Global Off Highway Electric Vehicle Market

市场规模(十亿美元)

CAGR :

%

USD

2.89 Billion

USD

13.54 Billion

2024

2032

USD

2.89 Billion

USD

13.54 Billion

2024

2032

| 2025 –2032 | |

| USD 2.89 Billion | |

| USD 13.54 Billion | |

|

|

|

全球非公路用電動車市場細分,按設備(自卸卡車、推土機、挖掘機、平地機、左舵駕駛、裝載機、割草機、噴霧器和拖拉機)、電池類型(鋰離子、鎳氫、鉛酸等)、電池容量(500 千瓦時)、推進類型(電池電動和混合動力電動)、功率輸出(300)、功率輸出(300)馬力)、電動拖拉機設備(割草機、噴霧器和拖拉機)、應用(建築、採礦、農業和園藝) - 行業趨勢和預測到 2032 年

非公路電動車市場分析

由於環境法規的不斷加強、電池技術的進步以及建築、採礦、農業和林業等行業對永續替代品的需求不斷增長,非公路電動車市場正在經歷顯著增長。嚴格的排放標準、政府激勵措施以及降低營運成本的需求推動了電氣化的轉變。高容量鋰離子電池、快速充電解決方案和再生煞車系統等技術進步正在提高電動非公路車輛的效率和性能。卡特彼勒、迪爾公司和小松等公司正在推出電動挖土機、裝載機和拖拉機,以滿足日益增長的零排放設備需求。此外,自動駕駛和物聯網車隊管理的整合正在進一步改變產業,提高生產力並降低維護成本。由於主要原始設備製造商的存在和較低的製造成本,亞太地區正在成為一個關鍵市場,而由於嚴格的環境政策,北美和歐洲的電氣設備採用率正在激增。對電氣化的日益關注將重新定義非公路用車市場的未來,使其更加永續、更具成本效益。

