Global Urinalysis Market

市场规模(十亿美元)

CAGR :

%

USD

3.78 Billion

USD

6.03 Billion

2024

2032

USD

3.78 Billion

USD

6.03 Billion

2024

2032

| 2025 –2032 | |

| USD 3.78 Billion | |

| USD 6.03 Billion | |

|

|

|

|

Global Urinalysis Market Segmentation, By Testing Type (Urine Biochemistry Testingand Urine Sediment Testing), Product (Instruments and Consumables), Modality (Portable, Standalone, Table Top, Bench Top, and Others), Application (Urinary Tract Infections, Kidney Diseases, Diabetes, Liver Diseases, Pregnancy and Fertility, and Others), End User (Hospital, Laboratory, Home Care Setting, and Others), Distribution Channel (Direct Tender and Retail Sales) - Industry Trends and Forecast to 2032

Urinalysis Market Size

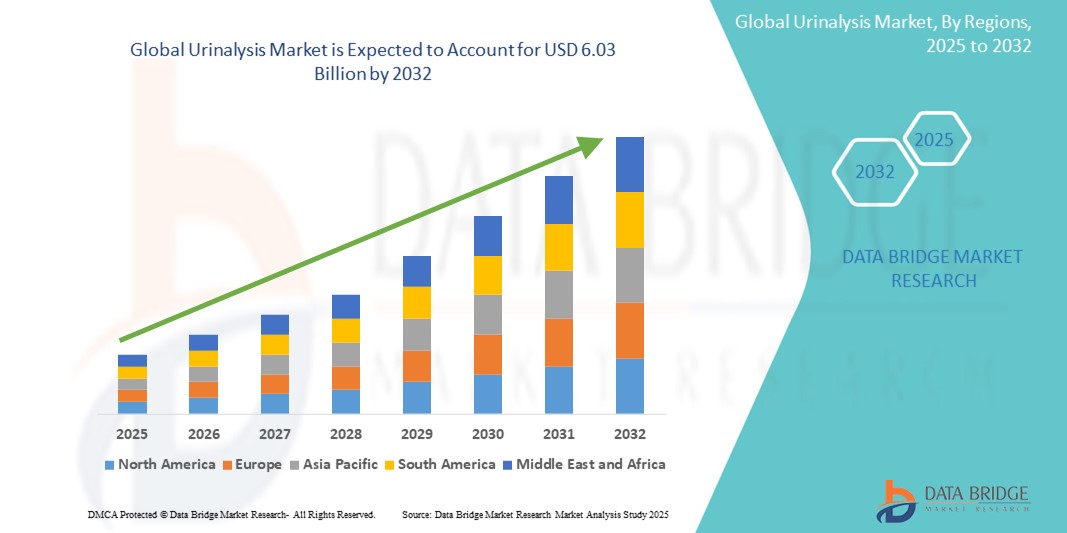

- The global urinalysis market size was valued atUSD 3.78 billion in 2024and is expected to reachUSD 6.03 billion by 2032, at aCAGR of 6.00%during the forecast period

- This growth is driven by factors such as the rising prevalence of chronic diseases, technological advancements, point-of-care testing (POCT)

Urinalysis Market Analysis

- Urinalysis is the world's oldest diagnostic test, and it has long been considered in laboratories as an essential and time-consuming technique that can offer clinicians with useful information

- Urinalysis is currently evolving in healthcare systems. Various non-invasive urine automated analyzers have been developed to provide quick and accurate test results

- North America is expected to dominate the urinalysis market with 81% due well-established healthcare systems with widespread access to diagnostic services, facilitating the adoption of advanced urinalysis technologies

- Asia-Pacific is expected to be the fastest growing region in the urinalysis market during the forecast period due to increasing healthcare investments and rising awareness of chronic diseases

- Consumables segment is expected to dominate the market with a market share of 67.5% due to its recurring nature of consumable purchases, including reagents, test strips, and disposables used in urine analysis testing

Report Scope and Urinalysis Market Segmentation

|

Attributes |

Urinalysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Urinalysis Market Trends

“Surge in Home-Based Urinalysis Devices”

- The global urinalysis market is experiencing significant growth, driven by the increasing demand for home-based urinalysis devices.

- These devices offer individuals the convenience of monitoring their health conditions from the comfort of their homes, aligning with the broader trend of personalized and preventive healthcare.

- Innovations in microfluidics, biosensors, and digital platforms have led to the development of compact, user-friendly urinalysis devices that provide accurate results without the need for laboratory visits.

- As individuals become more proactive about their health, the demand for tools that facilitate self-monitoring has increased, making home urinalysis devices a popular choice.

- Conditions such as diabetes and kidney disease require regular monitoring, and home urinalysis devices offer a convenient solution for ongoing health assessments.

