Malaysia Metal Roofing Market

市场规模(十亿美元)

CAGR :

%

USD

144.67 Million

USD

231.65 Million

2024

2035

USD

144.67 Million

USD

231.65 Million

2024

2035

| 2025 –2035 | |

| USD 144.67 Million | |

| USD 231.65 Million | |

|

|

|

|

馬來西亞金屬屋頂市場細分按產品類型(波紋板、立邊鎖邊、瓷磚屋頂、木瓦、搖動屋頂、板岩屋頂等)、材料(鋼、鋁、石材塗層、鋅、銅、錫、青銅等)、價格(5.1 至 10 美元、最高 5 美元和 10 美元飾面、顏色號等)、長度(12 英尺、10 英尺、14 英尺、16 英尺、8 英尺等)、應用(工業、商業、住宅和農業) - 行業趨勢和預測到 2035 年

金屬屋頂市場規模

- 2024 年馬來西亞金屬屋頂市場價值為1.4467 億美元,預計到 2035 年將達到 2.3165 億美元,預測期內複合年增長率為 4.4%。

- 市場成長主要得益於消費者對永續和節能金屬屋頂解決方案的日益偏好,包括具有耐用性和較低環境影響的塗層和環保屋頂系統

- 這一增長得益於政府大力支持國內基礎設施建設、住宅和商業建築投資增加以及對耐用屋頂替代品的認識不斷提高等因素。推動綠建築標準和城市發展的舉措進一步推動了馬來西亞各地金屬屋頂的普及。

金屬屋頂市場分析

- 馬來西亞金屬屋頂市場正在穩步增長,這得益於對耐用、經濟高效且可持續的建築材料日益增長的需求。越來越多的房主和建築商選擇金屬屋頂,因為它具有使用壽命長、耐極端天氣、可回收且維護成本低等特點,尤其是在城市和半城市地區。

- 金屬屋頂在馬來西亞廣泛應用於住宅、商業、工業和農業建築等多個領域。由於其結構輕巧、熱反射性好、耐腐蝕且適應熱帶氣候,金屬屋頂仍是首選。絕緣金屬板和塗層鋼板等持續的創新技術進一步推動了其應用。

- 強勁的政府基礎設施建設計劃、日益增長的城市化進程以及住房和商業項目投資的增加,推動了市場的成長。政府對綠色建築實踐和節能材料的激勵措施也加速了公共和私營部門建築中金屬屋頂的使用。

- 在產品類型中,瓦楞板因其成本效益、易於安裝、耐用性和廣泛可用性,預計將佔據市場主導地位。其能夠承受惡劣天氣條件,並適用於工業、農業和住宅領域的各種應用,進一步刺激了市場需求。

- 由於製造設施、倉庫和倉儲設施的建設不斷增加,預計工業領域將佔據市場主導地位。工業應用對耐用、經濟高效且維護成本低的屋頂解決方案的需求顯著推動了金屬屋頂在該領域的應用。

報告範圍和金屬屋頂市場細分

|

屬性 |

金屬屋頂關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

金屬屋頂市場趨勢

“基礎設施和住房項目激增推動馬來西亞金屬屋頂需求”

- 馬來西亞住宅、商業和工業領域建築活動的不斷增長,推動了對高性能屋頂材料的需求。這種上升趨勢主要歸功於國家城市發展規劃和基礎設施建設計劃,這些計劃和計劃持續在全國範圍內催生新的建築項目。

- 諸如「第十二個馬來西亞計畫」等主要政府策略高度重視城市基礎建設、永續建築和現代化建設。這些措施加快了施工進度,並增加了材料需求,而金屬屋頂系統因其耐用性和高效性而備受青睞。

- 根據馬來西亞建築業發展局 (CIDB) 預測,受住宅建設計劃和基礎設施投資的推動,馬來西亞建築業預計到 2025 年將成長 12.3%。這一預期成長將直接推動對金屬屋頂等材料的需求成長,這與快速推進的施工進度相契合。

- 金屬屋頂因其使用壽命長、耐惡劣天氣、維護成本低以及與各種建築設計的兼容性而日益受到青睞。這些特性使其成為追求經濟高效且可靠施工成果的開發商和承包商的首選解決方案。

- 隨著國家向綠色建築實踐轉型,金屬屋頂等可回收環保的屋頂解決方案正逐漸成為主流。它們在減少環境影響的同時,也能提高熱效率,使其成為馬來西亞不斷發展的建築格局中永續發展目標不可或缺的一部分。

