India Ultrasound Sensor Market

市场规模(十亿美元)

CAGR :

%

USD

158.24 Million

USD

270.45 Million

2024

2032

USD

158.24 Million

USD

270.45 Million

2024

2032

| 2025 –2032 | |

| USD 158.24 Million | |

| USD 270.45 Million | |

|

|

|

|

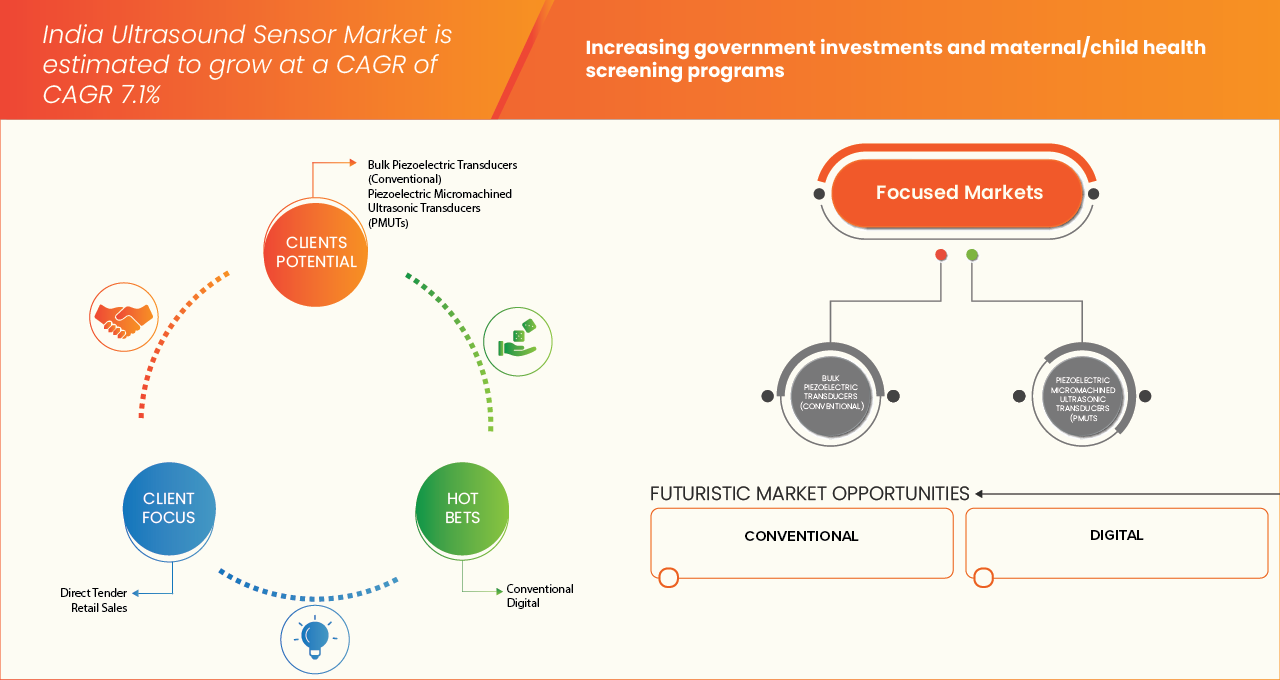

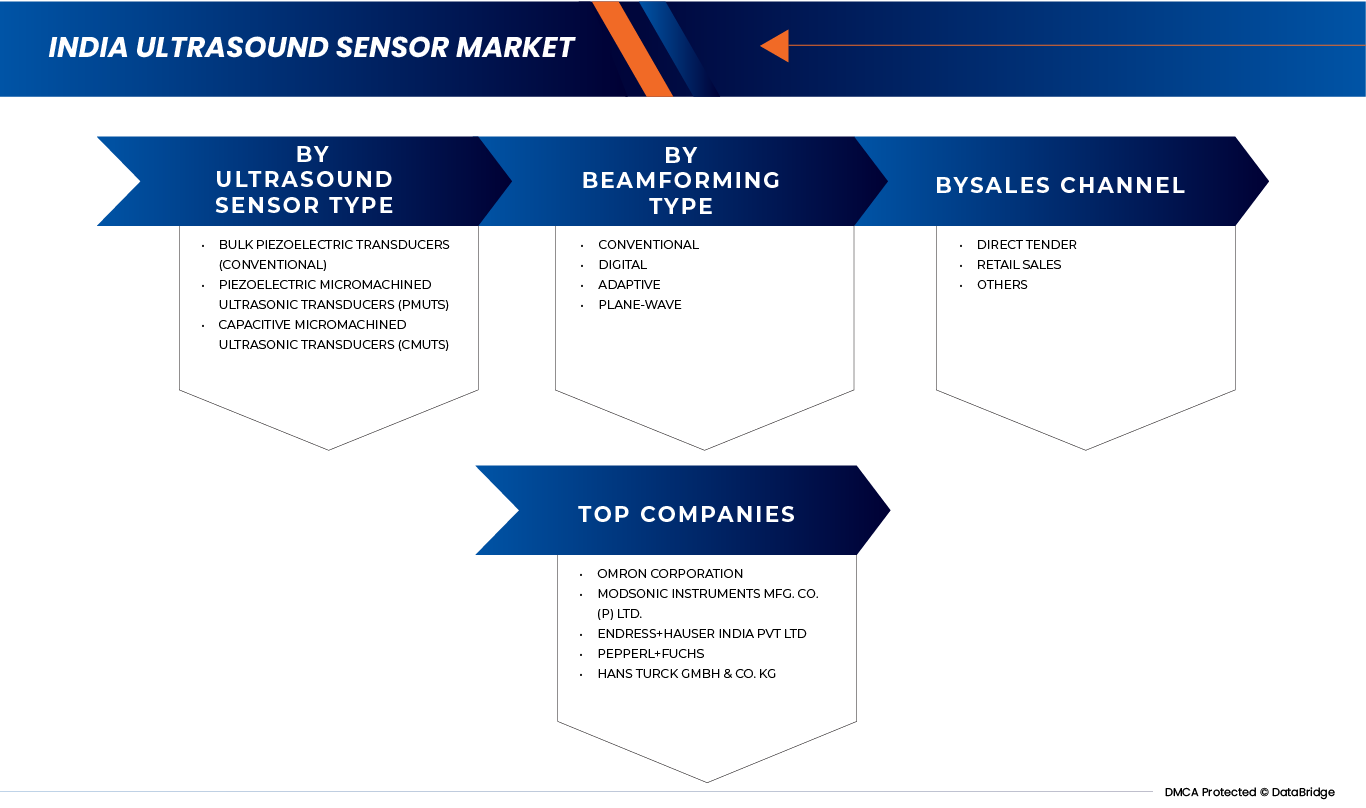

印度超音波感測器市場細分,按超音波感測器類型(體壓電換能器(傳統型)、壓電微機械超音波換能器 (PMUT) 和電容式微機械超音波換能器 (CMUT))、波束形成類型(傳統型、數位型、自適應型和平波型)、銷售通路(直接招標、零售及其他)劃分-產業趨勢及 2032 年的產業趨勢及 2032 年的趨勢

印度超音波感測器市場規模

- 2024年印度超音波感測器市場規模為1.5824億美元 ,預計 到2032年將達到2.7045億美元,預測期內複合 年增長率為7.1% 。

- 受醫療成像、工業自動化和汽車安全應用領域需求成長的推動,超音波感測器市場正在快速擴張。感測器技術的進步確保了其在各種應用中更高的精度、更緊湊的設計和更高的能源效率。

- 其他成長源於更廣泛的工業應用(無損檢測、汽車/機器人感測器)、本地製造業舉措以及擴大農村診斷覆蓋範圍的政府計畫——所有這些都促進了感測器數量和創新。

印度超音波感測器市場分析

- 超音波感測器是一種非接觸式設備,它利用人類耳朵聽不到的高頻聲波來檢測、測量和分析物體、距離或液位。其工作原理是發射超音波脈衝並解讀其回波。超音波感測器廣泛應用於醫療成像、工業自動化、機器人、汽車和環境監測等領域,可在各種應用中提供準確、即時和可靠的測量結果,從而確保操作的效率、安全性和精確性。

