Middle East And Africa Optical Fiber Components Market

市场规模(十亿美元)

CAGR :

%

USD

28.10 Billion

USD

58.65 Billion

2024

2032

USD

28.10 Billion

USD

58.65 Billion

2024

2032

| 2025 –2032 | |

| USD 28.10 Billion | |

| USD 58.65 Billion | |

|

|

|

|

受5G網路擴張、光纖到府(FTTH)部署和智慧城市計畫的推動,中東和非洲光纖組件市場正在穩步成長。隨著電信、政府和企業等行業加速數位轉型,光纖組件對於提供高速、低延遲連接以及支援該地區的下一代基礎設施至關重要。預測期:2025-2032年

中東和非洲光纖組件市場規模

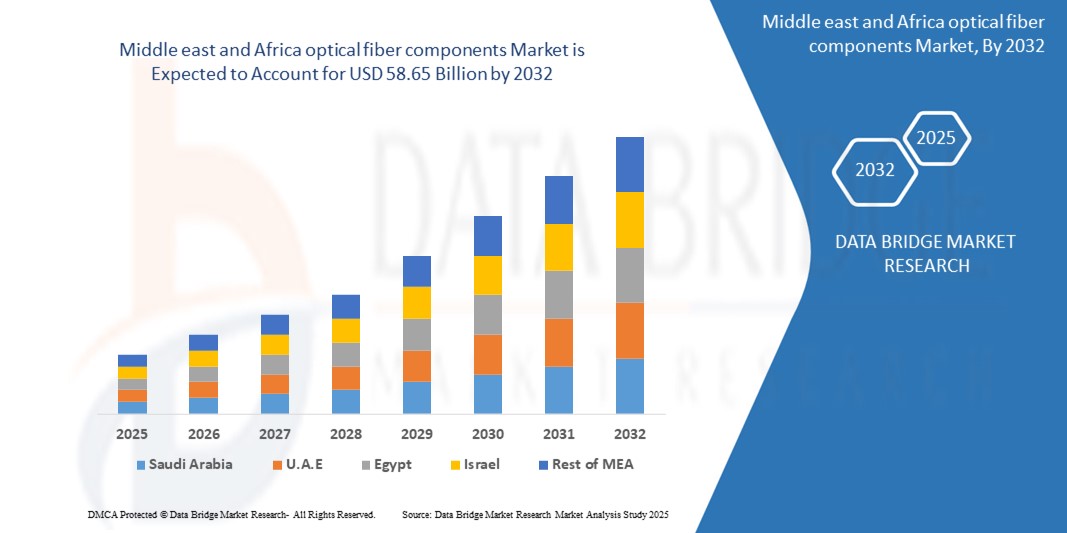

- 預計中東和非洲光纖組件市場到 2025 年將達到 281 億美元,到 2032 年預計將成長至約 586.5 億美元,在 2025 年至 2032 年的預測期內複合年增長率為 11.08%。

- 這一成長的驅動力源於5G網路的快速擴張、FTTH基礎設施投資的增加以及該地區對數位轉型的日益重視。隨著中東和非洲各國優先發展智慧城市、雲端運算和寬頻連接,光纖裝置在為公共和私營部門提供高速、安全且可擴展的通訊方面發揮關鍵作用。

中東和非洲光纖元件市場分析

- 在中東和非洲,隨著政府、電信業者和企業加強對高速連接的投資,光纖組件的需求正在加速成長。從海灣地區密集的城市網路到非洲農村地區不斷擴展的寬頻,光纖技術正成為網路存取、智慧城市、雲端運算和電子化政府等各領域發展的關鍵支撐。

- 那麼,是什麼推動了這項成長?一個關鍵因素是大力推進數位基礎設施建設。阿聯酋和沙烏地阿拉伯等國家正引領5G部署和全國光纖鋪面設計劃。同時,在整個非洲,縮小數位落差的舉措正在推動學校、醫療機構和地方政府網路對光纖的需求。

- 行動和數據流量的激增也給網路帶來了壓力,尤其是在不斷發展的城市中心。光纖正部署為骨幹解決方案,為家庭和企業提供更快、更可靠的網路。這包括光纖到府 (FTTH) 項目、企業級連接以及行動塔的光纖回程。

