Middle East And Africa Silk Market

市场规模(十亿美元)

CAGR :

%

USD

504.27 Million

USD

902.50 Million

2024

2032

USD

504.27 Million

USD

902.50 Million

2024

2032

| 2025 –2032 | |

| USD 504.27 Million | |

| USD 902.50 Million | |

|

|

|

|

中東和非洲絲綢市場細分,按類型(桑蠶絲、塔薩爾絲/野蠶絲、柞蠶絲、蜘蛛絲、穆加絲、阿納菲絲、花薑絲、科安絲、貽貝絲、海絲、絲綢軟緞(絲綢緞)、雪紡絲綢(縐雪紡)、絲綢雙縐(雙絲綢軟緞(絲質軟緞)、雪紡絲綢(縐雪紡)、絲綢雙縐(雙絲綢軟緞(雙絲彩或雙縐)、絲綢紗布、富士絲綢、絲綢落棉、絲綢山東綢、絲綢歐根紗、絲綢闊幅布、絲綢縐布、羽絨絲綢/電力紡絲綢、真絲春亞紡等)、產品類型(生絲、絲紗等)、重量(輕、中、重)、股數(2股、3 股、4 股等)、原產國(日本絲綢、印度絲綢、泰國絲綢等)、材料(純絲、標準絲、混紡絲)、生產工藝(繭生產、繅絲、投擲、織造、染色、其他)、結束-用戶(紡織、化妝品、醫療等)、分銷(線下和線上)- 產業趨勢

絲綢市場規模

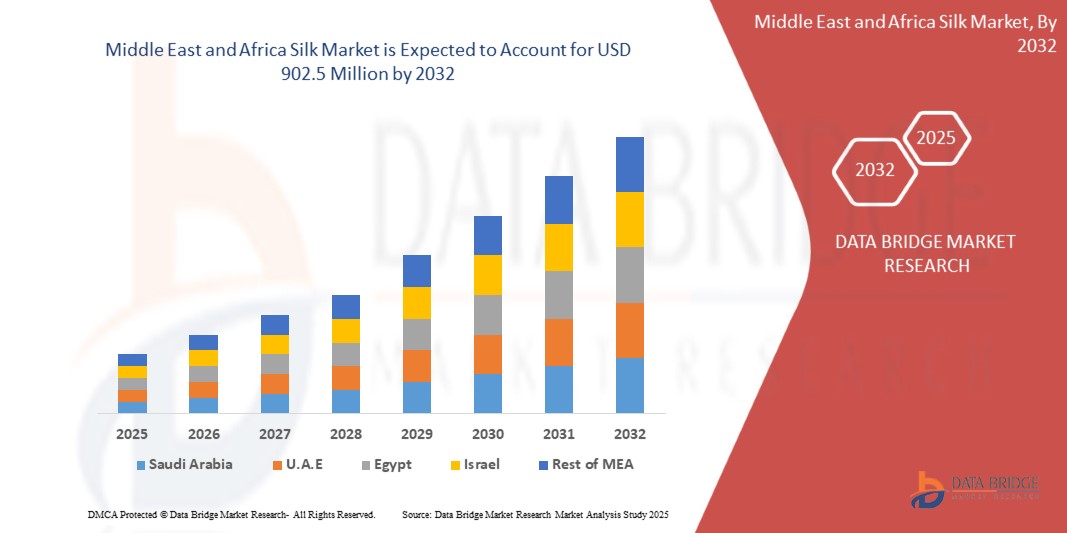

- 2024 年中東和非洲絲綢市場價值為5.0427 億美元,預計到 2032 年將達到 9.025 億美元,預測期內複合年增長率為 7.7%。

- 市場成長主要得益於消費者對永續和符合道德標準的絲綢(包括和平絲綢和有機絲綢)的偏好日益增長

- 這一增長得益於政府大力支持國內絲綢生產等因素,尤其是在南非和埃及等主要絲綢生產國。補貼、研發項目和基礎設施投資正在提升絲綢的品質和產量,進而支撐全球服裝、化妝品和醫療產業日益增長的需求。

