Global Non Alcoholic Rtd Beverages Market

市场规模(十亿美元)

CAGR :

%

USD

1,005.36 Billion

USD

1,530.09 Billion

2025

2033

USD

1,005.36 Billion

USD

1,530.09 Billion

2025

2033

| 2026 –2033 | |

| USD 1,005.36 Billion | |

| USD 1,530.09 Billion | |

|

|

|

|

Global Non-Alcoholic RTD Beverages Market Segmentation, By Product Type (Fermented Beverages and Non-Fermented Beverages), Packaging (Bottles, Cans/Tins, Tetra Packs, and Others), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail, and Others)- Industry Trends and Forecast to 2033

Non-Alcoholic RTD Beverages Market Size

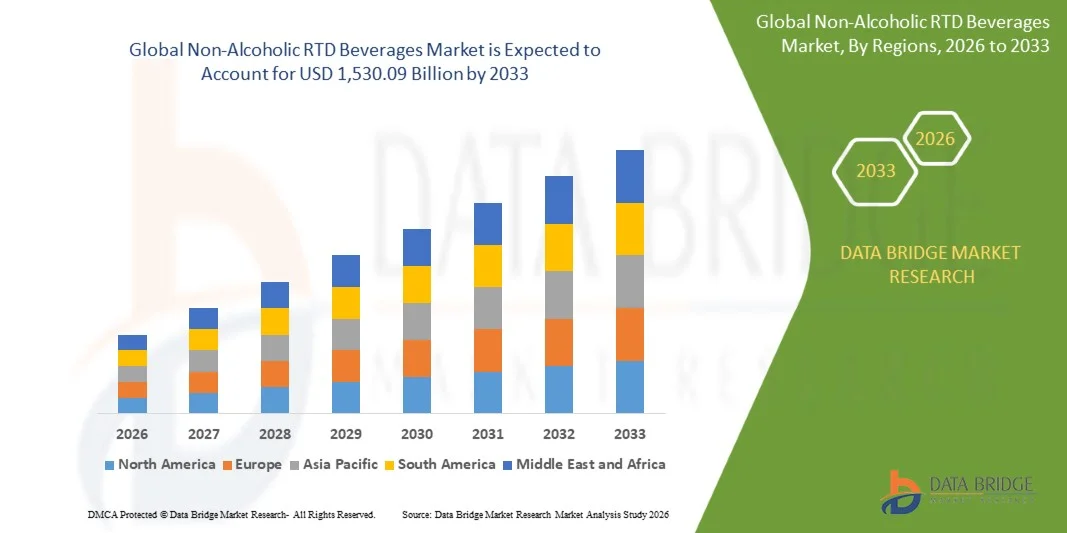

- The global non-alcoholic RTD beverages market size was valued at USD 1,005.36 billion in 2025 and is expected to reach USD 1,530.09 billion by 2033, at a CAGR of 5.39% during the forecast period

- The market growth is largely fuelled by rising health consciousness, increasing preference for low-sugar and functional beverages, and growing demand for convenient on-the-go drink options

- Expanding urban populations, busy lifestyles, and strong penetration of modern retail and e-commerce channels are further supporting market expansion

Non-Alcoholic RTD Beverages Market Analysis

- The market is characterized by continuous product innovation in functional, fortified, and natural beverage formulations to meet evolving consumer preferences

- Increasing demand from emerging economies, along with aggressive branding, flavor diversification, and sustainable packaging initiatives, is shaping competitive dynamics and long-term growth opportunities

- Asia-Pacific non-alcoholic RTD beverages market dominated the non-alcoholic RTD beverages market with the largest revenue share in 2025, driven by rapid urbanization, changing dietary habits, and rising disposable incomes in countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global non-alcoholic RTD beverages market, driven by rising health awareness, growing adoption of functional and plant-based beverages, and expanding availability through retail and e-commerce channels

- The bottles segment accounted for the largest market share in 2025, supported by their wide usage across juices, dairy-based RTD beverages, and functional drinks. Bottles offer product visibility, resealability, and suitability for both premium and mass-market beverages, making them a preferred choice for manufacturers and consumers

Report Scope and Non-Alcoholic RTD Beverages Market Segmentation

|

Attributes |

Non-Alcoholic RTD Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Alcoholic RTD Beverages Market Trends

