Middle East And Africa Hydrogen Sulfide Scavengers Market

市场规模(十亿美元)

CAGR :

%

USD

43.97 Million

USD

58.69 Million

2024

2032

USD

43.97 Million

USD

58.69 Million

2024

2032

| 2025 –2032 | |

| USD 43.97 Million | |

| USD 58.69 Million | |

|

|

|

中東和非洲硫化氫 (H2S) 清除劑市場細分,按產品(非再生型和再生型)、類型(水溶性、油溶性和金屬基)、應用(陸上和海上)、最終用途(天然氣、原油、廢水處理、中間體、精煉產品和其他)——行業趨勢和預測至 2032 年

中東和非洲硫化氫(H2S)清除劑市場分析

硫化氫 (H₂S) 清除劑化學品的歷史可以追溯到 20 世紀中葉,當時工業化導致人們認識到硫化氫是石油和天然氣、廢水處理和石化等行業的主要污染物和安全隱患。早期處理 H₂S 的方法主要集中於機械和物理去除技術,但這對於大規模操作而言不足。這促使人們開發出能夠有效中和 H₂S 的化學溶液。 1970 年代和 1980 年代,人們的環保意識不斷增強以及排放法規越來越嚴格,推動了更高效、更專業的 H₂S 清除劑的創新,例如基於三嗪的化合物和金屬螯合物。這些進步使行業能夠遵守環境標準,同時提高營運效率。多年來,對環保和永續的清除劑的需求進一步加速了創新。如今,氫清除劑在各種工業製程中發揮降低硫化氫風險、確保安全和保護環境的關鍵作用。

中東和非洲硫化氫(H2S)清除劑市場規模

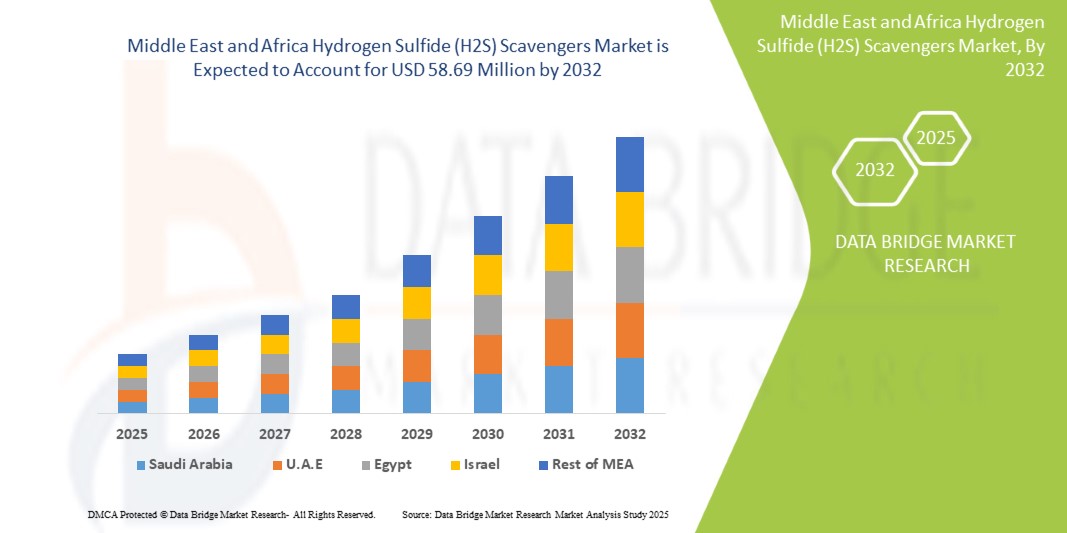

2024 年中東和非洲硫化氫 (H2S) 清除劑市場規模為 4,397 萬美元,預計到 2032 年將達到 5,869 萬美元,在 2025 年至 2032 年的預測期內複合年增長率為 3.9%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

中東和非洲硫化氫(H2S)清除劑市場趨勢

“石油和天然氣行業勘探和生產活動日益增加”

中東和非洲石油和天然氣行業日益增長的勘探和生產 (E&P) 活動極大地推動了對硫化氫 (H₂S) 清除劑的需求。隨著石油和天然氣公司不斷擴大勘探力度,特別是在酸性氣田,對有效的 H₂S 管理的需求變得越來越重要。硫化氫是一種經常出現在天然氣和原油中的有毒腐蝕性氣體,會帶來嚴重的安全、環境和操作風險。因此,石油和天然氣行業越來越依賴硫化氫清除劑來降低這些風險,確保遵守安全法規,並提高營運效率,隨著石油和天然氣行業勘探和生產活動的加強,對可靠、高效的硫化氫清除劑的需求正在增長,推動著市場擴張和創新。

