Global Phenol Market

市场规模(十亿美元)

CAGR :

%

USD

25.61 Billion

USD

34.25 Billion

2024

2032

USD

25.61 Billion

USD

34.25 Billion

2024

2032

| 2025 –2032 | |

| USD 25.61 Billion | |

| USD 34.25 Billion | |

|

|

|

|

全球苯酚市場細分,按產品類型(酚醛樹脂、己內酰胺、雙酚 A 等)、製造工藝(異丙苯工藝、陶氏工藝和 Ranching-Hooker 工藝)、分類(一元酚、二元酚和三元酚)、應用(環氧樹脂、聚碳酸酯、尼龍、電木、洗滌劑、酚醛、樹脂藥物和藥物細分劑)年預測

苯酚市場規模

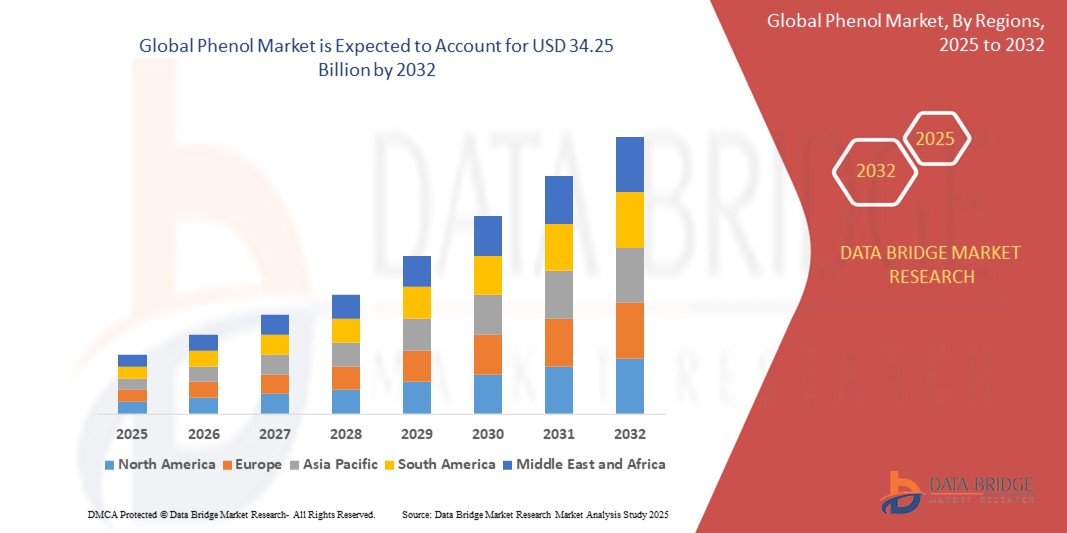

- 2024 年全球苯酚市場規模為256.1 億美元 ,預計 到 2032 年將達到 342.5 億美元,預測期內 複合年增長率為 3.70%。

- 市場成長主要得益於汽車、建築和電子產業對雙酚 A、酚醛樹脂和己內醯胺的需求不斷增長,以及製藥和化妝品領域應用的不斷增加

- 層壓板、黏合劑和絕緣材料中苯酚衍生物的使用量激增,也導致全球建築業苯酚的足跡不斷擴大

苯酚市場分析

- 全球苯酚市場正在經歷穩步轉型,受高成長終端用途產業消費增加以及轉向更永續的製造流程的推動

- 主要參與者正在投資擴大生產能力和技術創新,以滿足不斷增長的全球需求並遵守日益嚴格的環境法規

- 亞太地區在苯酚市場佔據主導地位,2024 年的營收份額最大,主要受高生產能力和建築、汽車和電子產業的強勁需求推動

- 受汽車、建築和消費電子等產業對聚碳酸酯和環氧樹脂需求不斷增長的推動,北美地區預計將成為全球苯酚市場成長率最高的地區

- 雙酚A細分市場在2024年佔據了最大的市場收入份額,達到44.6%,這得益於其在聚碳酸酯和環氧樹脂製造中的廣泛應用。汽車、建築和電子等行業的需求不斷增長,進一步增強了對雙酚A的需求,這直接推動了苯酚的消費。 BPA衍生產品具有較高的熱穩定性和化學穩定性,尤其是在要求嚴格的工業應用中,這進一步支持了該細分市場的發展。

