North America Background Check Market

市场规模(十亿美元)

CAGR :

%

USD

1.91 Billion

USD

4.90 Billion

2024

2032

USD

1.91 Billion

USD

4.90 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 4.90 Billion | |

|

|

|

北美背景調查市場,按產品(解決方案、服務)、部署模式(雲端、本地)、組織規模(大型企業、中小型企業 (SME)、作業系統(MAC、Windows、LINUX、行動)、應用程式(工業、商業)、國家(美國、加拿大、墨西哥)劃分的行業趨勢和預測(至 2032 年)

背景調查市場分析

北美背景調查市場包括旨在驗證就業、金融、醫療保健和租賃住房等行業的個人和組織資格的解決方案和服務。這些解決方案利用人工智慧、機器學習和區塊鏈等先進技術來提高準確性、實現流程自動化並確保遵守公平信用報告法 (FCRA) 和通用資料保護規範 (GDPR) 等監管框架。市場對工作場所安全、詐欺預防和嚴格的招聘規定的擔憂日益增加。人工智慧驅動的背景篩選和即時驗證的採用率正在上升,反映出人們正在轉向更高效和自動化的解決方案。然而,資料隱私問題、整合複雜性和高合規成本等挑戰仍然存在。擴大數位身分驗證、生物特徵認證和跨境背景篩選存在機遇,可支持該地區對安全透明驗證流程日益增長的需求。

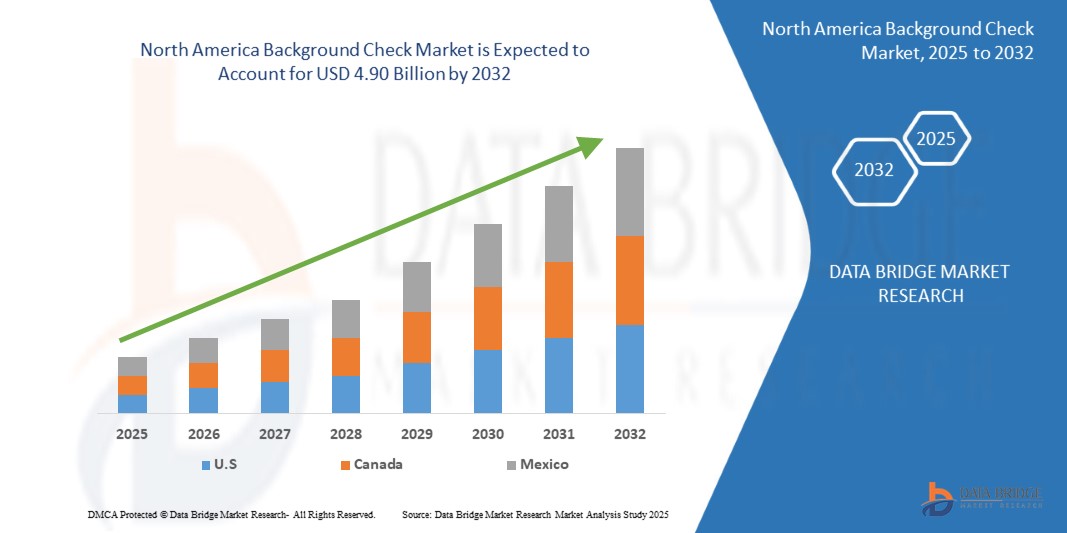

背景調查市場規模

2024 年北美背景調查市場規模價值 19.1 億美元,預計到 2032 年將達到 49 億美元,2025 年至 2032 年預測期內的複合年增長率為 12.6%。

背景調查市場趨勢

「人工智慧背景篩選的採用率不斷上升

北美背景調查市場正在見證向人工智慧驅動的篩選解決方案的重大轉變。隨著組織優先考慮效率、準確性和合規性,人工智慧和機器學習正在整合到背景驗證流程中,以簡化身分驗證、犯罪記錄檢查和就業歷史驗證。這些技術有助於減少人為錯誤,加快週轉時間並增強詐欺偵測能力。此外,金融、醫療保健和零工經濟平台等領域對持續監控和即時驗證的需求日益增加,也推動了需求。隨著監管審查愈發嚴格和數位轉型加速,人工智慧背景調查有望成為行業標準。

報告範圍和背景調查市場細分

|

屬性 |

背景調查關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

美國、加拿大、墨西哥 |

|

主要市場參與者 |

GoodHire(CHECKR 的一部分)、Accurate Background、Sterling(First Advantage 公司)、Paycom Payroll LLC.、Rentec Direct、Xref、Certn、Skuad、HireRight, LLC.、Spokeo, Inc.、TrustID、Kroll, LLC. 、MeridianLink、First Advantage 和 Ondato 等 |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的見解之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 PESTLE 分析。 |

