Global Orthopedic Implants Market

市场规模(十亿美元)

CAGR :

%

USD

53.35 Million

USD

83.76 Million

2024

2032

USD

53.35 Million

USD

83.76 Million

2024

2032

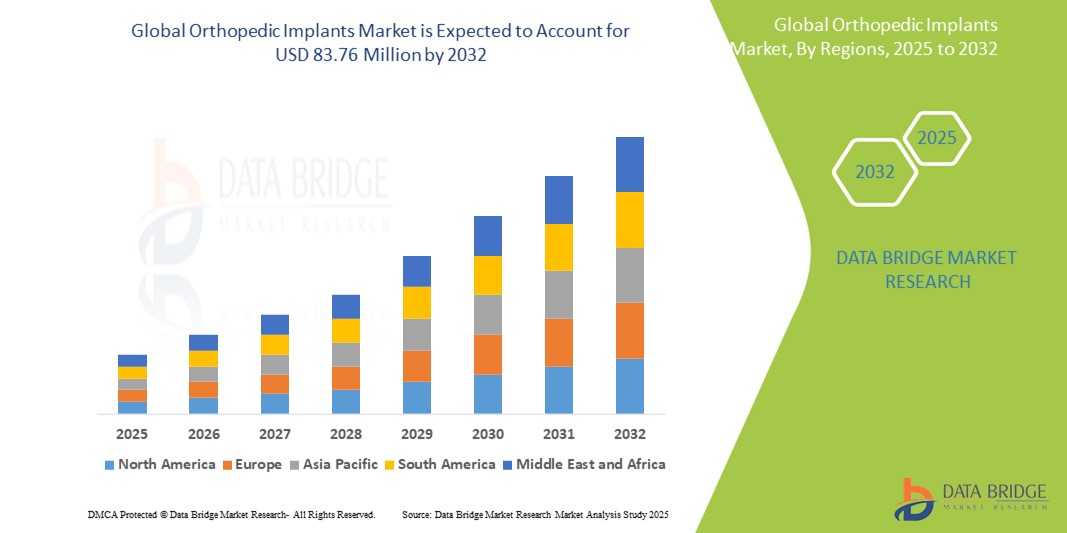

| 2025 –2032 | |

| USD 53.35 Million | |

| USD 83.76 Million | |

|

|

|

|

全球骨科植入物市場細分,按產品類型(重建關節置換、脊柱植入物、牙科植入物、骨科生物製品、創傷、顱頜面植入物等)、生物材料(陶瓷生物材料、金屬生物材料、聚合物生物材料和天然生物材料便秘)、手術方式(開放手術、微創手術 (MIS)等)、設備類型(內固定裝置和外固定裝置)、應用(頸部骨折、脊椎骨折、髖關節置換、肩關節置換等)、最終用戶(醫院、骨科診所、家庭護理等) - 行業趨勢和預測至 2032 年

骨科植入物市場規模

- 2024 年全球骨科植入物市場規模為5,335 萬美元 ,預計 到 2032 年將達到 8,376 萬美元,預測期內 複合年增長率為 5.80%。

- 市場成長主要得益於骨關節炎、類風濕性關節炎和骨質疏鬆症等骨科疾病的日益流行,以及全球人口老化的加劇。植入材料和手術技術的進步也推動了已開發市場和新興市場的創新和應用。

- 此外,患者意識的提升、報銷政策的改善以及微創手術需求的激增,使得骨科植入物成為長期活動能力和緩解疼痛的首選解決方案。這些因素共同加速了骨科植入物解決方案的普及,從而顯著促進了該行業的成長。

骨科植入物市場分析

- 用於支撐或替換受損骨骼和關節的骨科植入物,因其能夠恢復活動能力、減輕疼痛并改善創傷和慢性骨科疾病患者的生活質量,已成為現代肌肉骨骼疾病外科幹預中越來越重要的組成部分

- 骨科植入物需求的不斷增長,主要原因是全球骨關節炎負擔的加重、老年人口的增加以及運動傷害和道路交通事故的增加

- 北美在骨科植入物市場佔據主導地位,2024 年的收入份額最大,為 45.74%,其特點是醫療基礎設施先進、醫療支出高,以及領先的骨科器械製造商實力雄厚

- 由於快速的城市化、醫療保健投資的增加以及骨科手術患者群體的不斷擴大,預計亞太地區將成為預測期內骨科植入物市場成長最快的地區

- 金屬生物材料領域在骨科植入物市場佔據主導地位,2024 年的市佔率為 46.43%,這得益於其卓越的機械強度、生物相容性以及在承重骨科應用中經過驗證的耐用性

報告範圍和骨科植入物市場細分

|

屬性 |

骨科植入物關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

骨科植入物市場趨勢

“客製化和微創解決方案的技術進步”

