Middle East And Africa Lightweight Metals Market

市场规模(十亿美元)

CAGR :

%

USD

9.07 Billion

USD

61.35 Billion

2024

2052

USD

9.07 Billion

USD

61.35 Billion

2024

2052

| 2025 –2052 | |

| USD 9.07 Billion | |

| USD 61.35 Billion | |

|

|

|

|

中東和非洲輕質金屬市場細分,按類型(鋁和鋁合金、鈦和鈦合金、鎂和鎂合金、鈹和鈹合金、鋼和鋼合金等)、應用(汽車和運輸、航空航天和國防、農業、電子和消費品、海洋等) - 行業趨勢和預測到 2052 年

中東和非洲輕質金屬市場規模

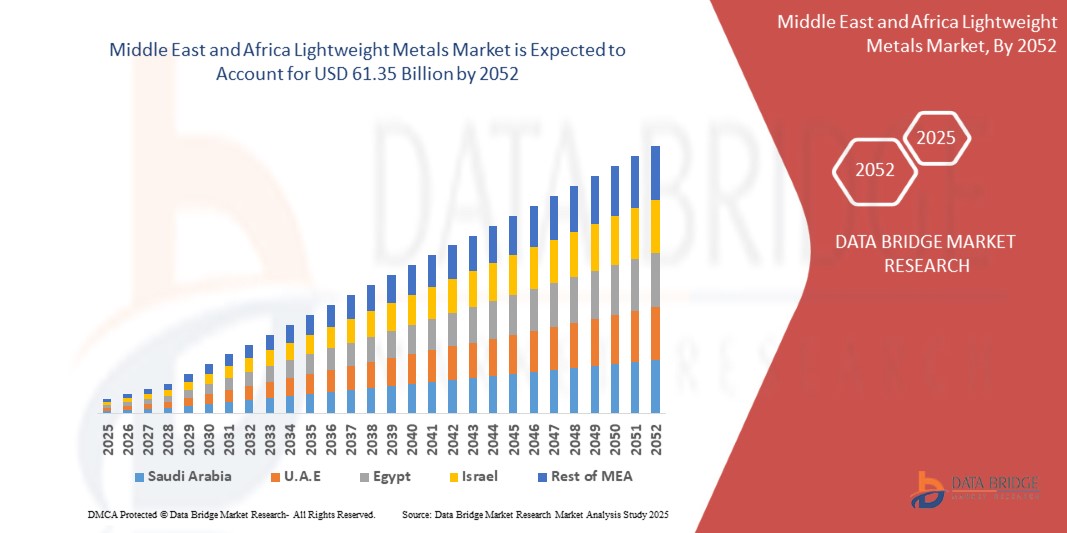

- 2024 年中東和非洲輕質金屬市場規模為90.7 億美元 ,預計 到 2052 年將達到 613.5 億美元,預測期內 複合年增長率為 7.1%。

- 市場成長主要受到汽車和航空航太領域需求成長的推動

- 此外,輕質金屬在耐用消費品和家用電器中的應用日益廣泛。這些因素正在加速輕質金屬解決方案的採用,從而顯著促進行業成長。

中東和非洲輕質金屬市場分析

- 輕質金屬因其在汽車、航空航太、建築和消費電子等行業中的重要作用而日益受到重視,在這些行業中,減輕零件重量對於提高燃油效率、性能和可持續性至關重要

- 對燃油效率的日益重視、碳排放法規的出台以及中東和非洲向電動車 (EV) 的轉變,極大地推動了對鋁、鎂和鈦等輕質金屬的需求。此外,冶金和金屬加工技術的進步使得生產更堅固、更輕、更耐腐蝕的材料成為可能。

- 阿聯酋在中東和非洲輕質金屬市場佔據主導地位,2025 年佔據 42.78% 的最大收入份額,這歸功於其強勁的航空航天和汽車工業、電動汽車的普及、強大的製造業基礎設施以及對先進材料技術的持續投資

- 預計阿聯酋將成為預測期內市場上成長最快的國家,這得益於嚴格的環境法規促進輕量化、電動和混合動力汽車產量增加以及對永續性和綠色製造實踐的高度重視。

- 鋁和鋁合金預計將在中東和非洲輕質金屬市場佔據主導地位,到 2025 年市場份額將達到 55.00%,這得益於其多功能性、可回收性以及在汽車、包裝、航空航天和建築等多個領域的廣泛使用,而中東和非洲對可持續和節能解決方案的需求不斷增長也進一步支持了這一趨勢。