背景調查市場定義

背景調查是用於核實個人的個人、職業和犯罪歷史以評估其可信度和可靠性的過程。它通常包括身份驗證、就業和教育歷史、信用報告和犯罪記錄檢查。背景調查廣泛應用於就業篩選、租戶驗證、金融服務、政府安全審查和零工經濟平台。企業和組織依靠這些檢查來確保遵守監管要求、降低風險並做出明智的招募或合作決策。隨著數位驗證和人工智慧解決方案的進步,背景調查在各個行業變得更有效率、準確和重要。

背景調查市場動態

驅動程式

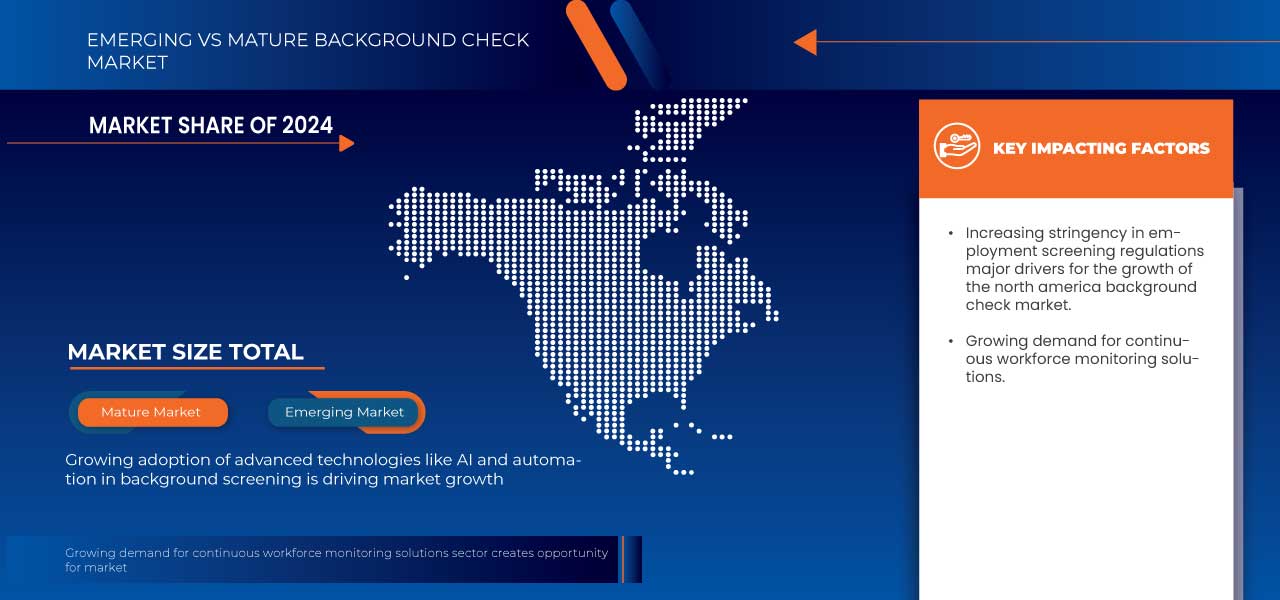

就業審查法規日益嚴格

由於政府和監管機構執行更嚴格的合規標準,就業審查規定日益嚴格,推動了北美背景調查市場的發展。各行各業的雇主現在必須進行徹底的背景調查,以確保工作場所的安全,降低風險,並遵守聯邦、州和行業特定的法規。隨著《公平信用報告法》(FCRA)和「禁止使用限制性規則」等法律的不斷發展,公司被迫採用更透明和合法的招聘方式,從而推動了對高級篩選解決方案的需求

隨著監管審查力度不斷加大,企業正在利用技術驅動的背景調查服務來簡化合規流程,同時保持招募流程的效率。自動篩選解決方案、人工智慧身分驗證和即時犯罪記錄檢查可協助組織毫不拖延地滿足監管要求。對資料安全和隱私的日益重視進一步加強了對可靠、合法的篩選提供者的需求,為背景調查市場持續成長奠定了基礎

例如,

- 2024年9月,根據DISA Global Solutions Inc.發布的文章,各州針對雇主的合規法律變得越來越複雜,對背景調查、資料隱私、工資透明度和招聘中人工智慧的使用都有更嚴格的規定。文章重點介紹了各州對未遵守不斷發展的法律的企業採取的執法行動和嚴厲處罰。就業篩選規定的收緊推動了對先進背景調查解決方案的需求。隨著各州推出更嚴格的法律和更高的罰款,企業被迫採用更全面和合規的篩選措施。這一趨勢正在加速採用自動化和人工智慧驅動的背景調查系統,幫助組織應對不斷變化的法律要求並推動市場成長

