Middle East And Africa Potassium Sulfate Fertilizers Market

市场规模(十亿美元)

CAGR :

%

USD

223.61 Million

USD

294.29 Million

2024

2032

USD

223.61 Million

USD

294.29 Million

2024

2032

| 2025 –2032 | |

| USD 223.61 Million | |

| USD 294.29 Million | |

|

|

|

|

中東和非洲硫酸鉀肥料市場細分,按形態(顆粒狀、粉狀和液體狀)、作物類型(水果、蔬菜、穀物和穀類、油籽豆類、草皮和觀賞植物)、最終用戶(商業農業、園藝、溫室和家庭)——行業趨勢和預測至 2032 年

硫酸鉀肥料市場規模

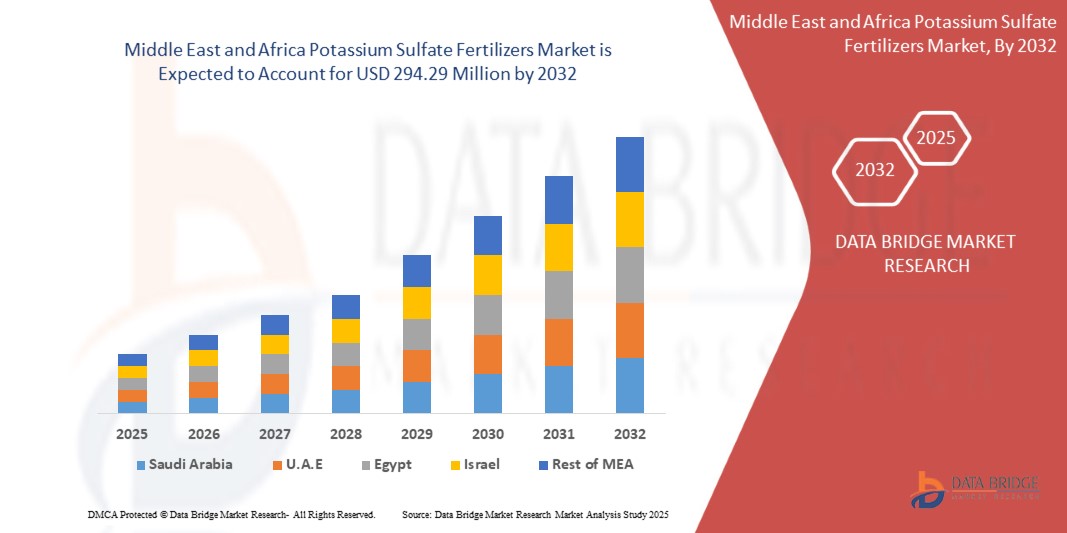

- 2024 年中東和非洲硫酸鉀肥料市場規模為2.2361 億美元 ,預計 到 2032 年將達到 2.9429 億美元,預測期內 複合年增長率為 3.5%。

- 市場成長很大程度上是由高價值作物種植對無氯肥料的需求不斷增長所推動的

- 此外,全球範圍內向永續農業和有機農業的轉變日益加劇,精準農業的採用也增加了對水溶性營養肥料的需求,從而顯著促進了該行業的成長

硫酸鉀肥料市場分析

- 硫酸鉀肥料因其在提高作物產量和品質方面的重要作用而日益受到重視,特別是對於水果、蔬菜、堅果和煙草等對氯敏感的作物,過量的氯會損害這些作物的生長並降低其市場價值

- 對高價值特種作物的需求不斷增長,加上人們對平衡營養管理和無氯肥料益處的認識不斷提高,推動了全球範圍內硫酸鉀肥料的採用

- 預計南非將主導硫酸鉀肥料市場,到 2025 年將佔據最大的收入份額,達到 29.66%,這歸因於該地區廣泛的農業生產、對高價值作物的需求不斷增長以及現代施肥方法的日益普及

- 預計南非也將成為預測期內市場成長最快的地區,這得益於人口增長、政府為提高作物產量而採取的支持性舉措以及農民對無氯肥料認識的不斷提高

- 顆粒肥料預計將在 2025 年佔據硫酸鉀肥料市場的主導地位,市佔率為 63.19%,這得益於其易於施用、保質期較長、適用於多種作物和土壤類型

報告範圍和硫酸鉀肥料市場細分

|

屬性 |

硫酸鉀肥料關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

硫酸鉀肥料市場趨勢

“對優質作物和永續農業的需求不斷增長”