- 全球骨科植入物市場的一個重要且加速發展的趨勢是患者專用和微創植入技術的進步,這些技術提高了手術精度,縮短了恢復時間,並改善了患者的整體治療效果

- 例如,Zimmer Biomet 和 Stryker 等公司推出了根據患者個體解剖結構量身定制的 3D 列印骨科植入物,從而實現更佳的貼合度和功能性。同樣,Conformis 提供基於患者特定 CT 掃描設計的客製化膝關節植入物,從而實現更精確的對準,並改善術後活動能力。

- 微創手術 (MIS) 技術正日益被採用,這得益於更小、更符合人體解剖學的植入物和先進手術工具的不斷發展。這些創新減少了組織損傷,降低了感染風險,並縮短了住院時間。機器人輔助手術(例如透過 Stryker 的 Mako 系統提供的手術)能夠以微創的方式實現精準的植入。

- 數位健康工具和導航系統與骨科手術的整合,進一步提高了手術的準確性。術中影像、擴增實境和即時數據分析等技術在關節和脊椎手術中越來越普遍。

- 這種個人化、數據驅動、微創的骨科解決方案趨勢正在重新定義臨床標準和患者期望。因此,製造商正在加大研發投入,開發兼俱生物力學性能、數位化相容性和更便捷的手術流程的植入物。

- 無論是在已開發還是新興醫療市場,對技術先進的骨科植入物的需求都在快速增長,這主要源於對加強患者護理、外科醫生效率和長期植入物性能的需求

骨科植入物市場動態

司機

“肌肉骨骼疾病發病率上升和人口老化”

- 全球範圍內,包括骨關節炎、骨質疏鬆症和退化性關節病變在內的肌肉骨骼疾病發生率不斷上升,加上人口老化加劇,是骨科植入物需求不斷增長的重要驅動因素

- 例如,根據世界衛生組織(2024年)的數據,肌肉骨骼疾病影響全球超過17億人,是全球造成殘疾的主要原因。預計關節重建、骨折固定和脊椎穩定的需求將相應增加。

- 隨著預期壽命的增加,特別是在已開發經濟體和新興經濟體,與年齡相關的骨科疾病(如髖部骨折和關節退化)的盛行率也在上升,因此需要使用耐用且有效的骨科植入物

- 此外,患者和醫療保健專業人員對早期手術幹預的好處以及先進植入材料和設計的可用性的認識不斷提高,使得骨科手術更容易獲得且更具吸引力

- 機器人技術、人工智慧輔助手術規劃和 3D 列印客製化植入物等技術進步正在改善手術效果並加速患者康復,進一步增強了骨科植入物的吸引力和普及率

- 發展中國家醫療基礎設施的不斷擴大以及公共和私人對骨科護理的投資不斷增加也促進了市場的成長,為全球植入物製造商和醫療保健提供者創造了新的機會

克制/挑戰

“植入物和手術費用高昂,且術後併發症風險高”

- 骨科植入物及相關外科手術的高昂成本,對更廣泛地推廣應用構成了重大挑戰,尤其是在中低收入國家。這些費用不僅包括植入物本身,還包括住院費用、手術設備和術後復健費用。

- 例如,在已開發國家,髖關節或膝關節置換等全關節置換手術的費用可能高達數萬美元,許多沒有保險或保險不足的患者無法負擔。可負擔性差距仍然是全球骨科護理發展面臨的主要問題。

- 此外,骨科植入手術還存在術後併發症的風險,例如感染、植入物鬆動、植入物材料過敏或需要修復手術。這些臨床問題可能會影響患者信心,並阻礙市場成長,尤其是在外科基礎設施或後續護理有限的地區。監管和報銷障礙進一步加劇了這些挑戰。複雜的審批流程、多變的報銷政策以及公共衛生系統的成本控制措施,可能會延遲創新植入物的引入,並限制其廣泛應用。

- 雖然生物相容性材料、滅菌規程和手術技術的進步正在解決其中一些問題,但風險認知和經濟負擔仍然是採用骨科植入物的障礙,尤其是在新興市場的老齡化人口中

- 克服這些挑戰需要植入物製造商、醫療保健提供者和政策制定者的協調努力,以提高可負擔性,確保手術安全,並讓外科醫生和患者了解骨科植入物幹預的長期益處和風險

骨科植入物市場範圍

市場根據產品類型、生物材料、程序、設備類型、應用和最終用戶進行細分。

- 依產品類型

On the basis of product type, the orthopedic implants market is segmented into reconstructive joint replacements, spinal implants, dental implants, orthobiologics, trauma and craniomaxillofacial implants, and others. The reconstructive joint replacements segment dominates the largest market revenue share in 2024, driven by the high prevalence of osteoarthritis and an aging population seeking improved mobility and quality of life. Hip and knee replacements lead this segment, supported by advancements in minimally invasive surgical techniques and implant design.

