Mexico Tractors Market

市场规模(十亿美元)

CAGR :

%

USD

23.09 Billion

USD

35.28 Billion

2025

2033

USD

23.09 Billion

USD

35.28 Billion

2025

2033

| 2026 –2033 | |

| USD 23.09 Billion | |

| USD 35.28 Billion | |

|

|

|

|

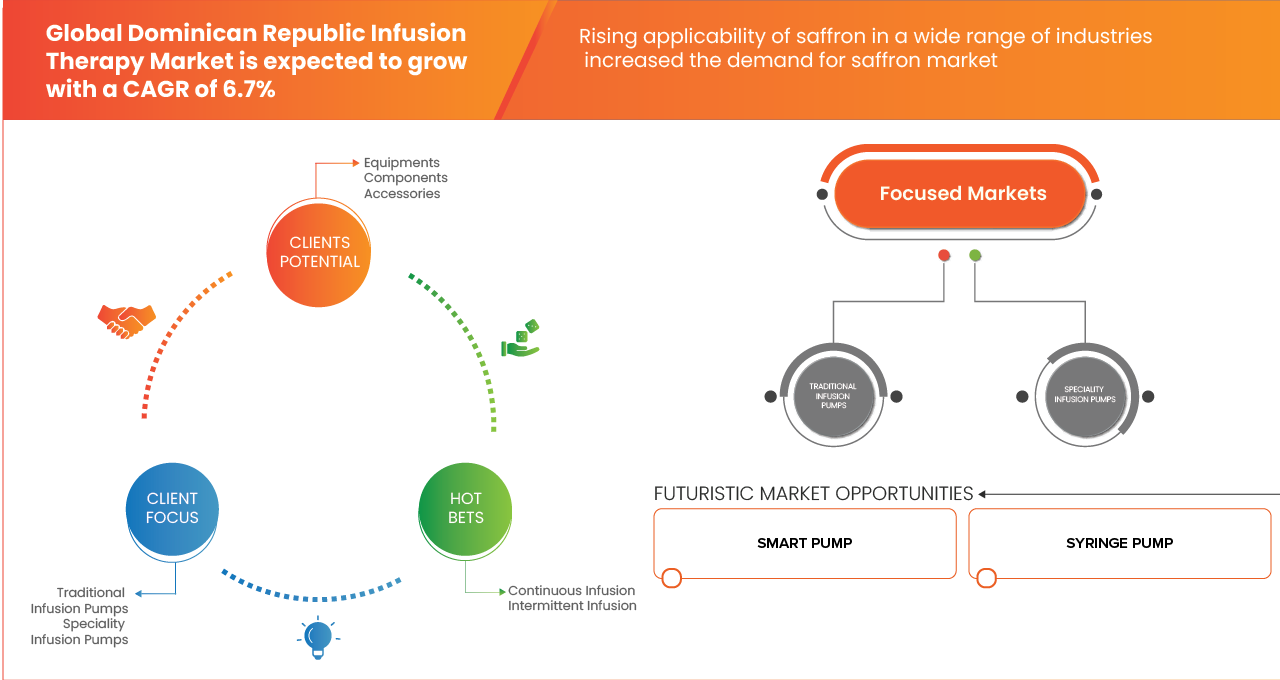

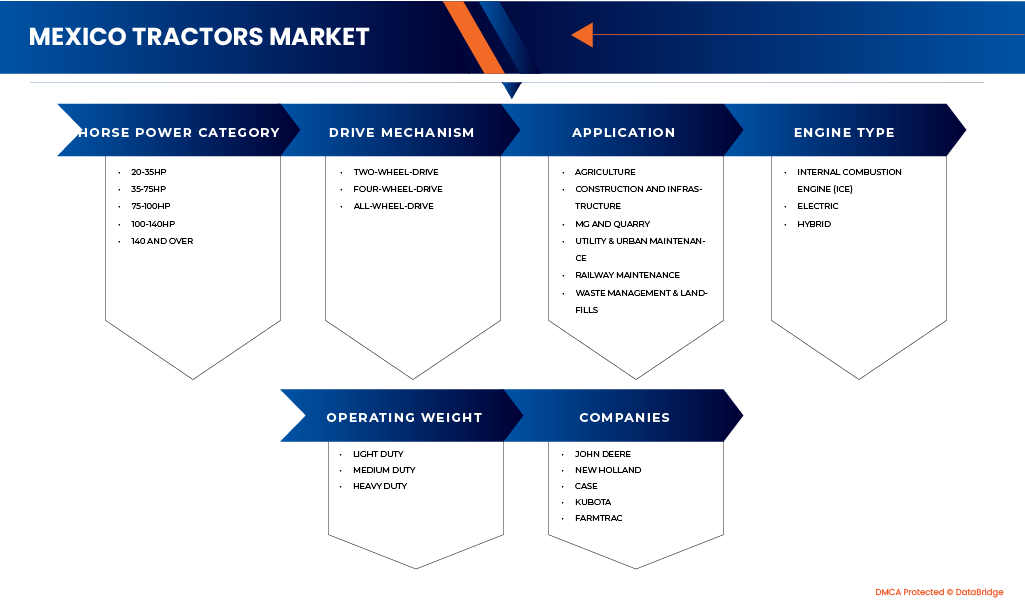

菲律賓墨西哥拖拉機市場,按馬力類別(20-35馬力、35-75馬力、75-100馬力、100-140馬力、140馬力及以上)、驅動方式(兩輪驅動、四輪驅動、全輪驅動)、應用領域(農業、建築物和基礎設施、鎂礦和採石場、公用事業和城市維護、鐵路維護、廢棄物管理和垃圾掩埋場)、引擎類型(內燃機、電動、混合動力)、工作重量(輕型、中型、重型)劃分-產業趨勢及至2032年的預測。

墨西哥拖拉機市場規模

- 2024年墨西哥拖拉機市值為230.9億西班牙比索,預計到2032年將達到352.8億西班牙比索,預測期內複合年增長率為5.59%。

- 強勁的建築活動、快速的城市化進程以及政府主導的基礎設施建設舉措推動了市場擴張,這些因素都促進了對耐用、高品質機械的需求。

- 此外,對環保、低排放和高性能技術的日益重視,為國內外製造商加強市場地位創造了新的機會。

墨西哥拖拉機市場分析

- 墨西哥拖拉機市場正穩步增長,這得益於快速的城市化進程、消費者生活方式的轉變以及健康飲食習慣的日益普及。罐裝和冷凍食品消費量的成長,加上素食族群的增加和便利商店的擴張,都推動了市場需求。

