North America Cocoa Market

市场规模(十亿美元)

CAGR :

%

USD

9.68 Billion

USD

13.55 Billion

2024

2032

USD

9.68 Billion

USD

13.55 Billion

2024

2032

| 2025 –2032 | |

| USD 9.68 Billion | |

| USD 13.55 Billion | |

|

|

|

|

北美可可市場細分,按產品類型(可可粉和可可餅、可可脂、可可豆、可可液塊和可可糊、可可碎粒及其他)、性質(傳統和有機)、可可品種(福拉斯特羅可可、特立尼達可可和克里奧羅可可)、分銷渠道(直接和間接)、應用(膳食補充劑、食品和飲料、飲料、藥物以及克里奧羅可可)、分銷渠道(直接和間接)、應用(膳食補充劑、食品和飲料、飲料、藥品以及2032年的行業劃分趨勢

北美洲可可市場規模

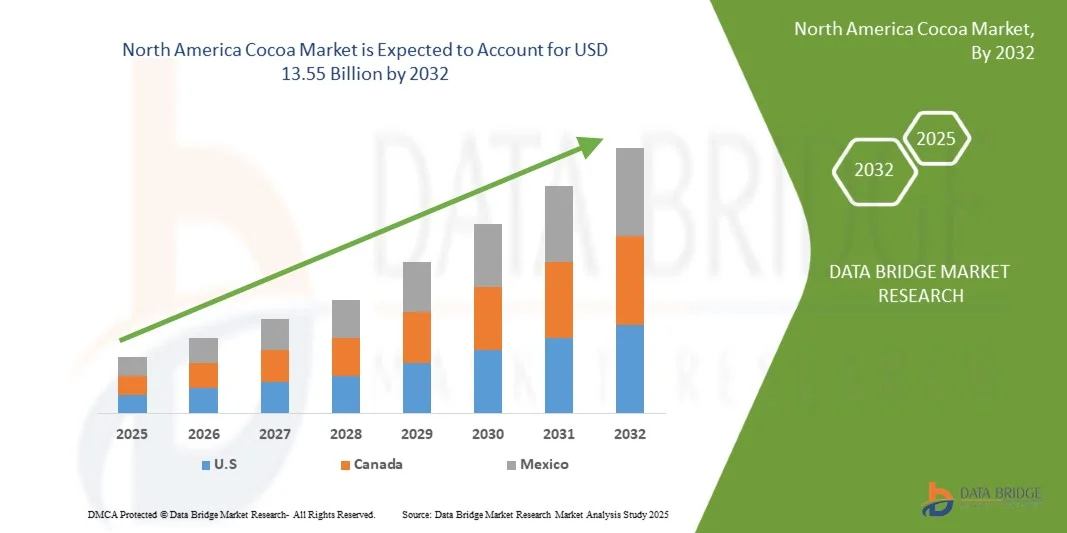

- 2024年北美可可市場價值為96.8億美元,預計到2032年將達到135.5億美元,預測期內複合年增長率為4.4% 。

- 市場成長主要得益於消費者對優質、有機和永續來源可可產品的需求不斷增長,而這種需求的驅動力又源於人們對黑巧克力和富含類黃酮的可可所帶來的健康益處的認識不斷提高。消費者對清潔標籤和符合道德規範生產的原料的日益青睞,促使製造商採用透明且可追溯的供應鏈,從而增強消費者信任度和品牌價值。

- 此外,可可的應用範圍不斷擴大,涵蓋糖果、飲料、化妝品和營養保健品等領域,加上植物性和低糖巧克力等產品配方不斷創新,正在加速市場對可可的接受度。這些因素共同推動了可可產業的成長,並使其成為食品飲料領域的重要組成部分。

北美洲可可市場分析

- 北美可可市場主要受各類消費族群對巧克力和糖果產品日益增長的需求所驅動。巧克力仍然是全球最受歡迎的休閒食品之一,在已開發經濟體和新興經濟體的消費量均穩定成長。可可作為巧克力生產的主要原料,其需求隨著巧克力產業的蓬勃發展而直接激增。消費者生活方式的轉變、可支配收入的增加以及高端和手工巧克力市場的擴張等因素,進一步推動了這一趨勢。

