Global Thermal Interface Material Market

市场规模(十亿美元)

CAGR :

%

USD

2.96 Billion

USD

7.02 Billion

2024

2032

USD

2.96 Billion

USD

7.02 Billion

2024

2032

| 2025 –2032 | |

| USD 2.96 Billion | |

| USD 7.02 Billion | |

|

|

|

|

全球熱界面材料市場細分,按化學成分(矽膠、環氧樹脂和聚醯亞胺)、類型(間隙填充物、油脂和黏合劑、彈性墊、金屬基和其他)、應用(電腦、電信、汽車、工業機械和其他)、產品類型(油脂和黏合劑、膠帶和薄膜、彈性墊、金屬基、相變材料和其他) - 12 年到產業趨勢

全球熱界面材料市場規模與成長率是多少?

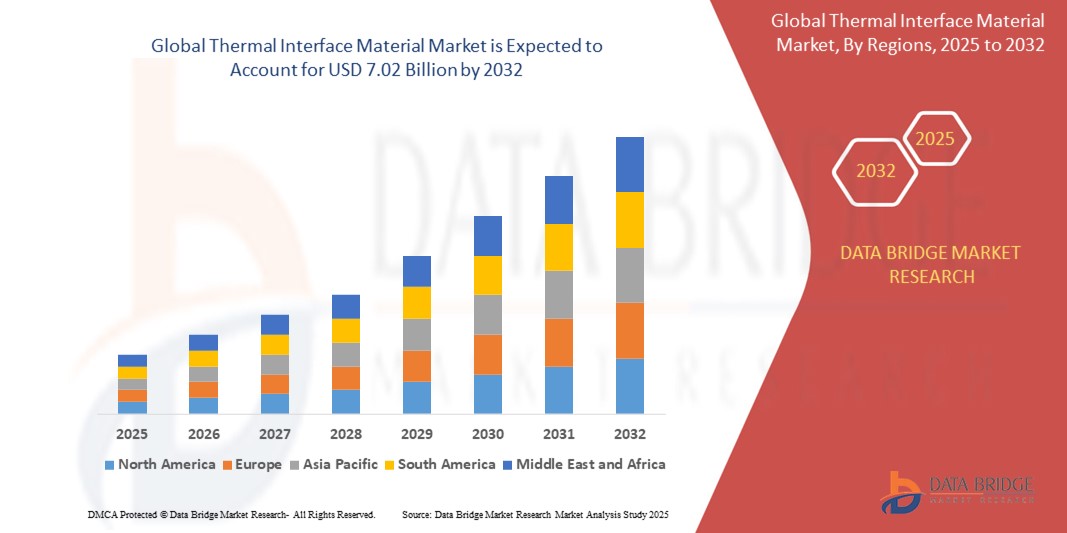

- 2024 年全球熱界面材料市場規模為29.6 億美元 ,預計 到 2032 年將達到 70.2 億美元,預測期內 複合年增長率為 11.40%。

- 熱界面材料 (TIM) 市場正在穩步增長,這得益於各行各業對高效熱管理解決方案日益增長的需求。電子設備日益複雜和小型化,導致發熱量增加,有效的熱管理對於防止過熱和確保最佳性能至關重要。

- 此外,電動車的普及以及消費性電子產品和電信設備需求的不斷增長,進一步刺激了對TIM的需求。技術進步,例如開發導熱係數更高、加工性能更佳的TIM,也推動了市場的成長。

熱界面材料市場的主要內容是什麼?

- 智慧型手機、筆記型電腦和伺服器等電子設備的需求日益增長,這推動了對高效熱管理解決方案的需求。隨著電子設備功能越來越強大、體積越來越小,它們產生的熱量也越來越多,這可能會對性能和可靠性產生負面影響。

- TIM 有助於散熱,確保電子元件在安全的溫度範圍內運作。物聯網 (IoT) 設備、智慧家電和穿戴式技術的普及進一步推動了對 TIM 的需求,因為這些設備需要有效的熱管理來維持其功能和使用壽命。

- 北美佔據熱界面材料市場的主導地位,2024 年其收入份額最大,為 43.5%,這得益於該地區電子製造商的強大影響力、技術的快速進步以及消費電子、汽車和電信等行業對熱管理的高需求

- 預計亞太地區熱界面材料市場在 2025 年至 2032 年間將以 12.65% 的複合年增長率增長,這得益於該地區消費電子產品生產的蓬勃發展、電動汽車的普及以及 5G 網路的快速擴張

- 矽膠憑藉其優異的熱穩定性、柔韌性和電絕緣性能,在熱界面材料市場佔據主導地位,2024 年市場收入份額最大,為 47.3%。

報告範圍和熱界面材料市場細分

|

屬性 |

熱界面材料關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

熱界面材料市場的主要趨勢是什麼?