金屬屋頂市場動態

司機

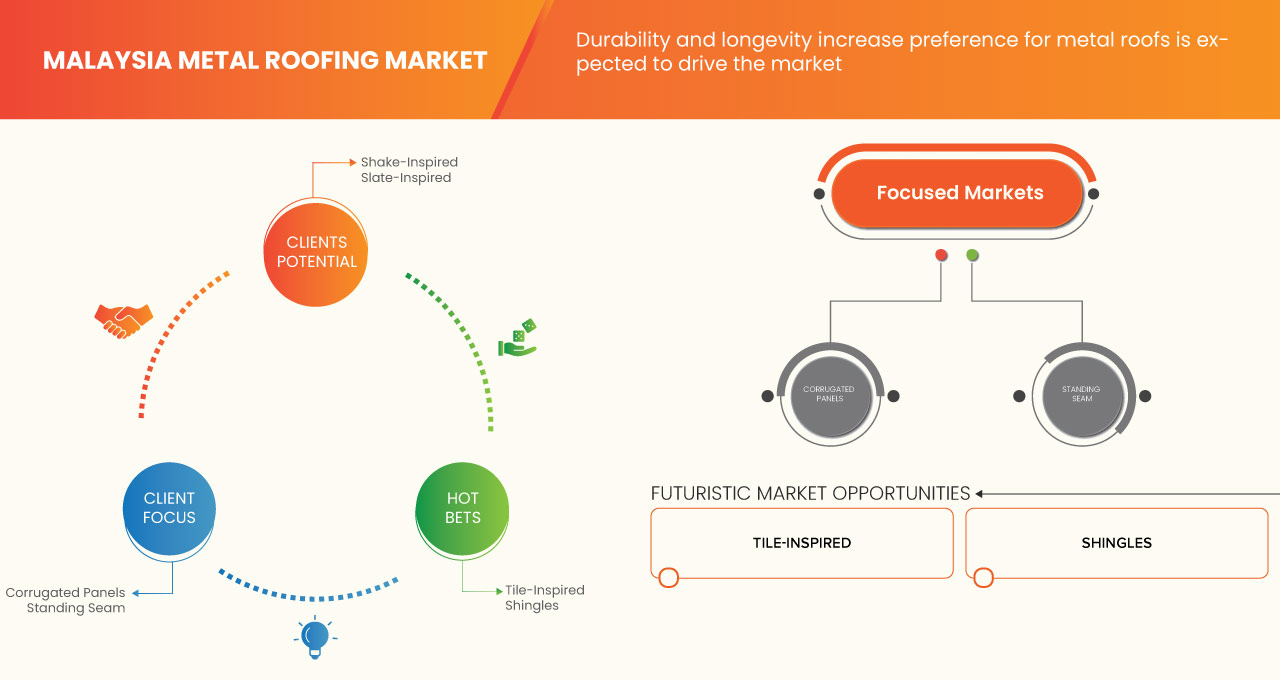

“耐用性和長壽命增加了人們對金屬屋頂的偏好”

- 在馬來西亞,金屬屋頂系統的需求正在強勁增長,因為它們能夠承受該國的熱帶氣候,包括長時間的紫外線照射、暴雨和高濕度。這些耐候性能使金屬屋頂比瀝青瓦或粘土瓦等傳統屋頂材料更耐用,而後者隨著時間的推移更容易開裂、變形和水漬。

- 金屬屋頂的主要優勢之一是其維修需求極低。與其他可能因苔蘚、藻類或水漬侵蝕而需要定期維修或清潔的材料不同,金屬屋頂能夠保持數十年的結構完整性和外觀,從而降低生命週期維護成本。

- 金屬屋頂系統在妥善維護的情況下,使用壽命可達40至50年,為業主和開發商帶來長期價值。這種延長的使用壽命在住宅和商業開發項目中尤其重要,因為成本效益、結構穩定性和投資回報率是關鍵的決策因素。

- 防護塗層和金屬合金的創新進一步提升了金屬屋頂的性能。先進的配方有助於提高耐腐蝕性和防火性能,使其成為極端天氣波動或高環境壓力地區的理想解決方案。

機會

“城市化推動現代屋頂需求”

- 馬來西亞快速的城市擴張推動了住宅、商業和工業建築的建設,增加了對金屬屋頂解決方案的需求

- 政府推出的經濟適用房和基礎設施項目正在加速屋頂材料的消費

- 城市發展中對耐用、低維護、美觀屋頂的偏好日益增長,有利於金屬屋頂的採用

- 智慧城市和綠色建築計畫的發展鼓勵使用節能屋頂材料

- 城市重建和改造計畫對現代屋頂升級的需求不斷增加

- 城市地區可支配收入的提高和生活方式的升級促進了對優質屋頂解決方案的投資增加

- 城市地區的開發商和承包商越來越重視快速安裝和耐候的屋頂系統,而金屬屋頂則提供了

- 人口密集的城市地區對隔音和熱反射屋頂的需求不斷增長

克制/挑戰

“高昂的初始安裝成本限制了市場採用”