絲綢市場分析

- 中東和非洲絲綢市場正在穩步增長,這得益於人們對天然、奢華和可生物降解紡織品的需求不斷增長,以及人們對永續性的日益關注。由於絲綢質地優良、防過敏和可生物降解的特性,越來越多的消費者選擇絲綢,尤其是在服裝、家居用品和個人護理產品領域。埃及和南非等主要市場繼續影響中東和非洲的絲綢供應和創新,而發展中國家則在政府支持和農村就業計畫的推動下,正在擴大絲綢產能。

- 絲綢廣泛應用於時尚、化妝品和醫療等多個領域。在服裝業,絲綢憑藉其光澤和舒適度,一直是高端服裝、婚紗和正裝的首選面料。除紡織品外,絲素蛋白和絲膠也被用於護膚、傷口癒合以及縫合線和支架等生物醫學創新領域。絲綢在傳統和現代應用中的適應性,使其在日益多元化和價值驅動的紡織領域中保持市場相關性。

- 2024 年,南非在全球絲綢市場佔據主導地位,主要得益於其完善的蠶桑基礎設施、豐富的桑樹種植以及涵蓋蠶繭生產到成品絲綢的一體化價值鏈

- 預計南非將見證中東和非洲絲綢市場最高的複合年增長率,這得益於對可持續養蠶實踐的持續投資、絲綢加工技術的進步以及國內對奢華和環保紡織品不斷增長的需求

- 2024年,桑蠶絲憑藉其卓越的纖維品質、柔軟度和光澤度,以及在高端紡織品中的廣泛應用,佔據了全球絲綢市場的主導地位。作為商業化種植和加工程度最高的絲綢品種,其穩定的供應以及在時尚、家居裝飾和化妝品領域的廣泛應用,使其成為全球的首選。

報告範圍和α-甲基苯乙烯市場細分

|

屬性 |

Silk Key市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中東和非洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

絲綢市場趨勢

“政府大力支持國內絲綢生產產業”

- 隨著印度和中國等主要絲綢生產國政府的持續大力支持,全球絲綢市場正在經歷顯著增長,這得益於人們對蠶桑業社會經濟影響的認識,特別是在農村就業和出口貢獻方面

- 補貼、研發項目、技術培訓和國家絲綢委員會等策略性幹預措施正在提高生產品質、疾病管理和市場連通性,從而形成更具彈性和更有效率的絲綢供應鏈

- 2025 年 4 月,印度絲綢 Samagra-2 計劃透過加強基礎設施、增加蠶種和種植材料供應以及技術升級(例如在卡納塔克邦安裝 42 台自動繅絲機)來支持綜合發展,從而提高競爭力和市場准入

- 根據 Fibre2Fashion 2025 年 4 月的數據,桑蠶絲仍然是主要品種,佔印度 2024 年 4 月至 12 月產量的 75% 以上,為 23,131 噸,而塔薩爾 (1,079 噸)、艾里 (6,217 噸) 和穆加 (187 噸) 基礎生產貢獻了基礎多元化

絲綢市場動態

司機

“消費者對永續和環保產品的偏好日益增長”

- 隨著注重環保的消費者行為成為主流,全球絲綢市場正經歷顯著增長,這主要得益於對可持續和環保產品的強烈偏好,對天然、可生物降解和符合道德標準的材料的需求不斷增長,影響著全球的購買決策

- 這種轉變反映了消費者優先考慮事項的更廣泛轉變,產品選擇不僅要考慮品質和美觀,還要考慮對環境影響和道德採購的整體評估,這使得絲綢等天然纖維對當今負責任的買家特別有吸引力

- 2025 年 5 月,《南亞紡織》報道稱,印度消費者越來越青睞絲綢等可生物降解的天然纖維,認為其較低的環境足跡和自然分解是推動其需求成長的關鍵因素

- 綠色網路亞洲 (Green Network Asia) 在 2025 年 6 月發表的一篇文章強調了環保紡織品在減少時尚產業環境損害方面的作用,並暗示絲綢是一種天然、可持續的選擇,符合減少浪費和負責任採購的目標

- 2025 年 5 月,Anuprerna 強調了可持續絲綢的需求如何受到道德關注和環保意識的推動,並指出“和平絲綢”等創新的興起以及高端時尚品牌越來越多地採用可持續絲綢,這推動了對環保生產方法的投資和創新

克制/挑戰

“來自合成纖維的競爭”