- 全球熱界面材料 (TIM) 市場的一個重要且快速成長的趨勢是開發先進材料,以支援日益強大和緊湊的電子設備。石墨烯增強型 TIM、相變材料 (PCM) 和混合複合材料等創新技術正在改變電子產品的熱管理。

- For instance, several manufacturers are introducing graphene-based TIMs that deliver exceptional thermal conductivity and mechanical stability, making them ideal for high-performance computing, 5G infrastructure, and electric vehicles (EVs)

- TIMs integrated with phase change properties are gaining popularity due to their ability to efficiently absorb and dissipate heat spikes, ensuring device reliability and prolonged lifespan

- The adoption of nanotechnology and engineered composites has enabled the production of ultra-thin, highly conductive TIMs suited for compact electronics where space constraints are critical

- Major players such as 3M, Henkel, and Dow are investing in research and commercialization of next-generation TIMs to meet the growing demand for efficient thermal management in advanced technologies

- The trend toward miniaturization of electronics, coupled with rising heat generation in high-performance devices, is significantly accelerating the adoption of innovative TIM solutions worldwide

What are the Key Drivers of Thermal Interface Material Market?

- The increasing demand for efficient thermal management in consumer electronics, automotive electronics, and telecommunications infrastructure is a primary driver for the TIM market. As devices become more powerful and compact, effective heat dissipation is essential to prevent performance degradation

- For instance, in February 2024, Henkel announced a new line of thermally conductive adhesives and TIM solutions designed for next-gen EV batteries and power electronics, supporting enhanced safety and longevity

- The rapid growth of the EV market, driven by stringent emission regulations and sustainability targets, is creating substantial demand for TIMs to manage heat in batteries, power modules, and electronic control units

- The expansion of 5G networks and data centers globally requires reliable thermal management to ensure uninterrupted performance of high-density electronics, further fueling TIM market growth

- In addition, the rising trend of wearable devices, IoT sensors, and compact medical electronics is accelerating the need for thin, lightweight, and highly effective TIMs

- The convergence of increasing electronic performance requirements and the emphasis on device reliability is propelling investments and innovation within the TIM industry

Which Factor is challenging the Growth of the Thermal Interface Material Market?

- The high production cost of advanced TIMs, particularly those using graphene, nanomaterials, or specialized composites, presents a significant challenge for widespread adoption, especially in cost-sensitive markets

- For instance, many small- and medium-scale electronics manufacturers face price barriers when integrating premium TIMs into their products, limiting market penetration in developing regions

- The complex application processes for some high-performance TIMs, such as precise alignment or curing requirements, can lead to increased assembly costs and technical difficulties for manufacturers

- Moreover, the fluctuating availability and cost of raw materials such as graphite, silver, or specialized polymers can impact production scalability and pricing stability

- To overcome these barriers, industry players are focusing on developing cost-effective TIM solutions with simplified application processes while exploring sustainable material alternatives to reduce overall production costs

How is the Thermal Interface Material Market Segmented?

The market is segmented on the basis of chemistry, type, application, and product type.

- By Chemistry

On the basis of chemistry, the thermal interface material market is segmented into Silicone, Epoxy, and Polyimide. The Silicone segment dominated the thermal interface material market with the largest market revenue share of 47.3% in 2024, attributed to its superior thermal stability, flexibility, and electrical insulation properties. Silicone-based TIMs are extensively used across electronics, automotive, and telecom sectors due to their high-performance characteristics and compatibility with a wide range of devices. Their ability to maintain performance under varying temperatures makes them ideal for demanding thermal management applications.

The Polyimide segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for ultra-thin, lightweight TIM solutions in miniaturized electronics and aerospace applications. Polyimide materials offer excellent thermal resistance, mechanical strength, and electrical insulation, supporting their growing adoption in next-generation high-density devices where space and performance are critical.

