Middle East And Africa Electrosurgery Equipment Market

市场规模(十亿美元)

CAGR :

%

USD

549.55 Million

USD

1,336.55 Million

2025

2033

USD

549.55 Million

USD

1,336.55 Million

2025

2033

| 2026 –2033 | |

| USD 549.55 Million | |

| USD 1,336.55 Million | |

|

|

|

|

Middle East and Africa Electrosurgery Equipment Market Segmentation, By Products (Electrosurgical Instruments, Electrosurgical Generators, Plasma and Smoke Management Systems, and Electrosurgical Accessories), Surgery (Gynaecological Surgery, Urology Surgery, Cardiovascular Surgery, General Surgery, Neurosurgery, Orthopaedic Surgery, Cosmetic Surgery, and Others), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centres, and Others), Distribution Channel (Direct and Retail) - Industry Trends and Forecast to 2033

Middle East and Africa Electrosurgery Equipment Market Size

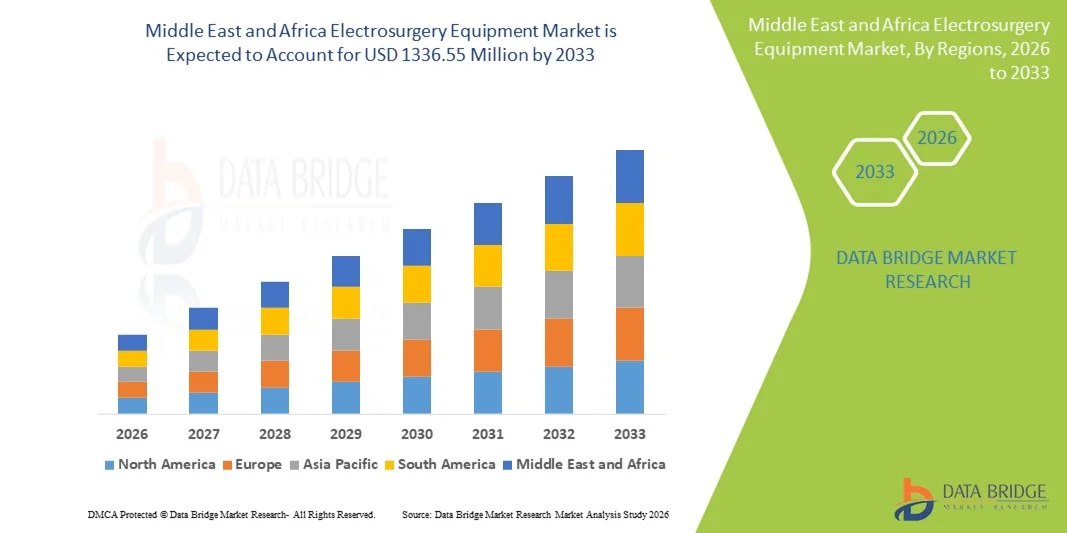

- The Middle East and Africa Electrosurgery Equipment market size was valued at USD 549.55 Million in 2025 and is expected to reach USD 1336.55 Million by 2033, at a CAGR of 11.75% during the forecast period

- The market growth is largely fueled by the increasing adoption of minimally invasive surgical procedures, advancements in electrosurgical technologies, and the rising demand for improved surgical efficiency and precision in both hospital and outpatient settings

- Furthermore, growing awareness among healthcare professionals about the benefits of electrosurgery equipment, combined with increasing surgical volumes and the need for faster patient recovery, is accelerating the uptake of Electrosurgery Equipment solutions, thereby significantly boosting the industry's growth

Middle East and Africa Electrosurgery Equipment Market Analysis

- Electrosurgery equipment, offering advanced devices for cutting, coagulation, and tissue ablation, is increasingly vital in modern surgical procedures across hospitals and outpatient surgical centers due to enhanced precision, safety, and procedural efficiency

- The escalating demand for electrosurgery equipment is primarily fueled by the rising adoption of minimally invasive and laparoscopic surgeries, growing surgical volumes, and the need for faster patient recovery and improved outcomes

- Saudi Arabia dominated the electrosurgery equipment market with the largest revenue share of 38.6% in 2025, driven by rapid healthcare modernization, strong government investments under Vision 2030, and accelerated adoption of advanced surgical technologies across hospitals and specialty centers. The country continues to experience substantial growth in surgical infrastructure, supported by rising procedural volumes, AI-enabled surgical platforms, and increasing involvement of leading domestic and international manufacturers