- 汽車領域高級駕駛輔助系統 (ADAS) 的日益普及加速了超音波感測器的應用。超音波感測器在泊車輔助、碰撞避免和自動駕駛等領域發揮著至關重要的作用,在全球範圍內提升了車輛的安全性、效率和用戶體驗。醫療保健領域投資的成長也促進了超音波感測器在診斷影像、病患監護和治療設備等領域的應用。超音波感測器具有非侵入性、可靠和無輻射等特性,使其成為首選工具,有助於預防性醫療保健、疾病早期檢測以及醫療設備的創新。

- 2024年,傳統型體壓電換能器在印度超音波感測器市場佔據主導地位,收入份額高達53.10%,這主要得益於其在醫療成像、工業無損檢測和汽車應用領域的廣泛使用。其可靠性、成本效益和高靈敏度使其成為診斷設備和工業感測器的理想選擇,從而滿足了醫療保健和製造業日益增長的需求。

報告範圍及印度超音波感測器市場細分

|

屬性 |

印度超音波感測器市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

印度超音波感測器市場趨勢

“數位成像技術的整合及其在即時診斷中的應用拓展”

- 隨著數位波束形成、便攜式系統和人工智慧成像解決方案的普及,印度超音波感測器市場正在不斷發展,以提高診斷準確性。

- 對即時診斷和床邊診斷日益增長的需求,正在推動小型超音波設備在基層醫療和急診護理中的應用。

- 醫院和診斷中心正越來越多地採用手持式超音波設備,這些設備具有移動性強、成本更低、成像速度更快等優點。

- 例如,印度醫療器材製造商正與全球技術供應商合作,實現生產本地化,並降低便攜式超音波解決方案的成本。

- 這一趨勢凸顯了超音波感測器在實現經濟高效、非侵入性診斷方面的重要作用,這與政府的醫療保健擴展計劃相契合。

印度超音波感測器市場動態

司機

“慢性病負擔日益加重,早期診斷日益受到重視”

- 心血管疾病、癌症和妊娠相關併發症的日益增多,導致對基於超音波的診斷影像的需求不斷增長。

- 人們越來越重視早期和預防性醫療保健,這正在加速超音波感測器在先進成像系統中的應用。

- 政府推出的諸如「阿尤斯曼·巴拉特」(Ayushman Bharat)計劃以及診斷基礎設施的擴建等舉措,為採用經濟高效的超音波設備創造了新的機遇。

- 2024年,多家公立和私立醫院在半城市和農村診所引入了便攜式和移動式超音波設備,體現了擴大醫療服務覆蓋範圍的努力。

- 預計這些進展將改善患者治療效果,支持更快速的診斷,並推動超音波感測器市場在印度的滲透。

克制/挑戰

“先進技術成本高且依賴進口”

- 高昂的系統和感測器成本限制了自適應波束形成和人工智慧成像等先進超音波技術的整合。

- 過度依賴進口超音波組件和設備加重了醫療機構的經濟負擔,尤其是在二、三線城市。

- 規模較小的診斷中心由於經濟能力限制和報銷額度有限,在引進高端超音波設備方面面臨挑戰。

- 2023年,產業報告指出,由於成本問題和資金批准延遲,多家醫院推遲了先進超音波系統的採購。

- 這些障礙減緩了尖端技術的應用,造成了印度先進城市醫院與資源匱乏的農村醫療機構之間的差距。

印度超音波感測器市場範圍

市場按超音波感測器類型、波束形成類型、銷售管道進行細分。

- 依超音波感測器類型

根據超音波感測器類型,印度超音波感測器市場可分為體壓電換能器(傳統型)、壓電微機械超音波換能器(PMUT)和電容式微機械超音波換能器(CMUT)。預計到2025年,體壓電換能器(傳統型)將佔據市場主導地位,市場份額達53.04%,這主要得益於其在產科、心臟病學和腹部診斷等醫學影像應用中久經考驗的可靠性、高靈敏度和成本效益。由於成熟的製造流程和醫護人員的熟悉度,這些傳統感測器在醫院和診斷中心仍然被廣泛使用。它們與各種超音波設備相容,且價格比先進的替代產品更具優勢,這確保了其持續普及,尤其是在中型診所和公共醫療機構。

