Global Rare Earth Elements Market

市场规模(十亿美元)

CAGR :

%

USD

3.65 Billion

USD

8.18 Billion

2024

2032

USD

3.65 Billion

USD

8.18 Billion

2024

2032

| 2025 –2032 | |

| USD 3.65 Billion | |

| USD 8.18 Billion | |

|

|

|

全球稀土元素市場細分,依元素(鈰、釹、鑭、釹、鉿、鉺、銪、釔、钬、镥、镨、钷、釤、铥、鐿、釔、釔等)、應用(催化劑、釤、銥、鐿、釔、釔等)、應用(催化劑、拋光劑、應用材和陶瓷劑。 2032 年)

稀土元素市場分析

稀土元素 (REE) 市場正經歷顯著成長,這得益於消費性電子、再生能源、汽車和國防等產業的需求不斷增長。釹、镨、鏑和铽等稀土元素在製造高性能磁鐵、電池和催化劑方面發揮關鍵作用。電動車 (EV)、風力渦輪機和先進防禦系統的擴張進一步推動了市場成長,因為這些應用需要稀土基組件來提高效率和性能。稀土元素提取、精煉和回收技術的進步正在提高供應鏈的可持續性,並減少對全球最大供應國中國的依賴。美國、澳洲、加拿大等國家正大力投資稀土開採和提煉設施,以建立獨立的供應鏈。市場也受益於政府促進國內生產和戰略夥伴關係的措施。然而,供應限制、環境問題和地緣政治緊張等挑戰對市場穩定構成風險。稀土回收、替代材料和高效提取技術的創新有望推動該行業的未來發展,確保這些關鍵元素的供應更加永續和多樣化。

