North America Butylated Hydroxytoluene Market

市场规模(十亿美元)

CAGR :

%

USD

61.71 Million

USD

99.98 Million

2024

2032

USD

61.71 Million

USD

99.98 Million

2024

2032

| 2025 –2032 | |

| USD 61.71 Million | |

| USD 99.98 Million | |

|

|

|

|

北美丁基羥基甲苯市場,依純度等級(技術級、工業級、食品級、化妝品級、醫藥級及其他)、功能(食品及飼料防腐劑、聚合物及燃料穩定劑、化妝品及醫藥穩定劑及其他)、劑型(液體、粉末)、包裝形式(IBC噸桶、散裝桶及其他)、應用領域(聚合物穩定劑/塑膠產業、食品業、動物飼料、化妝品成分、燃料/油添加劑、農藥製劑、橡膠及其他)劃分-產業趨勢及至2032年的預測

北美丁基羥基甲苯 (BHT) 市場規模

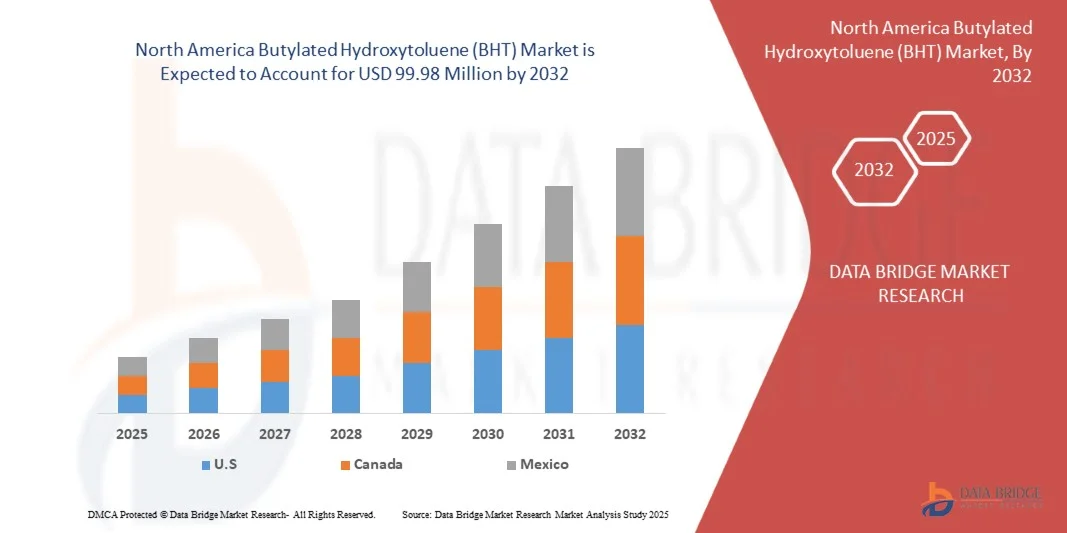

- 2024年北美丁基羥基甲苯(BHT)市場規模為6,171萬美元 ,預計 到2032年將達到9,998萬美元,預測期內 複合年增長率為6.39%。

- 北美丁基羥基甲苯 (BHT) 市場的成長主要受各行業(例如食品飲料、化妝品、塑膠、動物飼料和製藥)對高效合成抗氧化劑的需求不斷增長的推動,這些抗氧化劑用於防止產品氧化降解。 BHT 能夠增強產品穩定性、延長保質期並保持感官和營養品質,使其成為製造商的首選添加劑。此外,化學合成和穩定化製程的持續技術進步正在提高產品的純度和性能,從而促進其在終端用戶領域的廣泛應用。

- 此外,隨著加工食品和個人護理行業的蓬勃發展,對經濟高效的保鮮解決方案的需求日益增長,這也推動了BHT作為可靠抗氧化劑的應用。人們對氧化導致的品質下降的認識不斷提高,以及允許控制BHT使用的監管框架的支持,進一步促進了BHT的市場滲透。這些因素共同推動了北美丁基羥基甲苯(BHT)市場的穩定成長。

