Middle East And Africa Identity Verification Market

市场规模(十亿美元)

CAGR :

%

USD

728.14 Million

USD

1,828.77 Million

2022

2030

USD

728.14 Million

USD

1,828.77 Million

2022

2030

| 2023 –2030 | |

| USD 728.14 Million | |

| USD 1,828.77 Million | |

|

|

|

|

Middle East and Africa Identity Verification Market, By Component (Solution, Services), Type (Non-Biometrics, Biometrics), Deployment Mode (On-Premise, Cloud), Organization Size (Large Enterprises, SMEs), Application (Access Control and User Monitoring, KYC, KYB, and Onboarding, Identity Fraud Compliance and Forensics), Vertical (BFSI, Government and Defense, Energy and Utilities, Retail and E-commerce, I.T. and Telecom, Healthcare, Gaming, and Others) – Industry Trends and Forecast to 2030.

Middle East and Africa Identity Verification Market Analysis and Size

Identity verification is an important part of many business procedures. Many procedures for identity verification services comprise identity and access management (IAM) solutions, biometric identity, biometric authentication solutions, and security assertion markup language authentication (SAML) solutions. The verification of the identity process can be carried out in numerous different ways depending on the channel and verification. Identity verification is used in numerous industries to avoid financial crimes, fraud, and theft and offers complete security.

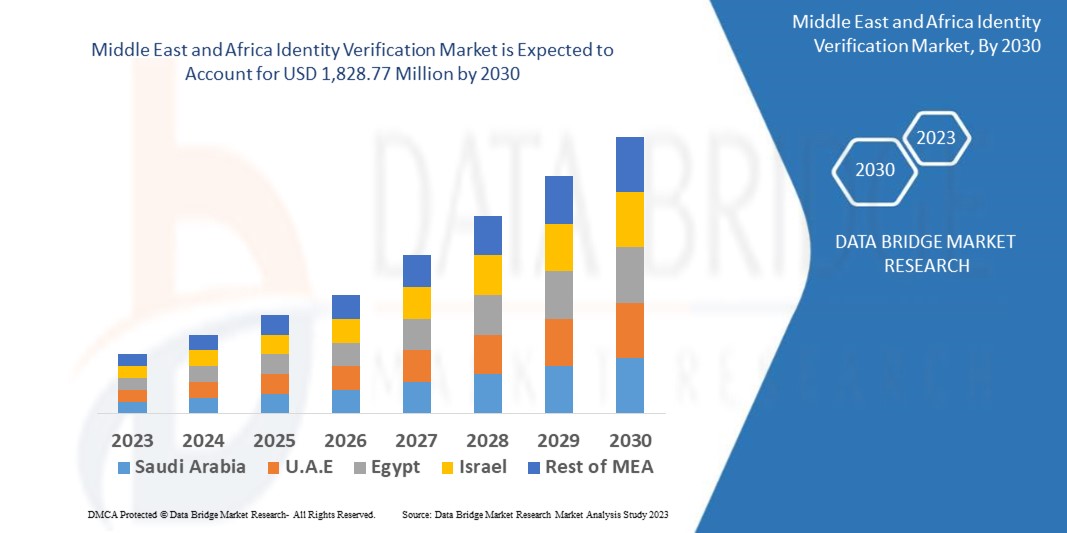

Data Bridge Market Research analyses that the identity verification market is expected to reach USD 1,828.77 million by 2030, which was USD 728.14 million in 2022, at a CAGR of 12.20% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Middle East and Africa Identity Verification Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Solution, Services), Type (Non-Biometrics, Biometrics), Deployment Mode (On-Premise, Cloud), Organization Size (Large Enterprises, SME's), Application (Access Control and User Monitoring, KYC, KYB and Onboarding, Identity Fraud Compliance and Forensics), Vertical (BFSI, Government and Defense, Energy and Utilities, Retail and E-commerce, I.T. and Telecom, Healthcare, Gaming, and Others) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Authenteq (U.S.), Ping Identity (U.S.), Okta (U.S.), ZignSec (Sweden), PENNEO A/S (Denmark), Finansiell ID-Teknik BID AB (Sweden), Precise Biometrics (Sweden), IDkollen, (Sweden), Experian Information Solutions, Inc. (Ireland), G.B. Group plc ('GBG') (U.K.), Equifax, Inc. (U.S.), Mitek Systems, Inc. (U.S.), Thales (France), LexisNexis Risk Solutions Group. (U.S.), Onfido (U.K.), Trulioo. (Canada), Acuant, Inc. (U.S.), IDEMIA (France), Jumio (U.S.), TransUnion LLC. (U.S.), AU10TIX (Israel), IDology. (U.S.), Innovatrics (Slovakia), Applied Recognition Corp. (Canada), Signicat (Norway), SecureKey Technologies Inc. (Canada), IDfy (India), among many others |

|

Market Opportunities |

|

Market Definition

Identity verification is the significant process of ensuring that an individual is who they claim to be when applying for a loan, opening a bank account, or other financial procedures. Identity verification is an essential security measure in combatting new account fraud. Identity verification also plays an important role in anti-money laundering (AML) and know your customer (KYC) efforts at financial institutions that monitor and assess customer risk.

