中东和非洲硫酸市场,按原材料(贱金属冶炼厂、元素硫、黄铁矿等)、形式(浓缩、66 波美度硫酸、塔/格洛弗酸、室/肥料酸、电池酸和稀硫酸)、制造工艺(接触工艺、铅室工艺、湿法硫酸工艺、焦亚硫酸盐工艺等)、分销渠道(离线和线上)、应用(肥料、化学制造、石油精炼、金属加工、汽车、纺织、药品制造、纸浆和造纸、工业等)行业趋势和预测到 2029 年。

中东和非洲硫酸市场分析及规模

硫酸是一种无色、无味、粘稠的液体,可溶于任何浓度的水。它是一种通过氧化二氧化硫溶液制成的强酸,大量用作工业和实验室试剂。硫酸或硫酸,也称为硫酸油,是一种由硫、氧和氢组成的矿物酸,分子式为 H2SO4,熔点为 10°C,沸点为 337°C。

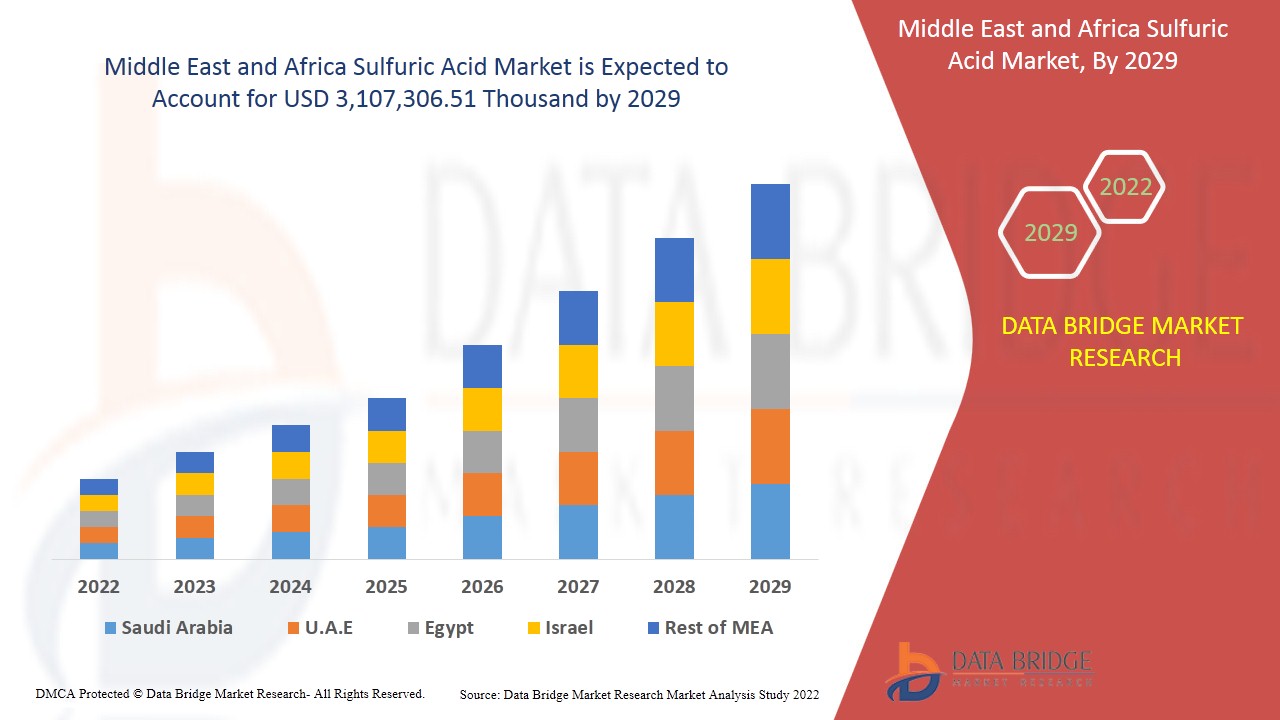

农业对肥料的需求不断增加,各行业对硫酸的需求不断增长,是推动市场对硫酸需求增长的一些因素。Data Bridge Market Research 分析称,预计到 2029 年,硫磺市场价值将达到 3,107,306.51 万美元,预测期内复合年增长率为 3.1%。由于全球硫磺供应充足,“元素硫”是各自领域中最突出的原材料部分。Data Bridge Market Research 团队策划的市场报告包括深入的专家分析、进出口分析、定价分析、生产消费分析和气候链情景。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(千美元)、产量(千吨)、定价(美元) |