報告範圍和中東和非洲輕質金屬市場細分

|

屬性 |

中東和非洲輕質金屬關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

中東和非洲輕質金屬市場趨勢

汽車和航空航太領域的需求不斷增長

- 中東和非洲輕質金屬市場的主要驅動力是對燃油效率、減排和性能優化的持續追求,特別是在汽車和航空航太產業,這是由整個地區的環境問題和監管要求所推動的

- 例如,2021年5月,研究人員Jovan Tan和Seeram Ramakrishna發表了一篇綜合評論,強調了鎂的工程吸引力,指出其輕質、高強度重量比和優異的可加工性。這些特性使其成為注重節能減排的汽車和航空航天應用的理想選擇。

- 在汽車產業,向電動車 (EV) 的轉型顯著增加了對輕質金屬的需求。汽車製造商目前正將鋁製車身面板、鎂製結構零件以及金屬合金融入底盤、車架和懸吊系統等關鍵零件中,以抵消電池重量並延長車輛續航里程。

- 同時,航空航太業持續採用先進的鋁鋰合金和鈦合金零件,以減輕起飛重量、提高燃油經濟性並延長飛機的使用壽命。隨著全球航空旅行和電動車產量的不斷增長,預計對輕質金屬的需求將持續旺盛。

- 根據《工業展望製造業》的新聞稿,鋁和鎂正在汽車設計中迅速普及,每減輕10%的車重,就能提升6-8%的燃油經濟性。鋁和鎂的價格實惠且結構性能優異,使其比傳統鋼材更適合電動車。

- 汽車和航空航太領域不斷增長的需求,加上積層製造和金屬合金創新的進步,正在加速區域輕質金屬的採用。隨著各行各業優先考慮永續旅行和下一代飛機,鋁、鎂和鈦在傳統和新興應用領域的作用不斷擴大。

中東和非洲輕質金屬市場動態

司機

耐用消費品和家用電器的普及率不斷提高

- 輕質金屬需求的不斷增長很大程度上是由於消費者對節能、耐用和輕便電器的偏好日益增長,這與耐用消費品領域的可持續發展目標和性能預期相一致。

- 例如,國際鎂協會的一篇部落格文章強調了緊湊型便攜式設備日益增長的需求,鎂合金正日益取代塑膠。鎂合金的重量與塑膠相當,但強度卻顯著提高,導熱性能更佳,並具有良好的電磁和射頻屏蔽性能,使其成為現代家用電器的理想選擇。

- 鋁和鎂等輕質金屬因其耐腐蝕性、優異的熱管理和設計靈活性而被廣泛應用於冰箱、洗衣機、空調和烹飪電器。這些優勢使其運輸和安裝更加便捷,同時降低了整體運輸成本和碳排放。

- Magnum Australia 在部落格文章中指出,鎂和其他輕質合金因其強度高、散熱性好和電磁屏蔽性能良好,被認為是塑膠的優質替代品。索尼於 2023 年 11 月在其 FE 300mm F2.8 GM OSS 鏡頭的內部結構中採用了鎂,這進一步凸顯了金屬在先進消費性電子產品中日益增長的作用。

- 此外,Bleno 還強調了鋁在現代廚房櫥櫃中日益流行的趨勢,其光滑的外觀、高強度和耐腐蝕性使其備受青睞。這些特性使其成為兼顧美觀與實用的現代廚房設計的理想材料。

- 美國國家醫學圖書館(National Library of Medicine)2023年12月發表的一篇文章指出,除了家用電器之外,鈦合金在生物醫學設備中的應用也日益廣泛。鈦合金優異的生物相容性、強度和耐腐蝕性使其在骨科植入物、牙科設備和心血管應用中廣泛應用,其生產技術通常與高端耐用消費品市場重疊。

- 鋁和鎂在家用電器的應用日益廣泛,這得益於監管舉措和能源之星等自願性標準,這些標準促使製造商達到更高的能源效率基準。隨著合金研發和設計創新的持續推進,輕質金屬正成為製造既能滿足消費者需求又符合環保標準的家用電器不可或缺的材料,並進一步鞏固了其在中東和非洲輕質金屬市場持續增長中的作用。

