Middle East And Africa Free Space Optical Communication Market

市场规模(十亿美元)

CAGR :

%

USD

34.04 Million

USD

213.30 Million

2024

2032

USD

34.04 Million

USD

213.30 Million

2024

2032

| 2025 –2032 | |

| USD 34.04 Million | |

| USD 213.30 Million | |

|

|

|

|

Middle East and Africa Free Space Optical Communication Market, Component (Transceivers, Transmitters, Receivers, and Others) Range (Short Range (Indoor & Campus Environments), Medium Range (Metropolitan Area Networks), and Long Range (Intercity & Satellite Communications)) Technology (Infrared (IR)-Based, Visible Light Communication (VLC), Ultraviolet (UV)-Based, and Quantum Communication) Network Type (Point-To-Point (P2P), Point-To-Multipoint (P2MP), and Mesh Networks) Application (Mobile Backhaul, Data Transmission, Disaster Recovery, Security and Surveillance, Airborne Applications, Last-Mile Access, and Others) End-Use (Telecommunications, Defense, Smart Cities, Healthcare, Retail & E-Commerce, Media & Entertainment, Oil & Gas, and Others) - Industry Trends and Forecast to 2032

Middle East and Africa Free Space Optical Communication Market Analysis

The Middle East and Africa free space optical communication market refers to the industry focused on the transmission of data using light propagation in free space, such as air, vacuum, or outer space, without the need for fiber-optic cables or traditional wireless communication methods. This technology enables high-speed, secure, and cost-effective data transfer for applications including satellite communication, 5G backhaul, military and defense, enterprise networking, and deep-space exploration. The market encompasses FSO transmitters, receivers, modulators, and related optical components, driven by advancements in laser technology, increasing demand for high-bandwidth communication, and growing integration with emerging technologies like artificial intelligence (AI) and the Internet of Things (IoT).

Middle East and Africa Free Space Optical Communication Market Size

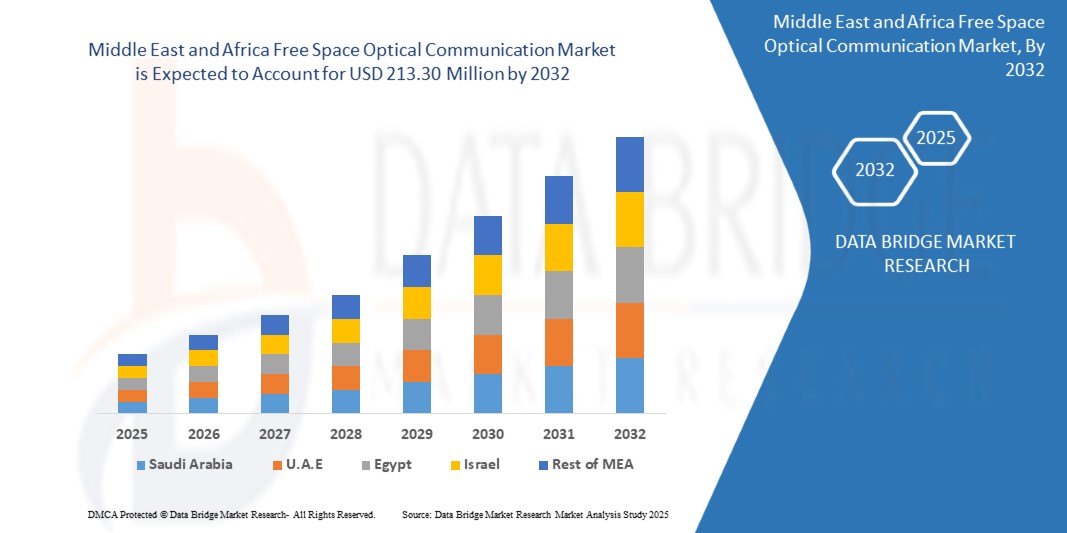

Middle East and Africa free space optical communication market is expected to reach USD 213.30 million by 2032 from USD 34.04 million in 2024, growing with a CAGR of 25.9% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Middle East and Africa Free Space Optical Communication MarketTrends

“Expanding Applications in Satellite-To-Ground and Deep-Space Communication"

Expanding applications in satellite-to-ground and deep-space communication are driving advancements in optical links, enabling faster data transmission between satellites, space stations, and Earth. Unlike traditional radio-frequency (RF) systems, FSO offers higher bandwidth and reduced spectrum congestion, making it ideal for future interplanetary missions, lunar bases, and deep-space exploration. As agencies like NASA and private space companies invest in optical communication technologies, FSO is poised to revolutionize space-based data transfer, enhancing real-time communication and scientific discoveries.

