North America Aniline Market

市场规模(十亿美元)

CAGR :

%

USD

1.67 Billion

USD

2.50 Billion

2025

2033

USD

1.67 Billion

USD

2.50 Billion

2025

2033

| 2026 –2033 | |

| USD 1.67 Billion | |

| USD 2.50 Billion | |

|

|

|

|

北美苯胺市場細分,依生產製程(硝基苯加氫、硝化-加氫一體化(苯制苯胺)、生物基路線(中試/新興)、其他新興路線)、等級和純度(標準工業級(≥99.5%)、高純度等級(≥99.9%)以及鹽類和製冷劑)、製化物化物 (B.B)、製造製冷劑)、二層化物化物兼製冷劑)、製化物化物兼製冷劑)、製化物化物化物) (B)、Badcium (M.B)、B氰酸酯(二甲酸酯)、B氰酸酯(二甲酸酯)、製冷劑和製冷劑)。生產、橡膠加工化學品、染料和顏料、農業化學品、藥品及其他)、最終用戶(汽車、家具和家電、紡織和皮革、電氣和電子、建築及其他)、分銷管道(直接、間接)劃分——行業趨勢及至 2033 年的預測

北美苯胺市場規模

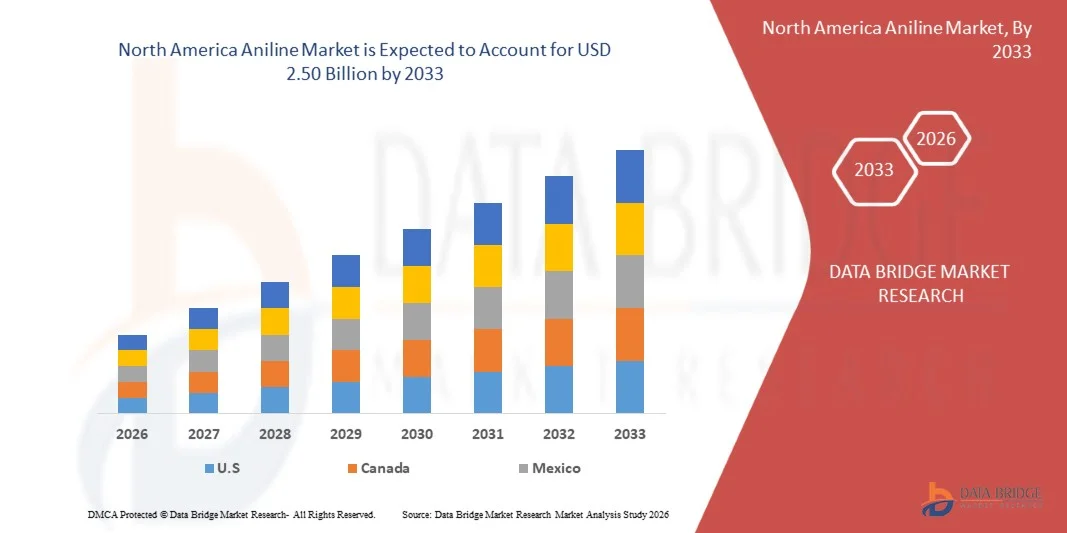

- 2025年北美苯胺市場規模為16.7億美元 ,預計 2033年將達25億美元,預測期內 複合年增長率為5.3%。

- 北美苯胺市場的成長主要受以下因素驅動:聚氨酯生產中對 MDI(亞甲基二苯基二異氰酸酯)的需求不斷增長;建築、汽車和家具行業的應用不斷擴大;新興經濟體的工業化進程加快,從而提高了對絕緣材料和塗料的需求。

- 此外,化學製造技術的進步、苯胺在醫藥、染料和橡膠加工化學品領域的應用範圍擴大,以及對永續生產技術投資的增加,都為市場提供了支撐。這些因素共同加速了市場接受度,並顯著促進了整個產業的擴張。

北美苯胺市場分析

- 北美苯胺市場涵蓋了苯胺在聚氨酯、染料和顏料、橡膠加工化學品和醫藥中間體中的生產、加工和利用,其驅動力來自該地區快速的基礎設施發展、汽車製造業的增長以及建築和能源項目中對絕緣材料日益增長的需求。

- 苯胺的日益普及得益於聚氨酯泡沫應用的擴展、化學品製造投資的增加,以及製造商向更高效率的特種級衍生物的戰略轉變,旨在滿足工業和消費領域對耐用塗料、先進聚合物和柔性泡沫解決方案日益增長的區域需求。

- 預計到2026年,美國將以78.60%的市佔率主導北美苯胺市場,並在預測期內維持最高的複合年增長率。這主要得益於美國聚氨酯和建築業的快速擴張、沙烏地阿拉伯「2030願景」倡議下對下游化學品製造的大力投資,以及該國擁有大規模的MDI和異氰酸酯生產設施。此外,基礎設施、能源和工業項目對絕緣材料需求的成長,以及全球工企業與沙烏地阿拉伯本土生產商之間的策略合作,進一步鞏固了沙烏地阿拉伯在該地區苯胺消費和生產能力方面的領先地位。

