Global Transcriptomics Market

市场规模(十亿美元)

CAGR :

%

USD

8.37 Billion

USD

17.54 Billion

2024

2032

USD

8.37 Billion

USD

17.54 Billion

2024

2032

| 2025 –2032 | |

| USD 8.37 Billion | |

| USD 17.54 Billion | |

|

|

|

|

全球轉錄組學市場細分,按產品和服務(儀器、耗材、軟體和服務)、技術(微陣列、即時 PCR(qPCR)和測序)、應用(診斷和疾病分析、藥物發現等)、最終用戶(製藥和 生物技術 公司、政府機構和學術中心以及合約研究組織(CRO)) - 行業趨勢和預測到 2032 年

轉錄組學市場規模

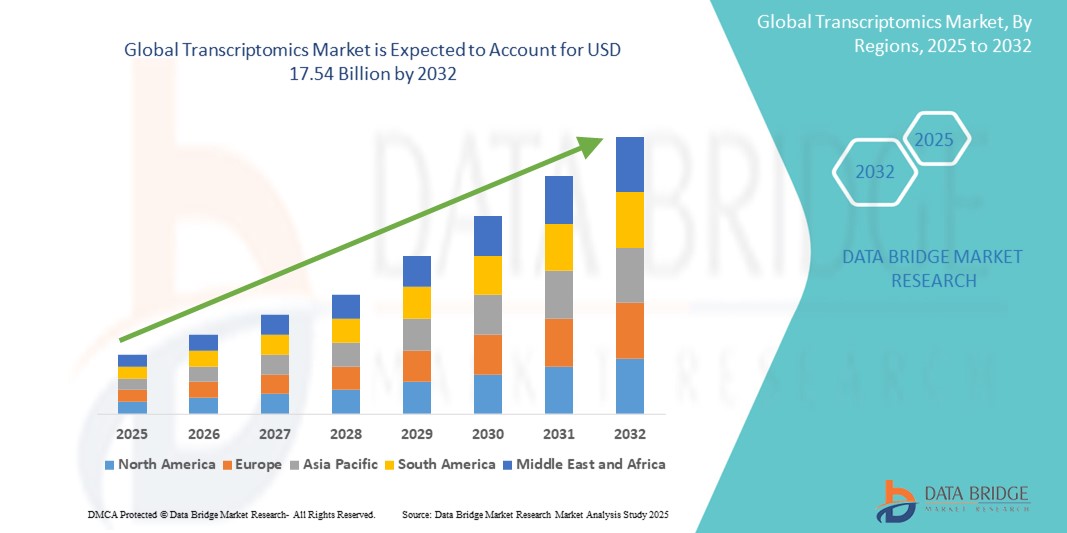

- 2024 年全球轉錄組學市場規模為83.7 億美元 ,預計 到 2032 年將達到 175.4 億美元,預測期內 複合年增長率為 9.68%。

- 市場成長主要得益於高通量定序技術的日益普及和生物資訊學的進步,從而導致轉錄組學在藥物發現、疾病診斷和個人化醫療領域的廣泛應用

- 此外,對全面基因表現分析和精準治療的需求日益增長,使得轉錄組學成為分子生物學和臨床研究的關鍵工具。這些因素正在加速轉錄組學解決方案的普及,從而顯著促進該行業的成長。

轉錄組學市場分析

- 轉錄組學是對 RNA 轉錄本的研究,由於其能夠深入了解各種生物系統中的基因表現、調控機制和疾病途徑,正成為現代生命科學和精準醫學中越來越重要的組成部分

- 轉錄組學解決方案需求的不斷增長,主要源於慢性病盛行率的上升、個人化醫療計劃的激增以及腫瘤學、免疫學和神經生物學研究的不斷增長

- 北美在轉錄組學市場佔據主導地位,2024 年的收入份額最高,為 38.5%,這歸功於該地區強大的研究基礎設施、政府和私營部門的強大資金支持以及先進測序技術的廣泛採用,其中美國在基於轉錄組學的臨床和學術研究方面處於領先地位

- 預計亞太地區將成為成長最快的地區,預測期內轉錄組學市場的複合年增長率為 13.4%,這得益於生物技術領域的擴張、政府對基因組學的投資增加以及中國、印度和韓國等國家臨床試驗和藥物研發活動數量的增加