北美丁基羥基甲苯 (BHT) 市場分析

- 丁基羥基甲苯(BHT)是一種合成酚類抗氧化劑,因其卓越的抗氧化能力、延長保質期和維持產品品質的特性,被廣泛應用於食品飲料、化妝品、塑膠、動物飼料和製藥等行業。其化學穩定性和多功能性使其成為保護產品免受熱、光和氧氣侵害的關鍵添加劑。

- BHT需求的成長主要受加工食品消費量增加、個人護理和聚合物產業擴張以及對高效防腐劑和穩定劑的需求所驅動。此外,生產技術的進步以及在潤滑劑和包裝材料等領域應用範圍的擴大也推動了北美市場的成長。

- 由於快速的工業化、加工食品產量的增加以及化妝品和塑膠製造業的強勁需求,預計到 2025 年,美國將主導北美丁基羥基甲苯 (BHT) 市場,佔據約 84.02% 的最大收入份額,並且也是成長最快的市場。

- 預計到2025年,技術級BHT將佔據北美BHT市場的主導地位,市佔率將超過38.65%,主要歸功於其在塑膠、橡膠、潤滑油、生物柴油和工業油等領域的廣泛應用。 BHT具有優異的熱穩定性、高純度以及防止非食品產品氧化降解的能力,使其成為工業製造過程中的首選。此外,市場對聚合物抗氧化劑和燃料穩定劑的需求不斷增長,進一步鞏固了技術級BHT在北美市場的領先地位。

報告範圍及北美丁基羥基甲苯(BHT)市場細分

|

屬性 |

丁基羥基甲苯 (BHT) 主要市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

北美丁基羥基甲苯(BHT)市場趨勢

“透過研發和更安全的抗氧化劑替代品實現創新和功能擴展”

- 北美丁基羥基甲苯 (BHT) 市場的一個顯著且加速發展的趨勢是,企業越來越重視創新和研發,致力於開發更安全、更有效率且更具應用針對性的抗氧化劑解決方案。食品飲料、製藥、化妝品和聚合物等行業正增加對先進配方的投資,以提高氧化穩定性、延長保質期並改善產品性能,同時確保符合不斷變化的安全和環境標準。

- 例如,伊士曼化學公司、朗盛公司和凱敏工業公司等行業領導者正在投資研發高純度、低毒性的BHT配方,並探索其與生育酚和抗壞血酸棕櫚酸酯等天然抗氧化劑的協同增效組合。這些創新旨在保持產品功效的同時,減少傳統抗氧化劑可能帶來的健康和生態問題。

- 在食品飲料產業,持續的研發工作致力於優化BHT的濃度和輸送系統,以提高其在複雜食品基質、油脂中的抗氧化功效。同樣,在化妝品和個人護理行業,BHT也被應用於抗衰老、保濕和防曬產品的先進配方中,幫助穩定活性成分,並防止護膚成分的氧化損傷。

- 在製藥和營養保健品應用中,受控 BHT 配方正在被評估其增強藥物穩定性、保護活性成分免受氧化以及延長產品保質期的能力,從而支持生產更可靠、更持久的配方。

- 工業和聚合物領域也正經歷技術革新,製造商們正在開發用於橡膠、塑膠、潤滑劑和燃料的客製化BHT基穩定劑。這些創新旨在提高耐熱性、防止聚合物降解並確保合成材料的長期耐久性。

- 在研發驅動下,BHT正不斷發展演進,從一種傳統的防腐劑轉型為一種高性能、多功能的抗氧化劑,並在現代工業領域擁有更廣泛的應用前景。因此,市場格局正在重塑,各方致力於平衡功效、安全性和永續性,推動產品轉向符合北美監管和環境目標的環保配方和混合抗氧化體系。

北美丁基羥基甲苯(BHT)市場動態

司機

“對更安全、更永續、更有效率的抗氧化劑解決方案的需求日益增長”

- 隨著各行業尋求在產品效率與環境和健康因素之間取得平衡,北美丁基羥基甲苯 (BHT) 市場正經歷著向可持續、安全且高性能化學添加劑的明顯轉變。儘管 BHT 因其優異的氧化穩定性和成本效益而仍然是重要的合成抗氧化劑,但製造商正日益關注開發更環保的配方,並探索將 BHT 與天然抗氧化劑相結合的混合配方,以滿足清潔標籤和監管要求。