報告範圍以及中東和非洲硫化氫(H2S)清除劑市場細分

|

屬性 |

中東和非洲硫化氫(H2S)清除劑市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋區域 |

沙烏地阿拉伯、南非、阿聯酋、卡達、科威特、阿曼、埃及、以色列、巴林以及中東和非洲其他地區 |

|

主要市場參與者 |

Baker Hughes Company (U.S.), Ecolab (U.S.), SLB (U.S.), BASF (Germany), Arkema (France), The Lubrizol Corporation (U.S.), Veolia (France), Innospec (U.S.), HEXION INC. (U.S.), Shepherd Chemicals (U.S.), Zirax (Russia), Chemical Products Industries, Inc. (U.S.), Q2Technologies (U.S.), International Chemical Group (U.S.), Al Moghera Petroleum Chem Ind LLC (U.A.E.), Osprey Specialty Group, LLC (U.S.), BERRYMAN CHEMICAL (U.S.), Middle East and Africa Drilling Fluids & Chemicals Limited (India), Imperial Oilfield Chemicals Pvt. Ltd (India), and NuGenTec (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Hydrogen Sulfide (H2S) Scavengers Market Definition

Hydrogen Sulfide (H₂S) scavengers are chemical agents specifically designed to neutralize and remove hydrogen sulfide, a highly toxic and corrosive gas, from industrial processes, environments, and products. These scavengers work by chemically reacting with H₂S, converting it into non-toxic and stable compounds, thereby mitigating its harmful effects on human health, infrastructure, and the environment. H₂S scavengers are widely utilized in industries such as oil and gas, refining, petrochemicals, wastewater treatment, and pulp and paper, where hydrogen sulfide is commonly produced as a byproduct. They are integral in sour gas processing, refining operations, and wastewater odor control. Scavengers can be categorized into regenerative and non-regenerative types, depending on whether the scavenger can be reused.

Middle East and Africa Hydrogen Sulfide (H2S) Scavengers Market Definition Dynamics

Drivers

- Increasing Demand for Clean Energy and Natural Gas Processing

The Middle East and Africa shift towards clean energy solutions and the growing demand for natural gas as a cleaner alternative to traditional fossil fuels are driving the demand for Hydrogen Sulfide (H₂S) scavengers. Natural gas, which is widely regarded as an efficient and environmentally friendly energy source, often contains hydrogen sulfide, a toxic and corrosive compound that must be removed to ensure safety, compliance with environmental regulations, and equipment longevity. This need is a significant factor propelling the growth of the hydrogen sulfide scavengers market.

Beyond oil and gas, other industries such as pulp and paper, wastewater treatment, and chemical manufacturing are also adopting H₂S scavengers to meet local and international environmental standards. For instance, wastewater treatment facilities are utilizing H₂S scavengers to control odor and reduce the corrosive effects of sulfur compounds on infrastructure, ensuring compliance with municipal regulations

For instance, In July 2024, according to article published on EPA website the Clean Air Act (CAA), enforced by the Environmental Protection Agency (EPA), has strict mandates on hazardous air pollutants, including H₂S. Industries like oil & gas and wastewater treatment are required to implement advanced gas treatment solutions to comply with emission limits.

Therefore, the Middle East and Africa hydrogen sulfide scavengers market is experiencing significant growth driven by the escalating enforcement of environmental regulations aimed at reducing H₂S emissions. Industries across oil and gas, wastewater treatment, and chemical manufacturing are adopting advanced H₂S scavenger technologies to ensure regulatory compliance, safeguard public health, and protect the environment.

