Global Optical Wavelength Services Market

市场规模(十亿美元)

CAGR :

%

USD

5.80 Billion

USD

11.60 Billion

2024

2032

USD

5.80 Billion

USD

11.60 Billion

2024

2032

| 2025 –2032 | |

| USD 5.80 Billion | |

| USD 11.60 Billion | |

|

|

|

|

全球光波長服務市場細分:按頻寬(低於 10 Gbps、10 Gbps 至 40 Gbps、40 Gbps 至 100 Gbps、超過 100 Gbps)、介面(SONET、乙太網路、OTN)、應用程式(短程、城域、長程)、最終用戶(電信供應商、政府與國防產業、OTN)、應用程式(短程、城域、長途2032 年

光波長服務市場規模

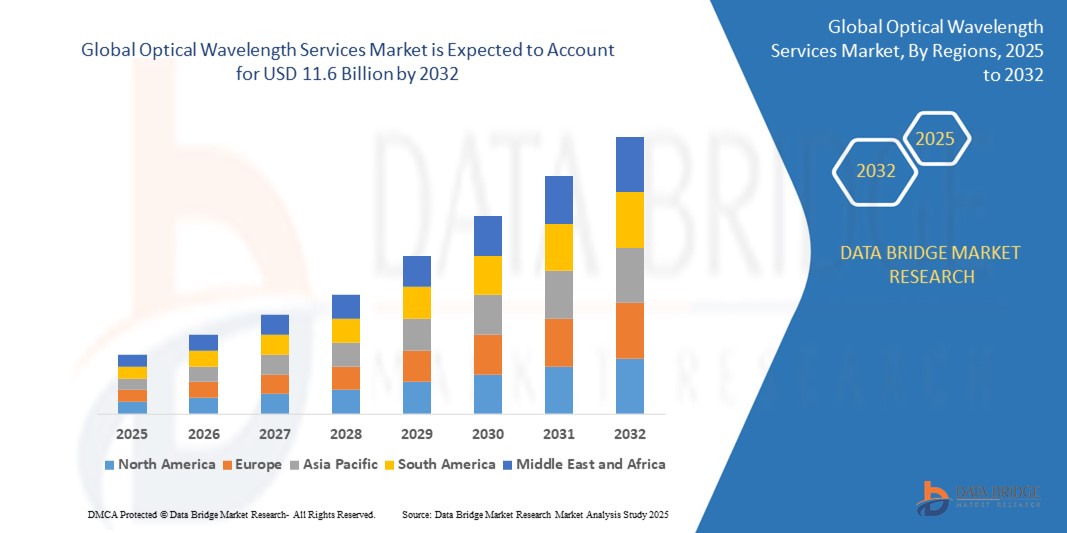

- 2025 年全球光波長服務市場價值為58 億美元,預計到 2032 年將達到 116 億美元,預測期內複合年增長率為 10.4% 。

- 這種成長是由數據消費的急劇增長、基於雲端的應用程式部署以及對高速、低延遲連接日益增長的需求所推動的。企業和通訊服務供應商正在大力投資波長服務,以確保透過高容量光纖網路有效率且安全地傳輸關鍵資料。光波長服務使用 WDM(波分複用)技術提供可擴展的專用頻寬解決方案,可安全、有效率地傳輸大量資料。

光波長服務市場分析

- 光波長服務是指透過光纖網路上的專用波長提供的高容量、點對點連接解決方案。這些服務使企業、電信供應商和政府機構能夠透過本地、城域和長途路線安全且有效率地傳輸大量資料。

- 密集波分複用 (DWDM)、軟體定義網路 (SDN)和光傳輸網路 (OTN)標準的技術進步顯著提高了網路效能、可擴展性和靈活性。這些創新支援跨核心和邊緣網路的即時頻寬配置、超低延遲和自動流量工程。

- 受5G 回程、視訊流量支援和可靠雲端互連需求不斷增長的推動,電信供應商在 2025 年仍將是領先的終端用戶。向混合IT 架構和多雲環境的持續轉變進一步推動了對強大光傳輸系統的需求。

- 企業領域(包括雲端供應商、BFSI和IT 服務)正在經歷最快的成長,這得益於資料驅動營運、災難復原設定和需要專用高吞吐量連線的即時分析工作負載的日益普及。

- 北美將在 2025 年引領光波長服務市場,這得益於先進的網路基礎設施、早期的雲端運算採用以及對城域和長途光纖擴展的大力投資。美國主要服務供應商也將人工智慧驅動的自動化和安全性融入波長產品。

- 預計到 2032 年,亞太地區的複合年增長率將最高,這主要得益於中國、印度和東南亞地區需求的激增,這些地區的快速城市化、5G 的推出和數據中心的投資正在重塑區域數位格局。