- 然而,蔬果損耗率高、冷鏈基礎設施不足等挑戰仍限製成長。儘管存在這些障礙,零售業數位化、生產商主導的舉措、冷凍技術的進步以及消費者對保質期更長產品的需求不斷增長,都為未來的擴張創造了充滿希望的機會。

- 預計到2025年,墨西哥州(Estado de México)將主導墨西哥拖拉機市場,佔據10.35%的最大市場份額。這一主導地位歸功於該地區快速的城市發展、大規模的基礎設施項目以及強勁的住宅和商業建設活動。此外,主要工業區的存在、不斷擴張的零售中心以及政府對基礎設施現代化的持續投資,進一步鞏固了墨西哥州作為該國拖拉機市場關鍵成長中心的地位。

- 預計在預測期內,哈利斯科州將成為墨西哥拖拉機市場成長最快的地區,複合年增長率將達到7.48%,這主要得益於快速的城市發展、不斷擴大的基礎設施項目以及日益活躍的住宅和商業建築活動。新興產業群聚的出現、零售網路的不斷拓展以及政府對農業和基礎設施現代化投入的增加,進一步鞏固了哈利斯科州作為墨西哥拖拉機市場關鍵成長中心的地位。

- 預計到2025年,35-75馬力細分市場將以24.00%的市佔率主導墨西哥拖拉機市場。這一成長主要得益於該細分市場拖拉機的廣泛普及、經濟高效和多功能性,使其適用於各種農業和工業應用。此外,市場對兼具性能、燃油效率和操作靈活性的中馬力拖拉機的需求不斷增長,也進一步鞏固了該細分市場的強勁地位。

報告範圍及墨西哥拖拉機市場細分

|

屬性 |

墨西哥拖拉機市場關鍵洞察 |

|

涵蓋部分 |

|

|

涵蓋的州 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場狀況的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括監管標準、對舒適和奢華的需求、技術進步、拖拉機在農業革命中的作用、定價分析、案例研究分析、公司比較分析、可持續發展舉措、各州增長機會、PESTLE 分析、供應鏈分析、消費者購買決策過程。 |

墨西哥拖拉機市場趨勢

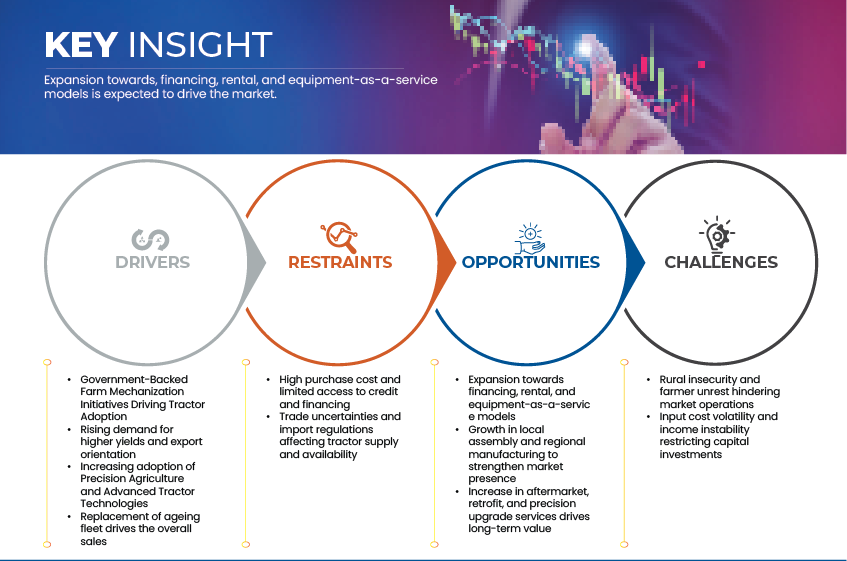

“向融資、租賃和設備即服務模式拓展”

- 墨西哥拖拉機市場的格局正在改變,融資、租賃和設備即服務 (EaaS) 模式的興起正在重塑市場格局。由於高昂的前期成本限制了農民直接擁有拖拉機,他們正越來越多地轉向靈活的替代方案,例如租賃、按使用付費模式和設備共享合作。這些解決方案不僅減輕了農民的經濟負擔,還使他們能夠在無需大量資本投入的情況下使用現代化的高性能拖拉機。在農業金融科技平台、經銷商主導的融資以及機構信貸措施的支持下,這項轉變正在促進墨西哥多樣化農業領域的機械化進程,並提高農業生產力。

- 2025 年 2 月,約翰迪爾墨西哥公司在其「綠色生產計畫」下推出了新的租賃解決方案,為農民提供租賃拖拉機並按使用小時付費的選擇,以支持該國日益增長的設備即服務 (EaaS) 趨勢。

- 2024 年 11 月,BBVA 墨西哥銀行和墨西哥國家農業委員會 (CNA) 簽署了一項合作協議,旨在促進農業設備和技術升級的融資,目標是在墨西哥 20 多個州擴大信貸管道。

- 在墨西哥,融資、租賃和設備即服務 (EaaS) 模式的日益普及正在重塑拖拉機的擁有方式,使中小農戶更容易實現機械化。這些模式透過降低前期成本並提供靈活獲取先進機械的途徑,提高了機械化的普及率,並確保了全國農業資產的更有效率利用。

墨西哥拖拉機市場動態

司機

“政府支持的農業機械化計劃推動拖拉機普及”

- 墨西哥拖拉機市場的成長主要得益於政府支持的農業機械化舉措,這些舉措旨在提高農業生產力和效率。為促進現代化農機設備的普及,政府實施了多項計畫和政策框架,包括「生產促進福祉」(Producción para el Bienestar)計畫和農村信貸支持方案。透過這些舉措,政府向農民提供補貼、財政援助和培訓項目,鼓勵他們從傳統的手工耕作方式過渡到機械化作業。因此,墨西哥中大型農場的拖拉機普及率穩步提高,進一步推動了該國農業部門的現代化進程。

- 2024 年 3 月,墨西哥農業和農村發展部 (SADER) 宣布,政府根據「生產促進福祉」計畫撥款超過 160 億墨西哥比索,透過直接補貼和設備融資來支持中小農戶,從而促進墨西哥農村地區拖拉機的普及和農業機械化。