由於壓電微機械超音波換能器(PMUT)設計緊湊、功耗低,且易於與便攜式和可穿戴超音波系統集成,預計在預測期內將以7.9%的複合年增長率(CAGR)實現最高增長。即時診斷、遠距醫療和家庭醫療保健需求的不斷增長也推動了PMUT的普及應用。感測器的微型化使其能夠更廣泛地應用於行動和手持式超音波設備,從而提高農村地區的醫療服務可近性。此外,不斷成長的研發投入以及印度新創企業與全球企業之間的合作正在加速PMUT技術的本土化進程,使其成為下一代超音波診斷解決方案。

- 按波束成形類型

根據波束形成類型,印度超音波感測器市場可分為傳統型、數位型、自適應型和平波型。預計到2025年,傳統型感測器將佔據市場主導地位,市佔率達40.39%,並在預測期內保持最快成長,複合年增長率(CAGR)為7.8%。傳統型超音波感測器設計具有性能穩定、經久耐用以及與現有成像平台相容等優點。醫院和診斷中心更傾向於選擇此類解決方案,因為它們操作簡單、成本效益高,並且非常適合常規診斷程序。隨著印度公立和私立醫療保健產業的快速發展,傳統型感測器仍然是廣泛部署的實用選擇。其成熟的供應鏈和經臨床驗證的療效進一步增強了大型診斷中心和婦產科醫院對傳統型感測器的需求。

- 按銷售管道

根據銷售管道,印度超音波感測器市場可分為直接招標、零售和其他管道。預計2025年,直接招標通路將佔據市場主導地位,市佔率達57.25%,並在預測期內保持最快成長,複合年增長率(CAGR)為7.3%。這是因為直接招標是印度超音波感測器需求的主要驅動力,尤其是在政府醫院、公共衛生計畫和大型三級醫療中心。中央和邦政府正大力投資醫療器材採購,例如透過「阿尤斯曼·巴拉特」(Ayushman Bharat)計劃擴大診斷服務的覆蓋範圍。直接招標能夠實現批量採購、成本談判,並加快配備先進感測器的超音波系統的分銷。此管道既能確保資源有限的醫療機構也能負擔得起,又能促進半城市和農村地區的更廣泛應用。

印度超音波感測器市場區域分析

印度

- 印度超音波感測器市場的發展動力來自對非侵入性診斷影像的需求不斷增長、慢性疾病日益普遍以及在母嬰保健領域應用日益廣泛。

- 政府加強醫療基礎建設的舉措,以及便攜式和人工智慧超音波設備等技術的進步,都促進了相關技術的普及。工業測試和汽車安全領域應用範圍的擴大,進一步推動了市場成長。

- 包括便攜式、可穿戴式和人工智慧整合式超音波系統在內的技術進步,正在提高診斷的準確性和可及性,尤其是在農村和偏遠地區。

- 在工業無損檢測、機器人技術和汽車安全系統(例如停車輔助和接近感應)等領域的應用不斷擴展,正使市場範圍從醫療保健領域擴展到其他領域。

- 公共和私人機構投資的增加,以及診斷中心和影像設施數量的成長,正進一步推動印度市場的成長。

印度超音波感測器市場份額

印度超音波感測器產業主要由一些成熟企業主導,其中包括:

- MakTechnosys(印度)

- Modsonic Instruments Mfg. Co. (P) Ltd. (印度)

- 印度電子工程有限公司(印度)

- Butterfly Network, Inc.(美國)

- 歐姆龍株式會社(日本)

- 漢斯·圖爾克有限公司(德國)

- 倍加福(德國)

- Endress+Hauser India Pvt Ltd(印度)

- 印度病患私人有限公司(德國)

- Banner Engineering India Pvt Ltd(美國)

- 脈衝星測量(英國)

- Microsonic(德國)

- Esaote SPA(義大利)