The global Free Space Optical (FSO) Communication Market is poised for significant growth, driven by its advantages in high-speed, secure, and spectrum-efficient data transmission. While challenges such as high initial investment, maintenance costs, and atmospheric interference hinder widespread adoption, emerging opportunities in satellite-to-ground and deep-space communication present a promising future. As technological advancements continue to enhance FSO capabilities, its role in next-generation communication networks, space exploration, and secure data transfer is expected to expand, making it a crucial component of future global connectivity solutions

Report Scope andMiddle East and Africa Free Space Optical Communication MarketSegmentation

|

Report Metric |

Middle East and Africa Free Space Optical Communication MarketInsights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

Lumentum Operations LLC (U.S.), Opto-Link Corporation Limited (U.S.), Wireless Excellence Limited (Cable Free) (U.K.), Axiom Optics (U.S.), QinetiQ (England), EC System (Czech Republic), Viasat, Inc. (U.S.), fSONA Systems Corp. (Canada), L3Harris Technologies, Inc. (U.S.), Laser Light Communications (U.S.), Exail (France), Oledcomm (France), Mostcom JSC. (Russia), and CACI International Inc (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Middle East and Africa Free Space Optical Communication MarketDefinition

The Middle East and Africa free space optical communication market refers to the industry focused on the transmission of data using light propagation in free space, such as air, vacuum, or outer space, without the need for fiber-optic cables or traditional wireless communication methods. This technology enables high-speed, secure, and cost-effective data transfer for applications including satellite communication, 5G backhaul, military and defense, enterprise networking, and deep-space exploration. The market encompasses FSO transmitters, receivers, modulators, and related optical components, driven by advancements in laser technology, increasing demand for high-bandwidth communication, and growing integration with emerging technologies like artificial intelligence (AI) and the Internet of Things (IoT).

Middle East and Africa Free Space Optical Communication Market Dynamics

Drivers

- Rising Demand for High-Speed and Secure Data Transmission

With the increasing adoption of bandwidth-intensive applications such as cloud computing, real-time video streaming, and AI-driven analytics, traditional communication networks often struggle with congestion and latency issues. FSO technology, leveraging laser-based communication, offers ultra-high-speed data transmission with minimal latency, making it an ideal solution for industries requiring real-time data exchange. Moreover, its ability to operate without electromagnetic interference makes it highly suitable for secure communications in military, defense, and financial sectors.

In addition to speed, security is a growing concern, particularly in industries where data confidentiality is critical. Unlike traditional wireless communication methods that can be intercepted or disrupted by radio frequency interference, FSO systems provide a highly secure transmission channel by using a narrow laser beam that is difficult to intercept without detection. This makes FSO an attractive option for applications such as satellite communication, inter-data center connectivity, and secure government networks. As cyber threats continue to rise, the demand for robust, high-speed, and secure optical communication solutions is expected to grow, further driving the adoption of FSO technology across various sectors.

For Instance,

In May 2022, according to the article published by Mitsubishi Electric Corporation, the company has developed the world’s first optical receiver for laser communication terminals (LCTs) that integrates space optical communication with spatial beam acquisition. This innovation enhances Free Space Optical (FSO) communication by enabling 10 times the speed, capacity, and range of RF systems. With real-time data transfer, it supports disaster response, remote connectivity, and high-resolution satellite imaging. Its compact design also allows deployment in areas without traditional infrastructure, driving FSO adoption

- Growing Deployment Of 5g Networks And Backhaul Solutions

With the rapid expansion of 5G services, there is an increasing need for robust backhaul networks that can efficiently handle massive data traffic. FSO technology offers a cost-effective and high-speed wireless solution for connecting 5G base stations, especially in urban environments where fiber deployment is challenging and in remote areas where laying cables is impractical. Its ability to deliver gigabit-speed connectivity without requiring spectrum licensing makes it an attractive choice for network operators looking to enhance 5G coverage and performance.

