中东和非洲蒸煮包装市场,按产品类型(袋装、托盘、纸箱等)、材料(PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 等)、分销渠道(线下和线上)、最终用途(食品、饮料、药品等)划分 – 行业趋势和预测至 2029 年

市场分析和规模

工业化和城镇化改变了介质或流体的加工技术和运输方式,导致几乎每个流体起主要作用的行业都需要蒸煮包装。因此,蒸煮包装市场受到更安全的生产和充足的基础设施需求的推动。

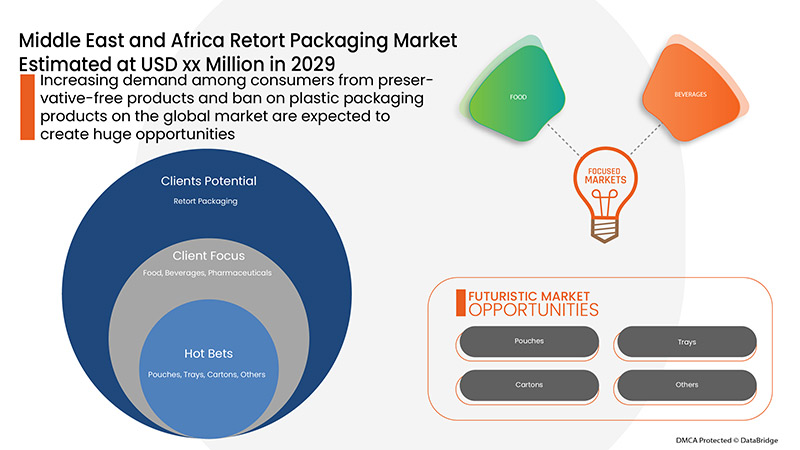

推动市场发展的一些因素包括消费者对不含防腐剂产品的需求不断增长、对可持续和美观包装解决方案的需求不断增长以及对避免食品浪费的智能包装的需求不断增长。然而,与研发活动相关的高成本阻碍了市场的增长。

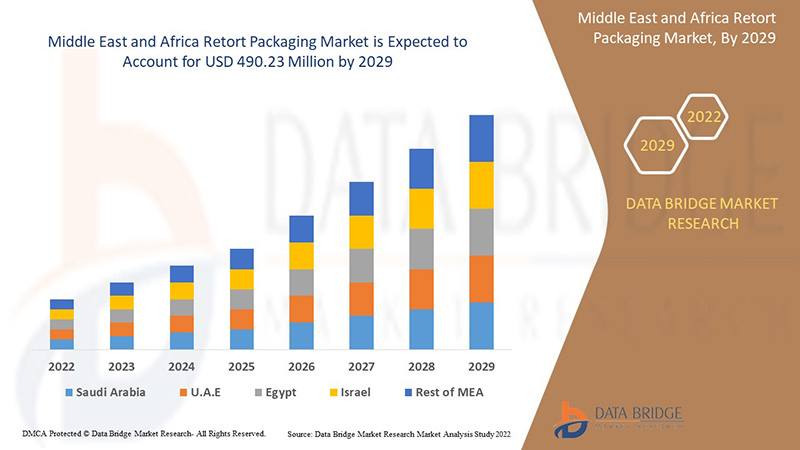

Data Bridge Market Research 分析称,到 2029 年,蒸煮包装市场预计将达到 4.9023 亿美元的价值,预测期内的复合年增长率为 4.6%。由于饮食模式的改变和西方影响力的增强,对包装和单份食品的需求不断增加,“袋装”是蒸煮包装市场中最大的产品类型细分市场。蒸煮包装市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020 |

|

定量单位 |

收入(百万美元),定价(美元) |

|

涵盖的领域 |

按产品类型(袋、托盘、纸箱等)、按材料(PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 等)、按分销渠道(线下和线上)、按最终用途(食品、饮料、药品等) |

|

覆盖国家 |

南非、沙特阿拉伯、阿联酋、以色列、埃及以及中东和非洲 (MEA) 的其他地区(作为中东和非洲 (MEA) 的一部分) |

|

涵盖的市场参与者 |

ProAmpac、Coveris、FLAIR Flexible Packaging Corporation、IMPAK CORPORATION、PORTCO PACKAGING、Constantia Flexibles、Mondi、Tetra Pak 等。 |

市场定义

蒸煮包装是一种由柔性塑料和金属箔层压而成的食品包装。它允许对通过无菌工艺处理的多种食品和饮料进行无菌包装,并用作传统工业罐装方法的替代品。包装食品范围从清水到完全煮熟、热稳定(热处理)、高热量(平均 1,300 千卡)的即食餐 (MRE),可以冷食、浸入热水加热或用无焰配给加热器加热,无焰配给加热器是军方于 1992 年首次推出的配餐成分。野战口粮、太空食品、鱼制品、露营餐、快餐面条以及 Capri Sun 和 Tasty Bite 等公司都采用蒸煮包装。