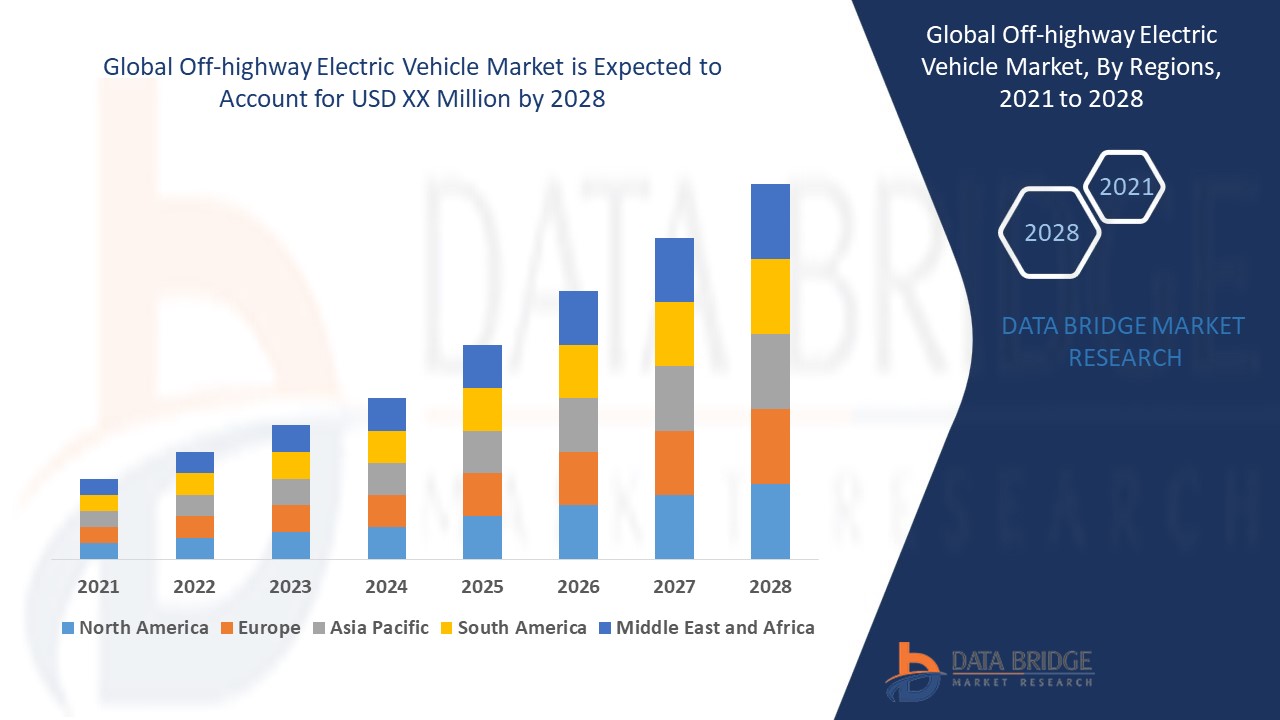

非公路電動車市場規模

2024 年全球非公路電動車市場規模為 28.9 億美元,預計到 2032 年將達到 135.4 億美元,在 2025 年至 2032 年的預測期內複合年增長率為 21.30%。除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和杵分析。

非公路電動車市場趨勢

“快速充電基礎設施的普及率不斷提高”

影響非公路電動車市場的關鍵趨勢是越來越多地採用快速充電基礎設施來提高營運效率並減少停機時間。隨著建築、採礦和農業等行業向電動機轉型,對快速充電解決方案的需求日益加劇。製造商正在開發高容量鋰離子電池並整合快速充電技術以支援長時間工作。例如,卡特彼勒和小鬆推出了具有快速充電功能的電動挖土機和裝載機,使設備能夠在短暫休息期間充電,從而提高生產力。此外,偏遠的採礦和建築工地正在部署無線和行動充電站,減少對傳統電網的依賴。直流快速充電器和電池更換技術的整合進一步加快了設備週轉時間。這種轉變支持可持續和零排放運營,並解決了電氣化充電停機的主要挑戰之一,使電動非公路車輛更適合大規模工業用途。

報告範圍和非公路電動車市場細分

|

屬性 |

非公路電動車關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Komatsu (Japan), AB Volvo (Sweden), Deere & Company (U.S.), CNH Industrial N.V. (U.K.), Sandvik AB (Sweden), Liebherr Group (Switzerland), Epiroc Mining India Limited (India), Terex Corporation (U.S.), DEUTZ AG (Germany), Atlas Copco UK Holdings (U.K.), AGCO Corporation (U.S.), Zoomlion Heavy Industry Science & Technology Co., Ltd. (China), KUBOTA Corporation (Japan), Rockwell Automation (U.S.), Hitachi Construction Machinery Co., Ltd. (Japan), and Caterpillar (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Off-highway Electric Vehicle Market Definition

Off-highway electric vehicles (EVs) refer to battery-powered or hybrid-electric machinery designed for use in industries such as construction, mining, agriculture, and forestry, where traditional road vehicles cannot operate. These vehicles include electric excavators, loaders, dump trucks, tractors, and sprayers, among others, and are engineered to perform heavy-duty tasks with reduced environmental impact.

Off-highway Electric Vehicle Market Dynamics

Drivers

- Stringent Emission Regulations and Sustainability Goals

Governments worldwide are implementing strict emission regulations to reduce carbon footprints and achieve sustainability goals, driving the adoption of electric off-highway vehicles (EVs). Regulatory bodies such as the European Union (EU), U.S. Environmental Protection Agency (EPA), and China’s National Development and Reform Commission (NDRC) have imposed stringent standards to limit diesel emissions in industries such as construction, mining, and agriculture. The EU’s Stage V emission regulations have compelled companies to replace traditional diesel-powered equipment with low-emission or fully electric machinery. As a result, manufacturers such as Caterpillar, Volvo CE, and Komatsu have increased investments in battery-powered excavators, electric wheel loaders, and zero-emission dump trucks. For instance, Volvo’s EC230 Electric Excavator is being widely used in urban construction projects, significantly reducing carbon emissions and aligning with global decarbonization goals. These policies are expected to accelerate the off-highway EV market growth, pushing manufacturers to innovate and meet evolving regulatory standards.

- Rising Fuel Costs and Lower Operational Expenses

The increasing price of diesel and gasoline is making off-highway EVs a more financially viable alternative, as they offer lower fuel and maintenance costs. The volatility in fuel prices, driven by global supply chain disruptions and geopolitical factors, has intensified the need for cost-effective alternatives in industries relying on heavy equipment. Unlike traditional diesel-powered machines, electric off-highway vehicles eliminate the need for fuel storage, regular engine servicing, and expensive hydraulic systems, significantly reducing long-term ownership costs. Companies such as John Deere and Volvo CE are at the forefront of this shift, offering electric models that enhance efficiency while cutting fuel expenses by up to 30%. For instance, John Deere’s electric tractors and Volvo’s electric wheel loaders have gained traction in agriculture and construction sectors, providing sustainable and cost-efficient solutions. This cost advantage is a major market driver, encouraging businesses to transition toward electrified machinery to achieve both economic and environmental benefits.