報告範圍和苯酚市場細分

|

屬性 |

苯酚關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

• 生物基苯酚生產技術的擴展 • 亞太地區新興經濟體需求不斷成長 |

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

苯酚市場趨勢

“轉向可持續和生物基苯酚替代品”

- 製造商越來越多地投資開發利用木質素和玉米秸稈等可再生資源的生物酚,以減少對石油基投入的依賴

- 消費者和企業環保意識的不斷增強,推動了對塑膠、塗料和樹脂等更環保替代品的需求

- 政府和監管機構正在為生物基化學品生產提供激勵和資金,以促進循環經濟目標

- 例如,歐盟綠色協議支持再生原料的開發,鼓勵企業採用生物基苯酚替代品

- Anellotech 等公司正在開拓生物質轉化為芳香烴的技術,標誌著市場向低排放苯酚製造的轉變

苯酚市場動態

司機

“聚碳酸酯和環氧樹脂製造中對雙酚A(BPA)的需求不斷增長”

- Bisphenol-A (BPA), derived from phenol, is used extensively in producing polycarbonate plastics for electronics, automotive, and consumer goods

- Rapid industrialization in Asia-Pacific is significantly increasing BPA consumption, thereby boosting phenol demand across multiple end-user industries

- Epoxy resins, another BPA application, are in high demand for protective coatings, adhesives, and structural composites in construction and aerospace

- For instance, the expanding electric vehicle (EV) sector is driving demand for lightweight, durable polycarbonates, intensifying phenol usage

- BPA’s versatility and high-performance properties continue to make it indispensable in modern industrial applications, supporting phenol market growth

Restraint/Challenge

“Environmental and Health Concerns Regarding Phenol Handling and Disposal”

- Phenol is classified as toxic and hazardous, with potential health impacts such as respiratory irritation, skin burns, and organ damage if not properly managed

- Environmental contamination due to accidental spills or improper disposal can lead to ecosystem degradation and water source pollution

- Regulatory frameworks such as the U.S. Toxic Substances Control Act (TSCA) require strict phenol monitoring and safety measures, increasing production costs

- For instance, manufacturers in Europe must comply with REACH guidelines that impose heavy restrictions on phenol usage and emissions

- These environmental and safety challenges pose entry barriers for small manufacturers and can hinder growth in highly regulated regions

Phenol Market Scope

The market is segmented on the basis of product type, manufacturing process, classification, application, and end-users.

• By Product Type

On the basis of product type, the phenol market is segmented into phenolic resins, caprolactum, bisphenol-A, and others. The bisphenol-A segment held the largest market revenue share of 44.6% in 2024, driven by its widespread usage in manufacturing polycarbonates and epoxy resins. The growing demand from sectors such as automotive, construction, and electronics continues to strengthen the need for bisphenol-A, which directly propels phenol consumption. This segment is further supported by the high thermal and chemical stability offered by BPA-derived products, especially in demanding industrial applications.

The caprolactum segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its extensive usage in the production of nylon-6 fibers and resins. The rising demand for lightweight, durable materials in textiles and engineering plastics, particularly in emerging markets, is contributing to this robust growth.

• By Manufacturing Process

On the basis of manufacturing process, the phenol market is segmented into the cumene process, Dow process, and Ranching–Hooker process. The cumene process dominated the market in 2024 due to its cost-effectiveness and ability to produce high-purity phenol and acetone simultaneously. This process is preferred by large-scale manufacturers for its operational efficiency and compatibility with modern production plants.

The Dow process is expected to witness the fastest growth rate from 2025 to 2032, as companies explore alternative techniques to improve sustainability and reduce dependence on fossil-based feedstocks.

• By Classification

On the basis of classification, the market is segmented into monohydric, dihydric, and trihydric. The monohydric segment led the market in 2024, accounting for a major share owing to its dominant application in the production of phenol and its derivatives. Its versatility in producing downstream chemicals used in plastics, pharmaceuticals, and flame retardants supports its leadership position.