Beyond its role in backhaul, FSO technology also supports fronthaul and midhaul solutions, ensuring seamless communication between different 5G network components. As 5G infrastructure expands, particularly with the rise of small cell deployments, the need for flexible and scalable connectivity solutions continues to grow. FSO's ability to transmit large volumes of data wirelessly without interference makes it a reliable alternative to fiber, complementing traditional network architectures. With ongoing advancements in optical communication and laser technology, FSO is expected to play a crucial role in optimizing 5G networks, enabling ultra-fast and secure wireless communication across diverse environments

For Instance,

In January 2023, according to ET Telecom, Free Space Optical Communication (FSOC) technology is expected to gain traction in India as 5G rollouts accelerate, offering a cost-effective, high-bandwidth alternative to fiber, particularly in challenging terrains. FSOC enables rapid deployment and enhances connectivity in rural and remote areas, addressing the growing demand for robust backhaul solutions in 5G networks. By providing low-latency, high-capacity links without extensive infrastructure, FSOC is set to drive market growth and support network expansion in underserved regions

Opportunities

- Integration of Free Space Optics with Li-Fi for High-Speed Wireless Networks

By combining the long-range, high-bandwidth capabilities of FSO with the ultra-fast, secure, and interference-free data transmission of Li-Fi, high-speed wireless networks become efficient in network communication. This hybrid approach can enable seamless connectivity in urban environments, smart cities, and industrial automation, where traditional RF-based communication faces congestion and security limitations. By leveraging FSO’s ability to transmit data over long distances without spectrum licensing issues and Li-Fi’s potential for high-speed indoor communication, this integration can revolutionize wireless networking, providing faster, more secure, and energy-efficient solutions for next-generation connectivity.

For instance,

In February 2023, according to the article published by Mint, IIT Guwahati has transferred its free-space optical communication technology to the telecom industry, enabling secure, high-speed wireless data transmission. With applications in defense and remote connectivity, integrating Free Space Optics (FSO) with Li-Fi offers a significant opportunity to enhance telecom and smart city infrastructure, driving demand for advanced optical wireless solutions

- GRowing Adoption in Smart Cities and Industrial IoT For Data Transmission

As urban areas become increasingly connected, FSO technology offers a secure and interference-free alternative for transmitting large volumes of data between smart infrastructure, traffic management systems, and surveillance networks. Similarly, in IoT environments, FSO enables real-time communication in manufacturing plants, logistics hubs, and automated systems without the need for extensive fiber deployment. With the rising demand for seamless connectivity in urban and industrial ecosystems, FSO is emerging as a vital solution for enhancing operational efficiency and data-driven decision-making.

For instance,

In October 2024, according to the article published by RCR Wireless News, Nokia and NTT DATA have deployed a private 5G network in Brownsville, Texas, to support smart city applications, including predictive maintenance, law enforcement connectivity, and IoT integration. This initiative highlights the growing adoption of advanced wireless solutions in smart cities. The expansion of private 5G and IoT infrastructure presents a major opportunity for the Free Space Optical Communication market, enabling high-speed, secure data transmission for smart city and industrial IoT applications while complementing traditional networks

Restraints/Challenges

- Limited Range and Line-Of-Sight Requirements Hindering Deployment

Unlike radio frequency communication, FSOC relies on direct, unobstructed pathways between transmitters and receivers, making it vulnerable to obstacles such as buildings, mountains, and atmospheric disturbances. This constraint limits its scalability, particularly for large-scale terrestrial networks, where maintaining clear optical links over long distances remains a significant problem.