- 全球絲綢(TSP)市場的一個顯著限制因素是大豆的致敏性,儘管TSP具有營養和功能益處,但其致敏性仍然限制著消費者的接受度。大豆是全球八大食品致敏原之一,即使是少量接觸也可能導致過敏反應,從輕微症狀到嚴重的過敏反應,尤其是在嬰幼兒中。這種風險使許多消費者望而卻步,也使製造商在開發面向大眾市場的產品時面臨挑戰。

- 為了應對這些挑戰,食品生產商越來越多地探索替代植物蛋白,例如豌豆、大米和鷹嘴豆,這些蛋白通常被認為致敏性較低。這些替代品通常被定位為“無過敏原”或“清潔標籤”,以吸引註重健康且敏感的消費者,同時也使品牌能夠進入更廣泛、更具包容性的細分市場。

- 嚴格的監管框架要求清楚標註過敏原訊息,尤其是在大豆方面,這進一步影響了消費者的決策。雖然這種透明度可以提高食品安全性,但也可能會使潛在買家因對過敏原風險的認識增強而不願選擇像TSP這樣的大豆製品。這種監管格局使大豆衍生成分與相對不含過敏原的成分相比處於相對劣勢。

- 儘管TSP價格實惠、蛋白質含量高且具有可持續性,但由於人們對大豆過敏的擔憂,其在獲得廣泛的市場滲透方面仍面臨重大障礙。在科學進步成功降低大豆的致敏性之前,預計這項限制將持續存在,並影響整個產業的產品策略。

- 例如,2024年11月,愛思唯爾公司發表的一篇文章重點介紹了一起由加工食品中隱藏的大豆成分引起的食物依賴性運動性過敏反應案例,凸顯了消費者在檢測過敏原方面面臨的困難。同樣,2022年12月,美國氣喘和過敏基金會透過「食物過敏兒童」網站強調,過敏兒童必須完全避免食用大豆,並強調了兒科營養中替代成分的必要性。

- 總體而言,對大豆過敏原的擔憂對 Silk 市場造成了相當大的限制,促使製造商轉向低過敏性替代品,並推動無過敏原產品開發的創新

絲綢市場範圍

市場根據類型、產品類型、重量、層數、原產國、材料、生產流程、最終用戶、分銷管道進行細分。

- 按類型

根據類型,絲綢市場分為桑蠶絲、柞蠶絲/野蠶絲、蓖麻蠶絲、蜘蛛絲、木加絲、阿納菲絲、花薑絲、科安絲、貽貝絲、海絲、絲綢軟緞(絲綢緞)、雪紡絲綢(縐雪紡)、雙縐絲綢(Dupioni 或絲綢緞Dupion)、絲綢紗布、富士絲綢、絲綢細棉布、山東絲綢、絲綢歐根紗、絲綢細幅布、絲綢縐布、羽絨紡絲綢/電力紡絲綢、真絲春亞紡等。預計到2025年,桑蠶絲將佔據市場主導地位,市佔率達46.15%。預計到2032年,其市場規模將達到454,017.41萬美元,在2025年至2032年的預測期內,其複合年增長率最高,達到9.0%,這得益於其卓越的纖維品質、穩定的供應能力以及在奢侈服裝和紡織品領域的廣泛應用。桑蠶絲與傳統織造工藝和現代製造工藝的兼容性,使其在各個應用領域更具吸引力。

- 依產品類型

根據產品類型,絲綢市場可細分為生絲、絲紗和其他。預計到2025年,絲綢布料將佔據市場主導地位,市場佔有率為35.78%。預計到2032年,絲綢市場規模將達到3.5271992億美元,在2025年至2032年的預測期內,複合年增長率最高,為9.0%。

按重量

根據重量,絲綢市場可分為輕質、中質和重質。預計到2025年,輕質絲綢將佔據主導地位,市場佔有率為54.26%。預計到2032年,其市場規模將達到4.9751237億美元,在2025年至2032年的預測期內,複合年增長率最高,為7.9%。這得益於其在服裝和室內裝飾產品中的多功能性,而這些產品對均衡的結構和懸垂性至關重要。

- 由 Ply 提供

根據股數,絲綢市場可分為2股 、3股、4股及其他股數。預計2025年,2股絲綢將佔據主導地位,市佔率為47.13%。預計到2032年,其市場規模將達到4.37779億美元,在2025年至2032年的預測期內,複合年增長率最高,達到8.1%。 2股絲綢兼具耐用性和精緻的做工,適合用於製作高品質的時尚產品和正裝。

