North America Blood Plasma And Plasma Derived Medicinal Products Market

市场规模(十亿美元)

CAGR :

%

USD

17.70 Billion

USD

31.93 Billion

2024

2032

USD

17.70 Billion

USD

31.93 Billion

2024

2032

| 2025 –2032 | |

| USD 17.70 Billion | |

| USD 31.93 Billion | |

|

|

|

|

北美血漿和血漿衍生藥品市場細分、按產品(免疫球蛋白、凝血因子(用於出血性疾病)、白蛋白(血漿擴容劑)、蛋白酶抑制劑(用於遺傳缺陷)、單株抗體(源自漿細胞)和其他血漿衍生蛋白)、應用(免疫學、血液學、重症監護、神經病學、肺病學、血液腫瘤學、風濕病學和其他應用)、加工技術(離子交換色譜法、親和色譜法、冷沉澱、超濾和微濾)、模式(現代和傳統血漿分餾)、最終用戶(醫院和診所、研究實驗室、學術機構等)、渠道(直接投標、第三方分銷商等)-產業趨勢與預測2032

血漿和血漿衍生藥物市場規模

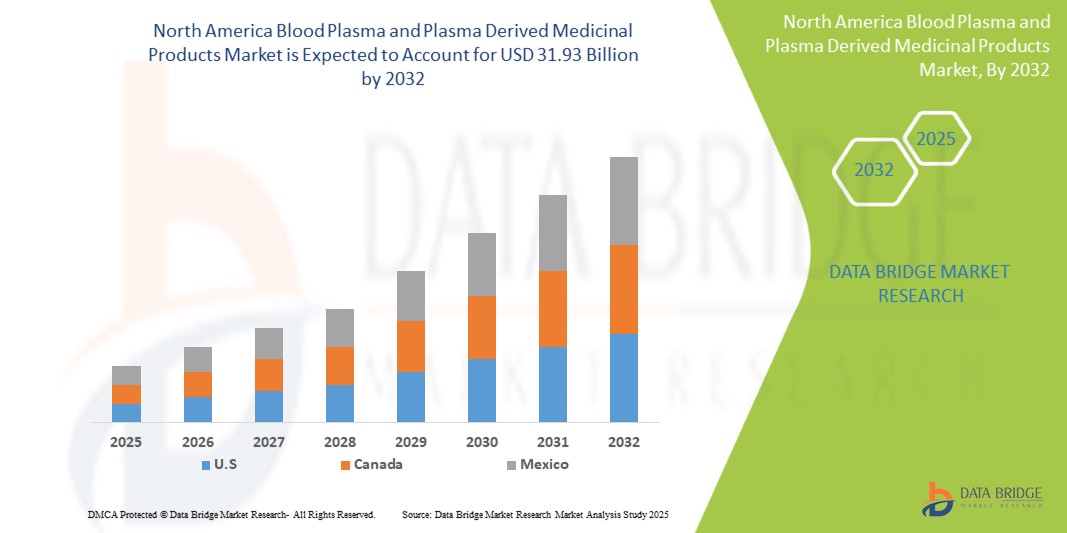

- 2024 年北美血漿和血漿衍生藥物市場規模為177 億美元 ,預計 到 2032 年將達到 319.3 億美元,預測期內 複合年增長率為 7.70% 。

- 市場成長主要受到罕見疾病和慢性病盛行率上升的推動

- 此外,血漿和血漿衍生醫療產品在血漿分離技術方面也取得了進展。這些因素正在加速血漿和血漿衍生醫療產品解決方案的普及,從而顯著促進該行業的成長。

血漿及血漿衍生藥物市場分析

- 血漿和血漿衍生藥物因其在治療多種罕見和慢性疾病(如免疫缺陷、血友病和自體免疫疾病)中的關鍵作用以及在急診醫學和重症監護中的廣泛應用而日益受到重視

- 罕見疾病和慢性免疫相關疾病的盛行率不斷上升,加上人們對血漿療法的認識不斷提高以及血漿分餾技術的進步,推動了北美對血漿衍生藥物的需求

- 美國在血漿和血漿衍生藥品市場佔據主導地位,2024 年將佔據 64.30% 的最大收入份額,這歸因於醫療支出的增加、患者人數的增加、政府法規的支持以及國際血漿產品的不斷滲透