“Rising Demand for Health-Oriented and Functional Beverages”

• The growing focus on health, wellness, and balanced lifestyles is significantly shaping the non-alcoholic RTD beverages market, as consumers increasingly prefer drinks that are low in sugar, free from artificial additives, and enriched with functional ingredients. Non-alcoholic RTD beverages are gaining traction due to their convenience, refreshing appeal, and ability to offer hydration, energy, and nutritional benefits without alcohol, strengthening adoption across urban and on-the-go consumption occasions

• Increasing awareness around preventive healthcare, fitness, and mindful consumption has accelerated demand for functional RTD beverages such as vitamin-fortified drinks, functional teas, kombucha, and plant-based beverages. Health-conscious consumers are actively seeking products that support immunity, digestion, and energy, prompting brands to invest in cleaner formulations and innovative ingredient blends

• Health-focused and clean-label trends are influencing purchasing decisions, with manufacturers emphasizing natural ingredients, reduced sugar content, and transparent labeling. These factors are helping brands differentiate products in a competitive market, build consumer trust, and strengthen brand loyalty, while also encouraging the adoption of sustainable packaging and responsible sourcing practices

• For instance, in 2024, PepsiCo in the U.S. and Nestlé in Switzerland expanded their non-alcoholic RTD beverage portfolios with functional and low-sugar product launches across teas, juices, and wellness drinks. These products were introduced in response to growing consumer demand for healthier alternatives, with strong distribution through retail, convenience stores, and e-commerce channels, supporting repeat purchases

• While demand for non-alcoholic RTD beverages is rising, sustained market expansion depends on continuous product innovation, flavor diversification, and maintaining taste profiles alongside health benefits. Manufacturers are focusing on improving scalability, supply chain efficiency, and cost optimization to balance affordability, functionality, and consumer appeal

Non-Alcoholic RTD Beverages Market Dynamics

Driver

“Growing Preference for Convenient and Healthy Beverage Options”

• Rising consumer demand for convenient, ready-to-consume beverages with health benefits is a major driver for the non-alcoholic RTD beverages market. Manufacturers are increasingly developing products that combine functionality, taste, and portability to cater to busy lifestyles, supporting market growth and product diversification

• Expanding applications across daily hydration, sports and fitness, workplace consumption, and social occasions are influencing market growth. Non-alcoholic RTD beverages offer versatility, longer shelf life, and ease of access, enabling brands to target a wide consumer base across age groups

• Beverage companies are actively promoting non-alcoholic RTD products through new launches, marketing campaigns, and strategic partnerships with retailers and foodservice providers. These efforts are supported by increasing consumer preference for healthier alternatives to carbonated soft drinks and sugary beverages

• For instance, in 2023, Coca-Cola in the U.S. and Suntory in Japan reported increased sales of non-alcoholic RTD teas and functional beverages, driven by rising demand for low-calorie and wellness-focused drinks. Both companies emphasized health benefits and flavor innovation to strengthen market positioning

• Although convenience and health trends support growth, wider adoption depends on competitive pricing, ingredient availability, and scalable manufacturing processes. Investment in sustainable sourcing, advanced formulation technology, and efficient distribution networks will be critical for maintaining long-term growth and competitiveness

Restraint/Challenge

“High Competition And Price Sensitivity In Mass Markets”

• Intense competition from traditional soft drinks, juices, and emerging functional beverage brands remains a key challenge for the non-alcoholic RTD beverages market. Price sensitivity among consumers, particularly in developing regions, can limit the adoption of premium and functional RTD offerings

• Consumer awareness and acceptance of functional claims vary across regions, especially in price-driven markets where taste and affordability remain primary purchase factors. Limited understanding of added health benefits can restrict adoption of value-added RTD beverages

• Supply chain challenges also impact market growth, as sourcing natural ingredients, functional additives, and sustainable packaging materials can increase production and logistics costs. Fluctuations in raw material prices further affect profitability and pricing strategies

• For instance, in 2024, beverage distributors in Southeast Asia and Latin America reported slower uptake of premium non-alcoholic RTD beverages due to higher prices and strong competition from conventional soft drinks. Limited shelf space and high promotional costs also affected product visibility and sales performance

