Global Phosphate Conversion Coatings For Oil And Gas Market

市场规模(十亿美元)

CAGR :

%

USD

1.76 Billion

USD

2.56 Billion

2025

2033

USD

1.76 Billion

USD

2.56 Billion

2025

2033

| 2026 –2033 | |

| USD 1.76 Billion | |

| USD 2.56 Billion | |

|

|

|

|

Global Phosphate Conversion Coatings for Oil and Gas Market Segmentation, By Product Type (Zinc Phosphate, Manganese Phosphate, and Iron Phosphate), Substrate (Steel, Cast Iron, and Others)- Industry Trends and Forecast to 2033

Phosphate Conversion Coatings for Oil and Gas Market Size

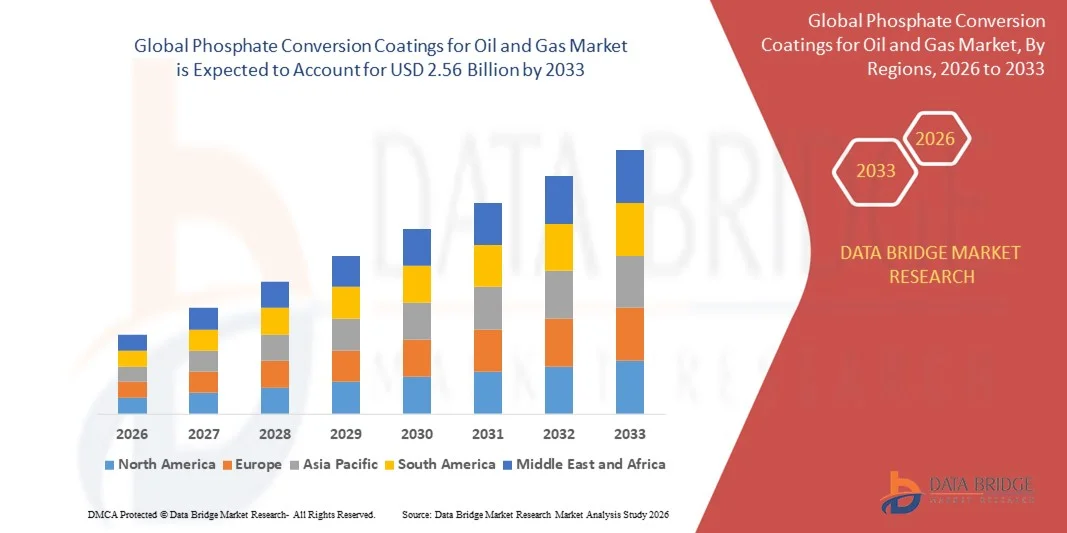

- The global phosphate conversion coatings for oil and gas market size was valued at USD 1.76 billion in 2025 and is expected to reach USD 2.56 billion by 2033, at a CAGR of 4.73% during the forecast period

- The market growth is largely fuelled by the increasing demand for corrosion-resistant coatings in oil and gas equipment, rising exploration and production activities, and the need for extended service life of pipelines and machinery

- The growing adoption of environmentally friendly and sustainable coating solutions is also supporting market expansion

Phosphate Conversion Coatings for Oil and Gas Market Analysis

- The market is characterized by high demand from upstream and downstream oil and gas sectors, particularly in regions with intensive exploration and drilling activities

- Key applications include corrosion prevention in pipelines, valves, pumps, and drilling equipment, where phosphate coatings improve durability and reduce maintenance costs

- North America dominated the phosphate conversion coatings for oil and gas market with the largest revenue share of 38.5% in 2025, driven by increasing exploration and production activities, the presence of major oilfield operators, and the demand for corrosion-resistant coatings to enhance equipment lifespan

- Asia-Pacific region is expected to witness the highest growth rate in the global phosphate conversion coatings for oil and gas market, driven by growing exploration and production activities, technological advancements, and increasing demand for durable, corrosion-resistant solutions

