Global Polyurethane Additives Market

市场规模(十亿美元)

CAGR :

%

USD

3.36 Billion

USD

5.54 Billion

2024

2032

USD

3.36 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 5.54 Billion | |

|

|

|

|

全球聚氨酯添加劑市場細分,按類型(表面活性劑、催化劑、填料、阻燃劑等)、應用(泡沫、粘合劑和密封劑、塗料、彈性體、粘合劑)、最終用途行業(家具、汽車和運輸、建築和施工、電子、製藥等)- 行業趨勢和預測到 2032 年

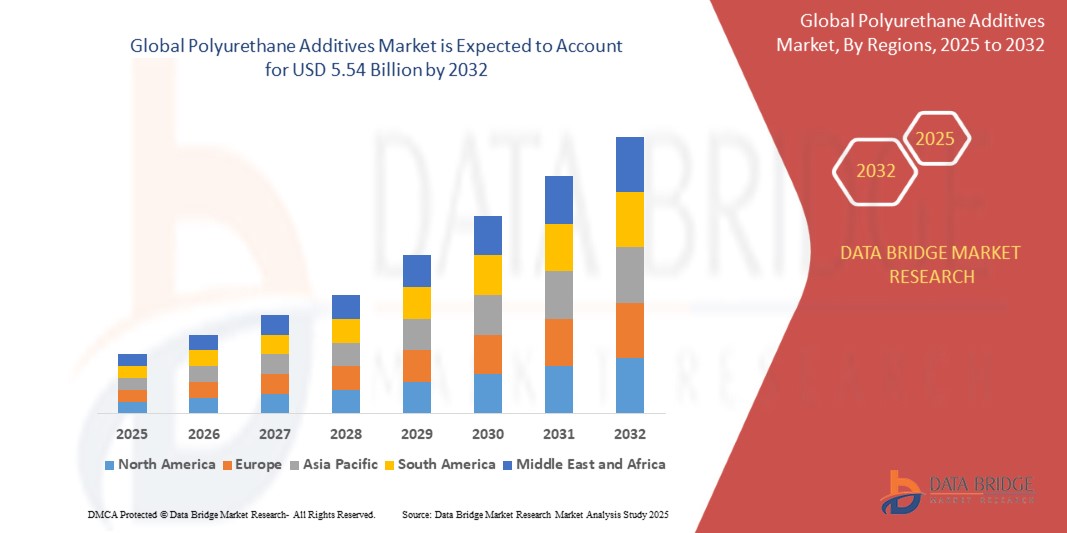

聚氨酯添加劑市場規模

- 2024 年全球聚氨酯添加劑市值為33.6 億美元,預計到 2032 年將達到 55.4 億美元

- 在 2025 年至 2032 年的預測期內,市場可能會以6.50% 的複合年增長率增長,主要受對生物基和可持續添加劑的需求不斷增加等因素的推動。

- 這種成長受到聚氨酯添加劑市場成長、對節能高性能材料的需求不斷增長以及監管壓力和環境問題等因素的推動。

聚氨酯添加劑市場分析

- 全球聚氨酯添加劑市場正在經歷顯著成長,這得益於汽車、建築、家具和鞋類等各行各業對聚氨酯基材料日益增長的需求。聚氨酯添加劑,例如催化劑、穩定劑和阻燃劑,能夠提升聚氨酯泡沫、塗料和彈性體的性能,使其成為生產高品質耐用產品的關鍵材料。

- 日益增長的環境問題和對永續性的日益關注,促使聚氨酯製造商開發環保添加劑。生物基聚氨酯添加劑和低VOC解決方案的創新日益受到關注,以應對監管壓力和消費者對環保產品的需求。

- 汽車和建築業的快速成長,加上對節能環保產品需求的不斷增長,推動了聚氨酯添加劑的需求。聚氨酯憑藉其優異的絕緣性、柔韌性和耐用性等性能,成為這兩個行業應用的理想材料。

例如,巴斯夫於2025年3月推出了一系列新的生物基聚氨酯添加劑,旨在減少聚氨酯泡沫生產對環境的影響。這些添加劑源自可再生資源,為傳統合成材料提供了環保的替代品,同時保留了汽車座椅和隔熱應用所需的性能特徵。

報告範圍和聚氨酯添加劑市場細分

|

屬性 |

聚氨酯添加劑關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

聚氨酯添加劑市場趨勢

“對生物基和可持續添加劑的需求不斷增長”

- 受日益增長的環境問題和減少對石化資源依賴的需求所推動,聚氨酯添加劑市場正經歷向生物基添加劑的轉變。製造商越來越多地轉向使用可再生材料(例如植物油和天然聚合物)來配製永續添加劑。

- 監管壓力鼓勵使用低VOC、無毒且可生物降解的聚氨酯添加劑,這有助於最大限度地減少製造過程對環境的影響。這些添加劑既符合嚴格的環保標準,也符合消費者對環保產品的偏好。

- 隨著永續性成為消費者購買決策的關鍵因素,將生物基添加劑加入聚氨酯產品的趨勢日益增長,特別是在汽車、建築和家具等行業,綠色建築材料和環保產品的需求日益增長。

- Bio-based additives not only offer environmental benefits but also improve the performance of polyurethane products, including better durability, flexibility, and overall product quality, making them an attractive alternative to traditional petroleum-based options.

Polyurethane Additives market Dynamics

Driver

“Rising Demand for Energy-Efficient and High-Performance Materials”

- The construction and automotive industries are increasingly seeking materials that offer superior insulation and energy efficiency, driving the demand for advanced polyurethane additives.