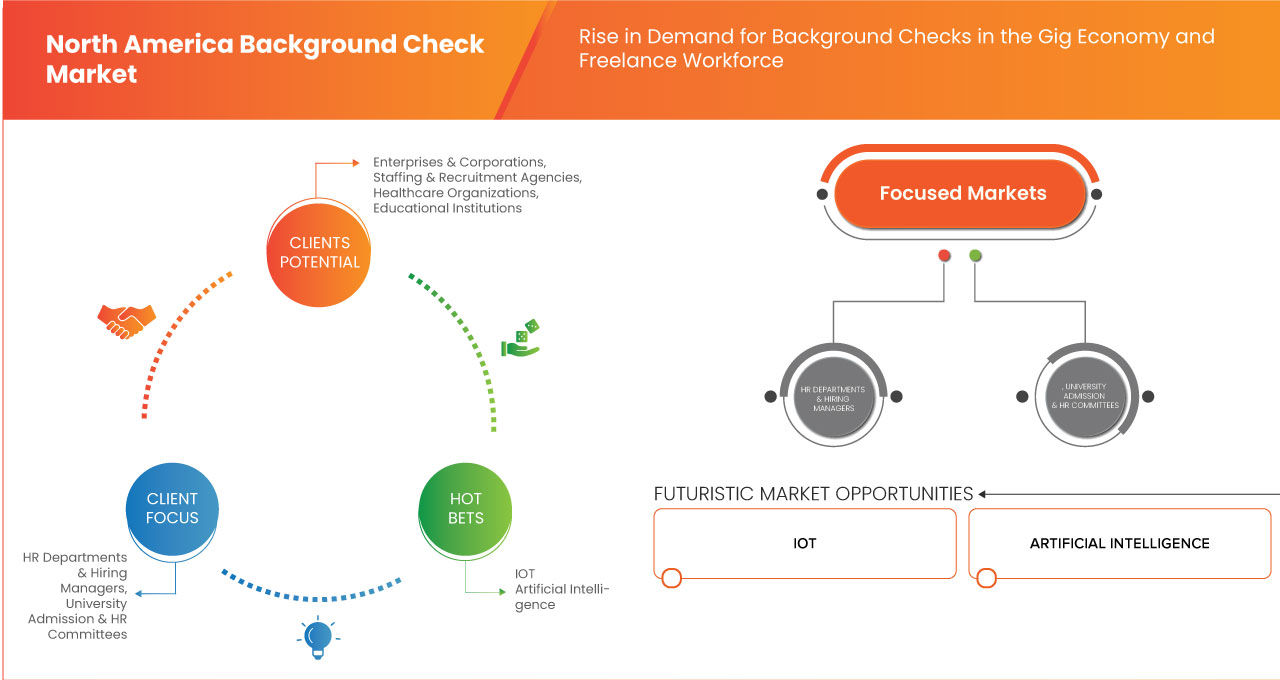

零工經濟和自由工作者對背景調查的需求上升

零工經濟和自由工作者的崛起推動了北美背景調查需求的增加。隨著企業越來越依賴獨立承包商、臨時工和遠端專業人員,確保信任和安全已成為首要任務。共乘、送貨服務和按需平台等行業的公司需要徹底的篩檢,以核實資格、犯罪記錄和工作經驗。對靈活勞動力的日益依賴促使組織採用全面的背景調查解決方案,以降低風險並維持安全的工作環境

由於零工工人通常在傳統就業結構之外工作,背景篩選提供者正在針對這類勞動力開發更快、更具可擴展性的解決方案。人工智慧驅動的驗證、即時資料庫檢查和自動合規追蹤使企業能夠有效地審查大量自由工作者。隨著對詐欺、身分盜竊和工作場所安全的擔憂日益加劇,對可靠篩選流程的需求將繼續推動北美背景調查市場的成長

例如,

- 2023年3月,根據《HR Today》發表的文章,零工工作的興起,目前36%的美國工人從事獨立承包工作,這推動了對高效背景調查的需求。隨著公司適應非傳統就業,他們正在投資自動化、身份驗證和無縫招聘工作流程,以減少候選人流失並吸引人才。 85% 的零工工人考慮退出複雜的招募流程,企業必須實施簡化的背景篩選才能保持競爭力。這種轉變正在塑造北美背景調查市場,增加對先進、行動友善和快速篩選解決方案的需求

機會

對持續勞動力監控解決方案的需求不斷增長

對持續勞動力監控解決方案的不斷增長的需求為北美背景調查市場帶來了巨大的機會。企業越來越多地從一次性的就業前篩選轉向持續的員工監控,以降低風險、確保工作場所安全並遵守不斷變化的監管要求。醫療保健、金融和交通運輸等信任和合規至關重要的行業正在推動即時背景調查和持續犯罪記錄監控。人工智慧風險評估和自動數據更新等先進技術正在提高勞動力監控解決方案的效率和準確性