- 此外,企業部門正在擴大光纖的使用,以支援雲端遷移、資料中心和遠端辦公設定。金融、教育、石油天然氣和物流等行業正在投資光纖基礎設施,以提高效能並降低營運延遲。

- 隨著區域轉型計劃的持續推進、公私合作夥伴關係的加強以及有利的監管支持,中東和非洲光纖組件市場預計將在已開發市場和新興市場實現強勁的長期成長

報告範圍及中東及非洲光學檢測細分

|

屬性 |

中東和非洲光學檢測市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

|

中東和非洲光纖組件市場趨勢

“光纖連接推動中東和非洲的數位成長”

- 影響中東和非洲光纖組件市場的關鍵趨勢之一是該地區對高速、低延遲連接日益增長的需求,以支援數位轉型。從智慧城市和5G網路到遠距教育和電子醫療,光纖正在成為無縫、面向未來的通訊基礎設施的基礎。

- 在城市地區,政府和電信業者正在迅速擴展光纖到府 (FTTH) 和光纖到企業 (FTTB) 網路。杜拜、利雅德和開普敦等城市正在投資光纖,將其作為智慧基礎設施的核心要素——連接從交通系統到監控系統和公共 Wi-Fi 的一切。

- 縱觀企業領域,金融、教育和醫療保健等行業正在使用收發器、連接器和放大器等光學組件升級其內部網路。這些升級旨在實現更快的資料傳輸、更強的安全性以及與雲端平台更好的整合。

- 農村互聯互通也重新受到關注。在服務不足的地區,各國正與基礎設施公司合作,部署長距離光纖骨幹網,以彌合數位鴻溝,並將寬頻服務帶入偏遠的學校、診所和家庭。

- 另一個新興趨勢是區域資料中心的興起。隨著雲端運算應用的不斷增長以及對本地化資料儲存的需求,光纖元件在連接伺服器群、確保超快速處理和支援邊緣運算方面的需求量龐大。

- 總而言之,這些趨勢凸顯了該地區向光纖驅動的數位經濟轉型。無論是支援下一代行動網絡,還是推動教育和創新,光纖元件都是在中東和非洲打造更快、更智慧、更具包容性的連接的核心。

中東和非洲光纖組件市場動態

司機

“互聯經濟對數位基礎設施的需求不斷增長”

- 在中東和非洲,數位轉型趨勢明顯且持續成長。各國政府和企業都在努力增強數位連接,而光纖技術正成為這項轉型的核心。隨著越來越多的人遠端辦公、依賴串流媒體服務和使用雲端工具,對快速可靠的網路的需求激增。光纖組件(例如收發器、分路器和放大器)對於支援這一增長至關重要,尤其是在它們能夠實現覆蓋城鄉的高速、低延遲網路方面。

- National development plans in countries such as the UAE, Saudi Arabia, South Africa, and Egypt increasingly highlight the importance of fiber in building smart cities, expanding 5G coverage, and powering tech-driven economies. As telecom operators expand their fiber networks and tech hubs multiply, there’s a strong need for quality components that ensure scalability, speed, and resilience.

- At the same time, sectors like healthcare, education, and finance are digitizing at a rapid pace—driving demand for data centers, cloud infrastructure, and high-speed connectivity. All of this is supported by optical fiber technology, which is being widely deployed to future-proof networks and reduce bandwidth limitations..

Restraint/Challenge

“High Deployment Costs and Regional Infrastructure Gaps”

- Despite the market’s strong growth potential, one of the most pressing challenges in the region is the high cost of deploying and maintaining fiber optic networks. From trenching and laying fiber in vast rural areas to managing international imports of high-quality components, the upfront capital investment can be significant—especially for developing countries with tight budgets.

- Additionally, the availability of skilled technicians, specialized installation tools, and standardized regulatory frameworks is inconsistent across the region. In countries with weaker infrastructure ecosystems, these gaps can lead to longer rollout timelines, network inefficiencies, and increased operational risks.

- Many parts of Sub-Saharan Africa also face power reliability issues and limited access to backhaul networks—further complicating efforts to scale fiber deployments beyond urban centers. While donor support and public-private partnerships are stepping in to address some of these hurdles, the pace of progress varies significantly between countries.