Opportunities

- Increasing Technological Advancements in Battery and Charging Infrastructure

電池技術和充電基礎設施的快速發展顯著提高了非公路電動車(EV)的可行性,創造了有利可圖的市場機會。高容量鋰離子電池、固態電池和快速充電解決方案的發展提高了電動建築、採礦和農業設備的性能和可靠性。可更換電池技術、再生煞車和人工智慧驅動的能源管理系統等進步正在優化能源消耗並減少停機時間。卡特彼勒和小松等公司正在率先推出配備智慧電池管理系統的自動電動自卸卡車,以確保長期的運作效率。例如,小鬆的自動運輸系統 (AHS) 使電動採礦卡車能夠以更高的精度運作並減少能源浪費,從而使電動車在重工業中的應用更加實用。這些進步提高了車隊效率,並使非公路電動車成為追求永續發展和成本節約的行業更具吸引力的選擇。

- 原始設備製造商和主要參與者對電氣化的投資不斷增加

非公路電動車市場正在見證領先的原始設備製造商 (OEM) 和主要行業參與者對電氣化的大量投資,創造了巨大的成長機會。日立建機、沃爾沃建築設備、愛科集團等公司正積極開發全電動和混合動力建築、農業和採礦設備,以符合零排放法規和永續發展目標。這些投資包括生產電池供電的採礦卡車、自動拖拉機和全電動挖土機。例如,Volvo建築設備的EC230電動挖土機正被廣泛應用於城市建設項目,幫助企業在提高營運效率的同時達到減排目標。同樣,約翰迪爾和愛科集團正在推出用於精準農業的自動電動拖拉機,以提高生產力並降低營運成本。這些發展標誌著市場向永續重型設備解決方案的強勁轉變,加速了向非公路電動車的轉變並擴大了該領域的商業機會。

限制/挑戰

- 初始投資和總擁有成本高

非公路電動車市場面臨的最大挑戰之一是高昂的初始投資和總擁有成本(TCO)。與傳統的柴油動力非公路車不同,電動建築設備、採礦卡車和農業機械需要先進的電池技術、專門的動力系統和強大的充電基礎設施,這使得它們的前期成本明顯更高。電池驅動的挖土機或裝載機的成本可能比柴油驅動的挖土機或裝載機高出 30-50%,這使得許多企業不願改用電動車。此外,電池更換成本、維護費用以及因充電需求而導致的停機時間都會增加總擁有成本。例如,在採礦業,公司需要能夠長時間運行而無需頻繁充電的車輛,但目前的電池技術難以與柴油引擎的耐用性相匹配。雖然電動車 (EV) 可以長期節省燃料並降低排放,但高資本支出 (CAPEX) 和營運成本 (OPEX) 仍然是一個重大障礙,尤其是對於中小型企業 (SME) 而言。由於缺乏大量的政府激勵措施、稅收優惠或租賃選擇,許多車隊營運商不願轉向電動車,減緩了市場成長。

- 來自混合動力和氫動力替代品的競爭

雖然全電動非公路車輛 (EV) 為柴油動力機械提供了可持續的替代方案,但它們面臨著來自混合動力和氫動力替代品的激烈競爭,這些替代品具有更長的運行時間、更高的能源效率和更快的加油時間。混合動力車型結合了電力和柴油動力系統,可以延長工作時間,且無需擔心行駛里程,因此對於建築、採礦和農業等車輛需要長時間連續運行的行業來說,它們更具吸引力。氫動力非公路車輛也越來越受歡迎,特別是在需要高功率輸出和最短停機時間的領域。例如,卡特彼勒和小鬆一直在投資採礦卡車的氫燃料電池技術,因為氫氣可以在幾分鐘內快速加油,而不是像電動替代品那樣需要數小時才能充電。此外,主要政府和產業正在透過補貼和研究資金支持氫氣的應用,創造出與電池電動解決方案競爭的替代成長路徑。因此,企業往往更傾向於採用混合動力或氫動力系統,而不是全電動汽車,這可能會在短期內阻礙非公路電動車的廣泛普及。

