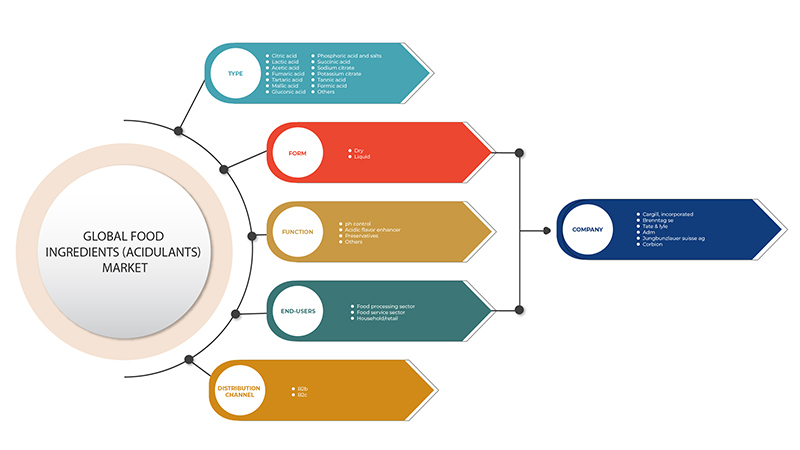

中东和非洲食品配料(酸化剂)市场,按类型(柠檬酸、乳酸、乙酸、富马酸、酒石酸、苹果酸、葡萄糖酸、磷酸及盐、琥珀酸、柠檬酸钠、柠檬酸钾、单宁酸、甲酸等)、形式(干性和液体)、功能(pH 值控制、酸性增味剂、防腐剂等)、分销渠道(B2B 和 B2C)、最终用户(食品加工部门、食品服务部门和家庭/零售)行业趋势和预测到 2029 年。

市场分析和见解

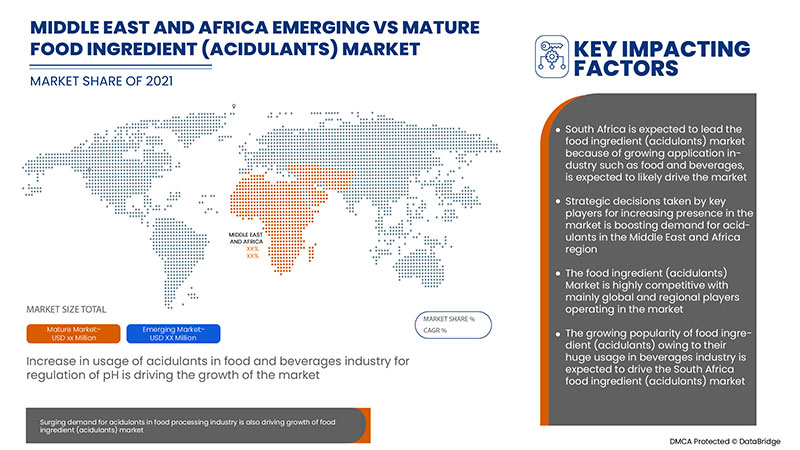

由于食品饮料行业的发展以及对调味饮料和食品的需求增加,中东和非洲食品配料(酸味剂)市场正在获得显着增长。葡萄酒等酒精饮料中对酸味剂的需求增加也促进了中东和非洲食品配料(酸味剂)市场的增长。然而,预计在预测期内,与酸味剂相关的严格政府法规和与某些酸味剂(如磷酸)相关的健康风险将抑制市场的增长。