- 按原產國

根據原產國,絲綢市場可分為日本絲綢、印度絲綢、泰國絲綢和其他絲綢。預計到2025年,中國絲綢將佔據主導地位,市佔率達61.72%。預計到2032年,中國絲綢市場規模將達到5.72億美元,在2025年至2032年的預測期內,複合年增長率最高,達8.1%。這得歸功於中國豐富的絲綢品種、雄厚的蠶桑基礎以及政府的大力支持,這些因素增強了中國絲綢的生產和出口潛力。

- 按材質

依材質,絲綢市場可分為純絲、標準絲和混紡絲。混紡絲細分市場進一步細分為棉絲、絲羊毛和人造絲。預計到2025年,純絲將佔據市場主導地位,市佔率將達到73.67%。由於純絲價格實惠、經久耐用,且在主流和時尚領域廣泛應用,預計到2032年其市場規模將達到6.6961942億美元,在2025年至2032年的預測期內,其複合年增長率最高,達到7.8%。

- 按生產工藝

根據生產工藝,絲綢市場可細分為繭絲生產、繅絲、拉坯、織造、染色及其他環節。預計2025年,繭絲生產環節將佔據市場主導地位,市佔率達50.20%。預計到2032年,繭絲生產規模將達到4.7147343億美元,在2025年至2032年的預測期內,複合年增長率最高,達8.3%。這主要得益於對高品質成品紡織品需求的不斷增長,以及支援複雜織物設計和紋理的織布機技術創新。

- 按最終用戶

根據最終用戶,絲綢市場細分為紡織、化妝品、醫療和其他領域。預計到2025年,紡織領域將佔據主導地位,市佔率達77.63%。由於全球對奢侈服裝、傳統服裝和永續時尚產品的需求不斷增長,預計到2032年,絲綢市場規模將達到7.064721億美元,在2025年至2032年的預測期內,複合年增長率最高,達到7.8%。

- 按分銷管道

根據分銷管道,絲綢市場分為線下和線上。線下細分市場進一步細分為超市、大賣場、品牌專賣店和其他。預計到2025年,線下細分市場將佔據主導地位,市佔率達68.96%。預計到2032年,線下細分市場將達到6.172億美元,在2025年至2032年的預測期內,複合年增長率最高,達到7.5%。這主要源自於消費者對絲質布料的偏好,尤其是在購買高檔服裝和家紡產品時。

絲綢市場區域分析

- 中東和非洲對全球絲綢市場的貢獻率為 2024 年的 3.14%,這得益於該地區根深蒂固的養蠶傳統、充足的熟練勞動力以及中國、印度、泰國和越南等國家適合桑樹種植的氣候條件

- 該地區的主導地位得益於政府大力推動的絲綢養殖、繅絲基礎設施建設和出口導向生產,尤其是在印度和中國,這兩個國家合計佔全球絲綢產量的90%以上。絲綢面料在傳統服飾中的廣泛文化和禮儀用途也支撐了持續的國內需求。

- 此外,可支配收入的提高、時尚和家紡行業的擴張,以及消費者對天然和永續纖維的日益偏好,正在推動絲綢在服裝、床上用品和個人護理產品中的應用。對先進繅絲、染色和環保絲綢生產技術的策略性投資,加上出口支援政策,將繼續鞏固亞太地區在全球絲綢市場的領導地位。

中東和非洲絲綢市場洞察

預計在預測期內,中東和非洲絲綢市場將出現溫和增長,這得益於可支配收入的提高、對高端紡織品的需求增長,以及傳統服裝和家居裝飾中對絲綢的文化認同。阿聯酋、沙烏地阿拉伯和南非等國家對奢華和環保時尚的興趣日益濃厚,而高淨值消費者群體則推動了對手工和客製化絲綢產品的需求。此外,區域紡織品製造商正在探索永續採購和絲綢混紡創新,以順應全球時尚潮流,並在國內外市場實現產品多元化。