機會

回收和綠色金屬生產的進步

- 人們對永續性和循環經濟的日益關注推動了對透過低排放方法和閉環回收系統生產的輕質金屬的需求。

- 人工智慧驅動的合金分選、太陽能冶煉和浮渣回收等先進技術正在推動高純度再生鋁和鎂的生產,用於汽車、航空航太和建築業

- 政府和企業正在透過政策激勵、以 ESG 為重點的採購以及對低碳基礎設施的投資來支持綠色金屬計劃。

- 2024 年,阿聯酋全球鋁業公司 (EGA) 成為首家利用太陽能 (CelestiAL) 進行商業化鋁生產的公司,大幅減少了與傳統冶煉製程相關的排放

- 2025 年 2 月,《資源、保護與回收》雜誌發表的一項研究介紹了一種基於 CNN 的系統,該系統具有 SIFT 和 HOG 特徵,可對鋁合金廢料進行分類,準確率超過 90%,從而提高了回收效率

- 歐盟支持的 RAD4AL 專案開發了歐洲第一條輻射固化鋁捲塗層生產線,消除了天然氣爐和 VOC 溶劑,大幅提高了能源效率並減少了排放

克制/挑戰

生產加工成本高

- 鋁、鈦、鎂等輕質金屬的生產和加工成本高昂,對區域市場擴張構成了重大障礙。這些金屬的提取和精煉需要能源密集的方法,例如高溫冶煉、電解和真空蒸餾,所有這些都需要先進的基礎設施和大量的資本投入。

- 例如,2023年12月,義大利國家研究理事會-科學與技術科學學院(CNR-STEMS)的研究人員發表了一項題為《鈦:高性能、高成本-廣泛應用的障礙與挑戰》的研究,強調克羅爾製程是導致鈦生產成本高昂的主要原因。研究指出,繁瑣的萃取步驟、鈦與氧和氮的反應性以及由於導熱性低而導致的加工性差是主要的成本驅動因素。

- 此外,MDPI 於 2023 年 2 月進行的一項研究探討了克羅爾 (Kroll) 製程的局限性,強調僅生產 1 公斤鈦就需要約 257.78 兆焦耳的能量。儘管克羅爾製程是行業標準,但其效率低下和能耗高的問題嚴重阻礙了鈦生產的可擴展性和經濟性。

- 輕質金屬的生產非常複雜,尤其是在航空航太和汽車等領域,因此需要嚴格的品質控制和精密加工,這會增加勞動成本和加工時間。這些因素阻礙了小型製造商和新興經濟體進入市場,並限制了這些金屬在成本敏感應用中的廣泛應用。

- 雖然正在進行的回收技術、合金優化和製造效率的研發前景廣闊,但當前的能源和成本限制繼續降低競爭力、阻礙投資並限制市場滲透——特別是在能源供應不穩定或昂貴的地區。

- 在諸如霍爾-埃魯特法(用於鋁)和克羅爾法(用於鈦)等工藝的經濟高效且可擴展的替代方案實現商業化之前,高成本結構仍將是中東和非洲輕質金屬市場發展的主要限制因素。克服這些挑戰對於在各種終端應用產業中實現更廣泛的應用至關重要。

中東和非洲輕質金屬市場範圍

市場根據類型和應用進行細分。

- 按類型

依類型,市場細分為鋁及鋁合金、鈦及鈦合金、鎂及鎂合金、鈹及鈹合金、鋼及鋼合金等。到2025年,鋁及鋁合金將佔據主導地位,市佔率達到55.00%,這得益於其在汽車、航空航太、包裝和建築業的廣泛應用。關鍵因素包括鋁的輕質特性、耐腐蝕性、高可回收性以及對節能和永續應用的適應性。

預計鋁及鋁合金領域將在2025年至2052年間實現7.3%的最快增長率,這得益於其較高的強度重量比、良好的生物相容性以及優異的耐極端環境性能,在航空航天、醫療植入物和國防領域的應用日益廣泛。鈦加工技術和回收利用技術的不斷進步也推動了其需求的成長。

- 按應用

根據應用領域,市場細分為汽車與運輸、航太與國防、農業、電子與消費品、船舶及其他。預計到2025年,汽車與運輸領域將佔據最大的市場收入份額,這得益於輕質金屬的廣泛應用,以提高燃油效率、減少排放並滿足嚴格的監管標準。電動車(EV)的日益普及,以及鋁和鎂等材料在車身結構和動力總成部件中的使用量增加,進一步推動了該領域的成長。