- 中東和非洲硫酸鉀肥料市場的主要驅動力是對優質水果、蔬菜和經濟作物的需求不斷增長,而這種需求的驅動力源於全球飲食偏好的變化、城市化和可支配收入的增加

- 例如,2025 年 3 月,糧農組織發布的一份報告強調,預計到 2030 年,全球水果和蔬菜消費量將增加 20% 以上,這將刺激對肥料的需求,這些肥料可以提高作物的產量、品質和復原力,且不含有害的氯化物

- 硫酸鉀 (SOP) 在種植對氯敏感的作物(如菸草、馬鈴薯、葡萄和柑橘類水果)中尤其受歡迎,因為它可以改善作物的口感、顏色和保質期,同時增強植物的抗旱和抗病能力

- 此外,全球範圍內越來越多地採用永續農業實踐和精準農業技術,鼓勵農民使用硫酸鉀肥料,與含氯或過量氮的替代品相比,硫酸鉀肥料對環境的影響較小

- 2025 年 1 月,聯合國環境規劃署的一項研究強調了包括硫酸鉀在內的平衡施肥在實現與糧食安全、土壤健康和氣候適應力相關的永續發展目標 (SDG) 方面的關鍵作用

硫酸鉀肥料市場動態

司機

“高價值作物種植對無氯肥料的需求不斷增長”

- 向水果、蔬菜、堅果和煙草等高價值園藝作物的轉變,推動了對專門的、作物友好的、不會損害土壤健康或產量品質的營養物質的需求

- 其中,硫酸鉀(K₂SO₄)因其不含氯離子的特性而備受青睞,成為氯敏感作物的理想選擇,因為這些作物在接觸過量氯離子時容易導致產量和品質下降。

- 例如,2025 年 1 月,美國園藝學會發表了一篇文章,指出垂直農場的受控環境試驗表明,將鉀濃度提高到 300-450 mg·L⁻¹ 可顯著提高草莓的葉面積、果實產量、大小和質量,凸顯了高價值系統中對精準、無氯鉀源的迫切需求

- 土壤中過量的氯會導致水果含糖量降低、草莓和柑橘等敏感作物的葉片灼傷,以及菸葉質地變差。與氯化鉀(KCl)不同,氯化鉀的氯含量高達47%,而硫酸鉀則兼具提供鉀和硫(必需營養素)的雙重功效,且不存在氯中毒的風險。

- 隨著全球高價值作物種植的持續擴張,對硫酸鉀等無氯營養液的需求正在加速成長。硫酸鉀與敏感作物的兼容性、優異的農藝性能以及與永續農業實踐的契合,共同鞏固了其作為首選肥料的地位,從而推動了中東和非洲硫酸鉀肥料市場的顯著增長。

克制/挑戰

“高生產成本限制了小規模農戶的承受能力”

- 硫酸鉀 (K₂SO₄) 的生產涉及能源密集和成本高昂的工藝,例如曼海姆法或從鉀鎂礬和軟鉀鎂礬等礦物中採用複雜的天然提取方法

- 這些方法需要高溫反應和處理硫酸等腐蝕性物質,與傳統的氯化鉀 (KCl) 肥料相比,導致資本和營運費用增加

- 例如,2023年3月,路透社的一篇報導強調,在2022-2023年種植季,津巴布韋農民面臨化肥價格飆升近30%的局面,50公斤一袋的價格從約35美元上漲至約45美元,迫使小農戶減少化肥用量或改用自製堆肥。許多小農無力負擔價格較高的硫酸鉀,這限制了價格敏感型種植者對硫酸鉀的採用。

- 硫酸鉀的生產和運輸成本較高,嚴重限制了小規模和成本敏感型農民的取得。這限制了其更廣泛的應用,尤其是在那些以價格承受能力為肥料選擇關鍵因素的地區。

硫酸鉀肥料市場範圍

根據形式、作物類型和最終用戶,市場分為三個顯著的部分。

- 按形式

根據形態,市場細分為顆粒狀、粉末狀和液體狀。預計到2025年,顆粒狀產品將佔據市場主導地位,因為它使用方便、易於處理和儲存,並且廣泛適用於各種作物類型的大規模農業實踐。