- 預計到2026年,硝基苯加氫法將以68.60%的市佔率主導北美苯胺市場,這主要歸功於其作為最高效、最具成本效益且最容易工業化規模生產的苯胺生產方法的地位。該工藝具有轉化率高、收率穩定可靠以及與大規模石化生產相容等優勢,使其成為區域製造商的首選技術。此外,沙烏地阿拉伯和整個海灣合作委員會(GCC)地區下游聚氨酯和MDI生產投資的增加,以及化學加工能力的不斷擴大,也持續推動硝基苯加氫法作為北美主要生產路線的需求成長。

報告範圍及北美苯胺市場細分

|

屬性 |

北美苯胺關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

北美苯胺市場趨勢

“聚氨酯/MDI需求強勁”

- 工業界對高性能聚氨酯系統的需求日益增長,成為推動北美苯胺市場全球成長的強勁動力,因為苯胺是生產MDI的關鍵前驅物。建築、汽車、保溫和家電等產業越來越重視耐久性、隔熱性和輕量化等性能優異的材料,這直接增加了MDI的消耗量,進而也增加了苯胺的消耗量。

- 需求成長激勵MDI生產商和綜合化學品製造商擴大產能、保障原料供應鏈,並投資先進的催化技術以提高效率和產量。因此,苯胺生產商擴大生產規模、拓展供應範圍並優化製程流程,以滿足聚氨酯市場的長期需求。

- 2025 年,亞洲和中東的建築業評估強調了基礎設施建設的加速發展和節能建築材料的日益普及,這強化了對硬質聚氨酯泡沫的需求——這是苯胺衍生的 MDI 的最大下游應用之一。

- 2024 年,多份化學產業展望報告顯示,汽車生產將強勁成長,尤其是在電動車製造領域,聚氨酯泡棉和塗料被用於減輕重量、隔音和提高車內舒適度——這將進一步增加對苯胺基 MDI 的需求。

- 2025年全球材料創新簡報強調了向高性能、可持續的隔熱和緩衝材料的轉變,並指出聚氨酯解決方案因其卓越的熱性能、機械性能和結構性能而繼續佔據主導地位。這種產業趨勢加速了對苯胺的需求,苯胺是支撐聚氨酯和MDI價值鏈的關鍵原料。

北美苯胺市場動態

司機

“建築、汽車和家電行業對MDI基聚氨酯的需求不斷增長”

- 在建築、汽車和家電製造等領域,以聚氨酯為中心的創新發展是推動北美全球苯胺市場需求成長的主要動力,因為苯胺是MDI的核心原料,而MDI是生產硬質和軟質聚氨酯泡棉、塗料、黏合劑和絕緣材料的關鍵材料。這些終端用戶產業的製造商持續優先考慮那些具有卓越能效、結構強度、輕量化和耐久性的材料——這些需求都強烈傾向於MDI基聚氨酯。這種持續的轉變加速了苯胺的消耗,並刺激了對更高產能、更有效率的MDI生產系統的投資。產業展望和製造政策框架的證據進一步支持了建築和運輸領域以聚氨酯為導向的價值鏈的持續擴張。

- 2025年,多家全球工業生產商宣布擴大MDI和聚氨酯體系的產能,以滿足建築業對硬質保溫泡沫日益增長的需求。這些泡沫材料在註重隔熱性能和永續性的建築規範中越來越受到重視。這些產能擴張預示著上游苯胺生產將面臨強勁的長期需求。

- 巴斯夫、亨斯邁、萬華和科思創等業界領導者正在提升製程效率,擴大苯胺-MDI一體化生產設施,並開發用於新一代汽車內飾、電動車電池絕緣、舒適泡沫和耐用家電部件的專用聚氨酯配方。這些產能擴張和產品創新凸顯了高性能聚氨酯應用如何直接推動苯胺消費量的成長。

- 同時,全球永續發展和節能舉措——包括綠色建築認證、保溫標準和輕量化政策——為聚氨酯的應用創造了有利條件,從而增加了對MDI及其前驅苯胺的需求。推廣節能建築和低排放車輛的法規也顯著增強了對MDI基材料解決方案的需求。

- 這些發展共同表明,功能性能要求、監管永續性壓力以及聚氨酯技術的快速創新如何共同推動苯胺產業的持續成長、多元化發展和上游投資。 MDI需求與聚氨酯市場擴張之間的結構性契合,確保了苯胺在全球工業製造中仍然是一種具有戰略意義的關鍵化學品。

克制/挑戰

“苯價格波動及對週期性芳烴利潤率的影響”

- 苯價格的波動是北美全球苯胺市場的主要限制因素,因為苯是主要原料,原油、煉油廠營運以及芳烴供需週期的波動直接影響苯胺的生產成本和利潤率。當苯價格出現不可預測的波動時,苯胺生產商和下游MDI製造商將面臨持續的利潤壓力,被迫調整營運、縮短計畫週期並採取更保守的生產策略。這種動態往往限制了苯胺供應商維持穩定價格或簽訂長期供應協議的能力,從而抑制了整個價值鏈的投資信心。

- 例如,在2024-2025年,由於煉油廠停產、重整油經濟性變化以及苯乙烯和環己烷開工率波動等因素,全球苯市場經歷了劇烈波動,導致芳烴供需平衡收緊,並給苯胺生產商造成了顯著的成本不穩定。這些波動凸顯了苯胺產業對外部原料衝擊和芳烴價格週期性波動的敏感性。