報告範圍和無人機市場細分

|

屬性 |

無人機市場關鍵洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

In addition to comprehensive market valuation, segmentation, and growth forecasts, the Global Optical Wavelength Services Market report includes in-depth insights on regulatory frameworks (e.g., net neutrality mandates, telecom licensing policies, and open-access fiber regulations), bandwidth scalability models, and standardization efforts impacting wavelength provisioning. The report features technology benchmarking of key interfaces (Ethernet, SONET, OTN), deployment cost analysis across metro and long-haul routes, and optical performance comparisons for latency-sensitive workloads. It highlights wavelength capacity planning strategies, capital expenditure trends, and innovations in coherent optics, transponders, and ROADMs (Reconfigurable Optical Add-Drop Multiplexers). It also includes supply chain evaluations, optical hardware sourcing trends, and data on multi-tenant infrastructure integration. Tools such as PESTLE analysis, Porter’s Five Forces, and regional telecom investment profiles are used for strategic assessment by operators, investors, and network architects. |

Optical Wavelength Services Market Trends

“Software-Defined Networks, Edge Connectivity, and On-Demand Optical Services are Reshaping Digital Transport”

- A leading trend shaping the optical wavelength services market is the integration of SDN (Software-Defined Networking) and NFV (Network Functions Virtualization), which enables real-time bandwidth provisioning, automated rerouting, and service orchestration—enhancing flexibility and operational efficiency.

- Edge computing and the proliferation of latency-sensitive applications such as cloud gaming, IoT, and AR/VR are accelerating demand for metro and regional wavelength services. Providers are deploying high-density DWDM systems closer to the edge to support localized data processing.

- Enterprises and cloud operators are increasingly adopting dynamic, wavelength-on-demand services to handle workload spikes, disaster recovery scenarios and inter-data center traffic surges. These flexible models are replacing traditional static capacity planning.

- High-capacity optical interconnects are becoming the backbone of 5G transport networks. Carriers are leveraging optical services to manage fronthaul and backhaul traffic while maintaining ultra-low latency and reliability.

- Environmental and energy efficiency concerns are prompting investment in green optical transport technologies, including coherent optics, intelligent routing and photonic integration, to reduce power consumption per bit transmitted.

Optical Wavelength Services Market Dynamics

Driver

“Rising Bandwidth Demand from Cloud Workloads, Video Streaming, and IoT Devices”

- The exponential increase in global data traffic—driven by hyperscale cloud operations, HD/4K video consumption, and billions of connected IoT devices—is fueling the need for scalable, secure, and high-throughput transport solutions. Optical wavelength services provide dedicated fiber connectivity that meets the performance requirements of modern digital ecosystems.

- Businesses are increasingly migrating to hybrid cloud models, necessitating consistent, low-latency connectivity between on-premises data centers and cloud infrastructure. Optical wavelength links provide guaranteed service levels for mission-critical applications.

- Government digitization initiatives, financial sector modernization, and real-time healthcare services are also adopting wavelength-based connections to ensure data sovereignty, business continuity, and patient data security.

- As smart cities expand and edge analytics grow in adoption, optical services are playing a key role in supporting traffic management, surveillance, and urban IoT infrastructure through fiber-deep connectivity.

Restraint/Challenge

“High Deployment Costs and Regulatory Complexity Constrain Network Expansion”

- Building fiber-optic infrastructure for long-haul and metro wavelength services involves substantial capital expenditure, including trenching, equipment deployment, and regulatory approvals for rights-of-way. These costs can deter investment, particularly in developing and rural regions.

- Lengthy permitting processes, fragmented local regulations, and restrictive policies on fiber sharing and open access pose major barriers to market expansion. These legal and bureaucratic hurdles delay time-to-market for new service deployments.

- Increased competition and price sensitivity among enterprise customers are pressuring service providers to reduce costs while maintaining performance. Balancing CapEx-heavy network builds with the need for service differentiation remains a core challenge.

- Cybersecurity risks in optical transport—including potential tapping at the physical layer—are prompting demand for end-to-end encryption and authentication frameworks. Compliance with evolving data protection regulations such as GDPR and HIPAA further increases operational complexity.

Global Optical Wavelength Services Market Scope

The market is segmented based on Bandwidth, Interface, application, and end user.

- By Bandwidth

Categorized into Less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and More than 100 Gbps, this segmentation reflects growing customer requirements for scalable high-speed connections, particularly in cloud computing, AI, and 8K video transmission.

- By Interface:

Includes SONET (legacy), Ethernet (widely used in enterprise and data centers), and OTN (modern standard for large-scale carrier-grade transport), showcasing the evolution from TDM to packet and optical transport convergence.

- By Application:

Short Haul (enterprise campuses, intra-city), Metro (urban aggregation and cloud access), and Long Haul (intercity and international backbones), illustrating diverse deployment scales and use cases.

- By End User:

Telecom Providers, Government & Defense, Cloud Providers, BFSI, Healthcare, IT & ITeS, and Others, capturing vertical-specific usage of secure, high-throughput connectivity for critical data services.