|

涵盖的领域 |

按原材料(贱金属冶炼厂、元素硫、黄铁矿等)、形式(浓缩、66 波美度硫酸、塔式/格洛弗酸、室式/肥料酸、电池酸和稀硫酸)、制造工艺(接触工艺、铅室工艺、湿法硫酸工艺、焦亚硫酸盐工艺等)、分销渠道(线下和线上)、应用(肥料、化学品制造、石油精炼、金属加工、汽车、纺织、药品制造、纸浆和造纸、工业等) |

|

覆盖国家 |

中东和非洲的南非、埃及、沙特阿拉伯、阿拉伯联合酋长国、以色列以及中东和非洲其他地区 |

|

涵盖的市场参与者 |

朗盛(德国科隆)、Brenntag GmbH(Brenntag SE 的子公司)(德国埃森)、Boliden Group(瑞典斯德哥尔摩)、安迪苏(法国安东尼)、威立雅(法国巴黎)、Univar Solutions Inc(美国伊利诺伊州)、NORAM Engineering & Construction Ltd.(加拿大温哥华)、诺力昂(荷兰阿姆斯特丹)、International Raw Materials LTD(美国宾夕法尼亚州)、Eti Bakir(土耳其卡斯塔莫努)、ACIDEKA SA(西班牙比斯开)、Airedale Chemical Company Limited.(英国北约克郡)、巴斯夫 SE(德国路德维希港)、Aguachem Ltd(英国雷克瑟姆)、Feralco AB(英国威德尼斯)、Fluorsid(意大利米兰)、Aurubis AG(德国汉堡)、Nyrstar(荷兰布德尔)、默克集团(德国达姆施塔特)和 Shrieve(美国德克萨斯州) |

市场定义

硫酸是一种具有吸湿性和氧化性的强酸。它用于化肥、化学、合成纺织和颜料工业。其他应用包括电池制造、金属酸洗以及其他工业制造工艺。市场上的硫酸有不同的浓度等级,如 98%、96.5%、76%、70% 和 38%。大量硫酸用于生产硫酸钾和肥料。农业对肥料的需求不断增加,各行各业对硫酸的需求不断增长,是推动市场对硫酸需求增长的一些因素。随着全球硫酸消费量的增加,主要参与者正在扩大其在不同国家的生产能力,以加强其在市场上的份额

监管框架

- DHHS(1994 年)和 EPA 尚未将三氧化硫或硫酸归类为致癌物。IARC 认为,职业接触含有硫酸的强无机雾气对人类具有致癌性(第 1 组)(IARC 1992 年)。ACGIH 已将硫酸归类为疑似人类致癌物(第 A2 组)(ACGIH 1998 年)。

硫酸被列在“紧急计划和社区知情权法案第 3 至 13 条所规定的有毒化学品”名单上(EPA 1998f)。

硫酸的职业允许接触限值 (PEL) 为 1 mg/m3 (OSHA 1998)。NIOSH 建议的接触限值 (REL) 也是 1 mg/m3 (NIOSH 1997)。ACGIH 建议的阈值限值时间加权平均值 (TLV-TWA) 为 1 mg/m3,短期接触限值 (STEL) 为 3 mg/m3 (ACGIH 1998)。

