoclonal antibody program, highlighting the need for long-acting preventive therapies to reduce RSV-related hospitalizations in high-risk infants

- Public health campaigns emphasizing RSV awareness and early prevention measures are boosting demand for next-generation vaccines and drugs

- Rising hospitalization costs and the economic burden of RSV-related complications are motivating healthcare systems to adopt prophylactic interventions

- Governments and healthcare authorities are providing reimbursement support and facilitating inclusion of RSV vaccines in immunization programs

- The aging global population and increased susceptibility among elderly individuals are further driving preventive therapy adoption

- High RSV prevalence during seasonal outbreaks creates demand for ready-to-use prophylactic solutions in both community and hospital settings

- Integration of RSV prevention strategies into maternal and pediatric care is increasing product uptake

- Collaboration between governments, NGOs, and pharmaceutical companies is promoting awareness and vaccination campaigns

- Investment in R&D by biopharma companies to improve efficacy and extend duration of protection is further fueling growth

- Healthcare providers are emphasizing preventive care, which is leading to broader adoption of next-generation RSV drugs and vaccines

- Global expansion of clinical trial networks allows for rapid validation of efficacy and safety across diverse populations, enhancing market credibility

Restraint/Challenge

High Costs, Regulatory Hurdles, and Market Access Limitations

- The high cost of next-generation RSV vaccines and long-acting monoclonal antibodies can limit adoption, particularly in low- and middle-income countries

- For instance, the nirsevimab monoclonal antibody launched by Sanofi and AstraZeneca in 2022 carries a premium price, restricting uptake in resource-constrained regions despite proven efficacy

- Stringent regulatory approvals and clinical trial requirements can delay product launches and increase development costs

- Reimbursement limitations in emerging markets and variable healthcare infrastructure may hinder accessibility to high-cost RSV therapies

- Storage and cold-chain requirements for biologics can present logistical challenges, particularly in remote or underdeveloped regions

- Prescriber hesitancy and lack of awareness among caregivers in certain regions may slow uptake

- Competition from existing standard-of-care treatments, such as palivizumab, may impact the adoption of newly developed therapies

- Intellectual property rights and patent-related issues can limit entry of generics or biosimilars, keeping prices high

- Global disparities in healthcare coverage can lead to uneven adoption rates across regions

- Monitoring and tracking vaccination or prophylaxis compliance in infants and high-risk populations is challenging, impacting overall market penetration

- Addressing these challenges requires cost-effective manufacturing, public-private partnerships, and educational campaigns to improve awareness

- Overcoming market access and regulatory hurdles is essential to ensure equitable availability of next-generation RSV drugs and vaccines worldwide

Next-Generation RSV Drug & Vaccine Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the Next-Generation RSV Drug & Vaccine market is segmented into monoclonal antibodies, vaccines, antiviral drugs, and others. In 2025, monoclonal antibodies dominated the market with the largest revenue share of 41.5%, driven by their proven efficacy in providing immediate passive immunity to high-risk infants and elderly populations. The strong preference for monoclonal antibody therapies is fueled by clinical adoption, favorable reimbursement policies, and growing awareness among healthcare providers regarding RSV prevention. The availability of long-acting monoclonal antibodies and favorable safety profiles further enhances adoption. Their use in neonatal intensive care units and pediatric hospitals also contributes significantly to market share. Furthermore, increasing research investments and partnerships among leading pharmaceutical companies are accelerating the development and rollout of next-generation antibody treatments, strengthening their dominance.

