Global Ultra Short Reach Optical Interconnect Market

市场规模(十亿美元)

CAGR :

%

USD

2.46 Billion

USD

10.82 Billion

2025

2033

USD

2.46 Billion

USD

10.82 Billion

2025

2033

| 2026 –2033 | |

| USD 2.46 Billion | |

| USD 10.82 Billion | |

|

|

|

|

Global Ultra-short Reach Optical Interconnect Market Segmentation, By Product (Board-To-Board Interconnects and Rack-To-Rack Interconnects), Technology (Vertical-Cavity Surface-Emitting Laser-Based Interconnects (VCSEL), Silicon Photonics (SiPh), and Micro Light-Emitting Diode Based Links (µ-LED) Based Links), Data Rate (Less Than 25 Gigabits Per Second (GBPS), 25 - 50 Gigabits Per Second (GBPS), 50 - 100 Gigabits Per Second (GBPS), and More Than 100 Gigabits Per Second (GBPS)), Distance (Less Than 1 Meter, 1 - 5 Meter, and More Than 5 Meter) - Industry Trends and Forecast to 2033

Ultra-short Reach Optical Interconnect Market Size

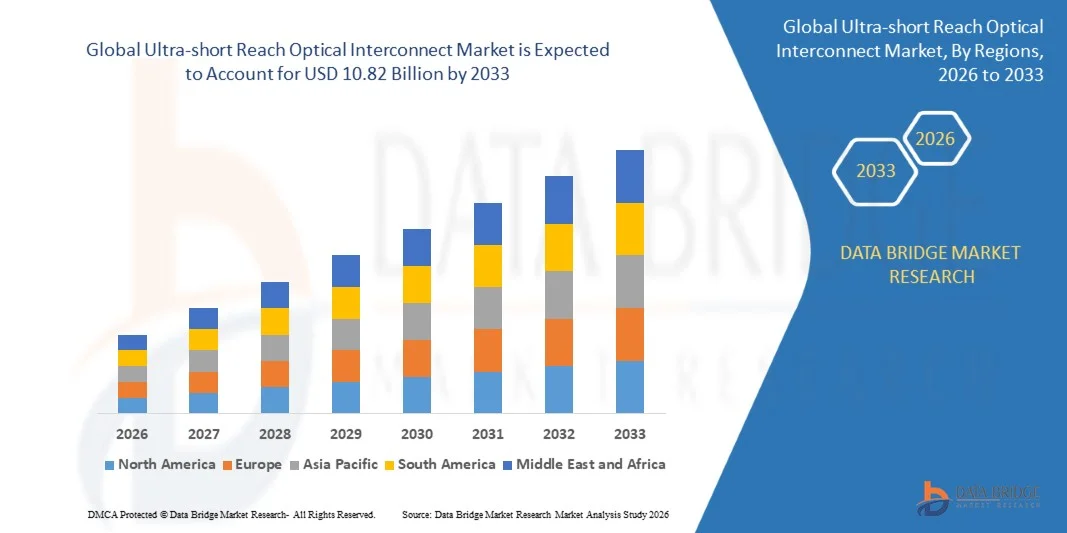

- The global ultra-short reach optical interconnect market size was valued at USD 2.46 billion in 2025 and is expected to reach USD 10.82 billion by 2033, at a CAGR of 20.31% during the forecast period

- The market growth is largely fueled by the increasing demand for high-speed, low-latency data transmission in hyperscale data centers, cloud computing, and AI-driven computing environments, driving the adoption of ultra-short reach optical interconnects

- Furthermore, the need for energy-efficient, high-density, and scalable optical links to support AI, HPC, and 5G applications is positioning ultra-short reach optical interconnects as the preferred solution for next-generation networking. These converging factors are accelerating deployment in both enterprise and cloud data center infrastructure, significantly boosting market growth