預計顆粒肥料領域在 2025 年至 2032 年間將實現 3.6% 的最快增長率,這得益於其易於使用、營養分佈均勻、大規模農業的成本效益以及種植者對高效營養管理的偏好日益增加。

- 按作物類型

根據作物類型,市場細分為水果、蔬菜、穀物和穀類、油籽、豆類以及草皮和觀賞植物。預計到2025年,水果領域將佔據市場主導地位,因為水果種植對硫酸鉀的需求很高,硫酸鉀可以提高水果品質,延長保質期,並支持最佳產量,而不會添加過量的氯化物,從而避免對敏感作物造成有害影響。

預計水果產業將在 2025 年至 2032 年間經歷最快的複合年增長率,這得益於消費者對優質農產品的需求不斷增長、出口導向型種植不斷增加,以及對無氯肥料的需求以改善口感、顏色和保質期。

- 按最終用戶

根據最終用戶,市場細分為商業農業、園藝、溫室和家庭。預計到2025年,商業農業將佔據市場主導地位,因為它在大規模作物生產中發揮關鍵作用,而硫酸鉀能夠高效地提供必需的鉀和硫營養,滿足日益增長的全球糧食需求和永續農業實踐。

預計商業農業領域將在 2025 年至 2032 年間經歷最快的複合年增長率,這得益於其大規模採用特種肥料來最大限度地提高產量、提高作物品質並滿足對高價值農產品日益增長的需求。

硫酸鉀肥料市場區域分析

- 預計南非將以 29.66% 的最大收入份額佔據硫酸鉀肥料市場的主導地位,預計到 2025 年將以 4.2% 的最快複合年增長率增長,這得益於高價值作物種植的擴大、無氯肥料的採用率的提高、政府的支持性補貼以及農民對可持續提高作物品質和產量的意識的提高

- 該國強大的監管框架、有針對性的農業發展計劃以及 K+S Kali GmbH、Compass Minerals 和 Yara International 等主要市場參與者的存在,使其成為硫酸鉀肥料生產和分銷領域的領先者

埃及硫酸鉀肥料市場洞察

預計埃及的硫酸鉀肥料市場將顯著成長,這得益於該國致力於提高乾旱地區農業生產力、果蔬種植者對無氯肥料的偏好日益增長,以及政府大力推廣永續農業實踐。此外,策略性進口通路和區域分銷網絡的存在,有助於提高關鍵農業區肥料的可及性。

沙烏地阿拉伯硫酸鉀肥料市場洞察

預計2025年沙烏地阿拉伯的硫酸鉀肥料市場將大幅成長,主要原因是溫室農業投資增加、高效灌溉系統擴張以及用於支持園藝作物的專用肥料需求不斷增長。沙烏地阿拉伯政府致力於提高國內農業產量,減少對糧食進口的依賴,這也推動了硫酸鉀肥料在全國範圍內的推廣。

硫酸鉀肥料市場份額

硫酸鉀肥料產業主要由知名公司主導,其中包括:

- 雅蔣(挪威)

- K+S Aktiengesellschaft(德國)

- ICL(以色列)

- Ameropa AG(瑞士)

- SQM SA(智利)

- 海法內蓋夫科技有限公司(以色列)

- IFFCO(印度)

- 河北三元九氣化肥有限公司 (中國)

- Utkarsh Agrochem(印度)

硫酸鉀肥料市場的最新發展

- 2024 年 11 月,巴西國家石油公司和雅苒公司簽署了兩項協議,下一步將在肥料和工業產品領域建立潛在的合作關係。這兩項協議均以巴西國家石油公司的全資子公司 Araucaria Nitrogenados SA (ANSA) 恢復生產為基礎。

- 2024年10月,雅苒特爾特(Yara Tertre)管理階層已告知工人代表雅苒計劃對該工廠進行改造。擬議的改造將包括關閉氨工廠,並將生產轉向該工廠最具競爭力的產品——優質硝酸鹽肥料和工業氮化學品。

- 2024年7月,雅苒與領先的國際綠化肥料計畫開發商ATOME PLC簽署了ATOME位於巴拉圭維列塔的可再生CAN計畫的承購協議。該協議涵蓋了ATOME位於巴拉圭維列塔的可再生生產設施的全部硝酸銨鈣的長期供應。

