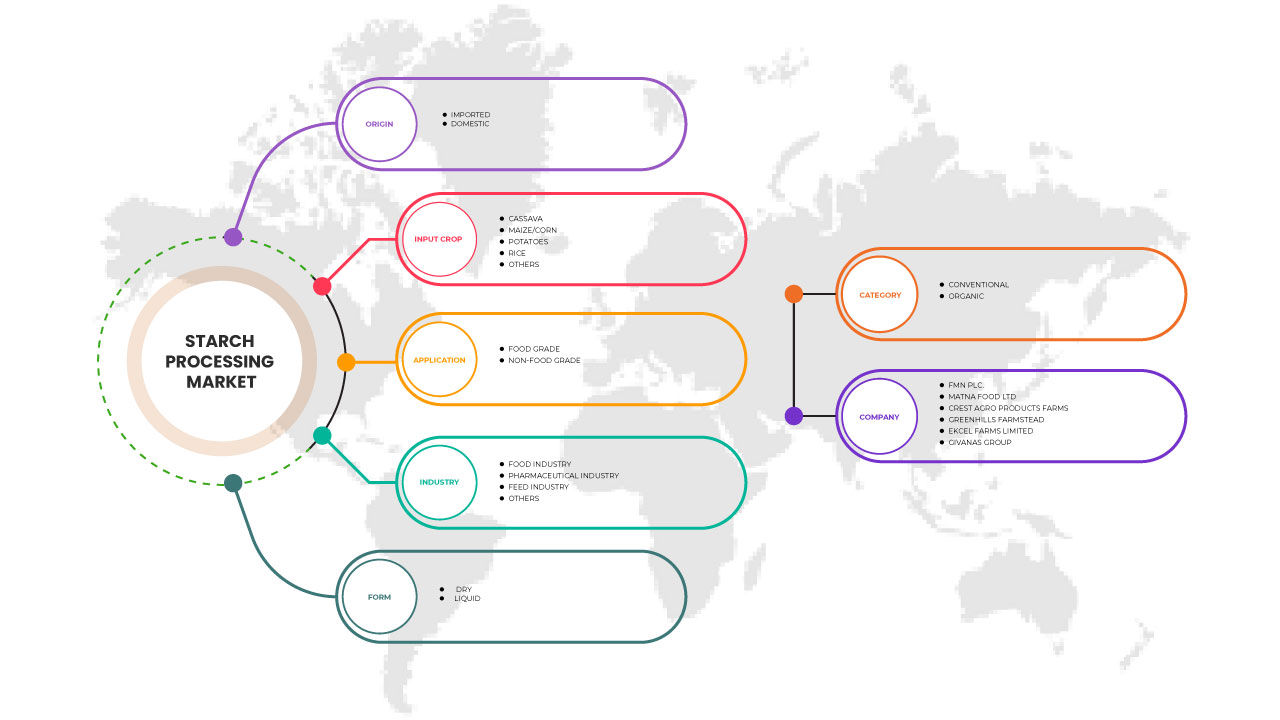

Nigeria Starch Processing Market, By Origin (Imported and Domestic), Input Crop (Cassava, Maize/Corn, Potatoes, Rice, and Others), Application (Food Grade and Non-Food Grade), Form (Liquid and Dry), Category (Conventional and Organic), Industry (Food Industry, Pharmaceutical Industry, Feed Industry, and Others), Industry Trends and Forecast to 2030.