- 新興趨勢包括對純素食和植物性可可產品的需求不斷增長,可可功能性和強化食品不斷創新,以及單一產地和特殊可可品種越來越受歡迎。

- 預計到 2025 年,美國將主導北美可可市場,佔據 77.54% 的最大收入份額,這主要歸功於人們對純素食和植物性可可產品的需求不斷增長。

- 預計在預測期內,美國將成為市場成長最快的國家,複合年增長率達 4.5%,這主要得益於可可飲料日益增長的人氣以及種類繁多的飲料產品,包括傳統熱巧克力、即飲可可飲料、風味牛奶、蛋白奶昔和功能性健康飲料。

- 由於可可粉在化妝品和個人護理產品中的應用日益廣泛,預計到 2025 年,可可粉和可可餅細分市場將主導北美可可市場,市場份額將達到 37.40%。

報告範圍及北美可可市場細分

|

屬性 |

北美可可市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

北美可可市場趨勢

“巧克力和糖果產品需求不斷增長”

- 北美可可市場的一個顯著趨勢是由不同消費群對巧克力和糖果產品的需求不斷增長所驅動的。

- 可可作為巧克力生產的主要原料,其需求隨著巧克力產業的蓬勃發展而直接成長。消費者生活方式的改變、可支配收入的增加以及高端和手工巧克力市場的擴張等因素,都進一步推動了這一趨勢。

- 例如,2024年5月,費列羅正式啟用其位於美國的巧克力加工廠,該工廠佔地7萬平方英尺,旨在為健達、費列羅Rocher、Butterfinger和Crunch等主要品牌提供服務。

- 糖果製造商的產品創新,包括推出異國風味、具有健康益處的功能性巧克力以及永續採購聲明,擴大了消費者的吸引力。

北美可可市場動態

司機

“人們對可可的健康和抗氧化功效的認識不斷提高”

- 推動北美可可市場發展的關鍵趨勢之一是,人們對可可的健康益處認識不斷提高,這已成為市場發展的強勁動力。

- 可可天然富含黃酮類化合物、多酚和其他抗氧化劑,這些物質與多種健康益處有關,包括改善心血管健康、改善血液循環和降低慢性病的風險。

- 例如,2024年11月,伯明罕大學的研究人員發現,在食用高脂肪餐後攝取富含黃烷醇的可可,即使在精神壓力下,也能在長達90分鐘的時間內顯著改善血液流動和血管功能,這表明可可對心血管健康在具有挑戰性的飲食條件下具有保護作用。

- 健康生活方式的興起,以及預防性醫療保健的普及,正推動可可的應用領域不斷拓展,涵蓋可可飲料、蛋白粉和美容產品等。隨著消費者對可可營養價值的了解不斷加深,市場預計將受益於持續的需求,從而在傳統巧克力製造以外的多個行業中開闢新的成長途徑。

- 製造商正利用這種意識,推廣「黑巧克力」和「高可可含量」產品,這些產品比牛奶巧克力含有更高水平的有益成分。

機會

“對純素和植物性可可製品的需求不斷增長”

- 受道德、環境和健康因素的驅動,素食主義和植物性生活方式的日益普及,正在推動對不含乳製品的可可製品的需求增長。

- 可可是一種天然植物萃取物,與糖果、烘焙和飲料行業的純素食主義趨勢非常契合。

- 不含乳製品的黑巧克力、植物性可可飲料和純素可可醬等產品創新也越來越受歡迎。

- 植物奶替代品(杏仁奶、燕麥奶和豆奶)的興起促進了不含乳製品的濃鬱可可飲品的開發。

- 2023 年,百樂嘉利寶 (Barry Callebaut) 報告稱,使用可可脂和植物奶的純素巧克力品牌獲得了強勁的市場反響,吸引了注重健康和可持續發展的消費者。

- 高端品牌正在提供符合道德規範、有機且採用永續包裝的純素可可產品,尤其是在蓬勃發展的北美地區。

克制/挑戰

“糖果生產中替代原料帶來的日益激烈的競爭”