Ultra-short Reach Optical Interconnect Market Analysis

- Ultra-short reach optical interconnects, providing high-bandwidth, low-power, and low-latency connectivity for server-to-server, processor-to-processor, and processor-to-memory links, are increasingly critical components of modern data center and AI infrastructure due to their enhanced performance, scalability, and energy efficiency

- The escalating demand for these interconnects is primarily fueled by rapid digitalization, adoption of AI and HPC workloads, and the growing requirement for modular, high-density optical solutions that enable efficient and scalable network architectures across hyperscale and enterprise environments

- North America dominated the ultra-short reach optical interconnect market with a share of 31.3% in 2025, due to rapid adoption of high-speed data center infrastructure and the growing deployment of hyperscale cloud computing solutions

- Asia-Pacific is expected to be the fastest growing region in the ultra-short reach optical interconnect market during the forecast period due to rapid digitalization, urbanization, and expansion of hyperscale data centers in countries such as China, Japan, and India

- Board-to-board interconnects segment dominated the market with a market share of 62.5% in 2025, due to its critical role in high-speed data transmission within server boards and computing modules. Its compact design allows seamless integration in dense server architectures, enabling faster and reliable interconnections. The segment also benefits from increasing deployment in data centers and high-performance computing systems where low latency and high bandwidth are essential. Compatibility with emerging technologies such as VCSEL-based links and silicon photonics further strengthens its adoption. The market continues to see robust demand for board-to-board interconnects due to their ability to support multi-channel communication and power-efficient operations

Report Scope and Ultra-short Reach Optical Interconnect Market Segmentation

|

Attributes |

Ultra-short Reach Optical Interconnect Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Ultra-short Reach Optical Interconnect Market Trends

“Rising Adoption of High-Bandwidth, Low-Latency Optical Links”

- A major trend in the ultra-short reach optical interconnect market is the increasing adoption of high-bandwidth, low-latency optical links within data centers and advanced computing environments, driven by the rapid growth of AI workloads, cloud computing, and high-performance computing architectures. These optical links are becoming essential for enabling faster data movement and reducing bottlenecks in processor-intensive systems

- For instance, NVIDIA and Broadcom are actively deploying high-speed optical interconnect technologies to support AI accelerator clusters and next-generation Ethernet platforms in hyperscale data centers. These solutions enhance data throughput and enable efficient communication between compute nodes under heavy processing loads

- The shift toward scale-up architectures in AI and HPC environments is further accelerating the use of ultra-short reach optical interconnects for processor-to-processor and accelerator-to-accelerator communication. This trend supports the development of tightly coupled computing systems that require consistent low-latency connectivity

- Data center operators are increasingly prioritizing optical interconnects over traditional copper-based solutions to address limitations related to signal integrity and power consumption. This preference is driving the adoption of optical technologies that support higher port densities and extended reach within racks and across adjacent racks

- The rising integration of optical interconnects into advanced packaging and chiplet-based designs is also shaping market growth. Companies are focusing on enabling seamless optical connectivity at the board and chip level to support next-generation computing platforms

- Overall, the growing reliance on high-speed optical communication is reinforcing the transition toward more scalable, energy-efficient, and performance-optimized data center architectures, strengthening the role of ultra-short reach optical interconnects across global digital infrastructure

Ultra-short Reach Optical Interconnect Market Dynamics

Driver

“Growing Demand from AI, HPC, and Hyperscale Data Centers”

- The expanding deployment of artificial intelligence, high-performance computing, and hyperscale data center infrastructure is a key driver for the ultra-short reach optical interconnect market, as these environments demand extremely fast and reliable data exchange between processors and memory systems. Optical interconnects enable higher bandwidth and lower latency compared to electrical connections, supporting increasingly complex computing workloads

- For instance, Intel and Cisco Systems are advancing optical interconnect solutions to enhance data center performance and scalability, particularly for AI-driven and cloud-native applications. These companies are focusing on improving interconnect efficiency to meet rising computational demands

- The rapid growth of hyperscale data centers operated by major cloud service providers is intensifying the need for scalable and energy-efficient interconnect solutions. Ultra-short reach optical links help reduce power consumption while maintaining high data throughput across dense server environments