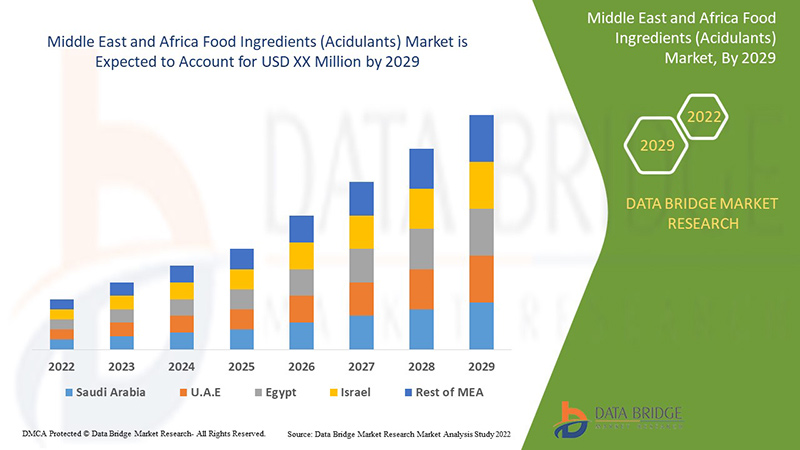

Data Bridge Market Research 分析称,中东和非洲食品配料(酸味剂)市场预计在 2022 年至 2029 年的预测期内以 5.8% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 (可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按类型(柠檬酸、乳酸、乙酸、富马酸、酒石酸、苹果酸、葡萄糖酸、磷酸及盐、琥珀酸、柠檬酸钠、柠檬酸钾、单宁酸、甲酸等)、形式(干性和液体)、功能(pH 控制、酸性增味剂、防腐剂等)、分销渠道(B2B 和 B2C)、最终用户(食品加工行业、食品服务行业和家庭/零售) |

|

覆盖国家 |

沙特阿拉伯、阿联酋、南非、科威特、阿曼、卡塔尔、中东和非洲其他地区 |

|

涵盖的市场参与者 |

Brenntag SE、Bartek Ingredients Inc.、Corbion、Cargill, Incorporated、ADM、Tate & Lyle、Foodchem International Corporation、Richest Group、INDUSTRIAL TECNICA PECUARIA, SA 等 |

市场定义

酸味剂是一种化合物,可使食物具有酸味或酸性,或增强食物的甜度。酸味剂还可以在某些加工食品中用作发酵剂和乳化剂。虽然酸味剂可以降低 pH 值,但它们与酸度调节剂不同,后者是专门用于改变食品稳定性或其中酶的食品添加剂。典型的酸味剂是乙酸(例如,泡菜中的乙酸)和柠檬酸。许多饮料(例如可乐)都含有磷酸。酸味糖果通常用苹果酸配制而成。食品生产中使用的其他酸味剂包括富马酸、酒石酸、乳酸和葡萄糖酸。

中东和非洲食品配料(酸味剂)市场动态

驱动程序

- 柠檬酸和苹果酸在新兴酒精和非酒精饮料中的广泛应用

在大多数饮料中,柠檬酸是首选的酸味剂。它具有特定的、相对温和至略带尖锐的酸味,并且对大多数水果口味都有提神作用。此外,当需要强烈的风味增强时,也会使用苹果酸,通常与柠檬酸结合使用。除了这些酸味剂外,磷酸和琥珀酸也用于饮料中。磷酸主要用于可乐等碳酸饮料,以带来特定的口味和对 pH 的强烈影响。苹果酸通常用于酒精饮料,主要是水果冷饮和低酒精饮料。琥珀酸仅用于家庭速溶饮料中。

例如,

- 2020 年 9 月,根据葡萄酒和烈酒贸易协会的数据,调味朗姆酒和香料朗姆酒类别的销量从 2014 年的不到 600 万瓶增长到 2019 年的 1000 多万瓶

- 2021 年 9 月,Svami 宣布推出印度本土优质可乐 2 Cal Cola 和 Svami Salted Lemonade

因此,为了满足消费者的需求,饮料制造商对饮料制造业酸化剂的需求不断增长,从而促进了市场的增长。

- 糖果行业对苹果酸、乳酸、乳酸钠等酸味剂的需求增加

糖果中使用的酸味剂,如苹果酸、乳酸和乳酸钠,具有独特的口感和风味效果。由于其挥发性,它还能增强一些芳香风味的影响。此外,如今,酸味剂的组合在糖果中很常见。此外,苹果酸和富马酸在相同浓度下比其他食品酸提供更持久的酸味,增强水果风味,并增强高强度甜味剂的影响。

因此,对糖果产品的需求增加,也增加了食品制造商对苹果酸、乳酸、富马酸、乳酸钠等酸味剂的需求,以满足需求。

机会

- 柠檬酸和乙酸的生物生产

消费者正在转向可持续产品,并选择使用可持续成分制造的产品。因此,制造商对可持续、经济高效的生物食品成分(酸化剂)的需求正在增加,例如柠檬酸和乙酸。然而,通过可持续产品(即微生物发酵)生产生物琥珀酸相当困难,尽管它具有成本效益。