- 例如,包括伊士曼化學公司和朗盛公司在內的多家企業正積極投資綠色化學創新,以提高BHT基產品的安全性並減少其環境足跡。這些舉措與行業日益增長的趨勢相符,即在保持食品、聚合物和化妝品應用領域性能效率的同時,採用可持續的生產流程和生物基原材料。

- 在食品飲料產業,BHT 的使用日益廣泛,其濃度需精確控制,以防止油脂、穀物和零食產品氧化。同時,持續的研發工作致力於將天然輔助抗氧化劑融入產品,以開發更安全的配方。同樣,個人護理和化妝品行業也在護膚品、防曬霜和彩妝產品中添加精製 BHT,以確保產品穩定性,同時保障消費者安全,從而響應消費者對更清潔、更可持續成分日益增長的需求。

- 由於BHT基穩定劑已被證實能夠有效保護橡膠、塑膠和潤滑劑等材料免受氧化損傷,因此工業和聚合物領域對其需求日益增長。然而,目前人們的關注點正轉向低排放、高能源效率的生產方法以及符合北美永續發展標準的無毒穩定劑體系。

- 這種向環境友善和安全至上的抗氧化劑解決方案的穩步轉型預計將塑造BHT市場的未來發展軌跡。隨著監管框架的日益嚴格和消費者意識的不斷增強,對優化、可持續和多功能BHT配方的需求將持續增長,使BHT成為傳統合成抗氧化劑和新一代環保防腐技術之間的橋樑。

克制/挑戰

“對石油化學原料的依賴”

- 北美丁基羥基甲苯 (BHT) 市場仍嚴重依賴石油化學衍生的原料,例如對甲酚和異丁烯。這種對不可再生原料的依賴帶來了巨大的永續性和供應鏈挑戰,尤其是在原油價格波動和日益增長的碳排放監管壓力下。儘管 BHT 仍然是各行業必不可少的合成抗氧化劑,但石油基中間體的供應有限以及其生產過程中存在的環境問題,促使人們呼籲尋找替代的、更環保的原料來源。

- 根據多項行業分析,生物基BHT類似物和可再生合成路線的開發正日益受到關注,這反映了北美地區向永續化學發展的更廣泛趨勢。研究人員和製造商正在探索利用從農業或木質纖維素生物質中提取的生物基酚類和烯烴作為石油化學原料的潛在替代品。然而,由於生產成本高、產率有限以及需要進行技術優化,此類生物基替代品的商業化生產仍處於早期階段。

- 對石化資源的依賴也使BHT市場易受供應波動、地緣政治動盪和價格不穩定的影響,這可能會影響主要參與者的生產計劃和獲利能力。此外,日益嚴格的VOC排放和石化廢棄物管理相關環境法規正迫使製造商重新評估其採購策略,並投資於更清潔、更循環的生產模式。

- 儘管BHT的化學合成技術已相對成熟,但其生產過程的高能耗以及前驅化學品的環境影響仍然令人擔憂。向生物基或混合型抗氧化劑系統的過渡被視為一種長期解決方案;然而,此類技術的規模化應用需要大量的研發投入、扶持性政策以及跨行業的合作。

- 在建立具有成本效益和商業可行性的可再生途徑之前,BHT 產業對石化原料的依賴將繼續帶來營運、經濟和環境方面的挑戰,從而限制其與北美永續發展目標和日益增長的綠色化學解決方案需求完全保持一致的能力。

北美丁基羥基甲苯 (BHT) 市場範圍

市場按純度等級、功能、配方、包裝形式和應用進行細分。

- 按純度等級

根據純度等級,北美丁基羥基甲苯 (BHT) 市場可分為技術級、工業級、食品級、化妝品級、醫藥級和其他等級。預計到 2025 年,技術級 BHT將佔據最大的市場份額,達到 38.65%,這主要得益於其在塑膠、橡膠和潤滑劑等工業應用中的廣泛使用,在這些應用中,抗氧化保護至關重要。