For instance,

In August 2024, according to the article published by TechTarget, Optical Wireless Communication (OWC) enables high-speed and secure data transmission but faces limitations due to its reliance on line-of-sight transmission and inability to penetrate solid barriers, restricting its scalability in large or obstructed environments. This dependence on direct visibility and short transmission range poses challenges for widespread deployment, particularly in enterprises with open spaces, outdoor settings, or dynamic configurations, thereby limiting its adoption in the free space optical communication market

- Susceptibility to Environmental Factors Like Fog, Rain, and Turbulence

Unlike RF-based communication, FSO relies on light propagation through the atmosphere, making it vulnerable to absorption, scattering, and beam dispersion in adverse weather conditions. Dense fog, for instance, can cause severe signal attenuation, while heavy rain and turbulence introduce fluctuations in transmission stability. Overcoming these challenges requires advanced adaptive optics, error correction techniques, and hybrid communication models that integrate FSO with RF or fiber-optic networks for seamless connectivity.

For instance,

In February 2024, according to Walter de Gruyter GmbH, a recent study highlights advancements and challenges in Free Space Optical (FSO) communication, focusing on the impact of weather fluctuations and turbulence. Since FSO relies on clear atmospheric conditions, it is highly susceptible to fog, rain, and turbulence, causing signal attenuation and performance degradation. Addressing these issues is crucial for its widespread adoption

Middle East and Africa Free Space Optical Communication Market Scope

The Middle East and Africa free space optical communication market is segmented into six notable segments based on the component, range, technology, network type, application and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Transceivers

- Transmitters

- Receivers

- Others

Range

- Short Range (Indoor And Campus Environments)

- Medium Range (Metropolitan Area Networks)

- Long Range (Intercity And Satellite Communications)

Technology

- Infrared (IR)-Based

- Visible Light Communication (VLC)

- Ultraviolet (UV)-Based

- Quantum Communication

Network Type

- Point-To-Point (P2p)

- Point-To-Multipoint (P2mp)

- Mesh Networks

Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

End-Use

- Telecommunications

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Defence

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Smart Cities

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Healthcare

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Retail & E-Commerce

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Media & Entertainment

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Oil & Gas

- Application

- Mobile Backhaul

- Data Transmission

- Disaster Recovery

- Security And Surveillance

- Airborne Applications

- Last-Mile Access

- Others

- Others

Middle East and Africa Free Space Optical Communication Market Regional Analysis

The Middle East and Africa free space optical communication market is segmented into six notable segments based on the component, range, technology, network type, application and end user

The countries covered in the free space optical communication market report as U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East & Africa.

U.A.E. is expected to dominate the free space optical communication market due to due to its early adoption of advanced communication technologies and strong investment in 5G and satellite communication. The region's high demand for secure, high-speed data transmission in defense, aerospace, and telecommunications sectors further fuels growth.

U.A.E. is expected to be the fastest growing region due to its the presence of leading tech companies and research institutions accelerates innovation and deployment of FSO solutions. Government initiatives and funding for smart city projects and secure military communication enhance market expansion.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Free Space Optical Communication Market Share

Free Space Optical Communication Market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa Free Space Optical Communication Market.

Middle East and Africa Free Space Optical Communication MarketLeaders Operating in the Marketare:

- Lumentum Operations LLC (U.S.)

- Opto-Link Corporation Limited (U.S.)

- Wireless Excellence Limited (Cable Free) (U.K)

- Axiom Optics (U.S.)

- QinetiQ (England)

- EC System (Czech Republic)

- Viasat, Inc. (U.S.)

- fSONA Systems Corp. (Canada)

- L3Harris Technologies, Inc. (U.S.)

- Laser Light Communications (U.S.)

- Exail (France)

- Oledcomm (France)

- Mostcom JSC. (Russia)

- CACI International Inc (U.S.)