- Rising Demand For Clean Water And Wastewater Treatment

Urbanization, industrialization, and population growth have increased the stress on water resources, driving the need for advanced treatment solutions. Hydrogen sulfide not only creates foul odors but also leads to the corrosion of treatment infrastructure and pipelines, escalating maintenance costs. Consequently, municipalities and industries are investing heavily in H₂S scavengers to mitigate these challenges, reduce downtime, and enhance the lifespan of their facilities. In emerging economies across Asia-Pacific, governments are initiating large-scale wastewater treatment projects to combat water scarcity and pollution. For instance, India’s Namami Gange Program and China’s Three-Year Action Plan for Clean Water emphasize improving wastewater treatment infrastructure, fostering the adoption of H₂S scavengers to combat sulfide-related issues

For instance, In July 2021 an article published on The White House official website, the USD 55 billion investment in clean drinking water infrastructure in the United States marks the largest in history, addressing the needs of up to 10 million households and 400,000 schools and childcare centers without safe water. This initiative includes replacing lead service lines and tackling hazardous chemicals like PFAS, ensuring access to safe water for rural, urban, and disadvantaged communities. As Hydrogen Sulfide (H₂S), a common contaminant in wastewater, poses health and environmental risks. The need to eliminate H₂S to meet stringent water safety standards significantly propels the market for H₂S scavengers, critical in ensuring a clean and safe water supply.

隨著中東和非洲水資源短缺問題加劇以及環境法規的收緊,硫化氫清除劑在實現清潔水和高效廢水處理方面的作用將持續增強。這種不斷增長的需求為製造商提供了一個有利可圖的機會,可以開發創新、環保且經濟高效的清除解決方案,以滿足不同的治療需求。

機會

- 清除劑配方的技術進步與創新

一項重大創新是開發更有效率、更經濟的液體和固體清除劑。即使在 H₂S 濃度不同的惡劣環境中,這些較新的配方也能提供卓越的硫化氫去除性能。液體清除劑,例如胺基和乙二醛基溶液,已經過優化,以確保更快的反應時間和更高的吸收率,使其適用於更廣泛的工業應用。固體清除劑,包括金屬氧化物和鐵海綿配方,也得到了改進,可提供更持久的性能且再生要求極低。

例如,2018 年 6 月,根據 Crambeth Allen Publishing Ltd 發表的一篇文章,基於三嗪的液體清除劑與先進設備相結合,為在各個生產階段去除硫化氫 (H₂S) 提供了經濟高效的解決方案。三嗪可有效將硫化氫濃度降低至較低水平,並針對特定應用量身定製配方,幫助生產商滿足監管標準並優化成本,尤其是在北美頁岩油繁榮時期

因此,清除配方的持續技術進步和創新正在幫助各行各業應對日益嚴峻的 H₂S 管理挑戰。這些發展有助於提高營運安全性、減少對環境的影響並節省成本,為市場持續成長和發展奠定基礎。

- 政府支持的清潔能源、環境保護和工業安全措施和資金

在清潔能源領域,各國政府正大力投資風能、太陽能和氫能等再生能源,這些能源在生產、開採或運輸過程中都會產生硫化氫排放。為了減輕對環境的影響,這些措施通常包括為硫化氫管理解決方案(例如先進的清除技術)提供資金。這鼓勵開發更有效率、更環保的清除劑配方,減少生產過程中的有害排放,並符合中東和非洲的永續發展目標。

例如,根據化學產品工業公司 (Chemical Products Industries, Inc.) 於 2024 年 1 月發布的一篇博客,水基、油溶性、再生和固體等類型的硫化氫清除劑對於工業環境中的 H2S 管理至關重要。每種類型都有其獨特的作用,從廢水處理到石油加工,確保工人安全、環境保護,並在各種應用中提供經濟高效、可持續的 H2S 去除解決方案

因此,政府支持的措施和資金在促進硫化氫清除技術進步方面發揮關鍵作用,支持更清潔、更安全、更永續的工業營運發展。

限制/挑戰

- 某些硫化氫清除劑處置不當造成的環境問題與影響

在石油和天然氣等通常使用硫化氫清除劑的行業中,不當的處理方法可能會導致嚴重的生態破壞。例如,在油田和煉油廠,生產過程中用於中和硫化氫的清除劑可能含有重金屬等有毒化合物或其他對環境有害的化學物質。如果這些食腐動物被不當丟棄,且不遵守適當的環境法規,它們就會污染當地的生態系統,影響水生生物、動植物,並帶來長期的環境風險。

例如,根據美國環保署(EPA)網站發表的一篇文章,2024年4月,美國環保署(EPA)對危險廢棄物的處理進行了監管,其中包括廢硫化氫清除劑。這促使整個產業重新評估處置流程,由於需要遵守更嚴格的廢棄物處置標準並投資於環保替代品,導致營運成本增加。