COVID-19 对中东和非洲硫酸市场影响甚微

2020-2021 年,COVID-19 影响了各个制造业,导致工作场所关闭、供应链中断和运输受限。然而,中东和非洲的硫酸业务和供应链受到了重大影响,多家制造工厂仍在运营。在后疫情时代,服务提供商在采取卫生和安全措施后继续提供硫酸。

中东和非洲硫酸市场的市场动态包括:

- 农业对肥料的需求不断增加

对农作物种植用高质量肥料的需求不断增加,推动了中东和非洲硫酸市场的发展。

- 化学工业大幅增长

通过制定可持续化学品战略来增加欧洲地区的化学品产量是绿色协议的重要组成部分,旨在加强化学工业的发展,从而更容易避免使用危险化学品,并鼓励创新以开发安全和可持续的替代品。因此,化学工业的可持续发展战略有助于保持化学工业的显著增长,并在未来几年推动中东和非洲硫酸市场的发展。

- 各行各业对硫酸的需求不断增长

预计制药、纺织、造纸和纸浆等多个行业对硫酸的需求将以越来越快的速度增长,并将推动中东和非洲硫酸市场的发展。

- 汽车行业对电池的需求不断增长

随着对废弃印刷电路板回收需求的增加,使用硫酸回收金、银、铁和铜等不同金属预计将推动中东和非洲硫酸市场的发展。

- 医疗保健行业显著增长

硫酸电池在机动车和电动汽车其他机器中的优势日益凸显,增加了对硫酸的需求,为中东和非洲硫酸市场创造了未来利用和实现更高增长的机会。

- 硫磺原料储量丰富

此外,如今世界各地的石油和天然气工业也生产硫磺用于工业用途。因此,全球丰富的硫磺储量为中东和非洲硫酸市场的增长创造了机会。

中东和非洲硫酸市场面临的限制/挑战

- 与硫酸有关的健康危害

硫酸对皮肤、眼睛和其他器官的健康危害日益增加,可能会阻碍中东和非洲的硫酸市场需求。

- 硫酸供应过剩导致销量下降

中东和非洲硫酸市场供应不足是该市场主要制造商面临的最大问题,这直接影响了他们的销售额和利润率,因为其他生产商的供应过剩导致价格下降。这是中东和非洲硫酸市场增长的最大挑战。

本硫酸市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入来源、市场法规变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新等方面的机会。如需了解有关硫酸市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

最新动态

- 2020 年 11 月,Airedale Chemical Company Limited 收购了 Alutech,后者提供一系列金属处理解决方案,包括铝光亮剂和预处理清洁剂。这一发展有助于该公司增加对硫酸的需求,从而增加了其利润

- 2017 年 5 月,巴斯夫 SE 推出了一种新型硫酸催化剂,该催化剂因其独特的几何形状而受到青睐。此次更新有助于公司提高生产能力,从而在未来产生收入

中东和非洲硫酸市场范围

中东和非洲硫酸市场根据原材料、形式、制造工艺、分销渠道和应用进行细分。这些细分市场之间的增长将帮助您分析行业中增长缓慢的细分市场,并为用户提供有价值的市场概览和市场洞察,帮助他们做出战略决策,确定核心市场应用。

原料

- 贱金属冶炼厂

- 元素硫

- 黄铁矿

- 其他的

根据原材料,市场分为贱金属冶炼厂、元素硫、黄铁矿和其他。由于全球硫资源丰富,预计 2022 年元素硫将占据主导地位。

形式

- 浓缩(98%)

- 塔/格洛弗酸 (77.67%)

- 室/肥料酸 (62.8%)

- 电池酸 (33.5%)

- 66 波美度硫酸 (93%)

- 稀硫酸(10%)

根据形式,市场细分为浓硫酸(98%)、塔/格洛弗酸(77.67%)、室/肥料酸(62.8%)、电池酸(33.5%)、66 波美度硫酸(93%)和稀硫酸(10%)。

制造过程

- 联系流程

- 铅室工艺

- 湿法硫酸工艺

- 焦亚硫酸盐工艺

- 其他的

Based on manufacturing process, the market is segmented into contact process, lead chamber process, wet sulfuric acid process, metabisulfite process, and others.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the Middle East and Africa sulfuric acid market is segmented into offline and online.

