Middle East And Africa Quinoa Market

市场规模(十亿美元)

CAGR :

%

USD

72.34 Million

USD

122.45 Million

2024

2032

USD

72.34 Million

USD

122.45 Million

2024

2032

| 2025 –2032 | |

| USD 72.34 Million | |

| USD 122.45 Million | |

|

|

|

|

中東和非洲藜麥市場細分,按類型(單色和三色)、按性質(傳統藜麥和有機藜麥)、按產品(種子、麵粉、薄片和泡芙)、按包裝類型(袋裝、小袋、盒裝、罐裝和其他)、按分銷渠道(線下和線上)——行業趨勢及預測至 2032 年

藜麥市場規模

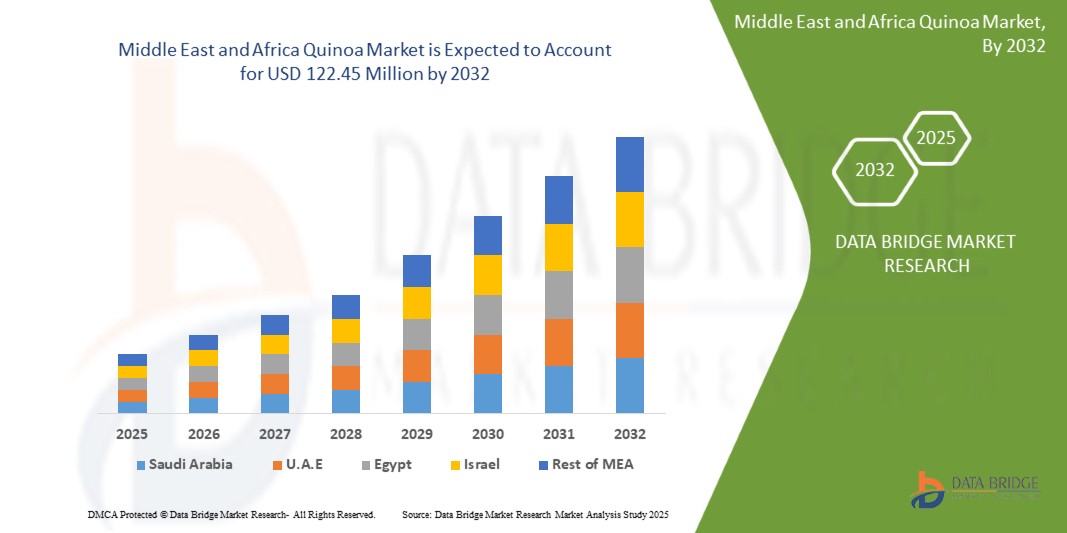

- 2024 年中東和非洲藜麥市場價值為7,234 萬美元,預計到 2032 年將達到 1.2245 億美元

- 在 2025 年至 2032 年的預測期內,市場可能會以6.9% 的複合年增長率增長,主要受對無麩質和植物性食品的需求不斷增長的推動。

- 這一增長受到全球城市消費者健康意識增強以及純素和素食飲食生活方式趨勢快速擴張等因素的推動。

藜麥市場分析

- 藜麥是一種營養豐富、不含麩質的假穀物,源自於原產於南美洲安第斯山脈地區的藜麥植物的種子。雖然藜麥通常被當作穀物食用,但嚴格來說,它是一種種子,因其高蛋白質含量而備受推崇,富含所有九種必需氨基酸。

- 藜麥在功能性和強化食品中的應用日益廣泛,是預計推動市場成長的一些驅動因素。

- 由於消費者對可追溯性、真實性和優質性的需求不斷增長,而這些需求通常與道德採購、永續性和區域營養差異相關,預計單一細分市場將佔據市場主導地位,市場份額為 63.08%。

報告範圍和藜麥市場細分

|

屬性 |

藜麥關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

阿拉伯聯合大公國、沙烏地阿拉伯、以色列、南非、埃及以及中東和非洲其他地區 |

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

藜麥市場趨勢

“針對農藝效率、營養增強和加工創新的研發進展”

