North America Compression Garments Stockings Market

市场规模(十亿美元)

CAGR :

%

USD

1.15 Billion

USD

1.70 Billion

2024

2032

USD

1.15 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.15 Billion | |

| USD 1.70 Billion | |

|

|

|

|

北美壓力衣和壓力襪市場細分,按產品類型(壓力襪、壓力服)、壓力等級(中度壓力、輕度壓力、強力壓力、超強力壓力)、應用(醫療用途、非醫療用途)、材質(尼龍和氨綸、棉、超細纖維、竹纖維、透氣網眼/吸濕排汗布料、羊毛混紡、再生/有機材料)、性別(女性、男女通用、男性)、分銷管道(線下、線上)、最終用戶(普通消費者、醫療機構、運動團隊和俱樂部、企業健康計劃)劃分——行業趨勢及至2032年的預測

北美壓縮衣和長襪市場規模

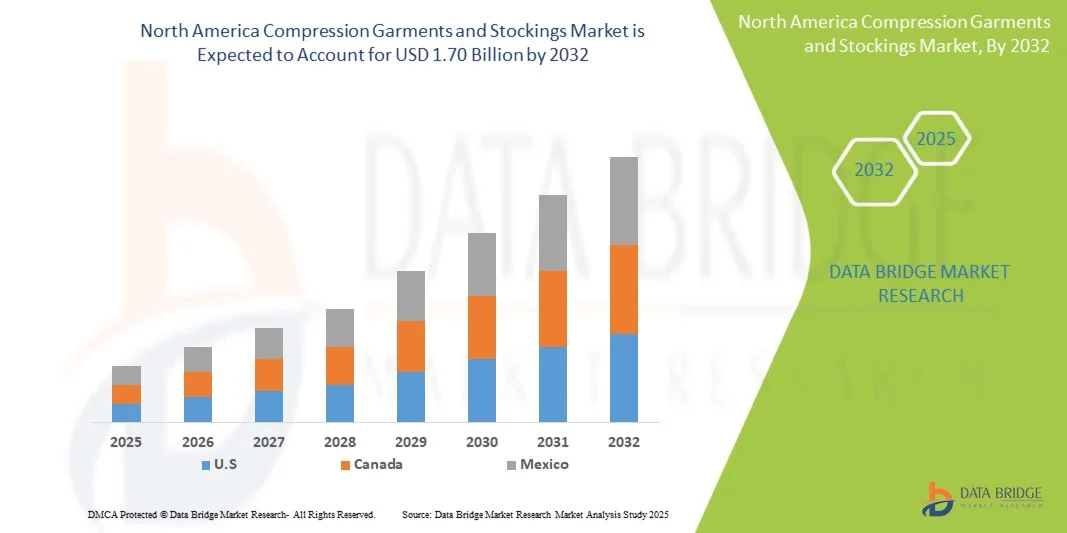

- 2024年北美壓縮衣和彈性襪市場規模為11.5億美元 ,預計 到2032年將達到17億美元,預測期內複合 年增長率為5.13% 。

- 市場成長主要得益於人們對靜脈疾病的認識不斷提高以及預防性醫療保健解決方案的日益普及。

- 此外,老年人口的成長、靜脈曲張發病率的增加以及術後恢復期壓力襪使用量的增加,都進一步推動了需求的成長。

北美壓力衣與彈性襪市場分析

- 靜脈疾病、淋巴水腫和糖尿病相關腫脹病例的增加推動了市場成長。壓力衣正成為控制慢性症狀和提高患者舒適度的首選方案,尤其是在老年族群。

- 術後復健和運動後恢復領域的應用推動了市場需求。運動員和健身愛好者越來越多地穿著壓縮衣來促進血液循環、減輕肌肉疲勞和加速癒合,這也促成了其強勁的市場表現。

- 預計到2025年,美國將在北美壓力衣和彈性襪市場佔據主導地位,市場份額將達到78.61%,這主要得益於醫療保健支出增加、人口老齡化加劇、人們對壓力療法益處的認識不斷提高,以及發展中國家醫用級壓力服的普及。

- 預計到2025年,壓力襪細分市場將佔據北美壓力衣和壓力襪市場70.22%的市場份額,主要驅動因素包括靜脈曲張、深部靜脈栓塞(DVT)和慢性靜脈功能不全病例的增加,以及醫生推薦和醫院使用量的增長。

報告範圍及北美壓縮衣及彈性襪市場細分

|

屬性 |

北美壓縮衣與彈性襪市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

北美壓力衣與彈性襪市場趨勢

“肥胖和久坐生活方式日益普遍”