- The Zinc Phosphate segment held the largest market revenue share in 2025, driven by its excellent corrosion resistance, strong adhesion properties, and widespread use in pipelines, valves, and drilling equipment. Zinc phosphate coatings are particularly preferred for offshore and onshore applications, as they enhance durability and reduce maintenance costs

Report Scope and Phosphate Conversion Coatings for Oil and Gas Market Segmentation

|

Attributes |

Phosphate Conversion Coatings for Oil and Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Henkel Adhesives Technologies India Private Limited (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phosphate Conversion Coatings for Oil and Gas Market Trends

Rising Demand for Corrosion-Resistant and Durable Coatings

- The growing focus on enhancing the lifespan and reliability of oil and gas equipment is significantly shaping the phosphate conversion coatings market, as operators increasingly seek coatings that prevent corrosion, reduce maintenance, and withstand harsh environments. Phosphate conversion coatings are gaining traction due to their ability to improve adhesion, surface protection, and chemical resistance across pipelines, valves, and machinery. This trend is driving adoption in upstream, midstream, and downstream oil and gas operations, encouraging manufacturers to innovate with formulations tailored for specific applications

- Increasing regulatory emphasis on safety, environmental compliance, and operational efficiency has accelerated the demand for phosphate conversion coatings in exploration, drilling, and refining equipment. Oil and gas companies are prioritizing coatings that meet industry standards while minimizing environmental impact, prompting collaborations between coating suppliers and operators to enhance functional performance and regulatory compliance

- Technological advancements and process optimizations are influencing purchasing decisions, with manufacturers focusing on high-performance, cost-effective, and eco-friendly solutions. These factors are helping companies differentiate products in a competitive market, reduce equipment downtime, and extend service life, while also driving adoption of certified and standardized coatings

- For instance, in 2024, Hempel in Denmark and AkzoNobel in the Netherlands expanded their product portfolios by introducing phosphate conversion coatings optimized for offshore platforms and pipeline protection. These launches addressed the increasing requirement for durable, corrosion-resistant solutions, with distribution across global oil and gas operations. The products were marketed as enhancing operational efficiency and sustainability, supporting long-term asset protection

- While demand for phosphate conversion coatings is rising, sustained market growth depends on continuous R&D, cost-efficient production, and maintaining performance standards under extreme conditions. Manufacturers are also focusing on improving scalability, supply chain reliability, and developing innovative solutions that balance cost, durability, and environmental compliance for broader adoption

Phosphate Conversion Coatings for Oil and Gas Market Dynamics

Driver

Growing Demand for Corrosion-Resistant and High-Performance Coatings

- Rising operational and maintenance costs in the oil and gas industry are a major driver for the phosphate conversion coatings market. Companies are increasingly replacing conventional coatings with phosphate-based alternatives to enhance surface protection, improve equipment lifespan, and comply with stringent industry standards. This trend is also pushing research into novel coating chemistries that offer better adhesion and chemical resistance, supporting product diversification

- Expanding applications in pipelines, drilling equipment, storage tanks, and refining machinery are influencing market growth. Phosphate conversion coatings help prevent corrosion, improve adhesion of subsequent paint layers, and enhance chemical and mechanical resistance, enabling manufacturers to meet operational and regulatory requirements. The global focus on offshore and onshore oil exploration further reinforces this trend

- Oil and gas operators are actively promoting phosphate conversion coatings through product specification, supplier partnerships, and technical support. These efforts are supported by the growing requirement for safety, regulatory compliance, and operational efficiency, encouraging collaborations between coating suppliers and operators to improve performance and reduce maintenance costs

- For instance, in 2023, Hempel in Denmark and Jotun in Norway reported increased adoption of phosphate conversion coatings for offshore platforms and onshore pipelines. The expansion followed higher demand for corrosion-resistant solutions in harsh operating conditions, driving equipment reliability and compliance. Both companies highlighted coating performance, durability, and sustainability in technical communications to strengthen client trust

