Global Street Roadway Lighting Market

市场规模(十亿美元)

CAGR :

%

USD

10.27 Billion

USD

16.31 Billion

2024

2032

USD

10.27 Billion

USD

16.31 Billion

2024

2032

| 2025 –2032 | |

| USD 10.27 Billion | |

| USD 16.31 Billion | |

|

|

|

|

全球街道和道路照明市場細分,按照明類型(傳統照明和智慧照明)、光源(LED、螢光燈和 HID 燈)、功率類型(小於 50W、50W 至 150W 之間和大於 150W)、最終用戶(高速公路、街道和道路等)、產品(硬體、軟體和服務)進行細分 - 行業趨勢和預測至 2032 年至 2032 年

街道和道路照明市場規模

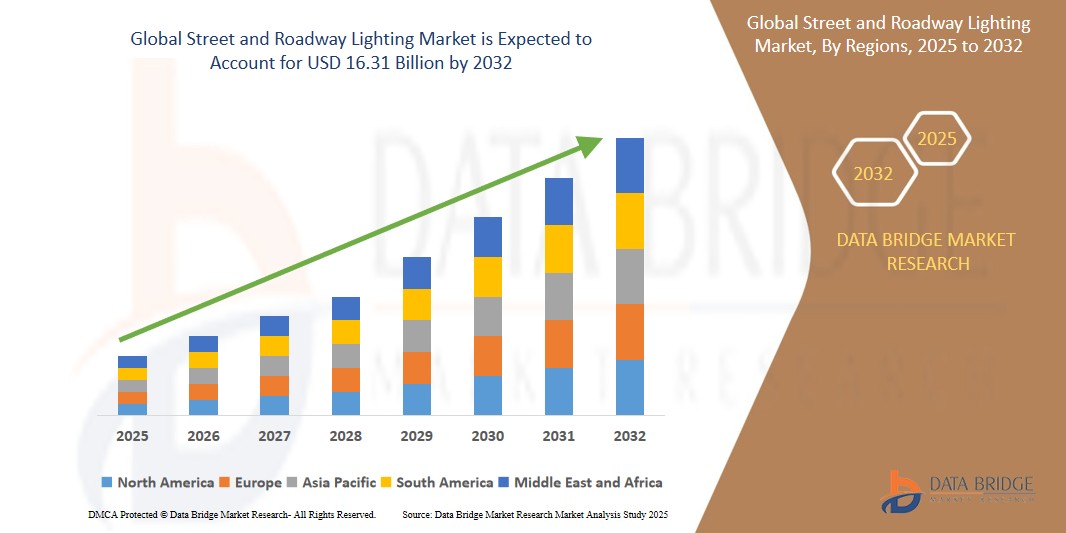

- 2024 年全球街道和道路照明市場規模為102.7 億美元 ,預計到 2032 年將達到 163.1 億美元,預測期內 複合年增長率為 5.96%。

- 這一增長受到許多因素的推動,例如智慧城市計劃的不斷增長、對節能解決方案的需求不斷增長、政府法規的支持、物聯網和感測器 技術的進步以及推動基礎設施發展的快速城市化

街道和道路照明市場分析

- 街道和道路照明是指用於照亮公共道路、高速公路和城市地區的系統和技術,旨在提高能見度、確保交通安全和支持城市基礎設施。這些系統包括 LED 燈、智慧照明網路和傳統光源等一系列解決方案

- 街道和道路照明市場正在經歷強勁增長,這得益於全球對智慧城市基礎設施的投資不斷增加、對節能照明解決方案的需求不斷增長、快速的城市化、政府對永續公共照明的要求以及物聯網智慧照明 技術的進步

- 由於各主要經濟體政府大力推動智慧城市發展和節能基礎設施升級,亞太地區預計將主導街道和道路照明市場

- 由於嚴格的監管規定旨在提高能源效率、永續性和公共安全,預計歐洲將成為預測期內街道和道路照明市場成長最快的地區

- LED 領域預計將佔據市場主導地位,佔據 80.2% 的最大市場份額,因為其具有卓越的能源效率、更長的使用壽命、更低的維護成本,以及日益增長的專注於可持續和智慧城市基礎設施發展的全球舉措