- By Type

On the basis of type, the thermal interface material market is segmented into Gap Fillers, Greases and Adhesives, Elastomeric Pads, Metal Based, and Others. The Gap Fillers segment held the largest market revenue share of 36.8% in 2024, driven by their versatile use in filling uneven surfaces between components to ensure efficient heat transfer. Gap fillers are preferred in consumer electronics, automotive electronics, and industrial machinery due to their ease of application, flexibility, and reliable thermal conductivity.

The Metal Based segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the growing need for high-performance thermal management in power electronics and EV battery systems. Metal-based TIMs, such as those using aluminum or copper, provide exceptional thermal conductivity and durability, making them ideal for high-heat, high-load applications in critical industries.

- By Application

On the basis of application, the thermal interface material market is segmented into Computer, Telecommunications, Automotive, Industrial Machinery, and Others. The Computer segment dominated the market with the largest revenue share of 34.5% in 2024, driven by the continuous growth in high-performance computing devices, gaming systems, and servers. The demand for efficient TIM solutions to manage heat in processors, graphic cards, and memory modules is fueling this segment's growth globally.

The Automotive segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the surging adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and in-vehicle infotainment systems. Efficient thermal management is essential for ensuring the safety and performance of automotive batteries and power electronics, boosting the demand for innovative TIM solutions.

- By Product Type

On the basis of product type, the thermal interface material market is segmented into Greases and Adhesives, Tapes and Films, Elastomeric Pads, Metal Based, Phase Change Materials, and Others. The Greases and Adhesives segment accounted for the largest market revenue share of 39.1% in 2024, owing to their widespread use in electronics, telecommunications, and industrial equipment for filling micro gaps and enhancing heat dissipation. Their ease of application and reliable performance across varying thermal cycles make them a preferred choice in numerous industries.

The Phase Change Materials (PCMs) segment is expected to register the fastest CAGR from 2025 to 2032, driven by their ability to absorb and release large amounts of thermal energy during phase transitions, providing effective thermal management in fluctuating temperature environments. The growing integration of PCMs in high-power electronics, EVs, and medical devices is fueling rapid market growth for this segment.

Which Region Holds the Largest Share of the Thermal Interface Material Market?

- North America dominated the thermal interface material market with the largest revenue share of 43.5% in 2024, driven by the region’s strong presence of electronics manufacturers, rapid technological advancements, and high demand for thermal management in sectors such as consumer electronics, automotive, and telecommunications

- The growing adoption of electric vehicles (EVs), data centers, and advanced computing devices across the U.S. and Canada is fueling the need for reliable and efficient thermal interface solutions to manage heat dissipation

- In addition, North America benefits from a mature semiconductor industry, continuous R&D in material technologies, and favorable government initiatives promoting electric mobility and high-performance electronics, collectively supporting market growth

U.S. Thermal Interface Material Market Insight

2024年,美國熱界面材料市場佔據北美最大的收入份額,這得益於高性能運算、電動車電池熱管理和先進消費性電子產品需求的不斷增長。美國在半導體製造業的領先地位,以及對5G基礎設施和電動車投資的不斷增加,正在加速市場擴張。此外,對節能電子產品和微型設備的關注,持續推動創新熱界面材料解決方案在多個產業的應用。

歐洲熱界面材料市場洞察

受該地區嚴格的能源效率標準、汽車電氣化發展以及5G網路普及率不斷提升的推動,預計歐洲熱界面材料市場在預測期內將穩步增長。電動車、再生能源基礎設施和智慧設備產量的不斷增長,推動了對熱界面材料 (TIM) 的需求。此外,歐洲高度重視減少碳排放和提升電子產品性能,也促進了先進熱管理材料的創新和應用。

英國熱界面材料市場洞察

英國熱界面材料市場預計在預測期內將以顯著的複合年增長率擴張,這得益於英國日益增長的電動車市場、對先進消費性電子產品的需求以及對節能技術的日益重視。半導體製造、智慧基礎設施和下一代行動解決方案領域的投資不斷增加,為英國電子和汽車行業採用熱界面材料 (TIM) 創造了有利機會。

德國熱界面材料市場洞察

預計德國熱界面材料市場將實現溫和成長,這得益於該國成熟的汽車產業、電動車的日益普及以及其在精密工程領域的技術領先地位。德國致力於提高能源效率並推廣先進材料技術,這正在推動電子、汽車和工業機械領域對高性能熱界面材料的需求。關鍵材料製造商的存在進一步支持了市場的發展。

哪個地區是熱界面材料市場成長最快的地區?