隨著組織注重維護安全且合規的員工隊伍,背景調查提供者正在利用自動化和數據分析來提供無縫和主動的監控。這種轉變不僅可以幫助公司更早發現潛在風險,還能增強整體員工的誠信。遠端和混合工作模式進一步推動了對持續監控的需求,因為這些模式需要持續驗證員工資質和背景歷史。隨著監管審查的不斷加強和對風險緩解的關注,企業優先考慮提供即時洞察的解決方案,將持續的勞動力監控定位為背景調查市場的主要成長動力

例如:

- 2021年4月,根據《招聘日報》發表的文章,自疫情爆發以來,隨著遠距工作、零工就業的興起以及員工流動率的提高,對持續勞動力監控的需求正在增加。企業正在優先進行持續篩檢,以減輕與工作場所安全、詐欺和合規相關的風險。這種日益增長的需求為北美的背景調查提供者帶來了重大機會。隨著公司注重即時風險評估以增強工作場所的安全性和法規遵循性,對自動化和人工智慧驅動的監控服務的需求正在上升。背景調查公司可以利用這一趨勢,擴大其服務範圍,包括持續篩選,確保企業對員工行為有最新的了解

背景調查擴展到社群媒體和數位足跡分析

背景調查擴展到社群媒體和數位足跡分析,為北美背景調查市場帶來了重大機會。雇主越來越認識到評估候選人的線上狀態的價值,以識別潛在風險,驗證資格,並確保與組織的文化一致性。隨著遠距工作和數位互動的興起,僅靠傳統的背景調查可能無法全面反映個人行為,因此社群媒體篩選成為招募和風險管理策略的重要補充

人工智慧和數據分析的進步使得高效分析大量數位內容同時確保遵守隱私法變得更加容易。企業正在利用自動化工具掃描公共社交媒體資料、部落格和線上活動,以查找仇恨言論、暴力行為或不道德行為等危險信號。隨著公司尋求更全面、即時地了解候選人和員工,對數位足跡分析的需求預計將增長,從而推動背景調查行業的創新和擴張

例如-

- 2024年9月,根據Statescoop發表的文章,社群媒體背景調查新創公司Ferretly正在擴展其服務,以在美國總統大選前篩選選舉工作人員。該平台分析社群媒體活動中的極端主義或攻擊性內容,協助政府機構和政治組織維護道德和安全標準。此舉凸顯了北美對於結合社群媒體和數位足跡分析的背景調查的需求日益增長。隨著組織注重聲譽管理和風險緩解,背景調查提供者可以利用人工智慧驅動的解決方案來增強篩選流程並推動市場成長

限制/挑戰

消費者對隱私和同意的擔憂日益加劇

Rising consumer concerns over privacy and consent are becoming a major challenge for the North American background check market. With growing awareness of data security risks, individuals are increasingly questioning how their personal information is collected, stored, and shared by background check companies. High-profile cases of inaccurate reports, misuse of personal data, and lack of proper consent mechanisms have fueled distrust, prompting calls for stronger regulations. Consumers are demanding more control over their data, including clear opt-out options, transparency in data sourcing, and mechanisms to dispute incorrect records. This shift in consumer sentiment is pressuring background check providers to adopt ethical data practices and comply with stricter privacy standards.

In response to these concerns, regulatory bodies such as the FTC are cracking down on non-compliant background check companies, imposing fines and enforcing stricter data accuracy requirements. However, the challenge remains in balancing privacy protections with the need for efficient screening solutions for employers and landlords. Companies must navigate evolving privacy laws while ensuring their background checks remain reliable and compliant. To regain consumer trust, firms will need to implement AI-driven verification systems, enhance data accuracy, and prioritize transparency in their processes. Failure to address these privacy concerns could lead to reputational damage, legal repercussions, and a shrinking customer base as users seek more secure and privacy-conscious alternatives.

For instance

- In September 2023 according to the article published by The Hill, inaccuracies in background checks conducted by unregulated "people search" companies have led to privacy violations and significant personal consequences. The FTC has fined TruthFinder and Instant Checkmate for failing to ensure report accuracy, signaling a move toward stricter industry regulations. Growing awareness of these errors and privacy concerns is driving consumer distrust in the background check sector. As a result, increased regulatory scrutiny, legal challenges, and demands for greater transparency are expected to reshape the North American background check market, compelling companies to implement stringent verification processes and comply with evolving privacy laws

Challenges in Screening International Candidates Due to Varying Global Regulations

The North American background check market faces significant challenges in screening international candidates due to varying global regulations on data privacy, employment verification, and criminal records. Different countries have distinct laws governing background checks, with some imposing strict data protection rules that limit access to candidate information. For example, the European Union's General Data Protection Regulation (GDPR) enforces stringent privacy standards, making it difficult for North American companies to obtain and process background data on European candidates. Similarly, countries like China and North America have restrictive policies on sharing criminal records and employment history, further complicating the verification process. These regulatory differences create inconsistencies in screening practices, leading to delays, incomplete reports, and potential compliance risks for employers.