The vaccines segment is expected to witness the fastest CAGR of 18.2% from 2026 to 2033, owing to the growing pipeline of RSV vaccines targeting infants, pregnant women, and older adults. Vaccines offer the advantage of long-term immunity and are gaining attention due to recent regulatory approvals in multiple countries. Government initiatives and immunization programs to prevent RSV outbreaks, combined with increasing public awareness of RSV-related hospitalizations, are propelling vaccine adoption. Companies are investing in mRNA-based and nanoparticle vaccines, enhancing efficacy and safety profiles. Rising demand from emerging markets and expansion of clinical trials across regions further accelerates growth in the vaccine segment.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, research & academic institutes, and homecare settings. In 2025, hospitals held the largest market revenue share of 52.3%, driven by high patient footfall, advanced diagnostic and treatment infrastructure, and the high prevalence of RSV-related hospitalizations among infants and elderly patients. Hospitals are the primary point for monoclonal antibody administration and vaccination, especially in neonatal and pediatric wards. The presence of trained medical personnel and integration with electronic medical record systems ensures timely administration and monitoring, further solidifying their dominance. In addition, hospitals benefit from bulk procurement contracts and collaborations with pharmaceutical companies, which facilitate access to next-generation RSV products.

The homecare segment is projected to witness the fastest CAGR of 15.7% from 2026 to 2033, fueled by the rising trend of home-based prophylactic treatments for at-risk infants and elderly patients. Increasing patient preference for convenient, at-home care, coupled with telemedicine support, allows caregivers to administer monoclonal antibodies or vaccines safely outside the hospital. Growth in homecare nursing services and enhanced patient education regarding RSV prevention also support adoption. Moreover, technological advancements in prefilled delivery devices and patient monitoring tools make homecare administration more feasible, creating a robust growth trajectory for this segment.

Next-Generation RSV Drug & Vaccine Market Regional Analysis

- North America dominated the next-generation RSV Drug & Vaccine market with the largest revenue share of approximately 42.5% in 2025, driven by advanced clinical infrastructure, high healthcare expenditure, early adoption of innovative RSV vaccines and therapeutics, and the strong presence of leading biopharmaceutical companies

- The region benefits from well-established immunization programs, high awareness regarding RSV prevention, and rapid uptake of newly approved monoclonal antibodies and next-generation vaccines

- This dominance is further supported by robust R&D activities, favorable reimbursement frameworks, and strong collaboration between pharmaceutical companies, research institutions, and healthcare providers, strengthening the adoption of next-generation RSV drugs and vaccines across pediatric and adult populations

U.S. Next-Generation RSV Drug & Vaccine Market Insight

The U.S. Next-Generation RSV Drug & Vaccine market captured the largest revenue share within North America in 2025, supported by early regulatory approvals, ongoing clinical trials, and government-backed immunization initiatives. The increasing burden of RSV among infants, older adults, and immunocompromised populations is driving demand for advanced preventive and therapeutic options. Strong investments in vaccine development, coupled with rapid commercialization of next-generation RSV biologics, continue to propel market growth in the country.

Europe Next-Generation RSV Drug & Vaccine Market Insight

The Europe Next-Generation RSV Drug & Vaccine market is projected to expand at a steady CAGR during the forecast period, driven by rising RSV incidence, expanding vaccination programs, and strong public healthcare systems. Increased focus on preventive healthcare, along with favorable regulatory support for innovative vaccines and monoclonal antibodies, is accelerating market adoption across major European countries.

U.K. Next-Generation RSV Drug & Vaccine Market Insight

The U.K. Next-Generation RSV Drug & Vaccine market is anticipated to grow at a notable CAGR, supported by government-led immunization strategies, increasing RSV awareness, and growing investment in infectious disease prevention. The integration of next-generation RSV vaccines into national healthcare programs is expected to further support market expansion.

Germany Next-Generation RSV Drug & Vaccine Market Insight

The Germany Next-Generation RSV Drug & Vaccine market is expected to witness considerable growth during the forecast period, driven by strong healthcare infrastructure, high R&D spending, and increasing adoption of advanced biologics. Germany’s emphasis on preventive medicine and early disease intervention supports the uptake of next-generation RSV drugs and vaccines.

Asia-Pacific Next-Generation RSV Drug & Vaccine Market Insight

The Asia-Pacific Next-Generation RSV Drug & Vaccine market is expected to grow at the fastest CAGR of around 11.4% during the forecast period of 2026 to 2033. Growth is driven by a large at-risk population, rising healthcare awareness, improving medical infrastructure, and expanding access to innovative RSV therapeutics and vaccines, particularly in China and India.