最初,蒸馏包装是为工业应用和管风琴而开发的。逐渐地,这种设计被应用于生物制药行业,通过使用符合要求的材料进行灭菌。现在,它几乎被用于所有行业,以确保安全生产和充足的基础设施,例如食品和饮料、化学加工等垂直行业。

蒸煮包装市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。以下内容将详细讨论所有这些内容:

- 消费者对不含防腐剂的产品的需求不断增加

蒸煮是指非无菌产品密封时进行的,字面意思是非无菌包装。包装装入蒸煮压力容器中,并经受加压蒸汽。产品暴露在高温下的时间也比热灌装长得多。额外的时间会显著降低产品的整体质量和营养成分。

全球消费者对不含防腐剂产品的需求不断增长,这是中东和非洲蒸煮包装市场的主要推动力。随着消费者越来越担心饮料中防腐剂的有害影响,对不含防腐剂产品的需求达到顶峰。

- 航空公司对蒸煮包装的需求增加

最近,消费者越来越多地转向可持续和环保的包装选择,这进一步引入了各种设计的完全可回收包装和立式袋。除了提供环境优势外,可持续包装还可以帮助公司增加利润并消除不必要的制造备件,从而提高生产线的安全性并最大限度地降低处理成本。包装的主要目的不仅是保护产品在运输过程中免受损坏,而且还要在产品出售前保护仓库和零售店。不同类型的包装用于不同类型的产品。此外,蒸煮包装用于重型和大件食品,也用于其他产品。

- 为避免食品浪费,对智能包装的需求不断增长

智能包装提供了各种减少食物浪费的解决方案,因为它提供了不同的指标来避免食物变质。因此,增加食物浪费正在吸引消费者购买带有智能包装的食品。

智能包装包括指示器(时间-温度指示器、完整性或气体指示器、新鲜度指示器)、条形码和射频识别标签(RFID)、传感器(生物传感器、气体传感器、荧光氧传感器)等。因此,智能包装可帮助食品制造商实时跟踪其食品的状态,从而有助于减少食品浪费。

此外,智能包装还可以成为消费者在零售层面选择产品的主要工具,因为智能包装概念可以让消费者判断产品的质量。因此,智能包装有望在吸引消费者方面发挥重要作用。

- 与研发活动相关的高成本

研发费用与公司产品或服务的研发以及在此过程中产生的任何知识产权直接相关。公司通常在寻找和创造新产品或服务的过程中产生研发费用。

包装公司高度依赖其研发能力,因此他们可以相对增加研发费用。例如,将消费者的偏好从常规包装转变为智能主动包装,提高消费者对食品安全的认识等。因此,随着技术的不断发展,公司必须投资研发活动以实现业务多元化并寻找新的增长机会。

- 禁止中东和非洲市场销售塑料包装产品

随着多个地区对环境问题的关注度不断上升,政府已采取严格措施,禁止在市场上销售一次性塑料制品和不可生物降解的包装产品。这是因为塑料制品需要更长的时间才能分解,而且对水生和陆生动物都很危险。

例如,

自然环境组织估计,每年约有 10 万只海龟和其他海洋动物因被袋子勒死或被误认为食物而死亡。

在北美,用于食品和消费品包装的一次性塑料袋被禁止。因此,该地区对纸板和蒸煮包装的需求正在增加。

多种类型的包装用于不同的用途,产生废物,对环境非常有害。塑料包装用于消费品包装,产生不可生物降解的塑料包装废物,向土壤释放有毒气体,对动物和地下水有害。因此,已采取措施禁止使用塑料袋包装,因为它对环境有害。

- 疫情导致供应链中断

COVID-19 扰乱了供应链,导致全球蒸煮包装市场萎缩。中断导致产品库存延迟,以及食品和饮料产品的获取和供应减少。随着 COVID-19 的持续存在,材料的运输、进出口受到了限制。此外,由于工人的流动受到限制,蒸煮包装的生产也受到影响,导致消费者的需求无法得到满足。此外,由于进出口受到限制,制造商难以向世界各国供应原材料及其最终产品,这也影响了蒸煮包装的价格。因此,由于 COVID-19 持续的限制,蒸煮包装的供应链已经中断,这给制造商带来了重大挑战。

由于COVID-19的持续存在和行动限制,供应链中断,这对中东和非洲蒸煮包装市场构成了重大挑战。

新冠肺炎疫情对蒸煮包装市场的影响

COVID-19 对蒸煮包装市场产生了重大影响,因为几乎每个国家都选择关闭除生产必需品的工厂以外的所有生产设施。政府采取了一些严格的措施,例如停止非必需品的生产和销售、封锁国际贸易等,以防止 COVID-19 的传播。在这种大流行情况下,唯一能开展业务的是获准开放和运行流程的基本服务。

