Global Stealth Warfare Market

市场规模(十亿美元)

CAGR :

%

USD

13.83 Billion

USD

27.02 Billion

2024

2032

USD

13.83 Billion

USD

27.02 Billion

2024

2032

| 2025 –2032 | |

| USD 13.83 Billion | |

| USD 27.02 Billion | |

|

|

|

|

全球隱形戰爭市場,按平台(機載和海軍)、設備(雷達、紅外線搜尋和追蹤 (IRST) 系統和聲學特徵)、材料(非金屬機身和雷達吸波材料)和應用(空軍、海軍和陸軍)劃分——行業趨勢和預測到 2032 年。

隱形戰爭市場規模

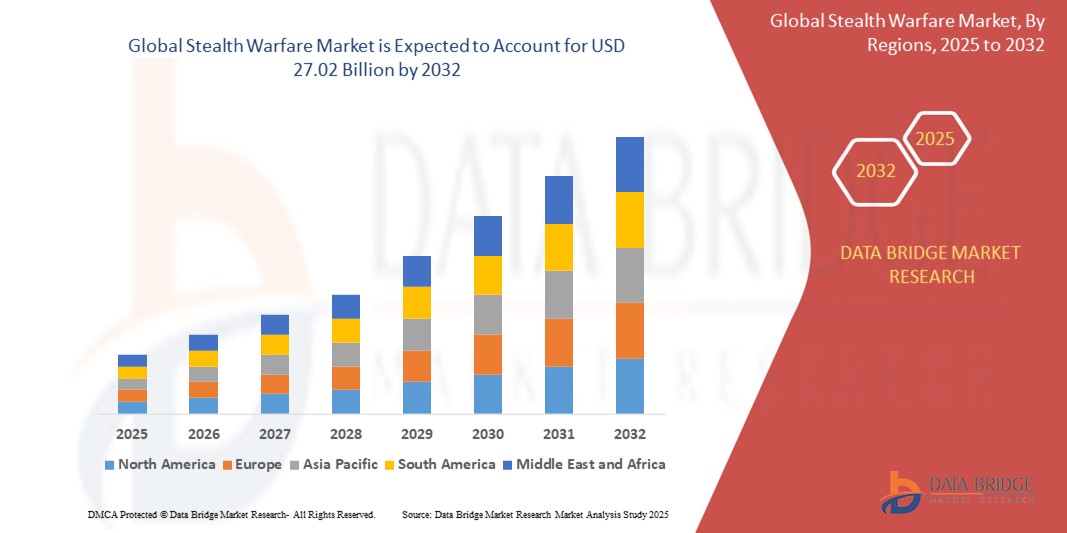

- 2024 年全球隱形戰爭市場規模為138.3 億美元 ,預計 到 2032 年將達到 270.2 億美元,預測期內 複合年增長率為 8.73%。

- 市場成長的動力來自國防預算的增加、隱形技術的進步以及日益加劇的地緣政治緊張局勢對先進軍事能力的需求

- 對隱形解決方案的需求源於對在對抗環境中增強生存能力的需求、尖端材料的整合以及用於空中和海軍應用的下一代平台的開發

隱形戰爭市場分析

- 隱形戰爭技術旨在減少雷達、紅外線和聲學系統的探測,對現代軍事行動至關重要,可在空中、海上和地面應用中提供戰略優勢

- 隱形技術的日益普及,得益於國防現代化計畫的不斷增加、對低可觀測平台的需求以及雷達吸波材料和感測器系統的進步

- 北美在隱形戰爭市場佔據主導地位,2024 年的收入份額最高,為 42.5%,這歸功於對國防研發的大量投資、主要行業參與者的強大影響力以及先進隱形技術的早期採用,尤其是在美國,該技術應用於下一代戰鬥機和海軍艦艇

- 預計亞太地區將成為預測期內成長最快的地區,這得益於快速的軍事現代化、不斷增加的國防開支以及日益增長的區域安全擔憂

- 2024 年,機載領域佔了最大的市場收入份額,達到 57.8%,這得益於隱形飛機在偵察、戰術交戰和空中優勢任務中的關鍵作用

報告範圍和隱形戰爭市場細分

|

屬性 |

隱形戰爭關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

隱形戰爭市場趨勢

“人工智慧與自主系統的融合日益加深”