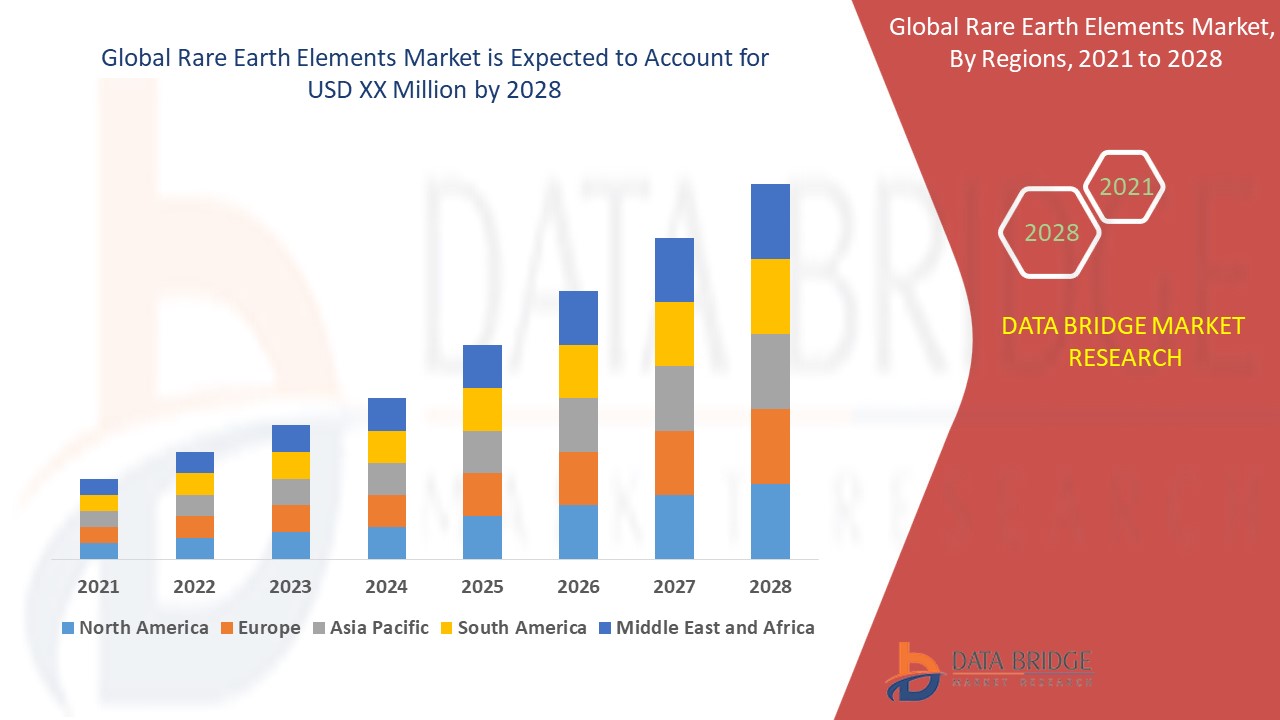

稀土元素市場規模

2024 年全球稀土元素市場規模為 36.5 億美元,預計到 2032 年將達到 81.8 億美元,2025 年至 2032 年預測期內的複合年增長率為 7.10%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

稀土元素市場趨勢

“日益關注稀土回收和循環經濟解決方案”

影響稀土 (REE) 市場的一個關鍵趨勢是越來越關注稀土回收和循環經濟解決方案,以減少對原生採礦的依賴。隨著中國在全球供應鏈中佔據主導地位,美國、日本和歐盟等國家正在投資回收技術,從廢棄的磁鐵、電池和電子垃圾中回收釹、鏑和镨。例如,美國稀土公司和 NEO Performance Materials 已啟動從報廢產品中提取稀土元素的計劃,以創造可持續且具有成本效益的供應。這一趨勢是由電動車(EV)、風力渦輪機和消費性電子產品不斷增長的需求所推動的,而稀土磁鐵在這些領域至關重要。此外,濕式冶金和生物浸出技術的進步使得稀土元素回收更加高效,減少了對環境的影響並增強了供應鏈的彈性。隨著各國政府推動永續採購,稀土回收將在市場擴張和資源保護中發揮關鍵作用。

報告範圍和稀土元素市場細分

|

屬性 |

稀土元素關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲的美國、加拿大和墨西哥、德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區 (APAC) 的其他地區、沙烏地阿拉伯、阿聯酋、南非、埃及、以色列、中東和非洲 (MEA) 的其他地區、其他地區的歐洲地區 |

|

主要市場參與者 |

中國五礦集團公司(中國)、Alkane Resources Ltd(澳洲)、Arafura Rare Earths(澳洲)、Lynas Rare Earths Ltd(澳洲)、中國稀土控股有限公司(中國)、Avalon Advanced Materials Inc.(加拿大)、IREL (India) Limited(印度)、Energy Transition Minerals Ltd(澳洲)、NE)、IREL (India) Limited(印度)、Energy Transition Minerals Ltd(澳洲)、NEarei)、Ware Limited(盧森堡)、加拿大稀土公司(加拿大)、Iluka Resources Limited(澳洲)、Northern Minerals(澳洲)、Krakatoa Resources Ltd.(澳洲)、Ucore Rare Metals Inc.(加拿大)和Namibia Critical Metals Inc.(加拿大) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

稀土元素市場定義

稀土元素 (REE) 是地殼中發現的一組 17 種化學性質相似的金屬元素,包括 15 種鑭系元素(如釹、鏑和鈰)以及鈧和釔。這些元素具有獨特的磁性、發光和催化特性,使其成為高科技應用的必需品。

稀土元素市場動態

驅動程式

- 清潔能源技術需求不斷成長

The shift toward renewable energy sources is significantly driving the demand for rare earth elements (REEs), particularly in wind energy and electric vehicle (EV) production. Neodymium and dysprosium are critical for manufacturing permanent magnets used in EV motors and wind turbine generators, as they enhance energy efficiency and durability. Countries aiming for carbon neutrality are investing heavily in offshore wind farms, where high-performance REE-based magnets are essential for efficient power generation. For instance, China’s ambitious wind energy expansion plan, which includes over 100 GW of new offshore wind installations by 2030, is expected to drive REE consumption significantly. Similarly, leading automakers such as Tesla and General Motors are increasing their reliance on REE-based electric drivetrains, ensuring sustained market growth. This rising demand for clean energy technologies strengthens the REE market, making it a crucial component in the global energy transition.