- 肥胖和久坐生活方式的日益普遍導致不同人群對壓力衣和彈性襪的使用量增加。長時間久坐、缺乏運動以及代謝紊亂發病率的上升,加劇了靜脈曲張、深部靜脈栓塞(DVT)和慢性靜脈功能不全等血管疾病的發生。為此,壓力療法作為一種非侵入性的預防和治療方法,正被廣泛採用,以促進循環系統健康,並緩解下肢腫脹和不適。

- 醫療保健機構不僅建議高風險族群穿著壓力衣,也建議一般民眾將壓力衣作為預防保健措施的一部分。都市化、久坐的工作模式以及人口老化(尤其是在已開發市場)進一步推動了壓力衣的普及。

- 隨著人們對循環系統健康風險的認識不斷提高,壓力服在醫療和生活方式應用方面持續獲得認可,從而支撐了市場的持續成長。

- 肥胖和久坐行為的日益普遍,持續成為全球血管健康問題的重要原因。隨著這些生活方式趨勢的持續,人們對有效、非侵入性的解決方案(例如壓力衣)的需求也日益增長。

- 隨著醫療保健提供者和消費者對壓力療法的認識不斷提高,壓力療法的應用範圍正從臨床環境擴展到日常健康養生領域。這種不斷變化的市場格局凸顯了在健康意識增強和高風險族群的推動下,市場持續成長的潛力。

北美壓力衣與彈性襪市場動態

司機

“運動恢復中壓縮服的使用日益增多”

- 人們越來越關注運動表現和更快的恢復速度,這促使專業運動員和健身愛好者越來越多地採用壓縮衣。壓縮服因其促進血液循環、減輕肌肉疲勞、減少腫脹和加速運動後恢復的益處而備受認可。運動醫學專家和物理治療師經常建議運動員在訓練和比賽中使用壓力襪和壓縮袖套來增強肌肉耐力並預防運動傷害。

- 紡織技術的進步使得輕盈透氣、符合人體工學的壓縮服得以生產,這些產品能夠更好地滿足運動員的需求。此外,隨著歐洲休閒運動和健身活動的參與度不斷提高,以及人們對運動傷害預防意識的增強,壓縮服的市場也從菁英運動員擴展到了一般大眾。體育專業人士的代言以及電商平台的日益普及進一步推動了這一趨勢,促使壓縮服被消費者廣泛接受,成為運動恢復的重要組成部分。

- 運動後恢復中壓縮服的日益普及,反映出人們越來越認識到其在減輕運動後肌肉疲勞、酸痛和發炎方面的益處。運動員和健身愛好者都在利用這些產品來縮短恢復時間並改善訓練效果。

克制/挑戰

“缺乏訓練有素的人員進行正確安裝”

- 正確選擇合適的壓力衣和彈性襪對於確保治療效果和患者舒適度至關重要。然而,歐洲市場普遍缺乏訓練有素、能夠測量、試穿和指導患者的醫護人員,這構成了一項重大挑戰。尺寸不合適或使用方法不當會導致壓力不足、皮膚刺激,甚至加重病情,從而降低患者的依從性和治療效果。

- 在醫療資源匱乏的農村地區,這種短缺尤其嚴重,因為這些地區難以獲得血管專科護理師或認證技師等專業人員。此外,全科醫生和護理人員對壓力療法的認識和培訓不足,也進一步加劇了這個問題,阻礙了最佳的處方和使用。隨著壓力療法越來越多地應用於家庭和門診護理,缺乏正確的佩戴指導仍然是其廣泛有效應用的關鍵障礙。

- 世界衛生組織(世衛組織)預測,到2030年,歐洲將面臨1,100萬衛生工作者的缺口,低收入和中低收入國家受到的影響尤其嚴重。這一缺口包括接受過正確使用醫療器材(如壓力衣)訓練的醫護人員。缺乏熟練人員限制了壓力療法的有效實施,導致壓力衣佩戴不當、療效降低以及患者依從性下降。

- 根據美國國家醫學圖書館於2021年12月發表的一項研究,一項護理教育幹預措施顯著提高了患者對壓力療法的依從性,並降低了靜脈性腿部潰瘍的復發率。此結構化項目包括由護理師主導的正確使用壓力襪、皮膚護理和自我監測技巧的培訓。接受此項教育支持的患者在穿著壓力襪方面表現出更高的依從性,並且與未接受干預的患者相比,潰瘍復發率更低。