- 根據墨西哥農業部 2023 年 8 月報道,MasAgro 計劃的擴展在八個農業州引入了本地化的機械化服務中心,為小農戶提供了兩輪和四輪拖拉機,提高了主要作物的生產效率。

- 哈利斯科州政府於 2024 年 10 月宣布啟動“農業機械化支持計劃”,為購買新拖拉機和農具提供部分補貼,體現了該地區為實現農業現代化和通過機械化耕作提高農業產量所做的努力。

- 政府支持的機械化計畫在加速墨西哥拖拉機普及方面發揮著至關重要的作用。透過提供補貼、信貸支持和州級援助,這些措施使農民能夠實現作業現代化並提高生產力。持續的政策支持有望維持拖拉機需求,並加強墨西哥向高效、技術驅動型農業的轉型。

約束

“高昂的購買成本和有限的信貸及融資管道”

- 這些成本壓力促使許多生產者採取選擇性價格調整、減少包裝用量或轉向樹脂依賴性較低的水性配方等措施。然而,全球大宗商品市場持續波動,繼續限制利潤率,並限制了本地製造商投資產品創新和永續發展轉型的能力。

- 高昂的購買成本以及有限的低成本信貸和融資管道仍然是墨西哥推廣拖拉機的主要障礙。大量中小農戶仍面臨資金緊張的困境,儘管機械化優勢顯而易見,但他們難以投資新農機。雖然政府支持的信貸計畫和農業銀行已經存在,但它們的覆蓋範圍往往有限,尤其是在農村和偏遠地區。這種資金缺口持續限制農機設備的現代化,並減緩了墨西哥農業機械化的整體步伐。

- 數位金融平台 Verqor 在 2025 年 3 月指出,超過 90% 的墨西哥農民缺乏獲得正規融資的管道,這限制了他們購買拖拉機和機械化設備的能力。

- 根據美洲開發銀行(IDB)於2024年10月簽署的針對墨西哥農村農業部門的信貸額度協議,2022年只有2.5%的小規模生產者獲得了任何類型的銀行貸款,這反映出用於購買設備的融資非常有限。

- FinTerra在2024年報告中強調,儘管墨西哥農業生產者每年的信貸需求高達180億美元,但現有的正規信貸額度仍低於100億美元,這表明包括拖拉機在內的資產購買存在巨大的融資缺口。

- 高昂的拖拉機成本和有限的融資管道仍然是墨西哥農業機械化的主要障礙。許多小農戶難以獲得負擔得起的貸款,這限制了他們升級設備。擴大農村信貸管道和補貼計畫對於加快拖拉機普及和提高農業生產力至關重要。

墨西哥拖拉機市場範圍

市場按馬力等級、驅動機構、應用、引擎類型、工作重量進行細分。

- 按馬力類別

根據馬力大小,墨西哥拖拉機市場可分為20-35馬力、35-75馬力、75-100馬力、100-140馬力以及140馬力及以上五個級別。預計到2025年,35-75馬力等級將佔據市場主導地位,市佔率達24.00%,主要得益於其價格實惠、操作簡便,並且非常適合中小農場使用。該級別拖拉機因其高效的性能和較低的維護成本,深受墨西哥不同農業環境下農民的青睞,尤其適用於輕型農活。

在墨西哥拖拉機市場,35-75馬力細分市場預計將成為成長最快的馬力級別,在預測期內複合年增長率將達到6.14%。這一增長主要得益於中小型農場對中等功率拖拉機的需求不斷增長,這類拖拉機在性能、燃油效率和多功能性方面實現了最佳平衡。此外,對經濟高效機械化的需求不斷增長,以及混合用途農業作業的擴張和政府對中檔設備購買的補貼,進一步鞏固了該細分市場的成長前景。同時,技術進步和適用於田間作業和運輸的多功能拖拉機的推出,預計將在未來幾年加速市場需求。

- 透過申請

根據應用領域,墨西哥拖拉機市場可分為農業、建築與基礎設施、採礦與採石、公用事業與城市維護、鐵路維護以及廢棄物管理與掩埋場。預計到2025年,農業領域將佔據市場主導地位,市佔率高達60.30%,主要得益於拖拉機在耕作、播種和收割等作業中的廣泛應用。農業拖拉機價格適中且易於獲取,加之政府推行農業機械化和改善中小農戶信貸管道的各項計劃,進一步鞏固了農業領域的領先地位。

預計建築和基礎設施產業將實現最快成長,預測期內複合年增長率將達到5.92%。這一增長主要得益於基礎設施投資的增加、快速的城市化進程以及不斷擴大的公共工程項目,這些因素都增加了對重型拖拉機和土方機械的需求。此外,政府主導的發展計畫、私人建築活動以及為提高效率和永續性而採用的先進技術設備,也將在未來幾年進一步推動該產業的擴張。

- 按引擎類型

根據引擎類型,墨西哥拖拉機市場可分為內燃機(ICE)、電動和混合動力三大類。預計到2025年,內燃機(ICE)拖拉機將佔據市場主導地位,市佔率高達93.11%,主要得益於其久經考驗的可靠性、高功率輸出以及相比新興替代技術更具成本效益。柴油和汽油基礎設施的廣泛普及,加上較低的前期成本和強大的售後服務網絡,將繼續鞏固內燃機拖拉機在農業和非農業應用領域的領先地位。

預計內燃機(ICE)細分市場也將成為成長最快的領域,在預測期內複合年增長率將達到5.68%。這一增長主要得益於農業機械化程度的提高、基礎設施項目的擴張以及對能夠應對各種地形和作業負荷的高扭矩拖拉機的需求不斷增長。此外,燃油效率、排放控制技術和引擎耐久性的持續進步,也鞏固了內燃機拖拉機的持續普及,即便市場正逐步向混合動力和電動拖拉機轉型。

- 透過驅動機構

根據驅動方式,墨西哥拖拉機市場可分為兩輪驅動、四輪驅動和全輪驅動。預計到2025年,兩輪驅動拖拉機將佔據市場主導地位,市佔率高達93.16%,主要歸功於其價格實惠、易於維護以及適用於輕型至中型農業作業。中小農戶尤其青睞這類拖拉機,用於耕作、運輸和犁地等日常田間作業,尤其是在地勢相對平坦的地區。較低的擁有成本、燃油效率以及本地化的服務網絡進一步促進了其在墨西哥農村地區的普及。