- 南非絲綢市場洞察

受城市消費者對天然優質紡織品日益增長的青睞,以及本土時尚和設計產業蓬勃發展的推動,南非絲綢市場正在逐步擴張。南非對手工工藝和永續時尚的熱情,正在推動服裝和室內裝潢領域對環保絲綢的需求。此外,專注於本土絲綢生產的利基項目以及政府扶持農村紡織企業的努力,正在為絲綢行業的長期增長奠定基礎。

- 埃及絲綢市場洞察

埃及絲綢市場正重新受到青睞,這得益於其與高級紡織品悠久的歷史淵源,以及傳統服裝和現代時尚領域對奢華面料日益增長的需求。政府為振興當地蠶桑業和推廣傳統工藝所採取的舉措,也促進了該行業的發展。此外,人們對永續材料的認識日益加深,以及旅遊業對正宗埃及紡織品的興趣,也推動了絲綢在服裝、紀念品和家居裝飾領域的應用。

市場中主要的市場領導者有:

- ERIS 中東和非洲 LLP(印度)

中東和非洲絲綢市場最新動態

- 2025年1月,LILYSILK在紐約市開設了首家概念店,標誌著其零售業務的一次重要擴張。此舉旨在透過奢華、永續的購物體驗提升品牌知名度和顧客參與度。該店也支持環保舉措,強化了公司對永續發展的承諾。

- 2025年2月,Bolt Threads 與 Goddess Maintenance Co. 宣布達成一項年度價值400萬美元的合作,將 Bolt 的 b-silk 技術融入其全新的生物科技美妝系列。此次合作將於2025年春季透過 Sally Beauty 在美國1300多家零售門市上市,標誌著可持續、科學驅動的護膚領域邁出的重要一步,鞏固 Bolt 在清潔美容市場的地位,並擴大其影響力。

- 2024年1月,萬事利集團被國家工信部等政府部門評為國家文化與科技融合示範基地。此項殊榮凸顯了萬事利集團在絲綢設計和生產中對人工智慧 (AI) 的創新運用。公司與無界人工智慧合作開發的人工智慧設計系統,擁有超過50萬種花型和300多種AI成像演算法的資料庫。該系統能夠創造多達10萬種獨特的絲巾設計,實現快速客製化和高效生產。此外,萬事利集團還採用了環保的數位化機器,在印染過程中減少用水,解決了紡織製造中的環境問題。

- 2024年8月,萬事利集團在杭州大廈購物中心舉辦了「時尚奧運:百年絲巾」展覽。這場文化盛會以絲綢藝術的形式,將現代設計與中國傳統工藝融合,頌揚奧運精神。此次展覽提升了萬事利的品牌知名度,促進了國際文化交流,並展示了公司在主題產品設計方面的創新,從而拓展了其在國內外的影響力。

- 2024年10月,Bolt Projects Holdings 將擴展其純素蠶絲技術平台,推出以 b-silk 為主要成分的新產品,包括 Freaks of Nature 防曬霜和即將上市的彩妝產品。該公司還預告了其第二款專有成分 xl-silk 的首次亮相。隨著更多品牌合作的到來,Bolt 將 2025 年定位為護髮、護膚和化妝品領域可持續、高性能美容創新的突破之年。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 CONSUMER BEHAVIOR ANALYSIS OF THE MIDDLE EAST AND AFRICA SILK MARKET

4.3 IMPACT OF THE COVID-19 PANDEMIC ON THE MIDDLE EAST AND AFRICA SILK MARKET

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 HIGH GOVERNMENT SUPPORT FOR DOMESTIC SILK PRODUCTION INDUSTRY

6.1.2 EXPANSION INTO EMERGING MARKETS & GROWING DISPOSABLE INCOME

6.1.3 TECHNOLOGICAL ADVANCEMENT IN SERICULTURE & PROCESSING

6.1.4 GROWING CONSUMER PREFERENCE FOR SUSTAINABLE AND ECO-FRIENDLY PRODUCTS

6.2 RESTRAINTS

6.2.1 COMPETITION FROM SYNTHETIC FIBRES

6.2.2 TRADE BARRIERS BETWEEN NATIONS

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF SILK IN NON-TEXTILE APPLICATIONS