- 耗材領域在轉錄組學市場佔據主導地位,2024 年的市佔率為 38.6%,這主要是由於轉錄組學市場佔據主導地位,2024 年的市佔率為 38.6%,這主要是由於轉錄組學工作流程中對試劑、試劑盒和探針的需求量很大,尤其是在大規模基因表現研究和臨床診斷中

報告範圍和轉錄組學市場細分

|

屬性 |

轉錄組學關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

轉錄組學市場趨勢

“透過人工智慧和多組學整合增強發現”

- A significant and accelerating trend in the global transcriptomics market is the deepening integration with artificial intelligence (AI) and advanced multi-omics platforms, such as genomics, proteomics, and metabolomics. This convergence of technologies is revolutionizing how researchers interpret gene expression data, enabling faster, more accurate insights into complex biological processes and disease mechanisms

- For instance, next-generation AI-powered analytics tools now assist researchers in analyzing massive RNA sequencing datasets to identify gene expression signatures linked to specific diseases. These platforms can predict transcriptomic patterns, suggest druggable targets, and even model disease progression based on temporal gene activity

- AI integration in transcriptomics enhances the accuracy and speed of data interpretation, automates quality control, and reduces manual errors. Advanced machine learning algorithms are being developed to detect novel RNA variants, alternative splicing events, and non-coding RNA roles, which were previously difficult to identify with conventional methods

- The seamless combination of transcriptomics with other omics data through AI platforms facilitates a systems biology approach, offering centralized insights into disease pathways. This unified view allows researchers to explore gene expression in conjunction with protein abundance and metabolic flux, dramatically improving biomarker discovery and therapeutic targeting

- This trend toward intelligent, automated, and interconnected transcriptomic platforms is reshaping expectations in life sciences research. As a result, companies are investing in AI-enhanced transcriptomics solutions that integrate cloud-based analysis, intuitive visualization, and predictive modeling capabilities for use in both research and clinical settings

- The demand for transcriptomics platforms that offer robust AI integration and cross-omics compatibility is rapidly increasing across pharmaceutical, academic, and diagnostic sectors, as stakeholders seek deeper biological insights, accelerated discovery timelines, and precision-driven outcomes in both research and healthcare applications

Transcriptomics Market Dynamics

Driver

“Growing Need Driven by Rising Demand for Precision Medicine and Genomic Research”

- The increasing focus on precision medicine and personalized healthcare, along with the expanding applications of transcriptomics in disease diagnosis and drug development, is a key driver of market growth

- For instance, in early 2024, several biotech firms announced collaborations to develop AI-powered transcriptomics platforms aimed at improving cancer biomarker discovery and therapeutic target identification. Such initiatives are expected to significantly boost the Transcriptomics market during the forecast period

- As researchers and clinicians seek deeper insights into gene expression patterns linked to complex diseases, transcriptomics provides critical data that enhances diagnostic accuracy and treatment customization

- Furthermore, the surge in government funding for genomics and transcriptomics research, alongside growing investments by pharmaceutical companies, is accelerating adoption across academic, clinical, and industrial settings

- The increasing availability of affordable, high-throughput sequencing technologies and user-friendly bioinformatics tools is also propelling the use of transcriptomics solutions in both research labs and clinical diagnostics, contributing to widespread market expansion

Restraint/Challenge

“Data Complexity, High Costs, and Regulatory Hurdles”

- The complexity and volume of transcriptomic data pose significant challenges for data analysis and interpretation, often requiring sophisticated bioinformatics infrastructure and expertise, which can limit adoption in smaller labs or emerging markets

- For instance, the high cost associated with RNA sequencing platforms, reagents, and computational tools can be a barrier for budget-conscious research institutions and healthcare providers, particularly in developing regions

- Moreover, the lack of standardized regulatory frameworks for clinical transcriptomics applications can delay market entry and clinical adoption, as companies must navigate rigorous validation and compliance processes

- Addressing these challenges through the development of streamlined data analysis pipelines, cost-effective sequencing methods, and clear regulatory guidelines will be critical for broader market penetration

- In addition, educating end users on the interpretation of transcriptomics data and demonstrating its clinical utility will help overcome skepticism and accelerate uptake in both research and clinical environments

Transcriptomics Market Scope

The market is segmented on the basis of product and services, technology, application, and end user.