- 雖然金屬屋頂憑藉其耐用性和低維護成本提供了長期價值,但其高昂的初始安裝成本仍然是馬來西亞推廣金屬屋頂的主要障礙。鋁、鋅和塗層鋼等優質材料的前期成本遠高於瀝青瓦或粘土瓦等傳統屋頂材料,這使得對價格敏感的買家難以負擔。

- 材料成本的上漲,加上安裝過程中對熟練工人和專用設備的需求,使成本更加複雜。與可由總承包商安裝的傳統屋頂系統不同,金屬屋頂通常需要經過培訓的專業人員,這會增加專案總成本,尤其是在複雜的建築設計或大型結構中。

- 對於個人房主、小型開發商以及預算有限的公共住宅專案來說,這種前期成本差異尤其顯著。即使意識到節能減排和延長使用壽命等長期效益,許多利害關係人仍難以證明更高的資本支出是合理的。

- 在馬來西亞農村和半城市地區,經濟承受能力仍然是建築決策的關鍵考慮因素。在這些市場中,傳統屋頂材料的成本優勢超過了金屬屋頂的長期價值,導致人們繼續依賴低成本的替代品。

- 如果沒有政府的定向獎勵措施、產業補貼或對生命週期成本節約意識的提升,高昂的安裝成本將繼續限制金屬屋頂的成長。克服這項挑戰對於擴大金屬屋頂在馬來西亞多元化建築領域的覆蓋範圍並確保更廣泛的市場滲透率至關重要。

金屬屋頂市場範圍

市場根據產品類型、材料、價格、顏色、厚度、長度和應用進行細分。

- 依產品類型

依產品類型,市場細分為瓦楞板、立邊鎖邊、瓷磚板、木瓦、木瓦、板岩板等。立邊鎖邊進一步按類型細分為按扣鎖、機械接縫、釘子/緊固件法蘭和板條板。機械接縫按類型進一步細分為單鎖(90 度接縫)和雙鎖(180 度接縫)。雙鎖(180 度接縫)部分進一步按類型細分為 1.5 英吋雙鎖和 2 英吋雙鎖輪廓。板條板按類型進一步細分為按扣蓋和 T 形接縫。到 2025 年,由於瓦楞板部分具有成本效益、易於安裝、耐用性和廣泛可用性,預計將以 39.07% 的市場份額佔據市場主導地位。它能夠承受惡劣的天氣條件,適用於工業、農業和住宅領域的各種應用,進一步推動了需求。

預計從 2025 年到 2035 年,瓦楞板領域將實現 4.7% 的最快增長率,這得益於其高耐用性、成本效益以及在屋頂和覆層應用方面的現代美學吸引力,其在商業和酒店領域的應用日益廣泛。

- 按材質

根據材料,市場細分為鋼、鋁、石材塗層、鋅、銅、錫、青銅等。鋼材細分市場進一步細分為鍍鋅鋼、鍍鋅鋼和耐候鋼。預計到2025年,鋼材將佔據主導地位,市場份額達到69.28%,這得益於其卓越的強度、經濟實惠、供應廣泛以及優異的耐惡劣天氣條件,使其成為住宅和商業屋頂應用的首選。

預計2025年至2035年期間,鋼鐵業將實現4.5%的最快成長率,這得益於其結構強度高、耐火性好、易於安裝和使用壽命長等特點,使其在商業和酒店業的應用日益廣泛。鋼鐵的多功能性和支撐大跨距屋頂系統的能力,也使其成為這些行業現代建築設計的理想選擇。

- 按價格

根據價格,市場分為 5.1 至 10 美元、5 美元以下和 10 美元以上三個檔次。預計到 2025 年,5.1 至 10 美元的市場將佔據主導地位,市場份額達到 47.69%,這得益於其成本與品質之間的平衡,對於尋求價格實惠、耐用且美觀的屋頂材料的住宅和商業買家來說,這是一個頗具吸引力的選擇。

預計2025年至2035年間, 5.1至10美元的市場將實現4.6%的最快成長率,這得益於消費者對在品質、性能和價格之間取得最佳平衡的中檔屋頂產品的日益青睞。這個價格區間吸引了尋求經濟高效且耐用解決方案的商業和酒店開發商,使其成為大型建築和翻新項目的熱門選擇。

- 按顏色

根據顏色,市場包括標準色、霧面飾面和設計師飾面。灰色進一步細分為灰燼灰、板岩灰和炭灰。白色進一步細分為帝王白和骨白。青銅色分為中等和深色。紅色分為殖民地紅和帝王紅,藍色包括板岩藍和帝王藍。霧面飾面進一步分為黑色、灰色、青銅色、鋅金屬色和其他。灰色包括火槍灰和炭灰。設計師飾面進一步分為仿古木紋、黑銅、斑點銅、做舊銅、古銅色、復古、斑點鏽和其他。到 2025 年,標準顏色預計將佔據市場主導地位,市場份額達到 75.36%,因為它用途廣泛、與高級飾面相比成本更低,並且在住宅和商業建築中都很受歡迎,因為它能提供乾淨、中性的美感,與各種建築風格相得益彰。