- 按功能

根據功能性,北美丁基羥基甲苯 (BHT) 市場可細分為食品和飼料防腐劑、聚合物和燃料穩定劑、化妝品和藥品穩定劑以及其他用途。預計到 2025 年,食品和飼料防腐劑將佔據主導地位,這主要得益於包裝和加工食品對延長保質期的需求不斷增長、北美食品消費量不斷攀升,以及 BHT 作為一種獲批的動物飼料抗氧化劑,在保持產品新鮮度和營養品質方面日益廣泛應用。

- 透過配方

根據劑型,北美丁基羥基甲苯 (BHT) 市場分為液體和粉末兩種。預計到 2025 年,液體 BHT將繼續佔據市場主導地位,佔據最大的市場份額,這主要歸功於其優異的溶解性、易於與其他配方混合,以及在潤滑油、燃料和化妝品等行業中日益增長的需求——在這些行業中,均勻分散和快速混合對於產品的性能和穩定性至關重要。

- 按包裝形式

根據包裝形式,北美丁基羥基甲苯 (BHT) 市場可分為 IBC 噸桶、散裝桶和其他包裝形式。由於IBC 噸桶具有儲存容量大、運輸便利、成本效益高等優點,預計到 2024 年,其市場份額將佔據最大份額。 IBC 噸桶便於搬運,降低了洩漏風險,是需要大量運輸且物流高效的行業的理想選擇。

- 透過申請

根據應用領域,北美丁基羥基甲苯 (BHT) 市場可細分為聚合物穩定劑/塑膠產業、食品產業、動物飼料、化妝品原料、燃料/油品添加劑、農藥製劑、橡膠及其他領域。 2024年,聚合物穩定劑/塑膠產業細分市場佔據最大的市場份額,這主要得益於包裝、汽車和建築等產業對耐用持久塑膠產品的需求不斷增長。 BHT 能夠有效防止聚合物降解並增強材料穩定性,因此被廣泛應用,並在北美塑膠生產和消費不斷增長的背景下,推動了該行業的成長。

北美丁基羥基甲苯 (BHT) 市場區域分析

- 預計在預測期內,北美市場將以 6.39% 的複合年增長率大幅增長,這主要得益於食品、包裝和化妝品應用領域對高性能、合規抗氧化劑添加劑的需求不斷增長。

- 此外,該地區日益重視產品品質提升、成本效益高的保鮮方式以及對食品安全法規的遵守,正在加速市場需求。終端用戶產業(包括食品飲料、塑膠和潤滑油等)的強勁發展,以及不斷壯大的中產階級對耐用消費品的偏好,共同推動了亞太地區的市場持續擴張。

- 生產技術的進步、原材料的本地化供應以及旨在開發更安全、更高效抗氧化劑配方的研發投入不斷加大,進一步鞏固了BHT的廣泛應用。此外,該地區向永續生產方式的轉型以及平衡的監管框架的完善,也持續推動BHT在工業和消費領域的受控使用。

美國北美丁基羥基甲苯 (BHT) 市場洞察

預計到2025年,美國北美丁基羥基甲苯(BHT)市場將佔據北美地區的主導地位,這主要得益於食品飲料、化妝品、塑膠和製藥等行業對高效合成抗氧化劑日益增長的需求。加工食品和包裝食品消費量的成長,以及消費者對產品穩定性和保存期限的日益關注,顯著推動了BHT作為防腐劑的應用。此外,美國先進的製造業基礎、強大的研發能力以及不斷完善的食品安全和化學品使用監管框架,也持續支撐著市場的穩定擴張。

對綠色化學創新和更安全BHT配方研發的日益重視也影響了市場動態。美國主要公司正投資改進生產技術,以減少對環境的影響並提高BHT基抗氧化劑的效率。此外,BHT在聚合物穩定劑、潤滑劑和個人護理產品中的廣泛應用,鞏固了其作為美國工業領域關鍵抗氧化劑的地位。

北美丁基羥基甲苯 (BHT) 市佔率

丁基羥基甲苯 (BHT) 產業主要由一些成熟企業主導,其中包括:

- 本州化學工業株式會社(日本)

- 阿澤利斯(比利時)

- KEMIN INDUSTRIES, INC.(美國)

- 伊士曼化學公司(美國)

- 薩索爾(南非)

- 朗盛(德國)

- 安徽海華化工技術集團有限公司(中國)

- VDH CHEM TECH PVT. LTD.(印度)

- IMPEXTRACO NV(比利時)

- 山東和思化工有限公司(中國)

- OXIRIS CHEMICALS SA(西班牙)

- 合肥天傑化工有限公司(中國)

- 中菲原料(中國)

北美丁基羥基甲苯 (BHT) 市場最新動態

- 2024年12月,Clean Fino-Chem有限公司位於浦那MIDC Kurkumbh工業園區的生產基地正式啟動了丁基羥基甲苯(BHT)的商業化生產。此次分階段生產充分利用了現有基礎設施,無需大量額外投資即可實現高效規模化生產。此舉鞏固了Clean Fino-Chem在抗氧化劑市場的地位,並與其現有的BHA、TBHQ和抗壞血酸棕櫚酸酯等抗氧化劑產品形成互補。公司計畫年產2,000至3,000噸BHT,目標市場為北美(包括歐洲、美國和拉丁美洲),預計此次擴產將帶來6,000萬至8,000萬印度盧比的收入成長。這項進展將進一步提升Clean Fino-Chem在蓬勃發展的北美BHT市場的競爭力。

- 2023年10月,該公司強調BHT主要用作食品/飼料添加劑,並著重介紹了其作為領先的BHT生產商,擁有不斷擴大的生產能力。此外,為了滿足客戶需求,該公司還推出了桶裝包裝(90公斤/桶),從而改善了北美市場BHT出口的包裝和物流。這些措施體現了上海精工致力於透過產品品質和包裝創新,不斷鞏固其在北美BHT市場的地位。

- 2025年7月,KANEBO將推出全新乳霜組合“日霜II”和“晚霜II”,其靈感源自胎脂——新生兒肌膚上那層乳狀的保護層。這項創新基於新研發的TAISHI™複合物,旨在模擬胎脂的保濕和強化肌膚屏障的功能。日霜可抵禦紫外線和乾燥,同時還能作為妝前乳使用;晚霜則可在夜間發揮緊緻和減少皺紋的功效。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PATENT ANALYSIS