The spinal implants segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing cases of spinal disorders, sedentary lifestyles, and a rising number of spinal fusion surgeries. Growing demand for motion-preserving devices and the integration of navigation-assisted surgeries are key contributors to this trend.

- By Biomaterial

On the basis of biomaterial, the orthopedic implants market is segmented into ceramic biomaterials, metallic biomaterials, polymeric biomaterials, and natural biomaterials. The metallic biomaterials segment dominates with the largest market share of 46.43% in 2024, driven by their superior mechanical strength, corrosion resistance, and long-term durability in load-bearing orthopedic applications. Titanium and stainless steel remain the most commonly used materials due to their biocompatibility and reliability.

The polymeric biomaterials segment is expected to grow steadily during forecast period, particularly in joint and spinal implants, due to their flexibility, lower weight, and ability to reduce wear in articulating surfaces.

- By Procedure

On the basis of the procedure, the orthopedic implants market is segmented into open surgery, minimally invasive surgery (MIS), and others. The open surgery segment continues to account for the highest market share in 2024 due to its widespread use in complex orthopedic reconstructions and fracture fixations.

The minimally invasive surgery (MIS) segment is expected to expand at the highest CAGR from 2025 to 2032, propelled by rising demand for quicker recovery times, reduced surgical trauma, and better cosmetic outcomes. The integration of robotic-assisted systems and real-time imaging is further supporting this trend.

- By Device Type

On the basis of device type, the orthopedic implants market is segmented into internal fixation devices and external fixation devices. Internal fixation devices dominate the market with the largest share in 2024, driven by their effectiveness in stabilizing fractures, shorter healing times, and wide application in trauma and orthopedic reconstructive surgeries.

External fixation devices are expected to witness fastest growth during forecast period, particularly in acute trauma cases and corrective orthopedic procedures, due to their non-invasive nature and adjustability during the healing process

By Application

On the basis of application, the orthopedic implants market is segmented into neck fracture, spine fracture, hip replacement, shoulder replacement, and others.The hip replacement segment holds the highest market share in 2024, attributed to the high prevalence of hip osteoarthritis and favorable outcomes of hip arthroplasty in elderly patients.

The spine fracture segment is projected to grow at the fastest pace during the forecast period due to increasing incidences of spinal injuries and advancements in spinal fusion technologies.

- By End User

On the basis of end user, the orthopedic implants market is segmented into hospitals, orthopedic clinics, home cares, and others. Hospitals dominate the market with the largest revenue share in 2024, driven by the availability of advanced surgical infrastructure, skilled professionals, and insurance coverage.

Orthopedic clinics are anticipated to grow rapidly during the forecast period, due to increasing specialization in orthopedic care, shorter patient wait times, and rising demand for outpatient surgical services

Orthopedic Implants Market Regional Analysis

- North America dominates the orthopedic implants market with the largest revenue share of 45.74% in 2024, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of leading orthopedic device manufacturers

- The region benefits from well-established healthcare infrastructure, strong reimbursement frameworks, and a high concentration of leading orthopedic device manufacturers such as Stryker, Zimmer Biomet, and Johnson & Johnson. These factors collectively contribute to robust demand and continuous innovation in implant technology

- Moreover, North American patients and healthcare providers show strong preferences for minimally invasive and robot-assisted surgical procedures, supporting the adoption of next-generation implants. The presence of a tech-savvy patient population and increasing elective surgical volumes further reinforce the region’s leadership in the global orthopedic implants market

U.S. Orthopedic Implants Market Insight

The U.S. orthopedic implants market captured the largest revenue share in North America in 2024, supported by a high burden of musculoskeletal disorders and an aging population requiring joint replacement and fracture fixation. Advanced healthcare infrastructure, favorable reimbursement scenarios, and the widespread adoption of robotic-assisted orthopedic surgeries have further bolstered market expansion. In addition, increasing sports injuries and obesity-related orthopedic complications continue to drive demand for various implants, particularly in hip and knee reconstruction.