- Growth in Defense and Aerospace Applications

The defense and aerospace industries are increasingly dependent on rare earth elements due to their unique properties, such as high magnetic strength and resistance to extreme conditions. REEs such as samarium, europium, and terbium are vital in producing radar systems, missile guidance systems, night vision goggles, and advanced communication equipment. For instance, neodymium-based permanent magnets are used in precision-guided missile systems, while yttrium-based phosphors improve the performance of night vision technology. Countries such as the U.S. and India are making significant investments in securing REE supply chains to reduce reliance on Chinese exports, given that China controls over 60% of global REE production. The Pentagon has initiated contracts with domestic REE suppliers to establish a self-sufficient supply chain, further bolstering market growth. As military and aerospace advancements continue, the demand for REEs is expected to remain strong, making it a key driver of the market.

Opportunities

- Increasing Government Initiatives and Investments in Rare Earth Mining

Several countries are strengthening domestic rare earth element (REE) mining efforts to reduce dependence on China, which accounts for over 60% of global REE production. The U.S., Canada, and Australia are leading this shift by investing in rare earth mining projects and REE magnet manufacturing facilities to secure a stable supply chain for industries such as electric vehicles (EVs), defense, and renewable energy. For instance, the U.S. Department of Defense (DoD) has provided USD 58.5 million in funding to MP Materials to develop a fully integrated rare earth magnet facility in Texas, aiming to support domestic production. Similarly, Australia’s Lynas Rare Earths Ltd. is expanding its Mount Weld mine to increase production of neodymium and praseodymium, essential for wind turbines and EV motors. These strategic investments present a significant market opportunity, ensuring long-term supply security while fostering technological advancements in REE processing.

- Increasing Focus on Recycling and Sustainable Extraction

As environmental concerns regarding REE mining grow due to its high energy consumption and ecological impact, companies are increasingly shifting toward REE recycling and sustainable extraction methods. Innovative technologies are being developed to recover REEs from discarded electronics, industrial waste, and old wind turbines, reducing reliance on traditional mining. For instance, Hitachi and Umicore are pioneering REE recovery processes that extract valuable neodymium and dysprosium from used magnets, creating a circular supply chain. In addition, Canada’s Geomega Resources has introduced a hydrometallurgical process to recycle REEs from industrial waste and electric motor components, minimizing environmental degradation. The EU’s Critical Raw Materials Act further supports REE recycling initiatives, pushing industries to adopt eco-friendly extraction techniques. As demand for sustainable rare earth solutions rises, companies investing in REE recycling technologies are well-positioned to capitalize on this growing market opportunity.

Restraints/Challenges

- High Extraction and Processing Costs

稀土元素市場面臨的主要挑戰之一是開採和加工成本高。與普通金屬不同,稀土元素 (REE) 並不存在於濃縮礦床中,需要大量的開採、破碎和化學分離過程。提取過程非常複雜,涉及多個精煉階段以分離單個元素,這大大增加了生產成本。此外,一些稀土礦床含有釷等放射性副產品,需要特殊處理和處置,進一步推高了費用。例如,美國的芒廷帕斯礦是中國境外少數的稀土礦之一,由於加工成本和環保合規成本高昂,該礦曾面臨停產。這些財務負擔使得新參與者難以進入市場,導致市場繼續依賴中國等主要供應商,而中國控制全球相當一部分稀土產量。

- 環境和永續性議題

稀土開採和加工對環境的影響對該行業提出了重大挑戰。稀土元素的開採會產生大量廢棄物,包括有毒污泥和放射性殘留物,這些廢棄物會污染水源和土壤。在許多情況下,監管不力的採礦作業導致了嚴重的生態破壞,迫使政府對新的採礦計畫實施更嚴格的環境法規。例如,在馬來西亞,萊納斯公司營運的稀土加工廠因對放射性廢棄物處理的擔憂而面臨持續的審查和反對。此外,能源密集的煉油過程會導致碳排放,使該產業成為永續發展改革的目標。隨著全球對稀土元素的需求持續增長,尋找環保的開採和回收解決方案對於減少該行業的生態足跡同時確保長期供應安全至關重要。

本市場報告提供了最新發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響的詳細信息,分析了新興收入領域的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業就開始受到影響。 DBMR 提供的市場洞察報告和情報服務考慮了經濟衰退對產品定價和可及性的預測影響。透過這種方式,我們的客戶通常可以領先競爭對手一步,預測他們的銷售額和收入,並估算他們的盈虧支出。