To navigate these complexities, background check providers must adopt a region-specific approach by partnering with local agencies and legal experts to ensure compliance with international regulations. Leveraging AI-driven data verification systems and blockchain technology can help enhance the security and accuracy of cross-border background checks. Additionally, companies must stay updated on evolving global privacy laws to avoid legal penalties and maintain trust with international candidates. As the demand for global talent increases, businesses that can streamline international screening while ensuring regulatory compliance will gain a competitive advantage in securing a diverse and qualified workforce.

For instance:

- In January 2025, according to the article published by First Advantage, the demand for global tech hiring is increasing due to talent shortages in established markets, the rising need for AI skills, and the growing preference for remote work. However, this expansion brings significant challenges, including fraud risks, compliance complexities, and the need for consistent background screening across different regions. In the North American tech sector, screening international candidates is particularly challenging due to diverse legal and cultural regulations. Varying privacy laws, restrictions on criminal record checks, and differing compliance requirements make it difficult to establish a standardized screening process. To address these issues, companies must stay updated on regional laws, provide multilingual support, and implement digital identity verification tools to ensure compliance and security. Without a strong framework, inconsistencies in screening could result in legal risks, hiring delays, and reputational damage

本市場報告詳細介紹了近期發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地市場參與者的影響,分析了新興收入來源方面的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品審批、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

背景調查市場範圍

北美背景調查市場根據產品、部署模式、組織規模、作業系統和應用程式分為五個顯著的部分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

北美背景調查市場,透過提供

- 服務

- 類型

- 培訓與諮詢

- 整合與實施

- 支援與維護

- 類型

- 解決方案

- 類型

- 背景篩檢

- 類型

- 身份檢查

- 犯罪背景

- 就業驗證

- 教育驗證

- 藥物和酒精測試

- 專業執照驗證

- 信貸/金融

- 駕駛/車輛記錄

- 社群媒體

- 性罪犯登記處

- 其他的

- 類型

- 合規管理

- 報告和統計

- 其他的

- 背景篩檢

- 類型

北美背景調查市場(依部署模式)

- 雲

- 本地

北美背景調查市場,依組織規模

- 大型企業

- 類型

- 公共組織

- 私人組織

- 政府機構

- 非營利組織

- 類型

- 雲

- 本地

- 類型

- 中小型企業

- 類型

- 公共組織

- 私人組織

- 政府組織

- 非營利組織

- 類型

- 雲

- 本地

- 類型

北美背景調查市場,依作業系統劃分

- 視窗

- 蘋果

- 移動的

- 類型

- 伊奧斯

- 安卓

- 類型

- Linux

北美背景調查市場,按應用劃分

- 商業

- 類型

- 銀行、金融服務和保險

- 醫療保健和生命科學

- 運輸

- 辦公室

- 零售

- 教育

- 飯店業

- 其他的

- 類型

- 奉獻

- 服務

- 類型

- 支援與維護

- 整合與實施

- 培訓與諮詢

- 類型

- 解決方案

- 類型

- 背景篩檢

- 類型

- 身份檢查

- 犯罪背景

- 就業驗證

- 教育驗證

- 藥物和酒精測試

- 專業執照驗證

- 信貸/金融

- 駕駛/車輛記錄

- 社群媒體

- 性罪犯登記處

- 其他的

- 類型

- 背景篩檢

- 合規管理

- 報告和統計

- 其他的

- 類型

- 服務

- 工業的

- 類型

- 製造業

- 它和 Bpo

- 建造

- 消費品

- 能源與公用事業

- 賭博

- 媒體與娛樂

- 其他的

- 類型

- 奉獻

- 服務

- 類型

- 支援與維護

- 整合與實施

- 培訓與諮詢

- 類型

- 解決方案

- 類型

- 背景篩檢

- 類型

- 身份檢查

- 犯罪背景

- 就業驗證

- 教育驗證

- 藥物和酒精測試

- 專業執照驗證

- 信貸/金融

- 駕駛/車輛記錄

- 社群媒體

- 性罪犯登記處

- 其他的

- 類型

- 背景篩檢

- 合規管理

- 報告和統計

- 其他的

- 類型

- 服務

背景調查市場區域分析

對市場進行分析,並透過上述產品、部署模型、組織規模、作業系統和應用程式提供市場規模洞察和趨勢。

市場涵蓋的國家包括美國、加拿大、墨西哥。

U.S. is expected to dominate the North America background check market due to its large workforce, strict employment regulations, and high adoption of background screening services across industries like finance, healthcare, and technology. The presence of major background check providers and advanced verification technologies further strengthens its market leadership. Additionally, stringent compliance requirements, such as FCRA and EEOC guidelines, drive higher demand for thorough screening processes compared to Canada and Mexico.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of South America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Background Check Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, South America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Background Check Market Leaders Operating in the Market Are:

- GoodHire (A PART OF CHECKR),

- Accurate Background,

- Sterling

- Paycom Payroll LLC.,

- Rentec Direct,

- Xref,

- Certn.,

- Skuad,

- HireRight, LLC.,

- Spokeo, Inc.,

- TrustID,

- Kroll, LLC.,

- MeridianLink,

- First Advantage, an

- Ondato

Latest Developments in North America Background Check Market

- In February 2024, Paycom expanded into the United Kingdom by launching Beti, its automated payroll solution that empowers employees to manage their own payroll. The expansion marked Paycom’s first international market outside North America, following its moves into Canada and Mexico. Beti® helped organizations reduce payroll processing time by 90% and consolidate multiple systems into one seamless platform. This move simplified HR tasks and improved efficiency for global employers.

- 2022年11月,First Advantage旗下公司Sterling與Yoti合作,在國際上推出獨家的便攜式數位身分解決方案。這些公司將數位身分驗證工作流程整合到歐洲、中東和非洲地區以及亞太地區的招募流程中,使雇主能夠快速驗證候選人身分並減少對實體文件的依賴。他們創建了一個系統,候選人可以建立一個安全、可重複使用的數位身份,以滿足多種驗證需求。此次合作簡化了就業前檢查和入職流程,並提高了整體招募效率和安全性。

- 2023 年 11 月,First Advantage 旗下公司 Sterling 和 Konfir 宣佈建立合作關係,在英國提供即時就業驗證服務。此次合作旨在將驗證時間從幾天縮短到幾秒鐘,從而加快招募速度。 First Advantage 旗下公司 Sterling 將其背景篩選專業知識與 Konfir 的 API 驅動解決方案相結合,可快速返回薪資、稅務和開放銀行資料。這項新服務改善了求職者的體驗並簡化了招募流程。

- 2024 年 3 月,Paycom Software, Inc. 連續第二年榮獲蓋洛普傑出工作場所獎。蓋洛普職場科學家對該公司的表現進行了評估,它是全球僅有的 60 家獲得該殊榮的組織之一。該公司優先考慮員工福利和參與度,從而提高了生產力並創造了蓬勃發展的工作文化。 Paycom 的創新人力資源和薪資技術簡化了流程並讓員工直接存取資料。這項成就鞏固了其作為雲端人力資本管理解決方案領導者的聲譽。

- 2024 年 8 月,Paycom Software, Inc. 以其創新的休假申請工具 GONE® 被《人力資源執行官》雜誌評為 2024 年頂級人力資源產品。 GONE 透過符合政策的決策來實現休假管理流程的自動化,從而減少了人工審查和決策疲勞。它根據預設的規則(如覆蓋閾值和提交時間)批准或拒絕請求。該工具消除了平均每次 30.92 美元的人工審查費用,幫助公司削減了成本。該獎項凸顯了 Paycom 增強的自動化功能如何為全球客戶提高效率並提供更高的投資報酬率。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BACKGROUND CHECK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 INDUSTRY ANALYSIS