• By Product and Services

On the basis of product and services, the transcriptomics market is segmented into instruments, consumables, software, and services. The consumables segment dominates market with a market share of 38.6% in 2024, primarily due to the high recurring demand for reagents, kits, and probes in transcriptomic workflows, particularly in large-scale gene expression studies and clinical diagnostics.

Software segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032 due to increasing adoption of AI-powered data analytics and cloud-based bioinformatics tools facilitating complex data interpretation.

- By Application

On the basis of application, the market is segmented into Therapeutics, Agriculture, Diagnostics, and Others. The Therapeutics segment dominates the largest market revenue share, estimated at around 40-45% in 2024. This dominance is driven by the significant investments in gene therapy research and development for treating a wide range of genetic disorders, cancers, and infectious diseases, offering the potential for curative treatments.

The Therapeutics segment is also anticipated to witness the fastest growth rate, projected at around 15-18% CAGR from 2025 to 2032. This rapid growth is fueled by increasing regulatory approvals for gene-edited therapies, a growing pipeline of clinical trials, and the expanding scope of diseases addressable by gene editing.

- By Workflow

On the basis of workflow, the market is segmented into CRISPR-based Workflow, ZFN-based Workflow, and Others. The CRISPR-based Workflow segment held the largest market revenue share, estimated at around 70-75% in 2024. This is driven by the inherent advantages of CRISPR, including its simplicity, cost-effectiveness, and high efficiency, which have made it the go-to tool for a vast majority of gene editing experiments and applications.

The CRISPR-based Workflow segment is expected to witness the fastest CAGR, projected at around 14-17% from 2025 to 2032. This growth is propelled by continuous innovations in CRISPR variants (e.g., base editing, prime editing), expansion into new therapeutic areas, and increased adoption in industrial and agricultural biotechnology workflows.

- By Delivery Method

On the basis of delivery method, the market is segmented into Viral Delivery, Non-viral Delivery, and Others. The Viral Delivery segment held the largest market revenue share, estimated at around 55-60% in 2024. This dominance is due to the high efficiency of viral vectors (such as AAVs and lentiviruses) in delivering gene editing components into target cells, which is crucial for therapeutic applications requiring stable and robust gene modification.

The Non-viral Delivery segment is expected to witness the fastest CAGR, projected at around 10-12% from 2025 to 2032. This growth is driven by ongoing research into safer, more scalable, and less immunogenic non-viral methods (e.g., lipid nanoparticles, electroporation), aiming to overcome some limitations of viral vectors for broad clinical application.[DS1]

Transcriptomics Market Regional Analysis

- North America dominates the transcriptomics market with the largest revenue share of 38.5% in 2024, driven by increased investment in genomic research, rising healthcare expenditure, and a strong presence of key industry players specializing in transcriptomic technologies

- Researchers and clinicians in the region benefit from advanced infrastructure and widespread adoption of next-generation sequencing and real-time PCR platforms, which support applications ranging from disease diagnostics to drug development

- This robust market position is further bolstered by government funding initiatives, collaborations between academic institutions and biotech firms, and the rapid integration of AI-based bioinformatics tools that enhance data interpretation and accelerate discovery in both academic and commercial settings

U.S. transcriptomics market insight

The U.S. transcriptomics market captured the largest revenue share of 78.2% in 2024 within North America, driven by rapid advancements in genomic research technologies and strong investment in precision medicine. Increasing demand for disease profiling and drug discovery applications fuels the market, supported by leading biotech firms and research institutions. Furthermore, integration of AI-powered bioinformatics tools enhances data analysis, promoting wider adoption of transcriptomics in both clinical and pharmaceutical sectors.

Europe transcriptomics market insight

The Europe transcriptomics market is projected to grow at a substantial CAGR during the forecast period, supported by government initiatives promoting genomic research and healthcare innovation. Rising funding for personalized medicine and growing collaborations between pharmaceutical companies and academic centers foster market expansion. Stringent regulatory frameworks and increasing healthcare expenditure also drive demand for transcriptomic diagnostics and drug development services.

U.K. transcriptomics market insight

The U.K. transcriptomics market is expected to expand at a notable CAGR over the forecast period, driven by increased adoption of precision medicine and ongoing government support for genomic initiatives. The country’s well-established biotech sector, combined with investments in clinical research infrastructure, is accelerating transcriptomics applications in diagnostics and drug discovery. The strong presence of contract research organizations (CROs) further enhances market growth.