Nigeria Starch Processing Market Analysis and Size

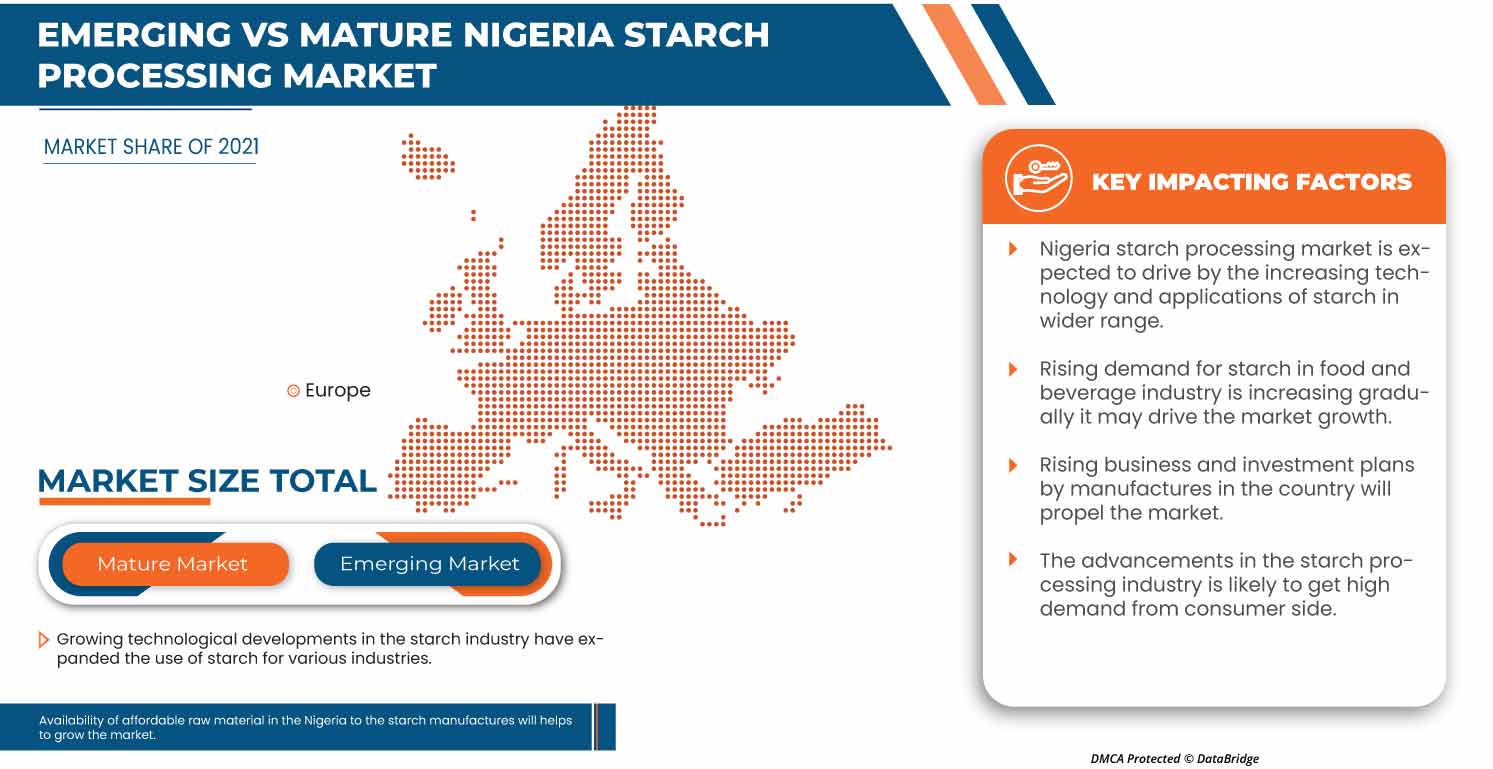

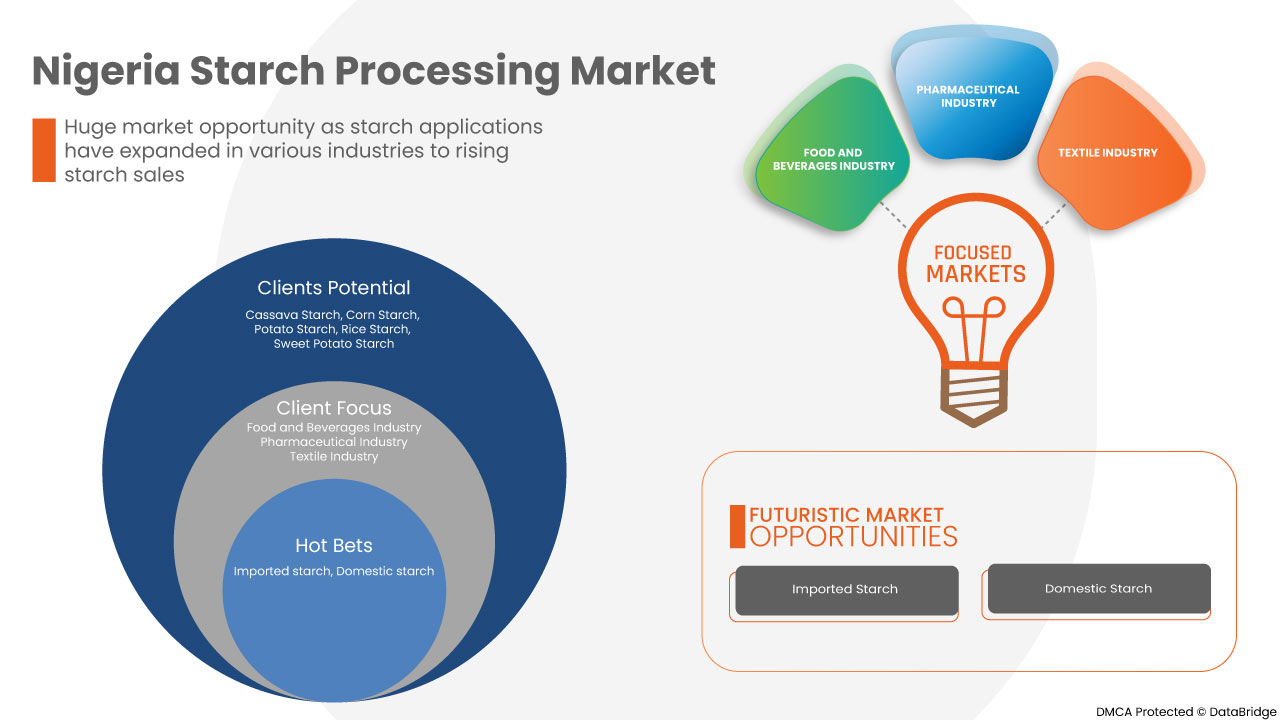

The growing demand for starch in the food & beverages industry and its application in pharmaceutical industries for health-improving drugs and syrups, along with increasing demand for non-food grade starch products, are the main drivers propelling the starch processing market's expansion.

In addition to the food business, industrial starch is utilized in non-food industries like paper, mining, textile, building materials, and consumer goods. The market for industrial starch is expanding due to rising packaging demand, which is likely to increase demand for starch processing.

Data Bridge Market Research analyses that the starch processing market is expected to reach a value of USD 574.11 million by 2030, at a CAGR of 5.2% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Origin (Imported and Domestic), Input Crop (Cassava, Maize/Corn, Potatoes, Rice, and Others), Application (Food Grade and Non-Food Grade), Form (Liquid and Dry), Category (Conventional and Organic), Industry (Food Industry, Pharmaceutical Industry, Feed Industry, and Others). |

|

Countries Covered |

Nigeria |

|

Market Players Covered |

Orient Global Manufacturing, Olo Industries Limited, Greenhills Farmstead, Matna Foods Ltd., Niji Group, FMN Plc., Ekcel Farms Limited, GIVANAS GROUP, Nsmfoodslimited, Ifgreen Industries, Crest Agro Products Farms., GreenTech Industries Ltd., and ACSMIN Nig. among others. |

Market Definition

Starch, or amylum, is a complex carbohydrate in many foods, including grains, vegetables, and fruits. Maize, tapioca, wheat, potatoes, and other plant foods are the main sources of starch. Pure starch is extracted from food to create a powder that is white, odorless, and tasteless but does not dissolve in alcohol or cold water. Starch