預計2025年至2032年,亞太地區熱界面材料市場將以12.65%的複合年增長率保持高速成長,這得益於該地區消費性電子產品生產的蓬勃發展、電動車普及率的提高以及5G網路的快速擴張。中國、印度、日本和韓國等國家對智慧型手機、電動車和運算設備等高效能熱管理解決方案的需求日益增長。此外,政府的扶持政策、極具競爭力的製造成本以及不斷擴張的半導體產業正在加速亞太地區熱界面材料市場的成長。

日本熱界面材料市場洞察

受節能電子產品、汽車電氣化以及半導體技術進步的需求不斷增長的推動,日本熱界面材料市場正蓬勃發展。日本高度重視高品質製造、小型化設備和熱可靠性,這推動了創新TIM在汽車、電信和消費性電子等多個產業的應用。

中國熱界面材料市場洞察

2024年,中國熱界面材料市場佔據亞太地區最大收入份額,這得益於中國在電子製造、電動車生產以及5G基礎設施快速擴張方面的主導地位。中國致力於發展國內半導體產業,電動車普及率不斷提高,以及政府對節能技術的激勵措施,這些都顯著推動了對先進熱界面材料解決方案的需求。本土主要製造商的佈局和極具競爭力的價格進一步鞏固了中國在該區域市場的領導地位。

熱界面材料市場中的頂級公司有哪些?

熱界面材料產業主要由知名公司主導,包括:

- Hylomar LLC(英國)

- CSL Silicones Inc.(加拿大)

- NUCO Inc.(加拿大)

- Sashco, Inc.(美國)

- 陶氏(美國)

- 3M(美國)

- Momentive(美國)

- HB Fuller(美國)

- 漢高股份公司(德國)

- 西卡股份公司(瑞士)

- 波斯膠(法國)

- 瓦克化學股份公司(德國)

- Pidilite Industries Ltd.(印度)

- MAPEI SpA(義大利)

- PPG工業公司(美國)

- CSW Industrials, Inc.(美國)

- 伊利諾工具廠公司(美國)

- Soudal集團(比利時)

- 阿科瑪(法國)

全球熱界面材料市場的最新發展是什麼?

- 2025年4月,派克漢尼汾推出了專為關鍵電子冷卻應用開發的新一代熱界面材料 (TIM) 系列。此產品系列包括凝膠、墊片和潤滑脂,均經過精心設計,可提供高導熱性和長期穩定性。這些材料專門針對汽車電子設備、電信基地台和工業控制系統進行了最佳化,重點提升了其在嚴格熱循環條件下的可製造性和性能。此次發布鞏固了派克漢尼汾在為嚴苛的工業和電子環境提供可靠 TIM 解決方案方面的地位。

- 2024年10月,Carbice與陶氏合作推出了專為高性能電子設備量身訂製的全新先進熱界面材料系列。這些材料旨在提升電子、汽車和電信等各行業的熱效率和可靠性。此次合作體現了兩家公司對創新的執著,並致力於滿足下一代電子產品對可靠熱管理解決方案日益增長的需求。

- In May 2024, Henkel responded to the rising market demand for thermal interface materials that deliver enhanced processability while meeting strict performance and cost criteria. Through an innovative formulation approach, Henkel developed the Bergquist Gap Filler TGF 4500CVO, a liquid, gap-filling TIM that significantly boosts dispensing speeds compared to traditional materials. This development reinforces Henkel’s competitive edge in providing efficient, high-performance TIMs for advanced electronics and automotive applications

- In March 2024, Dow expanded its portfolio of silicone-based thermal interface materials to support the evolving needs of advanced electronics. The new range of high-performance TIMs was designed to improve heat dissipation, reliability, and processing efficiency in electric vehicles, data centers, and 5G infrastructure applications. This strategic expansion underlines Dow’s focus on enabling miniaturization and supporting high-power density systems in critical industries

- In June 2022, Dow Corning Corporation launched its latest thermal interface material, the DOWSIL TC-4040, designed as a gap filler offering high thermal conductivity, easy dispensing, and excellent resistance to material slumping. This introduction enhanced Dow Corning’s product offering and competitiveness in the global TIM market by addressing key thermal management challenges in electronics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。