因此,由于存在大量细菌、真菌和酵母,可以增加酸味剂的生物产量,并可向全球食品和饮料行业提供可持续的生物酸味剂产品,因为这为包含生物可持续成分的食品和饮料产品提供了巨大的机会。

限制/挑战

- 食品监管机构对酸味剂产品的规则和监管

政府机构制定的酸味剂审批规则和条例确保酸味剂没有副作用,这可能会限制全球食品配料(酸味剂)市场的增长。人们对酸味剂对健康的副作用的担忧日益增加,迫使政府制定严格的产品审批规则。酸味剂可能会导致血压升高、眼睛暂时发红等。因此,在任何产品中使用酸味剂之前,都要仔细检查其用量。因此,审批程序的严格规定可能会阻碍市场的增长。

因此,为避免与之相关的健康风险而对酸味剂产品批准和撤回制定的严格规定可能会限制市场的增长,因为制造商可能发现很难完全满足政府制定的所有规定。

- 对酸化剂的健康担忧日益增加

酸味剂用于各种食品和饮料,如烘焙食品、糖果、酒精和非酒精饮料,以增强口感、质地和风味。然而,它有一些对人体有害的副作用。

因此,考虑到这些副作用,政府对酸化剂的使用制定了严格的规定,这可能会给制造商带来挑战。

例如,

- 食品和药品法规(B.01.090、B.01.091 和 B.01.092)允许在肉制品中添加磷酸盐和/或水。磷酸盐的允许形式是最大允许使用量为 0.5%,以添加到产品中的磷酸氢二钠计算

因此,由于严格的法规和安全问题,与酸化剂相关的副作用可能会对市场的增长构成挑战。

COVID-19 后对中东和非洲食品配料(酸味剂)市场的影响

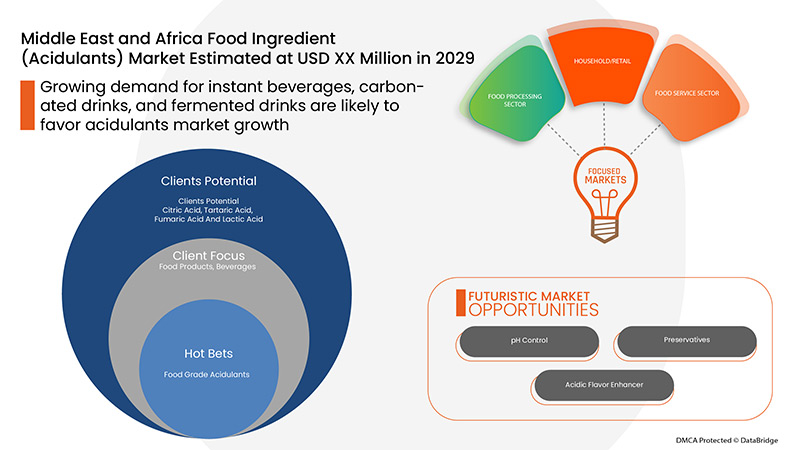

新冠肺炎疫情过后,由于消费者的购买模式以及食品和饮料等各种终端用户对酸味剂的需求逐渐增加,对酸味剂的需求有所增加。由于许多严格的规定和限制被取消,制造商和生产商可以满足该地区对酸味剂的需求。此外,年轻人尝试新菜系、软饮料和发酵饮料的趋势日益增长,将推动市场的增长。

对发酵饮料的需求增加使得制造商能够推出创新和调味的发酵饮料,这最终增加了对酸味剂的需求,从而帮助市场增长。

近期发展

- 2022 年 3 月,Brenntag SE 收购了以色列特种化学品分销商 YS Ashkenazi Agencies Ltd 及其子公司 Biochem Trading。此次收购代表 Brenntag 进入以色列市场。此次收购将提高公司的商誉

中东和非洲食品配料(酸味剂)市场范围

中东和非洲食品配料(酸味剂)市场分为类型、形式、功能、分销渠道和最终用户。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 柠檬酸