- 影響北美可可市場的主要限制因素之一是來自糖果生產中替代原料日益激烈的競爭。可可價格上漲,加上氣候變遷和作物病害造成的供應不確定性,促使生產商尋求更具成本效益的替代品。

- 角豆、合成可可香精和其他植物性替代品等成分正越來越多地被用於部分或完全替代巧克力、烘焙食品和飲料中的可可。

- 先進的食品技術使得可可風味替代品和混合產品的研發成為可能,這些產品在減少可用量的同時,也能保持可可的口感和質地。這種轉變在大眾市場糖果品牌中尤其顯著,這些品牌力求在不犧牲消費者吸引力的前提下,維持價格競爭力。

- 雖然這些替代品可能無法完全複製可可的優質品質,但它們在某些消費群體中日益受到歡迎,這對可可的需求構成了挑戰。

北美可可市場範圍

北美可可市場按產品類型、性質、可可種類、分銷管道和應用進行細分。

- 產品類型

依產品類型,可可市場可分為可可粉及可可塊、可可脂、可可豆、可可液塊及可可糊、可可碎粒及其他產品。預計到2025年,可可粉及可可塊將佔據市場主導地位,市佔率將達37.40%。可可粉及可可塊市場的主導地位可歸因於其在巧克力製造、烘焙和飲料配方中的廣泛應用。其易於儲存、保質期長且適用於大規模生產工藝,因此深受食品加工商的青睞。

由於對優質和單一產地巧克力的需求不斷增長,手工和工藝應用中生可可的使用量不斷增加,以及消費者對加工最少的天然成分的偏好日益增強,預計可可豆細分市場在預測期內將以 5.2% 的複合年增長率實現最高增長。

- 自然

依生產方式,可可市場可分為傳統可可和有機可可。預計到2025年,傳統可可將佔據市場主導地位,市佔率高達92.82%。傳統可可的優勢主要源自於其成本效益、成熟的供應鏈和大規模生產能力。傳統可可品質穩定,是面向大眾市場的生產商的理想選擇。

由於消費者對健康和保健的意識不斷提高,預計有機食品領域在預測期內將以 5.0% 的複合年增長率實現最高增長。

- 可可的種類

根據可可豆的類型,市場可分為福拉斯特羅可可豆、特立尼達可可豆和克里奧羅可可豆。預計到2025年,福拉斯特羅可可豆將佔據主導地位,市佔率達83.53%。福拉斯特羅可可豆的優勢可歸因於其適應性強、品質穩定且適合大規模生產。其區域性種植佈局有利於規模經濟,並滿足了大型巧克力生產商的需求。此外,其強健的植株不易受病蟲害侵襲,確保了穩定的供應和可負擔的價格,從而推動了其快速普及和市場持續成長。

由於產量高、生產成本低、種植廣泛,福拉斯特羅可可預計在預測期內將以 4.5% 的複合年增長率增長。

- 分銷管道

根據分銷管道,市場可分為間接通路和直接通路。預計到2025年,間接通路將佔據主導地位,市佔率達77.35%。間接通路的優勢得益於成熟的零售、批發和分銷網絡,這些網絡能夠幫助可可產品在已開發市場和新興市場獲得銷售。間接通路具有更優的物流、更廣泛的地域覆蓋和規模經濟效益,尤其對於透過超市、批發商和餐飲服務商分銷的製造商而言,這些優勢推動了間接通路的快速普及和市場持續成長。

預計在預測期內,間接銷售部分將以 4.9% 的複合年增長率實現最高增長,這主要得益於電子商務平台的快速擴張、在線零售渠道的日益普及以及消費者對便捷購買方式的偏好不斷增強。

- 應用

根據應用領域,可可市場可分為膳食補充品、食品飲料、飲料、藥品、個人護理和化妝品。預計到2025年,膳食補充劑領域將佔據主導地位,市佔率達39.78%。膳食補充劑領域的領先地位歸功於人們對可可健康益處的日益認可,包括其抗氧化特性、改善情緒和維護心血管健康等功效。可可補充劑正日益融入註重健康的飲食和功能性營養產品中,尤其是在已開發市場,預防性健康已成為一大趨勢,這推動了可可補充劑的快速普及和市場持續增長。