The trihydric segment is expected to witness the fastest growth rate from 2025 to 2032, due to its application in specialty polymers and chemical formulations, particularly in advanced resin manufacturing.

• By Application

On the basis of application, the phenol market is segmented into epoxy resins, polycarbonates, nylon, bakelite, detergents, phenolic resins, pharmaceutical drugs, and herbicides. The phenolic resins segment emerged as the largest in 2024, attributed to growing use in laminates, insulation, automotive, and construction materials. These resins offer strong thermal resistance and mechanical strength, which are crucial in industrial settings.

The epoxy resins segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand in electronics, coatings, and adhesives, particularly in Asia-Pacific and North America.

• By End-Users

On the basis of end-users, the market is segmented into bisphenol A, phenolic resins, caprolactam, and others. The bisphenol A segment dominated the market in 2024 and is expected to maintain its lead, driven by its role in multiple high-growth industries such as electronics, automotive, and packaging.

The caprolactam segment is expected to witness the fastest growth rate from 2025 to 2032, as the textile and engineering plastic industries increasingly turn to nylon-based materials for performance and sustainability benefits.

Phenol Market Regional Analysis

- Asia-Pacific dominated the phenol market with the largest revenue share in 2024, primarily driven by high production capacities and strong demand from the construction, automotive, and electronics sectors

- The region benefits from low-cost raw materials, favorable government regulations, and a rapidly expanding middle-class population, which fuels demand for polycarbonates and phenolic resins

- 此外,持續的工業基礎設施投資和強大的出口網絡支持該地區的市場擴張,使其成為苯酚製造和下游應用的戰略中心

中國苯酚市場洞察

2024年,中國苯酚市場佔據亞太地區最大收入份額,這得益於其成熟的製造業以及汽車、電子和建築業強勁的國內需求。低成本原料的供應、優惠的貿易政策以及政府支持的工業化舉措,為中國的苯酚生產和消費提供了支撐。此外,電子設備和消費品對環氧樹脂和聚碳酸酯的需求不斷增長,也持續增強了中國的市場活力。

日本苯酚市場洞察

由於其先進的製造能力以及電子和汽車行業的持續需求,預計日本苯酚市場將在2025年至2032年間實現最快增長。日本是聚碳酸酯所用高級苯酚衍生物的主要消費國,而聚碳酸酯對於小型電子元件和輕量化汽車零件至關重要。日本對精密工程、優質材料和永續聚合物創新的重視推動了苯酚需求的穩定成長。此外,本土企業持續投資環保樹脂技術和生物基苯酚替代品,以符合國家碳中和目標。

北美苯酚市場洞察

預計北美苯酚市場將在2025年至2032年間實現最快成長,這得益於汽車和電子產業日益增長的需求,尤其是對聚碳酸酯、雙酚A和環氧樹脂等應用的需求。該地區受益於完善的基礎設施、強勁的研發投入以及對永續化學製造的監管支援。此外,電動車和風能部件中苯酚基複合材料的日益普及也有助於該市場的長期永續發展。

美國苯酚市場洞察

2024年,美國苯酚市場佔據北美最大市場份額,這得益於其成熟的製造業基礎和先進的加工技術。建築、電子和製藥等終端行業的高消費量推動了苯酚市場的持續需求。此外,領先化學品製造商的入駐以及對生物基替代品和高性能聚合物投資的不斷增加,預計將增強市場競爭力。

歐洲苯酚市場洞察

預計2025年至2032年期間,歐洲苯酚市場將迎來最快的成長速度,這得益於環境法規、技術創新以及汽車和航空航天應用對輕質材料日益增長的需求。該地區對綠色化學和回收利用計畫的重視,正在鼓勵永續苯酚衍生物的使用。此外,德國、法國和英國建築和包裝行業的成長也進一步支撐了樹脂和塑膠製造業的苯酚消費。