- 預計美國也將成為預測期內市場上成長最快的國家,這得益於醫療保健基礎設施的發展、血漿捐贈和收集設施的普及以及對生物技術和醫療保健研發的大力投資

- 免疫球蛋白預計將在 2025 年佔據血漿和血漿衍生藥品市場的主導地位,市場份額為 41.40%,這得益於其在治療免疫缺陷疾病、發炎和神經系統疾病方面的廣泛應用,同時北美的認知度和監管批准也在不斷提高

報告範圍及血漿及血漿衍生性藥物市場細分

|

屬性 |

血漿和血漿衍生醫療產品關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深度專家分析、患者流行病學、管道分析、定價分析和監管框架。 |

血漿和血漿衍生藥物市場趨勢

“罕見疾病和慢性病盛行率上升”

- 北美血漿和血漿衍生藥品市場的主要驅動力是北美罕見疾病和慢性病的盛行率不斷上升,這得益於診斷技術的進步以及醫療保健提供者和患者意識的提高

- 例如,2025年4月,美國疾病管制與預防中心(CDC)的數據顯示,76.4%的美國成年人至少患有一種慢性疾病,51.4%的成年人患有多種疾病。這種上升趨勢(在年輕人中也同樣存在)加劇了對終身照護的需求,尤其是針對血友病、原發性免疫缺陷病和血管性血友病等疾病。

- 免疫球蛋白、凝血因子和白蛋白等血漿衍生療法對於控制這些終身疾病至關重要。原發性免疫缺陷症患者依賴靜脈注射免疫球蛋白(IVIG)來維持免疫功能,而血友病患者則需要定期輸注凝血因子以預防出血。

- 北美人口老化進一步推動了這一趨勢,老年人越來越多地受到肝硬化、多發性骨髓瘤和發炎性疾病等疾病的影響,所有這些疾病都需要血漿幹預

- 2025年3月,發表在《PMC》上的一項研究強調了北美地區罕見疾病的巨大負擔,尤其是在兒科族群。儘管基因組醫學和孤兒藥研發取得了進展,但診斷延遲和治療方案有限的問題依然存在,這凸顯了多學科和持續護理的必要性。

- 對安全、有效和高品質血漿衍生療法的需求不斷增長是推動血漿和血漿衍生藥物市場的關鍵因素,因為這些產品在管理終身疾病和滿足北美未滿足的醫療需求方面發揮著至關重要的作用

血漿和血漿衍生藥物市場動態

司機

“老年人口不斷擴大”

- 血漿和血漿衍生藥品的需求不斷增長,這在很大程度上受到北美人口老化的推動,北美人口更容易患上慢性和退化性疾病,如免疫系統疾病、神經系統疾病、肝臟併發症以及需要血漿療法(包括免疫球蛋白、白蛋白和凝血因子)的血液相關問題

- 例如,2025年3月,《PMC》雜誌刊登的一項研究分析了2010年至2024年美國全國住院患者樣本(NIS)數據,結果顯示,老齡人口的快速增長導致住院人數大幅增加、住院時間延長以及再入院率上升。這一趨勢主要由慢性病和多重疾病共同驅動,凸顯了醫療保健系統日益增長的壓力以及隨之而來的血漿衍生治療需求。

- 隨著年齡的增長,免疫系統逐漸衰弱,更容易受到感染和自體免疫疾病的影響。免疫球蛋白療法常用於治療慢性發炎性脫髓鞘性多發性神經病變 (CIDP) 等疾病,而白蛋白在老年患者外科手術和重症監護過程中維持體液平衡方面至關重要。

- 根據世界衛生組織的估計,北美60歲及以上人口預計將從2023年的11億增加到2050年的21億,這進一步凸顯了老年護理的關鍵作用。這種人口結構的變化不僅增加了對長期治療支持的需求,也使老年人口成為北美PDMP的關鍵且持久的市場。