預計在預測期內,食品飲料行業將以 5.0% 的複合年增長率實現最高增長,這主要得益於對可可零食、烘焙產品和乳製品替代品的需求不斷增長。

北美可可市場區域分析

- 預計到 2025 年,美國將主導北美可可市場,佔據 77.54% 的最大市場份額,這主要歸功於人們對純素食和植物性可可產品的需求不斷增長。

- 預計在預測期內,美國將成為市場成長最快的國家,複合年增長率達 4.5%,這主要得益於可可飲料日益增長的人氣以及種類繁多的飲料產品,包括傳統熱巧克力、即飲可可飲料、風味牛奶、蛋白奶昔和功能性健康飲料。

- 北美可可市場正經歷穩定成長,這主要得益於幾個關鍵因素。其中一個主要驅動因素是消費者對巧克力、糖果和烘焙食品等可可製品的需求不斷增長,而這又受到城市人口增長和可支配收入增加的推動。隨著消費者偏好轉向西式飲食和高熱量食品,巧克力和可可製品的消費日益普及,尤其是在該地區的城市中心。此外,食品飲料產業的擴張以及消費者對功能性食品和膳食補充劑日益增長的興趣,也進一步推動了可可在不同領域的應用。同時,由於消費者健康意識和永續發展意識的增強,該地區有機可可和符合道德標準的可可的需求也在不斷增長。此外,供應鏈基礎設施的改善和對本地可可加工設施投資的增加,透過提高產品供應量和減少對進口的依賴,也為市場成長提供了支持。

北美可可市場洞察

預計2025年至2032年,北美地區巧克力和可可製品的消費量將達到4.4%,尤其是在美國。北美擁有成熟且高度多元化的食品飲料產業,可可作為糖果、烘焙食品、乳製品、零食和飲料等眾多產品的關鍵原料。

美國北美可可市場洞察

預計美國將成為成長最快的市場,2025年至2032年複合年增長率將達到4.5%。包裝巧克力和品牌巧克力產品的需求旺盛,尤其是在假日和特殊場合等季節性高峰期。美國是全球最大的巧克力消費國之一,擁有成熟的市場,好時、瑪氏和億滋等領導企業引領巧克力的生產和創新。

加拿大北美可可市場洞察

加拿大正持續崛起為可可產業的重要市場,這得益於巧克力消費量的成長以及消費者對優質和手工產品的日益青睞。加拿大擁有完善的零售基礎設施,對有機和符合道德標準的可可原料的需求不斷增長,這些優勢使其受益匪淺。預計在2025年至2032年間,加拿大將成為北美成長最快的市場之一,複合年增長率將達到4.1%,這主要得益於注重健康的消費者對清潔標籤、公平貿易和低糖可可產品的追求。此外,加拿大製造商也不斷創新,推出植物性和功能性可可產品,以順應不斷變化的飲食趨勢和永續發展理念,推動這些產品的快速普及和市場持續成長。

北美洲可可市場佔有率

可可產業主要由一些老牌企業主導,其中包括:

- Neogric有限公司(英國)

- Macofa巧克力工廠(印度)

- Toutan SA(法國)

- 奧蘭國際有限公司(新加坡)

- 布洛默巧克力公司(美國)

- Deprama Cocoa(印尼)

- PT GRAND KAKAO 印尼(印尼)

- Jaya Saliem 工業(印尼)

- INDCRE SA(西班牙)

- PT ANDOW NGENSOWIDJAJA(印尼)

- INDOCOCOA (PT KENDO AGRI NUSANTARA)(印尼)

- 關崇有限公司(馬來西亞)

- ECUAKAO 集團有限公司(厄瓜多)

- CocoaCraft(印度)

- 蘇克登(法國)

- 嘉吉公司(美國)

- 可可加工有限公司(CPC)(加納)

- 罕見可可(美國)

- Puratos(比利時)

- ECOM Agroindustrial Corp. Limited(瑞士)

- 科科阿·卡米利(坦尚尼亞)