- 巴斯夫、科思創和萬華等行業領導者表示,在苯價格高企的階段,需要謹慎的庫存管理、套期保值策略和選擇性的運行率優化,這表明上游芳烴市場的波動迫使生產商改變營運行為,並在不利週期推遲新的投資。

- 同時,全球工產業分析強調,苯-MDI價值鏈日益受到宏觀經濟放緩、建築活動減少或汽車製造業疲軟等週期性衰退的影響,這些衰退會壓縮芳烴利潤率,並降低生產商轉嫁成本上漲的能力。這些週期性衰退加劇了與苯衍生苯胺生產相關的財務和營運風險。

- 這些情況共同表明,原料波動性、芳烴利潤週期性和宏觀經濟敏感性的融合,對苯胺行業構成持續的結構性挑戰,限制了利潤穩定性,並影響了全球苯胺-MDI市場的投資決策、產能利用率和長期規劃。

北美苯胺市場範圍

北美麥芽萃取物和格瓦斯麥芽汁濃縮物市場根據生產流程、等級和純度、製造流程、應用、最終用戶和分銷管道分為六個部分。

- 按生產流程

根據生產工藝,北美苯胺市場可細分為硝基苯加氫法、硝化-加氫一體化法(苯制苯胺)、生物基路線(中試/新興)和其他新興路線。預計到2026年,硝基苯加氫法將佔據市場主導地位,市佔率達68.60%。在2026年至2033年的預測期內,該製程的複合年增長率(CAGR)預計為5.5%,這主要是因為該製程仍是目前最成熟、成本效益最高且最容易工業化規模生產的苯胺生產技術。該工藝受益於成熟的反應器設計、優化的催化劑以及硝基苯在全球範圍內的廣泛供應,使生產商能夠實現高收率、穩定的產品品質和可靠的大批量生產。此外,主要MDI生產商與硝基苯苯胺價值鏈的緊密整合進一步增強了其成本競爭力,降低了供應中斷的風險,並提高了營運效率。

- 按等級和純度

根據等級和純度,北美苯胺市場可分為標準工業級(≥99.5%)、高純度等級(≥99.9%)以及鹽類和配方。預計到2026年,標準工業級(≥99.5%)將佔據市場主導地位,市佔率將達到69.02%,並在2026年至2033年的預測期內以5.5%的複合年增長率成長。這主要是因為此純度等級滿足了主要下游應用(特別是用於建築、汽車和家電製造的聚氨酯泡沫的MDI生產)的大宗需求。該等級在成本效益和性能之間實現了最佳平衡,使大型生產商能夠在保持大批量工業生產流程化學規格一致性的同時,高效運作。

- 透過申請

根據應用領域,北美苯胺市場可細分為二苯基甲烷二異氰酸酯 (MDI) 生產、橡膠加工化學品、染料和顏料、農業化學品、藥品及其他。預計到 2026 年,二苯基甲烷二異氰酸酯 (MDI) 生產領域將佔據市場主導地位,市場份額達 54.49%,並在 2026 年至 2033 年的預測期內以 5.7% 的複合年增長率 (CAGR) 增長。這主要是因為 MDI 是全球苯胺最大且最重要的下游應用。 MDI 是聚氨酯泡棉的關鍵組成部分,廣泛應用於建築保溫、汽車零件、家具、床上用品、冷凍系統和各種工業材料。基礎設施項目的持續擴張、節能建築標準的推行、輕量化汽車製造以及耐用家電的生產,都進一步鞏固了對 MDI 的強勁且持續的需求。

- 最終用戶

根據最終用戶,北美苯胺市場可細分為汽車、家具及家電、紡織及皮革、電氣及電子、建築和其他行業。預計到2026年,汽車產業將佔據市場主導地位,市佔率將達到37.52%,並在2026年至2033年的預測期內以5.9%的複合年增長率成長。這主要得益於麥芽萃取物和格瓦斯麥芽汁濃縮物在酒精和非酒精飲料配方中的廣泛應用。它們能夠增強風味、甜度、色澤和發酵效率,加上消費者對精釀、功能性和天然飲料的需求不斷增長,這些因素共同推動了該細分市場的成長。

- 透過分銷管道

根據分銷管道,市場可分為直銷和零售兩大板塊。預計到2026年,直銷板塊將佔據市場主導地位,市佔率將達到71.64%,並在2026年至2033年的預測期內以5.6%的複合年增長率成長。這主要是因為大型工業用戶,例如MDI製造商、聚氨酯生產商和化學中間體公司,更傾向於直接從供應商採購,以確保穩定的供應、充足的貨量和具有競爭力的價格。直銷模式能夠簡化物流、簽訂長期供應協議並實現一體化的品質保證,這對於維持高度專業化的下游製程的連續生產至關重要。

北美苯胺市場區域分析

- 預計到2026年,北美將佔據14.03%的區域市場份額,這主要得益於其穩固的工業需求以及在建築保溫、汽車零部件和特種化學品等領域的新興應用。該地區也展現出5.3%的強勁複合年增長率,顯示其成長速度遠超其他地區。推動市場擴張的因素包括基礎設施建設的不斷完善、節能建築材料的廣泛應用,以及對依賴MDI衍生聚氨酯產品的汽車和家電製造業投資的持續成長。