由于病毒引发的疫情爆发,许多小部门被关闭,另一方面,一些部门决定裁掉部分员工,导致大量失业。蒸煮包装也用于产品包装和工业。由于疫情的爆发,对此类产品的需求有所增加,尤其是医疗、医疗保健、制药、杂货、电子商务和其他各个部门。但意外的需求,加上有限的生产能力和供应链中断,继续给所有这些行业带来困难。

制造商正在制定各种战略决策,以在新冠疫情后实现复苏。参与者正在进行多项研发活动,以改进蒸煮包装所涉及的技术。借助此技术,这些公司将向市场推出先进而精确的控制器。此外,政府部门在食品和饮料中使用蒸煮包装也推动了市场的增长。

近期发展

- 2021 年 2 月,SEE 宣布收购 SEE Ventures 旗下的 Foxpak Flexibles Ltd. (Foxpak),这是其投资颠覆性技术和商业模式以加速增长的举措。Foxpak 利用数字印刷功能直接在其柔性包装材料上进行印刷,以增强其客户的品牌。他们的解决方案可以快速扩大或缩小,以满足任何规模客户的生产需求。此次收购将有助于加强现金流和收益。进一步扩大公司的包装产品组合。

- 2021 年 12 月,Sonoco 收购了 Ball Metalpack。此次收购补充了 Sonoco 最大的消费包装特许经营权。Ball Metalpack 是食品和家用产品可持续金属包装的领先制造商,也是北美最大的气雾剂生产商。此次收购将有助于加强现金流和收益。进一步扩大公司的包装产品组合。

中东和非洲蒸煮包装市场范围

蒸煮包装市场根据产品类型、材料、分销渠道和最终用途进行细分。这些细分市场之间的增长情况将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

产品类型

- 托盘

- 袋装

- 纸箱

- 其他的

根据产品类型,中东和非洲蒸煮包装市场分为托盘、袋装、纸箱和其他。

材料

- 宠物

- 聚丙烯

- 铝箔

- 聚酰胺(PA)

- 纸和纸板

- 乙烯醇

- 其他的

根据材料,中东和非洲蒸煮包装市场细分为 PET、聚丙烯、铝箔、聚酰胺 (PA)、纸和纸板、EVOH 和其他。

分销渠道

- 离线

- 在线的

根据分销渠道,中东和非洲蒸煮包装市场分为线下和线上。

最终用途

- 食物

- 饮料

- 药品

- 其他的

根据最终用途,中东和非洲蒸煮包装市场分为食品、饮料、药品和其他领域。

蒸煮包装市场区域分析/见解

对蒸煮包装市场进行了分析,并按上述产品类型、材料、分销渠道和最终用途行业提供了市场规模洞察和趋势。

蒸煮包装市场报告涵盖的国家包括南非、沙特阿拉伯、阿联酋、以色列、埃及以及中东和非洲 (MEA) 的其他地区(作为中东和非洲 (MEA) 的一部分)

南非在亚太地区蒸煮包装市场占据主导地位。该地区蒸煮包装需求预计将受到食品和饮料蒸煮包装需求增长的推动。

报告的国家部分还提供了影响市场当前和未来趋势的各个市场影响因素和市场监管变化。下游和上游价值链分析、技术趋势和波特五力分析、案例研究等数据点是用于预测各个国家市场情景的一些指标。此外,在提供国家数据的预测分析时,还考虑了中东和非洲品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀缺竞争而面临的挑战、国内关税和贸易路线的影响。

竞争格局和蒸煮包装市场份额分析

蒸煮包装市场竞争格局按竞争对手提供详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、中东和非洲业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度、应用主导地位。以上提供的数据点仅与公司对蒸煮包装市场的关注有关。

蒸煮包装市场的一些主要参与者包括 ProAmpac、Coveris、Berry Middle East and Africa Inc.、FLAIR Flexible Packaging Corporation、IMPAK CORPORATION、PORTCO PACKAGING、Constantia Flexibles、Mondi、Tetra Pak、Clifton Packaging Group Limited、DNP America, LLC.、Sonoco Products Company、Amcor plc 等

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE MIDDLE EAST & AFRICA MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 U.A.E.

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY MIDDLE EAST & AFRICA INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MIDDLE EAST AND AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 MIDDLE EAST AND AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 SOUTH AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 SOUTH AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 SAUDI ARABIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 SAUDI ARABIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 EGYPT POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 EGYPT FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 U.A.E. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 U.A.E. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 U.A.E. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 ISRAEL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 ISRAEL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。