Global Soy Based Infant Formula Market

市场规模(十亿美元)

CAGR :

%

USD

312.53 Million

USD

431.02 Million

2024

2032

USD

312.53 Million

USD

431.02 Million

2024

2032

| 2025 –2032 | |

| USD 312.53 Million | |

| USD 431.02 Million | |

|

|

|

|

全球大豆嬰兒配方奶粉市場細分,按產品類型(1 階段、2 階段、3 階段、4 階段和幼兒嬰兒)、形式(粉狀、液體和半液體)、類型(低脂大豆嬰兒配方奶粉和全脂大豆嬰兒配方奶粉)、應用(0 至 3 個月、4 至 7 個月、8 至 11 個月、12 個月及以上)產業趨勢和預測到 2032 年

大豆嬰兒配方奶粉市場規模

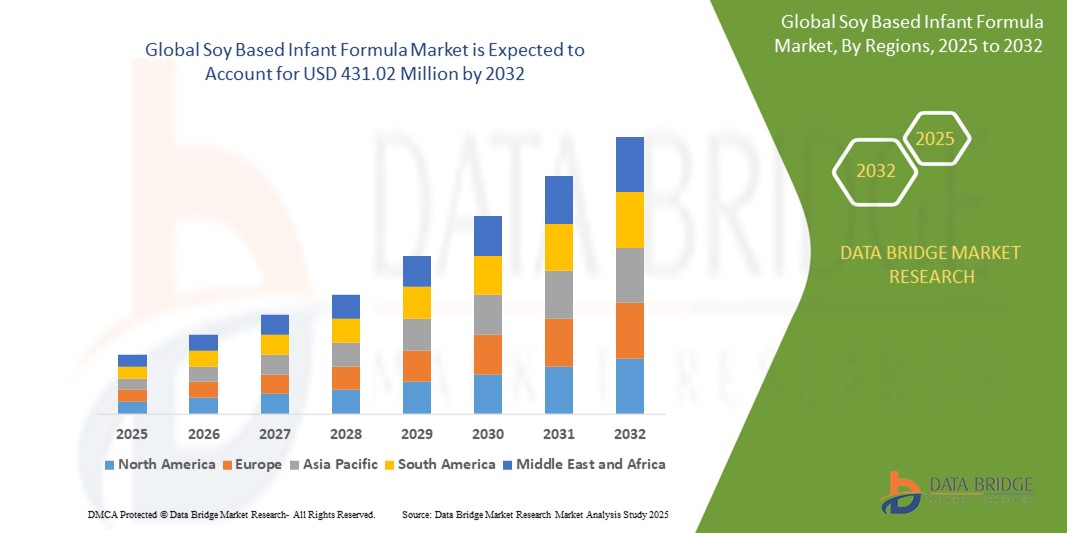

- 2024 年全球大豆嬰兒配方奶粉市場規模為3.1253 億美元,預計到 2032 年將達到 4.3102 億美元,預測期內 複合年增長率為 4.10%。

- 市場成長很大程度上是由於嬰兒乳糖不耐症和牛奶過敏的盛行率不斷上升,促使父母和醫療保健專業人員尋求植物性營養替代品,例如大豆基嬰兒配方奶粉

- 此外,隨著人們對嬰兒營養的認識不斷提高,加上對有機、非乳製品和防過敏配方奶粉的需求不斷增長,大豆製品正成為滿足特殊飲食需求的可靠解決方案。這些因素正在加速大豆嬰兒配方奶粉的普及,從而顯著促進該行業的成長。

大豆嬰兒配方奶粉市場分析

- 大豆嬰兒配方奶粉是一種植物性配方,可以取代傳統的乳製品,對於患有乳糖不耐症、牛奶過敏或飲食限制的兒童來說,大豆嬰兒配方奶粉在嬰兒營養中越來越重要,可以在早期發育階段提供全面的營養支持

- 大豆配方奶粉需求不斷增長,主要原因是人們對食物過敏的認識不斷提高,對純素和過敏原友好型食品的偏好日益增加,以及醫療保健專業人士對專門嬰兒營養的推薦越來越多

- 由於嬰兒人口快速增長、嬰兒營養意識不斷增強以及新興經濟體乳糖不耐症和牛奶過敏病例不斷增加,亞太地區在 2024 年佔據大豆嬰兒配方奶粉市場的主導地位,市場份額為45.5%