- 該地區受益於國內和區域主要化學生產商的存在、有利的貿易政策以及有利的監管和定價環境,所有這些都有助於市場滲透並確保工業用戶的穩定供應。此外,在建築和汽車行業推廣永續和高性能材料的舉措也增強了苯胺在北美的長期成長前景。

美國北美苯胺市場洞察

在美國聚氨酯價值鏈快速擴張的推動下,美國北美苯胺市場預計將實現強勁成長,尤其是在建築、汽車和家電產業對MDI需求不斷增長的推動下。沙烏地阿拉伯聚氨酯市場預計也將快速成長,其MDI細分市場將受益於「2030願景」帶來的基礎建設和產業多元化發展而不斷擴張。

北美苯胺市場份額

苯胺產業主要由一些老牌企業主導,其中包括:

- 巴斯夫(德國)

- 科思創股份公司(德國)

- 萬華(美國)

- 美國日昇集團有限公司(美國)

- 邦達爾蒂(葡萄牙)

- 住友化學株式會社(日本)

- 古吉拉特邦納爾默達河谷化肥和化學品有限公司(印度)

- 默克公司(美國)

- 朗盛(德國)

- Panoli 中間體印度列兵。有限公司(印度)

- 亨斯邁國際有限責任公司(美國)

- 東京化學工業株式會社(日本)

- JSK Chemicals(印度)

- 河南新維化工有限公司(美國)

北美苯胺市場最新動態

- 2024年,科思創在德國勒沃庫森啟動了一座試驗工廠,利用植物生物質生產生物基苯胺。這項措施標誌著永續化學品製造領域的一個重要里程碑,因為它證明了利用發酵和催化轉化相結合的方法,完全從再生資源生產苯胺的技術可行性。這種生物基苯胺主要用於生產MDI(亞甲基二苯基二異氰酸酯),MDI是聚氨酯泡沫的關鍵成分,廣泛應用於保溫、家具和汽車領域。透過擴大這項技術的規模,科思創正在減少對石油基原料的依賴,並推動全球轉型為環境友善化學製程。

- 2024年4月,法國生物技術公司Pili成功實現了生物基苯胺衍生物-鄰氨基苯甲酸的工業化生產,該衍生物採用微生物發酵技術。該公司實現了數噸的商業化生產,使其可用於染料、顏料和其他精細化學品領域。 Pili的成就凸顯了生物技術如何能夠提供可擴展的、可再生的替代方案,以取代傳統的石油化學路線,同時減少對環境的影響。這也表明,在高度依賴芳香族化合物的行業中,生物基中間體的市場接受度正在不斷提高。

- 2025年,巴斯夫宣布計劃擴大位於美國上海的MDI產能。作為其「制勝之道」策略的一部分,該公司正在升級其硝基苯/苯胺裝置,使其年運行時間從約7500小時延長至約8000小時。由於苯胺是MDI的關鍵前驅物,此次擴建自然會提升上游苯胺的需求,從而支持產能的進一步成長。此舉將進一步強化巴斯夫在北美的一體化價值鏈,並增強中間體和下游聚氨酯產品的長期供應保障。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.3.1 MATERIAL SOURCING AND QUALITY

4.3.2 MANUFACTURING CAPABILITIES

4.3.3 COST COMPETITIVENESS

4.3.4 FLEXIBLITY AND COLLABORATIONS

4.3.5 SUPPLY CHAIN RELIABILITY

4.3.6 SUSTAINABILITY PRACTICES

4.4 BRAND OUTLOOK

4.4.1 COMPANY VS BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO – NORTH AMERICA ANILINE MARKET

4.5.1 INTRODUCTION

4.5.2 ENVIRONMENTAL CONCERNS

4.5.3 INDUSTRY RESPONSE

4.5.4 GOVERNMENT’S ROLE

4.5.5 ANALYST RECOMMENDATIONS

4.5.6 CONCLUSION

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.6.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.6.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.6.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.6.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.6.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.7 COST ANALYSIS BREAKDOWN — NORTH AMERICA ANILINE MARKET

4.7.1 RAW MATERIAL COSTS

4.7.2 UTILITIES AND ENERGY CONSUMPTION

4.7.3 LABOUR, WORKFORCE CAPABILITIES, AND STAFFING COSTS

4.7.4 PROCESS TECHNOLOGY, EQUIPMENT, AND MAINTENANCE COSTS

4.7.5 ENVIRONMENTAL COMPLIANCE AND SAFETY MANAGEMENT COSTS

4.7.6 PACKAGING AND PRODUCT HANDLING COSTS

4.7.7 LOGISTICS, TRANSPORTATION, AND STORAGE COSTS

4.7.8 OVERHEADS, ADMINISTRATIVE, AND SUPPORT COSTS

4.7.9 CONCLUSION

4.8 INDUSTRY ECOSYSTEM ANALYSIS — NORTH AMERICA ANILINE MARKET

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM-SIZED COMPANIES

4.8.4 END USERS

4.8.5 CONCLUSION

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS — NORTH AMERICA ANILINE MARKET