- 百樂嘉利寶(瑞士)

- JB可可(馬來西亞)

- 可可中心(英國)

- Duc d'O(Baronie.com 集團旗下品牌)(比利時)

- 納特拉(西班牙)

- MONER COCOA, SA(西班牙)

- 帕卡里巧克力(厄瓜多)

- Icam Spa(義大利)

- ALTINMARKA(土耳其)

北美可可市場最新動態

- 2024年10月,嘉吉公司在其位於印尼格雷西克的工廠啟用了一條新的可可生產線,以滿足亞洲消費者對高檔食品日益增長的需求,尤其是在烘焙食品、冰淇淋、巧克力糖果和咖啡飲品方面。該生產線旨在提升客製化程度,能夠生產具有不同風味特徵的特殊可可粉和可可液塊,以滿足不同地區的消費者偏好。

- 2024年10月,ICAM Cioccolato推出了基於Shopify平台的全新改版網路商城,提供行動友善、便利安全的購物體驗。該平台展示了ICAM、Vanini和Otto三大品牌的產品,並著重強調永續性和包容性。此計畫由ICAM Cioccolato與Ecommerce School合作開發,並輔以推廣活動以提升品牌知名度和線上銷量,同時也具備顧客畫像功能,可實現個人化行銷。

- 2025年6月,自2013年起在坦尚尼亞基洛姆貝羅山谷開展業務的Kokoa Kamili公司重申了其使命,致力於將坦尚尼亞打造成為全球優質風味可可的領導者。聯合創始人西曼·賓德拉強調,儘管坦尚尼亞每年僅生產約1.4萬噸可可,遠低於科特迪瓦和加納等主要生產國,但該國的優勢在於其優良的基因、氣候和品質。 Kokoa Kamili與1,500名獲得有機認證的農民合作,已分發超過60萬株幼苗,並正在開發高產量優質可可樹的嫁接計畫。該公司曾三次榮獲“卓越可可獎”,並正在尋求國際可可組織對其優質風味可可的認可,以確保所有坦桑尼亞可可都能獲得更高的價格。面對氣候變遷的挑戰,Kokoa Kamili正在探索太陽能灌溉技術,並呼籲將可可納入國家灌溉策略。 Bindra 也旨在打破非洲祇生產大宗低品質可可的誤解,強調坦尚尼亞在高端市場的卓越表現。

- 2025年3月,Natra Cacao SL啟動了一個項目,該項目由歐洲區域發展基金(FEDER)和瓦倫西亞創新署支持,旨在開發與可可類似的用於巧克力生產的發酵產品。該計畫探索具有與發酵可可相同感官特性和功能的植物性替代原料,目標是創造具有健康益處的高附加價值產品,建立更短、更具韌性的供應鏈,並降低對波動較大的北美可可市場的依賴。該計畫也致力於降低碳足跡,減輕森林砍伐風險,並推動Natra集團價值鏈的創新。

- 2025年6月,Touton公司發布報告,展示了在2023-2024作物年度,合作、營運智慧和精準創新如何在森林保護、永續生產和社區參與方面取得顯著成效。報告重點介紹了在加納和科特迪瓦分發數十萬棵改良可可樹和多用途樹苗,以及培訓超過11.2萬名農民掌握氣候智慧型耕作方法等成就。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 VALUE CHAIN ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 SOURCE: DBMR ANALYSIS