4.1.1 PATENT FILING LANDSCAPE & VOLUME TRENDS

4.1.2 KEY ASSIGNEES AND ACTIVE FILERS

4.1.3 TECHNOLOGY FOCUS AREAS (WHAT PATENT FAMILIES COVER)

4.1.4 GEOGRAPHIC DISTRIBUTION & JURISDICTIONAL STRATEGY

4.1.5 PATENTABILITY CHALLENGES & FREEDOM-TO-OPERATE (FTO) NOTES

4.1.6 LICENSING, COMMERCIALIZATION & PARTNERSHIP OPPORTUNITIES

4.1.7 IP TRENDS & STRATEGIC RECOMMENDATIONS (NEXT 3–5 YEARS)

4.2 VALUE CHAIN ANALYSIS

4.2.1 RAW MATERIAL PROCUREMENT

4.2.2 MANUFACTURING & PROCESSING

4.2.3 PACKAGING & STORAGE

4.2.4 DISTRIBUTION & LOGISTICS

4.2.5 END-USE INDUSTRIES

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.4 BRAND OUTLOOK

4.4.1 BRAND COMPARATIVE ANALYSIS OF NORTH AMERICA URO-GYNECOLOGY MARKET

4.4.2 PRODUCT VS BRAND OVERVIEW

4.4.2.1 PRODUCT OVERVIEW

4.4.2.2 BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.6 CONSUMERS BUYING BEHAVIOUR

4.6.1 PRICE SENSITIVITY

4.6.2 HEALTH & SAFETY CONCERNS

4.6.3 SUSTAINABILITY PREFERENCE

4.6.4 BRAND & TRUST FACTOR

4.6.5 REGIONAL PREFERENCES

4.6.6 INDUSTRIAL VS. CONSUMER DEMAND

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COSTS

4.7.2 MANUFACTURING & PROCESSING COSTS

4.7.3 LOGISTICS & DISTRIBUTION COSTS

4.7.4 REGULATORY COMPLIANCE COSTS

4.7.5 MARGIN & PROFITABILITY CONSIDERATIONS

4.8 INDUSTRY ECO-SYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM SIZE COMPANIES

4.8.3 END USERS

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.9.1.1 JOINT VENTURES

4.9.1.2 MERGERS AND ACQUISITIONS

4.9.1.3 LICENSING AND PARTNERSHIP

4.9.1.4 TECHNOLOGY COLLABORATIONS

4.9.1.5 STRATEGIC DIVESTMENTS

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 RAW MATERIAL COVERAGE

4.10.1 TOLUENE

4.10.2 P-CRESOL

4.10.3 ISOBUTYLENE

4.10.4 CATALYSTS

4.10.5 SOLVENTS

4.10.6 ADDITIVES & PROCESSING AIDS

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTICS COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS

4.12.1 ADVANCED SYNTHESIS METHODS

4.12.2 GREEN CHEMISTRY & SUSTAINABILITY

4.12.3 AUTOMATION & DIGITALIZATION

4.12.4 APPLICATION INNOVATIONS

4.12.5 QUALITY ENHANCEMENT & SAFETY TECHNOLOGIES

4.13 TARIFFS AND THEIR IMPACT ON MARKET

4.13.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.13.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.13.3 VENDOR SELECTION CRITERIA DYNAMICS

4.13.4 IMPACT ON SUPPLY CHAIN

4.13.4.1 RAW MATERIAL PROCUREMENT

4.13.4.2 MANUFACTURING AND PRODUCTION

4.13.4.3 LOGISTICS AND DISTRIBUTION

4.13.4.4 PRICE PITCHING AND POSITION OF MARKET

4.13.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.13.5.1 SUPPLY CHAIN OPTIMIZATION

4.13.5.2 JOINT VENTURE ESTABLISHMENTS

4.13.6 IMPACT ON PRICES

4.13.7 REGULATORY INCLINATION

4.13.7.1 GEOPOLITICAL SITUATION

4.13.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.13.7.2.1 FREE TRADE AGREEMENTS

4.13.7.2.2 ALLIANCE ESTABLISHMENTS

4.13.7.3 STATUS ACCREDITATION (INCLUDING MFN)

4.13.8 DOMESTIC COURSE OF CORRECTION

4.13.8.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.13.8.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