- The adoption of AI accelerators and specialized processing units is increasing the volume of data exchanged within data centers, further strengthening demand for optical interconnect technologies. These solutions enable faster synchronization and communication between compute elements

- As AI and HPC workloads continue to scale, the demand for advanced optical connectivity solutions is expected to remain strong, positioning ultra-short reach optical interconnects as critical enablers of next-generation data center performance

Restraint/Challenge

“High Cost and Integration Complexity of Optical Interconnects”

- The ultra-short reach optical interconnect market faces challenges related to high costs and integration complexity, as optical solutions require advanced materials, precision manufacturing, and sophisticated packaging technologies. These factors increase development and deployment expenses compared to conventional electrical interconnects

- For instance, companies such as Ayar Labs and Ranovus invest heavily in silicon photonics and advanced optical integration techniques to achieve high performance and energy efficiency. These technologies demand specialized fabrication processes and design expertise, contributing to higher overall system costs

- Integrating optical interconnects into existing data center infrastructure can be complex, requiring compatibility with current networking standards and hardware architectures. This complexity may slow adoption among operators seeking cost-effective and easily deployable solutions

- Supply chain constraints related to specialized optical components and fabrication facilities can also impact cost stability and scalability. Manufacturers must balance performance innovation with economic feasibility to achieve broader market adoption

- Collectively, high costs and integration challenges continue to restrain market growth, encouraging ongoing efforts to simplify optical designs and reduce production expenses while maintaining performance and reliability

Ultra-short Reach Optical Interconnect Market Scope

The market is segmented on the basis of product, technology, data rate, and distance.

• By Product

On the basis of product, the ultra-short reach optical interconnect market is segmented into board-to-board interconnects and rack-to-rack interconnects. The board-to-board interconnect segment dominated the market with the largest market revenue share of 62.5% in 2025, driven by its critical role in high-speed data transmission within server boards and computing modules. Its compact design allows seamless integration in dense server architectures, enabling faster and reliable interconnections. The segment also benefits from increasing deployment in data centers and high-performance computing systems where low latency and high bandwidth are essential. Compatibility with emerging technologies such as VCSEL-based links and silicon photonics further strengthens its adoption. The market continues to see robust demand for board-to-board interconnects due to their ability to support multi-channel communication and power-efficient operations.

The rack-to-rack interconnect segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for inter-rack connectivity in large-scale data centers and hyperscale cloud infrastructures. For instance, companies such as Cisco are adopting high-speed rack-to-rack optical links to enhance data throughput and reduce latency across server racks. These interconnects allow efficient scaling of data center architecture while supporting high-bandwidth applications. Their flexibility in modular design and ease of deployment in expanding network setups contribute to rapid adoption. Increasing investment in edge computing and AI-driven data processing further accelerates the growth of rack-to-rack interconnects.

• By Technology

On the basis of technology, the ultra-short reach optical interconnect market is segmented into vertical-cavity surface-emitting laser (VCSEL)-based interconnects, silicon photonics (SiPh), and micro light-emitting diode (µ-LED) based links. The VCSEL-based interconnects segment dominated the market in 2025, driven by its established performance in short-distance, high-bandwidth applications such as data centers and server modules. VCSEL technology provides low power consumption and high thermal stability, enabling reliable operations in dense computing environments. The availability of mature manufacturing processes and standardization across optical components reinforces its widespread adoption. The segment also benefits from integration with multi-channel arrays, improving scalability and reducing system complexity. Demand is further strengthened by the increasing deployment of high-performance computing systems and cloud infrastructure requiring low-latency optical links.