Latest Developments in Middle East and Africa Free Space Optical Communication Market

- In February 2025, L3Harris advanced its technology for U.S. Navy torpedoes with the Improved Post-Launch Communications System (IPLCS). This fiber-optic tether enhances real-time data transmission, offering better bandwidth, communication range, and reliability compared to previous systems. It will significantly improve targeting accuracy and operational efficiency, benefiting submarine-launched MK-48 torpedoes, starting in 2029. The IPLCS system replaces outdated copper wire tethers and strengthens undersea capabilities for both U.S. and allied forces, with plans for integration into Royal Australian Navy submarines. This innovation will provide a strategic edge in Middle East and Africa maritime defense, particularly in the Indo-Pacific region

- In April 2024, L3Harris Technologies has extended its partnership with the U.S. Space Force through a contract worth up to USD 187 million for the MOSSAIC program. This initiative will enhance space domain awareness capabilities by modernizing and sustaining space infrastructure, including radar and optical sensors, vital for tracking deep space objects. The upgrade will improve space surveillance and security, benefiting military, civil, and commercial users. The extension could bring the total contract value to USD 1.2 billion over the next decade, ensuring the U.S. maintains its leadership in space operations and safeguarding critical space assets from potential threats

- In February 2024, QinetiQ participates in the Space Symposium, a premier Middle East and Africa event where leaders from government, military, commercial, and academic sectors convene to discuss advancements in space exploration and commercial travel. This platform allows QinetiQ to showcase its Free Space Optical Communication (FSOC) technology, positioning it as a secure, high-bandwidth alternative to RF communications for the future of space connectivity

- In January 2025, Viasat and The European Space Agency (ESA) partnered to develop a satellite direct-to-device (D2D) connectivity solution, enabling mobile broadband access without relying on ground infrastructure. This collaboration strengthens Viasat’s expertise in Free Space Optical Communication (FSOC) by advancing optical communication through initiatives like AIDAN Next, enhancing secure and high-speed satellite data transmission

- In January 2025, CACI International Inc. announced that its President and Chief Executive Officer, John Mengucci, and Chief Financial Officer and Treasurer, Jeff MacLauchlan, will participate in the TD Cowen 46th Annual Aerospace and Defense Conference. They will engage in a fireside chat followed by a question-and-answer session. The event will be held in 2025, and a live audio webcast of the event will be available on the CACI investor relations website. A replay will be posted for 90 days following the event

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 PESTLE ANALYSIS

4.3 REGULATORY STANDARDS

4.4 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.5 PENETRATION AND GROWTH PROSPECT MAPPING OF THE MIDDLE EAST AND AFRICA FREE SPACE OPTICAL (FSO) COMMUNICATION MARKET