- 壓力療法的有效性很大程度取決於精準的穿戴和病患教育,而這兩方面都需要訓練有素的人員。然而,歐洲專業醫護人員的短缺,尤其是在資源匱乏的地區,持續阻礙壓力療法的正確使用和病患依從性。這種限制不僅影響治療效果,還會導致患者不滿和治療中斷,對市場擴張構成重大障礙。

北美壓縮衣和長襪市場範圍

北美壓縮服裝和長襪市場根據產品類型、壓縮等級、應用、材料、性別、分銷管道和最終用戶分為七個主要細分市場。

- 依產品類型

根據產品類型,市場可分為壓力襪和壓力服。預計到2025年,壓力襪將佔據市場主導地位,市場份額將達到70.22%,這主要得益於慢性靜脈疾病患病率的上升、術後使用量的增加以及醫生對預防性和治療性壓力療法的大力推薦。

預計從 2025 年到 2032 年,壓力襪市場將以 5.84% 的最快速度增長,這主要得益於人們對靜脈健康的日益關注、老齡化人口的增加以及在醫療和非醫療應用領域(包括運動恢復和職業健康)的日益普及。

- 壓縮水平

根據應用領域,市場可細分為中等壓力、輕度壓力、強力壓力和超強力壓力。 2025年,中等壓力產品佔據了最大的市場份額,達到36.05%,這主要歸功於靜脈疾病患病率的不斷上升、術後康復中應用的日益廣泛,以及其在治療淋巴水腫、深部靜脈血栓形成(DVT)和靜脈曲張等慢性疾病方面的有效性。中等壓力產品也因其兼顧治療效果和患者舒適度而受到醫生的廣泛青睞,使其成為預防和治療應用中最常用和處方量最大的壓力等級。

- 透過申請

根據應用領域,市場可分為醫療用途和非醫療用途。醫療用途領域在2025年佔據最大的市場份額,達到60.98%,這主要得益於靜脈疾病發病率的上升、術後復健需求以及臨床上越來越多地採用壓力療法治療淋巴水腫、深部靜脈栓塞和靜脈曲張等慢性疾病。

預計從 2025 年到 2032 年,醫療用途領域將實現最快的複合年增長率,這主要得益於運動表現、健身恢復、職業健康和生活方式相關的預防保健方面對壓縮服的需求不斷增長。

- 按材料

根據材料的不同,市場可細分為尼龍和氨綸、棉、超細纖維、竹纖維、透氣網眼/吸濕排汗布料、羊毛混紡以及再生/有機材料。尼龍和氨綸布料憑藉其卓越的彈性、耐用性和提供持續壓縮壓力的能力(這些特性對於醫療和運動應用至關重要),在2025年佔據最大的市場份額,達到31.45%。

預計從 2025 年到 2032 年,尼龍和氨綸面料的複合年增長率將達到最快,其輕便的特性、優異的彈性、吸濕排汗功能以及在醫療和非醫療環境中長時間穿著時的舒適性都備受青睞。

- 按性別

依性別劃分,市場分為女性、中性及男性三個細分市場。到2025年,女性市場將佔據最大的市場份額,達到41.84%,這主要得益於靜脈曲張、妊娠相關靜脈問題以及出於醫療和美容目的對壓力衣的廣泛採用。

預計從 2025 年到 2032 年,女性市場將迎來最快的複合年增長率,這主要得益於健康意識的提高、健身活動參與度的增加以及對專為女性用戶量身定制的時尚舒適的壓縮解決方案的需求不斷增長。

- 透過分銷管道

根據分銷管道,市場可分為線下和線上兩大板塊。到2025年,線下板塊將佔據最大的市場份額,達到59.02%,這主要得益於醫療用品商店、藥房和醫院採購管道的強大影響力,這些管道能夠提供專業的試戴指導和即時的產品供應。

預計從 2025 年到 2032 年,線下市場將實現最快的複合年增長率,這主要得益於電子商務滲透率的提高、消費者對送貨上門的偏好日益增長、產品種類的豐富以及數位健康意識的提高。

- 最終用戶

根據最終用戶劃分,市場可分為一般消費者、醫療機構、運動隊伍和俱樂部以及企業健康計畫。到2025年,一般消費者細分市場將佔據最大的市場份額,達到41.30%,這主要得益於人們自我保健意識的增強、對預防性健康解決方案需求的增長以及壓縮衣因其舒適性和支撐性而得到廣泛應用。