- 迪佩爾電子(印度)

印度超音波感測器市場最新發展動態

- 2024年9月,SICK AG與Endress+Hauser達成策略合作,旨在提升製程自動化解決方案。根據合作協議,Endress+Hauser將負責SICK製程分析儀和氣體流量計的全球銷售和服務。

- 2025年8月,MyLab A50和MyLab A70超音波系統獲得FDA核准。這些便攜式電池供電系統採用先進的成像技術和基於人工智慧的診斷功能,進一步鞏固了Esaote在全球和印度市場的創新地位。

- 2024年6月,Esaote集團在印度北方邦諾伊達新建生產基地,進一步擴大在印度的生產規模。該基地將生產全系列先進的超音波產品,包括MyLab A系列、MyLab E系列以及可攜式超音波設備。所有產品均在印度製造,旨在透過人工智慧增強成像和觸控螢幕控制,提升臨床工作流程,從而更好地服務印度本土市場。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 INNOVATION PIPELINE

4.3 PROCUREMENT & TENDER INTELLIGENCE

4.3.1 PUBLIC AND PRIVATE SECTOR PROCUREMENT TRENDS FOR SENSORS/MODULES

4.3.2 TENDER PRICING BENCHMARKS FOR ULTRASOUND PROBES AND TRANSDUCERS

4.3.3 KEY MEDICAL PROCUREMENT AGENCIES

4.3.3.1 HLL LIFECARE LIMITED (HLL)

4.3.3.2 HLL INFRATECH SERVICES LTD (HITES)

4.3.3.3 GOVERNMENT E-MARKETPLACE (GEM)

4.3.3.4 CENTRAL PROCUREMENT AGENCY (CPA), DELHI

4.3.3.5 HSCC LIMITED (HEALTHCARE SECTOR CONSULTANCY COMPANY)

4.3.3.6 KARNATAKA STATE MEDICAL SUPPLIES CORPORATION LIMITED (KSMSCL)

4.3.3.7 UTTAR PRADESH MEDICAL SUPPLIES CORPORATION LIMITED (UPMSCL)

4.3.3.8 MAHARASHTRA MEDICAL GOODS PROCUREMENT AUTHORITY (MMGPA)

4.3.3.9 GUJARAT MEDICAL SERVICES CORPORATION (GMSC)

4.3.3.10 CHHATTISGARH MEDICAL SERVICES CORPORATION LIMITED

4.3.3.11 INDIAN COUNCIL OF MEDICAL RESEARCH (ICMR)

4.3.3.12 ALL INDIA INSTITUTE OF MEDICAL SCIENCES (AIIMS)

4.4 PRICING ANALYSIS

4.4.1 TARGET PRICING STRATEGY

4.5 SUPPLY CHAIN DYNAMICS

4.6 TECHNICAL BENCHMARKING

4.7 IP OWNERSHIP DISTRIBUTION FOR KEY TECHNOLOGIES AMONG LEADING GLOBAL AND REGIONAL VENDORS

4.8 PATENT LANDSCAPE AND MAJOR HOLDERS OF ULTRASOUND SENSOR RELATED IP

4.9 OWNERSHIP/PARTNERSHIP STRUCTURES OF RELEVANT MANUFACTURERS AND TECHNOLOGY PROVIDERS THAT SUPPLY INTO INDIA

4.1 CURRENT AND POTENTIAL DEMAND DRIVERS IN INDIA ACROSS KEY END-USER SECTORS

4.10.1 CURRENT DEMAND DRIVERS

4.10.1.1 MEDICAL DEVICE OEMS

4.10.1.2 INDUSTRIAL AUTOMATION & ROBOTICS

4.10.2 AUTOMOTIVE MANUFACTURERS

4.10.3 RESEARCH & ACADEMIC INSTITUTIONS

4.10.4 POTENTIAL DRIVERS

4.10.4.1 MEDICAL DEVICE OEMS

4.10.5 INDUSTRIAL AUTOMATION & ROBOTICS

4.10.6 RESEARCH & ACADEMIC INSTITUTIONS

4.11 CURRENT AND POTENTIAL DEMAND DRIVERS IN INDIA ACROSS KEY END-USER SECTORS

4.11.1 ULTRASOUND SENSORS – VALUE PROPOSITION STRATEGY

4.11.2 CORE BENEFITS & DIFFERENTIATORS

4.11.3 TECHNOLOGY-DRIVEN ADVANTAGES

4.11.4 MARKET GROWTH VALUE

4.11.5 SOCIETAL & ECONOMIC VALUE