4.6 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.7 PATENT ANALYSIS

4.8 EMERGING TRENDS AND FUTURE OUTLOOK OF FREE SPACE OPTICAL COMMUNICATION IN EUROPE

4.9 TECHNOLOGY ANALYSIS

4.1 COMPANY COMPARATIVE ANALYSIS

4.11 USE CASE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR HIGH-SPEED AND SECURE DATA TRANSMISSION

5.1.2 GROWING DEPLOYMENT OF 5G NETWORKS AND BACKHAUL SOLUTIONS

5.1.3 INCREASING ADOPTION IN MILITARY, DEFENSE, AND AEROSPACE APPLICATIONS

5.1.4 SURGING DEMAND FOR DISASTER RECOVERY AND EMERGENCY COMMUNICATION NETWORKS

5.2 RESTRAINTS

5.2.1 LIMITED RANGE AND LINE-OF-SIGHT REQUIREMENTS HINDERING DEPLOYMENT

5.2.2 HIGH INITIAL INVESTMENT AND MAINTENANCE COSTS FOR ADVANCED SYSTEMS

5.3 OPPORTUNITIES

5.3.1 EXPANDING APPLICATIONS IN SATELLITE-TO-GROUND AND DEEP-SPACE COMMUNICATION

5.3.2 INTEGRATION OF FREE SPACE OPTICS WITH LI-FI FOR HIGH-SPEED WIRELESS NETWORKS

5.3.3 GROWING ADOPTION IN SMART CITIES AND INDUSTRIAL IOT FOR DATA TRANSMISSION

5.4 CHALLENGES

5.4.1 SUSCEPTIBILITY TO ENVIRONMENTAL FACTORS LIKE FOG, RAIN, AND TURBULENCE

5.4.2 REGULATORY AND COMPLIANCE CHALLENGES IN CROSS-BORDER OPTICAL COMMUNICATION

6 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 TRANSCEIVERS

6.3 TRANSMITTERS

6.4 RECEIVERS

6.5 OTHERS

7 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE

7.1 OVERVIEW

7.2 SHORT RANGE (INDOOR AND CAMPUS ENVIRONMENTS)

7.3 MEDIUM RANGE (METROPOLITAN AREA NETWORKS)

7.4 LONG RANGE (INTERCITY AND SATELLITE COMMUNICATIONS)

8 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE

8.1 OVERVIEW

8.2 POINT-TO-POINT (P2P)

8.3 POINT-TO-MULTIPOINT (P2MP)

8.4 MESH NETWORKS

9 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MOBILE BACKHAUL

9.3 DATA TRANSMISSION

9.4 DISASTER RECOVERY

9.5 SECURITY AND SURVEILLANCE

9.6 AIRBORNE APPLICATIONS

9.7 LAST-MILE ACCESS

9.8 OTHERS

10 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 INFRARED (IR)-BASED

10.3 VISIBLE LIGHT COMMUNICATION (VLC)

10.4 ULTRAVIOLET (UV)-BASED

10.5 QUANTUM COMMUNICATION

11 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE

11.1 OVERVIEW

11.2 TELECOMMUNICATIONS

11.2.1 TELECOMMUNICATIONS, BY APPLICATION

11.2.1.1 MOBILE BACKHAUL

11.2.1.2 DATA TRANSMISSION

11.2.1.3 DISASTER RECOVERY

11.2.1.4 SECURITY AND SURVEILLANCE

11.2.1.5 AIRBORNE APPLICATIONS

11.2.1.6 LAST-MILE ACCESS

11.2.1.7 OTHERS

11.3 DEFENCE

11.3.1 DEFENCE, BY APPLICATION

11.3.1.1 MOBILE BACKHAUL

11.3.1.2 DATA TRANSMISSION

11.3.1.3 DISASTER RECOVERY

11.3.1.4 SECURITY AND SURVEILLANCE

11.3.1.5 AIRBORNE APPLICATIONS

11.3.1.6 LAST-MILE ACCESS

11.3.1.7 OTHERS

11.4 SMART CITIES

11.4.1 SMART CITIES, BY APPLICATION

11.4.1.1 MOBILE BACKHAUL

11.4.1.2 DATA TRANSMISSION

11.4.1.3 DISASTER RECOVERY

11.4.1.4 SECURITY AND SURVEILLANCE

11.4.1.5 AIRBORNE APPLICATIONS

11.4.1.6 LAST-MILE ACCESS

11.4.1.7 OTHERS

11.5 HEALTHCARE

11.5.1 HEALTHCARE, BY APPLICATION

11.5.1.1 MOBILE BACKHAUL

11.5.1.2 DATA TRANSMISSION

11.5.1.3 DISASTER RECOVERY

11.5.1.4 SECURITY AND SURVEILLANCE

11.5.1.5 AIRBORNE APPLICATIONS

11.5.1.6 LAST-MILE ACCESS

11.5.1.7 OTHERS

11.6 RETAIL & E-COMMERCE

11.6.1 RETAIL & E-COMMERCE, BY APPLICATION

11.6.1.1 MOBILE BACKHAUL

11.6.1.2 DATA TRANSMISSION

11.6.1.3 DISASTER RECOVERY

11.6.1.4 SECURITY AND SURVEILLANCE

11.6.1.5 AIRBORNE APPLICATIONS

11.6.1.6 LAST-MILE ACCESS

11.6.1.7 OTHERS

11.7 MEDIA & ENTERTAINMENT

11.7.1 MEDIA & ENTERTAINMENT, BY APPLICATION

11.7.1.1 MOBILE BACKHAUL

11.7.1.2 DATA TRANSMISSION

11.7.1.3 DISASTER RECOVERY

11.7.1.4 SECURITY AND SURVEILLANCE

11.7.1.5 AIRBORNE APPLICATIONS

11.7.1.6 LAST-MILE ACCESS

11.7.1.7 OTHERS

11.8 OIL & GAS

11.8.1 OIL & GAS, BY APPLICATION

11.8.1.1 MOBILE BACKHAUL

11.8.1.2 DATA TRANSMISSION

11.8.1.3 DISASTER RECOVERY

11.8.1.4 SECURITY AND SURVEILLANCE

11.8.1.5 AIRBORNE APPLICATIONS

11.8.1.6 LAST-MILE ACCESS

11.8.1.7 OTHERS

11.9 OTHERS

12 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E.