預計標準色彩領域將在2025年至2035年間實現4.4%的最快增長率,這得益於其廣泛的可用性、與各種建築設計的兼容性,以及住宅和商業屋頂項目對中性色和經典色彩選擇日益增長的需求。標準色彩也更容易獲得製造商的庫存和支持,使其成為開發商和承包商便捷且經濟實惠的選擇。

- 按厚度

依市場細分,市場可分為26號、24號、29號、22號、20號及其他規格。預計到2025年,26號規格將佔據主導地位,市佔率達到35.80%,這得益於其在強度和柔韌性之間的完美平衡,適用於各種屋頂應用。此外,26號規格價格實惠、易於操作且具有良好的耐候性,進一步促進了其廣泛應用。

預計2025年至2035年間,26號規格鋼管市場將實現4.8%的最快成長率,這得益於其在強度和柔韌性之間的最佳平衡,使其適用於各種住宅、商業和輕工業屋頂應用。與較厚規格鋼管相比,26號規格鋼管的廣泛應用、易於安裝和成本效益也使其在新建和翻新項目中的應用日益廣泛。

- 按長度

根據長度,市場細分為 12 英尺、10 英尺、14 英尺、16 英尺、8 英尺及其他長度。預計到 2025 年,12 英尺長度的鋼管將佔據主導地位,市場份額達到 30.50%,這得益於其最佳長度,能夠實現高效覆蓋、減少材料浪費且易於安裝。由於其能夠最大程度減少接縫並增強結構均勻性,它在住宅和商業項目中廣受青睞。

預計12英尺屋頂市場將在2025年至2035年間實現4.9%的最快增長率,這得益於其適用於覆蓋更大屋頂面積、接縫更少、安裝時間和人工成本更低的優勢。此外,其運輸便利性、材料浪費減少以及與標準屋頂尺寸的一致性更高,也使其在住宅和商業項目中廣受歡迎,成為承包商和建築商的首選。

- 按應用

根據應用,市場包括工業、商業、住宅和農業。工業領域按應用進一步細分為製造設施、倉庫和儲存單元以及其他。商業領域則分為零售中心、辦公大樓、教育機構、醫療保健、娛樂、交通運輸和其他。農業領域按應用進一步細分為家禽舍、穀倉、糧倉和其他。穀倉領域又進一步細分為牲畜棚、乾草棚和乳牛棚。由於馬來西亞對奢侈服裝、傳統服裝和永續時尚產品的需求不斷增長,預計到2025年,工業領域將佔據市場主導地位,市場份額達到36.46%。

預計2025年至2035年間,工業領域將實現4.7%的最快成長率,這得益於發展中國家製造設施、倉庫和物流中心數量的不斷增加。工業應用對耐用、耐候且維護成本低的屋頂材料的需求很高,這使得金屬屋頂成為理想的選擇。此外,金屬屋頂支援隔熱和太陽能板整合的能力進一步增強了其在註重節能的工業發展中的吸引力。

金屬屋頂市場範圍份額:

金屬屋頂市場主要由知名公司主導,包括:

- Astino Berhad(馬來西亞)

- 永金金屬屋頂有限公司(馬來西亞)

- Swissma(馬來西亞)

- Overseametal Sdn Bhd (馬來西亞)

- 屋頂密封 (馬) 有限公司有限公司(馬來西亞)

- Komiya Roofing (M) Sdn Bhd (馬來西亞)

- Hong Kong (KT) Sdn Bhd(馬來西亞)

- 同興金屬工業有限公司(馬來西亞)

- MUTIARA METAL ENTERPRISE SDN BHD(馬來西亞)

- 德順鋼鐵有限公司(馬來西亞)

- 巨塔鋼鐵有限公司(馬來西亞)

- Le Nam Megasheet(馬來西亞)

- Power Metal & Steel (M) Sdn. Bhd.(馬來西亞)

- Nikkata Metal Roofing Industries Sdn Bhd(馬來西亞)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS

4.1.1 PATENT QUALITY AND STRENGTH

4.1.2 PATENT FAMILIES

4.1.3 LICENSING AND COLLABORATIONS

4.1.4 REGION PATENT LANDSCAPE

4.1.5 IP STRATEGY AND MANAGEMENT

4.1.6 PATENT FILING TRENDS BY ROOF TYPE (2016–2024)

4.2 COST ANALYSIS BREAKDOWN: MALAYSIA METAL ROOFING MARKET

4.2.1 RAW MATERIAL COSTS

4.2.2 PROCESSING AND PROFILING COSTS

4.2.3 LABOR AND OVERHEAD COSTS

4.2.4 PACKAGING AND MATERIAL HANDLING

4.2.5 TRANSPORTATION AND LOGISTICS

4.2.6 REGULATORY COMPLIANCE AND CERTIFICATION

4.2.7 INSTALLATION AND POST-SALE SERVICES (OPTIONAL ADD-ON COST)

4.2.8 MARKETING, DISTRIBUTION, AND CHANNEL MARGINS

4.2.9 PROFIT MARGIN CONSIDERATION

4.2.10 CONCLUSION

4.3 CUSTOMER BEHAVIOR & PREFERENCES IN THE MALAYSIA METAL ROOFING MARKET

4.3.1 CUSTOMER SEGMENTATION BY END-USE APPLICATION

4.3.2 KEY PURCHASE DECISION DRIVERS

4.3.3 INFORMATION SOURCES AND PURCHASING JOURNEY

4.3.4 REGIONAL BEHAVIOR AND PREFERENCES

4.3.5 BRAND PERCEPTION AND LOYALTY BEHAVIOR

4.3.6 EMERGING PREFERENCES AND BEHAVIORAL TRENDS

4.3.7 LIFECYCLE BEHAVIOR AND REPURCHASE TRIGGERS

4.4 RAW MATERIAL SOURCING ANALYSIS: MALAYSIA METAL ROOFING MARKET

4.4.1 PRIMARY RAW MATERIAL INPUTS

4.4.2 GEOGRAPHIC SOURCING PATTERNS AND TRADE DEPENDENCIES

4.4.3 LOCAL SUPPLY CAPABILITIES AND LIMITATIONS

4.4.4 PROCUREMENT STRATEGIES AND COST DYNAMICS

4.4.5 GRADE SELECTION AND QUALITY STANDARDIZATION

4.4.6 CHALLENGES IN RAW MATERIAL SOURCING

4.4.7 STRATEGIC SOURCING RECOMMENDATIONS

4.4.8 ENVIRONMENTAL AND COMPLIANCE CONSIDERATIONS

4.4.9 CONCLUSION

4.5 STRATEGIC RECOMMENDATIONS FOR KEY PLAYERS IN THE MALAYSIA METAL ROOFING MARKET

4.5.1 PRODUCT DIFFERENTIATION AND INNOVATION

4.5.2 MARKET EXPANSION AND DISTRIBUTION NETWORK OPTIMIZATION

4.5.3 PRICING AND COST MANAGEMENT

4.5.4 BRANDING AND MARKETING STRATEGIES

4.5.5 REGULATORY ALIGNMENT AND GOVERNMENT ENGAGEMENT

4.5.6 STRATEGIC COLLABORATIONS AND PARTNERSHIPS

4.5.7 DIGITAL TRANSFORMATION AND SMART MANUFACTURING

4.5.8 AFTER-SALES SUPPORT AND WARRANTY PROGRAMS

4.5.9 TALENT DEVELOPMENT AND TRAINING PROGRAMS

4.5.10 COMPETITIVE INTELLIGENCE AND BENCHMARKING

4.6 SUPPLY CHAIN ANALYSIS: MALAYSIA METAL ROOFING MARKET

4.6.1 RAW MATERIAL SOURCING AND STEEL COIL PROCUREMENT

4.6.2 ROLL FORMING, PROFILING, AND COATING OPERATIONS

4.6.3 FABRICATION, ACCESSORIES, AND PACKAGING

4.6.4 DISTRIBUTION, LOGISTICS, AND INSTALLATION NETWORKS

4.6.5 MARKET TRENDS AND FUTURE OUTLOOK

4.6.6 CONCLUSION

4.7 CONSUMER BUYING BEHAVIOUR

4.8 IMPORT EXPORT SCENARIO

4.8.1 IMPORT SCENARIO

4.8.2 EXPORT SCENARIO

4.8.3 CONSUMPTION SCENARIO

4.8.4 PRODUCTION SCENARIO

4.9 TECHNOLOGICAL TRENDS IN THE MALAYSIA METAL ROOFING MARKET

4.9.1 ADVANCED COATING TECHNOLOGIES

4.9.2 INTEGRATION OF SMART ROOFING SYSTEMS

4.9.3 USE OF LIGHTWEIGHT AND HIGH-STRENGTH ALLOYS

4.9.4 PREFABRICATION AND MODULAR ROOFING SOLUTIONS

4.9.5 DIGITAL DESIGN AND CUSTOMIZATION TOOLS

4.9.6 SUSTAINABLE MANUFACTURING PRACTICES

4.1 TARIFFS AND THEIR IMPACT ON THE MARKET

4.10.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.10.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.10.3 VENDOR SELECTION CRITERIA DYNAMICS

4.10.4 IMPACT ON SUPPLY CHAIN

4.10.4.1 RAW MATERIAL PROCUREMENT

4.10.4.2 MANUFACTURING AND PRODUCTION

4.10.4.3 LOGISTICS AND DISTRIBUTION

4.10.4.4 PRICE PITCHING AND POSITION OF MARKET

4.10.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.10.5.1 SUPPLY CHAIN OPTIMIZATION