預計兩輪驅動拖拉機細分市場將成為成長最快的市場,在預測期內複合年增長率將達到5.75%。這一增長得益於小農戶農業機械化程度的提高、農村收入水平的提升以及政府推動農業現代化的各項計劃。此外,市場對經濟高效、節能環保且用途廣泛的拖拉機(用於作物種植、運輸和土地耕作)的需求不斷增長,也推動了該細分市場的擴張。兩輪驅動拖拉機在農業和輕型工程機械應用領域的強勁表現,預示著在2032年之前將繼續保持市場主導地位。

- 按操作重量

根據作業重量,墨西哥拖拉機市場可分為輕型、中型和重型。預計到2025年,輕型拖拉機將佔據市場主導地位,市佔率高達78.63%,主要得益於其價格實惠、用途廣泛以及適用於中小規模農業作業。輕型拖拉機廣泛應用於小型農場和果園的耕作、翻土、割草和物料運輸等作業。其緊湊的設計、燃油效率高以及易於操控的特點,使其對土地面積有限、田地佈局狹窄的地區尤為具有吸引力。此外,小農戶機械化程度的提高、融資管道的拓展以及入門級拖拉機在墨西哥農村地區的普及,也推動了該細分市場的發展。

預計中型拖拉機市場也將是成長最快的細分市場,在預測期內複合年增長率將達到 6.00%。這一成長主要歸功於商業農業的擴張、建築和公用事業領域拖拉機使用量的增加,以及對能夠同時勝任農業和工業作業的多用途、高扭矩機械的需求不斷增長。中型拖拉機正受到中等規模農場和承包商的青睞,他們尋求的是兼具動力、耐用性和作業效率的設備。此外,傳動系統、液壓性能和燃油效率的技術進步也進一步加速了中型拖拉機在墨西哥市場的普及。

墨西哥拖拉機市場區域分析

- 預計到2025年,墨西哥州(Estado de México)將主導墨西哥拖拉機市場,佔據10.35%的最大市場份額。這一主導地位歸功於該地區快速的城市發展、大規模的基礎設施項目以及強勁的住宅和商業建設活動。此外,主要工業區的存在、不斷擴張的零售中心以及政府對基礎設施現代化的持續投資,進一步鞏固了墨西哥州作為該國拖拉機市場關鍵成長中心的地位。

- 在預測期內,哈利斯科州預計將成為墨西哥拖拉機市場成長最快的地區,複合年增長率 (CAGR) 為 7.48%,這主要得益於快速的城市發展、不斷擴大的基礎設施項目以及日益活躍的住宅和商業建築活動。新興產業群聚的出現、不斷增長的零售網絡以及政府對農業和基礎設施現代化投入的增加,進一步鞏固了哈利斯科州作為墨西哥拖拉機市場關鍵增長中心的地位。

哈利斯科州拖拉機市場洞察

哈利斯科州拖拉機市場是墨西哥拖拉機市場的重要成長中心,其成長動力主要來自農業的快速現代化、不斷擴大的農業綜合企業投資以及政府對機械化的大力支持。該地區作物種類豐富、食品加工業蓬勃發展,以及信貸和融資管道的改善,進一步加速了拖拉機的普及。此外,基礎設施建設、灌溉系統的擴建以及商業化農業的興起,預計將進一步鞏固哈利斯科州作為墨西哥成長最快的區域拖拉機市場之一的地位。

吉娃娃拖拉機市場洞察

奇瓦瓦州拖拉機市場預計將穩定成長,這主要得益於農業活動的擴張、灌溉基礎設施投資的增加以及先進農機設備的普及。該地區高度重視作物多樣化,尤其是在穀物和園藝作物方面,加之政府鼓勵農業機械化的激勵措施,持續推動對拖拉機的需求。此外,農村物流的改善、融資通路的拓展以及本地經銷商和服務網絡的日益完善,預計也將進一步促進奇瓦瓦州拖拉機市場在預測期內的擴張。

市場上的主要市場領導者包括:

- 迪爾公司(美國)

- CNH Industrial NV(英國)

- 久保田株式會社(日本)

- Farmtrac(印度)

- 樂沃集團(中國)

- AGCO公司(馬西·弗格森)(美國)

- 印度拖拉機和農業設備有限公司

- 麥考密克(母公司:Argo Tractors SpA)(義大利)

- 馬恆達(印度)

- 索利斯(中國)

- 索納利卡(印度)

- 中聯重科(中國)

- 圓通集團(中國)

墨西哥拖拉機市場最新動態

- 2025年10月,雷沃在武漢舉行的中國國際農業機械展覽會(CIAME)上展示了其新能源拖拉機系列和中國首個智慧農業人工智慧模型,展現了其對智慧化、電氣化和全鏈智慧農業解決方案的承諾。

- 2025年9月,麥考密克(McCormick)推出了旗艦級拖拉機X8.634 VT-Drive,該機型擁有340馬力,配備先進的VT-Drive變速箱和創新的智慧駕駛室,顯著提升了操作員的舒適性和視野。這款拖拉機集強勁動力、尖端科技和舒適性於一身,有望角逐2026年度最佳拖拉機大獎。

- 2025 年 9 月,AGCO 宣布向其 AGCO Power 工廠投資 5,400 萬歐元,以擴大低排放引擎的生產,從而加強其對永續、高效動力系統的承諾。

- 2025 年 8 月,TAFE 在阿瓜斯卡連特斯開設了一家價值 2.8 億墨西哥比索的拖拉機組裝廠,旨在提高組裝能力,創造 300 多個就業崗位,並生產符合墨西哥可持續交通目標的電動拖拉機。

- 2025年1月,馬恆達墨西哥公司在拉丁美洲最大的農業綜合企業展覽會之一-墨西哥國際農業食品展覽會(Expo Agroalimentaria)上展示了最新推出的Mahindra 2025拖拉機。這款拖拉機以其強勁的性能和專為滿足墨西哥農民需求而量身打造的特點而備受矚目。馬恆達在墨西哥市場擁有強大的影響力,這得益於其高效的柴油引擎性能、充足的零件供應、完善的保固服務和靈活的融資方案,這些優勢使其深受當地農民的青睞。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 COUNTRY-WISE TRACTOR ECOSYSTEM

