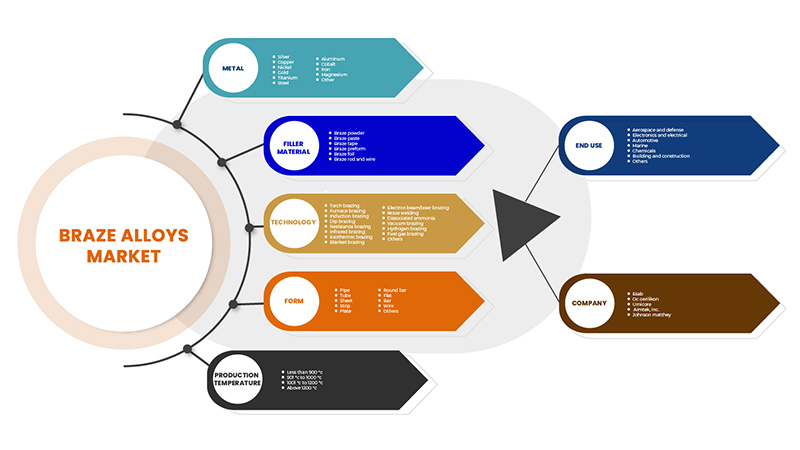

中东和非洲钎焊合金市场,按金属(镍、钴、银、金、铝、铜、钢、铁、镁、钛等)、填充材料(钎焊粉、钎焊膏、钎焊带、钎焊预制件、钎焊箔和钎焊棒和焊丝)、技术(火炬钎焊、炉钎焊、感应钎焊、浸焊、电阻钎焊、红外钎焊、放热钎焊、毯式钎焊、电子束/激光钎焊、钎焊、离解氨、真空钎焊、氢钎焊、燃气钎焊等)、形式(管、管、板、带、板、圆棒、扁钢、棒材、线材等)、生产温度(低于 900°C、901°C 至 1000°C、1001°C 至 1200°C 及高于 1200°C)划分°C)、最终用途(航空航天和国防、电子和电气、汽车、船舶、化学品、建筑和施工等)、行业趋势和预测到 2029 年。

市场分析和见解

用于连接应用的钎焊填料对于制造和设计先进材料至关重要。近几十年来,已经开发出几种类型的钎焊填料,用于连接类似或不同的工程材料。汽车和飞机部件(包括钢)的重要部件通常通过钎焊连接。此外,微波设备和电路中的陶瓷元件已在微电子设备中以高集成度连接。