- Although rising demand supports growth, wider adoption depends on cost optimization, raw material availability, and scalable production processes. Investment in supply chain efficiency, environmentally friendly formulations, and advanced coating technologies will be critical for meeting global demand and maintaining a competitive advantage

Restraint/Challenge

High Cost And Technical Complexity Compared To Conventional Coatings

- The relatively higher cost of phosphate conversion coatings compared to conventional alternatives remains a key challenge, limiting adoption among price-sensitive operators. Higher raw material costs, specialized application processes, and additional surface preparation requirements contribute to elevated pricing

- Uneven awareness and technical expertise across regions, particularly in emerging markets, restrict adoption. Limited understanding of performance benefits and application protocols slows uptake in developing economies where educational initiatives on advanced coatings are minimal

- Supply chain and logistical challenges also impact market growth, as phosphate coatings require certified materials, precise surface preparation, and adherence to application standards. Operational complexities and equipment downtime during coating processes increase implementation costs

- For instance, in 2024, distributors and operators in Southeast Asia supplying pipelines and refineries reported slower uptake due to higher prices and limited technical knowledge of phosphate conversion coatings. Compliance with quality standards and process optimization were additional barriers

- Overcoming these challenges will require cost-efficient production, training programs for operators, and expanded technical support networks. Collaboration with coating suppliers, oil and gas operators, and certification bodies can unlock long-term growth potential. Developing cost-competitive formulations and strengthening market education around performance and durability will be essential for widespread adoption

Phosphate Conversion Coatings for Oil and Gas Market Scope

The market is segmented on the basis of product type and substrate.

- By Product Type

On the basis of product type, the phosphate conversion coatings for oil and gas market is segmented into Zinc Phosphate, Manganese Phosphate, and Iron Phosphate. The Zinc Phosphate segment held the largest market revenue share in 2025, driven by its excellent corrosion resistance, strong adhesion properties, and widespread use in pipelines, valves, and drilling equipment. Zinc phosphate coatings are particularly preferred for offshore and onshore applications, as they enhance durability and reduce maintenance costs.

The Manganese Phosphate segment is expected to witness the fastest growth rate from 2026 to 2033, owing to its superior wear resistance and load-bearing capabilities. Manganese phosphate coatings are increasingly used in high-friction components, pumps, and machinery, providing long-lasting protection in demanding oil and gas environments.

- By Substrate

On the basis of substrate, the market is segmented into Steel, Cast Iron, and Others. The Steel segment dominated the market in 2025 due to the extensive use of steel in pipelines, structural frameworks, and processing equipment, where phosphate coatings prevent corrosion and improve surface adhesion for subsequent painting or coating layers.

The Cast Iron segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand in valves, pump components, and heavy machinery, where phosphate coatings enhance wear resistance and operational longevity.

Phosphate Conversion Coatings for Oil and Gas Market Regional Analysis

- North America dominated the phosphate conversion coatings for oil and gas market with the largest revenue share of 38.5% in 2025, driven by increasing exploration and production activities, the presence of major oilfield operators, and the demand for corrosion-resistant coatings to enhance equipment lifespan

- Oil and gas companies in the region prioritize coatings that improve surface protection, reduce maintenance costs, and withstand harsh operational conditions, boosting widespread adoption

- This growth is further supported by advanced industrial infrastructure, strong regulatory compliance standards, and rising awareness of operational efficiency, establishing phosphate conversion coatings as a preferred solution for upstream, midstream, and downstream operations

U.S. Phosphate Conversion Coatings Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by increasing offshore and onshore drilling projects and growing demand for durable, corrosion-resistant solutions. Operators are emphasizing coating technologies that extend equipment service life and minimize downtime. The adoption of phosphate coatings for pipelines, valves, and processing machinery, along with integration into preventive maintenance programs, is significantly driving market expansion.