Japan Next-Generation RSV Drug & Vaccine Market Insight

The Japan Next-Generation RSV Drug & Vaccine market is gaining momentum due to an aging population, increasing RSV-related hospitalizations, and strong focus on advanced biologics. High adoption of innovative vaccines and monoclonal antibody therapies, supported by Japan’s well-developed healthcare system, is driving market growth.

China Next-Generation RSV Drug & Vaccine Market Insight

The China Next-Generation RSV Drug & Vaccine market accounted for a significant revenue share in Asia-Pacific in 2025, attributed to a large pediatric population, rising healthcare expenditure, and growing government focus on vaccination programs. Expanding domestic pharmaceutical manufacturing capabilities and increasing access to next-generation RSV vaccines and drugs are key factors propelling market growth in China.

Next-Generation RSV Drug & Vaccine Market Share

The Next-Generation RSV Drug & Vaccine industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• GSK plc (U.K.)

• Sanofi (France)

• AstraZeneca plc (U.K.)

• Moderna, Inc. (U.S.)

• BioNTech SE (Germany)

• Johnson & Johnson (U.S.)

• Merck & Co., Inc. (U.S.)

• Bavarian Nordic A/S (Denmark)

• Novavax, Inc. (U.S.)

• CSL Limited (Australia)

• Serum Institute of India Pvt. Ltd. (India)

• Valneva SE (France)

• CureVac N.V. (Germany)

• Sinovac Biotech Ltd. (China)

• CanSino Biologics Inc. (China)

• Biogen Inc. (U.S.)

• GlaxoSmithKline Vaccines (U.K.)

• Takeda Pharmaceutical Company Limited (Japan)

• Emergent BioSolutions Inc. (U.S.)

Latest Developments in Global Next-Generation RSV Drug & Vaccine Market

- In July 2023, the U.S. Food and Drug Administration (FDA) approved Beyfortus™ (nirsevimab-alip), a long-acting monoclonal antibody developed by Sanofi and AstraZeneca, for the prevention of respiratory syncytial virus (RSV) lower respiratory tract disease in infants through their first RSV season and up to 24 months of age. Beyfortus became the first monoclonal antibody approved for broad infant RSV protection, offering a single-dose passive immunization that substantially reduces medically attended RSV disease and hospitalizations in newborns and young children, addressing a critical gap in pediatric RSV prevention

- In June 2025, the U.S. FDA approved ENFLONSIA (clesrovimab-cfor), Merck’s extended-half-life monoclonal antibody, for the prevention of RSV lower respiratory tract disease in infants born during or entering their first RSV season. ENFLONSIA provides direct, rapid, and durable protection with a single dose regardless of weight, representing a significant expansion of passive immunization options alongside Beyfortus for infant RSV prophylaxis

- In April 2025, the European Commission approved Pfizer’s RSV vaccine ABRYSVO® for use in adults aged 18 to 59 at increased risk of severe RSV disease across all 27 EU member states. This expanded regulatory approval marked one of the first adult RSV vaccine authorizations in Europe and broadened ABRYSVO’s preventive reach beyond older adults and pregnant women, strengthening adult RSV immunization strategies

- In March 2025, the World Health Organization (WHO) prequalified the first maternal RSV vaccine (RSVpreF), manufactured by Pfizer, to protect infants via antibody transfer during pregnancy. WHO prequalification enables global procurement, particularly for low- and middle-income countries, and supports broader immunization efforts to reduce severe RSV disease and deaths among infants in regions with limited access to preventive care

- In June 2025, Sanofi announced it accelerated global shipping of Beyfortus ahead of the 2025–2026 RSV season, tripling production capacity and doubling manufacturing sites since its launch. This strategic scale-up ensures broader global availability and reflects increasing demand and real-world uptake of infant RSV prophylaxis products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。