extraction from plant seeds, roots, or tubers is known as starch processing. The entire starch extraction process uses the physical separation method to separate cellulose, protein gradually, and other non-starch elements to obtain a pure and white starch powder. The produced starch powder and the raw starch have the same chemical makeup. The extraction of starch causes no chemical alterations. However, utilizing sulfur dioxide as an acid in the processing could result in a small amount of starch molecular breakdown, which could slightly reduce the starch levels in the sticky paste.

Starch Processing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers:

- Increase in the demand for starch in the food & beverages industry

People consumed raw, unprocessed vegetation with high starch content in the past. These starches were fermented or digested by microorganisms in the large intestine, which created short-chain fatty acids that provided energy and supported the microbes' survival and growth. However, when the consumption of highly processed meals rose, it became simpler to digest and release more glucose in the small intestine, which led to less starch reaching the large intestine and more energy being absorbed by the body. Because major players are creating cutting-edge products to appeal to a broad consumer base, this aspect is predicted to drive food starch sales in Nigeria.

- Growth application in pharmaceutical industries for health-improving drugs and syrups

One of the few naturally occurring products that, with minor processing, satisfies most of the excipient specifications is starch, making it one of the most commonly used pharmaceutical excipients. It is cheap, readily available, odorless, non-toxic, and biocompatible. In its natural state, starch is employed to create various dosage forms, each of which depends on it for its unique functionalities.