預計汽車和運輸領域將在 2025 年至 2052 年間實現最快的 7.0% 複合年增長率,這主要得益於對下一代飛機的需求不斷增長、軍事現代化力度加大以及使用鈦和鋁鋰合金減輕飛機重量、提高性能和提高燃油效率。

中東和非洲輕質金屬市場區域分析

中東和非洲輕質金屬市場洞察

在產業多元化措施、大型基礎設施項目以及航空航太和汽車產業擴張的推動下,中東和非洲地區輕質金屬市場預計將穩定成長。地區政府正在投資非石油製造業,而阿聯酋全球鋁業和Ma'aden等公司正在提升本地輕質金屬生產能力。永續發展目標和循環經濟措施進一步加速了建築、國防和運輸業對節能耐腐蝕材料的需求。

阿聯酋、中東和非洲輕質金屬市場洞察

預計到 2025 年,阿聯酋將佔據中東和非洲最大的市場收入份額,這得益於「3000 億行動」計劃下對工業多元化的戰略投資、阿聯酋全球鋁業公司 (EGA) 的擴張以及對汽車和建築行業可持續製造的日益關注。

沙烏地阿拉伯、中東和非洲輕質金屬市場洞察

預計沙烏地阿拉伯將在 2025 年至 2052 年期間實現最高的複合年增長率,這得益於「2030 願景」推動的工業轉型、對當地鋁產能的投資增加,以及需要先進輕質材料用於節能建築和運輸解決方案的基礎設施發展項目。

中東和非洲輕質金屬市場份額

輕質金屬產業主要由知名公司主導,其中包括:

- 中國宏橋集團有限公司 (中國)

- Hindalco 工業有限公司(印度)

- 蒂森克虜伯鋼鐵歐洲公司(德國)

- AMETEK Inc.(美國)

- 韋丹塔有限公司(印度)

- 阿聯酋環球鋁業股份公司(阿聯酋)

- ICL(以色列)

- 安賽樂米塔爾(盧森堡)

中東和非洲輕質金屬市場最新動態

- 2025年1月,虹橋氧化鋁二廠實施了先進的測試方案,顯著提升了生產流程的品質和效率。此方案著重更嚴格的品質控制、更快的數據分析和更完善的設備校準。由此,該分廠的產品標準更加一致,缺陷也得到了最大程度的減少。此舉體現了虹橋對卓越績效、安全營運和客戶滿意度的承諾。持續的培訓和升級的實驗室設施也是這項改進的關鍵因素。

- 2025年6月,Hindalco透過其子公司Aditya Holdings LLC以1.25億美元收購了總部位於美國的AluChem Companies, Inc.。 AluChem是一家高純度氧化鋁生產商,為Hindalco在中東和非洲地區高科技氧化鋁業務的擴張增添了戰略價值。此舉將增強Hindalco對加值產品的關注,並得益於其現有特種氧化鋁業務的強勁成長和獲利能力。

- 2024年10月,蒂森克虜伯鋼鐵公司改良了其藍薄荷鋼(Bluemint Steel),利用高爐廢鋼生產低二氧化碳排放鋼。這有助於公司及其客戶減少碳足跡。此外,該公司也正在開發高性能、超高強度鋼材,使車輛更輕、更安全,並提高燃油效率和性能。

- 2025年7月,塔塔集團董事長N. Chandrasekaran在塔爾伯特港為塔塔鋼鐵英國公司新電弧爐(EAF)舉行了奠基儀式。該綠色鋼鐵計畫耗資22.5億美元,由英國政府撥款5億英鎊,旨在減少90%的碳排放,並創造5,000個工作機會。該電弧爐將成為全球最大的電弧爐之一,每年可生產300萬噸低碳鋼。該計畫標誌著塔塔脫碳和英國工業轉型策略邁出的重要一步。

- 2024年4月,韋丹塔鋁業公司主辦了Auto-Edge高峰會,旨在推廣鋁在汽車產業的應用。這項活動匯集了許多領先的汽車公司,共同探討未來出行方式以及輕質金屬的作用。韋丹塔鋁業公司展示了其豐富的產品系列,包括用於汽車製造的鋁合金。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 VALUE CHAIN ANALYSIS: MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