預計從 2025 年到 2032 年,一般消費者群體將迎來最快的複合年增長率,這主要得益於業餘和職業運動員越來越多地採用壓縮服來提高運動表現、促進肌肉恢復和預防受傷。

北美壓縮衣與彈性襪市場區域分析

- 美國在北美壓力衣和彈性襪市場佔據主導地位,市佔率高達78.61%,預計到2025年將以5.27%的複合年增長率快速成長。這主要得益於靜脈疾病盛行率的上升、人們對壓力療法的認知度提高以及醫療和運動領域的強勁需求。

- 該國完善的醫療基礎設施、優惠的報銷政策以及不斷增長的老齡人口進一步推動了市場擴張。此外,日益增長的健身趨勢和預防保健意識也促進了非醫療需求的成長。

- 預計到2025年,美國將在北美壓力服和彈性襪市場佔據相當大的份額,這得益於強有力的宣傳活動、預防性醫療保健舉措,以及透過線上線下通路便捷地獲取高品質壓力產品。

加拿大北美壓縮衣與長襪市場洞察

受慢性靜脈疾病(如靜脈曲張和深部靜脈栓塞 (DVT))患病率上升、人口老化以及人們對壓力療法益處的認識不斷提高等因素的推動,加拿大和北美壓力服及彈性襪市場正穩步增長。製造技術的進步提升了產品的舒適度和有效性,同時零售、線上平台和醫療保健機構的普及也促進了市場的發展。各個年齡層的男性和女性消費者都在推動市場成長,其中年輕人越來越多地將壓力服用於健康和生活方式的改善。展望未來,由於技術創新、健康意識的增強以及預防性護理的普及,預計該市場將進一步擴張,壓力服將成為加拿大醫療、健身和日常健康解決方案的重要組成部分。

北美壓縮衣和長襪市場份額

壓力衣和彈性襪產業主要由一些老牌企業主導,其中包括:

- 3M(美國)

- 康德樂(美國)

- 索克韋爾(美國)

- Tynor Orthotics Pvt. Ltd.(印度)

- 吉博(法國)

- 舒爾健康公司(美國)

- ThermoTek(美國)

- 艾姆斯·沃克(美國)

- VIM 與 VIGR(美國)

- Rejuva Health(美國)

- Zensah(美國)

北美壓縮衣與彈性襪市場最新發展動態

- 2024年1月,康德樂公司宣布將在德州沃斯堡新建一座34萬平方英尺的配送中心,以支援其居家解決方案業務。該中心將整合先進的機器人技術和人工智慧驅動的倉儲系統,以提高訂單履行效率和安全性。它將取代現有的兩個倉庫,擴大庫存容量,並預計每日處理約1萬個包裹。該中心預計於2025年夏季全面投入營運。

- 2024年8月,康德樂公司宣布計劃在俄亥俄州沃爾頓山開設一座佔地24.9萬平方英尺的全新醫療產品配送中心,作為其擴大美國倉儲能力和實現營運現代化策略的一部分。該中心預計將於2025年春季投入運營,屆時將取代規模較小的索倫配送中心,並採用先進的自動化技術,以提高供應鏈效率和員工安全。

- 2024年11月,康德樂(Cardinal Health)在美國推出了Kendall SCD SmartFlow加壓系統,標誌著其Kendall加壓系列的全新升級。這款先進的系統採用血管充盈檢測(VRD)和患者感知技術,提供個人化的間歇性氣動加壓,以改善血液循環,預防靜脈血栓栓塞症(VTE),並減輕靜脈淤血症狀,例如疼痛和腫脹。該系統旨在提升臨床療效並提高醫護人員的工作效率。預計於2025年初在全球上市。

- 2024年11月,Sanyleg宣布將參加2024年慕尼黑ISPO展會,屆時將展出其義大利製造的漸進式壓力運動襪。該公司還發布了首份永續發展報告,重點強調了其對道德生產、環境保護和員工福祉的承諾。

- 2024年5月,Sockwell與Bombas、Comrad和Levsox等頂級品牌一同入選Parents.com網站「懷孕最佳8款壓力襪」榜單。文章重點介紹了Sockwell的專家推薦設計,其舒適度、15-20 mmHg的壓力以及有效減輕水腫和緩解孕期不適的功效。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PATENT ANALYSIS –

4.2.1 PATENT QUALITY AND STRENGTH

4.2.2 PATENT FAMILIES

4.2.3 LICENSING AND COLLABORATIONS

4.2.4 COMPETITIVE LANDSCAPE

4.2.5 IP STRATEGY AND MANAGEMENT

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY OF SUPPLY

4.3.2 RELIABILITY AND TIMELINESS

4.3.3 COST COMPETITIVENESS

4.3.4 TECHNICAL CAPABILITY AND INNOVATION

4.3.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.3.6 FINANCIAL STABILITY