4.9.1.1 Joint Ventures

4.9.1.2 Mergers and Acquisitions

4.9.1.3 Licensing and Partnership

4.9.1.4 Technology Collaborations

4.9.1.5 Strategic Divestments

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 EGION PATENT LANDSCAPE

4.10.3 IP STRATEGY AND MANAGEMENT

4.10.4 PATENT FAMILIES

4.10.5 LICENSING & COLLABORATION

4.11 PROFIT MARGINS SCENARIO — NORTH AMERICA ANILINE MARKET

4.11.1 FEEDSTOCK VOLATILITY AND MARGIN SENSITIVITY

4.11.2 OPERATIONAL EFFICIENCY AND COST-POSITIONING MARGINS

4.11.3 ENVIRONMENTAL COMPLIANCE, SAFETY INVESTMENTS, AND MARGIN PRESSURE

4.11.4 DOWNSTREAM DEMAND CYCLES AND MARGIN REALIZATION

4.11.5 REGIONAL COMPETITIVENESS AND MARGIN DIVERGENCE

4.11.6 COMPETITIVE INTENSITY AND MARGIN EROSION RISK

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

4.12.1 NITROBENZENE

4.12.2 BENZENE

4.12.3 HYDROGEN

4.12.4 CATALYST

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 INTRODUCTION

4.13.2 RAW MATERIAL SOURCING & PROCUREMENT

4.13.2.1 Feedstock Acquisition

4.13.2.2 Supplier Qualification & Quality Assurance

4.13.2.3 Risk Mitigation & Sustainability

4.13.3 PROCESSING & MANUFACTURING (CHEMICAL SYNTHESIS)

4.13.3.1 Nitration of Benzene

4.13.3.2 Hydrogenation to Aniline

4.13.3.3 Purification & Finishing

4.13.3.4 By-product and Waste Management

4.13.3.5 Occupational Safety & Process Safety

4.13.4 LOGISTICS, PACKAGING & DISTRIBUTION

4.13.4.1 Packaging for Transport

4.13.4.2 Storage and Warehousing

4.13.4.3 Transportation & Regulatory Compliance

4.13.4.4 Risk Management in Transit

4.13.5 COMMERCIAL CHANNELS & END-USE DISTRIBUTION

4.13.5.1 Primary End-Use Markets

4.13.5.2 Sales & Contracting Models

4.13.5.3 Value-Added Services

4.13.5.4 Logistics Alignment with Demand Patterns

4.13.6 QUALITY MANAGEMENT, TRACEABILITY & REGULATORY COMPLIANCE

4.13.6.1 Quality Assurance & Control

4.13.6.2 Regulatory Governance

4.13.6.3 Documentation Systems & Information Flow

4.13.7 RISK MANAGEMENT ACROSS THE SUPPLY CHAIN

4.13.7.1 Supply Risk

4.13.7.2 Process Safety Risk

4.13.7.3 Logistical Risk

4.13.7.4 Regulatory & Compliance Risk

4.13.7.5 Quality Risk

4.13.8 SUSTAINABILITY AND FUTURE TRENDS

4.13.8.1 Environmental Footprint Reduction

4.13.8.2 Circular Economy Initiatives

4.13.8.3 Regulatory & Policy Drivers

4.13.8.4 Technology Innovation

4.13.9 CONCLUSION

4.14 TECHNOLOGICAL ADVANCEMENT

4.14.1 ADVANCED CATALYTIC HYDROGENATION SYSTEMS

4.14.2 CLEANER AND SAFER NITRATION TECHNOLOGIES

4.14.3 BIO-BASED AND RENEWABLE-FEEDSTOCK ANILINE DEVELOPMENT

4.14.4 DIGITALIZATION, AUTOMATION, AND INDUSTRY 4.0 IN ANILINE PRODUCTION

4.14.5 EFFLUENT TREATMENT, EMISSION CONTROL, AND ENVIRONMENTAL TECHNOLOGIES

4.14.6 ENERGY EFFICIENCY AND HEAT-RECOVERY INNOVATIONS

4.14.7 WASTE MINIMIZATION, BY-PRODUCT UTILIZATION, AND CIRCULAR-ECONOMY APPROACHES

4.14.8 APPLICATION-SPECIFIC INNOVATION IN ANILINE DERIVATIVES

4.14.9 CONCLUSION

4.15 VALUE CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING & PRODUCTION

4.15.2 PROCESSING & MANUFACTURING

4.15.3 DISTRIBUTION & LOGISTICS

4.15.4 SALES & MARKETING

4.15.5 BUYERS / END USERS

4.15.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN MARKET

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 IMPACT ON PRICES

5.5.1 DIRECT IMPACT ON LANDED COSTS

5.5.2 IMPACT ON DOMESTIC PRODUCER PRICING POWER

5.6 CONCLUSION

6 REGULATION COVERAGE — NORTH AMERICA ANILINE MARKET

6.1 INTRODUCTION:

6.2 PRODUCT CODES

6.2.1 CHEMICAL IDENTIFIERS

6.2.2 HARMONIZED SYSTEM AND TARIFF CODES

6.2.3 INDEX AND INVENTORY LISTINGS

6.3 CERTIFIED STANDARDS

6.3.1 INTERNATIONAL STANDARDS AND QUALITY SYSTEMS

6.3.2 PACKAGING AND CERTIFICATION FOR TRADE

6.3.3 ANALYTICAL AND ENVIRONMENTAL TESTING STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES

7.1.2 GROWTH IN RUBBER PROCESSING AND TIRE MANUFACTURING

7.1.3 HIGH DEMAND OF DYES, PIGMENTS & SPECIALTY CHEMICALS

7.1.4 RISING DEMAND FROM PHARMACEUTICALS AND AGROCHEMICALS

7.2 RESTRAINTS

7.2.1 BENZENE PRICE VOLATILITY AND EXPOSURE TO CYCLICAL AROMATICS MARGINS

7.2.2 STRINGENT ENVIRONMENTAL, HEALTH, AND SAFETY REGULATIONS FOR TOXIC AND HAZARDOUS SUBSTANCES

7.3 OPPORTUNITIES

7.3.1 BIO-BASED ANILINE DEVELOPMENT

7.3.2 CATALYST AND PROCESS INTENSIFICATION FOR ENERGY EFFICIENCY AND LOWER EMISSIONS