4.3.1 PROCUREMENT:

4.3.2 MANUFACTURING:

4.3.3 MARKETING & DISTRIBUTION:

4.4 VENDOR SELECTION CRITERIA

4.4.1 QUALITY AND CONSISTENCY OF SUPPLY

4.4.2 RELIABILITY AND TIMELINESS

4.4.3 COST COMPETITIVENESS

4.4.4 TECHNICAL CAPABILITY AND INNOVATION

4.4.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.4.6 FINANCIAL STABILITY

4.4.7 CUSTOMER SERVICE AND SUPPORT

4.5 BRAND OUTLOOK

4.5.1 BRAND COMPETITIVE ANALYSIS OF THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

4.5.2 PRODUCT VS BRAND OVERVIEW

4.5.3 PRODUCT OVERVIEW

4.5.4 BRAND OVERVIEW

4.5.5 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIALS

4.7.2 ENERGY CONSUMPTION

4.7.3 LABOR AND OPERATIONAL COSTS

4.7.4 RESEARCH AND DEVELOPMENT

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM-SIZE COMPANIES

4.8.3 END USERS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.10.4 ANALYST RECOMMENDATIONS

4.11 CONSUMER BUYING BEHAVIOUR

4.12 PROFIT MARGINS SCENARIO

4.12.1 MARGIN RANGE BY PRODUCT TYPE

4.12.2 KEY FACTORS INFLUENCING MARGINS

4.12.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.13 RAW MATERIAL SOURCING ANALYSIS ON THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

4.13.1 ALUMINUM

4.13.2 MAGNESIUM

4.13.3 TITANIUM

4.13.4 BERYLLIUM

4.13.5 CARBON AND METAL MATRIX COMPOSITES (ADDITIVES)

4.13.6 CONCLUSION

4.14 TECHNOLOGIES ADVANCEMENTS

4.14.1 OVERVIEW

4.14.2 ADVANCED ALLOY DEVELOPMENT

4.14.3 METALLURGICAL PROCESS INNOVATIONS

4.14.4 SURFACE ENGINEERING AND COATINGS

4.14.5 RECYCLING AND CIRCULAR MANUFACTURING TECHNOLOGIES

4.14.6 INTEGRATED LIGHTWEIGHT DESIGN AND SIMULATION TOOLS

4.15 TARIFFS AND THEIR IMPACT ON MARKET

4.15.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.15.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.15.3 VENDOR SELECTION CRITERIA DYNAMICS

4.15.4 IMPACT ON SUPPLY CHAIN

4.15.4.1 RAW MATERIAL PROCUREMENT

4.15.4.2 MANUFACTURING AND PRODUCTION

4.15.4.3 LOGISTICS AND DISTRIBUTION

4.15.4.4 PRICE PITCHING AND POSITION OF MARKET

4.15.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.15.5.1 SUPPLY CHAIN OPTIMIZATION

4.15.5.2 JOINT VENTURE ESTABLISHMENTS

4.15.6 IMPACT ON PRICES

4.15.7 REGULATORY INCLINATION

4.15.7.1 GEOPOLITICAL SITUATION

4.15.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.15.7.2.1 FREE TRADE AGREEMENTS

4.15.7.2.2 ALLIANCE ESTABLISHMENTS

4.15.7.2.3 STATUS ACCREDITATION (INCLUDING MFN)

4.15.7.3 DOMESTIC COURSE OF CORRECTION

4.15.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.15.7.3.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE AND AEROSPACE SECTORS

6.1.2 GROWING ADOPTION OF CONSUMER DURABLES AND APPLIANCES

6.1.3 GROWING DEMAND FOR FUEL-EFFICIENT VEHICLES GLOBALLY

6.1.4 REGULATORY INITIATIVES SUPPORTING LIGHTWEIGHT DESIGN

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PROCESSING COSTS

6.2.2 CORROS.ION SENSITIVITY AND ALLOY LIMITATIONS

6.3 OPPORTUNITIES

6.3.1 RISING PENETRATION OF ELECTRIC VEHICLES WORLDWIDE

6.3.2 ADVANCEMENTS IN RECYCLING AND GREEN METAL PRODUCTION

6.3.3 MARINE INDUSTRY SHIFTING TOWARD WEIGHT-OPTIMIZED DESIGNS

6.4 CHALLENGES

6.4.1 RAW MATERIAL AVAILABILITY AND GEOPOLITICAL DEPENDENCY

6.4.2 COMPATIBILITY ISSUES WITH TRADITIONAL MANUFACTURING EQUIPMENT

7 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 ALUMINUM AND ALUMINUM ALLOY