- 藜麥種植和加工領域的研發 (R&D) 正在解決氣候適應性、產量變化性和收穫後損失等關鍵挑戰,從而釋放新興市場和成熟市場的新商業潛力。

- 農業研發也增強了藜麥的營養特性,例如更高的蛋白質含量、更高的賴氨酸水平和更低的皂苷濃度——這使得這種作物更受注重健康的消費者和嬰兒食品、無麩質烘焙和運動營養等特殊食品應用的青睞。

- 收穫後的創新,包括自動分類、低溫乾燥和精密脫殼系統,正在降低加工成本並提高品質和保質期的一致性。

- 此外,人們正在探索整合價值鏈發展模式——將農場改進與加工優化相結合——以增加農民收入並減少浪費。諸如農業大學和非政府組織支持的公私合作夥伴關係正在進一步加速該領域的研發工作。

藜麥市場動態

司機

“無麩質食品和植物性食品的需求不斷增長”

- 消費者日益轉向無麩質和植物性飲食模式,這大大推動了市場的發展。藜麥作為一種天然無麩質的假穀物,已成為乳糜瀉患者、麩質不耐症或選擇無麩質飲食作為生活方式人士的首選替代品。此外,藜麥富含蛋白質,包含所有九種必需氨基酸,使其成為優質的植物性蛋白質來源,對素食者、純素食者和彈性素食者極具吸引力。

- 隨著全球對健康、保健和營養透明度的認識不斷提高,藜麥富含膳食纖維、維生素、礦物質和抗氧化劑,這與注重健康的消費者不斷變化的偏好相契合。肉類替代品、乳製品替代品和功能性零食等植物性食品創新的興起,也使藜麥融入了主流應用,進一步提升了其知名度和消費量。

例如,

- 2024 年 9 月,根據美國心臟協會發布的新聞,藜麥被公認為現代營養寶庫,因其植物性蛋白質含量和無麩質特性而受到稱讚,使其成為注重健康的消費者追求均衡、無過敏原和可持續飲食習慣的理想飲食選擇

- 2024 年 3 月,根據《今日醫學新聞》發表的一篇文章,藜麥被重點介紹為一種營養豐富、無麩質的穀物,富含植物蛋白和必需氨基酸,這強化了其在素食和純素飲食中的價值,並支持其在註重健康、尋求均衡營養的全球消費者中越來越受歡迎

機會

“在亞洲、非洲、北美和歐洲國家擴大藜麥種植”

藜麥種植在亞洲、非洲、北美和歐洲等非傳統地區的擴張,為藜麥市場帶來了巨大的機會。藜麥傳統上種植於南美洲安第斯山脈地區,其對多樣化農業生態條件的適應性使其得以成功引入多個地區。印度、中國、肯亞、摩洛哥、美國、加拿大、法國和丹麥等國家已啟動藜麥試驗或商業化種植,以滿足日益增長的本地和全球需求。

這種地理多元化緩解了過度依賴安地斯山脈生產帶來的供應鏈風險,包括氣候波動和社會經濟動盪。此外,透過引進適應力強、營養豐富的作物,這種作物能夠在半乾旱和鹽鹼化土壤中生長——由於氣候變化,這些土壤條件日益普遍——從而增強了區域糧食安全。

例如,

- 2023 年 7 月,ResearchGate 發表的一篇題為《藜麥種植農藝管理實踐的全球發展:系統綜述》的文章指出,藜麥已在 100 多個國家/地區成功種植,包括亞洲、非洲、歐洲和北美洲等地區,凸顯了其全球適應性和市場拓展潛力

- 2022 年 3 月,根據愛思唯爾出版公司發表的一篇文章,藜麥種植已成功擴展到亞洲、非洲和歐洲等非傳統地區,展現出對惡劣農業生態條件的高度適應性,並為資源受限環境中的糧食安全、氣候適應力和永續農業發展提供了有希望的解決方案

克制/挑戰

“監管和貿易不確定性”

- 藜麥市場尤其受到不斷變化的監管框架和貿易不確定性的限制,這些因素阻礙了國際貿易的順利進行。歐盟等進口地區對藜麥產品的農藥殘留、食品安全、有機認證、標籤和可追溯性實施了嚴格的監管。要符合這些法律規定,需要在檢測、記錄和認證方面投入大量資金,這對中小型生產商和出口商的影響尤其嚴重。

- 此外,世貿組織的《衛生與植物檢疫措施》(SPS)和技術性貿易壁壘(TBT)措施等國際協定允許各國基於公共健康和安全引入非關稅貿易壁壘,這可能導致實施不一致或保護主義。