- 由於乳糖不耐症盛行率的增加以及純素食和素食人口的增加,預計北美將成為預測期內大豆嬰兒配方奶粉市場成長最快的地區。

- 奶粉市場佔據主導地位,2024 年市佔率達 65.5%,這得益於其更長的保質期、易於儲存和成本效益。追求性價比和便利性的消費者更青睞豆奶粉,尤其是在冷藏設施或供應鏈不穩定的地區。

報告範圍和大豆基嬰兒配方奶粉市場細分

|

屬性 |

大豆嬰兒配方奶粉關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

大豆嬰兒配方奶粉市場趨勢

“嬰兒營養意識的提高”

- 全球大豆嬰兒配方奶粉市場一個顯著且加速發展的趨勢是,家長和照顧者越來越意識到兒童早期發展過程中專業均衡營養的重要性。這種對營養充足性的高度關注推動了對滿足特定飲食需求的替代配方奶粉的需求,例如針對乳糖不耐症或牛奶蛋白過敏嬰兒的大豆配方奶粉。

- For instance, healthcare providers increasingly recommend soy-based formulas as safe and effective substitutes for dairy-based products, especially for infants experiencing gastrointestinal discomfort or allergic reactions. Public health campaigns and digital parenting platforms are also playing a critical role in educating caregivers about non-dairy nutritional solutions

- This growing awareness is supported by the rising availability of clinical research, pediatric endorsements, and product transparency in labeling, enabling informed decision-making by parents seeking optimal nutrition for their children. Brands such as Enfamil and Earth's Best have expanded their soy-based product lines to meet this demand

- The trend is also fueled by the increasing penetration of social media, online forums, and parenting communities, where information about hypoallergenic, plant-based feeding options is widely shared. These platforms help demystify soy-based formulas and reduce stigma associated with non-dairy feeding practices

- This shift in consumer mindset toward proactive, informed nutrition choices is fundamentally transforming the infant formula market, encouraging companies to innovate and launch scientifically supported, allergen-conscious, and nutritionally complete soy-based products

- The demand for soy-based infant formulas is growing rapidly across both developed and developing economies, as modern parents prioritize safe, tailored, and evidence-backed nutritional solutions for their infants’ well-being

Soy Based Infant Formula Market Dynamics

Driver

“Growing Awareness about Plant-Based Diets”

- The growing awareness about plant-based diets and their associated health and environmental benefits is a significant driver for the rising demand for soy-based infant formula

- For instance, in April 2024, Australian company Coco2 launched what is claimed to be the world’s first coconut-based infant formula after a decade of development. This breakthrough underscores the increasing interest in non-dairy, plant-based nutrition options for infants and reflects a broader shift in consumer preference toward sustainable and allergen-friendly alternatives

- As more families adopt plant-based lifestyles due to ethical, environmental, or health reasons, soy-based formulas offer a nutritionally viable and trusted dairy-free option for infant feeding, Furthermore, the increasing promotion of vegan and vegetarian diets by health organizations and pediatricians, combined with rising concerns over lactose intolerance and dairy allergies, is reinforcing demand for soy-based alternatives in infant nutrition

- The growing availability of certified organic, non-GMO, and clean-label soy infant formulas also appeals to health-conscious parents seeking transparency and quality in their purchasing decisions

- As this shift toward plant-based consumption continues to gain traction globally, soy-based infant formula is emerging as a mainstream solution, driving market growth across diverse consumer segments

Restraint/Challenge

“Price Sensitivity of Soy Formulas”

- The price sensitivity of soy-based infant formulas poses a significant challenge to broader market adoption, particularly among low- and middle-income households. These formulas often come at a premium compared to standard dairy-based options due to specialized ingredients, processing requirements, and certifications such as organic or non-GMO

- For instance, soy-based formulas marketed as organic or plant-based alternatives frequently carry higher price tags, which may deter cost-conscious parents, especially in regions where public subsidies or health insurance coverage for specialty formulas are limited

- Addressing this pricing challenge requires strategic efforts such as expanding affordable product lines, scaling production to achieve cost efficiencies, and working with healthcare providers and policymakers to increase access through nutritional support programs. Brands such as Earth's Best and Parent's Choice have introduced more budget-friendly options to cater to economically diverse consumer segments

- While premium soy-based formulas appeal to a health-conscious demographic, the perceived high cost remains a barrier to adoption for families weighing affordability against dietary or allergy-related needs

- Overcoming this challenge will be essential for expanding the market's reach, particularly in emerging economies, and requires a balance between maintaining quality and offering accessible price points through innovation in sourcing, manufacturing, and distribution

Soy Based Infant Formula Market Scope

The market is segmented on the basis of product type, form, type, application, and distribution channel.