因此,市場面臨著那些尋求符合環境標準且具有成本效益的解決方案的公司的阻力。這種限制在價格敏感地區和產業尤其明顯,因為環境合規性會增加大量營運成本,進而影響中東和非洲硫化氫清除劑市場的成長潛力。

- 替代氣體處理和過濾技術的進展

氣體處理領域最重要的發展之一是使用先進的過濾系統,例如分子篩、活性碳和沸石基材料。這些材料可以有效地捕獲和去除氣流中的硫化氫,為傳統化學清除劑提供潛在的替代品。這些過濾系統通常具有更長的使用壽命和更低的維護要求,因此對於尋求最大限度減少停機時間和降低營運成本的行業來說具有吸引力。

例如,2022 年 6 月,ResearchGate 的一篇文章回顧了硫化氫 (H₂S) 去除的最新進展,重點介紹了清除技術的新興趨勢。一個顯著的發展是使用固體吸附劑捕獲H₂S,具有高效率和可重複使用性。此類技術解決了傳統化學清除劑的挑戰,降低了營運成本和環境影響,使其成為工業應用中有吸引力的替代方案

雖然這些替代氣體處理技術具有良好的前景,但也帶來了挑戰。例如,某些過濾或催化系統的初始資本投資可能高於傳統的清除方法。此外,並非所有替代技術都適用於每種工業應用,尤其是在 H₂S 濃度變化或難以預測的環境中。

中東和非洲硫化氫(H2S)清除劑市場範圍

市場根據產品、類型、應用和最終用途進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

產品

- 非再生

- 再生

類型

- 水溶性

- 油溶性

- 金屬基

應用

- 陸上

- 海上

最終用途

- 天然氣

- 原油

- 廢水處理

- 中間體

- 精煉產品

中東和非洲硫化氫(H2S)清除劑市場區域分析

對市場進行分析,並提供市場規模洞察和趨勢,包括上述國家、產品、類型、應用和最終用戶。

市場涵蓋的區域包括沙烏地阿拉伯、南非、阿聯酋、卡達、科威特、阿曼、埃及、以色列、巴林以及中東和非洲其他地區。

沙烏地阿拉伯預計將佔據市場主導地位,並成為成長最快的國家,因為其擁有龐大的石油和天然氣產業,而硫化氫清除劑對於防止腐蝕和維護安全至關重要。該國不斷增長的石油產量和煉油能力對這些產品產生了持續的需求。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了中東和非洲品牌的存在和可用性,以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

中東和非洲硫化氫(H2S)清除劑市場份額

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Hydrogen Sulfide (H2S) Scavengers Market Leaders Operating in the Market Are:

- Baker Hughes Company (U.S.)

- Ecolab (U.S.)

- SLB (U.S.)

- BASF (Germany)

- Arkema (France)

- The Lubrizol Corporation (U.S.)

- Veolia (France)

- Innospec (U.S.)

- HEXION INC. (U.S.)

- Shepherd Chemicals (U.S.)

- Zirax (Russia)

- Chemical Products Industries, Inc. (U.S.)

- Q2Technologies (U.S.)

- International Chemical Group (U.S.)

- Al Moghera Petroleum Chem Ind LLC (U.A.E.)

- Osprey Specialty Group, LLC (U.S.)

- BERRYMAN CHEMICAL (U.S.)

- Middle East and Africa Drilling Fluids & Chemicals Limited (India)

- Imperial Oilfield Chemicals Pvt. Ltd (India)

- NuGenTec (U.S.)

Latest Developments in Middle East and Africa Hydrogen Sulfide (H2S) Scavengers Market

- In May 2024, Baker Hughes has expanded its Dammam facility in Saudi Arabia, adding new manufacturing capabilities and creating 60 jobs. The expansion will enhance compression train production, seal gas panels, vibration monitoring systems, and gear repairs to support major gas and hydrogen projects

- In November 2024, Ecolab has acquired Barclay Water Management, a provider of water safety and digital monitoring solutions. This acquisition enhances Ecolab's offerings, including the iChlor Monochloramine System, and supports growth in North America through improved water safety and operational performance

- In April 2024, BASF and Youyi Group signed a Letter of Intent , to strengthen their strategic partnership. The agreement focuses on supplying butyl acrylate and 2-ethylhexyl acrylate from BASF's Zhanjiang Verbund site to support the growing adhesive materials market in China

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 PRODUCT QUALITY AND PERFORMANCE