報告範圍及街道及道路照明市場細分

|

屬性 |

街道和道路照明關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、按地理位置表示的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和更新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

街道和道路照明市場趨勢

“智慧照明系統的普及率不斷提高”

- 全球街道和道路照明市場的一個突出趨勢是智慧照明系統的採用日益增多

- 這一趨勢是由對能源效率、降低營運成本以及物聯網、人工智慧和基於感測器的技術實現的即時控制能力日益增長的需求所推動的

- 例如,許多城市正在實施自適應街道照明,根據交通流量和環境條件調節亮度,幫助降低能源消耗並提高公共安全

- 智慧照明的應用正在歐洲和北美等發達地區以及亞太地區快速城市化地區不斷擴大,這些地區正在優先考慮智慧城市計劃

- 隨著城市地區努力實現永續性、自動化和增強基礎設施性能,向智慧照明系統的轉變預計將加速,從而塑造街道和道路照明市場的未來

街道和道路照明市場動態

司機

“加強政府監管”

- Increasing government regulations on energy efficiency and environmental standards are driving the growth of the street and roadway lighting market, as stricter guidelines push for more sustainable and energy-efficient lighting solutions

- These regulations are gaining momentum in regions worldwide, especially in urban areas where governments are aiming to reduce carbon footprints and lower energy consumption through better street lighting infrastructure

- The demand for smart, energy-efficient, and long-lasting lighting systems is increasing, prompting a shift toward LED technology and other advanced solutions that meet regulatory standards while reducing operational costs

- Governments are incentivizing the adoption of these technologies by offering rebates, grants, or tax credits for municipalities to replace outdated lighting systems with energy-efficient alternatives

- As regulations become more stringent, there is a growing emphasis on smart grid integration and automation in lighting systems to improve control, reduce energy waste, and meet sustainability targets

For instance,

- Companies such as Signify (formerly Philips Lighting) are innovating in connected LED street lights, integrating smart technology to offer enhanced energy savings and longer lifespans while complying with government standards

- Research and development efforts are focused on creating energy-efficient street lighting systems that meet or exceed governmental energy codes while providing better public safety and visibility

- As sustainability and energy efficiency continue to be prioritized by governments, the street and roadway lighting market is expected to see rapid growth in the adoption of compliant, smart, and environmentally friendly solutions

Opportunity

“Rise in Energy Efficiency Initiatives”

- The rising emphasis on energy efficiency presents a significant opportunity for the street and roadway lighting market, as municipalities and private entities increasingly focus on reducing energy consumption and operational costs

- Governments, urban planners, and infrastructure companies are leveraging energy-efficient lighting technologies, such as LED streetlights, to reduce electricity usage, lower maintenance costs, and meet sustainability goals

- This opportunity aligns with growing global initiatives to reduce carbon emissions, enhance environmental sustainability, and support smarter, more efficient urban infrastructure

For instance,

- Companies such as Cree Lighting and Acuity Brands are leading the way in developing energy-efficient, smart lighting solutions that provide long-term cost savings while meeting energy efficiency regulations

- Integration of smart lighting systems with sensors and automation is enabling cities to further reduce energy consumption while improving public safety and convenience

- 隨著全球能源效率措施的興起,街道和道路照明市場已做好準備,利用這一機遇,提供既能節省成本又能帶來環境效益的先進照明解決方案。

克制/挑戰

“日益增長的基礎設施限制”