4.2.1 INTRODUCTION

4.2.2 GLOBAL OVERVIEW AND MARKET DYNAMICS

4.2.3 MEXICO’S ROLE IN THE GLOBAL TRACTOR SUPPLY CHAIN

4.2.4 EMERGING SHIFTS IN GLOBAL TRADE PATTERNS

4.2.5 STRATEGIC IMPLICATIONS FOR MEXICO

4.3 CASE STUDY ANALYSIS

4.3.1 CASE STUDY 1: JOHN DEERE & THE HIGH-VALUE EXPORT FARMER

4.3.2 CASE STUDY 2: MASSEY FERGUSON & THE FINANCING CONUNDRUM

4.3.3 CASE STUDY 3: MAHINDRA & THE SMALLHOLDER "EJIDATARIO"

4.3.4 CASE STUDY 5: CNH INDUSTRIAL'S "PRECISION FOR ALL" STRATEGY

4.3.5 CASE STUDY 3: KUBOTA'S "RIGHT-SIZING FOR SMALLHOLDERS" STRATEGY

4.3.6 CONCLUSION

4.4 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.5 CONSUMER BUYING BEHAVIOR

4.6 CONSUMER PURCHASE DECISION PROCESS

4.6.1 PROBLEM RECOGNITION

4.6.2 INFORMATION SEARCH

4.6.3 INTERNAL SEARCH

4.6.4 EXTERNAL SEARCH

4.6.5 ALTERNATIVE EVALUATION

4.6.6 PURCHASE DECISION

4.6.7 POST-PURCHASE BEHAVIOR

4.6.8 INFLUENCING FACTORS

4.7 DEMAND FOR COMFORT AND LUXURY

4.7.1 ERGONOMIC CAB DESIGN

4.7.2 ADVANCED CLIMATE CONTROL

4.7.3 DIGITAL CONTROLS AND CONNECTIVITY

4.7.4 SUPERIOR SEATING AND OPERATOR COMFORT

4.7.5 ALL-WEATHER CABINS

4.7.6 ENHANCED SAFETY FEATURES

4.8 TECHNOLOGICAL ADVANCEMENTS

4.8.1 OVERVIEW

4.8.2 KEY TECHNOLOGY DOMAINS

4.8.2.1 PRECISION AGRICULTURE AND CONNECTIVITY

4.8.2.2 AUTOMATION & SMART MACHINES

4.8.2.3 SUSTAINABLE & ALTERNATIVE POWERTRAINS

4.8.2.4 AFTER-SALES, LOCALISATION & SERVICE TECH

4.8.3 CONCLUSION

4.9 KEY STRATEGIC INITIATIVES — MEXICO TRACTOR MARKET

4.9.1 PRODUCT INNOVATION AND TECHNOLOGICAL INTEGRATION

4.9.2 STRENGTHENED CAPITAL MARKET POSITIONING

4.9.3 MANUFACTURING EXPANSION AND SUPPLY CHAIN STRENGTHENING

4.9.4 STRATEGIC OEM COLLABORATIONS AND PRODUCT DIVERSIFICATION

4.9.5 DOMESTIC MANUFACTURING EXPANSION AND EMPLOYMENT GENERATION

4.9.6 PRODUCT DIFFERENTIATION AND HIGH-PERFORMANCE SEGMENT GROWTH

4.9.7 STRATEGIC SYNERGY AND MARKET IMPLICATIONS

4.9.8 OUTLOOK AND STRATEGIC CONCLUSION

4.1 PRICING ANALYSIS

4.10.1 COMPACT / SPECIALIZED TRACTORS (20–40 HP) — SMALLHOLDERS, ORCHARDS, VINEYARDS, VEGETABLE GROWERS

4.10.2 UTILITY / MID-UTILITY TRACTORS (40–80 HP) — SMALL & MEDIUM FARMS (MOST COMMON)

4.10.3 MID-TO-HIGH / PREMIUM-MID (80–150 HP) — COMMERCIAL FARMS, CONTRACTORS

4.10.4 HIGH-POWER & SPECIALTY (>150 HP) — LARGE COMMERCIAL, INDUSTRIAL, CUSTOM WORK

4.11 ROLE OF TRACTORS IN AGRICULTURAL REVOLUTION

4.11.1 HISTORICAL CONTEXT

4.11.2 STRUCTURAL IMPACT ON AGRICULTURE

4.11.2.1 PRODUCTIVITY GROWTH

4.11.2.2 EXPANSION OF CULTIVATED AREA

4.11.2.3 EMPLOYMENT TRANSFORMATION

4.11.3 GOVERNMENT AND INSTITUTIONAL SUPPORT

4.11.4 MODERN MECHANIZATION WAVE

4.11.5 SOCIOECONOMIC OUTCOMES

4.11.5.1 HIGHER RURAL INCOMES IN MECHANIZED REGIONS

4.11.5.2 EXPORT COMPETITIVENESS IN FRUITS, VEGETABLES, AND GRAINS

4.11.5.3 REDUCED RURAL-URBAN MIGRATION IN MECHANISED ZONES

4.11.6 CONCLUSION

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 UPSTREAM INPUTS: RAW MATERIALS AND COMPONENTS

4.12.1.1 RAW MATERIAL SOURCING

4.12.1.2 COMPONENT MANUFACTURING & SUB-ASSEMBLY

4.12.2 MANUFACTURING & ASSEMBLY OPERATIONS

4.12.2.1 MANUFACTURING FOOTPRINT IN MEXICO

4.12.2.2 PRODUCT CONFIGURATION & LOCALIZATION

4.12.3 LOGISTICS, DISTRIBUTION & DEALER NETWORKS

4.12.3.1 INBOUND LOGISTICS

4.12.3.2 DEALER NETWORK & OUTBOUND DISTRIBUTION

4.12.3.3 AFTER-SALES SERVICE AND PARTS FLOW

4.12.4 MARKET ACCESS, FINANCING & DEMAND-PULL MECHANISMS

4.12.4.1 FINANCING & MECHANIZATION SCHEMES

4.12.4.2 IMPORT/EXPORT AND TRADE FLOWS

4.12.4.3 DEMAND VOLATILITY AND SEASONALITY

4.12.5 RISK FACTORS AND SUPPLY-CHAIN DISRUPTIONS

4.12.5.1 RAW-MATERIAL AND COMPONENT SUPPLY RISK

4.12.5.2 TRADE-POLICY, TARIFF AND EXCHANGE-RATE RISK

4.12.5.3 INFRASTRUCTURE, LOGISTICS AND TRANSPORTATION RISK

4.12.5.4 DEMAND-SIDE & REPLACEMENT-CYCLE RISK