7.3 TITANIUM AND TITANIUM ALLOYS

7.4 MAGNESIUM AND MAGNESIUM ALLOY

7.5 STEEL AND STEEL ALLOYS

7.6 BERYLLIUM AND BERYLLIUM ALLOY

7.7 OTHERS

8 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.3 AEROSPACE & DEFENSE

8.4 ELECTRONICS & CONSUMER GOODS

8.5 MARINE

8.6 AGRICULTURE

8.7 OTHERS

9 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY REGION

9.1 MIDDLE EAST & AFRICA

9.1.1 U.A.E.

9.1.2 SAUDI ARABIA

9.1.3 QATAR

9.1.4 BAHRAIN

9.1.5 EGYPT

9.1.6 SOUTH AFRICA

9.1.7 KUWAIT

9.1.8 ISRAEL

9.1.9 OMAN

9.1.10 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CHINA HONGQIAO GROUP LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 RECENT FINANCIALS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HINDALCO INDUSTRIES LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 THYSSENKRUPP STEEL EUROPE

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AMETEK INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 RECENT FINANCIALS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 VEDANTA LIMITED

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ALCOA CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT/NEWS

12.7 ARCELORMITTAL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 AMAG AUSTRIA METALL AG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 AMETEK SPECIALTY METAL PRODUCTS (AMETEK INC.)

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 ATI, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 ATLAS STEELS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS/NEWS

12.12 BAVARIA STAHL UND METALL IMPORT/EXPORT GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS/NEWS

12.13 COSTELLIUM

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 CLINTON ALUMINUM

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 CORPORATION VSMPO-AVISMA

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 DWA ALUMINUM COMPOSITES USA, INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 EMIRATES MIDDLE EAST AND AFRICA ALUMINIUM PJSC