Natural resources like starch are freely accessible. Due to its various physical and functional characteristics, it is adaptable and has been used in various sectors. The high density of hydroxyl groups on the surface allows for several modifications or derivatives. This application is based on how it interacts and reacts in moisture, specifically water. This growing application in the pharmaceutical industry may act as a driver for the Nigeria starch processing market.

Restraint

- Ineffective agronomic practices and inefficient management of production resources

The demand for starch-based crops and their products is growing quickly. However, the sub-population region is increasing geometrically, and current food production is insufficient to meet their needs. Nigeria is currently the world's greatest cassava grower. However, the trend in yield performance (output per hectare) is still negative. This low yield can be attributed to poor agronomic techniques and improper production resource management. In sub-Saharan Africa [SSA], inadequate management of agricultural areas has continually hampered sustainable food production. Despite more than 60% of Nigeria's population working in agriculture, this has significantly contributed to the agricultural sector's poor performance and inefficient use of productive resources.

Ineffective agronomic techniques and ineffective resource management will be key inhibitors for the Nigeria starch processing market.

Opportunity

- Availability of affordable raw materials for the starch manufactures

The agricultural cultivation of plants with a high starch content, such as potatoes, wheat, corn (maize), cassava, and rice, serves as the primary supply of raw materials for synthesizing starch. The choice of raw material will rely on the possibilities for agricultural production in the production locations. Nigeria produces the most starch crops, and many acres are cultivated there. Because of this, starch manufacturers may readily get the highest production raw materials at reasonable costs. This easily accessible and reasonably priced natural resource gives producers many opportunities, such as obtaining more starch from fewer investments and spending the remaining investment on research and product development.

This region's abundance of raw materials is the primary factor driving opportunities for starch manufacturers to grow in the market.

Challenge

- Limited starch processing mills and manufactures

The majority of the world's cassava is produced in Nigeria. Despite being the world's greatest producer of cassava, Nigeria lacks the factories and industries necessary to process and turn the root vegetable into industrial raw materials; as a result, it is primarily consumed locally as fufu or gari. As a result of the majority of them providing certain essential infrastructures for the day-to-day functioning of their plants, which drives up the cost of production, the government's attempt to support local starch processors is negligible. There are challenges for the starch makers due to inadequate processing facilities and deterioration of raw materials due to the high production costs and limited government support.

Recent Developments

- In July 2022, Golden Agri Inputs Ltd, a subsidiary under the Agro-Allied Division of Flour Mills of Nigeria Plc (FMN), launched a Maize and Soybean Value Chain Development Programme for farmers called YALWA (Abundance) in Kaduna State following an official MoU signing ceremony with the State Government.

- In May 2022, The Greenhills Cassava Farmstead team launched the second scheme at Ihunbo Ogun, State Nigeria. The Ihunbo farm is a 50-hectare farmland with a Certificate of Occupancy from the Ogun State Government.

Nigeria Starch Processing Market Scope

Nigeria starch processing market is segmented based on origin, input crop, application, form, category, and industry. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Origin

- Imported

- Domestic

On the basis of origin, Nigeria starch processing market is segmented into imported and domestic.

Input crop

- Cassava

- Maize/corn

- Potatoes

- Rice

- Others

On the basis of input crop, Nigeria starch processing market is segmented into cassava, maize/corn, potatoes, rice, and others.

Application

- Food grade

- Non-food grade

On the basis of application, Nigeria starch processing market is segmented into food grade and non-food grade.

Form

- Liquid

- Dry

On the basis of form, the Nigeria starch processing market is segmented into liquid and dry.

Category

- Conventional

- Organic

On the basis of category, Nigeria starch processing market is segmented into conventional and organic.

Industry

- Food industry

- Pharmaceutical industry

- feed industry

- Others

On the basis of industry, Nigeria starch processing market is segmented into food industry, pharmaceutical industry, feed industry, and others.

Starch Processing Market Regional Analysis/Insights

The starch processing market is analyzed, and market size insights and trends are provided by origin, input crop, application, form, category, and industry, as referenced above.

The country covered in the starch processing market report is Nigeria.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Starch Processing Market Share Analysis

The starch processing market competitive landscape provides details of a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the starch processing market.