4.3.7 CUSTOMER SERVICE AND SUPPORT

4.4 BRAND OUTLOOK

4.5 COMPETITIVE BENCHMARKING ACROSS COMPRESSION LEVEL, FABRIC TYPE, AND DISTRIBUTION CHANNEL

4.5.1 COMPRESSION LEVEL BENCHMARKING

4.5.2 FABRIC TYPE BENCHMARKING

4.5.3 DISTRIBUTION CHANNEL BENCHMARKING

4.5.4 COMPETITIVE INSIGHTS

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 PROBLEM RECOGNITION AND AWARENESS

4.6.2 INFORMATION SEARCH

4.6.3 EVALUATION OF ALTERNATIVES

4.6.4 PURCHASE DECISION

4.6.5 POST-PURCHASE BEHAVIOUR

4.6.6 DEMOGRAPHIC INSIGHTS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIAL COST DYNAMICS

4.7.2 MANUFACTURING AND PROCESSING COSTS

4.7.3 REGULATORY COMPLIANCE AND CERTIFICATION COSTS

4.7.4 PACKAGING AND DISTRIBUTION EXPENSES

4.7.5 R&D AND TECHNOLOGICAL INNOVATION COSTS

4.7.6 MARKET-BASED PRICE BENCHMARKS

4.7.7 GEOGRAPHICAL VARIATIONS IN COST STRUCTURES

4.7.8 IMPACT ON PROFITABILITY AND STRATEGIC IMPLICATIONS

4.7.9 CONCLUSION

4.8 PROFIT MARGIN SCENARIO

4.8.1 INTRODUCTION TO PROFIT MARGINS IN MEDICAL TEXTILES

4.8.2 COST STRUCTURES AND MARGIN INFLUENCERS

4.8.3 PROFITABILITY BY PRODUCT TYPE

4.8.4 GEOGRAPHICAL MARGIN COMPARISON

4.8.5 PRIVATE LABELS VS. BRANDED PRODUCTS

4.8.6 IMPACT OF REGULATIONS ON PROFIT MARGINS

4.8.7 DIGITAL DISTRIBUTION AND DIRECT-TO-CONSUMER (D2C) PROFITABILITY

4.8.8 CONCLUSION

4.9 END USER EVOLUTION ANALYSIS – NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.9.1 CONCLUSION

4.1 IMPACT OF SUSTAINABILITY AND CIRCULAR FASHION INITIATIVES ON PRODUCT DEVELOPMENT

4.10.1 RECYCLABLE FIBERS AND ECO-FRIENDLY MATERIALS

4.10.2 CIRCULAR DESIGN AND EXTENDED PRODUCT LIFE

4.10.3 ECO-COMPLIANT INNOVATIONS IN COMPRESSION TECHNOLOGY

4.10.4 MARKET DRIVERS FOR SUSTAINABILITY IN COMPRESSION WEAR

4.10.5 CHALLENGES IN SUSTAINABLE PRODUCT DEVELOPMENT

4.10.6 CONCLUSION

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 Joint Ventures

4.11.1.2 Mergers and Acquisitions

4.11.1.3 Licensing and Partnership

4.11.1.4 Technology Collaborations

4.11.1.5 Strategic Divestments

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 RAW MATERIAL COVERAGE

4.12.1 INTRODUCTION

4.12.2 FOUNDATION OF RAW MATERIAL USE

4.12.3 DEPENDENCE ON SYNTHETIC FIBERS

4.12.4 INTEGRATION OF NATURAL FIBERS

4.12.5 ADOPTION OF TECHNICAL AND FUNCTIONAL TEXTILES

4.12.6 SUSTAINABLE MATERIAL INNOVATIONS

4.12.7 REGULATORY AND QUALITY COMPLIANCE

4.12.8 SUPPLY CHAIN CONSIDERATIONS

4.12.9 LIFECYCLE AND PERFORMANCE ATTRIBUTES

4.12.10 CONCLUSION

4.13 VALUE CHAIN

4.13.1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET VALUE CHAIN

4.13.2 RAW MATERIAL SOURCING & MANUFACTURING:

4.13.3 PRODUCT DESIGN & COMPONENT MANUFACTURING –

4.13.4 ASSEMBLY, BRANDING & PACKAGING

4.13.5 DISTRIBUTION & END-USE

4.14 SUPPLY CHAIN ANALYSIS

4.14.1 RAW MATERIAL SUPPLIERS

4.14.2 TEXTILE MANUFACTURERS

4.14.3 GARMENT & COMPONENT MANUFACTURERS

4.14.4 DESIGN, TESTING & ASSEMBLY UNITS

4.14.5 DISTRIBUTORS & RETAIL CHANNELS

4.14.6 MEDICAL PROFESSIONALS / PRESCRIBERS

4.14.7 END USERS

4.15 PORTER’S FIVE FORCES

4.15.1 INTENSITY OF COMPETITIVE RIVALRY – MODERATE TO HIGH

4.15.2 BARGAINING POWER OF BUYERS/CONSUMERS (MODERATE TO HIGH)

4.15.3 THREAT OF NEW ENTRANTS (LOW TO MODERATE)

4.15.4 THREAT OF SUBSTITUTES PRODUCTS ( LOW TO MODERATE)

4.15.5 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.16 CLIMATE CHANGE SCENARIO

4.16.1 INTRODUCTION

4.16.2 ENVIRONMENTAL CONCERNS

4.16.3 INDUSTRY RESPONSE

4.16.4 GOVERNMENT’S ROLE

4.16.5 ANALYST RECOMMENDATIONS

4.16.6 CONCLUSION

4.17 INDUSTRY ECOSYSTEM ANALYSIS

4.18 INTRODUCTION

4.18.1 PROMINENT COMPANIES

4.18.2 SMALL & MEDIUM SIZE COMPANIES

4.18.3 END USERS

4.18.4 CONCLUSION

4.19 STRATEGIC INITIATIVE ASSESSMENTS (CORPORATE WELLNESS PARTNERSHIPS, RETAIL COLLABORATIONS, OEM/ODM ARRANGEMENTS) ACROSS KEY GEOGRAPHIES

4.19.1 CORPORATE WELLNESS PARTNERSHIPS: INTEGRATING COMPRESSION SOLUTIONS INTO HOLISTIC HEALTH FRAMEWORKS

4.19.2 RETAIL COLLABORATIONS

4.19.3 OEM/ODM ARRANGEMENTS: COST-OPTIMIZED, CUSTOM-BUILT MANUFACTURING PARTNERSHIPS

4.19.4 GEOGRAPHY-SPECIFIC STRATEGIES

4.19.5 STRATEGIC DECISIONS CROSS-FUNCTIONAL NORTH AMERICA STRATEGY: UNIFYING PARTNERSHIPS FOR MARKET SYNERGY

4.19.6 CONCLUSION

4.2 TECHNOLOGICAL ADVANCEMENTS

4.20.1 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.20.2 SMART COMPRESSION TEXTILES AND WEARABLE SENSORS

4.20.3 3D KNITTING AND SEAMLESS CONSTRUCTION TECHNOLOGIES

4.20.4 ADVANCED AND FUNCTIONAL MATERIALS

4.20.5 AI-POWERED CUSTOMIZATION AND ON-DEMAND MANUFACTURING

4.20.6 INTEGRATION WITH DIGITAL THERAPEUTICS AND TELEHEALTH

4.20.7 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.20.8 AUTOMATION AND QUALITY CONTROL IN MANUFACTURING

4.20.9 CONCLUSION

4.21 TARIFFS & IMPACT ON THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.1 OVERVIEW

4.21.2 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

4.21.3 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

4.21.4 VENDOR SELECTION CRITERIA DYNAMICS

4.21.5 IMPACT ON SUPPLY CHAIN

4.21.5.1 Introduction

4.21.5.2 RAW MATERIAL PROCUREMENT

4.21.5.3 Manufacturing and Production

4.21.5.4 Logistics and Distribution

4.21.5.5 Conclusion

4.21.6 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.21.6.1 SUPPLY CHAIN OPTIMIZATION