• Overcoming these challenges will require cost-efficient production, strong brand differentiation, and targeted consumer education initiatives. Collaboration with retailers, foodservice operators, and digital platforms can help unlock long-term growth potential in the global non-alcoholic RTD beverages market, while affordable and innovative product offerings will support broader adoption

Non-Alcoholic RTD Beverages Market Scope

The market is segmented on the basis of product type, packaging, and distribution channel

• By Product Type

On the basis of product type, the global non-alcoholic RTD beverages market is segmented into fermented beverages and non-fermented beverages. The non-fermented beverages segment held the largest market revenue share in 2025, driven by high consumer preference for ready-to-drink juices, carbonated soft drinks, functional beverages, and energy drinks that offer convenience, longer shelf life, and wide flavor variety. These products are widely consumed across all age groups and benefit from strong brand presence and extensive retail availability.

The fermented beverages segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of gut health, probiotics, and functional nutrition. Increasing demand for kombucha, fermented teas, and cultured drinks among health-conscious consumers is supporting this growth, particularly in urban markets where premium and wellness-focused beverages are gaining traction.

• By Packaging

On the basis of packaging, the market is segmented into bottles, cans/tins, tetra packs, and others. The bottles segment accounted for the largest market share in 2025, supported by their wide usage across juices, dairy-based RTD beverages, and functional drinks. Bottles offer product visibility, resealability, and suitability for both premium and mass-market beverages, making them a preferred choice for manufacturers and consumers.

The cans/tins segment is expected to witness the fastest growth from 2026 to 2033, driven by rising demand for carbonated RTD beverages, energy drinks, and sustainable packaging solutions. Lightweight nature, recyclability, and improved shelf life are encouraging brands to increasingly adopt cans, especially for on-the-go consumption

• By Distribution Channel

Based on distribution channel, the non-alcoholic RTD beverages market is segmented into supermarkets/hypermarkets, specialty stores, convenience stores, online retail, and others. Supermarkets and hypermarkets dominated the market in 2025 due to their extensive product assortment, competitive pricing, and strong promotional activities that attract high consumer footfall.

The online retail segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing e-commerce penetration, doorstep delivery convenience, and the growing preference for digital grocery shopping. Subscription models, product bundling, and availability of niche and premium RTD beverages are further accelerating online channel adoption.

Non-Alcoholic RTD Beverages Market Regional Analysis

- Asia-Pacific non-alcoholic RTD beverages market dominated the non-alcoholic RTD beverages market with the largest revenue share in 2025, driven by rapid urbanization, changing dietary habits, and rising disposable incomes in countries such as China, Japan, and India

- Increasing adoption of Western-style convenience beverages, supported by a growing young population and expanding retail presence, is boosting market growth

- In addition, local flavor innovations and affordability are enhancing product penetration across urban and semi-urban areas

Japan Non-Alcoholic RTD Beverages Market Insight

The Japan non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong demand for convenient, functional, and premium-quality beverages. Consumers place high importance on health benefits, driving demand for fortified teas, functional drinks, and low-calorie RTD options. The integration of traditional flavors with modern formulations, along with Japan’s advanced vending and retail infrastructure, continues to support market growt.

China Non-Alcoholic RTD Beverages Market Insight

The China non-alcoholic RTD beverages market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, a growing middle-class population, and increasing health awareness. China represents one of the fastest-growing markets for ready-to-drink beverages, with strong demand for functional drinks, herbal teas, and juice-based RTD products. The expansion of modern retail, strong domestic brands, and government focus on healthy consumption habits are key factors driving the market in China.

North America Non-Alcoholic RTD Beverages Market Insight

North America non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health consciousness, increasing demand for convenient on-the-go beverages, and a growing shift away from sugary carbonated drinks. Consumers in the region highly value functional benefits, clean-label ingredients, and diverse flavor profiles offered by non-alcoholic RTD beverages such as iced teas, functional juices, kombucha, and plant-based drinks. This strong adoption is further supported by high disposable incomes, a well-established retail network, and continuous product innovation, positioning non-alcoholic RTD beverages as a preferred choice across daily consumption and lifestyle-oriented segments

U.S. Non-Alcoholic RTD Beverages Market Insight

The U.S. non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong consumer preference for health-focused and functional drinks. Increasing demand for low-sugar, organic, and fortified beverages is encouraging manufacturers to expand their portfolios. The growing popularity of ready-to-drink coffees, teas, and functional beverages, combined with strong penetration of convenience stores and e-commerce channels, continues to propel market growth. In addition, rising adoption of active and wellness-oriented lifestyles is accelerating demand for innovative RTD beverage offerings.