4.11.6 COST–BENEFIT POSITIONING VS. EXISTING ALTERNATIVES

4.12 SUGGESTED MESSAGING FOR MEDICAL OEMS, ROBOTIC SENSOR INTEGRATORS

4.12.1 MEDICAL DEVICE OEMS

4.12.1.1 STRATEGIC MESSAGING:

4.12.1.2 KEY MESSAGES:

4.12.2 ROBOTIC SENSOR INTEGRATORS & INDUSTRIAL AUTOMATION COMPANIES

4.12.2.1 STRATEGIC MESSAGING:

4.12.2.2 KEY VALUE MESSAGES:

5 REGULATORY ENVIRONMENT – CURRENT LANDSCAPE

5.1 MEDICAL DEVICE REGULATION (MDR, 2017)

5.2 PC-PNDT ACT (1994, AMENDED)

5.3 IMPORT CONTROLS & CDSCO LICENSING

5.4 STANDARDS & CERTIFICATIONS

5.5 GOVERNMENT PUSH FOR LOCALIZATION (MAKE IN INDIA)

5.6 TRIGGERS FOR FUTURE LOCAL MARKET DEVELOPMENT

5.6.1 EXPANSION OF MDR TO INCLUDE ALL DEVICES

5.6.2 PLI & LOCALIZATION MANDATES

5.6.3 TAX & IMPORT DUTY ADJUSTMENTS

5.6.4 DIGITAL HEALTH & AI REGULATION

5.6.5 PUBLIC PROCUREMENT & TIER-II/TIER-III MARKET PENETRATION

5.6.6 EXPORT-ORIENTED GROWTH PUSH

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING

6.1.2 GROWING ADOPTION OF POINT-OF-CARE AND PORTABLE ULTRASOUND SYSTEMS IN RURAL/REMOTE AREAS..

6.1.3 INCREASING GOVERNMENT INVESTMENTS AND MATERNAL/CHILD HEALTH SCREENING PROGRAMS..

6.1.4 CONTINUOUS PROBE TECHNOLOGY ADVANCEMENTS (MINIATURIZATION, DURABILITY, AI-ASSISTED IMAGING).

6.2 RESTRAINTS

6.2.1 HIGH PRICE SENSITIVITY AND LIMITED REIMBURSEMENT POLICIES IN THE INDIAN HEALTHCARE SYSTEM

6.2.2 REGULATORY DELAYS AND IMPORT DEPENDENCY FOR ADVANCED PROBES, SLOWING MARKET PENETRATION.

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF DOMESTIC MANUFACTURING UNDER “MAKE IN INDIA” AND MEDICAL DEVICE PARKS, REDUCING RELIANCE ON IMPORTS

6.3.2 RISING MEDICAL TOURISM IN INDIA, INCREASING DEMAND FOR ADVANCED IMAGING TOOLS AND PROBES IN PRIVATE HOSPITALS

6.3.3 EMERGENCE OF TELEMEDICINE & REMOTE DIAGNOSTICS, WHERE ULTRASOUND PROBES INTEGRATED WITH CLOUD/AI PLATFORMS CAN SERVE RURAL POPULATIONS.

6.4 CHALLENGES

6.4.1 HIGHLY FRAGMENTED MARKET FUELING INTENSE COMPETITION AND PRICING PRESSURE...

6.4.2 SHORT SHELF LIFE AND HANDLING CHALLENGES

7 INDIA ULTRASOUND SENSOR MARKET, TYPE.

7.1 OVERVIEW

7.2 BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL)

7.3 PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS)

7.4 CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS)

8 INDIA ULTRASOUND SENSOR MARKET, BEAMFORMING TYPE.

8.1 OVERVIEW

8.2 CONVENTIONAL

8.3 DIGITAL

8.4 ADAPTIVE

8.5 PLANE-WAVE

9 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL.