同样,在医学领域,金属植入物已焊接到陶瓷牙冠上。这些进步使人类的生活更加便利。然而,在钎焊中,存在金属间化合物 (IMC) 形成和高温下接头残余应力等问题。

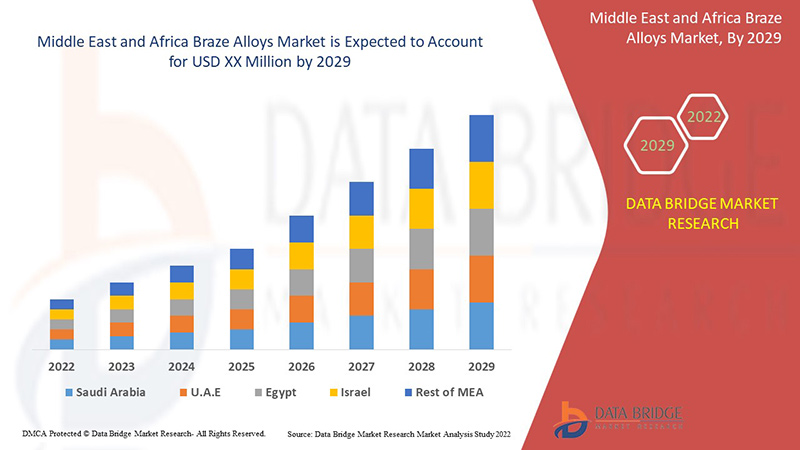

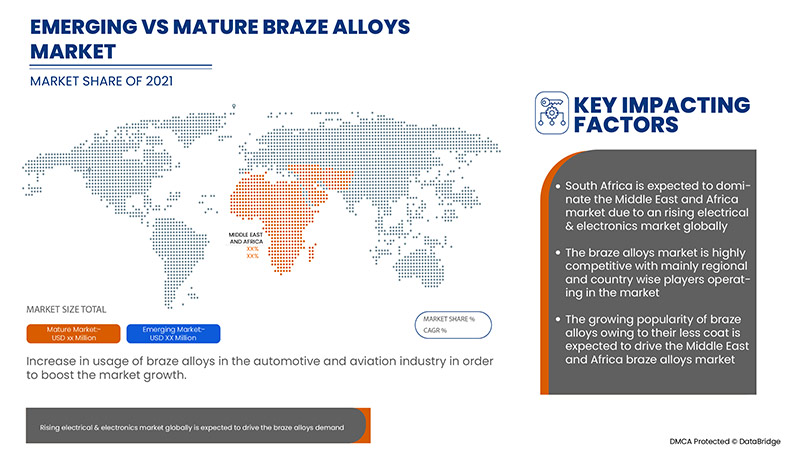

钎焊合金的使用量不断增加,加上钎焊合金在汽车、航空航天和国防、电子电气、建筑和施工领域的应用日益广泛,其需求量激增。Data Bridge Market Research 分析称,在 2022 年至 2029 年的预测期内,中东非洲钎焊合金市场的复合年增长率将达到 4.0%。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2020 - 2014 年) |

|

定量单位 |

收入(百万美元)、吨数、定价(美元) |

|

涵盖的领域 |

按金属(镍、钴、银、金、铝、铜、钢、铁、镁、钛等)、填充材料(钎焊粉、钎焊膏、钎焊带、钎焊预成型件、钎焊箔、钎焊棒和钎焊丝)、技术(火炬钎焊、炉钎焊、感应钎焊、浸焊、电阻钎焊、红外钎焊、放热钎焊、包层钎焊、电子束/激光钎焊、钎焊、离解氨、真空钎焊、氢钎焊、燃气钎焊等)、形式(管、管、片、带、板、圆棒、扁钢、棒材、线材等)、生产温度(低于 900°C、901°C 至 1000°C、1001°C 至 1200°C 及高于 1200°C)、最终用途(航空航天和国防、电子及电气、汽车、船舶、化工、建筑和施工等) |

|

覆盖国家 |

南非、以色列、埃及、沙特阿拉伯、阿联酋以及中东和非洲其他地区。 |

|

涵盖的市场参与者 |

庄信万丰、OC Oerlikon Management AG、Sulzer Ltd、Belmont Metals、Harris Products Group、Morgan Advanced Materials 及其附属公司、Aimtek, Inc.、Prince Izant Company、Lucas-Milhaupt, Inc.、Esprix Technologies、Indium Corporation、AMETEK. Inc.、TSI Technologies、ESAB 和 Umicore、Indian Solder and Brazing Alloys、SAXONIA Edelmetalle GmbH、Saru Silver Alloy Private Limited.、Cupro Alloys Corporation.、KRANTI METALLURGY PVT LTD.、SK METAL 等等。 |

中东非洲钎焊合金市场动态

驱动程序

- 汽车和航空工业中钎焊合金的使用量增加

汽车行业对钎焊合金的需求量巨大,它们被用作空调系统的冷凝器和蒸发器连接件、燃油喷射管和刹车片。汽车和航空业一直在努力开发轻量化的汽车零部件。

- 与锡焊、焊接等工艺相比,钎焊工艺的受欢迎程度日益提高

钎焊是一种金属连接工艺,通过熔化填充金属并将其注入接头,将两个或多个金属连接在一起。钎焊广泛用于连接高压至低压电气接地系统中的金属导体。目前,英国、爱尔兰和世界其他国家/地区都使用此工艺来将两种导电金属(通常是铜或钢)永久连接在一起。