- 2024年7月,百事歐洲與雅苒今日宣佈在歐洲建立長期合作夥伴關係,旨在為農民提供作物營養項目,協助食品價值鏈脫碳。作為這項覆蓋多個國家的合作的一部分,參與的百事歐洲農民將獲得一流的作物營養產品和建議,以及精準農業數位工具。

- 2025年1月,K+S股份公司推出了以電轉熱 (PtH) 技術生產的C:LIGHT系列鉀鎂肥,與傳統產品相比,其二氧化碳排放量可降低高達90%。高達90%的二氧化碳排放量降低使K+S在綠色肥料生產領域擁有顯著的先發優勢。這提升了K+S的ESG(環境、社會和治理)評分,使其對注重永續發展的投資者和合作夥伴更具吸引力。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE MODEL

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 RAW MATERIAL SOURCING

4.2.2 PRODUCTION AND MANUFACTURING

4.2.3 STORAGE AND PACKAGING

4.2.4 DISTRIBUTION AND LOGISTICS

4.2.5 RETAIL AND END USERS

4.2.6 REGULATORY AND SUSTAINABILITY FACTORS

4.2.7 CONCLUSION

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SWOT ANALYSIS:

4.5 PRICING ANALYSIS

4.6 COMPANY EVALUATION QUADRANT

4.6.1 MARGIN RANGE BY PRODUCT TYPE

4.6.2 DOMINANT PLAYERS

4.6.3 EMERGING PLAYERS

4.6.4 PARTICIPANTS

4.7 CONSUMER BUYING BEHAVIOUR

4.7.1 FUNCTIONAL AND CROP-SPECIFIC DEMAND

4.7.2 PRICE SENSITIVITY AND ECONOMIC CONSTRAINTS

4.7.3 INFLUENCE OF EDUCATION AND AWARENESS

4.7.4 DISTRIBUTION CHANNELS AND BRAND LOYALTY

4.7.5 CONCLUSION

4.8 COST ANALYSIS BREAKDOWN

4.8.1 RAW MATERIALS

4.8.2 ENERGY CONSUMPTION

4.8.3 LABOR AND OPERATIONAL COSTS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 FACTORS INFLUENCING BUYING DECISION OF END USERS IN THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZER MARKET