Germany transcriptomics market insight

Germany’s transcriptomics market is forecasted to grow at a significant CAGR, propelled by strong research activities in genomics and growing adoption of transcriptomics in pharmaceutical R&D. Increasing collaborations between government institutes and biotech companies, along with emphasis on sustainable healthcare innovation, support market expansion. The demand for advanced transcriptomic instruments and bioinformatics software is steadily increasing across research and clinical settings.

Asia-Pacific transcriptomics market insight

The Asia-Pacific transcriptomics market is anticipated to register the fastest CAGR of 13.4% between 2025 and 2032, fueled by expanding biotech and pharmaceutical sectors in China, India, and Japan. Government initiatives focused on digital health and genomics, alongside rising healthcare spending and technological advancements, boost market penetration. The availability of affordable transcriptomic tools and growing academic research further contribute to rapid growth.

日本轉錄組學市場洞察

日本的轉錄組學市場正蓬勃發展,這得益於其高水準的技術創新和對老齡化人口醫療保健解決方案的高度重視。轉錄組學與其他組學技術日益融合,用於全面的疾病分析,推動了其應用。日本對智慧醫療和精準醫療的投入,也提升了臨床和藥物研究應用領域的需求。

中國轉錄組學市場洞察

2024年,中國佔據亞太轉錄組學市場的最大收入份額,這得益於其不斷增長的中產階級人口、快速的城市化進程以及對生物技術基礎設施投資的增加。在政府優惠政策和國內製造能力的支持下,中國正努力成為全球基因組學研究中心,將加速轉錄組學的普及。學術機構與產業參與者之間日益密切的合作也為市場成長奠定了基礎。

轉錄組學市場份額

轉錄組學產業主要由知名公司主導,包括:

- 安捷倫科技公司(美國)

- Illumina公司(美國)

- F. Hoffmann-La Roche Ltd(瑞士)

- 貝克曼庫爾特公司(美國)

- 賽默飛世爾科技公司(美國)

- BD(美國)

- 賽多利斯股份公司(德國)

- 生物梅里埃(法國)

- Bio-Rad Laboratories, Inc.(美國)

- 造父變星(美國)

- Takara Bio Inc.(日本)

- Cytognomix Inc.(加拿大)

- 通用電氣公司(美國)

- 西門子(德國)

- QIAGEN(荷蘭)

- 默克集團(德國)

- AffiPCR Biosystems(美國)

- Bruker Spatial Biology, Inc.(美國)

全球轉錄組學市場的最新發展

- 2025年5月,賽默飛世爾科技公司宣布推出新一代RNA定序平台,旨在增強臨床研究中的轉錄組分析能力。該平台整合了自動化和雲端分析技術,使研究人員能夠以更高的效率和可重複性進行高通量轉錄組分析。這項創新彰顯了賽默飛世爾科技致力於透過強大的組學技術推動精準醫療發展的決心。

- 2025年4月,Illumina公司與歐洲領先的學術聯盟合作,開發用於癌症診斷的AI驅動轉錄組學工具。此次合作旨在利用機器學習演算法來識別與早期腫瘤相關的基因表現特徵,從而加速個人化治療方案的開發。這項計劃是Illumina將AI融入其基因組學生態系統的更廣泛努力的一部分。

- 2025年3月,Qiagen推出了一系列全新多重PCR試劑盒,專為自體免疫疾病和神經退化性疾病的轉錄組生物標記發現而優化。這些試劑盒專為轉化研究和臨床試驗而設計,能夠增強低表達基因的靈敏度和可重複性。此次研發標誌著Qiagen在疾病特異性轉錄組解決方案領域的策略性擴張。

- 2025年2月,10x Genomics公司推出了用於高級組織轉錄組學的太空分子成像儀(SMI),能夠以亞細胞分辨率繪製基因表現圖譜。該系統專為腫瘤學和免疫學研究量身定制,為轉錄組數據提供空間背景信息,從而更深入地洞察組織微環境。這項創新預計將顯著推動生物標誌物的發現和療法的開發。

- 2025年1月,Takara Bio Inc.宣布其Smart-seq單細胞轉錄組學試劑盒正式上市,該試劑盒簡化了高通量單細胞RNA定序工作流程。該試劑盒相容於領先的測序平台,面向免疫學和幹細胞生物學領域的研究人員。此次上市支持了Takara Bio的願景,即在學術和臨床研究領域普及單細胞技術。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。