4.1.2 KEY DRIVERS OF GROWTH

4.1.2.1 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS

4.1.2.2 RISE IN DEMAND FOR BACKGROUND CHECKS IN THE GIG ECONOMY AND FREELANCE WORKFORCE

4.1.3 MARKET TRENDS

4.1.4 FUTURISTIC SCENARIO (FORECAST TO 2032)

4.1.5 CONCLUSION

4.2 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES

4.2.1 AI-DRIVEN BACKGROUND SCREENING SOLUTIONS

4.2.2 CLOUD-BASED BACKGROUND SCREENING PLATFORMS

4.2.3 ENHANCED DATA SECURITY AND BLOCKCHAIN SOLUTIONS

4.2.4 EMPLOYEE AND WORKFORCE MONITORING SOLUTIONS

4.2.5 CONCLUSION

4.3 PENETRATION AND GROWTH PROSPECTS MAPPING

4.3.1 MARKET PENETRATION

4.3.2 GROWTH PROSPECTS

4.3.3 REGIONAL INSIGHTS

4.3.4 CONCLUSION

4.4 TECHNOLOGY ANALYSIS

4.4.1 KEY TECHNOLOGIES

4.4.2 COMPLEMENTARY TECHNOLOGIES

4.4.3 ADJACENT TECHNOLOGIES

5 REGULATORY STANDARDS

5.1 REGULATIONS

5.2 REGULATORY AGENCIES AND AUTHORITIES

5.3 REGULATORY PROCEDURES

5.4 CLASSIFICATION OF SERVICES

5.5 STANDARD GUIDELINES

5.6 POST MARKET SURVEILLANCE

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS

6.1.2 RISE IN DEMAND FOR BACKGROUND CHECKS IN THE GIG ECONOMY AND FREELANCE WORKFORCE

6.1.3 GROWING ADOPTION OF ADVANCED TECHNOLOGIES LIKE AI AND AUTOMATION IN BACKGROUND SCREENING

6.1.4 INCREASING CROSS-BORDER HIRING AND IMMIGRATION-RELATED SCREENING

6.2 RESTRAINT

6.2.1 DEPENDENCE ON THIRD-PARTY DATA PROVIDERS INCREASING VULNERABILITY TO ERRORS

6.2.2 INCONSISTENCIES IN PUBLIC RECORDS AND DATA AVAILABILITY ACROSS STATES

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR CONTINUOUS WORKFORCE MONITORING SOLUTIONS

6.3.2 EXPANSION OF BACKGROUND CHECKS INTO SOCIAL MEDIA AND DIGITAL FOOTPRINT ANALYSIS

6.3.3 RISING NEED FOR BACKGROUND CHECKS IN TENANT AND RENTAL SCREENINGS

6.4 CHALLENGES

6.4.1 RISING CONSUMER CONCERNS OVER PRIVACY AND CONSENT

6.4.2 CHALLENGES IN SCREENING INTERNATIONAL CANDIDATES DUE TO VARYING GLOBAL REGULATIONS

7 NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SERVICE

7.2.1 SOLUTION

7.2.1.1 IDENTITY CHECK

7.2.1.2 CRIMINAL BACKGROUND

7.2.1.3 EMPLOYMENT VERIFICATION

7.2.1.4 DRUG AND ALCOHOL TESTING

7.2.1.5 EDUCATION VERIFICATION

7.2.1.6 PROFESSIONAL LICENSE VERIFICATION

7.2.1.7 CREDIT/FINANCIAL

7.2.1.8 DRIVING/VEHICLE RECORD

7.2.1.9 SOCIAL MEDIA

7.2.1.10 SEX OFFENDER REGISTRY

7.2.1.11 OTHERS

8 NORTH AMERICA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 PUBLIC ORGANIZATION

8.2.2 PRIVATE ORGANIZATION

8.2.3 GOVERNMENT ORGANIZATION

8.2.4 NON-PROFIT ORGANIZATION

8.2.4.1 CLOUD

8.2.4.2 ON PREMISE

8.3 SMALL AND MEDIUM SIZE ENTERPRISES(SMES)

8.3.1 PUBLIC ORGANIZATION

8.3.2 PRIVATE ORGANIZATION

8.3.3 GOVERNMENT ORGANIZATION

8.3.4 NON-PROFIT ORGANIZATION

8.3.4.1 CLOUD

8.3.4.2 ON PREMISE

9 NORTH AMERICA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

10 NORTH AMERICA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM

10.1 OVERVIEW

10.2 WINDOWS

10.3 MAC

10.4 MOBILE

10.4.1 IOS

10.4.2 ANDROID

10.5 LINUX

11 NORTH AMERICA BACKGROUND CHECK MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 COMMERCIAL

11.2.1 BANKING, FINANCIAL SERVICE AND INSURANCE

11.2.2 HEALTHCARE AND LIFE-SCIENCE

11.2.3 TRANSPORTATION

11.2.4 OFFICES

11.2.5 RETAIL

11.2.6 EDUCATION

11.2.7 HOSPITALITY

11.2.8 OTHERS

11.2.9 BY OFFERING

11.2.9.1 SERVICES

11.2.9.1.1 SUPPORT AND MAINTENANCE

11.2.9.1.2 INTEGRATION AND IMPLEMENTATION

11.2.9.1.3 TRAINING AND CONSULTING

11.2.9.2 SOLUTION

11.2.9.2.1 BACKGROUND SCREENING

11.2.9.2.2 COMPLIANCE MANAGEMENT

11.2.9.2.3 REPORTING AND STATISTIC

11.2.9.2.4 OTHERS

11.2.9.2.4.1 IDENTITY CHECK

11.2.9.2.4.2 CRIMINAL BACKGROUND

11.2.9.2.4.3 EMPLOYMENT VERIFICATION

11.2.9.2.4.4 EDUCATION VERIFICATION

11.2.9.2.4.5 DRUG AND ALCOHOL TESTING

11.2.9.2.4.6 PROFESSIONAL LICENSE VERIFICATION

11.2.9.2.4.7 CREDIT/FINANCIAL

11.2.9.2.4.8 DRIVING/VEHICLE RECORD

11.2.9.2.4.9 SOCIAL MEDIA

11.2.9.2.4.10 SEX OFFENDER REGISTRY

11.2.9.2.4.11 OTHERS

11.3 INDUSTRIAL

11.3.1 MANUFACTURING

11.3.2 IT AND BPO

11.3.3 CONSTRUCTION

11.3.4 CONSUMER GOODS

11.3.5 ENERGY AND UTILITIES

11.3.6 GAMING

11.3.7 MEDIA AND ENTERTAINMENT

11.3.8 OTHERS

11.3.9 BY OFFERING

11.3.9.1 SERVICES

11.3.9.1.1 SUPPORT AND MAINTENANCE

11.3.9.1.2 INTEGRATION AND IMPLEMENTATION

11.3.9.1.3 TRAINING AND CONSULTING

11.3.9.2 SOLUTION

11.3.9.2.1 BACKGROUND SCREENING

11.3.9.2.2 COMPLIANCE MANAGEMENT

11.3.9.2.3 REPORTING AND STATISTIC

11.3.9.2.4 OTHERS

11.3.9.2.4.1 IDENTITY CHECK

11.3.9.2.4.2 CRIMINAL BACKGROUND

11.3.9.2.4.3 EMPLOYMENT VERIFICATION

11.3.9.2.4.4 EDUCATION VERIFICATION

11.3.9.2.4.5 DRUG AND ALCOHOL TESTING

11.3.9.2.4.6 PROFESSIONAL LICENSE VERIFICATION

11.3.9.2.4.7 CREDIT/FINANCIAL

11.3.9.2.4.8 DRIVING/VEHICLE RECORD

11.3.9.2.4.9 SOCIAL MEDIA

11.3.9.2.4.10 SEX OFFENDER REGISTRY

11.3.9.2.4.11 OTHERS

12 NORTH AMERICA BACKGROUND CHECK MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BACKGROUND CHECK MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 STERLING, A FIRST ADVANTAGE COMPANY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SERVICE PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 FIRST ADVANTAGE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 HIRERIGHT, LLC