Europe Non-Alcoholic RTD Beverages Market Insight

The Europe non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing awareness of health and wellness and the rising trend of mindful consumption. Consumers across the region are increasingly opting for natural, low-calorie, and functional beverage options. The demand for premium and sustainably packaged RTD beverages is expanding, with strong growth observed across retail, foodservice, and on-the-go consumption channels.

U.K. Non-Alcoholic RTD Beverages Market Insight

The U.K. non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033, supported by growing demand for healthier alternatives to traditional soft drinks. Rising interest in plant-based, organic, and functional beverages is shaping purchasing behavior. The country’s strong retail infrastructure, coupled with increasing innovation in flavor combinations and nutritional fortification, is expected to sustain market expansion.

Germany Non-Alcoholic RTD Beverages Market Insight

The Germany non-alcoholic RTD beverages market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing preference for natural and functional drinks and strong consumer focus on quality and sustainability. Demand for non-alcoholic RTD beverages such as functional waters, iced teas, and juice-based drinks is rising steadily. Germany’s emphasis on eco-friendly packaging and clean-label formulations is encouraging manufacturers to introduce premium and health-oriented products.

Non-Alcoholic RTD Beverages Market Share

The Non-Alcoholic RTD Beverages industry is primarily led by well-established companies, including:

- PepsiCo, Inc. (U.S.)

- The Coca-Cola Company (U.S.)

- Nestlé S.A. (Switzerland)

- Danone S.A. (France)

- Red Bull GmbH (Austria)

- Suntory Holdings Limited (Japan)

- Keurig Dr Pepper Inc. (U.S.)

- Asahi Group Holdings, Ltd. (Japan)

- Reed’s, Inc. (U.S.)

- Monster Beverage Corp. (U.S.)

Latest Developments in Global Non-Alcoholic RTD Beverages Market

- In February 2024, The Coca-Cola Company launched Coca-Cola Spiced in North America, marking a product innovation aimed at expanding its flavored cola portfolio. The launch includes both regular and zero-sugar variants to cater to evolving consumer preferences for taste and reduced sugar intake. This development is designed to attract younger demographics and flavor-seeking consumers. It strengthens Coca-Cola’s competitive positioning in the premium and flavored carbonated beverage segment. The launch is expected to intensify competition and drive flavor-led innovation across the RTD market

- In January 2023, PepsiCo, Inc. introduced the new and improved Pepsi Zero, featuring reformulated sweeteners and a more refreshing taste profile. The product upgrade addresses growing consumer demand for zero-sugar beverages without compromising flavor. This launch reflects PepsiCo’s focus on staying relevant amid shifting health and wellness trends. It enhances the company’s low-calorie beverage portfolio and supports brand loyalty. The development contributes to increased competition in the sugar-free carbonated drinks segment

- In July 2025, PepsiCo, Inc. launched Pepsi Prebiotic Cola, the first prebiotic beverage in the traditional cola category. This innovation combines classic cola flavor with functional gut health benefits. The launch targets health-conscious consumers seeking added functionality in everyday beverages. It represents the first major cola-category innovation in nearly two decades. The product is expected to create a new functional cola sub-segment and reshape market dynamics

- In May 2025, Milo’s Tea Company introduced new refrigerated lemonade and tea beverages made with natural ingredients and free from artificial additives. The launch expands the company’s clean-label and caffeine-free product offerings for summer consumption. It aims to strengthen Milo’s presence in the premium refrigerated RTD segment. The new flavors cater to growing consumer demand for natural and minimally processed drinks. This development enhances competition in the health-focused RTD beverage market

- In January 2025, True Citrus expanded its True Lemon portfolio with new lemonade variants featuring blended citrus and exotic flavors. The expansion focuses on offering variety while maintaining natural ingredient positioning. It supports the brand’s strategy to grow within the clean-label and convenient RTD beverage space. The new variants appeal to flavor experimentation and wellness-oriented consumers. This move reinforces innovation and differentiation in the citrus-based RTD segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。