- By Product Type

On the basis of product type, the soy-based infant formula market is segmented into Stage 1, Stage 2, Stage 3, Stage 4, and Toddler Baby. The Stage 1 segment dominated the largest market revenue share in 2024, primarily due to its critical role in meeting the nutritional needs of newborns from birth. Parents often opt for Stage 1 soy-based formulas when infants exhibit lactose intolerance or cow milk protein allergies. The demand is further supported by pediatric recommendations and increasing awareness regarding alternative feeding solutions for early infancy.

The Toddler Baby segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health consciousness among parents and the growing preference for plant-based nutrition during early childhood. Toddler-specific soy formulas often include fortified nutrients tailored for toddlers’ growth, supporting demand in developed and developing economies.

- By Form

On the basis of form, the market is segmented into Powder, Liquid, and Semi-Liquid. The Powder segment held the largest market revenue share of 65.5% in 2024 due to its longer shelf life, ease of storage, and cost-effectiveness. Powdered soy-based formulas are preferred by consumers seeking value and convenience, particularly in regions with limited access to refrigeration or consistent supply chains.

The Liquid segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by its ready-to-feed nature and rising demand in urban areas where parents prefer on-the-go feeding options. Liquid formulas also reduce the risk of incorrect mixing, appealing to first-time parents and caregivers.

- By Type

On the basis of type, the soy-based infant formula market is segmented into Low Fat Soy-based Infant Formula and Whole-fat Soy-based Infant Formula. The Low Fat segment accounted for the largest market revenue share in 2024, driven by pediatric preferences and regulatory standards emphasizing controlled fat intake for infants with specific dietary needs.

The Whole-fat segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing demand for high-energy formulas for underweight or nutritionally deficient infants. Whole-fat formulas are also gaining popularity among parents preferring more natural, less-processed alternatives.

- By Application

On the basis of application, the market is segmented into 0 to 3 Months, 4 to 7 Months, 8 to 11 Months, 12 to 23 Months, and 24 Months and Up. The 0 to 3 Months segment held the largest market revenue share in 2024, attributed to the high incidence of formula use during early infancy, especially among working mothers and parents of lactose-intolerant newborns.

The 12 to 23 Months segment is projected to grow at the fastest CAGR from 2025 to 2032, as soy-based formulas increasingly serve as a transition product before shifting to solid food. The segment benefits from heightened attention to nutritional continuity during the critical toddler development phase.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online and Offline. The Offline segment captured the largest market revenue share in 2024 due to the trust associated with pharmacies, supermarkets, and specialty baby stores. Parents prefer buying infant formula in-store for perceived freshness, immediate availability, and access to professional advice.

The Online segment is projected to witness the fastest growth rate from 2025 to 2032, driven by increasing e-commerce penetration, convenience, and the availability of subscription-based delivery models. Digital platforms also facilitate access to a wider variety of products, reviews, and price comparisons.

Soy Based Infant Formula Market Regional Analysis

- 亞太地區在嬰兒配方奶粉市場佔據主導地位,2024 年其收入份額最高,達到 45.5%,這得益於新興經濟體嬰兒人口的快速增長、嬰兒營養意識的增強以及乳糖不耐症和牛奶過敏病例的增加

- 該地區不斷擴大的中產階級、不斷增長的可支配收入以及日益普及的電子商務平台是市場成長的主要推動力

- 此外,政府對嬰兒營養和健康的支持性法規、本地製造能力以及對植物性營養產品研發的不斷增加的投資正在加速整個地區的採用

日本豆奶嬰兒配方奶粉市場洞察

日本市場正在不斷擴張,因為對專門針對有飲食限制和過敏症的嬰兒的嬰兒營養品的需求日益增長。日本消費者重視嬰兒配方奶粉的品質、安全性和創新性。本土製造商正致力於改進產品配方和包裝的便利性,以滿足忙碌的父母和老齡化人口的需求。

中國豆奶嬰兒配方奶粉市場洞察

2024年,中國市場佔據亞太地區最大份額,這得益於其龐大的嬰兒人口和不斷加速的城市化進程。政府推廣母乳哺育替代品和改善嬰兒健康的措施正在推動需求成長。中國製造商正在增加對產品創新的投資,並拓展包括線上平台在內的分銷管道,以覆蓋更廣泛的消費者群體。