Europe Orthopedic Implants Market Insight

The Europe orthopedic implants market is projected to expand at a steady CAGR throughout the forecast period, driven by a rising elderly population and increasing cases of degenerative joint diseases. Stringent regulatory standards for product safety and efficacy contribute to high-quality implant offerings across the region. Demand is rising for advanced, biocompatible implants as well as minimally invasive surgical solutions. The region is also witnessing growth in personalized orthopedic solutions, leveraging 3D printing and AI-assisted diagnostic

U.K. Orthopedic Implants Market Insight

The U.K. orthopedic implants market is expected to grow at a notable CAGR, fueled by a growing number of orthopedic procedures and rising awareness of joint health. NHS initiatives to reduce surgical wait times and promote orthopedic innovation are encouraging market growth. The increasing adoption of minimally invasive techniques and biologic implants, coupled with a rise in elective surgeries post-pandemic, is significantly contributing to market expansion. The presence of specialized orthopedic centers also supports innovation and demand.

Germany Orthopedic Implants Market Insight

The Germany orthopedic implants market is anticipated to grow steadily during the forecast period, supported by the country’s strong healthcare system and leadership in medical device manufacturing. Germany’s emphasis on quality care and early adoption of advanced surgical technologies is fueling demand for next-generation implants. In addition, an aging population and growing incidence of osteoporosis and fractures are key drivers. The market also benefits from significant investments in R&D and a preference for sustainable, biocompatible implant materials.

Asia-Pacific Orthopedic Implants Market Insight

The Asia-Pacific orthopedic implants market is poised to grow at the fastest CAGR of 8.9% during the forecast period of 2025 to 2032, driven by a rapidly aging population, expanding healthcare infrastructure, and rising disposable incomes. Increasing awareness of orthopedic conditions and government efforts to improve surgical access in countries such as China, India, and Japan are contributing to robust demand. In addition, the growth of local manufacturing and the entry of international players are enhancing affordability and access across the region.

Japan Orthopedic Implants Market Insight

The Japan orthopedic implants market is expanding steadily due to the country's large elderly population and emphasis on advanced medical technology. Japan’s healthcare system promotes innovation and minimally invasive surgeries, fostering demand for high-precision implants. Technological integration, such as robotic-assisted procedures and smart implants, is also gaining popularity. Moreover, Japan’s focus on geriatric care and rehabilitation services is reinforcing orthopedic implant usage in both hospital and outpatient settings.

India Orthopedic Implants Market Insight

2024年,印度骨科植入物市場在亞太地區成長率位居前列,這得益於快速的城市化進程、不斷壯大的中產階級以及日益提升的骨科健康意識。創傷病例、運動傷害病例的增加以及關節置換手術的激增,正在刺激需求。印度政府在「印度製造」策略下大力推廣醫療旅遊和本地製造,這些措施正在擴大市場准入,並提高醫療產品的可負擔性。龐大的患者群體以及市場對技術先進且經濟實惠的植入物的青睞,是推動市場成長的關鍵因素。

骨科植入物市場份額

骨科植入物產業主要由知名公司主導,包括:

- CONMED公司(美國)

- 史賽克(美國)

- 美敦力(愛爾蘭)

- Smith+Nephew(英國)

- Integra LifeSciences Corporation(美國)

- B. Braun SE(德國)

- Arthrex, Inc.(美國)

- 巴克斯特(美國)

- 醫療器材業務服務公司(美國)

- Globus Medical(美國)

- NuVasive, Inc.(美國)

- Flexicare(集團)有限公司(英國)

- 安捷倫科技公司(美國)

- Narang Medical Limited(印度)

- 奧克辛(印度)

- Implanet SA(法國)

- Baumer SA(巴西)

- Peter Brehm GmbH(德國)

全球骨科植入物市場的最新發展

- 2023年9月,Enovis以約8億歐元的價格完成了對知名骨科植入物製造商LimaCorporate SpA的收購。這項策略性舉措增強了Enovis提供創新植入物解決方案的能力,並鞏固了其在全球骨科市場的地位。

- 2023年7月,Smith+Nephew在印度推出了REGENETEN生物誘導植入物,以滿足日益增長的肩袖修復解決方案需求。該植入物旨在加速癒合過程,並改善肩袖手術患者的療效。

- 2023年5月,捷邁邦美公司推出了一款新型非骨水泥型膝關節植入物-Persona OsseoTi Keel Tibia。這款創新產品使外科醫生能夠根據患者的骨質靈活地決定手術過程中是否需要使用骨水泥,從而增強膝關節置換手術的手術選擇和患者預後。

- 2023年2月,CurvaFix推出了一款直徑較小(7.5毫米)的髓內植入物,旨在簡化小骨量患者的手術流程。該植入物提供牢固穩定的弧形固定,滿足此類患者群體的獨特需求,並改善手術效果。

- 2022年4月,骨科植入物公司 (OIC) 的高價值腕部骨折鋼板系統獲得美國食品藥物管理局 (FDA) 批准。這一里程碑預計將增強 OIC 的全球產品組合,並擴大其在骨科市場的供應,彰顯公司致力於提供創新的腕部骨折治療解決方案的承諾。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。