4.7.2 PRODUCT QUALITY AND CERTIFICATION

4.7.3 SOURCING AND TRACEABILITY

4.7.4 PRICING AND COST COMPETITIVENESS

4.7.5 SUSTAINABILITY AND ETHICAL PRACTICES

4.7.6 PRODUCTION CAPACITY AND RELIABILITY

4.7.7 COMPLIANCE WITH REGULATIONS

4.7.8 LOGISTICS AND SUPPLY CHAIN EFFICIENCY

4.7.9 REPUTATION AND REFERENCES

4.8 BRAND OUTLOOK

4.8.1 MARKET ROLES & POSITIONING (WHO PLAYS WHICH ROLE?)

4.8.2 PRODUCT & PACKAGING DIFFERENCES

4.8.3 SUSTAINABILITY & FARMER PROGRAMS (CRITICAL FOR REPUTATION & SUPPLY SECURITY)

4.8.4 STRENGTHS, COMPETITIVE EDGES, AND CUSTOMER FIT

4.8.5 RISKS & MARKET PRESSURES (INDUSTRY-WIDE)

4.8.6 STRATEGIC TAKEAWAYS FOR REPORT READERS

4.8.7 WHY THIS LAYOUT?

4.8.8 BARRY CALLEBAUT — FULL-SPECTRUM CHOCOLATE LEADER

4.8.9 CARGILL — CUSTOM SOLUTIONS + INDUSTRY SCALE

4.8.10 OLAM — ORIGINATION & PROCESSING BACKBONE

4.8.11 GUAN CHONG (GCB) — EFFICIENT PROCESSOR

4.8.12 BLOMMER — NORTH AMERICA PROCESSOR & SERVICE

4.9 CONSUMER BUYING BEHAVIOUR

4.9.1 PROBLEM RECOGNITION AND AWARENESS

4.9.2 INFORMATION SEARCH

4.9.3 EVALUATION OF ALTERNATIVES

4.9.4 PURCHASE DECISION

4.9.5 POST-PURCHASE BEHAVIOUR

4.9.6 DEMOGRAPHIC INSIGHTS

4.9.7 CONCLUSION

4.1 COST ANALYSIS BREAKDOWN

4.10.1 INITIAL INVESTMENT AND CAPITAL EXPENDITURE (CAPEX)

4.10.2 INSTALLATION AND INFRASTRUCTURE ADAPTATION

4.10.3 ENERGY CONSUMPTION AND OPERATIONAL COST (OPEX)

4.10.4 MAINTENANCE AND SERVICING

4.10.5 OVERHEAD AND INDIRECT COSTS

4.10.6 STRATEGIC INVESTMENT CONSIDERATIONS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGINS SCENARIO

4.12.1 FACTORS INFLUENCING PROFITABILITY

4.12.2 VALUE ADDITION:

4.12.3 QUALITY & CERTIFICATION:

4.12.4 MARKET DEMAND:

4.12.5 BUSINESS MODEL:

4.13 RAW MATERIAL COVERAGE

4.13.1 COCOA BEANS (PRIMARY RAW MATERIAL)

4.13.2 SUGAR (SWEETENING AGENT)

4.13.3 COCOA BUTTER (FAT COMPONENT)

4.13.4 MILK POWDER (DAIRY INGREDIENT)

4.13.5 LECITHIN (EMULSIFIER)

4.14 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.14.1 ADVANCED COCOA BEAN ROASTING TECHNOLOGIES

4.14.2 AUTOMATED COCOA PROCESSING AND PRODUCTION SYSTEMS

4.14.3 AI-DRIVEN QUALITY CONTROL AND DEFECT DETECTION

4.14.4 ENERGY-EFFICIENT GRINDING AND CONCHING EQUIPMENT

4.14.5 SMART PACKAGING AND SHELF-LIFE EXTENSION SOLUTIONS

4.14.6 DIGITAL SUPPLY CHAIN AND TRACEABILITY INTEGRATION

4.15 PATENT ANALYSIS –

4.15.1 PATENT QUALITY AND STRENGTH

4.15.2 PATENT FAMILIES

4.15.3 NUMBER OF INTERNATIONAL PATENT FAMILIES BY PUBLICATION YEAR

4.15.4 REGION PATENT LANDSCAPE

4.15.5 IP STRATEGY AND MANAGEMENT

4.15.6 PATENT ANALYSIS – TOP APPLICANTS

5 TARIFFS & IMPACT ON THE NORTH AMERICA COCOA MARKET

5.1 CURRENT TARIFF RATE(S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN THE COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