The silicon photonics segment is expected to witness the fastest growth from 2026 to 2033, fueled by its capability to integrate optical and electronic components on a single chip for ultra-high-speed interconnects. For instance, Intel has been leveraging silicon photonics technology to achieve data transmission rates beyond 100 Gbps in enterprise data centers. SiPh enables significant reductions in footprint, power consumption, and system cost while supporting modular expansion. Its compatibility with advanced modulation formats and future data rate upgrades positions it as a preferred technology for hyperscale and AI-driven data centers. Increasing investments in next-generation networking and optical communication solutions further drive growth in this segment.

• By Data Rate

On the basis of data rate, the ultra-short reach optical interconnect market is segmented into less than 25 Gbps, 25–50 Gbps, 50–100 Gbps, and more than 100 Gbps. The 50–100 Gbps segment dominated the market in 2025, driven by the growing need for high-bandwidth data transfer within servers and storage systems. This data rate balances performance and cost, making it ideal for a wide range of enterprise and hyperscale data center applications. The segment supports multi-lane transmission, enabling reliable, high-speed connectivity in dense server environments. Adoption is further strengthened by compatibility with established VCSEL and SiPh technologies, ensuring seamless deployment. Demand is bolstered by the increasing volume of cloud services, AI workloads, and high-speed computing applications. Enhanced reliability, low latency, and power efficiency also contribute to its market dominance.

The more than 100 Gbps segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by surging requirements for ultra-high-speed interconnects to support AI, HPC, and 5G infrastructure. For instance, Nvidia is deploying >100 Gbps optical links in its DGX AI systems to facilitate rapid parallel processing and low-latency data exchange. This segment offers future-proofing for next-generation data centers requiring extreme bandwidth and minimal signal loss. Increasing research in modulation techniques and high-speed transceivers accelerates adoption. The need for scalable, high-performance interconnect solutions in hyperscale cloud deployments also drives segment growth.

• By Distance

On the basis of distance, the ultra-short reach optical interconnect market is segmented into less than 1 meter, 1–5 meters, and more than 5 meters. The less than 1 meter segment dominated the market in 2025, driven by its widespread use in intra-board and intra-chassis connectivity where extremely short-distance, high-speed communication is required. This segment ensures minimal signal degradation and latency, critical for high-performance computing and data-intensive applications. Its compact form factor allows dense packaging and efficient airflow in server environments. Increasing adoption in enterprise data centers and networking equipment further strengthens market share. Standardization of connectors and high channel count arrays also boosts deployment. The segment remains favored due to its cost-effectiveness and compatibility with existing optical modules and transceivers.

The 1–5 meter segment is expected to witness the fastest growth from 2026 to 2033, fueled by expanding deployment in rack-to-rack and multi-rack data center architectures requiring high-bandwidth links. For instance, Juniper Networks is integrating 1–5 meter optical interconnects to enhance throughput and reduce latency across server racks. This distance range enables flexible cabling layouts while supporting modular network expansion. Increasing hyperscale and edge data center setups demand reliable interconnects capable of bridging medium-range distances efficiently. Ongoing innovations in VCSEL, SiPh, and µ-LED technologies also drive adoption in this segment.

Ultra-short Reach Optical Interconnect Market Regional Analysis

- North America dominated the ultra-short reach optical interconnect market with the largest revenue share of 31.3% in 2025, driven by rapid adoption of high-speed data center infrastructure and the growing deployment of hyperscale cloud computing solutions

- Organizations in the region highly prioritize low-latency, high-bandwidth connectivity solutions, which are critical for data centers, enterprise IT networks, and AI-driven computing applications

- This widespread adoption is further supported by strong investments in next-generation networking technologies, the presence of leading optical interconnect manufacturers, and the high technological maturity of North American enterprises, establishing ultra-short reach optical interconnects as a preferred solution for both enterprise and hyperscale data center applications

U.S. Ultra-short Reach Optical Interconnect Market Insight

The U.S. ultra-short reach optical interconnect market captured the largest revenue share in 2025 within North America, fueled by rapid deployment of cloud services, AI-driven computing, and hyperscale data centers. Enterprises are increasingly prioritizing pluggable, interoperable optical transceivers and integration with high-speed Ethernet standards to support AI/ML workloads and real-time data processing. The growing adoption of modular, low-latency, and energy-efficient optical solutions enhances network scalability and operational efficiency. In addition, investments by companies such as Cisco and Intel in optical interconnect technologies further propel market growth. The increasing focus on edge computing and 400G/800G Ethernet implementations is significantly contributing to the expansion of the U.S. market.