例如,

- 2020年11月,根據發展中國家進口促進中心(CBI)發表的一篇文章,藜麥出口商面臨歐盟關於農藥殘留、食品安全和有機認證的嚴格監管,凸顯了該地區市場准入和長期競爭力面臨的重大貿易和監管壁壘。

- 2025 年 3 月,根據 Essfeed 發表的一篇文章,歐盟對農藥限量和可追溯性的嚴格規定對藜麥進口產生了重大影響,對發展中國家的出口商提出了挑戰,使其難以滿足合規標準,並加劇了中東和非洲藜麥市場的貿易不確定性

藜麥市場範圍

中東和非洲藜麥市場根據類型、性質、產品、包裝類型和分銷管道分為五個顯著的部分。

類型

根據類型,市場分為單色和三色。單色進一步細分為白色、紅色、黑色、彩虹色、橙色、綠色、紫色、粉紅色和灰色。

到 2025 年,由於消費者對可追溯性、真實性和優質性的需求不斷增長,單一食品將佔據主導地位,這些需求通常與道德採購、永續性和區域營養差異相關。

自然

根據性質,市場分為傳統藜麥和有機藜麥。

2025年,傳統領域將因其生產成本較低、可用性更廣、適合大眾消費而滿足主流食品和零售業日益增長的需求。

產品

根據產品,市場分為種子、麵粉、薄片和泡芙。

2025 年,種子類食品將佔據主導地位,因為它們烹飪用途廣泛、保質期長,而且零售和餐飲服務業對營養豐富的植物性超級食品的需求不斷增長

包裝類型

根據包裝類型,市場分為袋、小袋、盒、罐和其他。

到 2025 年,袋子市場將佔據主導地位,因為它們提供方便、經濟高效且環保的包裝解決方案,迎合批量購買者、零售商和尋求可持續存儲選擇的環保消費者的需求。

分銷管道

根據分銷管道,市場分為線下和線上。線下進一步細分為超市和大賣場、雜貨店和本地零售商、保健食品店/有機食品店、專賣店和其他。線上再細分為第三方網站和公司自有網站。

2025年,線下市場將佔據主導地位,因為消費者青睞店內驗貨、個人化服務和即時購買。超市和健康食品商店也提升了消費者的信任度和便利性,從而推動線下藜麥需求的成長。

藜麥市場區域分析

中東

到 2025 年,中東預計將佔據主導地位,市佔率達到 6.58%。這得益於健康意識的提高、無麩質和植物性飲食、國內產量的增加、進口量的強勁增長以及創新藜麥產品推動主流消費者的接受。

南非藜麥市場洞察

由於健康意識的不斷提升、植物性飲食趨勢以及對無麩質食品的需求,南非藜麥市場正在穩步增長。國內藜麥產量的增加以及在零食、沙拉和穀物食品領域的多樣化產品應用,進一步支持了零售和餐飲服務業的市場擴張。

藜麥市場佔有率

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

市場中主要的市場領導者有:

- 藜麥食品公司

- 北方藜麥生產公司

- 藜麥公司

- 英國藜麥公司

- 滋養你

- 有機塔特瓦

- 阿迪納斯農業工業公司

- 薩爾基奧有限公司

- AARY 的食物

- 熱情磨坊

- Appkin農業私人有限公司

- 埃爾沃德有機

- Apex國際

- 尚蒂拉爾父子 HUF

- Vedaliya 工業股份有限公司

- 希洛農場

- 皇家堅果公司

- MAATITATVA 農業工業私人有限公司

- 德夫農業工業

- 純產品

- Alter Eco Foods

- 伊魯卡

中東和非洲藜麥市場的最新發展

- 2024年2月,投資公司Trek One Capital完成了對Alter Eco Foods的收購。 Alter Eco Foods是一家以藜麥、格蘭諾拉麥片、巧克力和松露而聞名的高端有機品牌。此次收購旨在加速Alter Eco Foods高端零食系列的成長,並拓展分銷管道。

- 2025 年 5 月,Mehrotra Consumer Products 在利雅得沙特食品展上展示了其“有機藜麥”,向國際買家重點介紹其無麩質、高蛋白、富含抗氧化劑的超級食品。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 COST ANALYSIS BREAKDOWN OF THE MIDDLE EAST AND AFRICA QUINOA MARKET

