North America Contraceptive Devices Market

市场规模(十亿美元)

CAGR :

%

USD

9.10 Billion

USD

13.70 Billion

2024

2032

USD

9.10 Billion

USD

13.70 Billion

2024

2032

| 2025 –2032 | |

| USD 9.10 Billion | |

| USD 13.70 Billion | |

|

|

|

|

North America Contraceptive Devices Market Segmentation, By Product Type (Male Contraceptive Devices, Female Contraceptive Devices), Technology (Hormonal Contraceptives, Barrier Contraceptives), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Clinics, Online Channel, Public Channel & NGOs, Others) - Industry Trends and Forecast to 2032

Contraceptive Devices Market Size

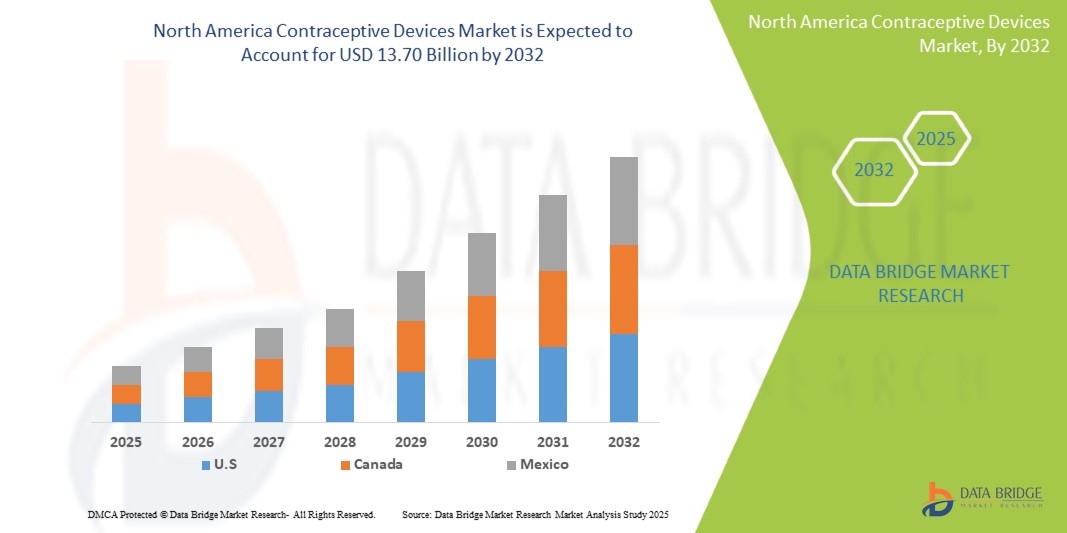

- The North America Contraceptive Devices Market was valued atUSD9.1 Billionin 2024and is expected to reachUSD13.70 Billionby 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 5.2%primarily driven by the anticipated launch of therapies

- The drivers of the Contraceptive Devices Market include the rising awareness about family planning and reproductive health, increasing government initiatives to promote contraceptive use, and the growing demand for effective and convenient birth control methods..

North America Contraceptive Devices Market Analysis

- Contraceptive devices play a crucial role in reproductive health management by enabling individuals and couples to prevent unintended pregnancies and plan families effectively. These devices are essential tools in reducing maternal mortality, improving child health outcomes, and enhancing women's participation in the workforce and education.

- The demand for contraceptive devices in North America is driven by increased awareness about sexual health, rising incidence of unintended pregnancies, and supportive governmental policies promoting family planning initiatives. Additionally, the growing acceptance of long-acting reversible contraceptives (LARCs), such as intrauterine devices (IUDs) and contraceptive implants, is propelling market growth.

- North America stands as a dominant region in the global contraceptive devices market, supported by its advanced healthcare systems, high levels of public and private sector investment in women's health, and the presence of major industry players. The United States, in particular, has seen robust efforts from healthcare organizations and advocacy groups aimed at increasing access to a wide range of contraceptive options.

- For instance, as of 2023, nearly 65% of women aged 15–49 in the United States were using some form of contraception, with IUD usage accounting for a significant and growing portion of this demographic.

- Globally, contraceptive devices such as IUDs, condoms, and subdermal implants rank among the most effective and widely used birth control methods. In North America, their availability and accessibility are continually enhanced through healthcare reforms, public health programs, and growing consumer preference for non-hormonal and minimally invasive options

Report ScopeContraceptive DevicesMarket Segmentation

|

Attributes |

Contraceptive DevicesKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Contraceptive Devices Market Trends

“Increased Adoption of Long-Acting and Non-Hormonal Contraceptive Solutions”

- Rising Preference for Long-Acting Reversible Contraceptives (LARCs): A growing number of women are opting for IUDs and implants due to their long-term efficacy, low maintenance, and reduced risk of user error compared to short-term methods like pills and condoms.