4.9.1 CROP-SPECIFIC NUTRITIONAL NEEDS

4.9.2 NUTRIENT QUALITY AND PRODUCT CONSISTENCY

4.9.3 AGRONOMIC ADVISORY AND PEER INFLUENCE

4.9.4 PRICE SENSITIVITY AND AFFORDABILITY

4.9.5 SUPPLIER REPUTATION AND REGIONAL AVAILABILITY

4.9.6 PACKAGING, TRANSPORTATION, AND HANDLING

4.9.7 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY GOALS

4.9.8 MARKETING, EDUCATION, AND EXTENSION SERVICES

4.9.9 CONCLUSION

4.1 IMPACT OF ECONOMIC SLOWDOWN ON THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET

4.11 INDUSTRY ECOSYSTEM ANALYSIS OF THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET

4.12 INNOVATION TRACKER AND STRATEGIC ANALYSIS–

4.12.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.12.1.1 JOINT VENTURES

4.12.1.2 MERGERS AND ACQUISITIONS

4.12.1.3 LICENSING AND PARTNERSHIP

4.12.1.4 TECHNOLOGY COLLABORATIONS

4.12.1.5 STRATEGIC DIVESTMENTS

4.12.1.6 NUMBER OF PRODUCTS IN DEVELOPMENT

4.12.2 STAGE OF DEVELOPMENT

4.12.3 INNOVATION STRATEGIES AND METHODOLOGIES

4.12.4 RISK ASSESSMENT AND MITIGATION

4.12.5 FUTURE OUTLOOK

4.13 PATENT ANALYSIS

4.13.1 PATENT QUALITY AND STRENGTH

4.13.2 PATENT FAMILIES

4.13.3 LICENSING AND COLLABORATIONS

4.13.4 COMPANY PATENT LANDSCAPE

4.13.5 REGION PATENT LANDSCAPE

4.13.6 IP STRATEGY AND MANAGEMENT

4.13.7 SUMMARY OF PATENT TRENDS AND INSIGHTS

4.14 PRODUCT ADOPTION SCENARIO

4.14.1 OVERVIEW

4.14.2 PRODUCT AWARENESS

4.14.3 PRODUCT INTEREST

4.14.4 PRODUCT EVALUATION

4.14.5 PRODUCT TRIAL

4.14.6 PRODUCT ADOPTION

4.14.7 CONCLUSION

4.15 PRODUCTION CAPACITY OUTLOOK

4.15.1 CAPACITY EXPANSION AND MODERNIZATION

4.15.2 STRATEGIC RESOURCE UTILIZATION

4.15.3 SUSTAINABILITY AND REGULATORY COMPLIANCE

4.15.4 AUTOMATION AND PROCESS OPTIMIZATION

4.15.5 STRATEGIC PARTNERSHIPS AND MIDDLE EAST AND AFRICA EXPANSION

4.15.6 CONCLUSION

4.16 PROFIT MARGINS SCENARIO

4.16.1 MARGIN RANGE BY PRODUCT TYPE

4.16.2 KEY FACTORS INFLUENCING MARGINS

4.16.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.17 RAW MATERIAL SOURCING ANALYSIS

4.17.1 POTASSIUM CHLORIDE (MOP)

4.17.2 SULFURIC ACID

4.17.3 LANGBEINITE / SULFATE MINERALS

4.17.4 BRINE SOURCES / SALT LAKE DEPOSITS

4.18 TARIFFS AND THEIR IMPACT ON THE MARKET

4.18.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.18.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.18.3 VENDOR SELECTION CRITERIA DYNAMICS

4.19 IMPACT ON SUPPLY CHAIN

4.19.1 RAW MATERIAL PROCUREMENT

4.19.2 MANUFACTURING AND VALUE ADDITION

4.19.3 LOGISTICS AND DISTRIBUTION

4.19.4 PRICE PITCHING AND POSITION OF MARKET

4.2 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.20.1 SUPPLY CHAIN REALIGNMENT

4.20.2 LOCAL PROCESSING INITIATIVES

4.21 REGULATORY INCLINATION

4.21.1 FTA-DRIVEN TARIFF RELIEF

4.21.2 INDUSTRIAL INCENTIVES

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR CHLORIDE FREE FERTILIZERS IN HIGH VALUE CROP CULTIVATION

6.1.2 GROWING SHIFT TOWARD SUSTAINABLE AND ORGANIC AGRICULTURE WORLDWIDE

6.1.3 PRECISION FARMING ADOPTION BOOSTS NEED FOR WATER SOLUBLE NUTRIENT FERTILIZERS

6.1.4 GOVERNMENT SUBSIDIES AND INITIATIVES SUPPORT SPECIALTY FERTILIZER USAGE

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS LIMIT AFFORDABILITY FOR SMALL-SCALE FARMERS

6.2.2 LIMITED AVAILABILITY OF NATURAL RESOURCES FOR POTASSIUM EXTRACTION

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF POTASSIUM SULFATE IN HYDROPONIC FARMING SYSTEMS

6.3.2 DIGITAL AGRICULTURE PLATFORMS AND E-COMMERCE DISTRIBUTION

6.3.3 DEVELOPMENT OF ENVIRONMENTALLY FRIENDLY, SLOW-RELEASE POTASSIUM FERTILIZER SOLUTIONS

6.4 CHALLENGES

6.4.1 COMPLEX PRODUCTION PROCESS RESTRICTS LARGE-SCALE MANUFACTURING CAPABILITY

6.4.2 VOLATILE RAW MATERIAL PRICES IMPACT PROFIT MARGINS AND SUPPLY

7 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM

7.1 OVERVIEW

7.2 GRANULAR

7.3 POWDERED

7.4 LIQUID

8 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE

8.1 OVERVIEW

8.2 FRUITS

8.3 VEGETABLES

8.4 CEREALS & GRAINS

8.5 OILSEEDS

8.6 PULSES

8.7 TURF & ORNAMENTALS

9 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER

9.1 OVERVIEW

9.2 COMMERCIAL FARMING

9.3 HORTICULTURE

9.4 GREENHOUSE

9.5 HOUSEHOLD

10 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 EGYPT

10.1.3 SAUDI ARABIA

10.1.4 U.A.E

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 YARA

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS/NEWS

13.2 K+S AKTIENGESELLSCHAFT

13.2.1 1.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARA ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 ICL