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 ICL

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS/NEWS

12.19 KAISER ALUMINUM

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 LUXFER HOLDINGS PLC

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

12.21 METALWERKS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS/NEWS

12.22 MATERION CORPORATION

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENTS/NEWS

12.23 MSKS IP INC.

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 NUCOR CORPORATION

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENTS

12.25 NORSK HYDRO ASA

12.25.1 COMPANY SNAPSHOT

12.25.2 PRODUCT PORTFOLIO

12.25.3 RECENT DEVELOPMENT/NEWS

12.26 PRECISION CASTPARTS CORP.

12.26.1 COMPANY SNAPSHOT

12.26.2 PRODUCT PORTFOLIO

12.26.3 RECENT DEVELOPMENT

12.27 POSCO

12.27.1 COMPANY SNAPSHOT

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENTS/NEWS

12.28 RUSAL

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENT

12.29 RIO TINTO

12.29.1 COMPANY SNAPSHOT

12.29.2 REVENUE ANALYSIS

12.29.3 PRODUCT PORTFOLIO

12.29.4 RECENT DEVELOPMENT

12.3 RELIANCE, INC.

12.30.1 COMPANY SNAPSHOT

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT

12.31 RYERSON HOLDING CORPORATION

12.31.1 COMPANY SNAPSHOT

12.31.2 REVENUE ANALYSIS

12.31.3 PRODUCT PORTFOLIO

12.31.4 RECENT DEVELOPMENTS

12.32 SCOPE METALS GROUP LTD.

12.32.1 COMPANY SNAPSHOT

12.32.2 REVENUE ANALYSIS

12.32.3 PRODUCT PORTFOLIO

12.32.4 RECENT DEVELOPMENT

12.33 SSAB

12.33.1 COMPANY SNAPSHOT

12.33.2 REVENUE ANALYSIS

12.33.3 PRODUCT PORTFOLIO

12.33.4 RECENT DEVELOPMENT

12.34 SMITHS METAL CENTRES LIMITED

12.34.1 COMPANY SNAPSHOT

12.34.2 PRODUCT PORTFOLIO

12.34.3 RECENT DEVELOPMENT

12.35 TW METALS, LLC.

12.35.1 COMPANY SNAPSHOT

12.35.2 PRODUCT PORTFOLIO

12.35.3 RECENT DEVELOPMENT

12.36 TATA STEEL

12.36.1 COMPANY SNAPSHOT

12.36.2 RECENT FINANCIALS

12.36.3 PRODUCT PORTFOLIO

12.36.4 RECENT DEVELOPMENT

12.37 THYSSENKRUPP MATERIALS NA, INC.

12.37.1 COMPANY SNAPSHOT

12.37.2 PRODUCT PORTFOLIO

12.37.3 RECENT DEVELOPMENT

12.38 TOHO TITANIUM CO., LTD.

12.38.1 COMPANY SNAPSHOT

12.38.2 REVENUE ANALYSIS

12.38.3 PRODUCT PORTFOLIO

12.38.4 RECENT DEVELOPMENT

12.39 US MAGNESIUM LLC

12.39.1 COMPANY SNAPSHOT

12.39.2 PRODUCT PORTFOLIO

12.39.3 RECENT DEVELOPMENT

12.4 VULCAN INC.

12.40.1 COMPANY SNAPSHOT

12.40.2 PRODUCT PORTFOLIO

12.40.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 REGULATORY COVERAGE

TABLE 3 MIDDLE EAST AND AFRICA ELECTRIC VEHICLE (EV) SALES AND MARKET SHARE (2023–2024)

TABLE 4 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM WELD PLATES (PER 100 PIECES)

TABLE 5 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM COVER PLATE (PER 100 PIECES)

TABLE 6 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND

TABLE 10 MIDDLE EAST AND AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES (LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA MARINE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (TONS)