4.14 REGULATORY COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR ANTIOXIDANTS IN PROCESSED FOOD AND BEVERAGES

5.1.2 GROWING CONSUMPTION OF PLASTIC AND RUBBER PRODUCTS IN AUTOMOTIVE AND PACKAGING INDUSTRIES

5.1.3 INCREASING USAGE OF BHT IN PERSONAL CARE AND COSMETIC FORMULATIONS

5.1.4 EXPANSION OF FUEL AND LUBRICANT ADDITIVE MARKETS IN EMERGING ECONOMIES

5.2 RESTRAINTS

5.2.1 HEALTH AND ENVIRONMENTAL CONCERNS RELATED TO SYNTHETIC ANTIOXIDANTS

5.2.2 STRINGENT REGULATORY RESTRICTIONS IN REGIONS LIKE THE EU AND JAPAN

5.3 OPPORTUNITY

5.3.1 RISING ADOPTION OF BHT IN ANIMAL FEED ADDITIVES FOR SHELF-LIFE ENHANCEMENT

5.3.2 GROWTH IN DEMAND FROM PHARMACEUTICAL EXCIPIENT APPLICATIONS

5.3.3 EXPANSION OF BHT APPLICATIONS IN EMERGING SECTORS LIKE BIOFUELS AND AGROCHEMICALS

5.4 CHALLENGES

5.4.1 VOLATILITY IN RAW MATERIAL PRICES IMPACTING PRODUCTION COSTS

5.4.2 INCREASING SHIFT TOWARD NATURAL ANTIOXIDANTS SUCH AS TOCOPHEROLS AND ROSEMARY EXTRACT

6 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE

6.1 OVERVIEW

6.2 TECHNICAL GRADE

6.3 INDUSTRIAL GRADE

6.4 FOOD GRADE

6.5 COSMETIC GRADE

6.6 PHARMACEUTICAL GRADE

6.7 OTHERS

7 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY

7.1 OVERVIEW

7.2 FOOD AND FEED PRESERVATIVES

7.3 POLYMER & FUEL STABILIZER

7.4 COSMETIC & PHARMACEUTICAL STABILIZER

7.5 OTHERS

8 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION

8.1 OVERVIEW

8.2 LIQUID

8.3 POWDER

9 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT

9.1 OVERVIEW

9.2 IBC TOTES

9.3 BULK DRUMS

9.4 OTHERS

10 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 POLYMER STABILIZERS/PLASTIC INDUSTRY

10.3 FOOD INDUSTRY

10.4 ANIMAL FEED

10.5 COSMETIC INGREDIENTS

10.6 FUEL/OIL ADDITIVES

10.7 PESTICIDE FORMULATIONS

10.8 RUBBER

10.9 OTHERS

11 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 EASTMAN CHEMICAL COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 SASOL

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 JIANGXI ALPHA HI-TECH PHARMACEUTICAL CO., LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 AARNEE INTERNATIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 ASESCHEM

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ANHUI HAIHUA CHEMICAL TECHNOLOGY GROUP CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CLEAN FINO-CHEM LIMITED.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EABC GLOBAL

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 GUANGZHOU ZIO CHEMICAL CO., LTD.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HANGZHOU KEYING CHEM CO.,LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 JINAN FUTURE CHEMICAL CO.,LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 LANXESS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 MP BIOMEDICALS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SCIMPLIFY

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHANDONG HOSEA CHEMICAL CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SHANGHAI DEBORN CO., LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SHANGHAI EXQUISITE BIOCHEMICAL CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SIGMA ALDRICH (SUBSIDIARY OF MERCK KGAA)

14.19.1 COMPANY SNAPSHOT

14.19.2 RECENT FINANCIALS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 SILVERLINE CHEMICALS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

14.21 SINOFI INGREDIENTS

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 KAO CORPORATION

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENT

14.23 VDH CHEM TECH PVT LTD

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT DEVELOPMENT

14.24 ZHENGZHOU CHORUS LUBRICANT ADDITIVE CO., LTD.

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT DEVELOPMENT

14.25 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO.,LTD.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA TECHNICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA INDUSTRIAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA FOOD GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA COSMETIC GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA PHARMACEUTICAL GRADE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA FOOD AND FEED PRESERVATIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA POLYMER & FUEL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA COSMETIC & PHARMACEUTICAL STABILIZER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA LIQUID IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA POWDER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA IBC TOTES IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA BULK DRUMS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA POLYMER STABILIZERS/ PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA POLYMER STABILIZERS/PLASTIC INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA FRAGRANCES & PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA FUEL/OIL ADDITIVE IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA PESTICIDE FORMULATION IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA OTHERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 71 NORTH AMERICA