Some of the major players operating in starch processing market are Orient Global Manufacturing, Olo Industries Limited, Greenhills Farmstead, Matna Foods Ltd., Niji Group, FMN Plc., Ekcel Farms Limited, GIVANAS GROUP, Nsmfoodslimited, Ifgreen Industries, Crest Agro Products Farms., GreenTech Industries Ltd., and ACSMIN Nig. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NIGERIA STARCH PROCESSING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF KEY CUSTOMERS, BY APPLICATION

4.1.1 FOOD GRADE

4.1.2 NON FOOD GRADE

4.2 LIST OF KEY CUSTOMERS, BY INPUT CROP

4.2.1 CASAVA

4.2.2 CORN

4.2.3 OTHERS

4.3 LIST OF KEY CUSTOMERS, BY ORIGIN

4.3.1 DOMESTIC

4.3.2 IMPORTED

4.4 LIST OF KEY CUSTOMERS

4.4.1 GLUCOSE

4.4.2 SORBITOL

4.4.3 MONO SODIUM GLUTAMATE (MSG)

4.5 NIGERIA STARCH MARKET, CUSTOMER'S BUYING CRITERIA

4.5.1 OVERVIEW

4.5.2 SOCIAL FACTORS

4.5.3 CULTURAL FACTORS

4.5.4 PERSONAL FACTORS

4.5.5 INDUSTRIAL FACTORS

4.5.6 ECONOMIC FACTORS

4.5.7 CUSTOMERS' RESPONSE

4.5.8 CONCLUSION

4.6 LIST OF KEY CUSTOMERS, BY INDUSTRY

4.6.1 FOOD

4.6.2 PHARMACEUTICALS

4.6.3 INDUSTRY

4.7 IMPORTS IN NIGERIA, 2021, (THOUSAND TONS)

4.8 NIGERIA STARCH MARKET, MACROECONOMIC FACTOR COVERAGE

4.8.1 INFLATION

4.8.2 GROSS DOMESTIC PRODUCT (GDP)

4.8.3 POSITIVE FACTOR

4.8.4 NEUTRAL FACTORS

4.8.5 NEGATIVE FACTOR

4.8.6 CONCLUSION

4.9 TOP-5 CASSAVA CROP PRODUCING, STATES OF NIGERIA

4.1 SUPPLY CHAIN OF NIGERIA STARCH PROCESSING MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 PREPARATION OF STARCH IN STARCH PROCESSING UNIT

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

4.11 VALUE CHAIN ANALYSIS: CASSAVA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE DEMAND FOR STARCH IN THE FOOD & BEVERAGES INDUSTRY

5.1.2 GROWTH APPLICATION IN PHARMACEUTICAL INDUSTRIES FOR HEALTH-IMPROVING DRUGS AND SYRUPS

5.1.3 INCREASE IN THE DEMAND FOR NON-FOOD GRADE STARCH PRODUCTS

5.1.4 RISE IN THE DEMAND FOR CASSAVA STARCH TO REDUCE DEPENDENCY ON IMPORTS AND FOREIGN EXCHANGE

5.2 RESTRAINTS

5.2.1 INEFFECTIVE AGRONOMIC PRACTICES AND INEFFICIENT MANAGEMENT OF PRODUCTION RESOURCES

5.2.2 HUGE ECONOMIC LOSS DUE TO CROP DISEASE, INFESTATION, AND PESTS ASSOCIATED WITH STARCH CROP

5.2.3 SHORT SHELF LIFE AND HIGH FEASIBILITY OF CONTAMINATION

5.3 OPPORTUNITIES

5.3.1 AVAILABILITY OF AFFORDABLE RAW MATERIALS FOR THE STARCH MANUFACTURES

5.3.2 INCREASE IN THE TREND OF CULTIVATION OF STARCH CROP LEAD TO EMPLOYMENT OPPORTUNITIES

5.3.3 RISE IN THE BUSINESS AND INVESTMENT PLANS BY MANUFACTURERS IN THE COUNTRY

5.4 CHALLENGES

5.4.1 LIMITED STARCH PROCESSING MILLS AND MANUFACTURES

5.4.2 HIGH DEMAND FOR IMPORTED STARCH THAN DOMESTICALLY PRODUCED STARCH

5.4.3 FLUCTUATION IN STARCH PRICE DUE TO IMPORT

6 NIGERIA STARCH PROCESSING MARKET, BY ORIGIN

6.1 OVERVIEW

6.2 IMPORTED

6.3 DOMESTIC

7 NIGERIA STARCH PROCESSING MARKET, BY INPUT CROP

7.1 OVERVIEW

7.2 CASSAVA

7.3 MAIZE/CORN

7.4 POTATOES

7.5 RICE

7.6 OTHERS

8 NIGERIA STARCH PROCESSING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 FOOD GRADE

8.3 NON-FOOD GRADE

9 NIGERIA STARCH PROCESSING MARKET, BY INDUSTRY

9.1 OVERVIEW

9.2 FOOD INDUSTRY

9.3 PHARMACEUTICAL INDUSTRY

9.4 FEED INDUSTRY

9.5 OTHERS

10 NIGERIA STARCH PROCESSING MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 NIGERIA STARCH PROCESSING MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 NIGERIA STARCH PROCESSING MARKET, BY REGION