德國苯酚市場洞察

預計2025年至2032年間,德國苯酚市場將迎來最快成長,這得益於其強勁的化學工業、特種樹脂的創新以及汽車製造商的強勁需求。德國對永續生產的重視以及其在工程聚合物和高性能材料領域的領先地位,使其成為苯酚的主要消費國。此外,研究機構與主要生產商之間的合作正在推動苯酚在塗料和電子產品中的生態高效應用。

英國苯酚市場洞察

預計英國苯酚市場將在2025年至2032年間實現最快成長,這主要得益於製藥、建築和包裝產業需求的成長。英國進口了大量苯酚及其衍生物,用於樹脂、塗料和藥品製造。綠色建築材料和永續包裝領域投資的不斷增長也支持了苯酚在增值應用領域的消費。此外,英國對循環經濟計畫和低碳創新的關注,正在激發人們對可回收和生物基酚類化合物的興趣,從而增強其長期市場前景。

苯酚市場佔有率

苯酚產業主要由知名公司主導,其中包括:

- 錦湖P&B化學公司(韓國)

- TPCC(中國)

- 殼牌公司(英國)

- 三井化學株式會社(日本)

- LG化學(韓國)

- 霍尼韋爾國際公司(美國)

- 索爾維(比利時)

- Aditya Birla Group(印度)

- 聖泉集團(中國)

- PTT苯酚有限公司(泰國)

- 拜耳公司(德國)

- AdvanSix(美國)

- Cepsa(西班牙)

- 英力士(英國)

- Domo Investment Group NV.(比利時)

- Altivia(美國)

- 台塑集團股份有限公司(台灣)

- Prasol Chemicals Pvt. Ltd.(印度)

- 薩索爾有限公司(南非)

- 中國藍星(集團)股份有限公司 (中國)

- 默克集團(德國)

全球苯酚市場最新動態

- 2023年1月,台塑化學與纖維股份有限公司與三菱化學株式會社宣布達成合作,共同推動推廣以酚為基礎的新型複合材料。此次合作旨在研發出在強度、重量和耐用性方面超越現有苯酚基複合材料的材料。

- In August 2022, INEOS Phenol revealed the purchase of Mitsui Phenols Singapore Ltd's asset base from Mitsui Chemicals for a total of USD 330 million. This acquisition includes the Jurong phenol and BPA assets, offering integration prospects with existing manufacturing facilities in Germany, Belgium, and the U.S. The acquisition is set to augment the total production capacity by 1 million tonnes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PHENOL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PHENOL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL PHENOL MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.1.1 ANALYSIS ON HAZARDOUS SUBSTANCES

9.1.2 ANALYSIS ON RECYCLING

9.1.3 ANALYSIS ON ENVIRONMENTAL TECHNOLOGY

9.1.4 ANALYSIS ON ENVIRONMENTAL POLICY

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL PHENOL MARKET, BY INTERMEDIATE , 2018-2032, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 PHENOLIC RESINS