稀土元素市場範圍

市場根據元素和應用進行細分。這些細分市場之間的成長將幫助您分析行業中微弱的成長細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

元素

- 鈰

- 釹

- 鑭

- 鎝

- 铽

- 鉺

- 銪

- 钆

- 钬

- 盧特西亞

- 镨

- 鯛

- 鈸

- 鉥

- 鐿

- 釔

- 鈧

- 其他的

應用

- 催化劑

- 陶瓷

- 螢光粉

- 玻璃和拋光

- 冶金

- 拋光添加劑

- 磁鐵

- 其他的

稀土元素市場區域分析

對市場進行分析,並按上述國家、要素和應用提供市場規模洞察和趨勢。

市場報告涵蓋的國家包括北美洲的美國、加拿大和墨西哥、歐洲的德國、法國、英國、荷蘭、瑞士、比利時、俄羅斯、義大利、西班牙、土耳其、歐洲其他地區、中國、日本、印度、韓國、新加坡、馬來西亞、澳洲、泰國、印尼、菲律賓、亞太地區(APAC)的其他地區、沙烏地阿拉伯、阿拉伯聯合大公國、南非、埃及、以色列、中東和其他地區的其他地區(MEA)。

Asia Pacific is projected to dominate the rare earth elements market due to the increasing demand from key industries, including consumer electronics, automotive, and renewable energy. The rapid expansion of manufacturing hubs in countries such as China, Japan, and South Korea is driving the need for rare earth materials used in magnets, batteries, and display technologies. In addition, government initiatives supporting domestic production and technological advancements are further strengthening the region's market position. The growing reliance on rare earth elements for high-tech applications continues to fuel market growth across Asia Pacific.

North America is expected to experience fastest growth in the rare earth elements market during the forecast period, driven by the expanding automotive sector. The increasing adoption of electric vehicles (EVs) and advanced automotive technologies is boosting the demand for rare earth materials used in batteries, motors, and electronic components. In addition, government initiatives to strengthen domestic supply chains and reduce reliance on imports are supporting market expansion. The region's focus on sustainable energy solutions and high-performance materials further contributes to its lucrative growth prospects.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rare Earth Elements Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rare Earth Elements Market Leaders Operating in the Market Are:

- China Minmetals Corporation (China)

- Alkane Resources Ltd (Australia)

- Arafura Rare Earths (Australia)

- Lynas Rare Earths Ltd (Australia)

- China Rare Earth Holdings Limited (China)

- Avalon Advanced Materials Inc. (Canada)

- IREL (India) Limited (India)

- Energy Transition Minerals Ltd (Australia)

- NEO (Canada)

- Rare Element Resources Ltd (U.S.)

- Frontier Rare Earths Limited (Luxembourg)

- Canada Rare Earth Corporation (Canada)

- Iluka Resources Limited (Australia)

- Northern Minerals (Australia)

- Krakatoa Resources Ltd. (Australia)

- Ucore Rare Metals Inc. (Canada)

- Namibia Critical Metals Inc. (Canada)

Latest Developments in Rare Earth Elements Market

- In April 2024, U.S.-based MP Materials secured USD 58.5 million to advance the construction of the country’s first integrated rare earth magnet manufacturing facility. Located in Fort Worth, Texas, the plant is expected to commence commercial production by late 2025

- In July 2023, USA Rare Earth announced plans to invest USD 100 million in establishing a neodymium magnet production facility in Stillwater, Oklahoma. The facility will have an initial capacity of 1,200 tons per annum, with production expected to start by early 2026 and later expand to 4,800 tons per annum

- In April 2023, India-based IREL (India) Ltd. revealed its strategy to increase its mining capacity by 400% over the next decade, raising production from 5,000 tons to 13,000 tons to meet growing demand

- In August 2022, Australia’s Lynas Rare Earths Ltd announced its plan to expand capacity at the Mt Weld mine, which contains deposits of neodymium (Nd) and praseodymium (Pr). Expansion work was set to begin in early 2023, with full operations planned for 2024

- In April 2022, Iluka Resources Ltd committed an investment of USD 1.2 billion to develop the Eneabba Phase 3 rare earth refinery in Western Australia. The project aims to position Iluka as a key player in the downstream processing of Australia’s rare earth resources

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。