7 BEANS AND RATIOS FOR HISTORY AND FORECAST AND WITH CONCRETE DATA

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS

8.1.2 GROWING AWARENESS OF COCOA’S HEALTH AND ANTIOXIDANT BENEFITS

8.1.3 EXPANDING USE OF COCOA IN COSMETICS AND PERSONAL CARE

8.1.4 GROWTH IN COCOA-BASED BEVERAGES

8.2 RESTRAINTS

8.2.1 GROWING COMPETITION FROM ALTERNATIVE INGREDIENTS IN CONFECTIONERY PRODUCTION

8.2.2 STRINGENT REGULATORY STANDARDS FOR COCOA QUALITY AND SAFETY COMPLIANCE

8.3 OPPORTUNITIES

8.3.1 RISING DEMAND FOR VEGAN AND PLANT-BASED COCOA-BASED PRODUCTS

8.3.2 INNOVATION IN COCOA-BASED FUNCTIONAL AND FORTIFIED FOOD PRODUCTS

8.3.3 INCREASING POPULARITY OF SINGLE-ORIGIN AND SPECIALTY COCOA VARIETIES

8.4 CHALLENGE

8.5 CLIMATE CHANGE REDUCING COCOA YIELDS AND AFFECTING QUALITY

8.5.1 LIMITED FARMER ACCESS TO MODERN FARMING TOOLS AND TRAINING

9 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 COCOA POWDER & CAKE

9.3 COCOA BUTTER

9.4 COCOA BEANS

9.5 COCOA LIQUOR & PASTE

9.6 COCOA NIBS

9.7 OTHERS

10 NORTH AMERICA COCOA MARKET, BY NATURE

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA

11.1 OVERVIEW

11.2 FORASTERO COCOA

11.3 TRINITARIO COCOA

11.4 CRIOLLO COCOA

12 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT

12.3 DIRECT

13 NORTH AMERICA COCOA MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 DIETARY SUPPLEMENTS

13.3 FOOD AND BEVERAGE

13.4 BEVERAGE

13.5 PHARMACEUTICALS

13.6 PERSONAL CARE AND COSMETICS

14 NORTH AMERICA COCOA MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA COCOA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 OLAM GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 RECENT FINANCIALS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT UPDATES

17.2 BARRY CALLEBAUT

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ECOM AGROINDUSTRIAL CORP. LIMITED.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS/NEWS

17.4 PURATOS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 GUAN CHONG BERHAD (GCB)

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS/NEWS

17.6 JB COCOA

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 RECENT DEVELOPMENT

17.7 ALTINMARKA

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 BLOMMER CHOCOLATE COMPANY

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CARGILL, INCORPORATED.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 COCOA HUB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS/NEWS

17.11 COCOA PROCESSING COMPANY LIMITED (CPC)

17.11.1 COMPANY SNAPSHOT

17.11.2 RECENT FINANCIALS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 COCOACRAFT

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS/NEWS

17.13 DEPRAMA COCOA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 DUC D’O

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS/NEWS

17.15 ECUAKAO GROUP LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS/NEWS

17.16 ICAM SPA

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATES

17.17 INDCRE S.A

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT UPDATES

17.18 INDOCOCOA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS/NEWS

17.19 JAYA SALIEM INDUSTRI

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 KOKOA KAMILI

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS/NEWS

17.21 MACOFA CHOCOLATE FACTORY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 MONER COCOA, S.A.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT UPDATES

17.23 NATRA

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENTS/NEWS

17.24 NEOGRIC LIMITED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 PACARI

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT UPDATES

17.26 PT ANDOW NGENSOWIDJAJA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS/NEWS

17.27 PT GRAND KAKAO INDONESIA

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 TOUTON S.A.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 UNCOMMON CACOA .

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 FIGURE 2. COMPANY VS BRAND OVERVIEW

TABLE 3 NUMBER OF PATENTS PER YEAR

TABLE 4 NUMBER OF PATENTS PER REGION/COUNTRY

TABLE 5 TOP PATENT APPLICANTS.