- U.A.E. is expected to be the fastest-growing region in the electrosurgery equipment market during the forecast period, projected to record a CAGR of 11.2% from 2026 to 2033, fueled by expanding medical tourism, increasing private healthcare investments, rising disposable incomes, and strong adoption of digital and advanced electrosurgical systems across both public and private healthcare facilities

- The Electrosurgical Instruments segment dominated the largest market revenue share of 45.6% in 2025, driven by their essential role in diverse surgical procedures across hospitals and specialty clinics. High adoption is due to precision, minimal blood loss, and reduced operative time

Report Scope and Electrosurgery Equipment Market Segmentation

|

Attributes |

Electrosurgery Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Electrosurgery Equipment Market Trends

Growing Adoption of Minimally Invasive Surgical Procedures

- A significant and accelerating trend in the global Electrosurgery Equipment market is the increasing adoption of minimally invasive surgeries (MIS) across hospitals and surgical centers

- These procedures are driving demand for advanced electrosurgical devices that enable precise cutting, coagulation, and hemostasis, while reducing patient recovery time

- For instance, in March 2024, Medtronic launched its Valleylab FT10 electrosurgery system with enhanced feedback control, enabling surgeons to perform complex procedures with greater precision and reduced tissue damage

- This development highlights the growing emphasis on safety and procedural efficiency in the Electrosurgery Equipment market

- Integration with imaging systems and energy-based surgical tools is also becoming prevalent, allowing surgeons to combine electrosurgical devices with other advanced surgical modalities for improved outcomes

- The trend toward procedure-specific, ergonomic, and multifunctional devices is reshaping user expectations in the surgical domain

- Hospitals are increasingly prioritizing equipment that offers operational efficiency, reduced procedure time, and improved patient outcomes, further propelling market adoption

Middle East and Africa Electrosurgery Equipment Market Dynamics

Driver

Rising Surgical Procedures and Healthcare Infrastructure Development

- The increasing number of surgeries, especially in emerging economies, coupled with the expansion of healthcare infrastructure, is a key driver for the Electrosurgery Equipment market

- Rising prevalence of chronic diseases, oncology cases, and elective procedures contributes to the heightened demand for electrosurgical tools

- For instance, in August 2023, Johnson & Johnson announced the launch of the ValleyLab LS10 Energy Platform in India, targeting multi-specialty hospitals to enhance surgical precision and reduce complications. Such initiatives by major companies are expected to drive market growth significantly

- Enhanced training programs for surgeons and the growing adoption of advanced surgical techniques are also facilitating higher utilization of electrosurgical devices

- The focus on reducing operative times, minimizing complications, and supporting same-day discharge surgeries is boosting demand

- Overall, the combination of increasing surgical volumes, expanding hospital networks, and emphasis on procedural efficiency is accelerating the uptake of advanced Electrosurgery Equipment

Restraint/Challenge

High Costs and Regulatory Constraints

- The relatively high cost of advanced electrosurgical systems can be a barrier to adoption, particularly for smaller clinics or budget-constrained healthcare facilities in developing regions

- Many hospitals may delay replacing older devices due to budget limitations

- For instance, reports indicate that premium devices with multifunctional capabilities can cost 3–4 times more than standard units, discouraging smaller hospitals from upgrading their equipment

- Strict regulatory requirements and lengthy approval processes for medical devices pose additional challenges. Compliance with local health authorities and international standards such as FDA, CE marking, or ISO certifications increases time-to-market and operational costs for manufacturers

- Overcoming these challenges requires strategies such as offering cost-effective device variants, leasing programs, and regional regulatory expertise to support timely approvals

- Market growth depends on balancing affordability, compliance, and technological advancement to ensure widespread adoption of electrosurgical solutions

Middle East and Africa Electrosurgery Equipment Market Scope

The market is segmented on the basis of products, surgery, end-user, and distribution channel.