- 全球隱形戰爭市場正經歷人工智慧 (AI) 與自主系統融合的重大趨勢

- 這些技術增強了資料處理和分析能力,為平台效能、威脅偵測和任務規劃提供了更深入的洞察。

- 人工智慧隱形系統能夠主動識別威脅,從而實現即時對抗措施並增強對抗環境中的生存能力

- 例如,各公司正在開發人工智慧驅動的平台,分析雷達、紅外線和聲學特徵,以優化隱形行動並適應先進的敵方探測系統

- 這一趨勢正在提高隱形平台的戰略價值,使其對空軍、海軍和陸軍更加有效

- 人工智慧演算法可以處理來自雷達和紅外線搜尋與追蹤 (IRST) 系統等感測器的大量資料集,以改善決策能力並在動態戰場條件下保持隱身能力

隱形戰爭市場動態

司機

“對先進隱形平台和反探測能力的需求不斷增長”

- 日益加劇的地緣政治緊張局勢和對戰略優勢的需求正在推動空中、海軍和陸軍對先進隱形平台的需求

- 隱身系統透過採用雷達吸波材料、非金屬機身和聲學特徵降低等技術降低可探測性,從而提高作戰效能

- Government initiatives, particularly in North America, which dominates the market due to robust investments in defense infrastructure, are promoting the adoption of stealth technologies

- The proliferation of advanced anti-access/area denial (A2/AD) systems and the development of 5G technology enable faster data transmission and lower latency, supporting more sophisticated stealth applications

- Defense contractors, such as Lockheed Martin and Northrop Grumman, are increasingly integrating stealth features as standard or optional components in aircraft, naval vessels, and ground vehicles to meet evolving military requirements

Restraint/Challenge

“High Development Costs and Counter-Stealth Technology Advancements”

- The substantial investment required for research, development, and integration of stealth technologies, such as radar-absorbing materials and non-metallic airframes, poses a significant barrier, particularly for emerging markets

- Integrating stealth systems into existing platforms, such as aircraft or naval vessels, can be complex and costly, requiring specialized engineering and materials

- In addition, advancements in counter-stealth technologies, such as improved radar and infrared detection systems, present a major challenge by reducing the effectiveness of stealth platforms

- The fragmented global regulatory landscape regarding military technology exports and intellectual property protection complicates operations for international manufacturers and service providers

- These factors can deter adoption in cost-sensitive regions and limit market expansion, particularly in areas with rapidly evolving detection technologies or limited defense budgets

Stealth Warfare market Scope

The market is segmented on the basis of platform, equipment, material, and application.

- By Platform

On the basis of platform, the global stealth warfare market is segmented into airborne and naval. The airborne segment dominated the largest market revenue share of 57.8% in 2024, driven by the critical role of stealth aircraft in reconnaissance, tactical engagements, and air superiority missions. Advancements in aerodynamics and radar-absorbing materials further enhance the adoption of airborne stealth platforms.

The naval segment is expected to witness the fastest growth rate of 10.2% from 2025 to 2032, fueled by increasing investments in stealth-enabled naval vessels, such as submarines and stealth ships, to ensure maritime security and counter evolving threats in contested waters.

- By Equipment

On the basis of equipment, the global stealth warfare market is segmented into radar, infrared search and track (IRST) system, and acoustic signature. The radar segment dominated the market with a revenue share of 45.3% in 2024, owing to its critical role in detecting and countering stealth platforms through advanced radar systems, including ground-based, airborne, naval, and synthetic aperture radar (SAR).

The infrared search and track (IRST) system segment is anticipated to experience the fastest growth rate of 11.5% from 2025 to 2032, driven by its ability to detect stealth platforms through thermal signatures, particularly in environments where radar performance is limited by weather or countermeasures.

- By Material

On the basis of material, the global stealth warfare market is segmented into non-metallic airframe and radar-absorbing material (RAM). The radar-absorbing material segment accounted for the largest market revenue share of 62.7% in 2024, driven by its widespread use in reducing the radar cross-section (RCS) of aircraft, ships, and ground vehicles, enhancing their stealth capabilities.