- 日益增長的基礎設施限制對街道和道路照明市場構成了重大挑戰,因為老化的基礎設施、資金不足和缺乏現代化阻礙了許多地區採用節能照明系統

- 舊城區和農村地區基礎設施升級步伐緩慢,意味著用節能 LED 系統取代老舊路燈的努力經常被推遲,從而限制了市場的成長潛力和可持續性

- 這項挑戰在預算有限的發展中地區和城市尤為明顯,這些地區的財政限制可能會阻礙先進照明解決方案的實施,從而減緩向更智慧、更節能係統的過渡

例如,

- 在美國部分地區,城市地區難以獲得大規模照明昇級的資金,導致採用可以降低能源消耗和維護成本的新技術的延遲

- 如果沒有對基礎設施現代化的策略性投資、增加對智慧城市計畫的資金投入以及加強政府支持力度,這些限制可能會嚴重阻礙街道和道路照明市場的成長和進步

街道和道路照明市場範圍

市場根據照明類型、光源、瓦數類型、最終用戶和產品進行細分。

|

分割 |

細分 |

|

依照明類型 |

|

|

按光源 |

|

|

按瓦數類型 |

|

|

按最終用戶

|

|

|

透過提供 |

|

預計到 2025 年,LED 將佔據光源市場最大份額

由於 LED 具有卓越的能源效率、更長的使用壽命、更低的維護成本,以及全球範圍內致力於可持續和智慧城市基礎設施發展的舉措日益增多,預計到 2025 年,LED 將佔據街道和道路照明市場的主導地位 ,佔據 80.2% 的最大份額。

預計智慧照明將在預測期內佔據照明類型領域的最大份額

In 2025, the smart lighting segment is expected to dominate the market due to increasing adoption of IoT and sensor-based technologies, which enable remote monitoring, adaptive lighting, energy savings, and improved public safety through real-time data analytics and automated control systems.

Street and Roadway Lighting Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Street and roadway lighting Market”

- Asia-Pacific dominates the street and roadway lighting market, driven by the robust government initiatives promoting smart city development and energy-efficient infrastructure upgrades across major economies

- China holds a significant share due to extensive urbanization, large-scale LED deployment in public infrastructure, and heavy investments in smart lighting systems by both central and local governments

- Regional dominance is further supported by favorable regulatory policies, public-private partnerships, and rapid advancements in connected lighting technologies and city digitization

- With sustained focus on reducing carbon emissions and improving public safety through intelligent lighting networks, Asia-Pacific is expected to retain its leading position in the street and roadway lighting market through 2032

“Europe is Projected to Register the Highest CAGR in the Street and roadway lighting Market”

- Europe is expected to witness the highest growth rate in the street and roadway lighting market, driven by strict regulatory mandates aimed at enhancing energy efficiency, sustainability, and public safety

- Germany holds a significant share due to aggressive adoption of smart lighting solutions, strong commitment to green infrastructure, and government-funded urban modernization programs

- Growth is further accelerated by rising demand for intelligent lighting systems, integration of IoT-based controls, and increasing replacement of conventional lights with LEDs across municipalities

- With continued investment in smart city frameworks and sustainable public infrastructure, Europe is poised to be the fastest-growing region in the street and roadway lighting market through 2032

Street and Roadway Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koninklijke Philips N.V. (Netherlands)

- Cree, Inc. (U.S.)

- General Electric Company (U.S.)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Hubbell (U.S.)

- Dongguan Kingsun Optoelectronic Co., Ltd. (China)

- Thorn (U.K.)

- LED ROADWAY LIGHTING LTD (Canada)

- Syska (India)

- Virtual Extension (Israel)

- Eaton (Ireland)

- OSRAM Opto Semiconductors GmbH (Germany)

- CIMCON Lighting, Inc. (U.S.)

- AGC Inc. (Japan)

- Electrolite Fitting & Equipments (India)

- Cree Lighting (U.S.)

- SpecGrade LED (U.S.)

- LEDVANCE GmbH (Germany)

- SKYLER TEK, Inc. dba SKYLER LED Lighting (U.S.)

- Itron Inc. (U.S.)

Latest Developments in Global Street and Roadway Lighting Market

- In June 2023, the Government of India approved the installation of 90,000 smart street lights on all Public Works Department (PWD) roads in Delhi. This initiative aims to eliminate dark spots and enhance women's security, with a focus on a robust central monitoring system to ensure the lights' uninterrupted functioning

- In February 2023, the Monroe City Council announced the approval of a motion to submit a grant request to the Southeast Michigan Council of Governments (SEMCOG). The grant, if approved, would cover up to 80 percent of the costs for converting the city's street lights to LED lamps, significantly reducing the financial burden on the city

- In April 2022, Ams OSRAM revealed plans to establish a EUR 800 million LED production facility in Malaysia. The company also announced substantial investments in advanced 8-inch LED front-end capacity in Malaysia, aiming to enhance the production of cutting-edge LED technologies and micro LEDs

- In March 2021, Smart Global Holdings Inc. acquired Cree Inc.'s LED Products business unit. This acquisition is part of Smart Global Holdings' strategy to diversify its portfolio and expand its presence in the LED market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。