10.2.1 BEKLITE

10.2.2 OTHERS

10.3 BISPHENOL A

10.3.1 POLYCARBONATE

10.3.2 EPOXY RESIN

10.4 CYCLOHEXANONE

10.4.1 CAPROLACTAM

10.5 CYCLOHEXANOL

10.5.1 ADIPIC ACID

10.6 ALKYL PHENOL

10.7 ANILINES

10.8 OTHERS

11 GLOBAL PHENOL MARKET, BY CLASSIFICATION, 2018-2032, USD MILLION

11.1 OVERVIEW

11.2 MONOHYDRIC

11.3 DIHYDRIC

11.4 TRIHYDRIC

12 GLOBAL PHENOL MARKET, BY MANUFACTURING PROCESS, 2018-2032, USD MILLION

12.1 OVERVIEW

12.2 CUMENE PROCESS

12.3 DOW PROCESS

12.4 RANCHING–HOOKER PROCESS

12.5 OTHERS

13 GLOBAL PHENOL MARKET, BY APPLICATION, 2018-2032, USD MILLION

13.1 OVERVIEW

13.2 PLASTICS

13.3 ADHESIVES

13.4 LAMINATES

13.5 COATINGS

13.6 CHEMICALS & INTERMEDIATES

13.7 OTHERS

14 GLOBAL PHENOL MARKET, BY END USE, 2018-2032, USD MILLION

14.1 OVERVIEW

14.2 AUTOMOTIVE

14.2.1 AUTOMOTIVE, BY INTERMEDIATE

14.2.1.1. PHENOLIC RESINS

14.2.1.2. BISPHENOL A

14.2.1.3. CYCLOHEXANONE

14.2.1.4. CYCLOHEXANOL

14.2.1.5. ALKYL PHENOL

14.2.1.6. ANILINES

14.2.1.7. OTHERS

14.3 CONSTRUCTION

14.3.1 CONSTRUCTION, BY INTERMEDIATE

14.3.1.1. PHENOLIC RESINS

14.3.1.2. BISPHENOL A

14.3.1.3. CYCLOHEXANONE

14.3.1.4. CYCLOHEXANOL

14.3.1.5. ALKYL PHENOL

14.3.1.6. ANILINES

14.3.1.7. OTHERS

14.4 ELECTRONICS

14.4.1 ELECTRONICS, BY INTERMEDIATE

14.4.1.1. PHENOLIC RESINS

14.4.1.2. BISPHENOL A

14.4.1.3. CYCLOHEXANONE

14.4.1.4. CYCLOHEXANOL

14.4.1.5. ALKYL PHENOL

14.4.1.6. ANILINES

14.4.1.7. OTHERS

14.5 CHEMICALS

14.5.1 CHEMICALS, BY INTERMEDIATE

14.5.1.1. PHENOLIC RESINS

14.5.1.2. BISPHENOL A

14.5.1.3. CYCLOHEXANONE

14.5.1.4. CYCLOHEXANOL

14.5.1.5. ALKYL PHENOL

14.5.1.6. ANILINES

14.5.1.7. OTHERS

14.6 HEALTHCARE

14.6.1 HEALTHCARE, BY INTERMEDIATE

14.6.1.1. PHENOLIC RESINS

14.6.1.2. BISPHENOL A

14.6.1.3. CYCLOHEXANONE

14.6.1.4. CYCLOHEXANOL

14.6.1.5. ALKYL PHENOL

14.6.1.6. ANILINES

14.6.1.7. OTHERS

14.7 OTHERS

14.7.1 OTHERS, BY INTERMEDIATE

14.7.1.1. PHENOLIC RESINS

14.7.1.2. BISPHENOL A

14.7.1.3. CYCLOHEXANONE

14.7.1.4. CYCLOHEXANOL

14.7.1.5. ALKYL PHENOL

14.7.1.6. ANILINES

14.7.1.7. OTHERS

15 GLOBAL PHENOL MARKET , BY GEOGRAPHY, 2018-2032, (USD MILLION) (KILO TONS)

15.1 GLOBAL PHENOL MARKET , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 SWITZERLAND

15.3.7 RUSSIA

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 AUSTRALIA AND NEW ZEALAND

15.4.6 SINGAPORE

15.4.7 THAILAND

15.4.8 INDONESIA

15.4.9 MALAYSIA

15.4.10 PHILIPPINES

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AMERICA

16 GLOBAL PHENOL MARKET , COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT ANALYSIS AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL PHENOL MARKET - COMPANY PROFILES

18.1 KUMHO P&B CHEMICALS.,INC,

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 ROYAL DUTCH SHELL

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 MITSUI CHEMICALS, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 LG CHEM

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 HONEYWELL INTERNATIONAL INC

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 SOLVAY

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 MITSUBISHI CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 ADITYA BIRLA CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENTS

18.9 SHENGQUAN GROUP

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 PTT PHENOL COMPANY LIMITED

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ADVANSIX

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 PTT GLOBAL CHEMICAL PUBLIC COMPANY LIMITED

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 CEPSA

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 INEOS

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 DOMO CHEMICALS

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 ALTIVIA

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.17 PRASOL CHEMICALS PVT. LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 CHINA NATIONAL BLUESTAR

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 MERCK KGAA

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 BOREALIS

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。