TABLE 6 REGULATORY COVERAGE

TABLE 7 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 9 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 10 NORTH AMERICA COCOA BUTTER IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA COCOA MARKET, BY NATURE, 2025-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA COCOA MARKET, BY NATURE, 2025-2032 (TONS)

TABLE 13 NORTH AMERICA COCOA MARKET, BY NATURE, 2025-2032 (PRICE USD/KG)

TABLE 14 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (TONS)

TABLE 16 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2025-2032 (PRICE USD/KG)

TABLE 17 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (TONS)

TABLE 19 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (PRICE USD/KG)

TABLE 20 NORTH AMERICA INDIRECT IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA BAKERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA CHOCLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2025-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA BEVERAGES IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2025-2032 (TONS)

TABLE 35 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2025-2032 (PRICE USD/KG)

TABLE 36 NORTH AMERICA COCOA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA COCOA MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 38 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 40 NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 41 NORTH AMERICA COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 44 NORTH AMERICA COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 45 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 47 NORTH AMERICA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 48 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 50 NORTH AMERICA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 51 NORTH AMERICA INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 NORTH AMERICA COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 56 NORTH AMERICA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 69 U.S. COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 70 U.S. COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 73 U.S. COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 74 U.S. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 76 U.S. COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 77 U.S. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 79 U.S. COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 80 U.S. INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 84 U.S. COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 85 U.S. FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 98 CANADA COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 99 CANADA COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 102 CANADA COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 103 CANADA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 105 CANADA COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 106 CANADA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 108 CANADA COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 109 CANADA INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 113 CANADA COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 114 CANADA FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 MEXICO COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (PRICE USD/KG)

TABLE 128 MEXICO COCOA BUTTER IN COCOA MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO COCOA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO COCOA MARKET, BY NATURE, 2018-2032 (TONS)

TABLE 131 MEXICO COCOA MARKET, BY NATURE, 2018-2032 (PRICE USD/KG)

TABLE 132 MEXICO COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (TONS)

TABLE 134 MEXICO COCOA MARKET, BY TYPE OF COCOA, 2018-2032 (PRICE USD/KG)

TABLE 135 MEXICO COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 137 MEXICO COCOA MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (PRICE USD/KG)

TABLE 138 MEXICO INDIRECT IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO OFFLINE DISTRIBUTION CHANNEL IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO COCOA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO COCOA MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 142 MEXICO COCOA MARKET, BY APPLICATION, 2018-2032 (PRICE USD/KG)

TABLE 143 MEXICO FOOD AND BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO BAKERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 MEXICO CONFECTIONERY IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MEXICO CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MEXICO CHOCOLATE IN COCOA MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 MEXICO WHITE CHOCOLATE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 MEXICO DAIRY PRODUCTS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MEXICO PROCESSED FOOD IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 MEXICO BEVERAGE IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 MEXICO DAIRY-BASED DRINKS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MEXICO PERSONAL CARE AND COSMETICS IN COCOA MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA COCOA MARKET

FIGURE 2 NORTH AMERICA COCOA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COCOA MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COCOA MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COCOA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COCOA MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA COCOA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA COCOA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA COCOA MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COCOA MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA COCOA MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SIX SEGMENTS COMPRISE THE NORTH AMERICA COCOA MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR CHOCOLATE AND CONFECTIONERY PRODUCTS IS EXPECTED TO DRIVE THE NORTH AMERICA COCOA MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE COCOA POWDER & CAKE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COCOA MARKET IN 2025 AND 2032

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 NORTH AMERICA COCOA MARKET, 2022-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 IPC CODE V/S NUMBER OF PATENTS

FIGURE 22 NUMBER OF PATENTS PER YEAR

FIGURE 23 NUMBER OF PATENTS PER REGION/COUNTRY

FIGURE 24 TOP PATENT APPLICANTS.

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA COCOA MARKET

FIGURE 26 NORTH AMERICA COCOA MARKET: BY PRODUCT TYPE, 2024

FIGURE 27 NORTH AMERICA COCOA MARKET: BY NATURE, 2024

FIGURE 28 NORTH AMERICA COCOA MARKET: BY TYPE OF COCOA, 2024

FIGURE 29 NORTH AMERICA COCOA MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 NORTH AMERICA COCOA MARKET: BY APPLICATION, 2024

FIGURE 31 NORTH AMERICA COCOA MARKET: SNAPSHOT (2024)

FIGURE 32 NORTH AMERICA COCOA MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。