6.3.2 ADOPTION OF SILK IN FUNCTIONAL AND SMART TEXTILES

6.3.3 RISING DISPOSABLE INCOME DRIVING DEMAND FOR HOME FURNISHINGS AND DECOR

6.4 CHALLENGES

6.4.1 HIGH PRODUCTION COSTS AND LABOR-INTENSIVE SERICULTURE

6.4.2 VULNERABILITY TO CLIMATIC CONDITIONS AND DISEASE OUTBREAKS IN SILKWORMS

7 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE

7.1 OVERVIEW

7.2 MULBERRY SILK

7.3 TASAR SILK/WILD SILK

7.4 ERI SILK

7.5 MUGA SILK

7.6 SPIDER SILK

7.7 ANAPHE SILK

7.8 FAGARA SILK

7.9 COAN SILK

7.1 MUSSEL SILK

7.11 SEA SILK

7.12 SILK CHARMEUSE ( SILK SATIN)

7.13 CHIFFON SILK (CREPE CHIFFON)

7.14 SILK DUPIONI ( DUPPIONI OR DUPION)

7.15 SILK GAUZE

7.16 FUJI SILK

7.17 SILK NOIL

7.18 SILK SHANTUNG

7.19 SILK ORGANZA

7.2 SILK BROADCLOTH

7.21 SILK CREPE

7.22 HABUTAI SILK / HABOTAI SILK

7.23 SILK PONGEE

7.24 OTHERS

8 MIDDLE EAST AND AFRICA SILK MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SILK FABRIC

8.3 RAW SILK

8.4 SILK YARNS

8.5 SILK WASTE

8.6 SILK BLENDS

8.7 DEGUMMED SILK

8.8 OTHERS

9 MIDDLE EAST AND AFRICA SILK MARKET, BY WEIGHT

9.1 OVERVIEW

9.2 LIGHT WEIGHT

9.3 MEDIUM WEIGHT

9.4 HEAVY WEIGHT

10 MIDDLE EAST AND AFRICA SILK MARKET, BY PLY

10.1 OVERVIEW

10.2 2 PLY

10.3 4 PLY

10.4 3 PLY

10.5 OTHERS

11 MIDDLE EAST AND AFRICA SILK MARKET, BY COUNTRY OF ORIGIN

11.1 OVERVIEW

11.2 CHINA SILK

11.3 INDIAN SILK

11.3.1 INDIAN SILK, BY TYPE

11.3.2 TUSSAH/TUSSAR, BY TYPE

11.4 JAPAN SILK

11.4.1 JAPAN SILK, BY TYPE

11.5 IRAN SILK

11.6 THAILAND SILK

11.6.1 THAILAND SILK, BY TYPE

11.7 OTHERS

12 MIDDLE EAST AND AFRICA SILK MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 PURE SILK

12.3 BLENDED SILK

12.3.1 BLENDED SILK, BY TYPE

12.4 STANDARD SILK

13 MIDDLE EAST AND AFRICA SILK MARKET, BY PRODUCTION PROCESS

13.1 OVERVIEW

13.2 COCOON PRODUCTION

13.3 REELING

13.4 WEAVING

13.5 DYEING

13.6 THROWING

13.7 OTHERS

14 MIDDLE EAST AND AFRICA SILK MARKET, BY END-USER

14.1 OVERVIEW

14.2 TEXTILE

14.2.1 TEXTILE, BY END-USE

14.2.2 CLOTHING, BY TYPE

14.2.3 TEXTILE, BY TYPE

14.3 MEDICAL

14.3.1 MEDICAL, BY TYPE

14.4 OTHERS

14.4.1 OTHERS, BY TYPE

15 MIDDLE EAST AND AFRICA SILK MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 OFFLINE

15.2.1 OFFLINE, BY TYPE

15.3 ONLINE

16 MIDDLE EAST AND AFRICA SILK MARKET, BY REGION

16.1 MIDDLE EAST AND AFRICA

16.1.1 SOUTH AFRICA

16.1.2 EGYPT

16.1.3 SAUDI ARABIA

16.1.4 UAE

16.1.5 ISRAEL

16.1.6 REST OF MIDDLE EAST & AFRICA

17 MIDDLE EAST AND AFRICA SILK MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 STARLING SILK MILLS PVT. LTD.

19.1.1 COMPANY SNAPSHOT

19.1.2 COMPANY SHARE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT UPDATES

19.2 WENSLI

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS/NEWS

19.3 SHENGKUN SILK MANUFACTURING CO., LTD

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATES

19.4 BOLT THREADS

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 LILYSILK

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT DEVELOPMENTS/NEWS

19.6 ALASHAN CASHMERE AND SILK

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS/NEWS

19.7 AMSILK GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 ANHUI SILK CO. LTD.

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 ARUN YARNS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS/NEWS