Europe Phosphate Conversion Coatings Market Insight

The Europe market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental and safety regulations, increasing oil and gas infrastructure projects, and rising adoption of advanced coating technologies. Demand for sustainable and high-performance phosphate coatings in pipelines, storage tanks, and machinery is accelerating market growth, particularly across offshore and onshore applications.

U.K. Phosphate Conversion Coatings Market Insight

The U.K. market is expected to experience rapid growth from 2026 to 2033, driven by the modernization of oil and gas infrastructure, increasing offshore exploration, and emphasis on equipment longevity. Rising awareness of environmentally friendly coatings and adherence to safety regulations are prompting operators to adopt phosphate conversion coatings for enhanced corrosion protection and operational efficiency.

Germany Phosphate Conversion Coatings Market Insight

The Germany market is expected to witness robust growth from 2026 to 2033, fueled by industrial innovation, advanced infrastructure, and focus on sustainable oil and gas operations. Operators are increasingly implementing phosphate conversion coatings to protect critical equipment, reduce maintenance costs, and meet strict environmental and safety standards. Integration with other protective systems and process optimization is further promoting adoption.

Asia-Pacific Phosphate Conversion Coatings Market Insight

The Asia-Pacific market is expected to witness significant growth from 2026 to 2033, driven by rising offshore and onshore exploration in countries such as China, Japan, and India. Rapid industrialization, increasing investments in energy infrastructure, and demand for corrosion-resistant coatings are boosting adoption. The presence of local coating manufacturers and government initiatives supporting safe and sustainable operations are expanding accessibility and affordability.

Japan Phosphate Conversion Coatings Market Insight

The Japan market is expected to witness notable growth from 2026 to 2033 due to advanced technological adoption, rigorous safety standards, and increasing offshore energy projects. Operators are focusing on phosphate conversion coatings to enhance equipment durability and minimize downtime, especially in pipelines, valves, and heavy machinery.

China Phosphate Conversion Coatings Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid industrialization, expanding oil and gas exploration, and strong domestic production of phosphate coatings. Increasing adoption in pipelines, processing facilities, and offshore platforms, along with cost-effective local solutions, is fueling growth. The country’s push for modern energy infrastructure and corrosion-resistant technologies is further supporting market expansion.

Phosphate Conversion Coatings for Oil and Gas Market Share

The Phosphate Conversion Coatings for Oil and Gas industry is primarily led by well-established companies, including:

• Henkel Adhesives Technologies India Private Limited (India)

• Crest Chemicals (U.S.)

• PPG Industries (U.S.)

• Axalta Coating Systems, LLC (U.S.)

• BASF SE (Germany)

• Freiborne Industries (U.S.)

• Nihon Parkerizing India Pvt. Ltd. (India)

• Hubbard-Hall (U.S.)

• Keystone Corporation (U.S.)

• The Sherwin Williams Company (U.S.)

• Westchem Technologies Inc. (U.S.)

• Kansai Paint Co., Ltd. (Japan)

• Pioneer Metal Finishing (U.S.)

• NuGenTec (U.S.)

Latest Developments in Global Phosphate Conversion Coatings for Oil and Gas Market

- In August 2025, BASF SE (Germany) launched a new line of eco-friendly phosphate conversion coatings for offshore oil and gas applications. The coatings are designed to enhance performance while minimizing environmental impact, aligning with global sustainability trends. This development is expected to attract environmentally conscious clients and strengthen BASF’s position in the growing market for greener oil and gas technologies

- In July 2025, Henkel AG & Co. KGaA (Germany) entered into a strategic alliance with a major oil and gas exploration company to co-develop advanced phosphate coatings. The collaboration aims to improve operational efficiency and provide tailored solutions for industry-specific challenges, enhancing Henkel’s competitive edge and fostering innovation in the phosphate coatings market

- In September 2025, Parker Hannifin Corporation (U.S.) expanded its manufacturing capabilities with a new production facility for phosphate conversion coatings. This investment is intended to increase production capacity, improve lead times, and strengthen supply chain reliability, supporting rising demand in North America and reinforcing Parker’s market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。