4.12.5.5 AFTER-SALES AND SPARE-PART RISK

4.12.5.6 TECHNOLOGY, SUSTAINABILITY & REGULATORY RISK

4.13 SUSTAINABILITY INITIATIVES

4.13.1 GOVERNMENT SUPPORT FOR SUSTAINABLE FARMING

4.13.2 ADOPTION OF FUEL-EFFICIENT AND ALTERNATIVE-FUEL TRACTORS

4.13.3 PRECISION AGRICULTURE AND SMART TECHNOLOGIES

4.13.4 TRAINING AND CAPACITY BUILDING

4.13.5 EMERGING MARKET TRENDS

4.13.6 CLIMATE-RESPONSIVE AGRICULTURE

4.13.7 CONCLUSION

4.14 STATE-WISE GROWTH OPPORTUNITIES

4.14.1 NORTHERN AND NORTHWESTERN STATES (SINALOA, SONORA, BAJA CALIFORNIA, CHIHUAHUA, COAHUILA)

4.14.2 CENTRAL REGION (JALISCO, GUANAJUATO, MICHOACÁN, PUEBLA, ESTADO DE MÉXICO)

4.14.3 SOUTHERN AND SOUTHEASTERN STATES (OAXACA, CHIAPAS, YUCATÁN, QUINTANA ROO, TABASCO)

4.14.4 WESTERN PLATEAU AND GRAIN BELT (ZACATECAS, DURANGO, SAN LUIS POTOSÍ)

4.14.5 URBAN AND INDUSTRIAL APPLICATIONS (MEXICO CITY, NUEVO LEÓN, QUERÉTARO)

5 REGULATORY STANDARDS

5.1 CERTIFICATION OF AGRICULTURAL MACHINERY & TRACTORS

5.2 SAFETY AND MACHINERY STANDARDS

5.3 IMPORT & EMISSION REQUIREMENTS

5.4 CIRCULATION ON ROADS & LOCAL USAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GOVERNMENT-BACKED FARM MECHANIZATION INITIATIVES DRIVING TRACTOR ADOPTION

6.1.2 RISING DEMAND FOR HIGHER YIELDS AND EXPORT ORIENTATION

6.1.3 INCREASING ADOPTION OF PRECISION AGRICULTURE AND ADVANCED TRACTOR TECHNOLOGIES

6.1.4 REPLACEMENT OF AGEING FLEET DRIVES THE OVERALL SALES

6.2 RESTRAINTS

6.2.1 HIGH PURCHASE COST AND LIMITED ACCESS TO CREDIT AND FINANCING

6.2.2 TRADE UNCERTAINTIES AND IMPORT REGULATIONS AFFECTING TRACTOR SUPPLY AND AVAILABILITY

6.3 OPPORTUNITY

6.3.1 EXPANSION TOWARDS FINANCING, RENTAL, AND EQUIPMENT-AS-A-SERVICE MODELS

6.3.2 GROWTH IN LOCAL ASSEMBLY AND REGIONAL MANUFACTURING TO STRENGTHEN MARKET PRESENCE

6.3.3 INCREASE IN AFTERMARKET, RETROFIT, AND PRECISION UPGRADE SERVICES DRIVES LONG-TERM VALUE

6.4 CHALLENGES

6.4.1 RURAL INSECURITY AND FARMER UNREST HINDERING MARKET OPERATIONS

6.4.2 INPUT COST VOLATILITY AND INCOME INSTABILITY RESTRICTING CAPITAL INVESTMENTS

7 MEXICO TRACTOR MARKET, BY HORSE POWER CATEGORY

7.1 OVERVIEW

7.2 20-35HP

7.3 35-75HP

7.4 75-100HP

7.5 100-140HP

7.6 140 AND OVER

8 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM

8.1 OVERVIEW

8.2 TWO-WHEEL-DRIVE

8.3 FOUR-WHEEL-DRIVE

8.4 ALL-WHEEL-DRIVE

9 MEXICO TRACTORS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AGRICULTURE

9.3 CONSTRUCTION AND INFRASTRUCTURE

9.4 MINING AND QUARRY

9.5 UTILITY & URBAN MAINTENANCE

9.6 RAILWAY MAINTENANCE

9.7 WASTE MANAGEMENT & LANDFILLS

10 MEXICO TRACTORS MARKET, BY ENGINE TYPE

10.1 OVERVIEW

10.2 INTERNAL COMBUSTION ENGINE (ICE)

10.3 ELECTRIC

10.4 HYBRID

11 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT

11.1 OVERVIEW

11.2 LIGHT DUTY

11.3 MEDIUM DUTY

11.4 HEAVY DUTY

12 MEXICO TRACTOR MARKET, BY STATE

12.1 OVERVIEW

12.1.1 AGUASCALIENTES

12.1.2 BAJA CALIFORNIA SUR

12.1.3 CAMPECHE

12.1.4 CHIAPAS

12.1.5 CHIHUAHUA

12.1.6 CIUDAD DE MÉXICO

12.1.7 COAHUILA

12.1.8 DURANGO

12.1.9 GUANAJUATO

12.1.10 GUERRERO

12.1.11 HIDALGO

12.1.12 JALISCO

12.1.13 MÉXICO (ESTADO DE MÉXICO)

12.1.14 MICHOACÁN

12.1.15 MORELOS

12.1.16 NAYARIT

12.1.17 NUEVO LEÓN

12.1.18 OAXACA

12.1.19 PUEBLA

12.1.20 QUERÉTARO

12.1.21 QUANTA ROO

12.1.22 SAN LUIS POTOSÍ

12.1.23 SALONA

12.1.24 SONORA

12.1.25 TABASCO

12.1.26 TAMAULIPAS

12.1.27 TLAXCALA

12.1.28 VERACRUZ

12.1.29 YUCATÁN

12.1.30 ZACATECAS

13 MEXICO TRACTORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CNH INDUSTRIAL N.V.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.3.1 NEW HOLLAND

15.1.3.2 CASE

15.1.4 RECENT DEVELOPMENT

15.2 DEERE & COMPANY

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 AGCO CORPORATION (MASSEY FERGUSON).