19.1 CHINA NATIONAL SILK GROUP CO., LTD.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT UPDATES

19.11 ERIS MIDDLE EAST AND AFRICA LLP

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS/NEWS

19.12 FISHERS FINERY

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 GARIMA SILKS.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS/NEWS

19.14 JINCHENGJIANG XINXING SILK CO., LTD

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS/NEWS

19.15 KRAIG BIOCRAFT LABORATORIES, INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENT

19.16 M. JIJU SILK MILLS

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS/NEWS

19.17 NISHA SILK EXPORTS.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS/NEWS

19.18 ORIENT GROUP

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 PRATHAM SILKS

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS/NEWS

19.2 SICHUAN NANCHONG LIUHE (GROUP) CO., LTD

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 SPIBER TECHNOLOGIES

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENT

19.22 UNNATI SILKS

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS/NEWS

19.23 WUJIANG FIRST TEXTILE CO. LTD.

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENT

19.24 ZHEJIANG JIAXIN SILK CORP., LTD.

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 4 MIDDLE EAST AND AFRICA MULBERRY SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA TASAR SILK/WILD SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA ERI SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MUGA SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA SPIDER SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ANAPHE SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FAGARA SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA COAN SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA MUSSEL SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA SEA SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA SILK CHARMEUSE (SILK SATIN) IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA CHIFFON SILK (CREPE CHIFFON) IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA SILK DUPIONI ( DUPPIONI OR DUPION) IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA SILK GAUZE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA FUJI SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SILK NOIL IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA SILK SHANTUNG IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA SILK ORGANZA IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA SILK BROADCLOTH IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA SILK CREPE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA HABUTAI SILK / HABOTAI SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA SILK PONGEE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA SILK FABRIC IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA RAW SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA SILK YARNS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA SILK WASTE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA SILK BLENDS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA DEGUMMED SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA LIGHT WEIGHT IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA MEDIUM WEIGHT IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA HEAVY WEIGHT IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA 2 PLY IN SILK MARKET, BY REGION, 2018-2032 (USD)

TABLE 41 MIDDLE EAST AND AFRICA 4 PLY IN SILK MARKET, BY REGION, 2018-2032 (USD)

TABLE 42 MIDDLE EAST AND AFRICA 3 PLY IN SILK MARKET, BY REGION, 2018-2032 (USD)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD)

TABLE 44 MIDDLE EAST AND AFRICA SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA CHINA SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA INDIAN SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA TUSSAH/TUSSAR IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA JAPAN SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA IRAN SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA THAILAND SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA PURE SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA BLENDED SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA STANDARD SILK IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA SILK MARKET BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA COCOON PRODUCTION IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA REELING IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA WEAVING IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA DYEING IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA THROWING IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA TEXTILE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA TEXTILE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA SILK MARKET BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA OFFLINE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA ONLINE IN SILK MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA SILK MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA SILK MARKET, BY COUNTRY, 2018-2032 (THOUSAND METER)