本市場報告提供了最新發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響的詳細信息,分析了新興收入領域的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

非公路電動車市場範圍

市場根據設備、電池類型、電池容量、推進類型、功率輸出、電動牽引車設備和應用進行細分。這些細分市場之間的成長將幫助您分析行業中微弱的成長細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

裝置

- 自卸卡車

- 推土機

- 挖土機

- 引擎等級

- 左駕

- 裝載機

- 割草機

- 噴霧器

- 聯結機

電池類型

- 鋰離子

- 鎳氫電池

- 鉛酸電池

- 其他的

電池容量

- 500度

推進類型

- 電池電動

- 油電混合

功率輸出

- 300 匹馬力

電動拖拉機設備

- 割草機

- 噴霧器

- 聯結機

應用

- 建造

- 礦業

- 農業

- 園藝

非公路電動車市場區域分析

對市場進行分析,並根據上述設備、電池類型、電池容量、推進類型、功率輸出、電動牽引車設備和應用提供市場規模洞察和趨勢。

市場報告涵蓋的國家包括北美洲的美國、加拿大和墨西哥、歐洲的德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區(APAC)的其他地區、沙烏地阿拉伯、阿拉伯聯合大公國、南非、埃及、以色列、中東和其他地區的其他地區(MEA)。

受人們對溫室氣體排放日益增長的擔憂以及建築、採礦和農業領域對環保替代品的追求推動,北美在非公路電動車市場佔據主導地位。政府推出的嚴格法規促進了電氣化和永續發展舉措,進一步加速了電動非公路車輛的普及。此外,該地區的主要製造商不斷推出採用先進電池技術的新型電動車型,以提高性能和效率。人們越來越關注減少碳足跡和行業創新,預計將推動整個北美市場的擴張。

Asia-Pacific is projected to experience significant growth in the off-highway electric vehicle market from 2025 to 2032, driven by the strong presence of original equipment manufacturers (OEMs) and the cost-effective production environment. The region benefits from high-volume manufacturing capabilities, enabling companies to produce electric off-highway vehicles at lower costs, making them more accessible to global markets. In addition, rising investments in industrial automation and infrastructure development are fueling demand for electric construction, mining, and agricultural machinery. With supportive government policies and a shift toward sustainable mobility solutions, Asia-Pacific is set to become a key hub for off-highway electric vehicle adoption.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Off-highway Electric Vehicle Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Off-highway Electric Vehicle Market Leaders Operating in the Market Are:

- Komatsu (Japan)

- AB Volvo (Sweden)

- Deere & Company (U.S.)

- CNH Industrial N.V. (U.K.)

- Sandvik AB (Sweden)

- Liebherr Group (Switzerland)

- Epiroc Mining India Limited (India)

- Terex Corporation (U.S.)

- DEUTZ AG (Germany)

- Atlas Copco UK Holdings (U.K.)

- AGCO Corporation (U.S.)

- Zoomlion Heavy Industry Science & Technology Co., Ltd. (China)

- KUBOTA Corporation (Japan)

- Rockwell Automation (U.S.)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Caterpillar (U.S.)

Latest Developments in Off-highway Electric Vehicle Market

- In August 2023, CASE IH, a CNH Industrial company, announced its plans to introduce the Farmall Subcompact tractor in Australia. The Farmall Subcompact 25SC model will be the smallest in its series, designed to meet the increasing demand for compact agricultural machinery in the region

- In October 2022, John Deere disclosed its strategy to manufacture a fully autonomous BR farm tractor, eliminating the need for an operator behind the wheel. Currently, the global fleet of such autonomous tractors is estimated to be fewer than 50 units

- In August 2022, AGCO introduced the Fendt 700 Vario series tractors to serve the North American market, with availability for orders through Fendt dealerships and scheduled delivery in 2023. This latest version of Fendt’s best-selling tractor range features an enhanced powertrain, VarioDrive transmission, Fendt iD low engine speed concept, a larger frame, and greater hydraulic capacity

- In May 2022, Caterpillar, a leading construction equipment manufacturer, launched two next-generation products in India—the Cat 303 CR Mini Excavator and the Cat 120 GC Motor Grader. These products are expected to strengthen Caterpillar’s presence in the infrastructure, mining, and energy sectors within the country

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。