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 KUBOTA CORPORATION.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MAHINDRA&MAHINDRA LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FARMTRAC MÉXICO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 LOVOL CORPORATION.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 MCCORMICK (A SUBSIDIARY OF ARGO TRACTORS S.P.A.)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 SOLIS MEXICO TRACTOR

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 SONALIKA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 TRACTORS AND FARM EQUIPMENT LIMITED

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 YTO GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ZOOMLION HEAVY INDUSTRY SCIENCE&TECHNOLOGY CO., LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

TABLE 2 TRACTOR PRICING ANALYSIS BY TYPE AND HORSEPOWER

TABLE 3 TIMELINE: TRACTORS AND AGRICULTURAL REVOLUTION IN MEXICO

TABLE 4 STATE-WISE GROWTH OPPORTUNITIES IN THE MEXICO

TABLE 5 KEY REGULATORY STANDARDS GOVERNING TRACTORS IN MEXICO

TABLE 6 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 7 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 8 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 9 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 10 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 ( THOUSAND)

TABLE 11 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 12 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 ( THOUSAND)

TABLE 13 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 14 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 ( THOUSAND)

TABLE 15 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 16 MEXICO TRACTOR MARKET, BY STATE, 2018-2032 (ESP THOUSAND)

TABLE 17 MEXICO TRACTOR MARKET, BY STATE, 2018-2032 (UNITS)

TABLE 18 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 19 MEXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 20 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 21 MEXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 22 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 23 MEXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 24 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 25 MEXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 26 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 27 MEXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 28 AGUASCALIENTES TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 29 AGUASCALIENTES TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 30 AGUASCALIENTES TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 31 AGUASCALIENTES TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 32 AGUASCALIENTES TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 33 AGUASCALIENTES TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 34 AGUASCALIENTES TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 35 AGUASCALIENTES TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 36 AGUASCALIENTES TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 37 AGUASCALIENTES TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 38 BAJA CALIFORNIA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 39 BAJA CALIFORNIA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 40 BAJA CALIFORNIA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 41 BAJA CALIFORNIA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 42 BAJA CALIFORNIA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 43 BAJA CALIFORNIA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 44 BAJA CALIFORNIA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 45 BAJA CALIFORNIA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 46 BAJA CALIFORNIA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 47 BAJA CALIFORNIA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 48 BAJA CALIFORNIA SUR TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 49 BAJA CALIFORNIA SUR TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 50 BAJA CALIFORNIA SUR TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 51 BAJA CALIFORNIA SUR TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 52 BAJA CALIFORNIA SUR TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 53 BAJA CALIFORNIA SUR TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 54 BAJA CALIFORNIA SUR TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 55 BAJA CALIFORNIA SUR TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 56 BAJA CALIFORNIA SUR TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 57 BAJA CALIFORNIA SUR TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 58 CAMPECHE TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 59 CAMPECHE TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 60 CAMPECHE TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 61 CAMPECHE TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 62 CAMPECHE TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 63 CAMPECHE TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 64 CAMPECHE TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 65 CAMPECHE TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 66 CAMPECHE TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 67 CAMPECHE TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 68 CHIAPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 69 CHIAPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 70 CHIAPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 71 CHIAPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 72 CHIAPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 73 CHIAPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 74 CHIAPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 75 CHIAPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 76 CHIAPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 77 CHIAPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 78 CHIHUAHUA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 79 CHIHUAHUA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 80 CHIHUAHUA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 81 CHIHUAHUA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 82 CHIHUAHUA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 83 CHIHUAHUA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 84 CHIHUAHUA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 85 CHIHUAHUA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 86 CHIHUAHUA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 87 CHIHUAHUA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 88 CIUDAD DE MÉXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 89 CIUDAD DE MÉXICO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 90 CIUDAD DE MÉXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 91 CIUDAD DE MÉXICO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 92 CIUDAD DE MÉXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 93 CIUDAD DE MÉXICO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 94 CIUDAD DE MÉXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 95 CIUDAD DE MÉXICO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 96 CIUDAD DE MÉXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 97 CIUDAD DE MÉXICO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 98 COAHUILA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 99 COAHUILA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 100 COAHUILA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 101 COAHUILA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 102 COAHUILA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 103 COAHUILA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 104 COAHUILA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 105 COAHUILA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 106 COAHUILA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 107 COAHUILA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 108 COLIMA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 109 COLIMA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 110 COLIMA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 111 COLIMA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 112 COLIMA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 113 COLIMA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 114 COLIMA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 115 COLIMA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 116 COLIMA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 117 COLIMA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 118 DURANGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 119 DURANGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 120 DURANGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 121 DURANGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 122 DURANGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 123 DURANGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 124 DURANGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 125 DURANGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 126 DURANGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 127 DURANGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 128 GUANAJUATO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 129 GUANAJUATO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 130 GUANAJUATO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 131 GUANAJUATO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 132 GUANAJUATO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 133 GUANAJUATO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 134 GUANAJUATO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 135 GUANAJUATO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 136 GUANAJUATO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 137 GUANAJUATO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 138 GUERRERO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 139 GUERRERO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 140 GUERRERO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 141 GUERRERO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 142 GUERRERO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 143 GUERRERO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 144 GUERRERO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 145 GUERRERO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 146 GUERRERO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 147 GUERRERO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 148 HIDALGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 149 HIDALGO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 150 HIDALGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 151 HIDALGO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 152 HIDALGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 153 HIDALGO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 154 HIDALGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 155 HIDALGO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 156 HIDALGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 157 HIDALGO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 158 JALISCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 159 JALISCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 160 JALISCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 161 JALISCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 162 JALISCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 163 JALISCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 164 JALISCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 165 JALISCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 166 JALISCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 167 JALISCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 168 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 169 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 170 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 171 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 172 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 173 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 174 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 175 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 176 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 177 MÉXICO (ESTADO DE MÉXICO) TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 178 MICHOACÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 179 MICHOACÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 180 MICHOACÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 181 MICHOACÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 182 MICHOACÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 183 MICHOACÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 184 MICHOACÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 185 MICHOACÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 186 MICHOACÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 187 MICHOACÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 188 MORELOS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 189 MORELOS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 190 MORELOS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 191 MORELOS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 192 MORELOS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 193 MORELOS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 194 MORELOS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 195 MORELOS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 196 MORELOS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 197 MORELOS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 198 NAYARIT TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 199 NAYARIT TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 200 NAYARIT TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 201 NAYARIT TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 202 NAYARIT TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 203 NAYARIT TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 204 NAYARIT TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 205 NAYARIT TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 206 NAYARIT TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 207 NAYARIT TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 208 NUEVO LEÓN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 209 NUEVO LEÓN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 210 NUEVO LEÓN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 211 NUEVO LEÓN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 212 NUEVO LEÓN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 213 NUEVO LEÓN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 214 NUEVO LEÓN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 215 NUEVO LEÓN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 216 NUEVO LEÓN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 217 NUEVO LEÓN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 218 OAXACA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 219 OAXACA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 220 OAXACA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 221 OAXACA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 222 OAXACA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 223 OAXACA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 224 OAXACA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 225 OAXACA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 226 OAXACA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 227 OAXACA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 228 PUEBLA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 229 PUEBLA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 230 PUEBLA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 231 PUEBLA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 232 PUEBLA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 233 PUEBLA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 234 PUEBLA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 235 PUEBLA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 236 PUEBLA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 237 PUEBLA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 238 QUERÉTARO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 239 QUERÉTARO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 240 QUERÉTARO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 241 QUERÉTARO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 242 QUERÉTARO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 243 QUERÉTARO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 244 QUERÉTARO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 245 QUERÉTARO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 246 QUERÉTARO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 247 QUERÉTARO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 248 QUANTA ROO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 249 QUANTA ROO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 250 QUANTA ROO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 251 QUANTA ROO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 252 QUANTA ROO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 253 QUANTA ROO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 254 QUANTA ROO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 255 QUANTA ROO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 256 QUANTA ROO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 257 QUANTA ROO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 258 SAN LUIS POTOSÍ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 259 SAN LUIS POTOSÍ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 260 SAN LUIS POTOSÍ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 261 SAN LUIS POTOSÍ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 262 SAN LUIS POTOSÍ TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 263 SAN LUIS POTOSÍ TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 264 SAN LUIS POTOSÍ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 265 SAN LUIS POTOSÍ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 266 SAN LUIS POTOSÍ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 267 SAN LUIS POTOSÍ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 268 SALONA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 269 SALONA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 270 SALONA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 271 SALONA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 272 SALONA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 273 SALONA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 274 SALONA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 275 SALONA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 276 SALONA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 277 SALONA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 278 SONORA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 279 SONORA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 280 SONORA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 281 SONORA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 282 SONORA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 283 SONORA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 284 SONORA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 285 SONORA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 286 SONORA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 287 SONORA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 288 TABASCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 289 TABASCO TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 290 TABASCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 291 TABASCO TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 292 TABASCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 293 TABASCO TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 294 TABASCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 295 TABASCO TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 296 TABASCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 297 TABASCO TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 298 TAMAULIPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 299 TAMAULIPAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 300 TAMAULIPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 301 TAMAULIPAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 302 TAMAULIPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 303 TAMAULIPAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 304 TAMAULIPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 305 TAMAULIPAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 306 TAMAULIPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 307 TAMAULIPAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 308 TLAXCALA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 309 TLAXCALA TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 310 TLAXCALA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 311 TLAXCALA TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 312 TLAXCALA TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 313 TLAXCALA TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 314 TLAXCALA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 315 TLAXCALA TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 316 TLAXCALA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 317 TLAXCALA TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 318 VERACRUZ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 319 VERACRUZ TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 320 VERACRUZ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 321 VERACRUZ TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 322 VERACRUZ TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 323 VERACRUZ TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 324 VERACRUZ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 325 VERACRUZ TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 326 VERACRUZ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 327 VERACRUZ TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 328 YUCATÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 329 YUCATÁN TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 330 YUCATÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 331 YUCATÁN TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 332 YUCATÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 333 YUCATÁN TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 334 YUCATÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 335 YUCATÁN TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 336 YUCATÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 337 YUCATÁN TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