TABLE 82 MIDDLE EAST & AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST & AFRICA SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 84 MIDDLE EAST & AFRICA SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST & AFRICA SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST & AFRICA SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST & AFRICA SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST & AFRICA INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST & AFRICA TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST & AFRICA JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST & AFRICA THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST & AFRICA SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 93 MIDDLE EAST & AFRICA BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST & AFRICA SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 95 MIDDLE EAST & AFRICA SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST & AFRICA TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 97 MIDDLE EAST & AFRICA CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST & AFRICA TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MIDDLE EAST & AFRICA MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST & AFRICA OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MIDDLE EAST & AFRICA SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST & AFRICA OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH AFRICA SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 105 SOUTH AFRICA SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH AFRICA SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH AFRICA INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH AFRICA TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH AFRICA JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH AFRICA THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH AFRICA SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 114 SOUTH AFRICA BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH AFRICA SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 116 SOUTH AFRICA SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH AFRICA TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 118 SOUTH AFRICA CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH AFRICA TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SOUTH AFRICA MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH AFRICA OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH AFRICA SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH AFRICA OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 EGYPT SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 126 EGYPT SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 EGYPT SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 128 EGYPT SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 129 EGYPT SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 130 EGYPT INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 EGYPT TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 EGYPT JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 EGYPT THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 EGYPT SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 135 EGYPT BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 EGYPT SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 137 EGYPT SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 138 EGYPT TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 139 EGYPT CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 EGYPT TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 EGYPT MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 EGYPT OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 EGYPT SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 144 EGYPT OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SAUDI ARABIA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SAUDI ARABIA SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 147 SAUDI ARABIA SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SAUDI ARABIA SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 149 SAUDI ARABIA SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 150 SAUDI ARABIA SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 151 SAUDI ARABIA INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SAUDI ARABIA TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SAUDI ARABIA JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SAUDI ARABIA OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SAUDI ARABIA SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 165 SAUDI ARABIA OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 UAE SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 UAE SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 168 UAE SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 UAE SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 170 UAE SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 171 UAE SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 172 UAE INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 UAE TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 UAE JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 UAE THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 UAE SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 177 UAE BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 UAE SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 179 UAE SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 180 UAE TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 181 UAE CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 UAE TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 UAE MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 UAE OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 UAE SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 186 UAE OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 ISRAEL SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 ISRAEL SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

TABLE 189 ISRAEL SILK MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 ISRAEL SILK MARKET, BY WEIGHT, 2018-2032 (USD THOUSAND)

TABLE 191 ISRAEL SILK MARKET, BY PLY, 2018-2032 (USD THOUSAND)

TABLE 192 ISRAEL SILK MARKET, BY COUNTRY OF ORIGIN, 2018-2032 (USD THOUSAND)

TABLE 193 ISRAEL INDIAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 ISRAEL TUSSAH/TUSSAR IN SILK MARKET BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 ISRAEL JAPAN SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 ISRAEL THAILAND SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 ISRAEL SILK MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 198 ISRAEL BLENDED SILK IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 ISRAEL SILK MARKET, BY PRODUCTION PROCESS, 2018-2032 (USD THOUSAND)

TABLE 200 ISRAEL SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 201 ISRAEL TEXTILE IN SILK MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 202 ISRAEL CLOTHING IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 ISRAEL TEXTILE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 ISRAEL MEDICAL IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 ISRAEL OTHERS IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 ISRAEL SILK MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 207 ISRAEL OFFLINE IN SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 REST OF MIDDLE EAST & AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 REST OF MIDDLE EAST & AFRICA SILK MARKET, BY TYPE, 2018-2032 (THOUSAND METER)

图片列表

FIGURE 1 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET

FIGURE 2 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET END-USE COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA SILK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)SILK MARKET: SEGMENTATION

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 TWENTY-THREE SEGMENTS COMPRISE THE MIDDLE EAST & AFRICA SILK MARKET, BY TYPE (2024)

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 HIGH GOVERNMENT SUPPORT FOR DOMESTIC SILK PRODUCTION INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SILK MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 17 THE MULBERY SILK SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SILK MARKET IN 2025 AND 2032

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA SILK MARKET

FIGURE 21 MIDDLE EAST AND AFRICA SILK MARKET: BY TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA SILK MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 MIDDLE EAST AND AFRICA SILK MARKET: BY WEIGHT, 2024

FIGURE 24 MIDDLE EAST AND AFRICA SILK MARKET: BY PLY, 2024

FIGURE 25 MIDDLE EAST AND AFRICA SILK MARKET: BY COUNTRY OF ORIGIN, 2024

FIGURE 26 MIDDLE EAST AND AFRICA SILK MARKET: BY MATERIAL, 2024

FIGURE 27 MIDDLE EAST AND AFRICA SILK MARKET: BY PRODUCTION PROCESS, 2024

FIGURE 28 MIDDLE EAST AND AFRICA SILK MARKET: BY END-USER, 2024

FIGURE 29 MIDDLE EAST AND AFRICA SILK MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 MIDDLE EAST AND AFRICA SILK MARKET: SNAPSHOT (2024)

FIGURE 31 MIDDLE EAST AND AFRICA SILK MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。