12.1.2 ISRAEL

12.1.3 SAUDI ARABIA

12.1.4 SOUTH AFRICA

12.1.5 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 L3HARRIS TECHNOLOGIES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 QINETIQ

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT NEWS

15.3 VIASAT, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CACI INTERNATIONAL INC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT NEWS

15.5 EXAIL (SUBSIDIARY OF EXAIL TECHNOLOGIES)

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AXIOM OPTICS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 EC SYSTEM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 FSONA NETWORKS CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 LASER LIGHT COMMUNICATIONS

15.9.1 COMPANY SNAPSHOT

15.9.2 SERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 LUMENTUM OPERATIONS LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MOSTCOM JSC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT NEWS

15.12 OLEDCOMM

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 OPTO-LINK CORPORATION LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 WIRELESS EXCELLENCE LIMITED

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 USE CASE AND ITS ANALYSIS

TABLE 4 WAVELENGTH RANGES OF OPTICAL WIRELESS COMMUNICATION SPECTRUMS

TABLE 5 COST BREAKDOWN OF KEY COMPONENTS IN A WIRELESS COMMUNICATION NETWORK

TABLE 6 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA TRANSCEIVERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA TRANSMITTERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA RECEIVERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA OTHERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA SHORT RANGE (INDOOR AND CAMPUS ENVIRONMENTS) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA MEDIUM RANGE (METROPOLITAN AREA NETWORKS) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LONG RANGE (INTERCITY AND SATELLITE COMMUNICATIONS) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POINT-TO-POINT (P2P) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POINT-TO-MULTIPOINT (P2MP) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA MESH NETWORKS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA MOBILE BACKHAUL IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA DATA TRANSMISSION IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA DISASTER RECOVERY IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SECURITY AND SURVEILLANCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA AIRBORNE APPLICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA LAST-MILE ACCESS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA INFRARED (IR)-BASED IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA VISIBLE LIGHT COMMUNICATION (VLC) IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ULTRAVIOLET (UV)-BASED IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA QUANTUM COMMUNICATION IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA OTHERS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 63 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 64 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 65 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 U.A.E. FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 68 U.A.E. TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 U.A.E. DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 U.A.E. SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 71 U.A.E. HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E. RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 U.A.E. MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 U.A.E. OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 76 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 77 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 78 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 ISRAEL FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 81 ISRAEL TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 82 ISRAEL DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 ISRAEL SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 ISRAEL HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 ISRAEL RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 ISRAEL MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 ISRAEL OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 89 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 90 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 91 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 SAUDI ARABIA HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 SAUDI ARABIA RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 SAUDI ARABIA MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 100 SAUDI ARABIA OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH AFRICA DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH AFRICA HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY RANGE, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT FREE SPACE OPTICAL COMMUNICATION MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT TELECOMMUNICATIONS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT DEFENSE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT SMART CITIES IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT HEALTHCARE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT RETAIL & E-COMMERCE IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 EGYPT MEDIA & ENTERTAINMENT IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 EGYPT OIL & GAS IN FREE SPACE OPTICAL COMMUNICATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 REST OF MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: END-USE COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET, BY COMPONENT (2024)

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RISING DEMAND FOR HIGH-SPEED AND SECURE DATA TRANSMISSION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 TRANSCEIVERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET IN 2025 & 2032

FIGURE 18 5G BASE STATIONS AS A PERCENTAGE OF EXISTING 4G BASE STATIONS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET

FIGURE 20 MIDDLE EAST AND AFRICA INTERNET USAGE

FIGURE 21 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY COMPONENT, 2024

FIGURE 22 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY RANGE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY NETWORK TYPE, 2024

FIGURE 24 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY TECHNOLOGY, 2024

FIGURE 26 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: BY END-USE, 2024

FIGURE 27 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA FREE SPACE OPTICAL COMMUNICATION MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。