- 柠檬酸钠

- 柠檬酸钾

- 醋酸

- 甲酸

- 葡萄糖酸

- 富马酸

- 苹果酸

- 磷酸及盐

- 酒石酸

- 乳酸

- 单宁酸

- 琥珀酸

- 其他的

根据类型,中东和非洲食品配料(酸化剂)市场分为柠檬酸、柠檬酸钠、柠檬酸钾、乙酸、甲酸、葡萄糖酸、苹果酸、磷酸和盐、酒石酸、乳酸、单宁、富马酸、琥珀酸等。

形式

- 干燥

- 液体

根据形式,中东和非洲食品配料(酸味剂)市场分为干性食品配料和液体食品配料。

功能

- pH 控制

- 酸性增味剂

- 防腐剂

- 其他的

根据功能,中东和非洲食品成分(酸化剂)市场分为 pH 控制、酸性增味剂、防腐剂和其他。

分销渠道

- B2B

- B2C

根据分销渠道,中东和非洲食品配料(酸味剂)市场分为 B2B 和 B2C。

终端用户

- 家庭/零售

- 食品加工行业

- 食品服务业

根据最终用户,中东和非洲食品配料(酸化剂)市场分为家庭/零售、食品加工部门和食品服务部门。

中东和非洲食品配料(酸味剂)市场区域分析/见解

The Middle East and Africa food ingredients (acidulants) market is analyzed, and market size insights and trends are provided by country, type, form, function, end-user, and distribution channel, as referenced above.

Some of the countries covered in the Middle East and Africa food ingredients (acidulants) market report are Saudi Arabia, U.A.E., South Africa, Kuwait, Oman, Qatar, and the Rest of the Middle East and Africa.

Saudi Arabia is expected to dominate the Middle East and Africa food ingredients (acidulants) market in terms of market share and revenue and will continue to grow its dominance during the forecast period. This is due to the growing demand for soft drinks and other beverages, and acidulants are used as they provide better taste and flavor to the products.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of the Middle East and African brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Food Ingredients (Acidulants) Market Share Analysis

The Middle East and Africa food ingredients (acidulants) market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East & Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Middle East and Africa food ingredients (acidulants) market.

Some of the major players operating in the Middle East and Africa food ingredients (acidulants) market are Brenntag SE, Bartek Ingredients Inc., Corbion, Cargill, Incorporated, ADM, Tate & Lyle, Foodchem International Corporation, Richest Group, INDUSTRIAL TECNICA PECUARIA, S.A., among others.

Research Methodology

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、中东和非洲与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 FACTORS INFLUENCING PURCHASING DECISION

4.2.1 PRICING OF FOOD INGREDIENTS (ACIDULANTS)

4.2.2 QUALITY AND PURITY OF ACIDULANTS

4.2.3 CERTIFIED FOOD INGREDIENTS (ACIDULANTS)

4.3 REGULATORY OR LEGAL RISK COVERAGE

4.4 NEW PRODUCT LAUNCH STRATEGIES

4.5 PATENT ANALYSIS

4.6 RAW MATERIAL ANALYSIS – TOP 10 ACIDULANTS

4.6.1 CITRIC ACID

4.6.2 ACETIC ACID

4.6.3 SODIUM CITRATE

4.6.4 LACTIC ACID

4.6.5 FUMARIC ACID

4.6.6 TARTARIC ACID

4.6.7 MALIC ACID

4.6.8 GLUCONIC ACID

4.6.9 PHOSPHORIC ACID AND SALT

4.7 RISK ANALYSIS (LIQUIDITY) – MAJOR PLAYERS

4.8 RISK ANALYSIS OF ACIDULANTS

4.8.1 CITRIC ACID

4.8.2 SODIUM CITRATE

4.8.3 ACETIC ACID

4.8.4 SUCCINIC ACID

4.8.5 MALIC ACID

4.8.6 TARTARIC ACID

4.8.7 POTASSIUM CITRATE

4.8.8 GLUCONIC ACID

4.8.9 FUMARIC ACID

4.8.10 LACTIC ACID

4.8.11 TANNIC ACID

4.8.12 FORMIC ACID

4.8.13 PHOSPHORIC ACID AND SALTS

4.9 RUSSIA AND UKRAINE WAR IMPACT

4.9.1 COUNTRIES THAT ARE LIKELY TO BE IMPACTED THE MOST –

4.9.2 RISK OF CIVIL UNREST

4.1 SUPPLY CHAIN OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 FOOD INGREDIENT (ACIDULANTS) PRODUCTION/PROCESSING