TABLE 46 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 48 MIDDLE EAST AND AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 73 U.A.E. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 74 U.A.E. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 75 U.A.E. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 76 U.A.E. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 77 U.A.E. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 78 U.A.E. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 79 U.A.E. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 80 U.A.E. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 81 U.A.E. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 82 U.A.E. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 83 U.A.E. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 84 U.A.E. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 85 U.A.E. LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 86 U.A.E. AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 87 U.A.E. PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 88 U.A.E. ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 89 U.A.E. LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 90 U.A.E. HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 91 U.A.E. TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 92 U.A.E. AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 93 U.A.E. ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 94 U.A.E. CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 95 U.A.E. PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 96 U.A.E. AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 97 U.A.E. HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 98 U.A.E. MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 99 U.A.E. AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 100 SAUDI ARABIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 101 SAUDI ARABIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 102 SAUDI ARABIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 103 SAUDI ARABIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 104 SAUDI ARABIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 105 SAUDI ARABIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 106 SAUDI ARABIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 107 SAUDI ARABIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 108 SAUDI ARABIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 109 SAUDI ARABIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 110 SAUDI ARABIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 111 SAUDI ARABIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 112 SAUDI ARABIA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 113 SAUDI ARABIA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 114 SAUDI ARABIA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 115 SAUDI ARABIA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 116 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 117 SAUDI ARABIA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 118 SAUDI ARABIA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 119 SAUDI ARABIA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 120 SAUDI ARABIA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 121 SAUDI ARABIA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 122 SAUDI ARABIA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 123 SAUDI ARABIA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 124 SAUDI ARABIA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 125 SAUDI ARABIA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 126 SAUDI ARABIA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 127 QATAR LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 128 QATAR LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 129 QATAR ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 130 QATAR ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 131 QATAR TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 132 QATAR TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 133 QATAR MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 134 QATAR MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 135 QATAR STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 136 QATAR STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 137 QATAR BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 138 QATAR BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 139 QATAR LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 140 QATAR AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 141 QATAR PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 142 QATAR ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 143 QATAR LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 144 QATAR HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 145 QATAR TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 146 QATAR AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 147 QATAR ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 148 QATAR CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 149 QATAR PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 150 QATAR AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 151 QATAR HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 152 QATAR MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 153 QATAR AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 154 BAHRAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 155 BAHRAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 156 BAHRAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 157 BAHRAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 158 BAHRAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 159 BAHRAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 160 BAHRAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 161 BAHRAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 162 BAHRAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 163 BAHRAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 164 BAHRAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 165 BAHRAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 166 BAHRAIN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 167 BAHRAIN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 168 BAHRAIN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 169 BAHRAIN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 170 BAHRAIN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 171 BAHRAIN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 172 BAHRAIN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 173 BAHRAIN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 174 BAHRAIN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 175 BAHRAIN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 176 BAHRAIN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 177 BAHRAIN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 178 BAHRAIN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 179 BAHRAIN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 180 BAHRAIN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 181 EGYPT LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 182 EGYPT LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 183 EGYPT ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 184 EGYPT ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 185 EGYPT TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 186 EGYPT TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 187 EGYPT MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 188 EGYPT MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 189 EGYPT STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 190 EGYPT STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 191 EGYPT BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 192 EGYPT BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 193 EGYPT LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 194 EGYPT AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 195 EGYPT PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 196 EGYPT ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 197 EGYPT LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 198 EGYPT HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 199 EGYPT TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 200 EGYPT AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 201 EGYPT ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 202 EGYPT CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 203 EGYPT PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 204 EGYPT AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 205 EGYPT HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 206 EGYPT MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 207 EGYPT AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 208 SOUTH AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 209 SOUTH AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 210 SOUTH AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 211 SOUTH AFRICA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 212 SOUTH AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 213 SOUTH AFRICA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 214 SOUTH AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 215 SOUTH AFRICA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 216 SOUTH AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 217 SOUTH AFRICA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 218 SOUTH AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 219 SOUTH AFRICA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 220 SOUTH AFRICA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 221 SOUTH AFRICA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 222 SOUTH AFRICA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 223 SOUTH AFRICA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 224 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 225 SOUTH AFRICA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 226 SOUTH AFRICA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 227 SOUTH AFRICA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 228 SOUTH AFRICA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 229 SOUTH AFRICA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 230 SOUTH AFRICA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 231 SOUTH AFRICA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 232 SOUTH AFRICA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 233 SOUTH AFRICA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 234 SOUTH AFRICA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 235 KUWAIT LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 236 KUWAIT LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 237 KUWAIT ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 238 KUWAIT ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 239 KUWAIT TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 240 KUWAIT TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 241 KUWAIT MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 242 KUWAIT MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 243 KUWAIT STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 244 KUWAIT STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 245 KUWAIT BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 246 KUWAIT BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 247 KUWAIT LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 248 KUWAIT AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 249 KUWAIT PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 250 KUWAIT ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 251 KUWAIT LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 252 KUWAIT HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 253 KUWAIT TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 254 KUWAIT AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 255 KUWAIT ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 256 KUWAIT CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 257 KUWAIT PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 258 KUWAIT AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 259 KUWAIT HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 260 KUWAIT MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 261 KUWAIT AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 262 ISRAEL LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 263 ISRAEL LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 264 ISRAEL ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 265 ISRAEL ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 266 ISRAEL TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 267 ISRAEL TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 268 ISRAEL MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 269 ISRAEL MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 270 ISRAEL STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 271 ISRAEL STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 272 ISRAEL BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 273 ISRAEL BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 274 ISRAEL LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 275 ISRAEL AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 276 ISRAEL PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 277 ISRAEL ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 278 ISRAEL LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 279 ISRAEL HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 280 ISRAEL TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 281 ISRAEL AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 282 ISRAEL ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 283 ISRAEL CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 284 ISRAEL PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 285 ISRAEL AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 286 ISRAEL HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 287 ISRAEL MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 288 ISRAEL AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 289 OMAN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 290 OMAN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 291 OMAN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 292 OMAN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 293 OMAN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 294 OMAN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 295 OMAN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 296 OMAN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 297 OMAN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 298 OMAN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 299 OMAN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 300 OMAN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 301 OMAN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 302 OMAN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 303 OMAN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 304 OMAN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 305 OMAN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 306 OMAN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 307 OMAN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 308 OMAN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 309 OMAN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 310 OMAN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 311 OMAN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 312 OMAN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 313 OMAN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 314 OMAN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 315 OMAN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 316 REST OF MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 317 REST OF MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET, BY TYPE

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND IN AUTOMOTIVE AND AEROSPACE SECTORS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET IN THE FORECAST PERIOD OF 2025 TO 2052

FIGURE 16 THE ALUMINUM AND ALUMINUM ALLOY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET IN 2025 AND 2052

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

FIGURE 19 VALUE CHAIN ANALYSIS OF THE MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DROC ANALYSIS

FIGURE 22 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: BY TYPE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: BY APPLICATION, 2024

FIGURE 24 MIDDLE EAST & AFRICA LIGHTWEIGHT METALS MARKET: SNAPSHOT (2024)

FIGURE 25 MIDDLE EAST AND AFRICA LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 26 ASIA-PACIFIC LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 27 COMPANY SHARE ANALYSIS: EUROPE

FIGURE 28 EUROPE LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 29 NORTH AMERICA LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 30 JAPAN LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 31 KOREA LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 32 U.S. LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 33 CANADA LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

FIGURE 34 MEXICO LIGHTWEIGHT METALS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。