Europe Ultra-short Reach Optical Interconnect Market Insight

The Europe ultra-short reach optical interconnect market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in data centers, cloud infrastructure, and high-speed networking. Rising demand for energy-efficient, high-performance networking solutions is fostering adoption across hyperscale and enterprise data centers. For instance, Arista Networks is deploying advanced optical interconnect solutions to enable scalable network architectures and improve data center efficiency. Enterprises are also drawn to modular, low-latency, and high-bandwidth solutions that support AI, HPC, and 5G workloads. The region is experiencing significant growth across commercial, enterprise, and research data centers, with ultra-short reach optical interconnects becoming integral to digital transformation initiatives.

U.K. Ultra-short Reach Optical Interconnect Market Insight

The U.K. ultra-short reach optical interconnect market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the demand for high-speed networking in enterprise, telecom, and financial sectors. The country’s advanced IT infrastructure, adoption of cloud computing, and 5G rollout are supporting ultra-short reach optical interconnect deployment. For instance, BT and Virgin Media O2 are investing in optical solutions to enhance network efficiency and reduce latency, encouraging adoption in hyperscale and enterprise data centers. The increasing preference for low-power, high-bandwidth connectivity and integration with modular network platforms continues to stimulate market growth. The U.K.’s strong focus on digital transformation and enterprise connectivity is expected to further propel market expansion.

Germany Ultra-short Reach Optical Interconnect Market Insight

The Germany ultra-short reach optical interconnect market is expected to expand at a considerable CAGR during the forecast period, fueled by industrial digitization and growing demand for high-speed, low-latency optical connectivity. Enterprises and data centers are prioritizing energy-efficient, high-performance solutions to support AI, HPC, and cloud workloads. For instance, Deutsche Telekom is deploying advanced optical interconnects to improve data center efficiency and network scalability. Germany’s strong infrastructure, focus on sustainability, and technological innovation are driving adoption. Growing requirements for modular, reliable, and high-bandwidth solutions are enhancing market penetration across commercial, enterprise, and government applications.

Asia-Pacific Ultra-short Reach Optical Interconnect Market Insight

The Asia-Pacific ultra-short reach optical interconnect market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid digitalization, urbanization, and expansion of hyperscale data centers in countries such as China, Japan, and India. Enterprises and telecom providers in the region increasingly adopt low-latency, high-bandwidth optical interconnects to support AI, cloud, and 5G applications. For instance, Huawei and Fujitsu are deploying ultra-short reach optical interconnect solutions to enhance connectivity and data center efficiency. Government initiatives for smart cities and increasing local manufacturing of optical modules are improving affordability and accessibility. The region’s growing inclination towards energy-efficient, scalable, and modular networking solutions is driving adoption across commercial, enterprise, and industrial sectors.

Japan Ultra-short Reach Optical Interconnect Market Insight

The Japan ultra-short reach optical interconnect market is gaining momentum due to strong demand for high-performance computing, AI, and cloud infrastructure, driven by the country’s advanced technology ecosystem and focus on energy efficiency. Enterprises and data centers prioritize ultra-short reach optical interconnects for low-latency, high-bandwidth communication across server racks. For instance, NEC and NTT are deploying these interconnects to enhance operational efficiency and network performance. The integration with IoT, AI, and edge computing solutions is further supporting market growth. The increasing adoption across commercial, research, and enterprise applications is expected to continue driving market expansion.