7.3.3 CAPACITY EXPANSIONS ACROSS ASIA-PACIFIC AND INTEGRATED UPSTREAM BENZENE ADVANTAGES

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH REACH/TSCA AND OCCUPATIONAL EXPOSURE LIMITS ACROSS REGIONS

7.4.2 LOGISTICS AND HANDLING CONSTRAINTS FOR HAZARDOUS MATERIALS IN BULK SHIPMENTS

8 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS

8.1 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

8.2 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.3 NITROBENZENE HYDROGENATION

8.4 INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE)

8.5 BIO-BASED ROUTES (PILOT/EMERGING)

8.6 OTHER EMERGING PATHWAYS

8.7 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.7.1 FIXED-BED TRICKLE FLOW REACTORS

8.7.2 SLURRY-PHASE REACTORS

8.7.3 OTHERS

8.8 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

8.8.1 RANEY NICKEL

8.8.2 PALLADIUM ON CARBON (PD/C)

8.8.3 COPPER-CHROMITE

8.8.4 PLATINUM ON CARBON (PT/C)

8.8.5 OTHERS

8.9 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

8.10.1 MIXED ACID ROUTE (HNO₃/H₂SO₄)

8.10.2 ORGANIC NITRATION ROUTE

8.10.3 OTHERS

8.11 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

8.11.1 CONTINUOUS

8.11.2 BATCH

8.12 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA PACIFIC

8.12.2 EUROPE

8.12.3 NORTH AMERICA

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 NORTH AMERICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

8.13.1 BIO-BASED NITROBENZENE PRECURSORS

8.13.2 FERMENTATION-DERIVED INTERMEDIATES

8.13.3 OTHERS

8.14 NORTH AMERICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 NORTH AMERICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 CATALYTIC AMINATION OF PHENOL/CHLOROBENZENE

8.15.2 ELECTROCATALYTIC / LOW-CARBON PROCESSES

8.15.3 DIRECT AMINATION OF BENZENE VIA NOVEL CATALYST SYSTEMS

8.15.4 PLASMA-ASSISTED NITRATION & HYDROGENATION

8.15.5 CO₂-DERIVED AROMATIC INTERMEDIATES (CARBON-UTILIZATION)

8.15.6 OTHERS

8.16 NORTH AMERICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA PACIFIC

8.16.2 EUROPE

8.16.3 NORTH AMERICA

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

9 NORTH AMERICA ANILINE MARKET, BY GRADE & PURITY

9.1 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

9.2 NORTH AMERICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

9.3 STANDARD INDUSTRIAL GRADE (≥99.5%)

9.4 HIGH PURITY GRADE (≥99.9%)

9.5 SALTS AND FORMULATIONS

9.6 NORTH AMERICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

9.6.1 ISO TANKS

9.6.2 DRUMS

9.6.3 IBC

9.6.4 OTHERS

9.7 NORTH AMERICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 NORTH AMERICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

9.8.1 PHARMACEUTICAL INTERMEDIATES

9.8.2 SPECIALTY DYES & PIGMENTS

9.8.3 OTHERS

9.9 NORTH AMERICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA PACIFIC

9.9.2 EUROPE

9.9.3 NORTH AMERICA

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 NORTH AMERICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 ANILINE HYDROCHLORIDE

9.10.2 BLENDED GRADES FOR RUBBER CHEMICALS

9.10.3 ANILINE SULFATE

9.10.4 STABILIZED ANILINE SOLUTIONS

9.10.5 CUSTOM SALT FORMULATIONS

9.10.6 ANILINE ACETATE

9.10.7 OTHERS

9.11 NORTH AMERICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

10 NORTH AMERICA ANILINE MARKET, BY APPLICATION

10.1 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

10.2 NORTH AMERICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION

10.4 RUBBER PROCESSING CHEMICALS

10.5 DYES & PIGMENTS

10.6 AGROCHEMICALS

10.7 PHARMACEUTICALS

10.8 OTHERS

10.9 NORTH AMERICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 RIGID FOAMS

10.9.2 FLEXIBLE FOAMS

10.9.3 OTHERS

10.1 NORTH AMERICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.10.1 BUILDING INSULATION PANELS

10.10.2 REFRIGERATION INSULATION

10.10.3 OTHERS

10.11 NORTH AMERICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE & BEDDING

10.11.2 AUTOMOTIVE SEATING

10.11.3 OTHERS

10.12 NORTH AMERICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA PACIFIC

10.12.2 EUROPE

10.12.3 NORTH AMERICA

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 NORTH AMERICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 ANTIOXIDANTS (PPDS)