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NIGERIA

14 SWOT ANALYSIS

15 COMPANY PPROFILE

15.1 FMN PLC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 MATNA FOODS LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 CREST AGRO PRODUCTS FARMS.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 GREENHILLS FARMSTEAD

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 EKCEL FARMS LIMITED

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ACSMIN NIG.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 GIVANAS GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GREENTECH INDUSTRIES LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 IFGREEN INDUSTRIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NIJI GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 NSMFOODSLIMITED

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 OLO INDUSTRIES LIMITED

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 ORIENT GLOBAL MANUFACTURING

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 NIGERIA STARCH PROCESSING MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 2 NIGERIA STARCH PROCESSING MARKET, BY ORIGIN, 2021-2030 (THOUSAND TONS)

TABLE 3 NIGERIA STARCH PROCESSING MARKET, BY INPUT CROP, 2021-2030 (USD MILLION)

TABLE 4 NIGERIA STARCH PROCESSING MARKET, BY INPUT CROP, 2021-2030 (THOUSAND TONS)

TABLE 5 NIGERIA STARCH PROCESSING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 NIGERIA STARCH PROCESSING MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONS)

TABLE 7 NIGERIA STARCH PROCESSING MARKET, BY INDUSTRY, 2021-2030 (USD MILLION)

TABLE 8 NIGERIA STARCH PROCESSING MARKET, BY INDUSTRY, 2021-2030 (THOUSAND TONS)

TABLE 9 NIGERIA STARCH PROCESSING MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 10 NIGERIA STARCH PROCESSING MARKET, BY FORM, 2021-2030 (THOUSAND TONS)

TABLE 11 NIGERIA STARCH PROCESSING MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 12 NIGERIA STARCH PROCESSING MARKET, BY CATEGORY, 2021-2030 (THOUSAND TONS)

图片列表

FIGURE 1 NIGERIA STARCH PROCESSING MARKET: SEGMENTATION

FIGURE 2 NIGERIA STARCH PROCESSING MARKET: DATA TRIANGULATION

FIGURE 3 NIGERIA STARCH PROCESSING MARKET: DROC ANALYSIS

FIGURE 4 NIGERIA STARCH PROCESSING MARKET: MARKET ANALYSIS

FIGURE 5 NIGERIA STARCH PROCESSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NIGERIA STARCH PROCESSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NIGERIA STARCH PROCESSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NIGERIA STARCH PROCESSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NIGERIA STARCH PROCESSING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NIGERIA STARCH PROCESSING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND FOR STARCH IN THE FOOD & BEVERAGES INDUSTRY AND GROWING APPLICATION IN PHARMACEUTICAL INDUSTRIES FOR HEALTH-IMPROVING DRUGS AND SYRUPS ARE THE KEY DRIVERS FOR THE NIGERIA STARCH PROCESSING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 ORIGIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NIGERIA STARCH PROCESSING MARKET IN 2022 & 2030

FIGURE 13 SUPPLY CHAIN OF STARCH

FIGURE 14 VALUE CHAIN OF CASSAVA

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NIGERIA STARCH PROCESSING MARKET

FIGURE 16 NIGERIA STARCH PROCESSING MARKET, BY ORIGIN, 2022

FIGURE 17 NIGERIA STARCH PROCESSING MARKET, BY INPUT CROP, 2022

FIGURE 18 NIGERIA STARCH PROCESSING MARKET, BY APPLICATION, 2022

FIGURE 19 NIGERIA STARCH PROCESSING MARKET, BY INDUSTRY, 2022

FIGURE 20 NIGERIA STARCH PROCESSING MARKET, BY FORM, 2022

FIGURE 21 NIGERIA STARCH PROCESSING MARKET, BY CATEGORY, 2022

FIGURE 22 NIGERIA STARCH PROCESSING MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。