Global Optical Wavelength Services Market Regional Analysis

- North America leads the global optical wavelength services market in 2025, driven by mature telecom infrastructure, significant investments in cloud connectivity, and aggressive 5G rollouts. The United States is at the forefront, with widespread adoption across government, hyperscale data centers, and enterprise cloud backbones. Regional players like Lumen Technologies, AT&T, and Verizon are pioneering metro and long-haul wavelength expansion across major urban corridors.

- Europe presents a robust market, bolstered by cross-border interconnectivity, national broadband strategies, and digital infrastructure modernization efforts. Countries such as Germany, France, and the U.K. are investing in wavelength services to support smart manufacturing, financial trading hubs, and EU-wide digital transformation goals.

- Asia-Pacific is projected to register the highest CAGR from 2025 to 2032, driven by massive demand in China, India, and Japan. These countries are experiencing exponential growth in internet usage, cloud service adoption, and edge computing requirements. National digital economy initiatives and rapid fiber deployments are propelling the need for high-capacity wavelength services across both metro and intercity networks.

- Middle East and Africa (MEA) is witnessing steady growth, particularly in the UAE, Saudi Arabia, and South Africa. These markets are expanding submarine cable connectivity and international gateway infrastructure to support rising bandwidth needs in financial services, media streaming, and public sector digitization.

- South America is seeing increased demand for optical wavelength services, led by Brazil and Argentina. These countries are leveraging wavelength solutions to support digital banking, agriculture analytics, and cloud-based enterprise modernization. Government efforts to improve rural connectivity and data sovereignty are further fueling market expansion.

Country-Level Insights

- United States

The U.S. dominates the global optical wavelength services market, fueled by high fiber penetration, 5G network densification, and strong presence of cloud hyperscalers. Major financial centers like New York, Chicago, and San Francisco rely heavily on low-latency wavelength services for trading and data center interconnect.

- China

Rapid urbanization, cloud-native growth, and state-led 5G infrastructure programs make China a key driver of wavelength demand. Companies such as China Telecom and China Unicom are building extensive metro and long-haul optical networks linking smart cities and digital zones.

- India

With accelerating data consumption, digital governance initiatives, and cloud localization policies, India is emerging as a hotspot for wavelength service investment. Tier-1 and Tier-2 city linkages are expanding to support enterprise, e-commerce, and public cloud ecosystems.

- Germany

Germany supports optical wavelength service growth through initiatives such as Industry 4.0 and cross-border fiber corridors across the EU. Enterprises are utilizing optical transport for secure, high-throughput data exchange in automotive, manufacturing, and logistics.

- UAE

As a digital connectivity hub in the Middle East, the UAE is investing in high-capacity fiber and wavelength infrastructure to support international data flows, smart city services, and regional cloud zones hosted by global tech giants.

Global Optical Wavelength Services Market Share

The competitive landscape of the global optical wavelength services market is shaped by the technological capabilities, fiber network reach, scalability of offerings, and strategic alliances among telecom operators and infrastructure providers. Market share is largely influenced by the ability to deliver secure, low-latency, and high-bandwidth connectivity solutions that cater to rapidly evolving enterprise and carrier demands.

Leading companies such as Lumen Technologies (U.S.), Zayo Group (U.S.), Verizon Communications (U.S.), AT&T Inc. (U.S.), and NTT Communications (Japan) dominate the market due to their vast fiber optic infrastructure, established relationships with hyperscale cloud providers, and integrated service portfolios across metro and long-haul routes.

Emerging players and regional carriers are gaining traction by offering wavelength-on-demand platforms, SDN-enabled transport, and competitively priced services for underserved markets. These companies are also capitalizing on edge computing, regional data center expansion, and open-access policies to grow their customer base.

The market continues to evolve with ongoing innovation in optical transport technologies, regulatory support for competitive network access, and growing demand for enterprise-grade connectivity in industries such as BFSI, healthcare, manufacturing, and cloud services.

- Lumen Technologies (U.S.),

- Zayo Group (U.S.)

- Verizon Communications (U.S.)

- AT&T Inc. (U.S.)

- NTT Communications (Japan)

- Ciena Corporation (U.S.)

- Colt Technology Services (U.K.)

- Cox Communications (U.S.)

- Crown Castle (U.S.)

- Orange S.A. (France)

- Tata Communications (India).

Latest Developments in Global Optical Wavelength Services Market

- In April 2025, Ciena Corporation announced a 1.6 Tbps upgrade to its optical platform enabling multi-terabit interconnect for cloud data centers across North America and Europe.

- In March 2025, Tata Communications partnered with AWS to deliver wavelength services integrated with Direct Connect for hybrid cloud deployments in APAC.

- In February 2025, Zayo Group launched its intelligent wavelength-on-demand platform for enterprise users requiring dynamic connectivity and traffic engineering.

- In January 2025, Verizon expanded its ultra-low latency wavelength network linking financial centers in New York, London, and Tokyo.

- In December 2024, NTT Communications deployed a new submarine cable route offering 100G wavelength services between Japan and Southeast Asia.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。