4.10.3 DISTRIBUTION

4.10.4 END-USERS

4.11 SUPPLIER DEEP DIVE – PART 1

4.12 PORTER'S FIVE FORCES ANALYSIS FOR CITRIC ACID-

4.13 PORTER'S FIVE FORCES ANALYSIS FOR LACTIC ACID-

4.14 PORTER'S FIVE FORCES ANALYSIS FOR ACETIC ACID-

4.15 PORTER'S FIVE FORCES ANALYSIS FOR FUMARIC ACID-

4.16 PORTER'S FIVE FORCES ANALYSIS FOR TARTARIC ACID-

4.17 PORTER'S FIVE FORCES ANALYSIS FOR MALIC ACID-

4.18 PORTER'S FIVE FORCES ANALYSIS FOR GLUCONIC ACID-

4.19 PORTER'S FIVE FORCES ANALYSIS FOR PHOSPHORIC ACID AND SALT-

4.2 PORTER'S FIVE FORCES ANALYSIS FOR SUCCINIC ACID-

4.21 PORTER'S FIVE FORCES ANALYSIS FOR SODIUM CITRATE –

4.22 SUPPLIERS DEEP DIVE – PART 2

4.22.1 PRODUCTION LOCATIONS

4.22.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.3 MARKETS THEY SELL TO

4.22.4 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.22.5 MARKETS THEY SELL TO

4.22.6 PRODUCTION LOCATIONS

4.23 ADM

4.23.1 PRODUCTION LOCATIONS

4.23.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.23.3 MARKETS THEY SELL TO

4.24 CORBION N.V

4.24.1 PRODUCTION LOCATIONS

4.24.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.24.3 MARKETS THEY SELL TO

4.25 TATE & LYLE

4.25.1 PRODUCTION LOCATIONS

4.25.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.25.3 MARKETS THEY SELL TO

4.26 JUNGBUNZLAUER SUISSE AG

4.26.1 PRODUCTION LOCATIONS

4.26.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.26.3 MARKETS THEY SELL TO

4.27 BARTEK INGREDIENTS INC.

4.27.1 PRODUCTION LOCATIONS

4.27.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.27.3 MARKETS THEY SELL TO

4.28 DAIRYCHEM

4.28.1 PRODUCTION LOCATIONS

4.28.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.28.3 MARKETS THEY SELL TO

4.29 WEIANG ENSIGN INDUSTRY CO.,LTD.

4.29.1 PRODUCTION LOCATIONS

4.29.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.29.3 MARKETS THEY SELL TO

4.3 INDUSTRIAL TECNICA PECUARIA, S.A.

4.30.1 PRODUCTION LOCATIONS

4.30.2 SUPPLIER SPECIFIC RISKS/OPPORTUNITIES

4.30.3 MARKETS THEY SELL TO

4.31 PRODUCTION CAPACITY – TOP FIVE PLAYERS

4.32 PRICING ANALYSIS FOR FOOD INGREDIENTS (ACIDULANTS)

4.33 SWOT ANALYSIS – TOP 10 ACIDULANTS

4.33.1 CITRIC ACID –

4.33.2 ACETIC ACID –

4.33.3 SODIUM CITRATE –

4.33.4 SUCCINIC ACID –

4.33.5 LACTIC ACID –

4.33.6 FUMARIC ACID –

4.33.7 TARTARIC ACID –

4.33.8 MALIC ACID –

4.33.9 GLUCONIC ACID –

4.33.10 PHOSPHORIC ACID AND SALTS -

5 REGULATIONS:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH

6.1.2 WIDE USE OF CITRIC ACID AND MALIC ACID IN EMERGING ALCOHOLIC AS WELL AS NON-ALCOHOLIC BEVERAGE APPLICATIONS

6.1.3 RISE IN DEMAND FOR ACIDULANTS SUCH AS MALIC ACID, LACTIC ACID, AND SODIUM LACTATE IN THE CONFECTIONERY INDUSTRY

6.1.4 GROWING DEMAND FOR INSTANT BEVERAGES, CARBONATED DRINKS, AND FERMENTED DRINKS IS LIKELY TO FAVOR ACIDULANTS MARKET GROWTH