4.10.5.2 JOINT VENTURE ESTABLISHMENTS

4.10.6 IMPACT ON PRICES

4.10.7 REGULATORY INCLINATION

4.10.7.1 FTAS ASEAN FTAS AND TRADE ALIGNMENT

4.10.7.2 BONDING & DUTY WAIVERS

4.10.7.3 SAFEGUARD & ANTI-DUMPING REGULATIONS

4.10.7.4 INDUSTRIAL POLICY ALIGNMENT

4.11 FACTORS INFLUENCING BUYING DECISION OF END-USERS IN THE MALAYSIA METAL ROOFING MARKET

4.11.1 CLIMATIC PERFORMANCE AND WEATHER RESILIENCE

4.11.2 MATERIAL TYPE, THICKNESS, AND COATING QUALITY

4.11.3 ARCHITECTURAL DESIGN AND AESTHETICS

4.11.4 COST AND LONG-TERM VALUE

4.11.5 ENERGY EFFICIENCY AND GREEN CERTIFICATIONS

4.11.6 SUPPLIER REPUTATION AND AFTER-SALES SERVICE

4.11.7 INSTALLATION EASE AND TECHNICAL COMPATIBILITY

4.11.8 FIRE RESISTANCE, SAFETY, AND COMPLIANCE STANDARDS

4.11.9 MARKETING, AWARENESS, AND EDUCATION PROGRAMS

4.11.10 CONCLUSION

4.12 IMPACT OF ECONOMIC SLOWDOWN ON THE MALAYSIA METAL ROOFING MARKET

4.12.1 IMPACT OF PRICE

4.12.2 IMPACT ON SUPPLY CHAIN

4.12.3 IMPACT ON SHIPMENT

4.12.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.12.5 CONCLUSION

4.13 ENVIRONMENTAL IMPACT OF THE MALAYSIA METAL ROOFING MARKET

4.13.1 LIFECYCLE EMISSIONS AND ENERGY USE

4.13.2 URBAN HEAT ISLAND (UHI) MITIGATION

4.13.3 WASTE GENERATION AND RECYCLING

4.13.4 WATER RUNOFF AND POLLUTION

4.13.5 ROLE IN GREEN BUILDING AND CIRCULAR ECONOMY

4.13.6 CONCLUSION

4.14 INDUSTRY ECO-SYSTEM ANALYSIS OF THE MALAYSIA METAL ROOFING MARKET

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 FABRICATION PLANTS

4.14.3 INSTALLERS & CONTRACTORS

4.14.4 POLICY & REGULATION

4.14.5 LOGISTICS INFRASTRUCTURE

4.14.6 ACCESSORIES & FINISHES

4.14.7 CERTIFICATIONS

4.15 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.15.1 JOINT VENTURES

4.15.2 MERGERS AND ACQUISITIONS (M&A)

4.15.3 LICENSING AND PARTNERSHIPS

4.16 COMPANY’S OVERVIEW

4.16.1 SWISSMA BUILDING TECHNOLOGIES SDN. BHD.

4.16.2 THUNG HING METAL INDUSTRY SDN. BHD.

4.16.3 ASTINO BERHAD

4.16.4 YARKER INDUSTRIES

4.16.5 SJ CLASSIC INDUSTRIES SDN. BHD.

4.16.6 KHP STEEL PRODUCT (M) SDN. BHD.

4.16.7 NS BLUESCOPE MALAYSIA SDN. BHD

4.16.8 RENZO BUILDERS (M) SDN. BHD.

4.16.9 UNITED SEASONS SDN. BHD.

4.16.10 TWENTY-TWENTY TECHNOLOGY SDN. BHD.

4.16.11 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING CONSTRUCTION ACTIVITIES BOOST DEMAND FOR METAL ROOFING

6.1.2 DURABILITY AND LONGEVITY INCREASE PREFERENCE FOR METAL ROOFS

6.1.3 GOVERNMENT INFRASTRUCTURE PROJECTS STIMULATE ROOFING MATERIAL CONSUMPTION

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INSTALLATION COST LIMITS MARKET ADOPTION

6.2.2 FLUCTUATING RAW MATERIAL PRICES IMPACT PROFIT MARGINS

6.3 OPPORTUNITIES

6.3.1 RISING GREEN BUILDING TRENDS FAVOR SUSTAINABLE ROOFING SOLUTIONS

6.3.2 URBANIZATION BOOSTS DEMAND FOR MODERN ROOFING

6.4 CHALLENGES

6.4.1 SKILLED LABOR SHORTAGE HAMPERS QUALITY METAL ROOF INSTALLATIONS

6.4.2 COMPETITION FROM ALTERNATIVE ROOFING MATERIALS LIMITS GROWTH

7 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CORRUGATED PANELS

7.3 STANDING SEAM

7.4 TILE-INSPIRED

7.5 SHINGLES

7.6 SHAKE-INSPIRED

7.7 SLATE-INSPIRED

7.8 OTHERS

8 MALAYSIA METAL ROOFING MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 STEEL

8.3 ALUMINUM

8.4 STONE-COATED

8.5 ZINC

8.6 COPPER

8.7 TIN

8.8 BRONZE

8.9 OTHERS

9 MALAYSIA METAL ROOFING MARKET, BY PRICE

9.1 OVERVIEW

9.2 5.1 TO 10 USD

9.3 UP TO 5 USD

9.4 MORE THAN 10 USD

10 MALAYSIA METAL ROOFING MARKET, BY COLOR

10.1 OVERVIEW

10.2 STANDARD COLOR

10.3 MATTE FINISHES USD

10.4 DESIGNER FINISHES

11 MALAYSIA METAL ROOFING MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 26 GAUGE

11.3 24 GAUGE

11.4 29 GAUGE

11.5 22 GAUGE

11.6 20 GAUGE

11.7 OTHERS

12 MALAYSIA METAL ROOFING MARKET, BY LENGTH

12.1 OVERVIEW