- For the optical fiber components market to truly flourish in the Middle East and Africa, greater regional cooperation, investment in local manufacturing, and streamlined regulatory policies will be needed to lower costs and expand accessibility.

By Type

- The optical fiber components market across the Middle East and Africa includes a wide range of core technologies that are fundamental to enabling high-speed, high-capacity communication. Optical Transceivers are among the most critical components, serving as the interface between electronic equipment and optical networks. These devices are used extensively in telecom networks and data centers for rapid signal conversion and transmission.

- Optical Amplifiers, such as EDFA (Erbium-Doped Fiber Amplifiers), are crucial for boosting signal strength over long distances without the need for electrical conversion. They’re commonly deployed in national fiber backbones and submarine cable systems.

- Optical Cables, the physical medium of transmission, are seeing growing demand due to network expansions and fiber-to-the-home (FTTH) deployments. Demand is strong in both urban connectivity projects and cross-border broadband corridors.

- Connectors and Splitters help maintain signal continuity and split data across different network branches. These components are essential in structured cabling, FTTH installations, and passive optical networks (PONs).

- Circulators and WDM (Wavelength Division Multiplexing) Components are gaining traction in advanced setups, helping increase bandwidth by allowing multiple signals to travel on a single fiber strand, a vital need in high-density data networks and regional backbones..

By Data Rate:

- Optical fiber components in MEA are categorized based on the speeds they support. Up to 10 Gbps components are still widely used in traditional telecom and enterprise setups, especially in countries where digital infrastructure is still maturing.

- 10 Gbps to 40 Gbps and 40 Gbps to 100 Gbps segments are witnessing strong growth, particularly in Gulf countries and South Africa, where digital transformation and demand for cloud-based services are accelerating.

- The Above 100 Gbps segment, while still niche, is growing steadily, driven by investments in hyperscale data centers and international internet exchanges (IXPs). These ultra-high-speed components are essential for emerging AI workloads, real-time streaming, and fintech platforms.

By Application:

- The market supports a wide range of applications. Data Communication leads in demand, driven by the rise of cloud services, data center interconnects, and enterprise-level communication networks.

- Telecommunication remains a dominant segment, with regional operators deploying fiber deeper into networks to support 5G and future-ready infrastructure.

- Enterprise applications include the use of optical fiber components in large-scale business campuses, IT parks, and commercial complexes for faster, secure internal networks.

- In Industrial sectors like mining, oil & gas, and utilities, fiber is preferred for its immunity to electromagnetic interference and ability to perform in harsh environments.

- Military & Aerospace sectors are using optical fiber for secure, mission-critical communication and sensor integration due to its lightweight, secure, and high-bandwidth nature.

- Retail: AV devices are used to attract and engage shoppers through tools like video walls, interactive displays, and in-store audio systems. Retailers are using these technologies to create modern, immersive shopping environments and convey brand messages effectively.

By End User:

- Telecom Operators are the biggest adopters, investing in large-scale deployments to meet bandwidth demand, particularly in urban corridors and smart city initiatives across the UAE, Saudi Arabia, and South Africa.

- Data Centers, especially those emerging in UAE, Nigeria, and Kenya, are driving high-volume demand for fiber components that support redundancy and high-speed data throughput.

- Government & Defense institutions use fiber for secure networks, border surveillance, and internal e-governance systems.

- IT & ITeS sectors in countries like Egypt and South Africa rely on optical networks to support offshore services, data outsourcing, and global connectivity.

- Healthcare, BFSI, and Education sectors are increasingly integrating fiber-based systems for telemedicine, secure banking infrastructure, and digital classrooms, respectively

Regional Analysis:

United Arab Emirates (UAE)

The UAE is leading fiber optic adoption in the region, supported by its strong commitment to digital infrastructure and smart city transformation. With major initiatives like Smart Dubai and widespread 5G deployment, the country has significantly upgraded its fiber backbone. Operators like Etisalat and du are investing in next-gen optical components to support data-intensive applications such as AI, IoT, and cloud computing. High-speed fiber connectivity is now a standard across most urban and commercial zones

Saudi Arabia

Driven by its Vision 2030 blueprint, Saudi Arabia is making large-scale investments in broadband and 5G, which heavily depend on advanced optical fiber components. The expansion of NEOM and other giga-projects is spurring demand for high-performance fiber optics in smart buildings, industrial zones, and public infrastructure. Local telecoms like STC and Mobily are ramping up fiber deployments in both urban and underserved rural areas to ensure universal access to high-speed internet...