6.2 RESTRAINTS:

6.2.1 RULES AND REGULATION OF FOOD REGULATORY BODIES ON ACIDULANTS PRODUCTS

6.2.2 ISSUES ARISING DUE TO OVER USAGE OF PHOSPHATE-BASED PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR ACIDULANTS FROM THE RISING FOOD PROCESSING INDUSTRY IN EMERGING ECONOMIES SUCH AS INDIA AND CHINA

6.3.2 BIOLOGICAL PRODUCTION OF CITRIC ACID AND ACETIC ACID

6.4 CHALLENGES

6.4.1 GROWING HEALTH CONCERNS REGARDING ACIDULANTS

6.4.2 HIGH PRICES OF ACIDULANTS

7 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

7.1 IMPACT ON DEMAND AND SUPPLY CHAIN

7.2 IMPACT ON PRICE

7.3 CONCLUSION

8 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 LACTIC ACID

8.4 ACETIC ACID

8.5 FUMARIC ACID

8.6 TARTARIC ACID

8.7 MALLIC ACID

8.8 GLUCONIC ACID

8.9 PHOSPHORIC ACID

8.1 SUCCINIC ACID

8.11 SODIUM CITRATE AND SALT

8.12 POTASSIUM CITRATE AND SALT

8.13 TANNIC ACID AND SALT

8.14 FORMIC ACID AND SALT

8.15 OTHERS

9 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 PH CONTROL

10.3 ACIDIC FLAVOR ENHANCER

10.4 PRESERVATIVES

10.5 OTHERS

11 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B

11.2.1 WHOLESALERS

11.2.2 ONLINE

11.3 B2C

11.3.1 SUPERMARKET

11.3.2 ONLINE

11.3.3 HYPERMARKET

11.3.4 DEPARTMENTAL STORES

11.3.5 SPECIALTY STORES

11.3.6 OTHERS

12 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER

12.1 OVERVIEW

12.2 FOOD PROCESSING SECTOR

12.2.1 FOOD

12.2.1.1 PROCESSED MEAT PRODUCTS

12.2.1.1.1 POULTRY

12.2.1.1.2 PORK

12.2.1.1.3 BEEF

12.2.1.1.4 OTHERS

12.2.1.2 DAIRY PRODUCTS

12.2.1.2.1 CHEESE

12.2.1.2.2 MILK-POWDER

12.2.1.2.3 ICE CREAM

12.2.1.2.4 SPREADS

12.2.1.2.5 OTHERS

12.2.1.3 CONVENIENCE FOOD

12.2.1.3.1 READY TO EAT PRODUCTS

12.2.1.3.2 SOUPS & SAUCES

12.2.1.3.3 SEASONING & DRESSING

12.2.1.3.4 NOODLES & PASTA

12.2.1.3.5 OTHERS

12.2.1.4 BAKERY

12.2.1.4.1 CAKES & PASTRIES

12.2.1.4.2 BREAD

12.2.1.4.3 BISCUITS & COOKIES

12.2.1.4.4 MUFFINS

12.2.1.4.5 OTHERS

12.2.1.5 CONFECTIONERY

12.2.1.5.1 CHOCOLATE

12.2.1.5.2 GUMS & JELLY

12.2.1.5.3 HARD & SOFT CANDY

12.2.1.5.4 CREAM FILLINGS

12.2.1.5.5 OTHERS

12.2.1.5.6 SEAFOOD PRODUCTS

12.2.1.5.7 PROCESSED FOOD

12.2.1.5.8 SPORTS NUTRITION

12.2.1.5.9 DIETARY SUPPLEMENTS

12.2.1.5.10 INFANT FORMULA

12.2.1.6 BEVERAGES

12.2.1.6.1 NON-ALCOHOLIC BEVERAGES

12.2.1.6.1.1 RTD

12.2.1.6.1.2 FRUIT JUICES

12.2.1.6.1.3 SOFT DRINKS

12.2.1.6.1.4 DAIRY DRINKS

12.2.1.6.1.5 FLAVORED DRINKS

12.2.1.6.1.6 OTHERS

12.2.1.6.1.7 ALCOHOLIC BEVERAGES

12.3 FOOD SERVICE SECTOR

12.3.1 RESTAURANTS

12.3.2 CAFÉS

12.3.3 HOTELS

12.3.4 CANTEEN/CAFETERIA

12.3.5 CLOUD KITCHEN

12.4 HOUSEHOLD/RETAIL

13 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 SOUTH AFRICA

13.1.4 KUWAIT

13.1.5 OMAN

13.1.6 QATAR

13.1.7 REST OF MIDDLE-EAST & AFRICA

14 MIDDLE EAST & AFRICA FOOD INGREDIENT (ACIDULANTS) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 COMPANY PROFILE