4.21.6.2 JOINT VENTURE ESTABLISHMENTS

4.21.7 IMPACT ON PRICES

4.21.7.1 Influence of Raw Material and Textile Innovations

4.21.7.2 Technological Advancements and Customization

4.21.7.3 Regulatory Compliance and Quality Standards

4.21.7.4 Logistics, Distribution, and Retail Dynamics

4.21.7.5 Sustainability and Ethical Production

4.21.7.6 Economic and North America Trade Factors

4.21.8 REGULATORY INCLINATION

4.21.8.1 Evolving Classification Standards

4.21.8.2 Compliance and Quality Assurance

4.21.8.3 Cross-Border Challenges

4.21.8.4 Digital Integration and Regulation

4.21.8.5 Geopolitical Situation

4.21.8.6 Trade Partnerships Between the Countries

4.21.8.7 Free Trade Agreements

4.21.8.8 Alliances Establishments

4.21.8.9 Conclusion

4.21.9 STATUS ACCREDITATION (INCLUDING MFTN) IN THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET

4.21.9.1 Medical Accreditation and Regulatory Compliance

4.21.9.2 Voluntary Certifications and Quality Seals

4.21.9.3 Role of MFTN (Medical Functional Textile Network)

4.21.9.4 Accreditation as a Strategic Differentiator

4.21.9.5 Domestic Course of Correction in the North America Compression Garments and Stockings Market

4.21.9.6 Incentive Schemes to Boost Production Outputs

4.21.9.7 Establishment of Special Economic Zones / Industrial Parks

4.21.9.8 Conclusion

4.22 PRICING ANALYSIS

4.23 PRODUCTION CONSUMPTION ANALYSIS

4.24 COMPANY COMPARATIVE ANALYSIS AND POSITIONING MATRICES FOR LIFESTYLE VS. THERAPEUTIC BRANDS

4.24.1 COMPANY COMPARATIVE ANALYSIS: LIFESTYLE VS. THERAPEUTIC FOCUS

4.24.2 POSITIONING MATRIX INSIGHTS:

4.24.2.1 BAUERFEIND AG

4.24.2.2 3M

4.24.2.3 CARDINAL HEALTH

4.24.2.4 THUASNE

4.24.2.5 LOHMANN & RAUSCHER GMBH & CO. KG

5 REGULATION COVERAGE

5.1 INTRODUCTION

5.2 PRODUCT CODES

5.3 CERTIFIED STANDARDS

5.4 SAFETY STANDARDS

5.5 MATERIAL HANDLING AND STORAGE

5.6 TRANSPORT AND PRECAUTIONS

5.7 HAZARD IDENTIFICATION

5.8 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING OBESITY AND SEDENTARY LIFESTYLES

6.1.2 RISING USE OF COMPRESSION WEAR IN SPORTS RECOVERY

6.1.3 ADVANCEMENTS IN TEXTILE TECHNOLOGY AND MATERIALS

6.1.4 GROWTH OF HOME-BASED AND OUTPATIENT CARE SERVICES

6.2 RESTRAINTS

6.2.1 SHORTAGE OF TRAINED PERSONNEL FOR PROPER FITTING

6.2.2 LIMITED CLINICAL BACKING IN NON-THERAPEUTIC USE CASES

6.3 OPPORTUNITIES

6.3.1 DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY COMPRESSION FABRICS

6.3.2 COLLABORATION WITH FASHION AND WELLNESS BRANDS

6.3.3 GROWING SALES FROM E-COMMERCE SECTOR

6.4 CHALLENGES

6.4.1 LOW AWARENESS AND DIAGNOSTIC ACCESS IN RURAL AREAS

6.4.2 COMPLEX REGULATORY CLASSIFICATION ACROSS MARKETS

7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 COMPRESSION STOCKINGS

7.3 COMPRESSION GARMENTS

8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL

8.1 OVERVIEW

8.2 MODERATE COMPRESSION

8.3 MILD COMPRESSION

8.4 FIRM COMPRESSION

8.5 EXTRA-FIRM COMPRESSION

9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL USE

9.3 NON-MEDICAL USE

10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 NYLON & SPANDEX

10.3 COTTON

10.4 MICROFIBER

10.5 BAMBOO FIBER

10.6 BREATHABLE MESH / MOISTURE-WICKING FABRICS

10.7 WOOL BLENDS

10.8 RECYCLED/ORGANIC MATERIALS

11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER

11.1 OVERVIEW

11.2 WOMEN

11.3 UNISEX

11.4 MEN

12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER

13.1 OVERVIEW

13.2 GENERAL CONSUMERS

13.3 HEALTHCARE INSTITUTIONS

13.4 SPORTS TEAMS & CLUBS

13.5 CORPORATE WELLNESS PROGRAMS

14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION

14.1 OVERVIEW

14.2 NORTH AMERICA

14.2.1 U.S.

14.2.2 CANADA

14.2.3 MEXICO

15 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

16.1 SWOT ANALYSIS FOR KEY SEGMENTS BY PRODUCT TYPE

17 DISTRIBUTOR COMPANY PROFILES

17.1 NOVOMED INC PVT. LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS/NEWS

17.2 TS COMPROZONE PVT. LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS/NEWS

17.3 SIMONSEN & WEEL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENTS/NEWS

17.4 YASHODHAN ENTERPRISE

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS/NEWS

17.5 YOGI KRIPA

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS/NEWS

18 MANUFACTURERS, COMPANY PROFILE

18.1 BAUERFEIND

18.1.1 COMPANY SNAPSHOT

18.1.2 COMPANY SHARE ANALYSIS

18.1.3 SWOT ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 3M

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 SWOT ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENTS/NEWS