克制/挑戰

“成本高,製造流程複雜”

- 血漿及血漿衍生藥品生產的高成本和複雜性,對市場拓展構成了重大障礙。該過程需要嚴格的血漿採集規程、全面的病原體篩檢,以及在符合GMP標準的無菌環境下進行多步驟分離,這使得生產過程資源密集且耗時。

- 例如,Aykon Biosciences 的詳細分析強調,由於原材料價格昂貴、對熟練勞動力的需求以及日益嚴格的合規監管要求,血漿衍生療法等複雜生物製劑的生產面臨著不斷上升的成本壓力。向專業化和個人化治療的轉變進一步推高了成本,因此需要先進的技術和嚴格的品質保證系統。

- 此外,PDMP的生產週期可能長達12個月,整個過程都需要冷鏈物流進行儲存和運輸。這些因素顯著增加了資本和營運支出,限制了可擴展性,並阻礙了小型企業和發展中經濟體有效參與市場。

- 生產成本密集的特性也導致最終產品價格高昂,降低了產品的可及性和可負擔性,尤其是在醫療保健預算有限的中低收入國家。這種財務負擔為滿足北美日益增長的需求帶來了挑戰,從而限制了PDMP在全球範圍內的廣泛應用。

- 雖然持續的技術創新或許能逐步提高成本效益,但目前高昂的生產和加工成本仍是限制其發展的主要因素。透過改善生產技術、擴大捐助方基礎設施以及提供公共衛生支援資金來應對這些挑戰,對於擴大市場准入和實現公平的治療覆蓋至關重要。

血漿和血漿衍生藥物市場範圍

市場根據產品、應用、加工技術、模式、最終用戶和分銷管道進行細分。

- 按產品

根據產品類型,市場細分為免疫球蛋白、凝血因子(用於治療出血性疾病)、白蛋白(血漿擴容劑)、蛋白酶抑制劑(用於治療遺傳缺陷)、單株抗體(源自漿細胞)和其他血漿衍生蛋白。預計到2025年,免疫球蛋白將佔據主導地位,市場份額將達到41.40%,這主要得益於免疫缺陷診斷、自體免疫疾病以及靜脈注射免疫球蛋白 (IVIG) 使用量的增加。

預計凝血因子(用於出血性疾病)領域在 2025 年至 2032 年間將出現 7.95% 的最快增長率,這得益於血友病病例的增加、診斷途徑的改善、政府的支持以及重組和血漿衍生療法的廣泛使用。

- 按應用

根據應用,市場細分為免疫學、血液學、重症監護、神經病學、肺病學、血液腫瘤學、風濕病學和其他應用。免疫學領域在2025年佔據了最大的市場收入份額,這得益於其在治療原發性免疫缺陷、自體免疫疾病方面的廣泛應用,以及北美對靜脈注射免疫球蛋白(IVIG)需求的不斷增長。

預計免疫學領域將在 2025 年至 2032 年間見證最快的複合年增長率,這得益於自體免疫疾病患病率的增加、人口老齡化加劇以及免疫球蛋白療法臨床應用的不斷擴大。

- 依加工技術

根據加工技術,市場細分為離子交換層析法、親和層析法、冷沉澱法、超濾法和微濾法。離子交換層析法在2025年佔據了最大的市場收入份額,這得益於其在純化免疫球蛋白、白蛋白和凝血因子等血漿蛋白方面的高效性、可擴展性和有效性。

親和層析技術領域預計將在 2025 年至 2032 年間經歷最快的複合年增長率,因其高特異性、分離目標蛋白質的能力以及在先進生物製劑純化中的日益普及而受到青睞。

- 按模式

根據模式,市場可分為現代血漿分離和傳統血漿分離。現代血漿分離在2025年佔據了最大的市場收入份額,推動了先進的加工技術、更高的產品純度、更佳的安全性,以及重組和高產血漿衍生療法的普及。

預計現代領域將在 2025 年至 2032 年間見證最快的複合年增長率,推動淨化技術的創新、對更安全生物製劑的需求不斷增長以及對下一代等離子體處理技術的投資不斷增加。