TABLE 338 ZACATECAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (ESP THOUSAND)

TABLE 339 ZACATECAS TRACTORS MARKET, BY HORSE POWER CATEGORY, 2018-2032 (UNITS)

TABLE 340 ZACATECAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (ESP THOUSAND)

TABLE 341 ZACATECAS TRACTORS MARKET, BY DRIVE MECHANISM, 2018-2032 (UNITS)

TABLE 342 ZACATECAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (ESP THOUSAND)

TABLE 343 ZACATECAS TRACTORS MARKET, BY APPLICATION, 2018-2032 (UNITS)

TABLE 344 ZACATECAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (ESP THOUSAND)

TABLE 345 ZACATECAS TRACTORS MARKET, BY ENGINE TYPE, 2018-2032 (UNITS)

TABLE 346 ZACATECAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (ESP THOUSAND)

TABLE 347 ZACATECAS TRACTORS MARKET, BY OPERATING WEIGHT, 2018-2032 (UNITS)

图片列表

FIGURE 1 MEXICO TRACTOR MARKET

FIGURE 2 MEXICO TRACTOR MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO TRACTOR MARKET: DROC ANALYSIS

FIGURE 4 MEXICO TRACTOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO TRACTOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO TRACTOR MARKET: MULTIVARIATE MODELLING

FIGURE 7 MEXICO TRACTOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MEXICO TRACTOR MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MEXICO TRACTOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 MEXICO TRACTOR MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE GLOBAL ELECTRICAL STEEL MARKET, BY HORSE POWER CATEGORY (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GOVERNMENT-BACKED FARM MECHANIZATION INITIATIVES DRIVING TRACTOR ADOPTION TO DRIVE THE MEXICO TRACTOR MARKET IN THE FORECAST PERIOD

FIGURE 15 THE HORSE POWER CATEGORY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO TRACTOR MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 MEXICO TRACTOR MARKET: BY HORSE POWER CATEGORY, 2024

FIGURE 18 MEXICO TRACTORS MARKET: BY DRIVE MECHANISM, 2024

FIGURE 19 MEXICO TRACTORS MARKET: APPLICATION, 2024

FIGURE 20 MEXICO TRACTORS MARKET: ENGINE TYPE, 2024

FIGURE 21 MEXICO TRACTORS MARKET: OPERATING WEIGHT, 2024

FIGURE 22 MEXICO TRACTORS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。