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL SALES

9.4 OTHERS

10 INDIA ULTRASOUND SENSOR MARKET MARKET

10.1 COMPANY SHARE ANALYSIS: INDIA

10.2 COMPANY SHARE ANALYSIS: INDIA (BY SENSOR TYPE)

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 OMRON CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 MODSONIC INSTRUMENTS MFG. CO. (P) LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENT

12.3 ENDRESS+HAUSER GROUP SERVICES AG,

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 PEPPERL+FUCHS

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 HANS TURCK GMBH & CO. KG

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 BANNER ENGINEERING CORP.

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 BUTTERFLY NETWORK, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 DIPEL ELECTRONICS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 ELECTRONIC & ENGINEERING COMPANY INDIA PRIVATE LIMITED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 ESAOTE SPA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 MAK TECHNOSYS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 MICROSONIC INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 PULSAR MEASUREMENT

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 SICK AG

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 3 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 4 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 5 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 7 INDIA BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 8 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS), BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 10 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 11 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 12 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 14 INDIA PIEZOELECTRIC MICROMACHINED ULTRASONIC TRANSDUCERS (PMUTS) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY FREQUENCY, 2018-2032 (USD THOUSAND)

TABLE 18 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 19 ) INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND

TABLE 20 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 21 INDIACAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 22 INDIA CAPACITIVE MICROMACHINED ULTRASONIC TRANSDUCERS (CMUTS) IN ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 INDIA ULTRASOUND SENSOR MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 25 INDIA RETAIL SALES IN ULTRASOUND SENSOR MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 INDIA ULTRASOUND SENSOR MARKET

FIGURE 2 INDIA ULTRASOUND SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 INDIA ULTRASOUND SENSOR MARKET: DROC ANALYSIS

FIGURE 4 INDIA ULTRASOUND SENSOR MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 INDIA ULTRASOUND SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA ULTRASOUND SENSOR MARKET: MULTIVARIATE MODELLING

FIGURE 7 INDIA ULTRASOUND SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 INDIA ULTRASOUND SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 INDIA ULTRASOUND SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY: INDIA ULTRASOUND SENSORS MARKET

FIGURE 11 INDIA ULTRASOUND SENSOR MARKET: SEGMENTATION

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE (2024)

FIGURE 14 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING IS EXPECTED TO DRIVE THE INDIA ULTRASOUND SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA ULTRASOUND SENSOR MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 OEM PRICING ULTRASOUND SENSORS PRICING TRENDS, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 18 OEM PRICING UULTRASOUND SENSORS PRICING TRENDS, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 19 RETAIL AND TENDER BY PRODUCT TYPE, 2024-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 20 SUPPLY CHAIN DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDIA ULTRASOUND SENSOR MARKET

FIGURE 22 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, 2024

FIGURE 23 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, CAGR (2025 TO 2032)

FIGURE 24 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, CAGR (2025 TO 2032)

FIGURE 25 INDIA ULTRASOUND SENSOR MARKET, BY ULTRASOUND SENSOR TYPE, LIFELINE CURVE

FIGURE 26 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, 2024

FIGURE 27 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, CAGR (2025-2032)

FIGURE 28 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, CAGR (2025-2032)

FIGURE 29 INDIA ULTRASOUND SENSOR MARKET, BY BEAMFORMING TYPE, LIFELINE CURVE

FIGURE 30 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL 2024

FIGURE 31 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, CAGR (2025-2032)

FIGURE 32 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, CAGR (2025-2032)

FIGURE 33 INDIA ULTRASOUND SENSOR MARKET, SALES CHANNEL, LIFELINE CURVE

FIGURE 34 INDIA ULTRASOUND SENSOR MARKET MARKET: COMPANY SHARE 2024 (%)

FIGURE 35 INDIA ULTRASOUND SENSOR MARKET: COMPANY SHARE, BY SENSOR TYPE, 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。