- Polyurethane additives enhance the thermal insulation properties of foams, contributing to energy savings in buildings and vehicles.

- The shift towards lightweight and fuel-efficient vehicles is also boosting the use of polyurethane materials, necessitating additives that improve performance and durability.

- This growing demand for energy-efficient and high-performance materials is propelling innovation and expansion in the polyurethane additives market.

For instance,

- BASF has introduced an innovative HFO-blown PIR system that improves the energy efficiency of insulation sandwich panels, aligning with the industry's move towards sustainable construction materials.

Opportunity

“Rising Demand for Sustainable and Low-VOC Polyurethane Products”

- Growing regulatory pressure to reduce volatile organic compound (VOC) emissions is pushing the demand for environmentally friendly polyurethane additives, particularly in sectors like construction, automotive, and furniture.

- Manufacturers are increasingly investing in the development of low-VOC catalysts, bio-based surfactants, and other eco-friendly additives that maintain performance while meeting environmental standards.

- The shift toward green chemistry and compliance with global frameworks such as REACH and the U.S. EPA’s Clean Air Act is opening new avenues for innovation in sustainable polyurethane formulations.

For instance,

- Evonik has introduced its new Low Carbon Footprint (LCF) TEGOSTAB R surfactants, based on renewable raw materials, to support sustainable polyurethane foam production. These VOC-optimized surfactants have an ultra-low cyclic siloxane content (<0.1% by weight), aiding formulators in meeting stringent emission targets while producing high-quality foam.

- As buyers across consumer and industrial segments have been increasingly prioritizing sustainability, the polyurethane additive suppliers with utilized green innovation attributes are well-positioned to capitalize on this evolving demand.

Restraint/Challenge

“Stringent Regulatory Environment and Compliance Costs”

- Polyurethane additive manufacturers must adhere to evolving global regulations related to chemical safety, emissions, and environmental impact, which increases operational complexity.

- Compliance with frameworks such as REACH, TSCA, and other regional mandates requires continuous investment in product testing, certification, and documentation.

- Reformulating existing products to meet new regulatory standards often demands significant R&D resources, increasing time-to-market and production costs.

- Smaller manufacturers face greater pressure, as compliance expenses and bureaucratic hurdles can act as barriers to innovation and market entry.

For instance,

- Regulatory frameworks like the EU's REACH and the U.S. EPA's TSCA mandate comprehensive safety assessments for chemical products. For instance, the EPA has increased fees for Pre-Manufacture Notices (PMNs) from $16,000 to $45,000, significantly raising the cost of introducing new additives.

Polyurethane Additives market Scope

The market is segmented on the basis product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-Use Industry |

|

Polyurethane Additives market Regional Analysis

“Asia Pacific is the Dominant Region in the Ink Additives market”

- Asia-Pacific leads the Polyurethane additives market due to rapid industrialization, significant expansion of packaging and printing sectors, and the increasing demand for eco-friendly and sustainable printing solutions across key economies like China, India, and Japan.

- China is the dominant force in the regional market, acting as a global hub for packaging, textiles, and publishing, where Polyurethane additives are crucial for print quality, performance, and durability.

- Japan is at the forefront of developing high-performance ink formulations, particularly in the electronics and label printing segments, supported by advanced R&D infrastructure.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The region is expected to maintain its high growth trajectory, driven by regulatory support for low-VOC and bio-based additives, and growing awareness among consumers and businesses about the importance of sustainable printing practices.

- The booming e-commerce and flexible packaging sectors in Southeast Asia, alongside the rise of digital printing, are major contributors to the region's growth.

- Government initiatives like China’s “dual carbon” goals and India’s environmental packaging regulations are accelerating innovation in ink formulations to meet sustainability targets.

- Rising demand from key industries such as food & beverage, cosmetics, and textile printing is creating abundant opportunities for ink additive manufacturers in the region.

Polyurethane Additives market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries (Germany)

- BASF (Germany)

- Huntsman Corporation (U.S.)

- Covestro (Germany)

- Dow Inc. (U.S.)

- Lanxess AG (Germany)

- Albemarle Corporation (U.S.)

- Tosoh Corporation (Japan)

- Momentive (U.S.)

- BYK (U.S.)

Latest Developments in Global Ink Additives market

- In August 2023, Marelli introduced a new lightweight polyurethane foam designed for use in all foam-in-place (FIP) applications, with a particular focus on the main dashboard panel. This innovation is the outcome of a collaborative development with materials partner Covestro AG.

- In July 2023, Everchem Specialty Chemicals acquired Specialty Products Inc. This acquisition is aligned with Everchem's objective of introducing high-value, solutions-driven chemical technologies to the expansive polyurethane markets, which is expected to boost the PU additive market.

- In September 2022, LANXESS expanded its LF urethane prepolymer range for adhesives with bio-based raw materials. These prepolymers enhance performance, processing, and productivity, allowing companies to reduce CO2 emissions and contribute to achieving climate-neutral objectives.

- In December 2021, Covestro and Eco-Mobilier partnered to collect and recycle discarded furniture, aiming to create value for mattresses and upholstery. Their goal is to expand the waste markets for foam used in these applications, enabling its use in highly efficient industrial chemical recycling processes. BASF also introduced Elastollan Thermoplastic Polyurethane (TPU) for applications in the furniture, automotive, and fashion industries.

- In November 2021, Evonik partnered with The Vita Group to develop an innovative and efficient method for recycling polyurethane mattresses. This collaboration aims to enhance the recycling process for a more sustainable solution.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。