4.3 FACTORS AFFECTING BUYING DECISION

4.3.1 PRICE

4.3.2 PRODUCT QUALITY

4.3.3 BRAND REPUTATION

4.3.4 ADVERTISEMENT AND PROMOTIONS

4.3.5 PRODUCT AVAILABILITY

4.3.6 FINANCIAL ACCESSIBILITY

4.3.7 PEER AND EXPERT RECOMMENDATIONS

4.4 IMPACT OF ECONOMIC SLOWDOWN ON MIDDLE EAST AND AFRICA QUINOA MARKET

4.4.1 IMPACT OF PRICE

4.4.2 IMPACT ON SUPPLY CHAIN

4.4.3 IMPACT ON SHIPMENT

4.4.4 IMPACT ON DEMAND

4.4.5 IMPACT ON STRATEGIC DECISIONS

4.5 INDUSTRY ECO-SYSTEM ANALYSIS

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.6.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.6.1.1 JOINT VENTURES

4.6.1.2 MERGERS AND ACQUISITIONS

4.6.1.3 LICENSING AND PARTNERSHIP

4.6.1.4 TECHNOLOGY COLLABORATIONS

4.6.1.5 STRATEGIC DIVESTMENTS

4.6.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.6.3 STAGE OF DEVELOPMENT

4.6.4 TIMELINES AND MILESTONES

4.6.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.6.6 RISK ASSESSMENT AND MITIGATION

4.6.7 FUTURE OUTLOOK

4.7 PATENT QUALITY AND STRENGTH

4.8 PATENT FAMILIES

4.8.1 LICENSING AND COLLABORATIONS

4.8.1.1 COMPANY PATENT LANDSCAPE

4.8.1.2 REGION PATENT LANDSCAPE

4.8.1.3 IP STRATEGY AND MANAGEMENT

4.8.2 PATENT ANALYSIS

4.8.3 CONSUMER BUYING BEHAVIOUR

4.9 PRODUCT ADOPTION SCENARIO

4.9.1 CONSUMER SEGMENT PENETRATION

4.9.2 INDUSTRIAL AND FOOD SERVICE ADOPTION

4.9.3 GEOGRAPHICAL EXPANSION

4.9.4 BARRIERS TO ADOPTION

4.1 RAW MATERIAL SOURCING ANALYSIS

4.10.1 KEY RAW MATERIAL: QUINOA SEEDS

4.10.2 MAJOR QUINOA-PRODUCING COUNTRIES

4.10.3 SOURCING CHANNELS

4.10.4 CERTIFICATIONS & QUALITY STANDARDS

4.10.5 CHALLENGES IN RAW MATERIAL SOURCING

4.10.6 TRENDS IN SOURCING STRATEGY

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS

7.1.2 INCREASING HEALTH AWARENESS AMONG MIDDLE EAST AND AFRICA URBAN CONSUMERS

7.1.3 FAST EXPANDING VEGAN AND VEGETARIAN DIETARY LIFESTYLE TRENDS

7.1.4 GROWING APPLICATION OF QUINOA IN FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION COSTS LIMIT LARGE-SCALE COMMERCIAL EXPANSION

7.2.2 EXPANSION OF SINGLE-CROP QUINOA LEADING TO SOIL DEGRADATION, BIODIVERSITY LOSS, AND SUSCEPTIBILITY TO CLIMATE STRESS

7.3 OPPORTUNITIES

7.3.1 EXPANDING QUINOA FARMING IN ASIA, AFRICA, NORTH AMERICA, AND EUROPE COUNTRIES

7.3.2 GOVERNMENT SUPPORT & POLICY INCENTIVES PROMOTING FARMERS TO ADOPT QUINOA AS A CLIMATE-RESILIENT CROP

7.3.3 RISING POPULARITY OF ORGANIC AND SUSTAINABLE AGRICULTURE PRACTICES

7.4 CHALLENGES

7.4.1 REGULATORY & TRADE UNCERTAINTIES

7.4.2 QUALITY INCONSISTENCIES ACROSS INTERNATIONAL QUINOA SUPPLY CHAINS

8 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE

8.3 TRICOLOR

9 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 SEEDS

9.3 FLOUR

9.4 FLAKES

9.5 PUFFS

10 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 BAGS

10.3 POUCHES

10.4 BOX

10.5 JAR

10.6 OTHERS

11 MIDDLE EAST AND AFRICA QUINOA MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL QUINOA

11.3 ORGANIC QUINOA

12 MIDDLE EAST AND AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 MIDDLE EAST AND AFRICA QUINOA MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 UAE