Application

- Fertilizer,

- Chemical Manufacturing

- Petroleum Refining

- Metal Processing

- Automotive

- Textile

- Drug Manufacturing

- Pulp & Paper

- Industrial

- Others

On the basis of application, the market is segmented into fertilizers, chemical manufacturing, petroleum refining, metal processing, automotive, textile, drug manufacturing, pulp & paper, industrial, and others. The fertilizers are expected to dominate the application segment as the demand for sulfuric fertilizers increases for crop plantation and soil fertility.

Middle East and Africa Sulfuric Acid Regional Analysis/Insights

Middle East and Africa sulfuric acid market is analyzed and market size insights and trends are provided by raw material, form, manufacturing process, distribution channel, and application as referenced above.

The countries covered in the Middle East and Africa sulfuric acid market report are South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and Rest of Middle East and Africa.

In Middle East and Africa, United Arab Emirates is dominating in Middle East and Africa sulfuric acid market due to fast growing fertilizer industry in the country. The main use of sulfuric acid is in the manufacture of the basic kinds of fertilizers, such as superphosphate of lime and ammonium sulfate.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Sulfuric Acid Market Share Analysis

The Middle East and Africa sulfuric acid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa sulfuric acid market.

灭鼠剂市场的一些主要参与者包括 LANXESS、Brenntag GmbH(Brenntag SE 的子公司)、Boliden Group、Adisseo、Veolia、Univar Solutions Inc、NORAM Engineering & Construction Ltd.、Nouryon、International Raw Materials LTD、Eti Bakir、ACIDEKA SA、Airedale Chemical Company Limited.、BASF SE、Aguachem Ltd、Feralco AB、Fluorsid、Aurubis AG、Nyrstar、Merck KGaA 和 Shrieve 等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 U.A.E.

12.1.2 SAUDI ARABIA

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.A.E. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.A.E. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.A.E. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.A.E. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.A.E. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.A.E. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.A.E. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.A.E. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.A.E. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.A.E. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.A.E. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.A.E. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.A.E. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.A.E. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.A.E. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 SAUDI ARABIA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 SAUDI ARABIA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 SAUDI ARABIA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 SAUDI ARABIA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 SAUDI ARABIA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 SAUDI ARABIA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 SAUDI ARABIA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 SAUDI ARABIA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 SAUDI ARABIA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 SAUDI ARABIA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 SAUDI ARABIA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 SAUDI ARABIA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 SAUDI ARABIA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 SOUTH AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 SOUTH AFRICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 SOUTH AFRICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 SOUTH AFRICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 SOUTH AFRICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 SOUTH AFRICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 SOUTH AFRICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 SOUTH AFRICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 SOUTH AFRICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 SOUTH AFRICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 SOUTH AFRICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 SOUTH AFRICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 SOUTH AFRICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 SOUTH AFRICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 SOUTH AFRICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 124 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 125 ISRAEL SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 126 ISRAEL SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 127 ISRAEL SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 128 ISRAEL SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 129 ISRAEL SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 ISRAEL FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 131 ISRAEL PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 132 ISRAEL METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 133 ISRAEL DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 134 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 135 ISRAEL CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 ISRAEL TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 138 ISRAEL AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 139 ISRAEL PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 140 ISRAEL OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 141 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 142 EGYPT SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 143 EGYPT SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 144 EGYPT SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 145 EGYPT SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 146 EGYPT SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 EGYPT FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 148 EGYPT PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 149 EGYPT METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 150 EGYPT DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 151 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 152 EGYPT CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 EGYPT TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 154 EGYPT INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 155 EGYPT AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 156 EGYPT PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 157 EGYPT OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 159 REST OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

图片列表

FIGURE 1 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 MIDDLE EAST & AFRICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。