4.5.2 TECHNOLOGY AND INNOVATION

4.5.3 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.5.4 COST EFFICIENCY AND VALUE PROPOSITION

4.5.5 CUSTOMER SUPPORT AND SERVICE

4.5.6 REPUTATION AND INDUSTRY EXPERIENCE

4.5.7 SUPPLY CHAIN AND DELIVERY CAPABILITIES

4.5.8 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO OF THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

4.6.1 IMPACT OF CLIMATE CHANGE ON THE OIL AND GAS INDUSTRY

4.6.2 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY CONCERNS

4.6.3 INCREASED DEMAND FOR CARBON CAPTURE AND STORAGE (CCS)

4.6.4 CLIMATE CHANGE AND THE AVAILABILITY OF RAW MATERIALS

4.6.5 RENEWABLE ENERGY TRANSITION AND IMPACT ON DEMAND

4.6.6 CONCLUSION

4.7 PRICING ANALYSIS OF THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

4.7.1 KEY FACTORS INFLUENCING PRICING

4.7.2 PRICE TRENDS

4.7.3 CONCLUSION

4.8 PRODUCTION CAPACITY OVERVIEW OF THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

4.8.1 MARKET DRIVERS AND DEMAND FOR HYDROGEN SULFIDE SCAVENGERS

4.8.2 KEY TYPES OF HYDROGEN SULFIDE SCAVENGERS

4.8.3 REGIONAL MARKET OVERVIEW

4.8.4 PRODUCTION CAPACITY TRENDS

4.8.5 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS OF THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

4.9.1 KEY STAGES OF THE SUPPLY CHAIN

4.9.2 CHALLENGES IN THE HYDROGEN SULFIDE SCAVENGERS SUPPLY CHAIN

4.1 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: RAW MATERIAL COVERAGE

4.10.1 TYPES OF RAW MATERIALS USED IN H2S SCAVENGER PRODUCTION

4.10.2 RAW MATERIAL SOURCING AND AVAILABILITY

4.10.3 SUSTAINABILITY AND ENVIRONMENTAL CONCERNS

4.10.4 CHALLENGES IN RAW MATERIAL SOURCING

4.10.5 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLEAN ENERGY AND NATURAL GAS PROCESSING

6.1.2 GROWING EXPLORATION AND PRODUCTION ACTIVITIES IN OIL AND GAS INDUSTRY

6.1.3 RISING DEMAND FOR CLEAN WATER AND WASTEWATER TREATMENT

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF HIGH-QUALITY HYDROGEN SULFIDE SCAVENGERS

6.2.2 ENVIRONMENTAL CONCERNS AND IMPACT OF IMPROPER DISPOSAL OF SOME H₂S SCAVENGERS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN SCAVENGER FORMULATIONS

6.3.2 GOVERNMENT-BACKED INITIATIVES AND FUNDING IN CLEAN ENERGY, ENVIRONMENTAL CONSERVATION, AND INDUSTRIAL SAFETY

6.3.3 EXPANSION OF THE CHEMICAL AND INDUSTRIAL MANUFACTURING SECTORS

6.4 CHALLENGES

6.4.1 RAPID DEGRADATION AND LIMITED EFFECTIVENESS OF CERTAIN HYDROGEN SULFIDE SCAVENGERS

6.4.2 ADVANCES IN ALTERNATIVE GAS TREATMENT AND FILTRATION TECHNOLOGIES

7 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 NON-REGENERATIVE

7.3 REGENERATIVE

8 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 WATER SOLUBLE

8.3 OIL-SOLUBLE

8.4 METAL-BASED

9 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ONSHORE

9.3 OFFSHORE

10 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE

10.1 OVERVIEW

10.2 NATURAL GAS

10.3 CRUDE OIL

10.4 WASTE WATER TREATMENT

10.5 INTERMEDIATES

10.6 REFINED PRODUCTS

10.7 OTHERS

11 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 SOUTH AFRICA

11.1.3 U.A.E.

11.1.4 QATAR

11.1.5 KUWAIT

11.1.6 OMAN

11.1.7 EGYPT

11.1.8 ISRAEL

11.1.9 BAHRAIN

11.1.10 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAKER HUGHES COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ECOLAB

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 SLB

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 BASF

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 ARKEMA

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AL MOGHERA PETROLEUM CHEMICALS INDUSTRY LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BERRYMAN CHEMICAL.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CHEMICAL PRODUCTS INDUSTRIES, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 MIDDLE EAST AND AFRICA DRILLING FLUIDS & CHEMICALS LIMITED