South Africa

South Africa has emerged as a key player in Africa’s fiber optics space, especially in urban corridors like Johannesburg, Cape Town, and Durban. With a growing number of data centers and increasing mobile traffic, demand for optical transceivers, cables, and WDM components is rising. However, challenges remain in rural fiber access, prompting government and private collaboration to bridge the digital divide through affordable fiber rollouts..

Egypt

Egypt is modernizing its telecom infrastructure under the Digital Egypt strategy. The expansion of the national fiber network and partnerships with global vendors are helping bring faster internet to homes, businesses, and government facilities. Cairo and Alexandria are leading in terms of fiber deployment, with ongoing projects targeting educational institutions and healthcare facilities that require high-bandwidth, low-latency connections.

Nigeria

作為非洲人口最多的國家,尼日利亞的光纖裝置市場擁有巨大的成長潛力。城鎮化、資料中心發展以及行動寬頻的擴張,正在推動可擴展且經濟高效的光纖解決方案的需求。尼日利亞的國家寬頻計畫旨在2025年大幅提升光纖覆蓋率,尤其是在服務不足的地區。然而,基礎設施挑戰和高昂的部署成本持續影響光纖的部署速度。

MEA 其餘地區

其他國家如阿曼、卡達、肯亞和摩洛哥正經歷穩定成長,這些國家正在推動公共服務數位化、提升企業互聯互通水準並強化國家寬頻計畫。儘管撒哈拉以南非洲部分地區仍然存在基礎設施缺口,但該地區的電信公司和政府正在投資跨境光纖線路、海底電纜和陸地骨幹網絡,以實現長期互聯互通和經濟一體化。

中東和非洲光纖組件市場份額

中東和非洲 (MEA) 光纖組件市場由許多全球技術供應商和強大的區域電信營運商主導。康寧、普睿司曼、康普和藤倉等公司憑藉可靠的光纖光纜、收發器和波分複用 (WDM) 系統佔據主導地位。在中東,阿聯酋電信 (Etisalat) 和沙烏地阿拉伯電信 (STC) 等主要電信業者正與這些品牌密切合作,以支持 5G 和智慧城市計畫。在非洲,Liquid Intelligent Technologies 和埃及電信 (Telecom Egypt) 等供應商正在使用來自全球供應商的組件來擴展光纖網路。本地分銷商和系統整合商提供客製化解決方案,包括安裝、維護和融資支持,以滿足區域需求。

- 阿聯酋電信集團(Etisalat Group)

- STC(沙烏地電信公司)(沙烏地阿拉伯)

- MTN集團(南非)

- Liquid Intelligent Technologies(原Liquid Telecom(南非))

- Zain集團(科威特)

- 埃及電信(埃及)

- Batelco(巴林電信公司)(巴林)

- 暗光纖非洲(DFA)南非)

中東和非洲光纖元件市場最新動態

- 2025年3月,Africa-1海底電纜系統正式啟動,連接埃及、阿聯酋、沙烏地阿拉伯和肯亞等主要中東和非洲地區,大幅提升區域網路頻寬和跨國資料連線。

- 2025 年 2 月,阿聯酋 du Telecom 與華為合作增強光纖骨幹基礎設施,為阿布達比和杜拜提供更高速的寬頻和 5G 網路。

- 2025 年 1 月,Liquid Intelligent Technologies 將其在南非的光纖網路再擴展 4,000 公里,旨在彌補服務不足的農村省份的連結性差距。

- 2024 年 11 月,沙烏地阿拉伯 STC 完成了全國光纖擴展階段,部署了超過 10,000 公里的光纖,這是「2030 願景」智慧基礎設施目標的一部分

- 2024 年 10 月,埃及電信簽署了一項戰略協議,為 2Africa 海底電纜提供登陸點,增強埃及作為非洲、亞洲和歐洲數位樞紐的地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。