机会

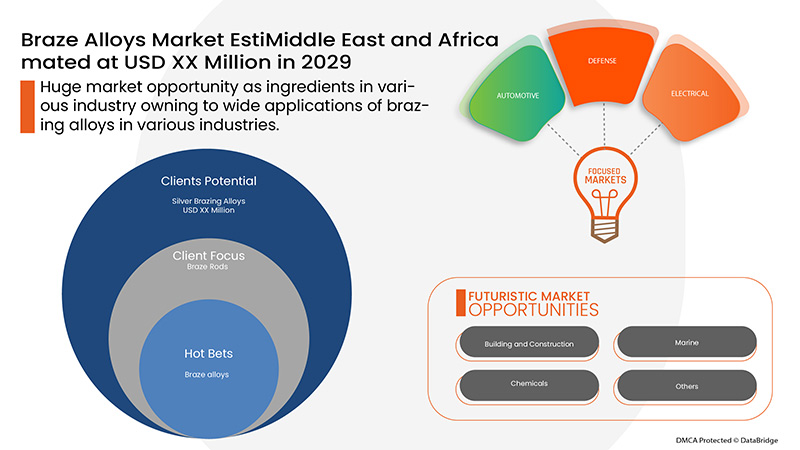

- 钎焊合金在各行业中的广泛应用

钎焊是一种广泛使用的连接工艺,因为它可以连接除铝和镁以外的几乎所有金属。它用于电气元件、管件等。厚度不均匀的金属可以通过钎焊连接。钎焊用于粘合各种金属、异种金属甚至非金属。它产生干净的接头,具有成本效益。此外,钎焊合金大多具有耐腐蚀性,并保留了材料的冶金特性,因为钎焊合金的低温有助于最大限度地减少热变形。此外,与焊接和其他工艺相比,钎焊合金具有出色的密封性。

限制/挑战

- 钎焊金属价格波动

目前,美国和世界其他地区的原材料价格波动幅度达到前所未有的水平。因为定价受到供应市场紧缩的影响。除了供需之外,另一个因素也影响着原材料价格的短期波动。投资者可能会突然放弃他们认为风险较高的投资,包括股票和大宗商品。

本钎焊合金市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关钎焊合金市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

COVID-19 对中东非洲 钎焊合金市场的影响

COVID-19 疫情严重扰乱了用于制造钎焊合金的原材料供应链,并扰乱了终端用户行业的供应链。这是由于资源和运输不足,导致原材料产品的获取减少、库存延迟和供应不足。此外,许多国家的政府限制了货物在各国之间的流动,整个供应链被扭曲。由于供应链中断,原材料运输中断,导致生产停滞。同样,价格上涨和钎焊合金生产停滞导致建筑、电子、航空航天和国防等各种终端用户对钎焊合金的需求得不到满足。COVID-19 疫情还对钎焊合金的终端用户行业产生了不利影响。它对建筑业产生了负面影响。

最新动态

- 2021 年 8 月,Indium Corporation 推出了新型多功能焊膏。Indium12.8HF 是一种多功能焊膏,可在各种系统上提供出色的喷射和微分配性能。此次发布将有助于公司增加客户群。

- 2021 年 6 月,OC Oerlikon Management AG 收购了 Coeurdor,后者是一家为快速增长的奢侈品行业提供零部件的领先全方位服务提供商。Coeurdor 是一家知名品牌,也是为世界领先的奢侈品品牌提供金属部件设计、制造和涂层的全方位服务提供商,为其在奢侈品领域提供立足点。因此,此次收购将有助于增加公司的收入。

- 2020 年 4 月,庄信万丰与 Stena Recycling Group 合作,共同打造可持续的锂离子电池回收循环解决方案,打造高效的锂离子电池和电池制造材料回收价值链。这一发展将有助于公司在未来几年快速发展。

中东非洲钎焊合金市场范围

钎焊合金市场细分为金属、填充材料、技术、产品形式、生产温度和最终用户。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

金属

- 银

- 铜

- 镍

- 金子

- 钛

- 钢

- 铝

- 钴

- 铁

- 镁

- 其他

根据金属,中东非洲钎焊合金市场分为银、铜、镍、金、钛、钢、铝、钴、铁、镁和其他。

填充材料

- 钎焊膏

- 钎焊棒和焊丝

- 钎焊粉

- 钎焊预成型

- 钎焊箔

- 钎焊胶带

根据填充材料,中东非洲钎焊合金市场分为钎焊膏、钎焊棒和钎焊丝、钎焊粉、钎焊预制件、钎焊箔和钎焊带。

技术

- 火炬钎焊

- 炉钎焊

- 电阻钎焊

- 感应钎焊

- 浸焊

- 红外钎焊

- 真空钎焊

- 电子束/激光钎焊

- 放热钎焊

- 钎焊

- 氢钎焊

- 覆盖钎焊

- 游离氨

- 燃气钎焊

- 其他的

根据技术,中东非洲钎焊合金市场分为火炬钎焊、炉钎焊、电阻钎焊、感应钎焊、浸焊、红外钎焊、真空钎焊、电子束/激光钎焊、放热钎焊、钎焊、氢钎焊、毯式钎焊、分离氨、燃气钎焊等。