歐洲大豆嬰兒配方奶粉市場洞察

預計歐洲市場將穩定成長,這得益於人們對過敏和不耐受問題的認識不斷提高,以及消費者對植物性和有機嬰兒營養產品的偏好日益增長。強而有力的監管架構確保了產品安全和標籤透明度,增強了消費者信心。西歐在優質大豆配方的創新和採用方面處於領先地位。

英國大豆嬰兒配方奶粉市場洞察

由於消費者日益青睞天然且無過敏原的嬰兒營養品,英國市場預計將溫和成長。超市和藥局中大豆配方奶粉供應的增加,加上醫療保健專業人士的推薦,支撐了市場的成長。永續性方面的擔憂以及對清潔標籤產品的需求進一步影響了消費者的購買決策。

德國大豆嬰兒配方奶粉市場洞察

德國大豆嬰兒配方奶粉市場正穩定成長,這得益於消費者對嬰兒健康和過敏管理的日益關注。德國消費者更青睞品質認證和永續採購的產品。配方成分和環保包裝的創新與德國嚴格的環保標準相契合。

北美大豆嬰兒配方奶粉市場洞察

預計北美市場將在2025年至2032年期間實現最快的複合年增長率,這主要得益於乳糖不耐症盛行率的上升以及純素食和素食人口的增加。日益增長的健康意識以及對無過敏原植物性嬰兒營養品的需求推動了市場普及。產品配方的進步和分銷網絡的不斷擴展也為市場成長提供了支撐。

美國大豆嬰兒配方奶粉市場洞察

2024年,美國市場佔據了北美最大的收入份額,這得益於市場對乳製品嬰兒配方奶粉替代品的強勁需求,以及醫療保健提供者的認可度不斷提升。電商和專業零售通路正在擴大大豆配方奶粉的覆蓋範圍。對非基因改造和有機認證的重視也激發了消費者的偏好。

大豆嬰兒配方奶粉市場份額

大豆嬰兒配方奶粉產業主要由知名公司主導,其中包括:

市場中主要的市場領導者有:

- 雀巢(瑞士)

- 達能(法國)

- 利潔時集團股份有限公司(英國)

- 雅培(美國)

- HiPP(德國)

- 卡夫亨氏公司(美國)

- 英雄集團(瑞士)

- 伊利集團(中國)

- 丘比株式會社(日本)

- 菲仕蘭坎皮納(荷蘭)

- Arla Foods amba(丹麥)

- 誠實公司(美國)

- 伍爾沃斯集團有限公司(澳洲)

- 紐迪希亞(美國)

- 美贊臣公司(Mead Johnson & Company, LLC.)(美國)

- 凱裡集團有限公司(愛爾蘭)

- MyOrganicCo(美國)

全球大豆嬰兒配方奶粉市場最新發展

- 2025年4月,Bobbie推出了其第四款嬰兒配方奶粉-Bobbie有機全脂嬰兒配方奶粉,這標誌著Bobbie成為首款也是唯一一款在美國生產的美國農業部有機全脂配方奶粉,標誌著一個重要的里程碑。經過三年的研發,這款產品為嬰兒營養的品質和安全樹立了新的標竿。該產品由Bobbie位於俄亥俄州希思的先進工廠生產,旨在滿足消費者在美國嬰兒配方奶粉市場持續存在的不確定性背景下對有機、可靠嬰兒營養日益增長的需求。這項創新鞏固了Bobbie作為值得信賴的領導者的地位,並有望透過提高品質標準和擴大有機配方奶粉的採用來影響市場動態。

- 2024年4月,澳洲公司Coco2推出了其聲稱的全球首款椰子基嬰兒配方奶粉。這款配方歷經十餘年研發,並得到了昆士蘭大學、家長和醫療保健專家的共同參與。配方旨在完美複製母乳的營養成分和健康益處,包含必需維生素、礦物質和脂肪酸。 Coco2的這款開創性產品有望透過提供一種全新的植物性替代品來顛覆嬰兒配方奶粉市場,吸引那些尋求無乳製品和無過敏原選擇的消費者,從而擴大市場多樣性,並促進全球嬰兒營養領域的創新。

- 雀巢將於2023年11月在香港推出一款採用專利配方的全新嬰兒配方奶粉。這款配方旨在提供全面的營養,支持消化、骨骼和認知健康等各個方面的成長。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。