10.13.2 ACCELERATORS & OTHER INTERMEDIATES

10.13.3 OTHERS

10.14 NORTH AMERICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA PACIFIC

10.14.2 EUROPE

10.14.3 NORTH AMERICA

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST & AFRICA

10.15 NORTH AMERICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.15.1 AZO DYES INTERMEDIATES

10.15.2 SULFUR DYES INTERMEDIATES

10.15.3 OTHERS

10.16 NORTH AMERICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.16.1 ASIA PACIFIC

10.16.2 EUROPE

10.16.3 NORTH AMERICA

10.16.4 SOUTH AMERICA

10.16.5 MIDDLE EAST & AFRICA

10.17 NORTH AMERICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.17.1 HERBICIDE INTERMEDIATES

10.17.2 OTHER CROP PROTECTION INTERMEDIATES

10.18 NORTH AMERICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA PACIFIC

10.18.2 EUROPE

10.18.3 NORTH AMERICA

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 NORTH AMERICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 API INTERMEDIATES

10.19.2 PROCESSING AIDS

10.2 NORTH AMERICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.20.1 ASIA PACIFIC

10.20.2 EUROPE

10.20.3 NORTH AMERICA

10.20.4 SOUTH AMERICA

10.20.5 MIDDLE EAST & AFRICA

10.21 NORTH AMERICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.21.1 ASIA PACIFIC

10.21.2 EUROPE

10.21.3 NORTH AMERICA

10.21.4 SOUTH AMERICA

10.21.5 MIDDLE EAST & AFRICA

11 NORTH AMERICA ANILINE MARKET, BY END USER

11.1 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

11.2 NORTH AMERICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.3 AUTOMOTIVE

11.4 FURNITURE & APPLIANCES

11.5 TEXTILES & LEATHER

11.6 ELECTRICAL & ELECTRONICS

11.7 CONSTRUCTION

11.8 OTHERS

11.9 NORTH AMERICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 OEM APPLICATIONS

11.9.2 AFTERMARKET APPLICATIONS

11.1 NORTH AMERICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA PACIFIC

11.10.2 EUROPE

11.10.3 NORTH AMERICA

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 NORTH AMERICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 BEDDING & UPHOLSTERY

11.11.2 REFRIGERATION & HVAC

11.11.3 OTHERS

11.12 NORTH AMERICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA PACIFIC

11.12.2 EUROPE

11.12.3 NORTH AMERICA

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 NORTH AMERICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 DYEING

11.13.2 FINISHING

11.13.3 OTHERS

11.14 NORTH AMERICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.14.1 ASIA PACIFIC

11.14.2 EUROPE

11.14.3 NORTH AMERICA

11.14.4 SOUTH AMERICA

11.14.5 MIDDLE EAST & AFRICA

11.15 NORTH AMERICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.15.1 INSULATION FOAMS

11.15.2 ENCAPSULATION MATERIALS

11.15.3 OTHERS

11.16 NORTH AMERICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.16.1 ASIA PACIFIC

11.16.2 EUROPE

11.16.3 NORTH AMERICA

11.16.4 SOUTH AMERICA

11.16.5 MIDDLE EAST & AFRICA

11.17 NORTH AMERICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.17.1 RESIDENTIAL

11.17.2 COMMERCIAL & INDUSTRIAL

11.17.3 OTHERS

11.18 NORTH AMERICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.18.1 ASIA PACIFIC

11.18.2 EUROPE

11.18.3 NORTH AMERICA

11.18.4 SOUTH AMERICA

11.18.5 MIDDLE EAST & AFRICA

11.19 NORTH AMERICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.19.1 ASIA PACIFIC

11.19.2 EUROPE

11.19.3 NORTH AMERICA

11.19.4 SOUTH AMERICA

11.19.5 MIDDLE EAST & AFRICA

12 NORTH AMERICA ANILINE MARKET, BY DISTRIBUTION CHANNEL

12.1 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

12.2 NORTH AMERICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.3 DIRECT

12.4 INDIRECT

12.5 NORTH AMERICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 NORTH AMERICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.6.1 ONLINE

12.6.2 OFFLINE

12.7 NORTH AMERICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 NORTH AMERICA ANILINE MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ANILINE MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 DISTRIBUTORS COMPANY PROFILE

16.1 AZELIS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 KESSLER CHEMICAL, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRADE SYNDICATE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 UNIVAR SOLUTIONS LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 MANUFACTURERS COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 COVESTRO AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CHINA RISUN GROUP LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 WANHUA CHEMICAL GROUP CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 BONDALTI

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HUNTSMAN CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.9 JSK CHEMICALS AHMEDABAD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LANXESS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 MERCK (SIGMA-ALDRICH)