形式

- 金属丝

- 条

- 酒吧

- 管道

- 管子

- 平坦的

- 床单

- 盘子

- 圆棒

- 其他的

根据形式,中东非洲钎焊合金市场分为线材、带材、棒材、管材、板材、薄板、圆棒和其他。

生产温度

- 1001 °C 至 1200 °C

- 低于 900 °C

- 901 °C 至 1000 °C

- 1200℃以上

根据生产温度,中东非洲钎焊合金市场分为 1001°C 至 1200°C、低于 900°C、901°C 至 1000°C 和 1200°C 以上。

最终用途

- Automotive

- Aerospace and Defense

- Electronics and Electrical

- Building and Construction

- Chemicals

- Marine

- Others

On the basis of end use, the Middle East Africa braze alloy market is segmented into automotive, aerospace and defense, electronics and electrical, building and construction, chemicals, marine and others.

Middle East Africa Braze Alloys Market Regional Analysis/Insights

The braze alloys market is analysed and market size insights and trends are provided by country, metal, filler material, technology, product form, production temperature and end use.

The countries covered in the Middle East Africa braze alloys market report are South Africa, Saudi Arabia, Israel, Egypt, U.AE. and rest of Middle East and Africa.

South Africa is dominating the braze Middle East Africa alloys market during the forecast period due to increase in use of braze alloys in automatic sector.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East Africa brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Braze Alloys Market Share Analysis

The braze Middle East Africa alloys market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on braze alloys market.

Some of the major players operating in the braze alloys market are Johnson Matthey, OC Oerlikon Management AG, Sulzer Ltd, Belmont Metals, Harris Products Group, Morgan Advanced Materials and its affiliates, Aimtek, Inc., Prince Izant Company, Lucas-Milhaupt, Inc., Esprix Technologies, Indium Corporation, AMETEK. Inc., TSI Technologies, ESAB and Umicore, Indian Solder and Brazing Alloys, SAXONIA Edelmetalle GmbH, Saru Silver Alloy Private Limited., Cupro Alloys Corporation., KRANTI METALLURGY PVT LTD., S. K. METAL among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, MEA Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 METAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET- VENDOR SELECTION CRITERIA

4.2 TECHNOLOGICAL ADVANCEMENT IN BRAZE ALLOYS MARKET

4.3 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: SUPPLY CHAIN ANALYSIS

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 MANUFACTURING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: REGULATIONS

4.4.1 REGULATIONS BY U.K. GOVERNMENT

4.4.2 FDA REGULATIONS

4.4.3 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS

4.4.4 ISO STANDARDS

4.5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET-RAW MATERIAL PRODUCTION COVERAGE

4.6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, PORTER’S FIVE FORCES ANALYSIS

4.6.1 BUYER POWER

4.6.2 SUPPLIER POWER

4.6.3 THE THREAT OF NEW ENTRANTS

4.6.4 THREAT OF SUBSTITUTES

4.6.5 RIVALRY AMONG EXISTING COMPETITORS

4.7 PESTEL ANALYSIS: MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

4.7.1 POLITICS:

4.7.2 ECONOMY:

4.7.3 SOCIAL:

4.7.4 TECHNOLOGY:

4.7.5 ENVIRONMENTAL:

4.7.6 LEGAL:

4.8 CLIMATE CHANGE-

4.9 ALLOY PRICES AFFECT MARKET GROWTH BY REGIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION INDUSTRY

5.1.2 INCREASING PREFERENCE TOWARD BRAZING PROCESS OVER SOLDERING, AND WELDING, AMONG OTHERS

5.1.3 INCREASING DEMAND FOR COPPER & ALUMINUM BRAZES ALLOYS

5.1.4 RISING ELECTRICAL & ELECTRONICS MARKET MIDDLE EAST & AFRICALY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF BRAZE METALS