China Ultra-short Reach Optical Interconnect Market Insight

The China ultra-short reach optical interconnect market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid digitalization, expansion of cloud infrastructure, and growing demand for high-speed connectivity in enterprise and hyperscale data centers. For instance, ZTE and Huawei are deploying ultra-short reach optical interconnect solutions to support AI workloads and hyperscale networks. The rising enterprise sector, government digital initiatives, and strong domestic manufacturing of optical modules enhance affordability and accessibility. The push for smart cities, 5G networks, and AI-driven applications continues to fuel widespread adoption. The combination of domestic production capabilities and increasing enterprise demand is driving rapid market expansion across commercial, industrial, and residential segments.

Ultra-short Reach Optical Interconnect Market Share

The ultra-short reach optical interconnect industry is primarily led by well-established companies, including:

- Ayar Labs Incorporated (U.S.)

- Fujitsu Limited (Japan)

- Ranovus Incorporated (Canada)

- Intel Corporation (U.S.)

- OpenLight Incorporated (U.S.)

- NEC Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Corning Incorporated (U.S.)

- Huawei Technologies Co. Ltd. (China)

- Cisco Systems Inc. (U.S.)

- Lumentum Holdings Inc. (U.S.)

- Sumitomo Electric Industries Ltd. (Japan)

- Ciena Corporation (U.S.)

- Skorpios Technologies Incorporated (U.S.)

- Broadcom Inc. (U.S.)

- Marvell Technology Inc. (U.S.)

- Molex LLC (U.S.)

- Celestial AI Incorporated (U.S.)

- Amphenol Corporation (U.S.)

- NVIDIA Corporation (U.S.)

Latest Developments in Global Ultra-short Reach Optical Interconnect Market

- In October 2025, optical communications leader Coherent introduced next‑generation 2D VCSEL and photodiode arrays designed to accelerate short‑reach optical interconnect performance for AI and cloud data centers, enabling power‑efficient, high‑density links that help reduce latency and energy consumption in scale‑out networks. This advancement strengthens the market’s ability to support high‑bandwidth, low‑power optical connections critical for intra‑rack and inter‑rack communications in high‑performance computing and AI clusters, addressing the growing demands for speed and efficiency in data centers

- In May 2025, TSMC partnered with California‑based startup AvicenaTech Corp. to enhance photodetector arrays for MicroLED‑based LightBundle optical interconnects targeting data centers, focusing on replacing traditional electrical connections with optical links to meet escalating performance requirements from complex AI models — this collaboration is expected to significantly improve ultra‑short reach optical interconnect density, lower power consumption, and extend link reach for Processor‑to‑Processor and Processor‑to‑Memory communications, thereby enabling more efficient next‑generation AI infrastructures

- In May 2025, a research team at Keio University developed a multi‑core graded‑index polymer optical fiber (GI‑POF) capable of supporting data transmission speeds up to 106.25 Gbps per core, facilitating high‑density, low‑latency, and high‑capacity optical communication for next‑generation AI data centers — the multi‑core design enhances scalability for future data traffic increases and positions GI‑POF as a promising solution for ultra‑short reach interconnects in high‑performance optical networks

- In April 2025, the Open Compute Project Foundation (OCP) and the Ultra Accelerator Link (UALink) Consortium entered into a formal collaboration to advance scale‑up interconnect performance for AI clusters and high‑performance computing (HPC) environments, focusing on optimizing short‑range, high‑bandwidth interconnects crucial for efficient data exchange between accelerators — this partnership aims to drive industry alignment and innovation that will reduce latency and increase throughput in accelerator‑dense systems, directly benefiting the ultra‑short reach optical interconnect segment

- In April 2025, optical interconnect innovator Ayar Labs unveiled its first Universal Chiplet Interconnect Express (UCIe) optical chiplet capable of delivering up to 8 Tbps bandwidth and designed to fit into standard chiplet architectures, improving interoperability and reducing latency and power use in AI infrastructure — this chiplet‑level optical interconnect breakthrough directly supports the scaling of optical fabrics within compute modules, helping to overcome bottlenecks in conventional electrical interconnects and accelerating deployment of high‑performance optical systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。