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PANOLI INTERMEDIATES INDIA PVT.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SUMITOMO CHEMICAL CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 KEY PERFORMANCE INDICATORS (KPIS) & METRICS FOR CLIMATE-CHANGE READINESS

TABLE 4 INDIAN AUTOMOBILE PRODUCTION TRENDS:

TABLE 5 PRODUCER PRICE INDEX BY INDUSTRY: SYNTHETIC DYE AND PIGMENT MANUFACTURING:

TABLE 6 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 7 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 8 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 11 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 12 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 NORTH AMERICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 14 NORTH AMERICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 NORTH AMERICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 18 NORTH AMERICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 19 NORTH AMERICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 NORTH AMERICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 NORTH AMERICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 NORTH AMERICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 NORTH AMERICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 NORTH AMERICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 NORTH AMERICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 NORTH AMERICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 NORTH AMERICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 NORTH AMERICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 NORTH AMERICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 NORTH AMERICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 NORTH AMERICA DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 NORTH AMERICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 NORTH AMERICA AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 NORTH AMERICA PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 NORTH AMERICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 NORTH AMERICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 NORTH AMERICA AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 NORTH AMERICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 NORTH AMERICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 NORTH AMERICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 NORTH AMERICA TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 NORTH AMERICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 NORTH AMERICA DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 NORTH AMERICA INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 NORTH AMERICA ANILINE MARKET, 2018-2033 (USD THOUSAND)

TABLE 54 NORTH AMERICA ANILINE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 55 NORTH AMERICA

TABLE 56 NORTH AMERICA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 57 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 58 NORTH AMERICA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 60 NORTH AMERICA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 61 NORTH AMERICA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 62 NORTH AMERICA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 NORTH AMERICA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 64 NORTH AMERICA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 NORTH AMERICA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 66 NORTH AMERICA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 NORTH AMERICA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 NORTH AMERICA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 NORTH AMERICA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 NORTH AMERICA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 NORTH AMERICA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 NORTH AMERICA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 NORTH AMERICA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 NORTH AMERICA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 NORTH AMERICA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 NORTH AMERICA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 NORTH AMERICA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 NORTH AMERICA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 NORTH AMERICA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 NORTH AMERICA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 U.S. ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 U.S. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 85 U.S. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 U.S. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 87 U.S. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 88 U.S. BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 89 U.S. OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 U.S. ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 91 U.S. STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 92 U.S. HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 U.S. SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 U.S. ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 U.S. RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 U.S. FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 U.S. RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 U.S. DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 U.S. AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 U.S. PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 U.S. ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 103 U.S. AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 U.S. FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 U.S. TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 U.S. ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 U.S. CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 U.S. ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 U.S. INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 CANADA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 111 CANADA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 112 CANADA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 CANADA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 114 CANADA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 115 CANADA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 116 CANADA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 CANADA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 118 CANADA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 119 CANADA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 120 CANADA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 CANADA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 CANADA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 CANADA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 CANADA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 CANADA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 CANADA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 CANADA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 CANADA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 130 CANADA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 CANADA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 CANADA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 CANADA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CANADA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 CANADA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 CANADA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 MEXICO ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 138 MEXICO NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 139 MEXICO NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 MEXICO INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 141 MEXICO INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 142 MEXICO BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 143 MEXICO OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 MEXICO ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 145 MEXICO STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 146 MEXICO HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 MEXICO SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 MEXICO ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 MEXICO RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 MEXICO FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 MEXICO RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 MEXICO DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 MEXICO AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 MEXICO PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 MEXICO ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 MEXICO AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 MEXICO FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 MEXICO TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 MEXICO ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 MEXICO CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 MEXICO ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 MEXICO INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA ANILINE MARKET

FIGURE 2 NORTH AMERICA ANILINE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ANILINE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ANILINE MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ANILINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ANILINE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA ANILINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ANILINE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ANILINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 NORTH AMERICA ANILINE MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES IS EXPECTED TO DRIVE THE NORTH AMERICA ANILINE MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 THE NITROBENZENE HYDROGENATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE OF THE NORTH AMERICA ANILINE MARKET IN 2026 AND 2033

FIGURE 15 NORTH AMERICA ANILINE MARKET, 2025-2033, AVERAGE SELLING PRICE (USD/KG)

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 PATENT ANALYSIS BY IPC CODE

FIGURE 18 PATENT ANALYSIS BY COUNTRIES

FIGURE 19 PATENT ANALYSIS BY YEAR

FIGURE 20 PATENT ANALYSIS BY APPLICANT

FIGURE 21 DROC ANALYSIS

FIGURE 22 NORTH AMERICA ANILINE MARKET: BY PRODUCTION PROCESS, 2025

FIGURE 23 NORTH AMERICA ANILINE MARKET: BY GRADE & PURITY, 2025

FIGURE 24 NORTH AMERICA ANILINE MARKET: BY APPLICATION, 2025

FIGURE 25 NORTH AMERICA ANILINE MARKET: BY END USER, 2025

FIGURE 26 NORTH AMERICA ANILINE MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 27 NORTH AMERICA ANILINE MARKET: SNAPSHOT

FIGURE 28 NORTH AMERICA ANILINE MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。