- 按最終用戶

根據最終用戶,市場細分為醫院和診所、研究實驗室、學術機構和其他。醫院和診所細分市場在2025年佔據了最大的市場收入份額,這得益於其龐大的患者數量、專科護理的可及性、慢性病治療的增多以及先進血漿衍生療法的可及性。

預計醫院和診所部門也將在 2025 年至 2032 年間見證最快的複合年增長率,這得益於醫療基礎設施的擴大、住院人數的增加以及對複雜疾病血漿療法的日益依賴。

- 按分銷管道

根據分銷管道,市場細分為直接招標、第三方分銷商和其他。 2025年,直接招標市場佔據了最大的市場收入份額,這得益於政府機構的批量採購、成本效益、可靠的供應鏈以及公共部門對血漿衍生藥物投資的不斷增加。

受政府醫療保健計劃擴大、集中採購政策以及對具有成本效益的大規模血漿療法分銷的需求不斷增長的推動,直接招標領域預計也將在 2025 年至 2032 年間見證最快的複合年增長率。

血漿和血漿衍生藥物市場區域分析

- 美國在血漿和血漿衍生醫療產品市場佔據主導地位,收入份額最大,為 64.61%,預計到 2025 年將以最快的複合年增長率 8.19% 增長,這得益於先進的醫療基礎設施、罕見病和慢性病診斷率的提高以及人均醫療支出的高昂

- 該地區強大的監管框架、健全的報銷系統以及 Grifols、CSL Behring 和 Takeda 等主要市場參與者的存在,有助於北美在血漿收集和治療分銷方面保持領先地位

- 生物製藥研發、擴大血漿採集網路以及改善免疫學、血液學和神經病學血漿衍生療法獲取途徑的主要經濟體

加拿大血漿和血漿衍生藥物市場洞察

預計2025年至2032年期間,加拿大將在該地區實現顯著的複合年增長率,這得益於其全民醫療保健體系、對罕見疾病認識的不斷提高以及政府對擴大國內血漿採集能力的投資。戰略合作夥伴關係和生物製劑製造領域的進步正在增強加拿大在血漿製品管理計劃(PDMP)領域的影響力。

墨西哥血漿和血漿衍生藥物市場洞察

2025年,墨西哥佔據了北美地區最大的市場收入份額,這得益於其完善的醫療生態系統、不斷增長的罕見疾病和慢性病患者群體,以及政府大力推廣血漿捐獻的舉措。該國擁有眾多血漿採集中心,並加快了血漿捐贈管理計劃(PDMP)的審批速度,這提高了治療的可及性,並推動了市場擴張。

血漿和血漿衍生藥品市場份額

血漿和血漿衍生醫療產品產業主要由知名公司主導,包括:

- CSL(澳洲)

- 武田藥品工業株式會社(日本)

- Grifols, SA(西班牙)

- Octapharma AG(瑞士)

- Kedrion(義大利)

- ADMA Biologics, Inc(美國)

- Biotest AG(德國)

- 費森尤斯卡比股份公司(德國)

- GC Biopharma公司(韓國)

- Intas Pharmaceuticals Ltd.(印度)

- Kamada Pharmaceuticals(以色列)

- KM Biologics(日本)

- LFB(美國)

- Proliant Health & Biologicals(美國)

- 普羅米亞(印度)

- Reliance Life Sciences(印度)

- SK Plasma(韓國)

- Synthaverse SA(波蘭)

血漿和血漿衍生藥物市場的最新發展

- 2024年11月,CSL Plasma將其先進的Rika血漿捐贈系統推廣至科羅拉多州丹佛附近的六個美國捐贈中心。這些與Terumo Blood & Cell Technologies共同開發的新設備將採集時間縮短了約30%,同時提高了捐贈者的舒適度、安全性和效率。

- 2022年12月,CSL在澳洲維多利亞州啟用了其新的Broadmeadows血漿分餾設施,這是南半球最大的血漿顆粒加工基地。該設施每年可處理920萬公升血漿當量,耗資9億美元,滿足北美對血漿療法的需求,這些療法可用於治療免疫缺陷、神經系統疾病以及移植和燒傷等重症疾病。