- Shift Toward Non-Hormonal Options: There's increasing demand for hormone-free contraceptive devices, such as copper IUDs, driven by consumer concerns over hormonal side effects and a preference for natural alternatives.

Contraceptive Devices Market Dynamics

Driver

“High Awareness and Access to Family Planning Services”

- Government and NGO-Led Initiatives: Federal and state-level programs in the U.S. and Canada, such as Title X in the U.S., are expanding access to affordable contraceptive services, significantly driving market growth.

- https://opa.hhs.gov/title-x-family-planning

- Growing Demand for Modern Contraceptive Methods: The continued emphasis on sexual wellness, education, and proactive reproductive health is leading to higher adoption of modern and effective contraceptive devices across demographics.

- Widespread Availability in Retail and Online Pharmacies: The ease of access through retail outlets and e-commerce channels is increasing user convenience and boosting sales of over-the-counter contraceptive devices such as condoms and emergency contraception.

Opportunity

“Technological Advancements and Telehealth Expansion”

- Smart Contraceptive Devices and Apps: Integration of digital technologies with contraceptive methods (e.g., fertility tracking apps paired with devices) is opening new market segments for tech-enabled family planning solutions.

- Increased Access Through Policy Reform: Policy improvements, including expanded Medicaid coverage and employer-provided health plans, offer new opportunities for growth and greater consumer access to a variety of contraceptive options.

- For instance, under the Affordable Care Act, most health insurance plans are required to cover FDA-approved contraceptive methods without charging a copayment or coinsurance.

- https://www.hrsa.gov/womens-guidelines

Restraint/Challenge

“Cultural Sensitivities and Access Inequities”

- Social and Religious Barriers: In certain regions and communities, cultural or religious opposition to contraceptive use can hinder adoption, particularly of long-term or invasive devices.

- Disparities in Insurance and Healthcare Access: Despite overall availability, unequal access to insurance coverage and healthcare services—especially among low-income or rural populations—continues to limit equitable adoption of contraceptive devices.

Contraceptive Devices Market Scope

The market is segmented on the basis, product type, technology, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

ByDistribution Channel

|

|

Contraceptive Devices Market Regional Analysis

“U.S. is the Dominant Country in the Contraceptive Devices Market”

- North America leads the global Contraceptive Devices market, fueled by a robust healthcare infrastructure, widespread access to modern contraceptive options, and strong presence of major industry players such as CooperSurgical, Bayer, and Church & Dwight.

- The United States holds a substantial market share, driven by high awareness of reproductive health, supportive government policies including Title X and ACA contraceptive mandates, and rising demand for long-acting reversible contraceptives (LARCs) like IUDs and implants.

- Comprehensive insurance coverage, including no-cost access to FDA-approved contraceptive methods under the Affordable Care Act (ACA), significantly boosts product adoption and utilization across diverse population groups.

- Ongoing research & development investments, combined with increasing integration of contraceptive counseling into digital and telehealth platforms, are accelerating the adoption of user-friendly, personalized, and tech-integrated birth control solutions

“Canada is Projected to Register the Highest Growth Rate”

- Canada is witnessing steady growth in the Contraceptive Devices market, supported by a universal healthcare system, strong public health policies, and increasing emphasis on sexual and reproductive health education.

- Government-led initiatives, such as expanded access to contraceptives through provincial health plans and youth-focused sexual health programs, are driving wider adoption of both hormonal and non-hormonal contraceptive methods across the country.

- Urban centers such as Toronto, Vancouver, and Montreal are leading in the uptake of long-acting reversible contraceptives (LARCs) like IUDs and implants, reflecting a shift toward user-friendly, effective, and low-maintenance birth control options.

- With growing advocacy for reproductive rights, rising educational levels, and increased availability of digital health platforms offering contraceptive counseling, Canada is poised to become a more significant contributor to the North American contraceptive devices market

Contraceptive Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CooperSurgical, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Medicines360 (U.S.)

- Veru Inc. (U.S.)

- Reckitt Benckiser Group plc (U.K.)

- Church & Dwight Co., Inc. (U.S.)

Latest Developments in Global Contraceptive Devices Market

- In September 2023, Medicines360, a rare nonprofit pharma, spent $82 million to bring a $50 hormonal IUD, Liletta, to market. Despite hurdles like FDA regulations, funding challenges, and market resistance, it expanded access for low-income women, saving the U.S. healthcare system $100 million and sparking ongoing legislative efforts for nonprofit drug development.

- https://toronto.citynews.ca/2023/09/01/medicines360s-long-and-winding-82-million-road-to-create-and-distribute-50-birth-control/

- In January 2024, Medicines360, a nonprofit women’s health pharmaceutical organization, in partnership with Theramex, announced the commercial launch of LILETTA® (levonorgestrel-releasing intrauterine system) in Canada. This milestone expands access to long-acting reversible contraceptives (LARCs) for Canadian women, aligning with public health efforts to improve reproductive health options and equity.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。