The non-metallic airframe segment is expected to witness significant growth from 2025 to 2032, propelled by advancements in composite materials and metallurgy, which enable lightweight, durable, and low-observable structures for stealth platforms.

- By Application

On the basis of application, the global stealth warfare market is segmented into air force, navy, and army. The air force segment dominated the market with a revenue share of 50.4% in 2024, driven by the extensive use of stealth aircraft, such as the F-35 and B-21 Raider, for covert operations and precision strikes in contested environments.

The navy segment is anticipated to grow at the fastest rate of 10.8% from 2025 to 2032, fueled by the increasing adoption of stealth technology in naval vessels, including submarines and frigates, to enhance survivability and operational effectiveness in maritime warfare.

Stealth Warfare Market Regional Analysis

- North America dominated the stealth warfare market with the largest revenue share of 42.5% in 2024, attributed to significant investments in defense R&D, a strong presence of key industry players, and early adoption of advanced stealth technologies, particularly in the U.S. for next-generation fighter jets and naval vessels

- Demand is fueled by the need for enhanced survivability, tactical surprise, and penetration capabilities in contested environments, particularly for air, naval, and ground operations

- Growth is supported by innovations in stealth technologies, such as radar-absorbing materials, infrared signature reduction, and acoustic suppression, alongside increasing adoption in both military modernization programs and new platform deployments

U.S. Stealth Warfare Market Insight

The U.S. stealth warfare market captured the largest revenue share of 78.6% in 2024 within North America, fueled by robust defense spending and a strong focus on maintaining strategic superiority. The development of next-generation stealth platforms, such as the B-21 Raider, and advancements in radar-absorbing materials drive market growth. Increasing integration of stealth technologies in unmanned systems and stringent regulations for countering advanced detection systems further boost demand.

歐洲隱形戰市場洞察

歐洲隱形作戰市場預計將顯著成長,這得益於該地區對國防能力現代化和應對不斷演變的威脅的重視。英國和法國等國家正在投資用於空中和海軍平台的隱形技術,以提高作戰效能。對多域作戰的關注以及人工智慧驅動的隱形系統的整合有助於市場擴張,尤其是在改裝和新平台應用方面。

英國隱形戰爭市場洞察

英國隱形戰市場預計將經歷快速成長,這主要得益於對先進雷達系統以及海空平台隱形塗層的投資。增強態勢感知能力和複雜戰場生存能力的需求推動了隱形戰市場的採用。促進互通性和網路中心戰的監管框架,加上歐洲戰鬥機「颱風」升級等合作,將支撐市場的持續成長。

德國隱形戰市場洞察

由於德國先進的國防製造業和對技術創新的重視,德國預計將在隱形戰爭市場實現顯著成長。德國軍事計畫優先考慮飛機和海軍艦艇的隱形技術,以降低其可偵測性並提高任務成功率。非金屬機身等先進材料的整合以及與亨索爾特等公司的合作推動了市場的成長。

亞太隱形戰爭市場洞察

預計亞太地區將見證全球隱形戰爭市場最快的成長速度,這得益於中國、印度和日本等國國防預算的不斷增長以及地緣政治緊張局勢。人們對隱形技術在空中優勢、海上安全和地面作戰中的作用的認識不斷提高,這刺激了市場需求。各國政府推動的本土國防生產和現代化計畫也進一步加速了市場成長。

日本隱形戰市場洞察

由於對空中和海上平台先進隱身技術的強勁需求,日本的隱身戰爭市場預計將快速成長。大型國防承包商的參與以及戰鬥機等原始設備製造商平台對隱身功能的集成,提升了市場滲透率。人們對應對區域威脅和採用人工智慧驅動的隱身系統的興趣日益濃厚,也推動了市場的顯著擴張。

中國隱形戰爭市場洞察

中國在亞太隱形作戰市場佔據最大份額,這得益於其快速的軍事現代化、不斷增長的國防預算以及對自主隱形平台研發的重視。海軍和空軍對雷達吸波材料和聲學特徵抑制的需求推動了市場的成長。國內製造業的競爭力以及對具備隱形能力的無人系統的投資,增強了市場的可及性和擴張性。

隱形戰爭市場佔有率

隱形戰爭產業主要由知名公司主導,其中包括:

- BAE系統公司(英國)

- 諾斯羅普·格魯曼公司(美國)

- 雷神科技公司(美國)

- 洛克希德馬丁公司(美國)

- 泰雷茲集團(美國)

- L3Harris Technologies, Inc.(美國)

- 以色列航空航太工業(以色列)

- SAAB AB(瑞典) Zoho Corporation(印度)

- WebHR(美國)

- Infor(美國)

- Kronos Incorporated(美國)

- Sage Group plc.(美國)

- 三菱重工(日本)

- 達梭航空(法國)

- 蘇霍伊(俄羅斯)

全球隱形戰爭市場的最新發展是什麼?