15.1 CARGILL, INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TATE & LYLE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ADM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 JUNGBUNZLAUER SUISSE AG

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 BRENNTAG SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ARIHANT CHEMICALS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ARSHINE PHARMACEUTICAL CO.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BARTEK INGREDIENTS INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHEMVERA SPECIALTY CHEMICALS PVT. LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 CORBION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 DAIRYCHEM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 DIRECT FOOD INGREDIENTS LTD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FBC INDUSTRIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

1.13.3 RECENT DEVELOPMENTS 306

15.14 FOODCHEM INTERNATIONAL CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 HAWKINS WATTS LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 INDUSTRIAL TECNICA PECUARIA, S.A.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 INNOVA CORPORATE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICHEST GROUP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SUNTRAN.CN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 WEIFANG ENSIGN INDUSTRY CO.,LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 REGULATORY OR LEGAL RISK COVERAGE FRAMEWORK

TABLE 2 MICROORGANISMS USED FOR THE PRODUCTION OF CITRIC ACID

TABLE 3 COMPARISON OF CITRIC ACID PRODUCTION FROM THE VARIOUS SUBSTRATES USING Y. LIPOLYTICA STRAINS

TABLE 4 CITRIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 5 MICROORGANISMS USED TO PRODUCE ACETIC ACID

TABLE 6 ACETIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 7 MICROORGANISMS USED FOR PRODUCING SODIUM CITRATE

TABLE 8 SODIUM CITRATE APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 9 MICROORGANISMS USED FOR BIO-SUCCINIC ACID PRODUCTION

TABLE 10 SUCCINIC ACID APPLICATION IN THE FOOD AND BEVERAGES INDUSTRY

TABLE 11 MICROORGANISMS USED TO PRODUCE LACTIC ACID-

TABLE 12 COMPARISON OF DIFFERENT STRAINS AND SUBSTRATES FOR LACTIC ACID PRODUCTION

TABLE 13 LACTIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 14 MICROORGANISMS USED IN THE PRODUCTION OF FUMARIC ACID

TABLE 15 FUMARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 16 TARTARIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 17 MALIC ACID APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 18 APPLICATIONS OF GLUCONIC ACID IN DIFFERENT FOOD AND BEVERAGES INDUSTRY-

TABLE 19 PHOSPHORIC ACID AND SALTS APPLICATION IN DIFFERENT FOOD AND BEVERAGES INDUSTRY

TABLE 20 RAW MATERIAL FOR DIFFERENT FOOD INGREDIENTS (ACIDULANTS)-

TABLE 21 MARKET SHARE OF CITRIC ACID

TABLE 22 MARKET SHARE OF LACTIC ACID

TABLE 23 MARKET SHARE OF FUMARIC ACID

TABLE 24 MARKET SHARE OF TARTARIC ACID

TABLE 25 MARKET SHARE OF MALIC ACID

TABLE 26 CATEGORY AND THEIR FUNCTIONALITY

TABLE 27 ACIDULANTS IN VARIOUS FOOD FUNCTIONALITY

TABLE 28 ACIDULANTS PRODUCTS AND THEIR APPLICATIONS

TABLE 29 MIDDLE EAST & AFRICA AVERAGE SELLING PRICES OF ACIDULANTS

TABLE 30 THE BELOW TABLE SHOWS THE ACIDULANTS AND THEIR APPLICATIONS IN BEVERAGES

TABLE 31 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 32 THE TABLE BELOW SHOWS CITRIC ACID-PRODUCING MICROORGANISMS AND THEIR SPECIES:

TABLE 33 BELOW TABLE SHOWS THE SIDE EFFECTS OF ACIDULANTS:

TABLE 34 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (MILLION TONS)

TABLE 36 MIDDLE EAST & AFRICA CITRIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA LACTIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA ACETIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FUMARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA TARTARIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA MALLIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA GLUCONIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHOSPHORIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SUCCINIC ACID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SODIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA POTASSIUM CITRATE AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA TANNIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA FORMIC ACID AND SALT IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 THE TABLE BELOW SHOWS THE FUNCTIONS OF DIFFERENT ACIDULANTS IN SOLID FORM:

TABLE 52 MIDDLE EAST & AFRICA DRY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 THE BELOW TABLE SHOWS THE FUNCTIONS OF LIQUID ACIDULANTS IN THE FOOD PROCESSING INDUSTRY:

TABLE 54 MIDDLE EAST & AFRICA LIQUID IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA PH CONTROL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA ACIDIC FLAVOR ENHANCER IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA PRESERVATIVES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA OTHERS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MIDDLE EAST & AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (TONS)

TABLE 82 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 MIDDLE EAST AND AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MIDDLE EAST AND AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MIDDLE EAST AND AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SAUDI ARABIA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 105 SAUDI ARABIA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 117 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 118 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 U.A.E. B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.A.E. B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.A.E. FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 122 U.A.E. FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 U.A.E. FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 U.A.E. FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.A.E. DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.A.E. BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 U.A.E. CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 U.A.E. PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.A.E. CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.A.E. BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.A.E. NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 134 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 135 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 SOUTH AFRICA B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SOUTH AFRICA B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SOUTH AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 139 SOUTH AFRICA FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SOUTH AFRICA FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 SOUTH AFRICA FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 SOUTH AFRICA DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 151 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 152 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 153 KUWAIT B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 KUWAIT B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 KUWAIT FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 KUWAIT FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 KUWAIT FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 158 KUWAIT FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 KUWAIT DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 KUWAIT BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 KUWAIT CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 KUWAIT PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 KUWAIT CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 KUWAIT BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 KUWAIT NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 170 OMAN B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 OMAN B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 OMAN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 173 OMAN FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 OMAN FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 OMAN FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 OMAN DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 OMAN BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 OMAN CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 OMAN PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 OMAN CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 OMAN BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 OMAN NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 185 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 186 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 187 QATAR B2B IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 QATAR B2C IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 QATAR FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 190 QATAR FOOD SERVICE SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 QATAR FOOD PROCESSING SECTOR IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 192 QATAR FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 QATAR DAIRY PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 QATAR BAKERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 QATAR CONVENIENCE FOOD IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 QATAR PROCESSED MEAT PRODUCTS IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 QATAR CONFECTIONERY IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 QATAR BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 QATAR NON-ALCOHOLIC BEVERAGES IN FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 200 REST OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY TYPE, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING DEMAND FOR CONVENIENCE FOOD PRODUCTS IS LIKELY TO FAVOR FOOD ACIDULANTS INDUSTRY GROWTH WHICH IS DRIVING THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET IN THE FORECAST PERIOD

FIGURE 13 CITRIC ACID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET IN 2022 & 2029

FIGURE 14 UKRAINE AND RUSSIA’S SHARE OF MIDDLE EAST & AFRICA TRADE (2018-2020)-

FIGURE 15 SUPPLY CHAIN OF MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET

FIGURE 17 THE BELOW GRAPH SHOWS THE MIDDLE EAST & AFRICA MARKET SIZE FOR BEVERAGES

FIGURE 18 THE BELOW GRAPH SHOWS THE SALES OF MIDDLE EAST & AFRICA NON-ALCOHOLIC BEVERAGES FROM 2018 TO 2022:

FIGURE 19 THE BELOW GRAPH SHOWS THE SALES OF NON-ALCOHOLIC BEVERAGES IN U.S. FROM 2019 TO 2021-

FIGURE 20 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FORM, 2021

FIGURE 22 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY FUNCTION, 2021

FIGURE 23 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 MIDDLE EAST & AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY END-USER, 2021

FIGURE 25 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA FOOD INGREDIENTS (ACIDULANTS) MARKET: BY TYPE (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA FOOD INGREDIENT (ACIDULANTS) MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。