- By Products

On the basis of products, the Asia-Pacific Electrosurgery Equipment market is segmented into Electrosurgical Instruments, Electrosurgical Generators, Plasma and Smoke Management Systems, and Electrosurgical Accessories. The Electrosurgical Instruments segment dominated the largest market revenue share of 45.6% in 2025, driven by their essential role in diverse surgical procedures across hospitals and specialty clinics. High adoption is due to precision, minimal blood loss, and reduced operative time. Training programs and physician familiarity further enhance uptake. Continuous innovation in minimally invasive instruments supports sustained demand. Hospitals invest in high-quality instruments to improve patient outcomes. Integration with advanced generators increases efficiency. Emerging markets in APAC are expanding procurement. Cost-effective options for mid-tier hospitals also support adoption. Regulatory approvals improve trust. Rising surgical procedure volumes contribute to market leadership. Increasing healthcare expenditure strengthens segment dominance. Technological improvements, including ergonomic designs, enhance user preference.

The Plasma and Smoke Management Systems segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, fueled by rising awareness of surgical smoke hazards and OR safety. Hospitals and surgical centers invest in smoke evacuation and plasma-based solutions. Compact, portable, and energy-efficient systems accelerate adoption. Government mandates and occupational health regulations drive demand. Integration with advanced electrosurgical generators improves workflow. Training programs for surgeons and OR staff enhance utilization. Growing numbers of minimally invasive surgeries increase demand. Technological innovations in filtration and plasma delivery systems support expansion. Urban hospitals in emerging APAC economies are early adopters. Rising adoption in elective surgeries promotes market growth. Telemedicine-assisted OR management further boosts usage.

- By Surgery

On the basis of surgery, the market is segmented into Gynaecological, Urology, Cardiovascular, General, Neurosurgery, Orthopaedic, Cosmetic, and Others. The General Surgery segment dominated the largest market revenue share of 41.8% in 2025, driven by the high volume of procedures such as laparoscopic, gastrointestinal, and emergency surgeries. Surgeons rely heavily on electrosurgical instruments for precision cutting and coagulation. Hospitals prioritize general surgery setups, resulting in widespread adoption. Government healthcare initiatives promoting surgical infrastructure expansion reinforce demand. Training and standardization of surgical protocols increase utilization. Integration with modern energy-based devices improves outcomes. Increasing hospital bed capacity drives demand. Surgeons’ preference for minimally invasive tools strengthens dominance. Rising procedure volume in China, India, and Japan supports leadership. Continuous product innovation enhances efficiency. Hospitals invest in comprehensive surgical suites. Electrosurgical solutions reduce operative time and patient recovery periods.

The Cosmetic Surgery segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by rising aesthetic awareness, increasing medical tourism, and higher disposable income. Surgeons prefer precise and minimally invasive equipment. Clinics and hospitals invest in advanced instruments tailored for cosmetic procedures. Technological innovations supporting rapid recovery and reduced scarring accelerate adoption. Social media influence and urbanization contribute to demand. Cosmetic centers expand procedure offerings with electrosurgical solutions. High demand for dermatological, facial, and body contouring procedures increases market potential. Training programs for cosmetic surgeons improve instrument utilization. Equipment manufacturers offer compact, versatile devices for outpatient use. Growth in private healthcare and specialty clinics promotes adoption. Rising investment in elective surgeries supports expansion. Emerging markets like Thailand and India contribute significantly to growth.

- By End-User

On the basis of end-user, the market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centres, and Others. The Hospitals segment dominated the largest market revenue share of 50.3% in 2025, due to centralized procurement, higher surgical volumes, and availability of trained surgical teams. Hospitals invest in electrosurgical generators and instruments to improve efficiency. Comprehensive surgical suites and multidisciplinary teams support adoption. Integration with hospital IT systems and OR management platforms increases utilization. Government funding for modern infrastructure boosts demand. Hospitals lead in implementing plasma and smoke management solutions. Preference for high-quality, reliable equipment ensures dominance. Expansion of tertiary care facilities in China, Japan, and India strengthens segment leadership. Training programs and clinical collaborations improve utilization. Regulatory compliance reinforces adoption. Hospitals prioritize bulk procurement and maintenance services.