- 2025年3月,未來今日策略集團(FTSG)發布的《2025年科技趨勢報告》重點關注了「生命智慧系統」的崛起——該系統融合了人工智慧、先進感測器和生物工程,使系統能夠即時感知、學習、適應和演化。這項技術變革,加上愛立信等公司在全球推出的5G基礎設施,標誌著先進通訊系統新時代的到來。這些發展將顯著影響隱身能力,增強資料處理、訊號情報以及軍事和國防應用(包括低可偵測性作戰)的即時適應性。

- 2024年6月,下一代衛星通訊系統領導者SatixFy Communications Ltd.獲得一筆價值超過2000萬美元的里程碑式訂單,其Prime2太空級數位波束形成器晶片及軟體來自一位未公開的客戶。 Prime2晶片是一款尖端的專用積體電路(ASIC),專為低地球軌道(LEO)和地球靜止軌道(GEO)衛星系統中的大規模MIMO天線而設計。此技術可實現多波束電控天線,提供增強的可擴展性、靈活性和效能。

- 2024年5月,美國眾議院軍事委員會發布了《2025財年軍人生活品質改善與國防授權法案》報告。雖然這份簡短的報告並未詳述具體的隱形戰爭計劃,但此類立法通常包含對先進國防技術(包括隱形技術)研發和採購的資金和戰略指令。

- In February 2024, Ericsson achieved a major milestone by deploying 100,000 Massive MIMO 5G radios for Bharti Airtel across 12 telecom circles in India, completing the rollout in just over 500 days. This large-scale deployment enhances Airtel’s 5G network capacity and energy efficiency, serving over 65 million users. While primarily aimed at advancing commercial 5G infrastructure, Massive MIMO technology—with its ability to dynamically steer beams and reduce interference—also holds significant potential for advanced communication systems used in stealth operations, particularly in signal intelligence and low-detectability communications

- In July 2023, it remains evident that due to the inherent secrecy of stealth warfare, comprehensive public disclosures on specific product launches, mergers, acquisitions, partnerships, or recalls in this domain are extremely limited. Instead, developments are typically reported under the broader umbrella of defense technology advancements, classified R&D programs, or through national defense budgets and strategic modernization initiatives. For instances, the U.S. FY2025 defense budget allocates emphasizing next-generation air superiority, hypersonic strike capabilities, and multi-domain deterrence—all of which have direct implications for stealth technologies. Similarly, India’s 2025–26 defense budget allocates with a strong focus on AI-driven systems, cyber warfare, and domestic procurement, further underscoring the shift toward advanced, often stealth-related, capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL STEALTH WARFARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL STEALTH WARFARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL STEALTH WARFARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