Middle East and Africa Identity Verification Market

Drivers

- Rising integration of A.I. and ML technologies into identity verification solutions

Increasing integration of artificial intelligence (A.I.) and machine learning (ML) technologies into identity verification solutions will likely drive market growth. After artificial intelligence (A.I.) and machine learning (ML) technologies into identity verification solutions, organizations can stay proactive and make very effective detection and remediation in response to suspicious and invasive activities. For instance, GBG partnered with Contemi Solutions to know your client (KYC) processes and fully automate anti-money laundering (AML) for Contemi clients and financial services institutions in 2020. This alliance offers a paperless onboarding experience with a single API without compromising security.

- Growing usage of verification services in the healthcare sector

Verification services such as adopting bring your own devices (BYOD) in organizations, blockchain-based identity verification, know your customer (KYC), and identity verification in healthcare are vigorously responding to organizations' increasing vulnerabilities and cyber risks. For instance, Financial Action Task Force encouraged member countries to constrain art dealers, virtual asset dealers, and legal professionals to conduct anti-money laundering (AML) screening on their customers in 2021.

Opportunities

- Increasing need for digitization

The growing need for digitization will likely create lucrative market growth opportunities in the forecast period. Numerous industries, such as manufacturing, retail, consumer products, and healthcare, broadly embrace digitalization. Still, on the other hand, these industries are more susceptible to cyber-attacks because of I.T. resources' utilization. Identity verification solution aids in stopping invasions in these industries, due to which it is becoming more popular among numerous industries.

- The growing trend of smart services by various industries for their customers

The increasing capacity of internet processes, such as online onboarding and financial transaction activities, has augmented the market's requirement for business identity verification. This increase in demand for online services has given way to the growth of third-party identity verification companies in the Middle East and Africa. Also, the increasing number of online customers of various online services is driving the growth of the online identity verification market. Hence, various industries' growing trend of smart services for their customers will likely drive the market's growth during the forecast period.

Restraints

- High maintenance and deployment expenses

High expenses of maintenance and deployment of the technology will hamper the market's growth rate. The pricing of identity verification services and solutions is decided based on factors such as linguistics, data storage, price per verification, and technical support. Maximum companies provide pricing per verification, yearly and monthly, in which limited identity verification checks are included. All these factors are likely to hamper the market growth.

- Lack of professionals and technical expertise

The dearth of professionals and technical expertise, particularly in the Middle East and Africa developing and developed areas, will create market problems. Furthermore, low experience quotient and lack of skilled professionals again hamper the market's growth rate.

This identity verification market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the identity verification market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2022, Seracle, a worldwide blockchain-as-a-service provider, partnered with Sumsub to develop compliance, anti-money laundering, and risk assessment infrastructure in the extremely regulated NFT, blockchain, and cryptocurrency industries. Over the following year, Seracle aims to complete the verification processes for more than a million firms as part of the cooperation.

- In 2022, Certific, a platform for remote medical testing, announced its collaboration with Veriff, a provider of identity verification services globally. This collaboration would enhance its remote medical testing capabilities and increase Certificates' international growth. Veriff can check above 10,200 distinct identity documents from more than 190 countries in more than 45 languages.

Identity Verification Market Scope

The identity verification market is segmented on the component, type, deployment mode, organization size, application, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Solution

- Services

Type

- Non-Biometrics

- Biometrics

Deployment Mode

- On-Premise

- Cloud

Organization Size

- Large Enterprises

- SME's

Application

- Access Control and User Monitoring

- KYC, KYB and Onboarding

- Identity Fraud Compliance and Forensics

Vertical

- BFSI

- Government and Defence

- Energy and Utilities

- Retail and E-commerce

- I.T. and Telecom

- Healthcare

- Gaming

- Others

- Education

- Travel

- Gaming

Identity Verification Market Regional Analysis/Insights

The identity verification market is analyzed and market size insights and trends are provided by country, component, type, deployment mode, organization size, application and vertical as referenced above.

The countries covered in the identity verification market report are U Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa dominates the identity verification market due to the increasing adoption of biometric identity verification solutions in this region. Furthermore, a strong focus on identity theft and security and various organizations' high adoption of digital identity services will further boost the market growth in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Identity Verification Market Share Analysis

The identity verification market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to identity verification market.

Some of the major players operating in the identity verification market are:

- Authenteq (U.S.)

- Ping Identity (U.S.)

- Okta (U.S.)

- ZignSec (Sweden)

- PENNEO A/S (Denmark)

- Finansiell ID-Teknik BID AB (Sweden)

- Precise Biometrics (Sweden)

- IDkollen, (Sweden)

- Experian Information Solutions, Inc. (Ireland)

- G.B. Group plc ('GBG') (U.K.)

- Equifax, Inc. (U.S.)

- Mitek Systems, Inc. (U.S.)

- Thales (France)

- LexisNexis Risk Solutions Group. (U.S.)

- Onfido (U.K.)

- Trulioo. (Canada)

- Acuant, Inc. (U.S.)

- IDEMIA (France)

- Jumio (U.S.)

- TransUnion LLC. (U.S.)

- AU10TIX (Israel)

- IDology. (U.S.)

- Innovatrics (Slovakia)

- Applied Recognition Corp. (Canada)

- Signicat (Norway)

- SecureKey Technologies Inc. (Canada)

- IDfy (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。