The Ambulatory Surgical Centres segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, fueled by the rise in outpatient procedures and cost-efficient care models. ASCs increasingly adopt compact electrosurgical devices. Growth in elective and minimally invasive surgeries in urban areas accelerates adoption. Government initiatives for outpatient care expansion promote growth. ASCs prefer versatile instruments that support multiple surgery types. Rising medical tourism in APAC encourages adoption. Technological advancements in lightweight and portable devices benefit ASCs. Smaller facilities adopt online procurement channels for efficiency. Increased training and awareness of staff enhance utilization. Collaboration with diagnostic and imaging centers improves workflow. Regulatory approvals for smaller devices further support market expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct and Retail. The Direct segment dominated the largest market revenue share of 62.1% in 2025, as manufacturers prefer direct sales to hospitals and high-volume surgical centers for training, service, and warranty support. Direct distribution ensures control over product quality and after-sales service. Strong relationships with procurement teams enhance adoption. Regulatory compliance and installation support strengthen trust. Training programs for surgeons improve product utilization. Bulk purchasing agreements favor direct channels. Post-sale technical support reinforces loyalty. Bundled packages of instruments and generators improve efficiency. Hospitals prefer long-term contracts with manufacturers. Equipment upgrades and software updates support continuous adoption. Customization options enhance segment dominance.

The Retail segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, supported by growing e-commerce adoption and smaller specialty clinics purchasing online. Simplified ordering, quick delivery, and competitive pricing drive retail growth. Emerging clinics in tier-2 and tier-3 cities increasingly rely on online channels. Availability of electrosurgical accessories through retail platforms accelerates adoption. Manufacturers are offering bundled kits and promotional packages to attract small buyers. Easy access to customer support and product tutorials enhances confidence in retail purchases. Growing awareness of electrosurgical innovations among smaller healthcare facilities further fuels adoption, making retail a key growth channel.

Middle East and Africa Electrosurgery Equipment Market Regional Analysis

- The Middle East and Africa electrosurgery equipment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rapid healthcare modernization, strong government investments, and the escalating adoption of advanced surgical technologies across hospitals and specialty centers

- The increase in healthcare infrastructure, coupled with the growing demand for minimally invasive procedures and AI-enabled surgical platforms, is fostering the adoption of Electrosurgery Equipment

- The region is experiencing significant growth across hospitals, specialty clinics, and ambulatory surgical centers, with Electrosurgery Equipment being incorporated into both new facilities and upgrades of existing surgical suites

Saudi Arabia Electrosurgery Equipment Market Insight

Saudi Arabia electrosurgery equipment market dominated the Electrosurgery Equipment market with the largest revenue share of 38.6% in 2025, driven by rapid healthcare modernization, strong government investments under Vision 2030, and accelerated adoption of advanced surgical technologies across hospitals and specialty centers. The country continues to experience substantial growth in surgical infrastructure, supported by rising procedural volumes, AI-enabled surgical platforms, and increasing involvement of leading domestic and international manufacturers.

U.A.E. Electrosurgery Equipment Market Insight

The U.A.E. electrosurgery equipment market is expected to be the fastest-growing region in the Electrosurgery Equipment market during the forecast period, projected to record a CAGR of 11.2% from 2026 to 2033, fueled by expanding medical tourism, increasing private healthcare investments, rising disposable incomes, and strong adoption of digital and advanced electrosurgical systems across both public and private healthcare facilities.

Middle East and Africa Electrosurgery Equipment Market Share

The Electrosurgery Equipment industry is primarily led by well-established companies, including:

• Medtronic (Ireland)

• Johnson & Johnson (U.S.)

• ConMed Corporation (U.S.)

• Olympus Corporation (Japan)

• ERBE Elektromedizin (Germany)

• Aesculap AG (Germany)

• Smith & Nephew (U.K.)

• Richard Wolf GmbH (Germany)

• Stryker Corporation (U.S.)

• Arthrex, Inc. (U.S.)

• B. Braun Melsungen AG (Germany)

• Medline Industries, Inc. (U.S.)

• Storz Medical AG (Switzerland)

Latest Developments in Middle East and Africa Electrosurgery Equipment Market

- In June 2023, Olympus Corporation (Japan) introduced the ESG‑410 Electrosurgical Generator, a next‑generation generator designed for urology and related procedures. The device reportedly features enhanced ignition capacitors for more stable plasma generation during resection loops, an upgraded touchscreen interface for improved user control, and optional wireless foot-pedal operation — representing a notable product launch during this period

- In March 2024, Medtronic launched its new Valleylab FT10 energy platform, an advanced electrosurgical generator with so-called “smart tissue‑sensing” capability — which adjusts energy delivery in real time based on tissue response, aiming to optimize cutting/coagulation balance and reduce thermal damage. This was widely reported as a key device upgrade in the global electrosurgical equipment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。