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 ACCURATE BACKGROUND

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 KROLL, LLC

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 CERTN.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 GOODHIRE (A PART OF CHECKR)

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 MERIDIANLINK

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ONDATO

15.9.1 COMPANY SNAPSHOT

15.9.2 SERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 PAYCOM PAYROLL LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 RENTEC DIRECT

15.11.1 COMPANY SNAPSHOT

15.11.2 SOLUTION PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 SKUAD

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SPOKEO, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 TRUSTID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 XREF

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 REGULATORY ASSOCIATION RELATED TO EMPLOYMENT SCREENING

TABLE 2 NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA LARGE ENTERPRISE IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL AND MEDIUM SIZE ENTERPRISE(SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SMALL AND MEDIUM SIZE ENTERPRISE(SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA BACKGROUND CHECK MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.S. LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 CANADA LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 57 CANADA SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CANADA SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 59 CANADA BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 60 CANADA MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 CANADA BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO SERVICE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO BACKGROUND CHECK MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO LARGE ENTERPRISES IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MEXICO SMALL AND MEDIUM SIZE ENTERPRISE (SMES) IN BACKGROUND CHECK MARKET, BY DEPLOYMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO BACKGROUND CHECK MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO MOBILE IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MEXICO BACKGROUND CHECK MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO COMMERCIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO COMMERCIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO INDUSTRIAL IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO INDUSTRIAL IN BACKGROUND CHECK MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO SERVICES IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO SOLUTION IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO BACKGROUND SCREENING IN BACKGROUND CHECK MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA BACKGROUND CHECK MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BACKGROUND CHECK MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BACKGROUND CHECK MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BACKGROUND CHECK MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BACKGROUND CHECK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BACKGROUND CHECK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BACKGROUND CHECK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BACKGROUND CHECK MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BACKGROUND CHECK MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA BACKGROUND CHECK MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA BACKGROUND CHECK MARKET: APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA BACKGROUND CHECK MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE NORTH AMERICA BACKGROUND CHECK MARKET, BY OFFERING (2024)

FIGURE 14 NORTH AMERICA BACKGROUND CHECK MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 INCREASING STRINGENCY IN EMPLOYMENT SCREENING REGULATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA BACKGROUND CHECK MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 BACKGROUND SCREENING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BACKGROUND CHECK MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BACKGROUND CHECK MARKET

FIGURE 19 EXPECTED NUMBER OF FREELANCERS IN U.S. OVER THE YEARS

FIGURE 20 NORTH AMERICA BACKGROUND CHECK MARKET: BY OFFERING, 2024

FIGURE 21 NORTH AMERICA BACKGROUND CHECK MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 22 NORTH AMERICA BACKGROUND CHECK MARKET: BY DEPLOYMENT MODEL, 2024

FIGURE 23 NORTH AMERICA BACKGROUND CHECK MARKET: BY OPERATING SYSTEM, 2024

FIGURE 24 NORTH AMERICA BACKGROUND CHECK MARKET: BY APPLICATION, 2024

FIGURE 25 NORTH AMERICA BACKGROUND CHECK MARKET: SNAPSHOT (2023)

FIGURE 26 NORTH AMERICA BACKGROUND CHECK MARKET:2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。