TABLE 72 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 73 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 74 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 75 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 76 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 77 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 NORTH AMERICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 NORTH AMERICA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 80 NORTH AMERICA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 NORTH AMERICA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 NORTH AMERICA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 NORTH AMERICA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 NORTH AMERICA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 85 NORTH AMERICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 86 NORTH AMERICA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 NORTH AMERICA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 NORTH AMERICA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 NORTH AMERICA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 NORTH AMERICA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 NORTH AMERICA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 NORTH AMERICA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NORTH AMERICA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NORTH AMERICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 96 NORTH AMERICA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NORTH AMERICA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NORTH AMERICA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 NORTH AMERICA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 NORTH AMERICA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 NORTH AMERICA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 NORTH AMERICA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NORTH AMERICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NORTH AMERICA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 105 NORTH AMERICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORTH AMERICA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 107 NORTH AMERICA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORTH AMERICA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NORTH AMERICA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NORTH AMERICA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORTH AMERICA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORTH AMERICA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NORTH AMERICA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NORTH AMERICA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 117 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 118 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 119 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 120 U.S. BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 U.S. POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 U.S. POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 123 U.S. PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 U.S. FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 U.S. INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 U.S. FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.S. FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 128 U.S. FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 129 U.S. FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.S. PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.S. PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.S. BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 U.S. SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.S. CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.S. DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.S. BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.S. SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.S. ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 139 U.S. ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.S. COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.S. SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.S. HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.S. MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.S. BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.S. FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.S. FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.S. FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 148 U.S. PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.S. PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 150 U.S. CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.S. FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.S. VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.S. OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.S. COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.S. RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.S. SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.S. SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 160 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 CANADA PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 CANADA BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 CANADA SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 CANADA CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 CANADA DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 CANADA BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 CANADA SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 CANADA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 182 CANADA ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 CANADA COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 CANADA SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 CANADA HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 CANADA MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 CANADA BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 CANADA FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 CANADA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 CANADA FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 191 CANADA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 CANADA PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 193 CANADA CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 CANADA FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 CANADA VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 CANADA OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 CANADA COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 CANADA RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 CANADA SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 CANADA SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE, 2018-2032 (TONS)

TABLE 203 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTIONALITY, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY PACKING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO BUTYLATED HYDROXYTOLUENE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO POLYMER STABILIZERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO FOOD CONTACT PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO INDUSTRIAL PACKAGING IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO FOOD INDUSTRY IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO FOOD ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO FOOD MODIFIERS IN BUTYLATED HYDROXYTOLUENE MARKET, BY FOOD TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY ANIMAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO PROCESSED MEAT PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO BAKERY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO SNACK FOODS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO CEREALS AND GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO DAIRY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO BEVERAGES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO SAUCES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED ADDITIVES, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO ANIMAL FEED IN BUTYLATED HYDROXYTOLUENE MARKET, BY FEED TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO COSMETIC INGREDIENTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO SKIN CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO HAIR CARE PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO MAKEUP & COLOR COSMETICS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO BATH & BODY PRODUCTS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MEXICO FRAGRANCES AND PERFUMES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MEXICO FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MEXICO FUEL OIL ADDITIVES IN BUTYLATED HYDROXYTOLUENE MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 234 MEXICO PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MEXICO PESTICIDE FORMULATIONS IN BUTYLATED HYDROXYTOLUENE MARKET, BY CROP, 2018-2032 (USD THOUSAND)

TABLE 236 MEXICO CEREALS & GRAINS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 MEXICO FRUITS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 MEXICO VEGETABLES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 MEXICO OILSEEDS & PULSES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 MEXICO COMMERCIAL CROPS IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 MEXICO RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 MEXICO SYNTHETIC RUBBER IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 MEXICO SYNTHETIC RUBBER LATTICES IN BUTYLATED HYDROXYTOLUENE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 SIX SEGMENTS COMPRISE THE NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET, BY PURITY GRADE(2024)

FIGURE 15 RISING DEMAND FOR ANTIOXIDANTS IN PROCESSED FOOD AND BEVERAGES IS EXPECTED TO DRIVE THE NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 TECHNICAL GRADE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET IN 2025 & 2032

FIGURE 17 TOTAL PATENTS IN THE NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET

FIGURE 18 TOTAL PATENTS IN THE BUTYLATED HYDROXYTOLUENE MARKET BY COUNTRY

FIGURE 19 TOTAL PATENTS IN THE BUTYLATED HYDROXYTOLUENE MARKET UNDER IPC CODE

FIGURE 20 VALUE CHAIN OF NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DROC ANALYSIS

FIGURE 23 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: BY PURITY GRADE, 2024

FIGURE 24 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: BY FUNCTIONALITY, 2024

FIGURE 25 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: BY FORMULATION, 2024

FIGURE 26 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: BY PACKAGING FORMAT, 2024

FIGURE 27 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: BY APPLICATION, 2024

FIGURE 28 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA BUTYLATED HYDROXYTOLUENE MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。