12.2 12 FT

12.3 10 FT

12.4 14 FT

12.5 16 FT

12.6 8 FT

12.7 OTHERS

13 MALAYSIA METAL ROOFING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 INDUSTRIAL

13.3 COMMERCIAL

13.4 RESIDENTIAL

13.5 AGRICULTURAL

14 MALAYSIA METAL ROOFING MARKET, BY REGION

14.1 MALAYSIA

14.1.1 PENINSULAR

14.1.2 SABAH METAL

14.1.3 SARAWAK

14.1.4 REST OF MALAYSIA

15 MALAYSIA METAL ROOFING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MALAYSIA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 ASTINO BERHAD

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 EVERGOLD METAL ROOFING SDN. BHD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 SWISSMA

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 OVERSEAMETAL SDN BHD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 ROOFSEAL (M) SDN. BHD

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 DEP SOON STEEL SDN. BHD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 JUTA STEEL SDN BHD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 KOMIYA ROOFING (M) SDN BHD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 KONG HONG (KT) SDN BHD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LE NAM MEGASHEET

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MUTIARA METAL ENTERPRISE SDN BHD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 NIKKATA METAL ROOFING INDUSTRIES SDN BHD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 POWER METAL & STEEL SDN. BHD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 THUNG HING METAL INDUSTRY SDN BHD

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 CUSTOMER JOURNEY PHASES AND DOMINANT CHANNELS:

TABLE 2 CONSUMER BUYING BEHAVIOUR

TABLE 3 STRATEGIC INNOVATION TYPES AND THEIR ROLE IN ENHANCING COMPETITIVENESS IN MALAYSIA'S METAL ROOFING MARKET

TABLE 4 REGULATORY COVERAGE

TABLE 5 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 6 MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ. FT)

TABLE 7 MALAYSIA STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 8 MALAYSIA MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 9 MALAYSIA DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 10 MALAYSIA BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 11 MALAYSIA METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 12 MALAYSIA STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 13 MALAYSIA METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 14 MALAYSIA METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 15 MALAYSIA STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 16 MALAYSIA GRAY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 17 MALAYSIA WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 18 MALAYSIA BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 19 MALAYSIA RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 20 MALAYSIA BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 21 MALAYSIA MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 22 MALAYSIA GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 23 MALAYSIA DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 24 MALAYSIA METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 25 MALAYSIA METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 26 MALAYSIA METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 27 MALAYSIA INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 28 MALAYSIA COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 29 MALAYSIA AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 30 MALAYSIA BARN IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 31 MALAYSIA METAL ROOFING MARKET, BY REGION, 2015-2035 (USD THOUSAND)

TABLE 32 MALAYSIA METAL ROOFING MARKET, BY REGION, 2015-2035 (THOUSAND SQ FT)