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HEXION INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 IMPERIAL OILFIELD CHEMICALS PVT LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 INNOSPEC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 INTERNATIONAL CHEMICAL SERVICE LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NUGENTEC

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 OSPREY SPECIALTY GROUP, LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 Q2TECHNOLOGIES

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHEPHERD CHEMICALS

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 THE LUBRIZOL CORPORATION

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 VEOLIA

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 ZIRAX

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 4 MIDDLE EAST AND AFRICA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 6 MIDDLE EAST AND AFRICA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (KILO TONS)

TABLE 11 MIDDLE EAST AND AFRICA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA WATER-SOLUBLE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA OIL-SOLUBLE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA METAL-BASED IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ONSHORE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA OFFSHORE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 35 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 37 MIDDLE EAST AND AFRICA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 51 SAUDI ARABIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 53 SAUDI ARABIA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 69 SOUTH AFRICA NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH AFRICA TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH AFRICA REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH AFRICA NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH AFRICA INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 85 U.A.E. NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 86 U.A.E. TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 87 U.A.E. TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 88 U.A.E. REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 89 U.A.E. HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.A.E. HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 U.A.E. HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 92 U.A.E. NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 U.A.E. CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 U.A.E. WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 U.A.E. INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 U.A.E. REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 U.A.E. REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 98 U.A.E. OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 99 QATAR HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 100 QATAR HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 101 QATAR NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 102 QATAR TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 103 QATAR TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 104 QATAR REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 105 QATAR HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 QATAR HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 107 QATAR HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 108 QATAR NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 QATAR CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 QATAR WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 111 QATAR INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 112 QATAR REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 113 QATAR REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 114 QATAR OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 115 KUWAIT HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 116 KUWAIT HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 117 KUWAIT NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 118 KUWAIT TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 KUWAIT TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 120 KUWAIT REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 121 KUWAIT HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 KUWAIT HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 KUWAIT HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 124 KUWAIT NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 125 KUWAIT CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 KUWAIT WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 127 KUWAIT INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 128 KUWAIT REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 129 KUWAIT REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 130 KUWAIT OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 131 OMAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 132 OMAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 133 OMAN NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 134 OMAN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 135 OMAN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 136 OMAN REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 137 OMAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 OMAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 OMAN HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 140 OMAN NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 141 OMAN CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 142 OMAN WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 143 OMAN INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 144 OMAN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 145 OMAN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 146 OMAN OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 147 EGYPT HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 148 EGYPT HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 149 EGYPT NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 150 EGYPT TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 151 EGYPT TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 152 EGYPT REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 EGYPT HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 EGYPT HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 EGYPT HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 156 EGYPT NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 157 EGYPT CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 158 EGYPT WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 159 EGYPT INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 EGYPT REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 161 EGYPT REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 162 NORWAY OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 ISRAEL HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 ISRAEL HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 165 ISRAEL NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 ISRAEL TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 167 ISRAEL TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 168 ISRAEL REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 169 ISRAEL HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 ISRAEL HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 ISRAEL HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 172 ISRAEL NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 173 ISRAEL CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 ISRAEL WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 175 ISRAEL INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 176 ISRAEL REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 177 ISRAEL REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 178 ISRAEL OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 179 BAHRAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 180 BAHRAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 181 BAHRAIN NON-REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 182 BAHRAIN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 183 BAHRAIN TRIAZINE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 184 BAHRAIN REGENERATIVE IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 BAHRAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 BAHRAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 BAHRAIN HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 188 BAHRAIN NATURAL GAS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 BAHRAIN CRUDE OIL IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 190 BAHRAIN WASTE WATER TREATMENT IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 191 BAHRAIN INTERMEDIATES IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 192 BAHRAIN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN REFINED PRODUCTS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN OTHERS IN HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 195 REST OF MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 196 REST OF MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY PRODUCT (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FOR CLEAN ENERGY AND NATURAL GAS PROCESSING IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE NON-REGENERATIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET

FIGURE 23 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: BY PRODUCT, 2024

FIGURE 24 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY TYPE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY APPLICATION, 2024

FIGURE 26 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET, BY END-USE, 2024

FIGURE 27 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA HYDROGEN SULFIDE SCAVENGERS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。