6 GLOBAL STEALTH WARFARE MARKET, BY TYPE OF PLATFORM

6.1 OVERVIEW

6.2 STEALTH AIRCRAFT

6.3 STEALTH MISSILES

6.4 STEALTH UAVS

6.5 STEALTH NAVAL PLATFORMS

7 GLOBAL STEALTH WARFARE MARKET, BY TECHNOLOGIES

7.1 OVERVIEW

7.2 RADAR CROSS SECTION (RCS)

7.3 RADAR ABSORBENT MATERIALS (RAM)

7.4 NON-METALLIC/METALLIC COATING

7.5 PLASMA CLOUD

7.6 IR SIGNATURE EMISSION

7.7 RADAR EMISSION

7.8 ACOUSTIC EMISSION

7.9 RF EMISSION

8 GLOBAL STEALTH WARFARE MARKET, BY END USER

8.1 OVERVIEW

8.2 MILITARY

8.3 LAW ENFORCEMENT

9 GLOBAL STEALTH WARFARE MARKET, BY GEOGRAPHY

9.1 GLOBAL STEALTH WARFARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.1.1 NORTH AMERICA

9.1.1.1. U.S.

9.1.1.2. CANADA

9.1.1.3. MEXICO

9.1.2 EUROPE

9.1.2.1. GERMANY

9.1.2.2. FRANCE

9.1.2.3. U.K.

9.1.2.4. ITALY

9.1.2.5. SPAIN

9.1.2.6. RUSSIA

9.1.2.7. TURKEY

9.1.2.8. BELGIUM

9.1.2.9. NETHERLANDS

9.1.2.10. NORWAY

9.1.2.11. FINLAND

9.1.2.12. SWITZERLAND

9.1.2.13. DENMARK

9.1.2.14. SWEDEN

9.1.2.15. POLAND

9.1.2.16. REST OF EUROPE

9.1.3 ASIA PACIFIC

9.1.3.1. JAPAN

9.1.3.2. CHINA

9.1.3.3. SOUTH KOREA

9.1.3.4. INDIA

9.1.3.5. AUSTRALIA

9.1.3.6. NEW ZEALAND

9.1.3.7. SINGAPORE

9.1.3.8. THAILAND

9.1.3.9. MALAYSIA

9.1.3.10. INDONESIA

9.1.3.11. PHILIPPINES

9.1.3.12. TAIWAN

9.1.3.13. VIETNAM

9.1.3.14. REST OF ASIA PACIFIC

9.1.4 SOUTH AMERICA

9.1.4.1. BRAZIL

9.1.4.2. ARGENTINA

9.1.4.3. REST OF SOUTH AMERICA

9.1.5 MIDDLE EAST AND AFRICA

9.1.5.1. SOUTH AFRICA

9.1.5.2. EGYPT

9.1.5.3. SAUDI ARABIA

9.1.5.4. U.A.E

9.1.5.5. OMAN

9.1.5.6. BAHRAIN

9.1.5.7. ISRAEL

9.1.5.8. KUWAIT

9.1.5.9. QATAR

9.1.5.10. REST OF MIDDLE EAST AND AFRICA

9.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

10 GLOBAL STEALTH WARFARE MARKET,COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.5 MERGERS & ACQUISITIONS

10.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

10.7 EXPANSIONS

10.8 REGULATORY CHANGES

10.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

11 GLOBAL STEALTH WARFARE MARKET, SWOT & DBMR ANALYSIS

12 GLOBAL STEALTH WARFARE MARKET, COMPANY PROFILE

12.1 NORTHROP GRUMMAN

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 GEOGRAPHIC PRESENCE

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 LOCKHEED MARTIN CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 GEOGRAPHIC PRESENCE

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 RTX

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 GEOGRAPHIC PRESENCE

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 SAAB

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 GEOGRAPHIC PRESENCE

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 BAE SYSTEMS

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 GEOGRAPHIC PRESENCE

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 GENERAL DYNAMICS MISSION SYSTEMS, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 GEOGRAPHIC PRESENCE

12.6.4 PRODUCT PORTFOLIO

12.6.5 RECENT DEVELOPMENT

12.7 KRATOS DEFENSE & SECURITY SOLUTIONS, INC

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 GEOGRAPHIC PRESENCE

12.7.4 PRODUCT PORTFOLIO

12.7.5 RECENT DEVELOPMENT

12.8 BOEING

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 GEOGRAPHIC PRESENCE

12.8.4 PRODUCT PORTFOLIO

12.8.5 RECENT DEVELOPMENT

12.9 LEONARDO S.P.A.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 GEOGRAPHIC PRESENCE

12.9.4 PRODUCT PORTFOLIO

12.9.5 RECENT DEVELOPMENT

12.1 BAYRAKTAR K

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 GEOGRAPHIC PRESENCE

12.10.4 PRODUCT PORTFOLIO

12.10.5 RECENT DEVELOPMENT

12.11 SUKHOI

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 GEOGRAPHIC PRESENCE

12.11.4 PRODUCT PORTFOLIO

12.11.5 RECENT DEVELOPMENT

12.12 AVIC

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 GEOGRAPHIC PRESENCE

12.12.4 PRODUCT PORTFOLIO

12.12.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

16 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。