TABLE 33 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 34 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 35 PENINSULAR MALAYSIA STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 36 PENINSULAR MALAYSIA MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 37 PENINSULAR MALAYSIA DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 38 PENINSULAR MALAYSIA BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 39 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 40 PENINSULAR MALAYSIA STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 41 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 42 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 43 PENINSULAR MALAYSIA STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 44 PENINSULAR MALAYSIA GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 45 PENINSULAR MALAYSIA WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 46 PENINSULAR MALAYSIA BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 47 PENINSULAR MALAYSIA RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 48 PENINSULAR MALAYSIA BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 49 PENINSULAR MALAYSIA MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 50 PENINSULAR MALAYSIA GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 51 PENINSULAR MALAYSIA DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 52 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 53 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 54 PENINSULAR MALAYSIA METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 55 PENINSULAR MALAYSIA INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 56 PENINSULAR MALAYSIA COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 57 PENINSULAR MALAYSIA AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 58 PENINSULAR MALAYSIA BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 59 SABAH METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 60 SABAH METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 61 SABAH STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 62 SABAH MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 63 SABAH DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 64 SABAH BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 65 SABAH METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 66 SABAH STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 67 SABAH METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 68 SABAH METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 69 SABAH STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 70 SABAH GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 71 SABAH WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 72 SABAH BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 73 SABAH RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 74 SABAH BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 75 SABAH MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 76 SABAH GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 77 SABAH DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 78 SABAH METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 79 SABAH METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 80 SABAH METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 81 SABAH INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 82 SABAH COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 83 SABAH AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 84 SABAH BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 85 SARAWAK METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 86 SARAWAK METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

TABLE 87 SARAWAK STANDING SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 88 SARAWAK MECHANICAL SEAM IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 89 SARAWAK DOUBLE LOCK (180-DEGREE SEAM) IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 90 SARAWAK BATTEN PANEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 91 SARAWAK METAL ROOFING MARKET, BY MATERIAL, 2015-2035 (USD THOUSAND)

TABLE 92 SARAWAK STEEL IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 93 SARAWAK METAL ROOFING MARKET, BY PRICE, 2015-2035 (USD THOUSAND)

TABLE 94 SARAWAK METAL ROOFING MARKET, BY COLOR, 2015-2035 (USD THOUSAND)

TABLE 95 SARAWAK STANDARD COLOR IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 96 SARAWAK GRADE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 97 SARAWAK WHITE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 98 SARAWAK BRONZE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 99 SARAWAK RED IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 100 SARAWAK BLUE IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 101 SARAWAK MATTE FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 102 SARAWAK GREY IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 103 SARAWAK DESIGNER FINISHES IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 104 SARAWAK METAL ROOFING MARKET, BY THICKNESS, 2015-2035 (USD THOUSAND)

TABLE 105 SARAWAK METAL ROOFING MARKET, BY LENGTH, 2015-2035 (USD THOUSAND)

TABLE 106 SARAWAK METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 107 SARAWAK INDUSTRIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 108 SARAWAK COMMERCIAL IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 109 SARAWAK AGRICULTURE IN METAL ROOFING MARKET, BY APPLICATION, 2015-2035 (USD THOUSAND)

TABLE 110 SARAWAK BARN IN METAL ROOFING MARKET, BY TYPE, 2015-2035 (USD THOUSAND)

TABLE 111 REST OF MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (USD THOUSAND)

TABLE 112 REST OF MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE, 2015-2035 (THOUSAND SQ FT)

图片列表

FIGURE 1 MALAYSIA METAL ROOFING MARKET

FIGURE 2 MALAYSIA METAL ROOFING MARKET: DATA TRIANGULATION

FIGURE 3 MALAYSIA METAL ROOFING MARKET: DROC ANALYSIS

FIGURE 4 MALAYSIA METAL ROOFING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 MALAYSIA METAL ROOFING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MALAYSIA METAL ROOFING MARKET: MULTIVARIATE MODELLING

FIGURE 7 MALAYSIA METAL ROOFING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MALAYSIA METAL ROOFING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MALAYSIA METAL ROOFING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MALAYSIA METAL ROOFING MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 SEVEN SEGMENTS COMPRISE THE MALAYSIA METAL ROOFING MARKET, BY PRODUCT TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING CONSTRUCTION ACTIVITIES IS EXPECTED TO DRIVE THE MALAYSIA METAL ROOFING MARKET IN THE FORECAST PERIOD OF 2025 TO 2035

FIGURE 15 THE CORRUGATED PANELS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MALAYSIA METAL ROOFING MARKET IN 2025 AND 2035

FIGURE 16 PATENT ANALYSIS BY PRODUCT

FIGURE 17 TOTAL PATENTS IN THE METAL ROOFING MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MALAYSIA METAL ROOFING MARKET

FIGURE 19 MALAYSIA METAL ROOFING MARKET: BY PRODUCT TYPE, 2024

FIGURE 20 MALAYSIA METAL ROOFING MARKET: BY MATERIAL, 2024

FIGURE 21 MALAYSIA METAL ROOFING MARKET: BY PRICE, 2024

FIGURE 22 MALAYSIA METAL ROOFING MARKET: BY COLOR, 2024

FIGURE 23 MALAYSIA METAL ROOFING MARKET: BY THICKNESS, 2024

FIGURE 24 MALAYSIA METAL ROOFING MARKET: BY LENGTH, 2024

FIGURE 25 MALAYSIA METAL ROOFING MARKET: BY APPLICATION, 2024

FIGURE 26 MALAYSIA METAL ROOFING MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。