13.1.2 SAUDI ARABIA

13.1.3 ISRAEL

13.1.4 SOUTH AFRICA

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA QUINOA MARKET COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ARDENT MILLS

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 ADINATH AGRO INDUSTRIES

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 NOURISH YOU

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APEX INTERNATIONAL

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 AARY'S FOOD

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALTER ECO FOODS

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 APPKIN AGRO PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DEV AGRO INDUSTRIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 ELWORLD ORGANIC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 IRUPANA ANDEN ORGANIC FOOD S.A.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MAATITATVA AGRO INDUSTRIES PRIVATE LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 NORTHERN QUINOA PRODUCTION CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORGANIC TATTVA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT/NEWS

16.14 PURE PRODUCTS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 QUINOA CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 QUINOA FOODS COMPANY SRL

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ROYAL NUT COMPANY.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SARCHIO SPA

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SHANTILAL & SONS HUF

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHILOH FARMS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 THE BRITISH QUINOA COMPANY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 VEDALIYA INDUSTRIES LLP.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 MIDDLE EAST AND AFRICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA SINGLE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA TRICOLOR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA SEEDS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FLOUR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FLAKES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA PUFFS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA BAGS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA POUCHES IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA BOX IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA JAR IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA OTHERS IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA CONVENTIONAL QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA ORGANIC QUINOA IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA OFFLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA ONLINE IN QUINOA MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA QUINOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 29 MIDDLE EAST AND AFRICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 36 UAE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 UAE QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 38 UAE SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 UAE QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 40 UAE QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 41 UAE QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 UAE QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 UAE OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 44 UAE ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 45 SAUDI ARABIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 SAUDI ARABIA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 47 SAUDI ARABIA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 SAUDI ARABIA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 49 SAUDI ARABIA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 50 SAUDI ARABIA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SAUDI ARABIA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 54 ISRAEL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ISRAEL QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 56 ISRAEL SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ISRAEL QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 58 ISRAEL QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 59 ISRAEL QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ISRAEL QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 ISRAEL OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 62 ISRAEL ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 65 SOUTH AFRICA SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH AFRICA OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH AFRICA ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 EGYPT QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EGYPT QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

TABLE 74 EGYPT SINGLE IN QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 EGYPT QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 76 EGYPT QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 77 EGYPT QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EGYPT QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 79 EGYPT OFFLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 80 EGYPT ONLINE IN QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 81 REST OF MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 REST OF MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND) (KILO TONS)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA QUINOA MARKET

FIGURE 2 MIDDLE EAST AND AFRICA QUINOA MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA QUINOA MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA QUINOA MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA QUINOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA QUINOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA QUINOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA QUINOA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA QUINOA MARKET: EXECUTIVE SUMMARY

FIGURE 11 MIDDLE EAST AND AFRICA QUINOA MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DEMAND FOR GLUTEN-FREE AND PLANT-BASED FOODS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA QUINOA MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SINGLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA QUINOA MARKET IN 2025 AND 2032

FIGURE 16 MIDDLE EAST AND AFRICA LONG CHAIN POLYAMIDE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 17 PATENT FAMILIES

FIGURE 18 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA ZEOLITE MARKET

FIGURE 20 MIDDLE EAST AND AFRICA QUINOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

FIGURE 21 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

FIGURE 22 MIDDLE EAST AND AFRICA QUINOA MARKET, BY PACKAGING TYPE, 2018-2032 (USD THOUSAND)

FIGURE 23 MIDDLE EAST AND AFRICA QUINOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

FIGURE 24 MIDDLE EAST AND AFRICA QUINOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

FIGURE 25 MIDDLE EAST & AFRICA QUINOA MARKET: SNAPSHOT (2023)

FIGURE 26 MIDDLE EAST AND AFRICA QUINOA MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。