18.3 CARDINAL HEALTH

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SWOT ANALYSIS

18.3.5 PRODUCT PORTFOLIO

18.3.6 RECENT DEVELOPMENT

18.4 THUSANE

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 SWOT ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 LOHMANN & RAUSCHER GMBH & CO. KG

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 SWOT ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 AMES WALKER

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS/NEWS

18.7 CALZIFICIO ZETA SRL

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 CEP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 COMPRESSANA GMBH

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 GIBAUD

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GLORIA MED S.P.A.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 HEINZ SCHIEBLER GMBH & CO KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 JUZO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MAXWELL INDIA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 MEDI GMBH & CO. KG

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 NOVAMED

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 REJUVA HEALTH

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 SANYLEG SRL A SOCIO UNICO

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 SCHOLL’S WELLNESS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 SWISSLASTIC AG ST. GALLEN

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SIGVARIS GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SOCKWELL

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS/NEWS

18.23 SURGIWEAR

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THERMOTEK

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 TYNOR ORTHOTICS PVT. LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 VIM & VIGR

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS/NEWS

18.27 VISSCO NEXT

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENTS/NEWS

18.28 ZENSAH

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 BRAND OUTLOOK: COMPRESSION STOCKINGS MARKET

TABLE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKWEAR COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA MODERATE COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILD COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA EXTRA-FIRM COMPRESSION IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA NYLON & SPANDEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA COTTON IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA MICROFIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAMBOO FIBER IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA BREATHABLE MESH / MOISTURE-WICKING FABRICS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA WOOL BLENDS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA RECYCLED/ORGANIC MATERIALS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA WOMEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA UNISEX IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA MEN IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ONLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA HEALTHCARE INSTITUTIONS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA SPORTS TEAMS & CLUBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA CORPORATE WELLNESS PROGRAMS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CANADA COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO COMPRESSION STOCKINGS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO WORKWEAR COMPRESSION SOCKS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO INDUSTRIAL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO HOSPITALITY & RETAIL WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO TRANSPORT & LOGISTICS WORKERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO COMPRESSION GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO LOWER BODY GARMENTS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY COMPRESSION LEVEL, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO NON-MEDICAL USE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OCCUPATIONAL USE / WORKWEAR IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO OFFLINE IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO COMPRESSION GARMENTS AND STOCKINGS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO GENERAL CONSUMERS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO WORKERS IN PHYSICALLY DEMANDING JOBS IN COMPRESSION GARMENTS AND STOCKINGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: PRODUCT TYPE LIFELINE CURVE

FIGURE 9 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: EXECUTIVE SUMMARY

FIGURE 14 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET, BY PRODUCT TYPE (2024)

FIGURE 16 INCREASING OBESITY AND SEDENTARY LIFESTYLES IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET FROM 2025 TO 2032

FIGURE 17 THE COMPRESSION STOCKINGS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET IN 2025 & 2032

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DISTRIBUTION OF PATENTS BY IPC CODE

FIGURE 20 COUNTRY-WISE PATENT COUNT

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 NORTH AMERICA GARMENT AND COMPRESSIBLE STOCKING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS: NORTH AMERICA GARMENTS AND COMPRESSION STOCKINGS MARKET

FIGURE 24 DROC ANALYSIS

FIGURE 25 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2024

FIGURE 26 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 28 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2024

FIGURE 30 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, CAGR (2025- 2032)

FIGURE 32 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY COMPRESSION LEVEL, LIFELINE CURVE

FIGURE 33 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2024

FIGURE 34 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 36 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2024

FIGURE 38 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, CAGR (2025- 2032)

FIGURE 40 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 41 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2024

FIGURE 42 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, CAGR (2025- 2032)

FIGURE 44 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 46 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 48 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 49 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2024

FIGURE 50 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 52 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: SNAPSHOT (2024)

FIGURE 54 NORTH AMERICA COMPRESSION GARMENTS AND STOCKINGS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。