5.2.2 COMPLEXITIES IN THE MANUFACTURING PROCESS OF BRAZE ALLOYS

5.2.3 AVAILABILITY OF SUBSTITUTES FOR BRAZE ALLOYS

5.3 OPPORTUNITIES

5.3.1 WIDE APPLICATIONS OF BRAZING ALLOYS IN VARIOUS INDUSTRIES

5.3.2 COST-EFFECTIVENESS OF BRAZE ALLOYS

5.3.3 RISING NUMBER OF INNOVATIONS IN THE BRAZING INDUSTRY

5.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO COVID -19

5.4.2 ADVERSE EFFECT OF BRAZING ON THE ENVIRONMENT

6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL

6.1 OVERVIEW

6.2 SILVER

6.3 COPPER

6.4 NICKEL

6.5 GOLD

6.6 TITANIUM

6.7 STEEL

6.7.1 STAINLESS STEEL

6.7.2 CARBON STEEL

6.7.3 LOW ALLOY STEEL

6.7.4 OTHERS

6.8 ALUMINUM

6.9 COBALT

6.1 IRON

6.11 MAGNESIUM

6.12 OTHERS

7 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL

7.1 OVERVIEW

7.2 BRAZE PASTE

7.3 BRAZE ROD AND WIRE

7.4 BRAZE POWDER

7.5 BRAZE PREFORM

7.6 BRAZE FOIL

7.7 BRAZE TAPE

8 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 TORCH BRAZING

8.3 FURNACE BRAZING

8.4 RESISTANCE BRAZING

8.5 INDUCTION BRAZING

8.6 DIP BRAZING

8.7 INFRARED BRAZING

8.8 VACUUM BRAZING

8.9 ELECTRON BEAM/LASER BRAZING

8.1 EXOTHERMIC BRAZING

8.11 BRAZE WELDING

8.12 HYDROGEN BRAZING

8.13 BLANKET BRAZING

8.14 DISSOCIATED AMMONIA

8.15 FUEL GAS BRAZING

8.16 OTHERS

9 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FORM

9.1 OVERVIEW

9.2 WIRE

9.3 STRIP

9.4 BAR

9.5 PIPE

9.6 TUBE

9.7 FLAT

9.8 SHEET

9.9 PLATE

9.1 ROUND BAR

9.11 OTHERS

10 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE

10.1 OVERVIEW

10.2 1001 °C TO 1200 °C

10.3 LESS THAN 900 °C

10.4 901 °C TO 1000 °C

10.5 ABOVE 1200 °C

11 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY END USER

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 SILVER

11.2.2 COPPER

11.2.3 NICKEL

11.2.4 GOLD

11.2.5 TITANIUM

11.2.6 STEEL

11.2.7 ALUMINUM

11.2.8 COBALT

11.2.9 IRON

11.2.10 MAGNESIUM

11.2.11 OTHERS

11.3 AEROSPACE AND DEFENSE

11.3.1 SILVER

11.3.2 COPPER

11.3.3 NICKEL

11.3.4 GOLD

11.3.5 TITANIUM

11.3.6 STEEL

11.3.7 ALUMINUM

11.3.8 COBALT

11.3.9 IRON

11.3.10 MAGNESIUM

11.3.11 OTHERS

11.4 ELECTRONICS AND ELECTRICAL

11.4.1 SILVER

11.4.2 COPPER

11.4.3 NICKEL

11.4.4 GOLD

11.4.5 TITANIUM

11.4.6 STEEL

11.4.7 ALUMINUM

11.4.8 COBALT

11.4.9 IRON

11.4.10 MAGNESIUM

11.4.11 OTHERS

11.5 BUILDING AND CONSTRUCTION

11.5.1 SILVER

11.5.2 COPPER

11.5.3 NICKEL

11.5.4 GOLD

11.5.5 TITANIUM

11.5.6 STEEL

11.5.7 ALUMINUM

11.5.8 COBALT

11.5.9 IRON

11.5.10 MAGNESIUM

11.5.11 OTHERS

11.6 CHEMICALS

11.6.1 SILVER

11.6.2 COPPER

11.6.3 NICKEL

11.6.4 GOLD

11.6.5 TITANIUM

11.6.6 STEEL

11.6.7 ALUMINUM

11.6.8 COBALT

11.6.9 IRON

11.6.10 MAGNESIUM

11.6.11 OTHERS

11.7 MARINE

11.7.1 SILVER

11.7.2 COPPER

11.7.3 NICKEL

11.7.4 GOLD

11.7.5 TITANIUM

11.7.6 STEEL

11.7.7 ALUMINUM

11.7.8 COBALT

11.7.9 IRON

11.7.10 MAGNESIUM

11.7.11 OTHERS

11.8 OTHERS

11.8.1 SILVER

11.8.2 COPPER

11.8.3 NICKEL

11.8.4 GOLD

11.8.5 TITANIUM

11.8.6 STEEL

11.8.7 ALUMINUM

11.8.8 COBALT

11.8.9 IRON

11.8.10 MAGNESIUM

11.8.11 OTHERS

12 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 U.A.E.