- 2024年6月,武田宣布斥資3,000萬美元擴建其位於洛杉磯的血漿分離設施,該設施是其北美產能最高的設施。此次升級預計將使產量增加至每年200萬公升,有助於滿足北美對用於治療免疫缺陷和出血性疾病的血漿衍生療法日益增長的需求。

- 2023年,武田承諾斥資約7.65億美元在日本大阪新建一座血漿衍生療法生產工廠,使其現有成田工廠的產能幾乎翻五倍。該工廠預計將於2030年全面投入運營,服務日本和北美市場。

- 2025 年 3 月,Grifols 與 Inpeco 合作,整合先進的自動化機器人 (FlexLab X)、診斷技術和試劑,打造“未來實驗室”,用於輸血中的高通量、更安全、可追溯的血液和血漿檢測。醫學實驗室分析生物樣本,以診斷、監測和研究疾病

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 SUPPLY CHAIN IMPACT ON THE NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL AVAILABILITY

4.3.3 MANUFACTURING CAPACITY

4.3.4 LOGISTICS AND LAST-MILE HURDLES

4.3.5 PRICING MODELS AND MARKET POSITIONING

4.4 INNOVATION STRATEGIES

4.4.1 KEY INNOVATION STRATEGIES

4.4.2 EMERGING DELIVERY TECHNIQUES

4.4.3 STRATEGIC IMPLICATIONS

4.4.4 CONCLUSION

4.5 RISK AND MITIGATION

4.6 VENDOR SELECTION DYNAMICS

4.6.1 PRODUCT QUALITY AND REGULATORY COMPLIANCE

4.6.2 SUPPLY CHAIN CAPABILITIES AND RELIABILITY

4.6.3 CLINICAL EFFICACY AND INNOVATION

4.6.4 COST COMPETITIVENESS AND REIMBURSEMENT COMPATIBILITY

4.6.5 LOCAL MARKET PRESENCE AND SUPPORT INFRASTRUCTURE

4.6.6 ETHICAL SOURCING, ESG COMPLIANCE, AND TRANSPARENCY

4.6.7 CONCLUSION

4.7 TARIFFS AND THEIR IMPACT ON MARKET

4.7.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.7.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.7.3 VENDOR SELECTION CRITERIA DYNAMICS

4.7.4 IMPACT ON SUPPLY CHAIN

4.7.5 IMPACT ON PRICES

4.7.6 REGULATORY INCLINATION

4.7.6.1 GCC TRADE ALIGNMENT & FTAS

4.7.6.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.7.6.3 LOCAL SUBSIDY & POLICY RESPONSE

4.7.6.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF RARE AND CHRONIC DISEASES

6.1.2 EXPANDING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN PLASMA FRACTIONATION

6.1.4 GOVERNMENT AND INSTITUTIONAL SUPPORT

6.2 RESTRAINTS

6.2.1 HIGH COST AND COMPLEX MANUFACTURING PROCESS

6.2.2 LACK OF PLASMA SUPPLY AND DONOR

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN PLASMA PROCESSING TECHNOLOGIES TO ENHANCE YIELD AND REDUCE COSTS

6.3.2 REIMBURSEMENT FRAMEWORKS AND INCREASED GOVERNMENTAL FOCUS ON RARE DISEASE TREATMENT

6.3.3 STRATEGIC ALLIANCES, MERGERS, AND ACQUISITIONS TO STRENGTHEN NORTH AMERICA MARKET PENETRATION

6.4 CHALLENGES

6.4.1 COMPETITIVE PRESSURE FROM RECOMBINANT AND ALTERNATIVE BIOLOGICAL THERAPIES

6.4.2 INFRASTRUCTURE LIMITATIONS IN COLD CHAIN LOGISTICS IMPACTING PRODUCT DISTRIBUTION

7 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 IMMUNOGLOBULINS

7.3 COAGULATION FACTORS (FOR BLEEDING DISORDERS)

7.4 ALBUMIN (PLASMA VOLUME EXPANDER)

7.5 PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)

7.6 MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS)

7.7 OTHER PLASMA DERIVED PROTEINS

8 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IMMUNOLOGY

8.3 HEMATOLOGY

8.4 CRITICAL CARE

8.5 NEUROLOGY

8.6 PULMONOLOGY

8.7 HAEMATO-ONCOLOGY

8.8 RHEUMATOLOGY

8.9 OTHER APPLICATIONS

9 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ION EXCHANGE CHROMATOGRAPHY