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARA ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS/NEWS

13.4 AMEROPA AG

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARA ANALYSIS

13.4.3 BUSINESS PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 SQM S.A.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARA ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 HAIFA NEGEV TECHNOLOGIES LTD

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS/NEWS

13.7 HEBEI SANYUANJIUQI FERTILIZER CO., LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 IFFCO

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS/NEWS

13.9 KSM INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 UTKARSH AGROCHEM

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS/NEWS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 DEVELOPMENT STAGE OF COMPANIES

TABLE 2 RISK ASSESSMENT AND MITIGATION

TABLE 3 REGULATORY COVERAGE

TABLE 4 YEAR-WISE DETAILS OF FUNDS RELEASED UNDER PARAMPARAGAT KRISHI VIKAS YOJANA (PKVY) AND MISSION ORGANIC VALUE CHAIN DEVELOPMENT FOR NORTH EASTERN REGION (MOVCDNER) SCHEME FROM 2021-22 TO 2023-24

TABLE 5 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 7 MIDDLE EAST AND AFRICA GRANULAR IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA POWDERED IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA LIQUID IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA TURF & ORNAMENTALS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA COMMERCIAL FARMING IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA HORTICULTURE IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA GREENHOUSE IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA HOUSEHOLD IN POTASSIUM SULFATE FERTILIZERS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY COUNTRY, 2018-2032 (THOUSAND TONS)

TABLE 31 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 33 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 42 SOUTH AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 43 SOUTH AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 44 SOUTH AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 SOUTH AFRICA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 SOUTH AFRICA CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 SOUTH AFRICA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 SOUTH AFRICA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 SOUTH AFRICA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 SOUTH AFRICA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SOUTH AFRICA PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 SOUTH AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 53 EGYPT POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 54 EGYPT POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 55 EGYPT POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 EGYPT FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 EGYPT CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 EGYPT VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EGYPT CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EGYPT OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EGYPT PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EGYPT PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EGYPT POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 66 SAUDI ARABIA POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SAUDI ARABIA POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 75 U.A.E. POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 76 U.A.E. POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 77 U.A.E. POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.A.E. FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.A.E. CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.A.E. VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.A.E. CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.A.E. OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.A.E. PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.A.E. PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.A.E. POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 ISRAEL POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 87 ISRAEL POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

TABLE 88 ISRAEL POTASSIUM SULFATE FERTILIZERS MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 ISRAEL FRUITS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ISRAEL CITRUS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ISRAEL VEGETABLES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 ISRAEL CEREALS & GRAINS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 ISRAEL OILSEEDS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 ISRAEL PULSES IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 ISRAEL PEAS IN POTASSIUM SULFATE FERTILIZERS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 ISRAEL POTASSIUM SULFATE FERTILIZERS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 97 REST OF MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 98 REST OF MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, BY FORM, 2018-2032 (THOUSAND TONS)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: EXECUTIVE SUMMARY

FIGURE 13 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: BY FORM

FIGURE 14 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR CHLORIDE FREE FERTILIZERS IN HIGH VALUE CROP CULTIVATION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 THE GRANULAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZER MARKET

FIGURE 19 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET, 2025-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 NUMBER OF PATENT VS PUBLISHING YEARS

FIGURE 21 NUMBER OF PATENTS BY APPLICANTS

FIGURE 22 NUMBER OF PATENTS BY COUNTRY

FIGURE 23 PRODUCT ADOPTION SCENARIO

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR THE MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET

FIGURE 25 ORGANIC FARMING BY COUNTRY (2025)

FIGURE 26 AGRITECH COMPANIES RECEIVED INVESTMENTS (2000-2021)

FIGURE 27 LEVEL OF INVESTMENT (PAST 5 YEARS)

FIGURE 28 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: BY FORM, 2024

FIGURE 29 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: BY CROP TYPE, 2024

FIGURE 30 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: BY END USER, 2024

FIGURE 31 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: SNAPSHOT (2024)

FIGURE 32 MIDDLE EAST AND AFRICA POTASSIUM SULFATE FERTILIZERS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。