- The approval of over-the-counter urinalysis devices by regulatory bodies has further fueled their adoption, ensuring safety and reliability for consumers

Urinalysis Market Dynamics

Driver

“Technological Advancements in Urinalysis”

- Modern urinalysis systems are increasingly incorporating AI and machine learning capabilities for more accurate result interpretation and reduced human error

- Automated systems enable the analysis of hundreds of samples per hour, improving efficiency in clinical laboratories

- Advancements in user interface design make urinalysis systems more accessible to healthcare providers with varying levels of technical expertise

- Urinalysis devices are increasingly being integrated with electronic health records (EHR) and laboratory information systems (LIS), facilitating seamless data management

- The development of compact and portable urinalysis devices allows for testing in diverse settings, including point-of-care locations and at home

Opportunity

“Expansion of Point-of-Care (POC) Testing and At-Home Diagnostics”

- With the increasing preference for home-based healthcare solutions, there is a growing demand for at-home urinalysis devices. These devices offer patients the convenience of monitoring their health indicators without frequent visits to healthcare facilities

- Innovations in technology have led to the development of user-friendly, portable urinalysis devices that provide accurate results quickly. These advancements make it easier for individuals to perform tests and receive timely feedback on their health status

- The integration of urinalysis devices with digital health platforms allows for seamless tracking and management of health data. This connectivity enhances patient engagement and facilitates proactive health management

- At-home urinalysis devices enable early detection of potential health issues, promoting preventive healthcare practices. Early identification of conditions such as urinary tract infections or kidney-related disorders can lead to timely interventions and better health outcomes

Restraint/Challenge

“High Costs and Accessibility Issues”

- Advanced urinalysis systems, particularly automated analyzers, can be costly, limiting their adoption in low-resource settings

- Inconsistent reimbursement policies across regions can affect the affordability and accessibility of urinalysis tests

- The availability of refurbished urinalysis equipment at lower prices may deter investment in newer, more advanced systems

- Stringent regulatory requirements can delay the introduction of new urinalysis technologies to the market

- The complexity of some urinalysis systems necessitates specialized training for healthcare providers, which can be a barrier in regions with limited resources

Urinalysis Market Scope

The market is segmented on the basis of testing type, product, modality, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Testing Type |

|

|

By Product |

|

|

By Modality |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the consumables surgery is projected to dominate the market with a largest share in product segment

The consumables surgery segment is expected to dominate the urinalysis market with the largest share of 67.5% in 2025 due to its recurring nature of consumable purchases, including reagents, test strips, and disposables used in urine analysis testing. The high consumption rate in both clinical and point-of-care settings, coupled with the increasing adoption of automated urinalysis systems, has sustained the segment's market leadership

The urine biochemistry testing is expected to account for the largest share during the forecast period in testing type market

In 2025, the urine biochemistry testing segment is expected to dominate the market with the largest market share of 39.5% due to widespread use of biochemical examinations in routine urine tests, which typically involve reagent strips for detecting various parameters such as protein (albumin), glucose, ketones, leukocyte esterase, nitrite, bilirubin, and urobilinogen. The segment's dominance is further strengthened by the increasing adoption of automated analyzer in clinical laboratories, which has streamlined the biochemical testing process and improved accuracy

Urinalysis Market Regional Analysis

“North America Holds the Largest Share in the Urinalysis Market”

- North America holds the largest share of the global urinalysis market with 81% at the global level

- The region reports a significant number of UTI cases, particularly among high-risk populations such as the elderly and infants, driving the demand for urinalysis

- North America boasts well-established healthcare systems with widespread access to diagnostic services, facilitating the adoption of advanced urinalysis technologies

- Major companies in the urinalysis sector, including Abbott Laboratories and Siemens Healthineers, have a strong presence in North America, contributing to the region's market dominance

- Companies are undertaking strategic initiatives, such as product launches and partnerships, to enhance their market position in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Urinalysis Market”

- The Asia-Pacific region is projected to witness the fastest growth in the urinalysis market during the forecast period, driven by increasing healthcare investments and rising awareness of chronic diseases

- Countries such as China and India have large and aging populations, leading to higher demand for diagnostic solutions, including urinalysis

- Governments in the region are implementing screening programs and health awareness campaigns to promote early detection of diseases, further boosting the demand for urinalysis

- The adoption of affordable, rapid diagnostic tests and the expansion of healthcare infrastructure are accelerating market growth in the region

- The increasing disposable income and improving healthcare access in the Asia-Pacific region are contributing to the expansion of the urinalysis market

Urinalysis Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott(U.S.)

- Siemens(Germany)

- BD(U.S.)

- Thermo Fisher Scientific(U.S.)

- Bio-Rad Laboratories Inc.(U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Beckman Coulter Inc. (U.S.)

- ACON Laboratories Inc. (U.S.)

- ARKRAY Inc. (Japan)

- Trinity Biotech (Ireland)

- Quidel Corporation (U.S.)

- ACON Laboratories Inc. (U.S.)

- Sysmex Corporation (Japan)

- Analyticon Biotechnologies Ag (Germany)

- Ekf Diagnostics (U.K.)

- Hti Medical Inc. (U.S.)

- Teco Diagnostics (U.S.)

- Tenko Medical System Corp (U.S.)

- Wama Diagnostica (Brazil)

Latest Developments in Global Urinalysis Market

- In December 2024,Copan Diagnosticsannounced FDA approval for its urine collection and transport device “UriSponge” that uses a new formulation of advanced preservatives to maintain specimen stability

- In August 2024,Alpha Laboratories Ltd. entered into a partnership with Clinical Design Technologies Ltd. To support the marketing and distribution of world's first digital closed urine testing system

- In June 2024,Community Health Center (CHC) Marwah introduced a digital urine and blood analyser to revolutionize diagnostic capabilities

- In December 2023,Siemens HealthineersNow Offers High-resolution, Digital Urine Microscopy with its Compact AtellicaUAS 60 Analyzer

- In September 2022,Sysmex Corporationlaunched theUF-1500Fully Automated Urine Particle Analyzer (UF-1500). The product is used in urine sediment testing

- In June 2022,Mylab DiscoverySolutions launchedPregaScreen, an at-home pregnancy test kit that allows women to detect their pregnancy status themselves. With the launch of this test kit, the company marks its foray into the female healthcare segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。