9.3 AFFINITY CHROMATOGRAPHY

9.4 CRYOPRECIPITATION

9.5 ULTRAFILTRATION

9.6 MICROFILTRATION

10 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE

10.1 OVERVIEW

10.2 MODERN

10.3 TRADITIONAL PLASMA FRACTIONATION

11 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 RESEARCH LABS

11.4 ACADEMIC INSTITUTES

11.5 OTHERS

12 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

12.4 OTHERS

13 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CSL

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GRIFOLS, S.A.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 OCTAPHARMA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KEDRION

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ADMA BIOLOGICS, INC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AEGROS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BHARAT SERUMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIOTEST AG.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FRESENIUS KABI AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GC BIOPHARMA CORPORATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ICHOR

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTAS PHARMACEUTICALS LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KAMADA PHARMACEUTICALS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KM BIOLOGICS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LFB

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PLASMAGEN BIOSCIENCES PVT. LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PROLIANT HEALTH & BIOLOGICALS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PROMEA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 RELIANCE LIFE SCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 BUSINESS PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SICHUAN YUANDA SHYUANG PHARMACEUTICAL CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SK PLASMA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SYNTHAVERSE S. A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TAIBANG BIO GROUP CO., LTD

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 VIRCHOW BIOTECH

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COAGULATION FACTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA FACTOR IX IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA FACTOR VIII IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA FIBRINOGEN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA VON WILLEBRAND FACTOR (VWF) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 18 IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA ALBUMIN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS )IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA IMMUNOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA HEMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA CRITICAL CARE IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA NEUROLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA PULMONOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA HEMATOLOGY -ONCOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA RHEUMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OTHER APPLICATIONS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ION EXCHANGE CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA AFFINITY CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA CRYOPRECIPITATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA ULTRAFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA MICROFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2025-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA MODERN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA TRADITIONAL PLASMA FRACTIONATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2025-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA HOSPITALS & CLINICS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA RESEARCH LABS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA ACADEMIC INSTITUTES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA OTHERS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA DIRECT TENDERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NORTH AMERICA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MEXICO OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MEXICO ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 158 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 159 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 160 MEXICO BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT (2024)

FIGURE 13 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING PREVALENCE OF RARE AND CHRONIC DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 IMMUNOGLOBULINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET IN THE FORECAST PERIOD OF 2025 & 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR THE NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

FIGURE 19 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY PRODUCT, 2024

FIGURE 20 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY PRODUCT, 2025-2032 (USD THOUSAND)

FIGURE 21 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY PRODUCT, CAGR (2025-2032) (2025-2032)

FIGURE 22 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY APPLICATION, 2024

FIGURE 24 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 25 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY APPLICATION, CAGR (2025-2032) (2025-2032)

FIGURE 26 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY TECHNOLOGY, 2024

FIGURE 28 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 29 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY TECHNOLOGY, CAGR (2025-2032) (2025-2032)

FIGURE 30 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY MODE, 2024

FIGURE 32 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY MODE, 2025-2032 (USD THOUSAND)

FIGURE 33 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY MODE, CAGR (2025-2032) (2025-2032)

FIGURE 34 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY MODE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY END USER, 2024

FIGURE 36 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 37 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY END USER, CAGR (2025-2032) (2025-2032)

FIGURE 38 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 39 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 41 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032) (2025-2032)

FIGURE 42 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: SNAPSHOT (2024)

FIGURE 44 NORTH AMERICA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。