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ESAB

15.1.1 COMPANY SANPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSYS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 OC OERLIKON MANAGEMENT AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 UMICORE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 AMETEK.INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 JOHNSON MATTHEY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSI

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 AIMTEK

15.6.1 COMPANY SANPSHOT

15.6.2 COMPANY SHARE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BELMONT METALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CUPRO ALLOYS CORPORATION.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ESPRIX TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HARRIS PRODUCTS GROUP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 INDIAN SOLDER AND BRAZING ALLOYS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INDIUM CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KRANTI METALLURGY PVT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 LUCAS-MILHAUPT, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MORGAN ADVANCED MATERIALS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PRINCE IZANT COMPANY.

15.16.1 COMPANY SANPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SARU SILVER ALLOY PRIV ATE LIMITED.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SAXONIA EDELMETALLE GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 S. K. METAL

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SULZER LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 TSI TECHNOLOGIES

15.21.1 COMPANY SANPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 CHINA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 2 INDIA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 3 U.S. AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 6 MIDDLE EAST & AFRICA SILVER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COPPER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA NICKEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA GOLD IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA TITANIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA STEEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALUMINUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COBALT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA IRON IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MAGNESIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA BRAZE PASTE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BRAZE ROD AND WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BRAZE POWDER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BRAZE PREFORM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BRAZE FOIL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BRAZE TAPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TORCH BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FURNACE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RESISTANCE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INDUCTION BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA DIP BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA INFRARED BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA VACUUM BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ELECTRON BEAM/LASER BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EXOTHERMIC BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA BRAZE WELDING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA HYDROGEN BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA BLANKET BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA DISSOCIATED AMMONIA IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FUEL GAS BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FORM, 2014-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA STRIP IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA PIPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA TUBE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FLAT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SHEET IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA PLATE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA ROUND BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA 1001 °C TO 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA LESS THAN 900 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA 901 °C TO 1000 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ABOVE 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY END-USER, 2014-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MARINE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (TONS)

TABLE 74 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 91 SOUTH AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 93 SOUTH AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 97 SOUTH AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 99 SOUTH AFRICA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 104 U.A.E. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 105 U.A.E. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 106 U.A.E. STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 107 U.A.E. BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 108 U.A.E. BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 109 U.A.E. BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 110 U.A.E. BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 111 U.A.E. BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 112 U.A.E. AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 113 U.A.E. AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 114 U.A.E. ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 115 U.A.E. BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 116 U.A.E. CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 117 U.A.E. MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 118 U.A.E. OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 121 SAUDI ARABIA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 134 EGYPT BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 135 EGYPT BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 136 EGYPT STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 137 EGYPT BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 138 EGYPT BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 139 EGYPT BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 140 EGYPT BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 141 EGYPT BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 142 EGYPT AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 143 EGYPT AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 144 EGYPT ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 145 EGYPT BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 146 EGYPT CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 147 EGYPT MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 148 EGYPT OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 149 ISRAEL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 150 ISRAEL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 151 ISRAEL STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 152 ISRAEL BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 153 ISRAEL BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 154 ISRAEL BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 155 ISRAEL BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 156 ISRAEL BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 157 ISRAEL AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 158 ISRAEL AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 159 ISRAEL ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 160 ISRAEL BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 161 ISRAEL CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 162 ISRAEL MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 163 ISRAEL OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA BRAZE ALLOY MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA CONDENSING UNIT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION IS A MAJOR DRIVER FOR THE GROWTH OF MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET IN THE FORECAST PERIOD OF 2022-2029

FIGURE 12 METAL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET IN 2021 AND 2029

FIGURE 13 VENDOR SELECTION CRITERIA:

FIGURE 14 SUPPLY CHAIN OF MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

FIGURE 15 VARIOUS CLASSES OF BRAZING FILLERS ACCORDING TO ISO 17672:2016

FIGURE 16 THE FOLLOWING GRAPH SHOWCASES THE DIFFERENT PRICES RANGE IN DIFFERENT REGIONS IN USD MILLION PER TON.

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

FIGURE 18 PRICE GRAPH OF SOME OF THE METALS USED IN BRAZE ALLOYS

FIGURE 19 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY METAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY FILLER MATERIAL, 2021

FIGURE 21 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY TECHNOLOGY, 2021

FIGURE 22 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY FORM, 2021

FIGURE 23 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY PRODUCTION TEMPERATURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY END USER, 2021

FIGURE 25 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY METAL (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA BRAZE ALLOY MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。